false

0001066923

0001066923

2024-09-30

2024-09-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 30, 2024

Future FinTech Group Inc.

(Exact name of registrant as specified in its

charter)

| Florida |

|

001-34502 |

|

98-0222013 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

Americas Tower, 1177 Avenue of The Americas,

Suite 5100, New York, NY 10036

(Address of principal executive offices, including

zip code)

888-622-1218

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

| Common Stock, par value $0.001 per share |

|

FTFT |

|

Nasdaq Stock Market |

Item 5.02 Departure of Directors or Certain Officers; Election of

Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On September 30, 2024, the Board of Directors

(the “Board”) of Future FinTech Group, Inc. (the “Company”) received a resignation letter from Mr. Johonson (Shun-Pong)

Lau, to resign from the positions as a member of the Board, Chairman of the Audit Committee and a member of Compensation Committee, effective

on September 30, 2024. Mr. Lau’s resignation is due to his other business commitments and not because of any disagreement with the

Board.

On October 1, 2024, the Board appointed Mr. Mingyong

Hu as a member of the Board, Chairman of the Audit Committee and a member of Compensation Committee

of the Board, effective immediately, to fill the vacancy following the resignation of Mr. Lau.

Mr. Mingyong Hu, age 46, was the founder and CFO

of Beijing Xiaowu Supply Chain Technology Co., Ltd. from August 2021 to April 2024. From March 2019 to July 2021, Mr. Hu was the executive

vice president of Zhenghua Guotai International Trading Co., Ltd. From October 2017 to March 2019, Mr. Hu was the general manager of Zhongrong

Dinghui (Beijing) Equity Investment Fund Management Co., Ltd. From January 2016 to October 2017, Mr. Hu was the executive vice president

of Zhongsheng Wantong Equity Investment Fund Management (Beijing) Co., Ltd. From June 2007 to December 2015, Mr. Hu was a partner and

executive deputy general manager of Zhonghao Investment Group Co., Ltd.

Mr. Mingyong Hu received his bachelor’s degree in accounting

from Hunan University in July 2001. Mr. Hu is a Certified Public Accountant of China, and he also holds Certification of Securities Professional

and Fund Qualification Certificate in China.

There are no arrangements or understandings between

Mr. Mingyong Hu and any other person pursuant to which Mr. Hu was appointed as a director of the Company. In addition, there is no family

relationship between Mr. Hu and any director or executive officer of the Company. The Board deems Mr. Hu an “independent director”

as defined by NASDAQ Rule 5605(a)(2). The Board also determines that Mr. Hu an “audit committee financial expert” as defined

by NASDAQ Rule 5605(c)(2)(A) and Item 407(d)(5) of Regulation S-K.

In connection with his appointment, the Company entered into a director

agreement with Mr. Mingyong Hu (the “Agreement”) on October 1, 2024. Under the terms of the Agreement, Mr. Hu shall receive

from the Company a fee in the amount of US$10,000 a year for his director services, payable quarterly. The Agreement imposes certain customary

confidentiality and non-disclosure obligations on Mr. Hu customary for the agreements of this nature. The foregoing description is merely

a summary of the Agreement and therefore does not purport to be complete and is qualified in its entirety by reference to the Agreement,

a copy of which is attached hereto as Exhibit 10.1 and is incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Future FinTech Group Inc. |

| |

|

| Date: October 4, 2024 |

By: |

/s/ Hu Li |

| |

Name: |

Hu Li |

| |

Title: |

Chief Executive Officer |

2

Exhibit 10.1

DIRECTOR AGREEMENT

This Director Agreement (the “Agreement’’)

is made and entered into as of October 1, 2024 (the “Effective Date”), by and between Future FinTech Group Inc. (the “Company”),

and Mingyong Hu, an individual (the “Director”).

I. SERVICES

1.1 Board of Directors. The Company has

appointed the Director to the Company’s Board of Directors (the “Board”), the Chairman of the Audit Committee and a

member of the Compensation Committee of the Board. Director agrees to perform such tasks as may be necessary to fulfill Director’s

obligations as a member of the Board and serve as a director so long as she is duly appointed or elected and qualified in accordance with

the applicable provisions of the Articles of Incorporation, Bylaws and any applicable stockholders’ agreement of the Company and

until such time as she resigns, fails to stand for election, fails to be elected by the stockholders of the Company or is removed from

his position. Director may at any time and for any reason resign or be removed from such position (subject to any other contractual obligation

or other obligation imposed by operation of law), in which event the Company shall have no obligation under this Agreement with respect

to the Director.

1.2 Director Services. Director’s

services to the Company hereunder shall include service on the Board to manage the business of the Company in accordance with applicable

law and stock exchange rules as well as the Articles of Incorporation and Bylaws of the Company, serving on committees of the Board as

appointed and such other services mutually agreed to by Director and the Company (the “Director Services”).

1.3 Member of Committees. Director agrees

to serve as a member of Compensation Committee and the Chairman of the Audit Committee of the Board. The Company and the Director acknowledge

that all official appointments to committees of the Board are made by the Board.

1.4 Expiration Date. This Agreement shall

terminate upon the “Expiration Date”, which shall be the earlier of the date on which Director ceases to be a member of the

Board for any reason, including death, resignation, removal, or failure to be elected by the stockholders of the Company, or the date

of termination of this Agreement in accordance with Section 5.2 hereof.

II. COMPENSATION

2.1 Expense Reimbursement. The Company

shall reimburse Director for all reasonable travel and other out-of-pocket expenses incurred in connection with the Director Services

rendered by Director.

2.2 Fees to Director. The Company agrees

to pay Director a fee of US$10,000 a year for Director Services, service as a member of the Compensation Committee and the Chairman of

the Audit Committee of the Board and other services mutually agreed by the parties. The fee to the Director shall be paid by the Company

quarterly.

III. CONFIDENTIALITY AND NONDISCLOSURE

3.1 Confidentiality. During the term of

this Agreement, and for a period of five (5) years after the Expiration Date, Director shall maintain in strict confidence all information

she has obtained or shall obtain from the Company, which the Company has designated as “confidential” or which is by its nature

confidential, relating to the Company’s business, operations, properties, assets, services, condition (financial or otherwise),

liabilities, employee relations, customers (including customer usage statistics), suppliers, prospects, technology, or trade secrets,

except to the extent such information (i) is in the public domain through no act or omission of the Director, (ii) is required to be disclosed

by law or a valid order by a court or other governmental body, or (iii) is independently learned by Director outside of this relationship

with the Company (the “Confidential Information”).

3.2 Nondisclosure and Nonuse Obligations.

Director will use the Confidential Information solely to perform his obligations for the benefit of the Company hereunder. Director will

treat all Confidential Information of the Company with the same degree of care as Director treats his own Confidential Information, and

Director will use his best efforts to protect the Confidential Information. Director will not use the Confidential Information for his

own benefit or the benefit of any other person or entity, except as being specifically permitted in this Agreement. Director will immediately

give notice to the Company of any unauthorized use or disclosure by or through his, or of which she becomes aware, of the Confidential

Information. Director agrees to assist the Company in remedying any such unauthorized use or disclosure of the Confidential Information.

3.3 Return of Company Property. All materials

furnished to Director by the Company, whether delivered to Director by the Company or made by Director in the performance of Director

Services under this Agreement (the “Company Property”), are the sole and exclusive property of the Company. Director agrees

to promptly deliver the original and any copies of the Company Property to the Company at any time upon the Company’s request. Upon

termination of this Agreement by either party for any reason, Director agrees to promptly deliver to the Company or destroy, at the Company’s

option, the original and any copies of the Company Property. Director agrees to certify in writing that Director has so returned or destroyed

all such Company Property.

IV. COVENANTS OF DIRECTOR

4.1 No Conflict of interest. During the

term of this Agreement, and for a period of one (1) year after the Expiration Date, Director shall not be employed by, own, manage, control

or participate in the ownership, management, operation or control of any person, firm, partnership, corporation or unincorporated association

or entity of any kind that is competitive with the Company or otherwise undertake any obligation inconsistent with the terms hereof. Director

represents that nothing in this Agreement conflicts with Director’s obligations to his current affiliation or other current relationships

with the entity or entities. A business shall be deemed to be “competitive with the Company” for purpose of this Article IV

if and to the extent it engages in the business substantially similar to the Company’s businesses described in its annual report.

The ownership by the Director of not more than 5% of a corporation, partnership or other enterprise shall not constitute a violation hereof.

4.2 Noninterference with Business. During

the term of this Agreement, and for a period of two (2) years after the Expiration Date, Director agrees not to interfere with the business

of the Company in any manner. By way of example and not of limitation, Director agrees not to solicit or induce any employee, independent

contractor, customer or supplier of the Company to terminate or breach his, her or its employment, contractual or other relationship with

the Company.

V. TERM AND TERMINATION

5.1 Term. This Agreement is effective as

of the date first written above and will continue until the Expiration Date.

5.2 Termination. Either party may terminate

this Agreement at any time upon thirty (30) days prior written notice to the other party, or such shorter period as the parties may agree

upon.

5.3 Survival. The rights and obligations

contained in Articles Ill and IV will survive any termination or expiration of this Agreement.

VI. MISCELLANEOUS

6.1 Assignment. Except as expressly permitted

by this Agreement, neither party shall assign, delegate, or otherwise transfer any of its rights or obligations under this Agreement without

the prior written consent of the other party. Subject to the foregoing, this Agreement will be binding upon and inure to the benefit of

the parties hereto and their respective heirs, legal representatives, successors and assigns.

6.2 No Waiver. The failure of any party

to insist upon the strict observance and performance of the terms of this Agreement shall not be deemed a waiver of other obligations

hereunder, nor shall it be considered a future or continuing waiver of the same terms.

6.3 Notices. Any notice required or permitted

by this Agreement shall be in writing and shall be delivered as follows with notice deemed given as indicated: (i) by personal delivery

when delivered personally; (ii) by overnight courier upon written verification of receipt; (iii) by facsimile transmission upon acknowledgment

of receipt of electronic transmission; or (iv) by certified or registered mail, return receipt requested, upon verification of receipt.

Notice shall be sent to the addresses set forth on the signature page of this Agreement or such other address s either party may specify

in writing.

6.4 Severability. Should any provisions

of this Agreement be held by a court of law to be illegal, invalid or unenforceable, the legality, validity and enforceability of the

remaining provisions of this Agreement shall not be affected or impaired thereby.

6.5 Entire Agreement. This Agreement constitutes

the entire agreement between the parties relating to this subject matter and supersedes all prior or contemporaneous oral or written agreements

concerning such subject matter. The terms of this Agreement will govern all Director Services undertaken by Director for the Company.

6.6 Amendments. This Agreement may only

be amended, modified or changed by an agreement signed by the Company and Director. The terms contained herein may not be altered, supplemented

or interpreted by any course of dealing or practices.

6.7 Counterparts. This Agreement may be

executed in two counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument.

6.8 Governing Law. Any disputes arising

from or in connection with this Agreement, and the rights and obligations of the parties hereunder, shall be determined in accordance

with the law of state of New York.

(Signature pages to follow)

lN WITNESS WHEREOF, the parties have executed

this Agreement as of the date first written above.

| Company: Future FinTech Group Inc. |

|

Director: |

| |

|

|

|

|

| By: |

/s/ Hu Li |

|

By: |

/s/ Mingyong Hu |

| Name: |

Hu Li, Chief Executive Officer |

|

Name: |

Mingyong Hu |

| Address: |

Americas Tower, 1177 Avenue of The |

|

Address: |

|

| |

Americas |

|

|

|

| |

Suite 5100, New York, NY |

|

|

|

4

v3.24.3

Cover

|

Sep. 30, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 30, 2024

|

| Entity File Number |

001-34502

|

| Entity Registrant Name |

Future FinTech Group Inc.

|

| Entity Central Index Key |

0001066923

|

| Entity Tax Identification Number |

98-0222013

|

| Entity Incorporation, State or Country Code |

FL

|

| Entity Address, Address Line One |

Americas Tower

|

| Entity Address, Address Line Two |

1177 Avenue of The Americas

|

| Entity Address, Address Line Three |

Suite 5100

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10036

|

| City Area Code |

888

|

| Local Phone Number |

622-1218

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

FTFT

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

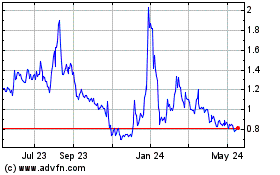

Future FinTech (NASDAQ:FTFT)

Historical Stock Chart

From Mar 2025 to Apr 2025

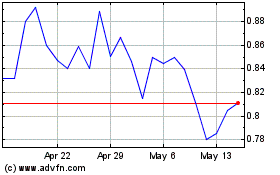

Future FinTech (NASDAQ:FTFT)

Historical Stock Chart

From Apr 2024 to Apr 2025