L.B. Foster Company (Nasdaq: FSTR), a global technology solutions

provider of products and services for rail and infrastructure

markets (the "Company"), reported fourth quarter and 2024 results2.

CEO CommentsJohn Kasel,

President and Chief Executive Officer, commented, "We finished 2024

with strong cash generation and improving profitability in the

fourth quarter. Rail segment growth was robust, with sales up 14.2%

and gross margins of 22.2% up 300 basis points ("bps").

Infrastructure results were weaker versus last year, with sales

down 25.2% and gross margins of 22.6% down 90 bps driven primarily

by lower pipeline coating volumes within our Steel Products

division. As expected, lower employment costs, in part from our

2024 restructuring program, drove improved operating expenses and

profitability versus last year's quarter. Free cash flow was

stronger than we expected and the operating cash was used to

continue to reduce debt and improve leverage while also stepping up

the pace of our share repurchase program. Share repurchases during

2024 totaled 300,302 shares, or approximately 3% of outstanding

shares. The results achieved by our team in 2024 demonstrate that

the execution of our strategic playbook is translating into a

structural improvement in profitability, free cash flow and

economic profit generation."

Mr. Kasel concluded, "While near-term macro

conditions are expected to remain volatile, the benefits of our

strategy and disciplined execution over the last three years have

positioned us well. We remain optimistic about our prospects for

growth, as evidenced by our 2025 financial guidance. We're starting

2025 with backlog down 13% with the decline primarily in less

profitable product lines, and expect the beginning of 2025 to be

softer than last year's exceptionally strong start. However, our

guidance midpoints imply 34% growth in adjusted EBITDA on 5.5%

organic sales growth, highlighting improved portfolio profitability

driven by investments in our growth platforms of Rail Technologies

and Precast Concrete. The guidance assumes federal infrastructure

investment support remains largely intact, and we'll monitor

developments in these programs closely. Our balanced approach to

capital allocation is unchanged, and includes a new, 3-year $40

million share repurchase program which highlights the confidence we

have in our future. Our strategy is sound and delivering

shareholder value, and we look forward to continuing progress in

2025."

1 See "Non-GAAP Disclosures" at the end of this

press release for a description of and information regarding

adjusted EBITDA, gross leverage ratio per the Company's credit

agreement, new orders, backlog, book-to-bill ratio, organic results

adjusted for portfolio movement, net debt, free cash flow, and

related reconciliations to the comparable United States Generally

Accepted Accounting Principles financial measures. 2 As reported in

the Company's Current Report on Form 8-K filed on October 8, 2024,

the Company corrected certain errors in previously reported 2024

quarterly financials, and certain immaterial errors in 2023

previously reported financials. All comparisons are based on the

corrected historical results.

Financial Guidance

|

2025 Full Year Financial Guidance |

Low |

|

High |

|

Net sales |

$ |

540,000 |

|

|

$ |

580,000 |

|

|

Adjusted EBITDA |

$ |

42,000 |

|

|

$ |

48,000 |

|

|

Capital spending as a percent of sales |

|

~2% |

|

|

|

~2% |

|

|

Free cash flow |

$ |

20,000 |

|

|

$ |

30,000 |

|

|

|

|

|

|

|

|

|

|

Share Repurchase Program

AuthorizationOn March 3, 2025, the Company’s Board of

Directors authorized the repurchase of up to $40.0 million of the

Company’s common stock in open market transactions and/or 10b5-1

trading plans through February 29, 2028. The new authorization

replaces the previous $15.0 million share repurchase authorization

which expired at the end of February 2025. Any repurchases will be

subject to the Company’s liquidity, including availability of

borrowings and covenant compliance under its revolving credit

facility, and other capital needs of the business.

Fourth Quarter Consolidated

HighlightsThe Company’s fourth quarter performance

highlights are reflected below:

| |

Three Months EndedDecember 31, |

|

Change |

|

PercentChange |

| |

|

2024 |

|

|

|

2023 |

|

|

2024 vs. 2023 |

|

2024 vs. 2023 |

| |

(Unaudited) |

|

|

|

|

|

$ in thousands, unless otherwise noted: |

|

|

|

|

|

|

Net sales |

$ |

128,183 |

|

|

$ |

134,877 |

|

|

$ |

(6,694 |

) |

|

|

(5.0 |

)% |

|

Gross profit |

|

28,615 |

|

|

|

28,709 |

|

|

|

(94 |

) |

|

|

(0.3 |

) |

|

Gross profit margin |

|

22.3 |

% |

|

|

21.3 |

% |

|

100 bps |

|

|

4.7 |

|

|

Selling and administrative expenses |

$ |

24,421 |

|

|

$ |

27,263 |

|

|

$ |

(2,842 |

) |

|

|

(10.4 |

) |

|

Selling and administrative expenses as a percent of sales |

|

19.1 |

% |

|

|

20.2 |

% |

|

(110) bps |

|

|

(5.4 |

) |

|

Amortization expense |

|

1,142 |

|

|

|

1,195 |

|

|

|

(53 |

) |

|

|

(4.4 |

) |

|

Operating income |

$ |

3,052 |

|

|

$ |

251 |

|

|

$ |

2,801 |

|

|

|

** |

|

|

Net loss attributable to L.B. Foster Company |

|

(242 |

) |

|

|

(430 |

) |

|

|

188 |

|

|

|

43.7 |

|

|

Adjusted EBITDA1 |

|

7,238 |

|

|

|

6,099 |

|

|

|

1,139 |

|

|

|

18.7 |

|

|

New orders1 |

|

107,187 |

|

|

|

105,509 |

|

|

|

1,678 |

|

|

|

1.6 |

|

|

Backlog1 |

|

185,909 |

|

|

|

213,780 |

|

|

|

(27,871 |

) |

|

|

(13.0 |

) |

**Results of this calculation not considered

meaningful.

- Net sales for the 2024 fourth

quarter were $128.2 million, a $6.7 million decrease, or 5.0%, from

the prior year quarter. Net sales decreased due to lower volumes in

the Steel Products business unit, including a $1.6 million impact

from the discontinued bridge grid deck product line. The decline in

organic sales was entirely in the Infrastructure Solutions

segment.

- Gross profit for the 2024 fourth

quarter was $28.6 million, flat with the prior year quarter. Gross

profit margin for the 2024 fourth quarter was 22.3%, a 100 basis

point improvement over the prior year quarter. Margin improvement

was due to improved portfolio profitability in the Rail,

Technologies, and Services segment.

- Selling and administrative expenses

for the 2024 fourth quarter were $24.4 million, a

$2.8 million decrease, or 10.4%, from the prior year quarter.

The decrease was attributable to overall lower personnel expenses

as well as lower bad debt expenses, primarily related to a

$1.0 million charge incurred in 2023 related to a customer

filing for administrative protection in the United Kingdom. Selling

and administrative expenses as a percent of net sales decreased to

19.1% compared to 20.2% in the prior year quarter.

- Operating income for the 2024

fourth quarter was $3.1 million, favorable $2.8 million

over the prior year quarter, primarily due to the improvement in

selling and administrative expenses.

- Net loss attributable to the

Company for the 2024 fourth quarter was $0.2 million, or $0.02

per diluted share, favorable $0.2 million over the prior year

quarter.

- Adjusted EBITDA for the 2024 fourth

quarter was $7.2 million, a $1.1 million increase, or

18.7%, over the prior year quarter.

- Cash provided by operating

activities was $24.3 million for the fourth quarter, a $2.6 million

increase over the prior year quarter due to improved profitability

and working capital.

- Total debt as of December 31,

2024 was $46.9 million, a $21.6 million decline during the quarter

and an $8.3 million decrease from the prior year quarter. Net debt1

as of December 31, 2024 was $44.5 million, a $20.9 million

decline during the quarter and an $8.2 million decrease from the

prior year quarter. The Company's gross leverage ratio per its

credit agreement was 1.2x as of December 31, 2024, an

improvement from 1.7x versus December 31, 2023.

- New orders totaling

$107.2 million for the 2024 fourth quarter increased

$1.7 million, or 1.6%, over the prior year quarter. The

increase occurred within the Infrastructure Solutions segment, and

is primarily related to strong orders in the Protective Pipe

Coatings business within Steel Products. This increase was

partially offset by lower demand in the Rail, Technologies, and

Services segment's Rail Products business unit. The trailing twelve

month book-to-bill ratio1 was 0.95 : 1.00, up from 0.94 : 1.00 at

the end of the third quarter.

- Backlog was $185.9 million,

$27.9 million decrease, or 13.0%, from the prior year quarter.

The decline was due primarily to softer Rail Products demand

coupled with the impact of decreasing commercial activity in our UK

business as we continue to scale back initiatives in that market.

Also contributing to the lower backlog was a decline in Steel

Products, including $2.7 million due to the exit of the bridge grid

deck product line.

Fourth Quarter Business Results by

Segment

Rail, Technologies, and Services Segment

| |

Three Months EndedDecember 31, |

|

Change |

|

PercentChange |

| |

|

2024 |

|

|

|

2023 |

|

|

2024 vs. 2023 |

|

2024 vs. 2023 |

| |

(Unaudited) |

|

|

|

|

|

$ in thousands, unless otherwise noted: |

|

|

|

|

|

|

Net sales |

$ |

79,154 |

|

|

$ |

69,294 |

|

|

$ |

9,860 |

|

|

|

14.2 |

% |

|

Gross profit |

$ |

17,552 |

|

|

$ |

13,329 |

|

|

$ |

4,223 |

|

|

|

31.7 |

|

|

Gross profit margin |

|

22.2 |

% |

|

|

19.2 |

% |

|

|

300 bps |

|

|

|

15.6 |

|

|

Segment operating income (loss) |

$ |

4,700 |

|

|

$ |

(925 |

) |

|

$ |

5,625 |

|

|

|

** |

|

|

Segment operating income (loss) margin |

|

5.9 |

% |

|

|

(1.3 |

)% |

|

|

720 bps |

|

|

|

** |

|

|

New orders1 |

$ |

54,982 |

|

|

$ |

60,058 |

|

|

$ |

(5,076 |

) |

|

|

(8.5 |

) |

|

Backlog1 |

$ |

62,449 |

|

|

$ |

84,418 |

|

|

$ |

(21,969 |

) |

|

|

(26.0 |

) |

**Results of this calculation not considered

meaningful.

- Net sales for the 2024 fourth

quarter were $79.2 million, a $9.9 million increase, or 14.2%, over

the prior year quarter, driven primarily by higher sales volumes in

the Rail Products business unit.

- Gross profit for the 2024 fourth

quarter was $17.6 million, a $4.2 million increase, and gross

profit margins increased 300 basis points to 22.2%. Gross profit

improvement was driven primarily by improved margins in Global

Friction Management and Technology Services and Solutions,

including recovery in our UK business. The Rail Products business

unit also realized improved margins driven by higher sales

volumes.

- Segment operating income for the

2024 fourth quarter was $4.7 million, favorable $5.6 million over

the prior year quarter, due to the increase in gross profit and a

$1.4 million decrease in segment selling and administrative

expenses. The decrease in selling and administrative expenses is

due in part to a $1.0 million decline in bad debt expense due to a

UK customer that filed for administrative protection in the prior

year.

- Orders decreased by $5.1 million,

driven primarily by Rail Products, partially offset by order growth

in the Global Friction Management and Technology Services and

Solutions business units. The trailing twelve month book-to-bill

ratio was 0.94 : 1.00. Backlog of $62.4 million decreased $22.0

million from the prior year quarter driven by declines in Rail

Products and Technology Services and Solutions, partially offset by

a 53.4% increase in Global Friction Management.

Infrastructure Solutions Segment

| |

Three Months EndedDecember 31, |

|

Change |

|

PercentChange |

| |

|

2024 |

|

|

|

2023 |

|

|

2024 vs. 2023 |

|

2024 vs. 2023 |

| |

(Unaudited) |

|

|

|

|

|

$ in thousands, unless otherwise noted: |

|

|

|

|

|

|

Net sales |

$ |

49,029 |

|

|

$ |

65,583 |

|

|

$ |

(16,554 |

) |

|

|

(25.2 |

)% |

|

Gross profit |

$ |

11,063 |

|

|

$ |

15,380 |

|

|

$ |

(4,317 |

) |

|

|

(28.1 |

) |

|

Gross profit margin |

|

22.6 |

% |

|

|

23.5 |

% |

|

|

(90) bps |

|

|

|

(3.8 |

) |

|

Segment operating income |

$ |

2,030 |

|

|

$ |

5,390 |

|

|

$ |

(3,360 |

) |

|

|

(62.3 |

) |

|

Segment operating income margin |

|

4.1 |

% |

|

|

8.2 |

% |

|

|

(410) bps |

|

|

|

(49.9 |

) |

|

New orders1 |

$ |

52,205 |

|

|

$ |

45,451 |

|

|

$ |

6,754 |

|

|

|

14.9 |

|

|

Backlog1 |

$ |

123,460 |

|

|

$ |

129,362 |

|

|

$ |

(5,902 |

) |

|

|

(4.6 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Net sales for the 2024 fourth

quarter were $49.0 million, a $16.6 million decrease, or 25.2%,

from the prior year quarter. The decrease in sales is attributed

primarily to Steel Products which declined $15.2 million due to

soft market conditions in the end markets served, including a $1.6

million decrease from the exit of the bridge grid deck product

line.

- Gross profit for the 2024 fourth

quarter was $11.1 million, a $4.3 million decrease, or 28.1%, from

the prior year quarter, and gross profit margins decreased by 90

basis points to 22.6%. The decrease is due to lower overall sales

volumes and unfavorable mix primarily within Steel Products.

- Segment operating income for the

2024 fourth quarter was $2.0 million, unfavorable $3.4 million from

the prior year quarter, due to the decrease in gross profit,

partially offset by a $0.9 million improvement in selling and

administrative costs.

- New orders increased by $6.8

million, driven primarily by an increase in new orders in the

Protective Coatings business within Steel Products. The trailing

twelve month book-to-bill ratio was 0.97 : 1.00. Backlog of $123.5

million decreased $5.9 million from the prior year quarter, $2.7

million of which stems from the bridge grid deck product line exit.

The remaining decline in the backlog is attributed to the retained

bridge forms product line and the Protective Coatings business.

Precast Concrete backlog improved $3.6 million over the prior year

quarter due to strengthening in the business.

Full Year Consolidated

HighlightsThe Company’s full year 2024 performance

highlights are reflected below.

| |

Year EndedDecember 31, |

|

Change |

|

PercentChange |

| |

|

2024 |

|

|

|

2023 |

|

|

2024 vs. 2023 |

|

2024 vs. 2023 |

| |

(Unaudited) |

|

|

|

|

|

|

|

$ in thousands, unless otherwise noted: |

|

|

|

|

|

|

|

|

Net sales |

$ |

530,765 |

|

|

$ |

543,744 |

|

|

$ |

(12,979 |

) |

|

|

(2.4 |

)% |

|

Gross profit |

|

118,062 |

|

|

|

112,044 |

|

|

|

6,018 |

|

|

|

5.4 |

|

|

Gross profit margin |

|

22.2 |

% |

|

|

20.6 |

% |

|

160 bps |

|

|

7.8 |

|

|

Selling and administrative expenses |

$ |

96,398 |

|

|

$ |

97,623 |

|

|

$ |

(1,225 |

) |

|

|

(1.3 |

) |

|

Selling and administrative expenses as a percent of sales |

|

18.2 |

% |

|

|

18.0 |

% |

|

20 bps |

|

|

1.1 |

|

|

(Gain) on sale of former joint venture facility |

|

(3,477 |

) |

|

|

— |

|

|

|

(3,477 |

) |

|

|

** |

|

|

Amortization expense |

|

4,628 |

|

|

|

5,314 |

|

|

|

(686 |

) |

|

|

(12.9 |

) |

|

Operating income |

$ |

20,513 |

|

|

$ |

9,107 |

|

|

$ |

11,406 |

|

|

|

125.2 |

|

|

Net income attributable to L.B. Foster Company |

|

42,946 |

|

|

|

1,464 |

|

|

|

41,482 |

|

|

|

** |

|

|

Adjusted EBITDA1 |

|

33,576 |

|

|

|

31,775 |

|

|

|

1,801 |

|

|

|

5.7 |

|

|

New orders1 |

|

506,538 |

|

|

|

529,030 |

|

|

|

(22,492 |

) |

|

|

(4.3 |

) |

|

Backlog1 |

|

185,909 |

|

|

|

213,780 |

|

|

|

(27,871 |

) |

|

|

(13.0 |

) |

**Results of this calculation not considered

meaningful.

- Net sales for the year ended

December 31, 2024 were $530.8 million, a $13.0 million decrease, or

2.4%, from the prior year. Net sales declined $13.8 million

primarily due to divestitures and product line exits. Organic sales

increased by $0.8 million driven by the Rail, Technologies, and

Services segment, partially offset by organic sales declines in the

Infrastructure Solutions segment, primarily within the Steel

Products business.

- Gross profit for the year ended

December 31, 2024 was $118.1 million, an increase of $6.0 million,

or 5.4%, over the prior year and gross profit margins expanded by

160 basis points to 22.2%. The increase in gross profit in 2024 was

due to the absence of the adverse impact realized in the prior year

period of the bridge grid deck product line exit which reduced

prior year gross profit by $3.1 million, coupled with related exit

costs of $1.1 million. Additionally, the improvement in gross

profit was driven by the business portfolio changes in line with

the Company's strategic transformation along with favorable

business mix and the recovery in our UK Technology Services and

Solutions businesses.

- Selling and administrative expenses

for the year ended December 31, 2024 were $96.4 million, a

$1.2 million decrease, or 1.3%, from the prior year. The

decrease was primarily attributed to $2.9 million of lower

employments costs in 2024 and the absence of $1.9 million of

bad debt expense incurred in 2023 due to a customer filing for

administrative protection. Partially offsetting these decreases

were $1.2 million in legal costs associated with a resolved

legal matter, $0.8 million of professional services expenditures

associated with the announced enterprise restructuring, and

$1.2 million in employee-related restructuring expense

incurred in 2024.

- Operating income for the year ended

December 31, 2024 was $20.5 million, favorable

$11.4 million over the prior year, due to improved gross

profit, lower selling and administrative expenses, and a

$3.5 million gain on the sale of a former joint venture

facility in Magnolia, Texas.

- Net income attributable to the

Company for the year ended December 31, 2024 was

$42.9 million, or $3.89 per diluted share, favorable by

$41.5 million over the prior year period. The change in net

income attributable to the Company was due primarily to a

$31.9 million favorable tax valuation allowance adjustment in

2024, as well as improved operating income, including the bridge

exit impacts in 2023 and $3.5 million Magnolia facility sale

gain in 2024.

- Adjusted EBITDA for the year ended

December 31, 2024 was $33.6 million, a $1.8 million

increase, or 5.7%, over the prior year.

- Net cash flow from operations in

the year ended December 31, 2024 totaled $22.6 million.

- New orders totaling

$506.5 million for the year ended December 31, 2024 decreased

$22.5 million, or 4.3%, from the prior year, with

$10.6 million of the decrease due to divestitures and product

line exits. The remaining decline was realized across the Steel

Products business. Organic order rates1 in the Rail, Technologies,

and Services segment improved $14.9 million, with strong

growth realized in both Rail Products and Friction Management.

Precast Concrete order rates also improved $2.3 million as

compared to the prior year period.

Fourth Quarter Conference

CallL.B. Foster Company will conduct a conference call and

webcast to discuss its fourth quarter and full year 2024 operating

results on March 4, 2025 at 11:00 AM ET. The call will be

hosted by Mr. John Kasel, President and Chief Executive Officer.

Listen via audio and access the slide presentation on the L.B.

Foster website: www.lbfoster.com, under the Investor Relations

page. A conference call replay will be available through

March 11, 2025 via webcast through L.B. Foster’s Investor

Relations page of the company’s website.

Those interested in participating in the

question-and-answer session may register for the call at

https://register.vevent.com/register/BI7fa688d1459244e0bb31550782a2d32b to

receive the dial-in numbers and unique PIN to access the call. The

registration link will also be available on the Company’s Investor

Relations page of its website.

About L.B. Foster

CompanyFounded in 1902, L.B. Foster Company is a global

technology solutions provider of engineered, manufactured products

and services that builds and supports infrastructure. The Company’s

innovative engineering and product development solutions address

the safety, reliability, and performance needs of its customer's

most challenging requirements. The Company maintains locations in

North America, South America, Europe, and Asia. For more

information, please visit www.lbfoster.com.

Non-GAAP Financial MeasuresThis

press release contains financial measures that are not calculated

and presented in accordance with generally accepted accounting

principles in the United States ("GAAP"). These non-GAAP financial

measures are provided as additional information for investors. The

presentation of this additional information is not meant to be

considered in isolation or as a substitute for GAAP measures. For

definitions of the non-GAAP financial measures used in this press

release and reconciliations to the most directly comparable

respective GAAP measures, see the “Non-GAAP Disclosures” section

below.

The Company has not reconciled the

forward-looking adjusted EBITDA and free cash flow to the most

directly comparable GAAP measure because this cannot be done

without unreasonable effort due to the variability and low

visibility with respect to certain costs, the most significant of

which are acquisition and divestiture-related costs, impairment

expense, and changes in operating assets and liabilities. These

underlying expenses and others that may arise during the year are

potential adjustments to future earnings. The Company expects the

variability of these items to have a potentially unpredictable, and

a potentially significant, impact on our future GAAP financial

results.

The Company believes free cash flow is useful

information to investors as it provides insight on cash generated

by operations, less capital expenditures, which we believe to be

helpful in assessing the Company's long-term ability to pursue

growth and investment opportunities as well as service its

financing obligations and generate capital for shareholders.

Additionally, the Company's annual incentive plans for management

provide for the utilization of free cash flow as a metric for

measuring cash-generation performance in determining annual

variable incentive achievement.

The Company defines new orders as a contractual

agreement between the Company and a third-party in which the

Company will, or has the ability to, satisfy the performance

obligations of the promised products or services under the terms of

the agreement. The Company defines backlog as contractual

commitments to customers for which the Company’s performance

obligations have not been met, including with respect to new orders

and contracts for which the Company has not begun any performance.

Management utilizes new orders and backlog to evaluate the health

of the industries in which the Company operates, the Company’s

current and future results of operations and financial prospects,

and strategies for business development. The Company believes that

new orders and backlog are useful to investors as supplemental

metrics by which to measure the Company’s current performance and

prospective results of operations and financial performance. The

Company defines book-to-bill ratio as new orders divided by

revenue. The Company believes this is a useful metric to assess

supply and demand, including order strength versus order

fulfillment.

The Company views its Gross Leverage Ratio per

its credit agreement, as defined in the Second Amendment to its

Fourth Amended and Restated Credit Agreement dated August 12, 2022,

as an important indication of the Company's financial health and

believes it is useful to investors as an indicator of the Company's

ability to service its existing indebtedness and borrow additional

funds for its investing and operational needs.

Forward-Looking Statements

This release may contain forward-looking

statements within the meaning of Section 21E of the Securities

Exchange Act of 1934, as amended, and Section 27A of the Securities

Act of 1933, as amended. Forward-looking statements include any

statement that does not directly relate to any historical or

current fact. Sentences containing words such as “believe,”

“intend,” “plan,” “may,” “expect,” “should,” “could,” “anticipate,”

“estimate,” “predict,” “project,” or their negatives, or other

similar expressions of a future or forward-looking nature generally

should be considered forward-looking statements. Forward-looking

statements in this release are based on management's current

expectations and assumptions about future events that involve

inherent risks and uncertainties and may concern, among other

things, L.B. Foster Company’s (the “Company’s”) expectations and

assumptions about future events that involve inherent risks and

uncertainties and may concern, among other things, the Company’s

expectations relating to our strategy, goals, projections, and

plans regarding our financial position, liquidity, capital

resources, and results of operations and decisions regarding our

strategic growth initiatives, market position, and product

development. While the Company considers these expectations and

assumptions to be reasonable, they are inherently subject to

significant business, economic, competitive, regulatory, and other

risks and uncertainties, most of which are difficult to predict and

many of which are beyond the Company’s control. The Company

cautions readers that various factors could cause the actual

results of the Company to differ materially from those indicated by

forward-looking statements. Accordingly, investors should not place

undue reliance on forward-looking statements as a prediction of

actual results. Among the factors that could cause the actual

results to differ materially from those indicated in the

forward-looking statements are risks and uncertainties related to:

a continuation or worsening of the adverse economic conditions in

the markets we serve, including recession, the continued volatility

in the prices for oil and gas, tariffs or trade wars, inflation,

project delays, and budget shortfalls, or otherwise; volatility in

the global capital markets, including interest rate fluctuations,

which could adversely affect our ability to access the capital

markets on terms that are favorable to us; restrictions on our

ability to draw on our credit agreement, including as a result of

any future inability to comply with restrictive covenants contained

therein; a decrease in freight or transit rail traffic;

environmental matters and the impact of environmental regulations,

including any costs associated with any remediation and monitoring

of such matters; the risk of doing business in international

markets, including compliance with anti-corruption and bribery

laws, foreign currency fluctuations and inflation, global shipping

disruptions, the imposition of increased or new tariffs, and trade

restrictions or embargoes; our ability to effectuate our strategy,

including cost reduction initiatives, and our ability to

effectively integrate acquired businesses or to divest businesses,

such as the recent dispositions of the Chemtec and Ties businesses,

and acquisition of VanHooseCo Precast LLC and Cougar Mountain

Precast, LLC businesses and to realize anticipated benefits; costs

of and impacts associated with shareholder activism; the timeliness

and availability of materials from our major suppliers, as well as

the impact on our access to supplies of customer preferences as to

the origin of such supplies, such as customers’ concerns about

conflict minerals; labor disputes; cybersecurity risks such as data

security breaches, malware, ransomware, “hacking,” and identity

theft, which could disrupt our business and may result in misuse or

misappropriation of confidential or proprietary information, and

could result in the disruption or damage to our systems, increased

costs and losses, or an adverse effect to our reputation, business

or financial condition; the continuing effectiveness of our ongoing

implementation of an enterprise resource planning system; changes

in current accounting estimates and their ultimate outcomes; the

adequacy of internal and external sources of funds to meet

financing needs, including our ability to negotiate any additional

necessary amendments to our credit agreement or the terms of any

new credit agreement, the Company’s ability to manage its working

capital requirements and indebtedness; domestic and international

taxes, including estimates that may impact taxes; domestic and

foreign government regulations, including tariffs; our ability to

maintain effective internal controls over financial reporting

(“ICFR”) and disclosure controls and procedures, including our

ability to remediate any existing material weakness in our ICFR and

the timing of any such remediation, as well as our ability to

reestablish effective disclosure controls and procedures; any

change in policy or other change due to the results of the UK’s

2024 parliamentary election and the U.S. 2024 Presidential election

that could affect UK or U.S. business conditions; other

geopolitical conditions, including the ongoing conflicts between

Russia and Ukraine, conflicts in the Middle East, and increasing

tensions between China and Taiwan; a lack of state or federal

funding for new infrastructure projects; an increase in

manufacturing or material costs; the loss of future revenues from

current customers; any future global health crises, and the related

social, regulatory, and economic impacts and the response thereto

by the Company, our employees, our customers, and national, state,

or local governments, including any governmental travel

restrictions; and risks inherent in litigation and the outcome of

litigation and product warranty claims. Should one or more of these

risks or uncertainties materialize, or should the assumptions

underlying the forward-looking statements prove incorrect, actual

outcomes could vary materially from those indicated. Significant

risks and uncertainties that may affect the operations,

performance, and results of the Company’s business and

forward-looking statements include, but are not limited to, those

set forth under Item 1A, “Risk Factors,” and elsewhere in our

Annual Report on Form 10-K/A for the year ended December 31, 2023,

as amended on November 1, 2024, or as updated and/or amended by our

other current or periodic filings with the Securities and Exchange

Commission.

The forward-looking statements in this release

are made as of the date of this release and we assume no obligation

to update or revise any forward-looking statement, whether as a

result of new information, future developments, or otherwise,

except as required by the federal securities laws.

Investor Relations:Lisa

Durante(412) 928-3400investors@lbfoster.comL.B. Foster Company415

Holiday DriveSuite 100Pittsburgh, PA 15220

|

L.B. FOSTER COMPANY AND SUBSIDIARIESCONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS(In thousands, except per share data) |

| |

| |

Three Months EndedDecember 31, |

|

Year EndedDecember 31, |

| |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

2023* |

| |

(Unaudited) |

|

(Unaudited) |

|

|

|

Sales of goods |

$ |

116,457 |

|

|

$ |

113,580 |

|

|

$ |

462,659 |

|

|

$ |

475,350 |

|

|

Sales of services |

|

11,726 |

|

|

|

21,297 |

|

|

|

68,106 |

|

|

|

68,394 |

|

|

Total net sales |

|

128,183 |

|

|

|

134,877 |

|

|

|

530,765 |

|

|

|

543,744 |

|

|

Cost of goods sold |

|

86,722 |

|

|

|

85,570 |

|

|

|

351,265 |

|

|

|

368,197 |

|

|

Cost of services sold |

|

12,846 |

|

|

|

20,598 |

|

|

|

61,438 |

|

|

|

63,503 |

|

|

Total cost of sales |

|

99,568 |

|

|

|

106,168 |

|

|

|

412,703 |

|

|

|

431,700 |

|

|

Gross profit |

|

28,615 |

|

|

|

28,709 |

|

|

|

118,062 |

|

|

|

112,044 |

|

|

Selling and administrative expenses |

|

24,421 |

|

|

|

27,263 |

|

|

|

96,398 |

|

|

|

97,623 |

|

|

(Gain) on sale of former joint venture facility |

|

— |

|

|

|

— |

|

|

|

(3,477 |

) |

|

|

— |

|

|

Amortization expense |

|

1,142 |

|

|

|

1,195 |

|

|

|

4,628 |

|

|

|

5,314 |

|

|

Operating income |

|

3,052 |

|

|

|

251 |

|

|

|

20,513 |

|

|

|

9,107 |

|

|

Interest expense - net |

|

1,016 |

|

|

|

1,124 |

|

|

|

4,992 |

|

|

|

5,528 |

|

|

Other expense (income) - net |

|

1,601 |

|

|

|

(147 |

) |

|

|

1,076 |

|

|

|

2,635 |

|

|

Income (loss) before income taxes |

|

435 |

|

|

|

(726 |

) |

|

|

14,445 |

|

|

|

944 |

|

|

Income tax expense (benefit) |

|

712 |

|

|

|

(256 |

) |

|

|

(28,398 |

) |

|

|

(355 |

) |

|

Net (loss) income |

|

(277 |

) |

|

|

(470 |

) |

|

|

42,843 |

|

|

|

1,299 |

|

|

Net loss attributable to noncontrolling interest |

|

(35 |

) |

|

|

(40 |

) |

|

|

(103 |

) |

|

|

(165 |

) |

|

Net (loss) income attributable to L.B. Foster Company |

$ |

(242 |

) |

|

$ |

(430 |

) |

|

$ |

42,946 |

|

|

$ |

1,464 |

|

|

Basic (loss) earnings per common share |

$ |

(0.02 |

) |

|

$ |

(0.04 |

) |

|

$ |

4.01 |

|

|

$ |

0.14 |

|

|

Diluted (loss) earnings per common share |

$ |

(0.02 |

) |

|

$ |

(0.04 |

) |

|

$ |

3.89 |

|

|

$ |

0.13 |

|

|

Average number of common shares outstanding - Basic |

|

10,613 |

|

|

|

10,784 |

|

|

|

10,721 |

|

|

|

10,799 |

|

|

Average number of common shares outstanding - Diluted |

|

10,613 |

|

|

|

10,784 |

|

|

|

11,048 |

|

|

|

10,995 |

|

*As reported in the Company's Current Report on

Form 8-K filed on October 8, 2024, the Company corrected certain

errors in previously reported 2024 quarterly financials, and

certain immaterial errors in 2023 previously reported financials.

All comparisons are based on the corrected historical results.

|

L.B. FOSTER COMPANY AND SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE

SHEETS(In thousands) |

| |

| |

December 31, 2024 |

|

December 31, 2023 |

| |

(Unaudited) |

|

|

|

ASSETS |

|

|

|

|

Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

2,454 |

|

|

$ |

2,560 |

|

|

Accounts receivable - net |

|

64,978 |

|

|

|

53,484 |

|

|

Contract assets |

|

16,720 |

|

|

|

29,489 |

|

|

Inventories - net |

|

70,506 |

|

|

|

73,111 |

|

|

Other current assets |

|

6,947 |

|

|

|

8,711 |

|

|

Total current assets |

|

161,605 |

|

|

|

167,355 |

|

|

Property, plant, and equipment - net |

|

75,374 |

|

|

|

75,579 |

|

|

Operating lease right-of-use assets - net |

|

18,247 |

|

|

|

14,905 |

|

|

Other assets: |

|

|

|

|

Goodwill |

|

31,907 |

|

|

|

32,587 |

|

|

Other intangibles - net |

|

14,801 |

|

|

|

19,010 |

|

|

Deferred income taxes |

|

28,900 |

|

|

|

— |

|

|

Other assets |

|

3,483 |

|

|

|

2,965 |

|

|

TOTAL ASSETS |

$ |

334,317 |

|

|

$ |

312,401 |

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

Current liabilities: |

|

|

|

|

Accounts payable |

$ |

50,083 |

|

|

$ |

39,500 |

|

|

Deferred revenue |

|

10,205 |

|

|

|

12,479 |

|

|

Accrued payroll and employee benefits |

|

15,393 |

|

|

|

16,978 |

|

|

Current portion of accrued settlement |

|

— |

|

|

|

8,000 |

|

|

Current maturities of long-term debt |

|

167 |

|

|

|

102 |

|

|

Other accrued liabilities |

|

12,316 |

|

|

|

17,442 |

|

|

Total current liabilities |

|

88,164 |

|

|

|

94,501 |

|

|

Long-term debt |

|

46,773 |

|

|

|

55,171 |

|

|

Deferred income taxes |

|

1,150 |

|

|

|

1,232 |

|

|

Long-term operating lease liabilities |

|

14,608 |

|

|

|

11,865 |

|

|

Other long-term liabilities |

|

4,608 |

|

|

|

6,797 |

|

|

Stockholders' equity: |

|

|

|

|

Class A Common Stock |

|

111 |

|

|

|

111 |

|

|

Paid-in capital |

|

43,550 |

|

|

|

43,111 |

|

|

Retained earnings |

|

167,579 |

|

|

|

124,633 |

|

|

Treasury stock |

|

(11,208 |

) |

|

|

(6,494 |

) |

|

Accumulated other comprehensive loss |

|

(21,716 |

) |

|

|

(19,250 |

) |

|

Total L.B. Foster Company stockholders’

equity |

|

178,316 |

|

|

|

142,111 |

|

|

Noncontrolling interest |

|

698 |

|

|

|

724 |

|

|

Total stockholders’ equity |

|

179,014 |

|

|

|

142,835 |

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY |

$ |

334,317 |

|

|

$ |

312,401 |

|

|

|

Non-GAAP

Disclosures(unaudited)

This earnings release discloses earnings before

interest, taxes, depreciation, and amortization (“EBITDA”),

adjusted EBITDA, net debt, and organic results adjusted for the

impact of 2024 and 2023 divestiture and product line exit activity.

The Company believes that EBITDA is useful to investors as a

supplemental way to evaluate the ongoing operations of the

Company’s business since EBITDA may enhance investors’ ability to

compare historical periods as it adjusts for the impact of

financing methods, tax law and strategy changes, and depreciation

and amortization. In addition, EBITDA is a financial measure that

management and the Company’s Board of Directors use in their

financial and operational decision-making and in the determination

of certain compensation programs. Adjusted EBITDA adjusts for

certain charges to EBITDA from continuing operations that the

Company believes are unusual, non-recurring, unpredictable, or

non-cash.

In the three and twelve months ended

December 31, 2024, the Company made adjustments to exclude

gains on asset sales, pension termination costs, restructuring

costs, and a legal settlement. In the three and twelve months ended

December 31, 2023, the Company made adjustments to exclude the

loss on a divestiture, expenses from the exit of the bridge grid

deck product line, bad debt provision for customer bankruptcy,

restructuring costs, and contingent consideration adjustments

associated with the VanHooseCo acquisition. The Company believes

the results adjusted to exclude the items listed above are useful

to investors as these items are nonroutine in nature.

The Company views net debt, which is total debt

less cash and cash equivalents, as an important metric of the

operational and financial health of the organization and believes

it is useful to investors as an indicator of its ability to incur

additional debt and to service its existing debt.

Organic sales growth (decline) is a non-GAAP

financial measure of net sales growth (decline) (which is the most

directly comparable GAAP measure) excluding the effects of

divestitures and product line exit activities. Management believes

this measure provides investors with a supplemental understanding

of underlying trends by providing sales growth on a consistent

basis. Management provides organic sales growth (decline) at the

consolidated and segment levels. Portfolio changes are considered

based on their comparative impact over the last twelve months, to

determine the differences in 2023 versus 2024 results due to these

transactions.

Non-GAAP financial measures are not a

substitute for GAAP financial results and should only be considered

in conjunction with the Company’s financial information that is

presented in accordance with GAAP. Quantitative reconciliations of

EBITDA, adjusted EBITDA, net debt, free cash flow, and organic

sales (in thousands, except percentages and ratios) are as

follows:

| |

Three Months EndedDecember 31, |

|

Year EndedDecember 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Adjusted EBITDA Reconciliation |

|

|

|

|

|

|

|

|

Net (loss) income, as reported |

$ |

(277 |

) |

|

$ |

(470 |

) |

|

$ |

42,843 |

|

|

$ |

1,299 |

|

|

Interest expense - net |

|

1,016 |

|

|

|

1,124 |

|

|

|

4,992 |

|

|

|

5,528 |

|

|

Income tax expense (benefit) |

|

712 |

|

|

|

(256 |

) |

|

|

(28,398 |

) |

|

|

(355 |

) |

|

Depreciation expense |

|

2,376 |

|

|

|

2,500 |

|

|

|

9,452 |

|

|

|

9,949 |

|

|

Amortization expense |

|

1,142 |

|

|

|

1,195 |

|

|

|

4,628 |

|

|

|

5,314 |

|

|

Total EBITDA |

$ |

4,969 |

|

|

$ |

4,093 |

|

|

$ |

33,517 |

|

|

$ |

21,735 |

|

|

Gain on asset sale |

|

— |

|

|

|

— |

|

|

|

(4,292 |

) |

|

|

— |

|

|

Restructuring costs |

|

547 |

|

|

|

676 |

|

|

|

1,456 |

|

|

|

676 |

|

|

Pension termination costs |

|

1,722 |

|

|

|

— |

|

|

|

1,722 |

|

|

|

— |

|

|

Legal expense |

|

— |

|

|

|

— |

|

|

|

1,173 |

|

|

|

— |

|

|

Loss on divestiture |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3,074 |

|

|

VanHooseCo contingent consideration |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(26 |

) |

|

Bridge grid deck exit impact |

|

— |

|

|

|

334 |

|

|

|

— |

|

|

|

4,454 |

|

|

Bad debt provision |

|

— |

|

|

|

996 |

|

|

|

— |

|

|

|

1,862 |

|

|

Adjusted EBITDA |

$ |

7,238 |

|

|

$ |

6,099 |

|

|

$ |

33,576 |

|

|

$ |

31,775 |

|

| |

December 31,2024 |

|

September 30,2024 |

|

December 31,2023 |

|

Net Debt Reconciliation |

|

|

|

|

|

|

Total debt |

$ |

46,940 |

|

|

$ |

68,544 |

|

|

$ |

55,273 |

|

|

Less: cash and cash equivalents |

|

(2,454 |

) |

|

|

(3,135 |

) |

|

|

(2,560 |

) |

|

Net debt |

$ |

44,486 |

|

|

$ |

65,409 |

|

|

$ |

52,713 |

|

| |

December 31,2024 |

|

Free Cash Flow Reconciliation |

|

|

Net cash provided by operating activities |

$ |

22,632 |

|

|

Less capital expenditures on property, plant, and equipment |

|

(9,791 |

) |

|

Free cash flow |

$ |

12,841 |

|

|

Change in Consolidated Sales |

Three Months EndedDecember 31, |

|

PercentChange |

|

Year EndedDecember 31, |

|

PercentChange |

|

2023 net sales, as reported |

$ |

134,877 |

|

|

|

|

|

|

$ |

543,744 |

|

|

|

|

Decrease from divestitures and exit |

|

(1,585 |

) |

|

|

(1.2 |

)% |

|

|

(13,819 |

) |

|

|

(2.5 |

)% |

|

Change due to organic sales (decline) growth |

|

(5,109 |

) |

|

|

(3.8 |

)% |

|

|

840 |

|

|

|

0.2 |

% |

|

2024 net sales, as reported |

$ |

128,183 |

|

|

|

|

|

|

$ |

530,765 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Total sales change, 2023 vs 2024 |

$ |

(6,694 |

) |

|

|

(5.0 |

)% |

|

$ |

(12,979 |

) |

|

|

(2.4 |

)% |

|

Change in Infrastructure Solutions Sales |

Three Months EndedDecember 31, |

|

|

PercentChange |

|

2023 net sales, as reported |

$ |

65,583 |

|

|

|

|

|

|

Decrease due to product line exit |

|

(1,585 |

) |

|

|

(2.4 |

)% |

|

Change due to organic sales decline |

|

(14,969 |

) |

|

|

(22.8 |

)% |

|

2024 net sales, as reported |

$ |

49,029 |

|

|

|

|

|

| |

|

|

|

|

|

|

Total sales change, 2023 vs 2024 |

$ |

(16,554 |

) |

|

|

(25.2 |

)% |

|

Change in Rail, Technologies, and Services New

Orders |

Year EndedDecember 31, |

|

PercentChange |

|

2023 new orders, as reported |

$ |

299,584 |

|

|

|

|

Decrease due to divestitures |

|

(6,105 |

) |

|

|

(2.0 |

)% |

|

Change due to organic new orders |

|

14,915 |

|

|

|

5.0 |

% |

|

2024 new orders, as reported |

$ |

308,394 |

|

|

|

| |

|

|

|

|

Total new orders change, 2023 vs 2024 |

$ |

8,810 |

|

|

|

2.9 |

% |

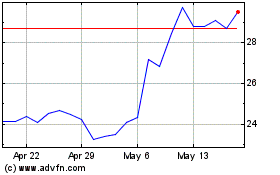

L B Foster (NASDAQ:FSTR)

Historical Stock Chart

From Feb 2025 to Mar 2025

L B Foster (NASDAQ:FSTR)

Historical Stock Chart

From Mar 2024 to Mar 2025