Compelling clinical results for GLPG5101 in

three NHL indications underscore potential of innovative

decentralized cell therapy platform to deliver fresh, fit cells, in

median seven days vein-to-vein

Focusing on accelerating GLPG5101 program,

expanding to eight indications with significant unmet needs, and

aiming for first approval by 2028

Plan to separate into two companies listed

on Nasdaq and Euronext, with SpinCo to build a pipeline through

deals and Galapagos to advance novel cell therapies for cancers of

high unmet need

Management to host

conference call tomorrow, February 13,

2025, at 14:00 CET / 8:00 am ET

Mechelen, Belgium; February 12, 2025,

22:01 CET; regulated information – Galapagos NV (Euronext

& NASDAQ: GLPG), a global biotechnology company dedicated to

transforming patient outcomes through life-changing science and

innovation, today reported its financial results for the full year

2024 and provided an update on the fourth quarter 2024 and its

year-to-date performance.

“We are making significant strides to position

Galapagos for long-term value creation and to advance our global

leadership in cell therapy by addressing high unmet medical needs

in oncology,” said Paul Stoffels1, MD, CEO and Chair of the Board

of Directors of Galapagos. “With the FDA’s IND clearance and the

compelling clinical data we presented at ASH for our lead CD19

CAR-T candidate, GLPG5101, in three relapsed/refractory non-Hodgkin

lymphoma indications, there is strong validation of our innovative,

globally scalable cell therapy platform to deliver fresh, stem-like

early memory CAR T-treatment in a median vein-to-vein time of seven

days. These advantages further reinforce our conviction that

GLPG5101 can drive positive outcomes for patients around the world

with rapidly progressive diseases, including those who are at risk

of rapid clinical deterioration.

“In line with our goal of becoming a more

focused and streamlined organization, we are optimizing our CD19

CAR-T portfolio by prioritizing resources where they can have the

greatest impact. We are expanding the development of GLPG5101, our

most advanced asset by extending its reach into additional

aggressive B-cell malignancies, including Richter transformation of

CLL, and are taking action to expand into double-refractory CLL. We

are deprioritizing activities related to GLPG5201, our second CD19

CAR-T candidate, pending the advancement of GLPG5101 in those

additional indications. At the same time, we are advancing the

Phase 1/2 study of GLPG5301 in multiple myeloma while strengthening

our early-stage pipeline of next-generation, multi-targeting,

armored cell therapies for hematological and solid tumors,

accelerating innovation and driving long-term value creation.

Additionally, through our partnership with Adaptimmune, we are

progressing uza-cel, a TCR-T candidate for head and neck cancer,

reinforcing our commitment to delivering transformational

therapies,” concluded Dr. Stoffels.

Thad Huston, CFO and COO of Galapagos, added,

“We continue to advance our strategic plan to separate into two

publicly traded companies to be listed on Euronext and Nasdaq,

Galapagos and SpinCo, with the aim to complete the transaction by

mid-2025. Our Board, supported by the Nomination Committee, is

actively working on recruiting a seasoned executive team and

independent non-executive directors with a proven track record in

biotech company-building and strategic transaction execution for

SpinCo. We thank our shareholders, employees, and all stakeholders

for their continued support and dedication as we work through this

planned transition. We ended 2024 with €3.3 billion in cash and

cash equivalents, of which approximately €2.45 billion will be used

to capitalize SpinCo, the newly to be formed spin-off company,

which will focus on building a pipeline of innovative medicines

through transformational transactions. At the time of the

separation, Galapagos will have approximately €500 million in cash

and autonomy to unlock the full potential of its differentiating

cell therapy platform and to accelerate its cell therapy pipeline

of potentially best-in-class assets, addressing high unmet medical

needs in oncology. Galapagos expects to have a normalized annual

cash burni in the range of €175 million to €225 million, excluding

restructuring costs, upon separation.”

Fourth Quarter 2024 and Recent Business

Update

CELL THERAPY PORTFOLIO

GLPG5101 (CD19 CAR-T) program to expand

to eight aggressive B-cell malignancies, broadening patient reach

and impact

- New data from the ongoing ATALANTA-1 Phase 1/2 study presented

at ASH 2024 included updated data on patients with mantle cell

lymphoma (MCL), marginal zone lymphoma (MZL) / follicular lymphoma

(FL), and diffuse large B-cell lymphoma (DLBCL). As of the data

cut-off on April 25, 2024, 49 patients had received cell therapy

infusion, and safety and efficacy results were available for 45

patients and 42 patients, respectively. The results are summarized

below:

- High objective response rates (ORR) and complete response rates

(CRR) were observed in the pooled Phase 1 and Phase 2 efficacy

analysis set, split by indication:

- In MCL, all 8 of 8 efficacy-evaluable patients responded to

treatment (ORR and CRR 100%).

- In MZL/FL, objective and complete responses were observed in 20

of 21 efficacy-evaluable patients (ORR and CRR 95%).

- In DLBCL, 9 of 13 efficacy-evaluable patients responded to

treatment (ORR 69%), with 7 patients achieving a complete response

(CRR 54%). Of the 7 patients with DLBCL who received the

higher dose, 6 responded to treatment (ORR 86%) with 5 achieved a

complete response (CRR 71%).

- Of the 15 minimal residual disease (MRD)-evaluable patients

with a complete response, 12 patients (80%) achieved MRD negativity

and remained in complete response at data cut-off.

- The median study follow-up was 3.3 months for FL and DLBCL with

a range of 0.9-21.2 months, and 4.4 months for MCL with a range of

1-24.4 months.

- GLPG5101 showed an encouraging safety profile, with the

majority of Grade ≥ 3 treatment emergent adverse events being

hematological. One case of CRS Grade 3 was observed in Phase 1

and one case of ICANS Grade 3 was observed in Phase 2.

- 96% of patients (47 of 49) received an infusion with fresh,

fit, stem-like early memory CD19 CAR T-cell therapy, with 91.5% (43

of 47) achieving a vein-to-vein time of seven days, thereby

avoiding cryopreservation, and eliminating the need for bridging

therapy.

- Strong and consistent in vivo CAR-T expansion levels

and products consisting of stem-like, early memory phenotype T

cells were observed in all doses tested.

- Beyond MCL, MZL/FL and DLBCL, the ATALANTA-1 study also

includes high-risk first line DLBCL, Burkitt lymphoma (BL), and

primary CNS lymphoma (PCNSL). Patient recruitment is ongoing in

Europe, and with U.S. Food and Drug Administration (FDA)

Investigational New Drug (IND) application clearance secured, and

leading cancer centers in Boston engaged, we continue to work

towards enrolling the first U.S. patient into the

study. Boston-based Landmark Bio is operational and serves as

the decentralized manufacturing unit (DMU) for ATALANTA-1.

Galapagos aims to present additional new data at a medical meeting

in 2025.

- Building on these encouraging data and in line with its goal to

streamline the business, Galapagos is focusing its resources on

accelerating GLPG5101 as its flagship CD19 CAR-T program, and

pending the advancement of GLPG5101 in additional indications, is

deprioritizing activities for GLPG5201, the Company’s second CD19

CAR-T candidate. With the addition of double-refractory chronic

lymphocytic leukemia (CLL) and Richter transformation (RT) of CLL,

both indications with significant unmet needs, GLPG5101 would be

developed across eight aggressive B-cell malignancies, further

unlocking its broad potential to address significant unmet medical

needs.

- Galapagos is preparing to initiate pivotal development in 2026

and is aiming for a first approval in 2028. To support those goals,

and supported by its strong collaborations with Lonza (for the

Cocoon® platform) and Thermo Fisher Scientific (for the development

of an ultra-rapid PCR sterility test together with miDiagnostics),

the Company is scaling up manufacturing capacity at its existing

DMUs in the U.S., including Landmark Bio (Boston area), Excellos

(San Diego area), and recently signed Catalent (New Jersey, New

York, and surrounding areas), as well as at multiple DMUs in key

European markets. Additional DMUs will be integrated into the

Company’s network to ensure sufficient capacity to support its

future pivotal studies in key regions.

GLPG5301 (BCMA CAR-T) in

relapsed/refractory multiple myeloma (R/R MM)

- The Phase 1 part of the PAPILIO-1

Phase 1/2 is currently recruiting patients. Upon completion of

Phase 1 and analysis of the data, Galapagos will evaluate the most

appropriate development strategy and next steps. The Company aims

to present Phase 1 data at a future medical conference.

Early-stage pipeline comprising ten

potential best-in-class cell therapies in hematology and solid

tumors

- Galapagos’ proprietary early-stage

pipeline provides a strong foundation for sustainable

value-creation. It comprises multi-targeting, armored cell therapy

constructs designed to improve potency, prevent resistance, and

improve persistence of CAR-Ts in hematological and solid tumors.

The Company plans to initiate clinical development of a novel CAR-T

candidate in 2025 and expand its clinical pipeline of

next-generation programs with the addition of two new clinical

assets in 2026.

- Galapagos presented strong

preclinical proof-of-concept data at ASH for uza-cel, a MAGE-A4

directed TCR T-cell therapy candidate in head and neck cancer, in

partnership with Adaptimmune. The data demonstrated that Galapagos’

decentralized cell therapy manufacturing platform can produce

uza-cel with features that may result in improved efficacy and

durability of response in the clinic compared with the existing

manufacturing procedure. Preparations are ongoing with the goal to

start clinical development in 2026.

SMALL MOLECULE PORTFOLIO

- Galapagos is advancing its TYK2

inhibitor, GLPG3667, in two Phase 3-enabling studies for systemic

lupus erythematosus (SLE) and dermatomyositis (DM). Screening for

the SLE study was completed in January 2025, ahead of schedule.

Topline results for the entire GLPG3667 program are anticipated in

the first half of 2026.

- Following the planned strategic

reorganization as announced early this year, Galapagos is seeking

potential partners to take over its small molecule assets,

including GLPG3667 for SLE, DM, and other potential auto-immune

indications.

POST-PERIOD EVENTS

- On January 8, 2025, Galapagos

announced a plan to separate into two publicly traded entities

aimed at unlocking shareholder value and creating strategic focus.

- SpinCo (to be

named later) will be a newly formed company with approximately

€2.45 billion in current Galapagos cash, focusing on building a

pipeline of innovative medicines through transformational

transactions, with Gilead as a strategic partner.

- SpinCo will establish a Board of

Directors with the majority of its members being independent.

SpinCo will be led by a small seasoned executive team with a proven

track record in biotechnology company-building and strategic

transaction execution.

- SpinCo plans to apply for listing

on Nasdaq and Euronext, with all Galapagos shareholders receiving

SpinCo shares on a pro rata basis, proportional to their ownership

of Galapagos shares as of a record date to be established.

- As of the separation, the global

Option, License and Collaboration Agreement with Gilead (OLCA) will

be assumed by SpinCo. For future transactions, Gilead has committed

to negotiating in good faith amendments to the OLCA on a

transaction-by-transaction basis to achieve positive value for

SpinCo and all of its shareholders. To date, Gilead has

demonstrated flexibility in amending the key financial and

structural terms of the OLCA to support Galapagos in its assessment

of potential business development opportunities to enable value

creation. We expect incentives between SpinCo and Gilead to be

aligned such that SpinCo can pursue high-quality assets, fund

development and invest in its portfolio, so that potential

significant future value creation is retained for SpinCo and all of

its shareholders.

- Galapagos will

focus on unlocking the broad potential of its innovative

decentralized cell therapy manufacturing platform, enabling the

delivery of fresh, early stem-like memory cell therapy within a

median vein-to-vein time of seven days, and advancing its cell

therapy pipeline of potentially best-in-class assets which will not

be subject to the OLCA as of the separation. Galapagos will have

approximately €500 million in cash at the expected time of the

spin-off of SpinCo, providing it a cash runway to 2028. To advance

its goal of becoming a global leader in cell therapy in oncology

and as part of its focused strategy and optimized capital

allocation, Galapagos will seek partners for its small molecule

assets.

Financial performance

Full year 2024 key figures

(consolidated)(€ millions, except basic & diluted

earnings per share)

|

|

December 31, 2024 |

December 31, 2023 |

% Change |

|

Supply revenues |

34.8 |

- |

|

|

Collaboration revenues |

240.8 |

239.7 |

+0% |

|

Total net revenues |

275.6 |

239.7 |

+15% |

|

Cost of sales |

(34.8) |

- |

|

|

R&D expenses |

(335.5) |

(241.3) |

+39% |

|

G&Aii and S&Miii expenses |

(134.4) |

(134.0) |

+0% |

|

Other operating income |

40.8 |

47.3 |

-14% |

|

Operating loss |

(188.3) |

(88.3) |

|

|

Fair value adjustments and net exchange differences |

95.8 |

16.3 |

|

|

Net other financial result |

89.4 |

77.6 |

+15% |

|

Income taxes |

1.8 |

(9.6) |

|

|

Net loss from continuing operations |

(1.3) |

(4.0) |

|

|

Net profit from discontinued operations, net of tax |

75.4 |

215.7 |

|

|

Net profit of the year |

74.1 |

211.7 |

|

|

Basic and diluted earnings per share (€) |

1.12 |

3.21 |

|

|

|

|

|

|

|

Financial investments, cash & cash

equivalents |

3,317.8 |

3,684.5 |

|

DETAILS OF THE FULL YEAR 2024 FINANCIAL

RESULTS

The planned strategic reorganization and

separation into two publicly traded companies announced on January

8, 2025, was assessed to be a non-adjusting subsequent event for

the financial statements for the year ended December 31, 2024.

Further information will be disclosed in the Annual Report

2024.

As a consequence of the transfer of its

Jyseleca® business to Alfasigma, the revenues and costs related to

Jyseleca® for the full years 2024 and 2023 are presented separately

from the results of the Company’s continuing operations on the line

‘Net profit from discontinued operations, net of tax’ in the

consolidated income statement.

Results from continuing

operationsTotal operating loss

from continuing operations amounted to €188.3

million in 2024, compared to an operating loss of €88.3 million in

2023.

- Total net revenues

amounted to €275.6 million in 2024, compared to €239.7 million last

year. The revenue recognition related to the exclusive access

rights granted to Gilead for Galapagos’ drug discovery platform

amounted to €230.2 million in 2024, compared to €230.2 million in

2023. Galapagos also recognized royalty income from Gilead for

Jyseleca® for €10.6 million in 2024, compared to €9.5 million in

2023. The deferred income balance at December 31, 2024 includes

€1.1 billion allocated to the Company’s drug discovery

platform.

- Cost of sales

amounted to €34.8 million in 2024 and related to the supply of

Jyseleca® to Alfasigma under the transition agreement. The related

revenues are reported in total net revenues.

- R&D expenses

in 2024 amounted to €335.5 million, compared to

€241.3 million in 2023. Subcontracting costs increased by

€77.1 million from €83.0 million in 2023 to €160.1 million in 2024

primarily driven by the cell therapy programs in oncology.

Depreciation and impairment costs in 2024 amounted to €35.4

million, compared to €22.3 million in 2023. Personnel costs

decreased from €95.8 million in 2023 to €87.7 million in 2024

primarily due to lower accelerated non-cash cost recognition for

subscription right plans related to good leavers and reduced

severance costs.

- S&M and

G&A expenses amounted to

€134.4 million in 2024, compared

to €134.0 million in 2023. The increase in S&M

and G&A expenses was mainly due to higher legal and

professional fees amounting to €34.9 million compared to €23.4

million in 2023 related to corporate projects and strategic

investments. This increase was offset by a decrease in personnel

costs amounting to €59.2 million in 2024 (€69.1 million in 2023)

and a decrease in depreciation and impairment amounting to €13.2

million in 2024 compared to €16.1 million in 2023.

- Other operating

income of €47.3 million in 2023 decreased to

€40.8 million in 2024, mainly driven by lower grant and

R&D incentives income.

Net financial income in 2024

amounted to €185.2 million, compared to net financial income

of €93.9 million in 2023.

- Fair value adjustments and

net currency exchange results amounted to €95.8 million in

2024, compared to fair value adjustments and net currency exchange

results in 2023 of €16.3 million and were primarily attributable to

€73.7 million of positive changes in fair value of current

financial investments, and to €22.2 million of unrealized currency

exchange gains on our cash and cash equivalents and current

financial investments at amortized cost in U.S. dollars.

- Net other financial

income in 2024 amounted to €89.4 million, compared to net

other financial income of €77.6 million in 2023. Net interest

income amounted to €88.5 million in 2024 compared to €77.5 million

of net interest income in 2023, due to an increase in the interest

rates.

Galapagos had €1.8 million of tax income in

2024, compared to €9.6 million of tax expenses in 2023. This

decrease was primarily due to the re-assessment in 2023 of net

deferred tax liabilities and corporate income tax payables due to a

one-off intercompany transaction.

The Company reported a net loss from

continuing operations in 2024 of €1.3 million, compared to

a net loss from its continuing operations of €4.0 million in

2023.

Results from discontinued

operations(€ millions)

|

|

December 31, 2024 |

December 31, 2023 |

% Change |

|

Product net sales |

11.5 |

112.3 |

-90% |

|

Collaboration revenues |

26.0 |

431.5 |

-94% |

|

Total net revenues |

37.5 |

543.8 |

-93% |

|

Cost of sales |

(1.7) |

(18.0) |

-91% |

|

R&D expenses |

(8.1) |

(190.2) |

-96% |

|

G&Aii and S&Miii expenses |

(12.6) |

(131.3) |

-90% |

|

Other operating income |

56.2 |

13.0 |

+332% |

|

Operating profit |

71.3 |

217.3 |

-67% |

|

Net financial result |

4.2 |

0.5 |

|

|

Income taxes |

(0.1) |

(2.1) |

|

|

Net profit from discontinued operations |

75.4 |

215.7 |

|

Total operating profit from discontinued

operations amounted to €71.3 million in 2024, compared to

an operating profit of €217.3 million in 2023.

- Product net sales

of Jyseleca® in Europe were €11.5 million in 2024, which consisted

of sales to customers in January 2024. Product net sales to

customers in 2023 amounted to €112.3 million. Beginning February 1,

2024, all economics linked to the sales of Jyseleca® in Europe are

to the benefit of Alfasigma.

- Collaboration

revenues for the development of filgotinib with Gilead

amounted to €26.0 million in 2024, compared to €429.4 million in

2023. The sale of the Jyseleca® business to Alfasigma on January

31, 2024 led to the full recognition in revenue of the remaining

deferred income related to filgotinib.

- Cost of sales

related to Jyseleca® net sales were €1.7 million in 2024, compared

to €18.0 million in 2023.

- R&D expenses

for the filgotinib development in 2024 amounted to

€8.1 million, compared to €190.2 million in 2023.

Beginning February 1, 2024, all filgotinib development expenses

still incurred during the transition period are recharged to

Alfasigma.

- S&M and

G&A expenses related to the Jyseleca® business

amounted to €12.6 million in 2024, compared

to €131.3 million in 2023. Beginning February

1, 2024, all remaining G&A and S&M expenses relating to

Jyseleca® are recharged to Alfasigma.

- Other operating

income amounted to €56.2 million in 2024 compared to

€13.0 million in 2023 and comprised €52.3 million related to

the gain on the sale of the Jyseleca® business to Alfasigma. The

result of this transaction is considering the following elements:

- €50.0 million of upfront payment

received at closing of the transaction, of which €40.0 million was

paid on an escrow account. This amount was kept in escrow for a

period of one year after the closing date of January 31, 2024, and

was partially released in February 2025 (the remaining part being

under discussion). Galapagos gave customary representations and

warranties, which are capped and limited in time. At December 31,

2024, this €40.0 million is presented as “Escrow account” in the

Company’s statement of financial position.

-

€9.8 million of cash received from Alfasigma related to the closing

of the transaction as well as €0.75 million of accrued negative

adjustment for the settlement of net cash and working capital.

-

€47.0 million of fair value on January 31, 2024 of the future

earn-outs payable by Alfasigma to Galapagos (the fair value of

these future earn-outs at December 31, 2024 is presented on the

lines “Non-current contingent consideration receivable” and “Trade

and other receivables”). Beginning February 1, 2024, Galapagos is

entitled to receive earn-outs on net sales of Jyseleca® in Europe

from Alfasigma.

-

€40.0 million of liability towards Alfasigma on January 31, 2024

for R&D cost contributions of which €15.0 million was paid in

2024 (at December 31, 2024, €25.0 million of liabilities for

R&D cost contribution is presented in the Company’s statement

of financial position on the line “Trade and other

liabilities”).

Net financial income

attributable to the Jyseleca® business in 2024 amounted to

€4.2 million, compared to a net financial income of

€0.5 million in 2023. The increase is primarily attributed to

the positive discounting component of the earn-outs payable by

Alfasigma to Galapagos.Net profit from

discontinued operations related to Jyseleca® amounted to €75.4

million, compared to net profit amounting to €215.7 million for the

year 2023.

Galapagos reported a net profit

in 2024 of €74.1 million, compared to a net profit of €211.7

million in 2023.

Cash positionFinancial

investments and cash and cash equivalents totaled €3,317.8 million

on December 31, 2024, as compared to €3,684.5 million on December

31, 2023.

Total net decrease in cash and cash

equivalents and financial investments amounted to €366.7

million in 2024, compared to a net decrease of €409.6 million in

2023. This net decrease was composed of (i) €374.0 million of

operational cash burn including €80.4 million cash impact of

business development activities, (ii) €36.9 million for the

acquisition of financial assets held at fair value through other

comprehensive income, (iii) €27.5 million of net cash in related to

the sale of the Jyseleca® business to Alfasigma of which €40.0

million has been transferred to an escrow account, partly offset by

(iv) €56.7 million of positive exchange rate differences, positive

changes in fair value of current financial investments and

variation in accrued interest income.

Financial GuidanceAs of

December 31, 2024, Galapagos had €3.3 billion in cash and financial

investments. Galapagos intends to separate into two publicly traded

companies and to establish SpinCo with approximately €2.45 billion

in current cash. Following this planned transaction, Galapagos

expects its normalized annual cash burn to be between €175 million

and €225 million, excluding restructuring costs. Upon separation,

Galapagos expects to have approximately €500 million in cash to

accelerate its pipeline and fund its operations to 2028.

Annual Report 2024Galapagos is

currently finalizing the financial statements for the year ended

December 31, 2024. The Company’s independent auditor has confirmed

that its audit procedures in relation to the financial information

for the year ended December 31, 2024, in accordance with the

International Standards on Auditing are substantially completed and

have not revealed any material corrections required to be made to

the financial information included in this press release. Should

any material changes arise during the audit’s finalization, an

additional press release will be issued. Galapagos aims to publish

the fully audited full year 2024 annual report on, or around, March

27, 2025.

Conference call and webcast

presentationGalapagos will host a conference call and

webcast presentation on February 13, 2025, at 14:00 CET / 8:00 am

ET. To participate in the conference call, please register using

this link. Dial-in numbers will be provided upon registration. The

conference call can be accessed 10 minutes prior to the start of

the call using the access information provided in the e-mail

received upon registration or by using the “call me” feature. The

live webcast is available on glpg.com or via the following link.

The archived webcast will be available for replay shortly after the

close of the call on the investor section of the website.

Financial calendar 2025

|

Date |

Details |

|

March 27 |

Publication Annual Report 2024 and 20-F 2024 |

|

April 23 |

First quarter 2025 results (webcast April 24, 2025) |

|

April 29 |

Annual Shareholders’ meeting |

|

July 23 |

Half Year 2025 results (webcast July 24, 2025) |

|

October 22 |

Third quarter 2025 results (webcast October 23, 2025) |

About GalapagosWe are a

biotechnology company with operations in Europe and the U.S.

dedicated to transforming patient outcomes through life-changing

science and innovation for more years of life and quality of life.

Focusing on high unmet medical needs, we synergize compelling

science, technology, and collaborative approaches to create a deep

pipeline of best-in-class medicines. With capabilities from lab to

patient, including a decentralized cell therapy manufacturing

platform, we are committed to challenging the status quo and

delivering results for our patients, employees, and shareholders.

Our goal is not just to meet current medical needs but to

anticipate and shape the future of healthcare, ensuring that our

innovations reach those who need them most. For additional

information, please visit www.glpg.com or follow us on LinkedIn or

X.

For further information, please

contact:

| Media

inquiries:Srikant Ramaswami+1 412 699 0359 |

Investor

inquiries:Srikant Ramaswami+1 412 699 0359 |

| Marieke

Vermeersch+32 479 490 603 |

Sandra

Cauwenberghs +32 495 58 46 63 |

| media@glpg.com |

ir@glpg.com |

Forward-looking statementsThis

press release contains forward-looking statements, all of which

involve certain risks and uncertainties. These statements are

often, but are not always, made through the use of words or phrases

such as “believe,” “anticipate,” “expect,” “intend,” “plan,”

“seek,” “upcoming,” “future,” “estimate,” “may,” “will,” “could,”

“would,” “potential,” “forward,” “goal,” “next,” “continue,”

“should,” “encouraging,” “aim,” “progress,” “remain,’ “explore,”

“further” as well as similar expressions. These statements include,

but are not limited to, the guidance from management regarding our

financial results (including guidance regarding the expected

operational use of cash for the fiscal year 2024), statements

regarding the intended separation of Galapagos into two public

companies, the corporate reorganization and related transactions,

including the expected timeline of such transactions, anticipated

changes to the management and Board of Directors of each of

Galapagos and SpinCo, the anticipated benefits and synergies of

such transactions; the receipt of regulatory and shareholder

approvals for such transactions; and the anticipated cash burn and

cash runway of Galapagos following such transactions, statements

regarding capital allocation and the intended deprioritization of

GLPG5201, statements regarding our regulatory outlook,

statements regarding the amount and timing of potential future

milestones, and potential future milestone payments, statements

regarding our R&D plans, strategy and outlook, including

progress on our oncology or immunology portfolio, and potential

changes in such strategy and plans, statements regarding our

pipeline and complementary technology platforms facilitating future

growth, statements regarding our product candidates and partnered

programs, and any of our future product candidates or approved

products, if any, statements regarding the global R&D

collaboration with Gilead and the amendment of our arrangement with

Gilead for the commercialization and development of filgotinib,

statements regarding the expected timing, design and readouts of

our ongoing and planned preclinical studies and clinical trials,

including but not limited to (i) GLPG3667 in SLE and DM, (ii)

GLPG5101 in R/R NHL, and (v) GLPG5301 in R/R MM, including

recruitment for trials and interim or topline results for trials

and studies in our portfolio, statements regarding the potential

attributes and benefits of our product candidates, statements

regarding our commercialization efforts for our product candidates

and any of our future approved products, if any, statements about

potential future commercial manufacturing of T-cell therapies,

statements related to the IND application for the Phase 1/2

ATALANTA-1 study, statements related to the anticipated timing for

submissions to regulatory agencies, including any INDs or CTAs,

statements relating to the development of our distributed

manufacturing capabilities on a global basis, and statements

related to our portfolio goals, business plans, and sustainability

plans. Galapagos cautions the reader that forward-looking

statements are based on our management’s current expectations and

beliefs and are not guarantees of future performance.

Forward-looking statements may involve known and unknown risks,

uncertainties and other factors which might cause actual events,

financial condition and liquidity, performance or achievements, or

the industry in which we operate, to be materially different from

any historic or future results, financial conditions, performance

or achievements expressed or implied by such forward-looking

statements. In addition, even if our results, performance,

financial condition and liquidity, and the development of the

industry in which it operates are consistent with such

forward-looking statements, they may not be predictive of results

or developments in future periods. Such risks include, but are not

limited to, the risk that our expectations and management’s

guidance regarding our 2024 operating expenses, cash burn and other

financial estimates may be incorrect (including because one or more

of its assumptions underlying our revenue or expense expectations

may not be realized), he risks associated with the anticipated

transactions, including the risk that regulatory and shareholder

approvals required in connection with the transactions will not be

received or obtained within the expected time frame or at all, the

risk that the transactions and/or the necessary conditions to

consummate the transactions will not be satisfied on a timely basis

or at all, uncertainties regarding our ability to successfully

separate Galapagos into two companies and realize the anticipated

benefits from the separation within the expected time frame or at

all, the two separate companies’ ability to succeed as stand-alone,

publicly traded companies, the risk that costs of restructuring

transactions and other costs incurred in connection with the

transactions will exceed our estimates, the impact of the

transactions on our businesses and the risk that the transactions

may be more difficult, time consuming or costly than expected,

risks associated with Galapagos’ product candidates and partnered

programs, including GLPG5101 and uza-cel, the risk that ongoing and

future clinical trials may not be completed in the currently

envisaged timelines or at all, the inherent risks and uncertainties

associated with competitive developments, clinical trials,

recruitment of patients, product development activities and

regulatory approval requirements (including the risk that data from

Galapagos’ ongoing and planned clinical research programs in DM,

SLE, R/R NHL, RT, R/R MM and other oncologic indications or any

other indications or diseases, may not support registration or

further development of its product candidates due to safety or

efficacy concerns or other reasons), the risk that we may not be

able to realize the expected benefits from the appointment (by way

of co-optation) of the new Director, the risk that the preliminary

and topline data from our studies, including the ATALANTA-1 and

PAPILIO-1-studies, may not be reflective of the final data, risks

related to our reliance on collaborations with third parties

(including, but not limited to, our collaboration partners Gilead,

Lonza, Adaptimmune and Blood Centers of America), the risk that the

transfer of the Jyseleca® business will not have the currently

expected results for our business and results of operations the

risk that we will not be able to continue to execute on our

currently contemplated business plan and/or will revise our

business plan, including the risk that our plans with respect to

CAR-T may not be achieved on the currently anticipated timeline or

at all, the risk that our estimates regarding the commercial

potential of our product candidates (if approved) or expectations

regarding the costs and revenues associated with the

commercialization rights may be inaccurate, and risks related to

our strategic transformation exercise, including the risk that we

may not achieve the anticipated benefits of such exercise on the

currently envisaged timeline or at all. A further list and

description of these risks, uncertainties and other risks can be

found in our filings and reports with the Securities and Exchange

Commission (SEC), including in our most recent annual report on

Form 20‐F filed with the SEC and our subsequent filings and reports

filed with the SEC. Given these risks and uncertainties, the reader

is advised not to place any undue reliance on such forward-looking

statements. In addition, even if the result of our operations,

financial condition and liquidity, or the industry in which we

operate, are consistent with such forward-looking statements, they

may not be predictive of results, performance or achievements in

future periods. These forward-looking statements speak only as of

the date of publication of this release. We expressly disclaim any

obligation to update any such forward-looking statements in this

release to reflect any change in our expectations or any change in

events, conditions or circumstances, unless specifically required

by law or regulation.

1 Throughout this press release, ‘Dr. Paul

Stoffels’ should be read as ‘Dr. Paul Stoffels, acting via Stoffels

IMC BV’

i The operational cash burn (or operational cash flow if this

liquidity measure is positive) is equal to the increase or decrease

in the cash and cash equivalents (excluding the effect of exchange

rate differences on cash and cash equivalents), minus:• the net

proceeds, if any, from share capital and share premium increases

included in the net cash flows generated from/used in (-) financing

activities• the net proceeds or cash used, if any, related to the

acquisitions or disposals of businesses; the acquisition of

financial assets held at fair value through other comprehensive

income; the movement in restricted cash and movement in financial

investments, if any, the cash advances and loans given to third

parties, if any, included in the net cash flows generated from/used

in (-) investing activities• the cash used for other liabilities

related to the acquisition or disposal of businesses, if any,

included in the net cash flows generated from/used in (-) operating

activities.This alternative liquidity measure is in the view of the

Company an important metric for a biotech company in the

development stage. The operational cash burn for the year 2024

amounted to €374.0 million and can be reconciled to the cash flow

statement by considering the decrease in cash and cash equivalents

of €104.4 million, adjusted by (i) the net sale of financial

investments amounting to €319.0 million, (ii) the cash-out related

to the sale of subsidiaries of €12.5 million, and (iii) the

acquisition of financial assets held at fair value through other

comprehensive income of €36.9 million.

ii General and administrativeiii Sales and

marketing

- fy24_financial_tables_EN

- Galapagos Reports Full Year 2024 Results and Provides Fourth

Quarter Business Update

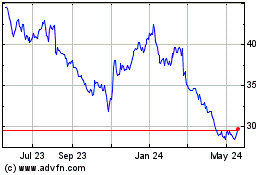

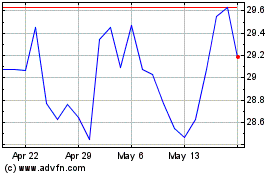

Galapagos NV (NASDAQ:GLPG)

Historical Stock Chart

From Jan 2025 to Feb 2025

Galapagos NV (NASDAQ:GLPG)

Historical Stock Chart

From Feb 2024 to Feb 2025