false

0001556266

CN

0001556266

2024-07-15

2024-07-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

July 15, 2024

BAIYU Holdings, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-36055 |

|

45-4077653 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

139, Xinzhou 11th Street, Futian District

Shenzhen, Guangdong, PRC 518000

(Address of Principal Executive Offices)

+86 (0755) 82792111

(Issuer’s telephone number)

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation to the registrant under any of the following provisions:

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 |

|

BYU |

|

Nasdaq Capital Market |

Item 5.02 Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Resignation of Xiangjun Wang

On July 15, 2024, Xiangjun

Wang, an independent director of the board of directors (the “Board”) of BAIYU Holdings, Inc. (the “Company”),

notified the Company of his decision to resign as a director of the Board of the Company, including as to his membership on the Audit

Committee of the Board (the “Audit Committee”), the Compensation Committee of the Board (the “Compensation

Committee”), as well as his membership on, and his office as the Chairman of, the Nominating and Governance Committee of the

Board (the “Nominating and Governance Committee”), effective July 15, 2024. Mr. Wang’s resignation was for various

personal reasons, and was not on account of any disagreement with the Board or the Company concerning any matter relating to the Company’s

operations, policies, or practices, or otherwise.

Appointment of Rongrong (Rita) Jiang

On July 15, 2024, the Board

of the Company, acting unanimously and upon the recommendation of the Nominating and Governance Committee, appointed Ms. Rongrong (Rita)

Jiang, to serve as a director of the Board, and a member of the Audit Committee, the Compensation Committee, and the Nominating and Governance

Committee, respectively, filling the vacancies occurring as a result of the above-noted resignation, effective July 15, 2024.

For her service on the Board,

Ms. Jiang will receive annual compensation of 100,000 shares of the Company’s capital stock pursuant to the terms and conditions

set forth in that certain letter agreement entered into by and between the Company and Ms. Jiang.

Ms. Jiang does not have any

material interest in any transaction requiring disclosure under Item 404(a) of Regulation S-K, and there are no arrangements or understandings

between Ms. Jiang and any other person pursuant to which she was appointed as a director of the Board (including as to her membership

on the Audit Committee, the Compensation Committee, and the Nominating and Governance Committee).

The Board has determined that

Ms. Jiang (i) is independent under Nasdaq’s listing standards and applicable law, and (ii) has the requisite level of financial

literacy required by Nasdaq’s listing standards for service on the Audit Committee.

The biography of Ms. Jiang

is set forth below.

Rongrong (Rita) Jiang, CFA,

is a professional with over a decade of expertise in entrepreneurship, senior executive management, corporate finance, management consulting,

and venture capital investment. As a founding partner of Ginger Capital LLC since April 2011, Ms. Jiang has been instrumental in providing

comprehensive investment and strategic advisory services, focusing on market expansion, cross-border M&A, financial reporting, IPO

preparation, and strategic partnerships. Additionally, Ms. Jiang serves as the Chief Financial Officer for Broad Capital Acquisition Corp,

a NASDAQ-listed blank check company. Ms. Jiang co-founded Whitestone Investment Management LLC in April 2015, where she leads early-stage

venture investments in technology companies worldwide, fostering cross-border collaborations and mentoring startups. Her previous roles

include being a director at Woodlake Group, Executive Vice President of Finance at V Media Corp., and Vice President at Hayden Communications

International. Ms. Jiang has also held board positions at Bionik (China) Medical Technology Co., Ltd, and Jade International Financing

and Leasing Co., Ltd. She holds a CFA charter, a Bachelor of Science from the University of Science and Technology of China, and a Master

of Science in Chemistry from Northwestern University, Chicago.

Appointment of Donghong Xiong as Chairman of

the Nominating and Governance Committee

Effective as of July 15, 2024

and upon the recommendation of the Nominating and Governance Committee, Donghong Xiong, a current director and member of the Nominating

and Governance Committee, will assume responsibilities as the Chairman of the Nominating and Governance Committee.

Item 9.01 Financial Statement and Exhibits

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

BAIYU HOLDINGS, INC. |

| |

|

|

| Date: July 17, 2024 |

By: |

/s/ Renmei

Ouyang |

| |

Name: |

Renmei Ouyang |

| |

Title: |

Chief Executive Officer |

2

Exhibit 10.1

BAIYU Holdings, Inc.

3607 Avenida Madera, Unit B

Bradenton, FL 34210

941-592-5888

July 15, 2024

Re: Director Offer Letter

Dear Ms. Rongrong (Rita) Jiang,

BAIYU Holdings, Inc., a Delaware

corporation (the “Company”), is pleased to offer you a position as a member of its Board of Directors (the “Board”).

We believe your background and experience will be a significant asset to the Company and we look forward to your participation on the

Board. Should you choose to accept this position as a member of the Board, this letter agreement (the “Agreement”)

shall constitute an agreement between you and the Company and contains all the terms and conditions relating to the services you agree

to provide to the Company.

1. Term. This

Agreement is effective upon your acceptance and signature below through the last date of your current term as a member of the Board. This

Agreement shall be automatically renewed on the date of your reelection as a member of the Board for the period of such new term unless

the Board determines not to renew this Agreement.

2. Services. You

agree, subject to your continued status as a director, to serve on the Company’s Board, and to serve as a member of the Audit Committee

of the Board and the Compensation Committee of the Board, as well as a member of the Nominating and Governance Committee of the Board,

and to provide those services required of a director and/or member of applicable committee of the Board under (w) the Company’s

Certificate of Incorporation, Bylaws, and charter of the applicable committee of the Board, as each may be amended from time to time,

(x) the Delaware General Corporation Law, the federal securities laws and other state and federal laws and regulations, as applicable,

(y) the rules and regulations of the Securities and Exchange Commission, and (z) any stock exchange or quotation system on which the Company’s

securities may be traded from time to time (collectively, the “Duties”). During the term of this Agreement, you shall

attend and participate in such number of meetings of the Board and of the committee(s) of which you are a member as regularly or specially

called. You may attend and participate at each such meeting via teleconference, video conference or in person. You shall consult with

the other members of the Board and committee(s) as necessary via telephone, electronic mail or other forms of correspondence.

3. Compensation.

In consideration for your services provided pursuant to Section 2 of this Agreement, you will receive a monthly grant of 8,333 shares

(100,000 shares annually) of the Company’s common stock, par value $0.001 per share, for each month of your services to the Company

during the term of this Agreement. The Company will reimburse you for reasonable, documented, and out-of-pocket business related expenses

incurred in connection with your Duties, provided such expenses are approved by the Company in advance. Invoices for expenses, with receipts

attached, shall be submitted.

4. No

Assignment. Because of the personal nature of the services to be rendered by you, this Agreement may not be assigned

by you without the prior written consent of the Company.

5. Confidential

Information; Non-Disclosure. In consideration of your access to certain Confidential Information (as defined below)

of the Company, in connection with your business relationship with the Company, you hereby represent and agree as follows:

(a) Definition. For

purposes of this Agreement the term “Confidential Information” means:

(i) Any

information which the Company possesses that has been created, discovered or developed by or for the Company, and which has or could have

commercial value or utility in the business in which the Company is engaged; or

(ii) Any

information which is related to the business of the Company and is generally not known by non-Company personnel.

(iii) Confidential

Information includes, without limitation, trade secrets and any information concerning services provided by the Company, concepts, ideas,

improvements, techniques, methods, research, data, know-how, software, formats, marketing plans, and analyses, business plans and analyses,

strategies, forecasts, customer and supplier identities, characteristics and agreements.

(b) Exclusions. Notwithstanding

the foregoing, the term Confidential Information shall not include:

(i) Any

information which becomes generally available to the public other than as a result of a breach of the confidentiality portions of this

Agreement, or any other agreement requiring confidentiality between the Company and you;

(ii) Information

received from a third party in rightful possession of such information who is not restricted from disclosing such information; and

(iii) Information

known by you prior to receipt of such information from the Company, which prior knowledge can be documented.

(c) Documents. You

agree that, without the express written consent of the Company, you will not remove from the Company’s premises, any notes, formulas,

programs, data, records, machines or any other documents or items which in any manner contain or constitute Confidential Information,

nor will you make reproductions or copies of same. You shall promptly return any such documents or items, along with any reproductions

or copies, to the Company upon the earliest of Company’s demand or expiration or termination of this Agreement

(d) Confidentiality. You

agree that you will hold in trust and confidence all Confidential Information and will not disclose to others, directly or indirectly,

any Confidential Information or anything relating to such information without the prior written consent of the Company, except as maybe

necessary in the course of your business relationship with the Company. You further agree that you will not use any Confidential Information

without the prior written consent of the Company, except as may be necessary in the course of your business relationship with the Company,

and that the provisions of this paragraph (d) shall survive termination of this Agreement.

(e) Ownership. You

agree that Company shall own all right, title and interest (including patent rights, copyrights, trade secret rights, mask work rights,

trademark rights, and all other intellectual and industrial property rights of any sort throughout the world) relating to any and all

inventions (whether or not patentable), works of authorship, mask works, designations, designs, know-how, ideas and information made or

conceived or reduced to practice, in whole or in part, by you during the term of this Agreement and that arise out of your Duties (collectively,

“Inventions”) and you will promptly disclose and provide all Inventions to the Company. You agree to assist the Company,

at its expense, to further evidence, record and perfect such assignments, and to perfect, obtain, maintain, enforce, and defend any rights

assigned.

6. Non-Competition.

You agree and undertake that you will not, so long as you are a member of the Board and for a period of 12 months following termination

of this Agreement for whatever reason, directly or indirectly as owner, partner, joint venture, stockholder, employee, broker, agent principal,

corporate officer, director, licensor or in any other capacity whatsoever, engage in, become financially interested in, be employed by,

or have any connection with any business or venture that is engaged in any activities involving services or products which compete, directly

or indirectly, with the services or products provided or proposed to be provided by the Company or its subsidiaries or affiliates; provided, however,

that you may own securities of any public corporation which is engaged in such business but in an amount not to exceed at any one time,

one percent of any class of stock or securities of such company, so long as you has no active role in the publicly owned company as director,

employee, consultant or otherwise.

7. Non-Solicitation. So

long as you are a member of the Board and for a period of 12 months thereafter, you shall not directly or indirectly solicit for employment

any individual who was an employee of the Company during your tenure.

8. Director’s

Representations and Warranties. You hereby represent and warrant that no other party has exclusive rights to your services in

the specific areas in which the Company is conducting business and that you are in no way compromising any rights or trust between any

other party and you or creating a conflict of interest as a result of your participation on the Board. You also represent, warrant, and

covenant that so long as you serve on the Board, you will not enter into another agreement that will create a conflict of interest with

this Agreement or the Company. You further represent, warrant, and covenant that you will comply with the Company’s Certificate

of Incorporation (as amended), Bylaws (as amended), policies and guidelines, all applicable laws and regulations, including Sections 10

and 16 of the Securities Exchange Act of 1934, as amended, and listing rules of The Nasdaq Stock Market LLC or any other stock exchanges

on which the Company’s securities may be traded; that you shall promptly notify the Board of any circumstances that may potentially

impair your independence as a director of the Company; and that you shall promptly notify the Board of any arrangements or agreements

relating to compensation provided by a third party to you in connection with your status as a director or director nominee of the Company

or the services requested under this Agreement.

9. Termination. This

Agreement shall automatically terminate upon your death or upon your resignation or removal from, or failure to win election or reelection

to, the Board. In the event of expiration or termination of this Agreement, you agree to return or destroy any materials transferred to

you under this Agreement except as may be necessary to fulfill any outstanding obligations hereunder. Upon the expiration or termination

of this Agreement, your right to compensation hereunder will terminate, subject to the Company’s obligations to make any fees and

expenses payments or pay other compensation required pursuant to Section 3, in each case, due up to the date of the expiration or termination.

Notwithstanding the expiration or termination of this Agreement, neither party hereto shall be released hereunder from any liability or

obligation to the other which has already accrued as of the time of such expiration or termination or which thereafter might accrue in

respect of any act or omission of such party prior to such expiration or termination. Sections 5, 6, 7, 9, 10, 11, 12, 13, 14, 15 and

any other provisions of this Agreement which by their nature should survive termination, cancellation, or expiration of this Agreement,

shall so survive.

10. Governing

Law. All questions with respect to the construction and/or enforcement of this Agreement, and the rights and obligations

of the parties hereunder, shall be determined in accordance with the law of the State of New York applicable to agreements made and to

be performed entirely in the State of New York.

11. Entire

Agreement; Amendment; Waiver; Counterparts. This Agreement expresses the entire understanding with respect to the

subject matter hereof and supersedes and terminates any prior oral or written agreements with respect to the subject matter hereof. Any

term of this Agreement may be amended and observance of any term of this Agreement may be waived only with the written consent of the

parties hereto. Waiver of any term or condition of this Agreement by any party shall not be construed as a waiver of any subsequent breach

or failure of the same term or condition or waiver of any other term or condition of this Agreement. The failure of any party at any time

to require performance by any other party of any provision of this Agreement shall not affect the right of any such party to require future

performance of such provision or any other provision of this Agreement. This Agreement may be executed in separate counterparts each of

which will be an original and all of which taken together will constitute one and the same agreement, and may be executed using facsimiles

of signatures, and a facsimile of a signature shall be deemed to be the same, and equally enforceable, as an original of such signature.

12. Indemnification.

The Company shall, to the maximum extent provided under applicable law, indemnify and hold you harmless from and against any expenses,

including reasonable attorney’s fees, judgments, fines, settlements and other legally permissible amounts (“Losses”),

incurred in connection with any proceeding arising out of, or related to, your performance of your Duties, other than any such Losses

incurred as a result of your negligence or willful misconduct. The Company shall advance to you any documented and reasonable expenses,

including reasonable attorneys’ fees and costs of settlement, incurred in defending any such proceeding to the maximum extent permitted

by applicable law. Such costs and expenses incurred by you in defense of any such proceeding shall be paid by the Company in advance of

the final disposition of such proceeding promptly upon receipt by the Company of (a) written request for payment; (b) appropriate documentation

evidencing the incurrence, amount and nature of the costs and expenses for which payment is being sought; and (c) an undertaking adequate

under applicable law made by or on your behalf to repay the amounts so advanced if it shall ultimately be determined pursuant to any non-appealable

judgment or settlement that you are not entitled to be indemnified by the Company. The Company will also provide you with director and

officer liability insurance coverage to the extent provided to the directors of the Company generally.

13. Nature

of Relationship. You are an independent contractor and will not be deemed as an employee of the Company for any purposes by virtue

of this Agreement. You shall be solely responsible for the payment or withholding of all federal, state, or local income taxes, social

security taxes, unemployment taxes, and any and all other taxes relating to the compensation you earn under this Agreement. You shall

not, in your capacity as a director of the Company, enter into any agreement or incur any obligations on the Company’s behalf, without

appropriate Board action.

14. Severability.

Any provision of this Agreement which is determined to be invalid or unenforceable shall not affect the remainder of this Agreement, which

shall remain in effect as though the invalid or unenforceable provision had not been included herein, unless the removal of the invalid

or unenforceable provision would substantially defeat the intent, purpose or spirit of this Agreement.

15. Acknowledgement. You

accept this Agreement subject to all the terms and provisions of this Agreement. You agree to accept as binding, conclusive, and final

all decisions or interpretations of the Board of Directors of the Company of any questions arising under this Agreement.

[Signature Page Follows]

The Agreement has been executed and delivered

by the undersigned and is made effective as of the date set first set forth above.

Sincerely,

| BAIYU HOLDINGS, INC. |

|

| |

|

|

| By: |

/s/ Renmei Ouyang |

|

| Name: |

Renmei Ouyang |

|

| Title: |

Chief Executive Officer |

|

| AGREED AND ACCEPTED: |

|

| |

|

|

| RONGRONG (RITA) JIANG |

|

| |

|

|

| By: |

/s/

Rongrong (Rita) Jiang |

|

[Signature Page to Director Offer Letter]

v3.24.2

Cover

|

Jul. 15, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 15, 2024

|

| Entity File Number |

001-36055

|

| Entity Registrant Name |

BAIYU Holdings, Inc.

|

| Entity Central Index Key |

0001556266

|

| Entity Tax Identification Number |

45-4077653

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

139, Xinzhou 11th Street

|

| Entity Address, Address Line Two |

Futian District

|

| Entity Address, City or Town |

Shenzhen

|

| Entity Address, Country |

CN

|

| Entity Address, Postal Zip Code |

518000

|

| City Area Code |

0755

|

| Local Phone Number |

82792111

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001

|

| Trading Symbol |

BYU

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

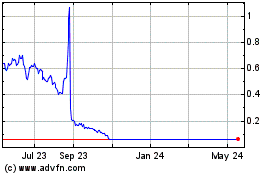

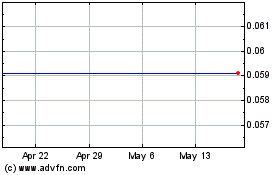

TD (NASDAQ:GLG)

Historical Stock Chart

From Oct 2024 to Nov 2024

TD (NASDAQ:GLG)

Historical Stock Chart

From Nov 2023 to Nov 2024