FORM

6-K

U.S.

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES

EXCHANGE ACT OF 1934

For

the Month of November , 2024

Commission

File Number 0-51504

GENETIC

TECHNOLOGIES LIMITED

(Exact

Name as Specified in its Charter)

N/A

(Translation

of Registrant’s Name)

Suite

7, Level 1, 321 Chapel Street

Prahran Victoria 3181

Australia

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

This

Report on Form 6-K (including exhibits thereto) is hereby incorporated by reference into the registrant’s Registration Statement

on Form F-3 (File Nos. 333-276168), to be a part thereof

from the date on which this report is submitted, to the extent not superseded by documents or reports subsequently filed or furnished.

Exhibit

Index

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused the Report to be signed on its behalf by the

undersigned, thereunto duly authorized.

Date:

November 20, 2024

| GENETIC

TECHNOLOGIES LIMITED |

|

| |

|

| By: |

/s/

Mark Ziirsen |

|

| Name: |

Mark

Ziirsen |

|

| Title: |

Company

Secretary |

|

Exhibit 99.1

| ASX Announcement |

20 November 2024 |

Appointment of Voluntary Administrators to Genetic

Technologies Limited

(ASX Code: GTG; Nasdaq: GENE)

Appointment of Voluntary Administrators

Genetic Technologies Limited (Administrators Appointed)

(ASX: GTG; NASDAQ: GENE) (“Genetic Technologies” or the “Company”) announces that its directors

have resolved to appoint Ross Blakeley and Paul Harlond of FTI Consulting as Joint and Several Voluntary Administrators (“Administrators”)

pursuant to section 436A of the Corporations Act 2001 (Cth), effective 20 November 2024.

Why the appointment of Administrators?

As previously announced to the ASX and investors on

26 July 2024, Genetic Technologies commenced a restructure to focus on USA sales growth, strategic investment and distribution agreements.

As part of this restructure, the Company has been

in extensive discussions and negotiations with investors, financiers and other parties to bring funding and distribution agreements into

the Company, including via an Entitlement Offer to raise a minimum of $2 million and up to a maximum of $3.85 million (“Offer”).

The Board also assumed executive roles to reduce operating

costs and cash burn, with the Board agreeing to defer their director fees until the end of 2024 (at the earliest) and, subject to shareholder

approval, to take their director fees in equity.

Despite the above, the Company has been unsuccessful

in raising the minimum required capital under the Offer and alternative strategic partnerships and the Board has determined that voluntary

administration is now the most appropriate way forward.

Strategy moving forward

The Administrators intend to operate on a business-as-usual

basis in the short term while pursuing an accelerated dual-track strategy to either sell or recapitalise Genetic Technologies’ business

and intellectual property. Interested parties should contact the Administrators.

While undertaking this process, the Administrators

will collaborate closely with the Company’s Directors and Executive, subsidiaries (which are not directly subject to voluntary administration),

employees, customers, and suppliers to maximise the financial outcomes for all stakeholders.

During the Administration period, trading in the Company’s

listed securities on the ASX and NASDAQ will remain suspended.

FTI Consulting (Australia)

Pty Limited

ABN 49 160 397 811 | ACN 160

397 811 | AFSL Authorised Representative # 001269325

Level 50, Bourke Place | 600

Bourke Street | Melbourne VIC 3000 | Australia

Postal Address | GPO Box 538

| Melbourne VIC 3001 | Australia

+61 3 9604 0600 telephone | +61

3 9604 0699 fax | fticonsulting.com

Liability limited by a scheme

approved under Professional Standards Legislation.

p. 2 of 2

First statutory meeting of creditors

A first statutory meeting of creditors must be held

within eight business days after commencement of the Administration, therefore by 2 December 2024.

Meeting notices setting out the time and location

for the first meeting of creditors will be distributed to the Company’s creditors by Friday 22 November 2024.

Contact details and further information

Information will be uploaded to the FTI Consulting

website: https://www.fticonsulting.com/creditors

This announcement has been approved by the Administrators.

For all further inquiries please

contact:

| Media enquiries |

Creditor enquiries |

| |

|

|

David Whitely

Strategic Communications

+61 475 110 928

david.whitely@fticonsulting.com |

GeneticTechnologies@fticonsulting.com |

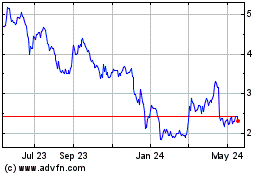

Genetic Technologies (NASDAQ:GENE)

Historical Stock Chart

From Feb 2025 to Mar 2025

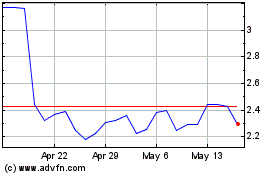

Genetic Technologies (NASDAQ:GENE)

Historical Stock Chart

From Mar 2024 to Mar 2025