false

0001866547

0001866547

2023-11-01

2023-11-01

0001866547

GMFI:UnitsEachConsistingOfOneShareOfClassCommonStockAndOneRedeemableWarrantMember

2023-11-01

2023-11-01

0001866547

GMFI:ClassCommonStockParValue0.0001PerShareMember

2023-11-01

2023-11-01

0001866547

GMFI:WarrantsMember

2023-11-01

2023-11-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

8-K

Current

Report

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

November

1, 2023

Date

of Report (Date of earliest event reported)

Aetherium

Acquisition Corp.

(Exact

Name of Registrant as Specified in its Charter)

| Delaware |

|

001-41189 |

|

86-3449713 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

79B

Pemberwick Rd.

Greenwich,

CT |

|

06831 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (650) 450-6836

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of each exchange on which registered |

| Units,

each consisting of one share of Class A Common Stock and one Redeemable Warrant |

|

GMFIU |

|

The

Nasdaq Stock Market LLC |

| Class

A Common Stock, par value $0.0001 per share |

|

GMFI |

|

The

Nasdaq Stock Market LLC |

| Warrants

|

|

GMFIW |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

7.01 Regulation FD Disclosure.

On

November 1, 2023, a press release was made by a well-established Southeast Asian aviation company (the “Target”) announcing

that it had entered into a non-binding letter of intent for a business combination (the “Business Combination”) with Aetherium

Acquisition Corp (the “Company”).

A

copy of the press release is furnished herewith as Exhibit 99.1 to this Current Report on Form 8-K.

Forward-Looking

Statements

Certain

matters discussed in this Current Report on Form 8-K (including Exhibit 99.1 hereto) constitute

forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of

1934, as amended, and the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements involve many

risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. These

forward-looking statements speak only as of the date hereof, and the Company expressly disclaims any obligation or undertaking to disseminate

any updates or revisions to any forward-looking statement contained herein to reflect any change in its expectations with regard thereto

or any change in events, conditions or circumstances on which any such statement is based. Please refer to the publicly filed documents

of the Company, including its most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, for risks and uncertainties

related to the Company’s business which may affect the statements made in this Current Report on Form 8-K.

Item

9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Dated:

November 2, 2023 |

|

| |

|

|

| AETHERIUM

ACQUISITION CORP. |

|

| |

|

|

| By: |

/s/

Jonathan Chan |

|

| Name: |

Jonathan

Chan |

|

| Title: |

Chief

Executive Officer and Chairman |

|

Exhibit

99.1

Capital

A Berhad signs Letter of Intent with NASDAQ-listed Aetherium Acquisition Corp for business combination

KUALA

LUMPUR, 1 November 2023 - Capital A Berhad, the investment holding company of AirAsia, airasia MOVE (formerly known as airasia Superapp),

logistics venture Teleport, and Capital A aviation services group, announced today that it has entered into a Letter of Intent (“LOI”)

with Aetherium Acquisition Corp (NASDAQ: GMFI), a Special Purpose Acquisition Company (“SPAC”) listed on the Nasdaq stock

exchange, for a proposed business combination merger with Capital A International, to be incorporated.

The

proposed business combination would result in Capital A International, a new investment and strategic development company that leverages

the “AirAsia” brand and capitalises on core capabilities in aviation, travel and hospitality and digital technologies, becoming

a standalone publicly traded company in the U.S. With 100% equity interest in AirAsia Brand and Leasing, Capital A International intends

to generate revenue from brand royalty and the leasing of aircraft. Additionally, it will be involved in tactical acquisition, incubation

and partnerships to provide platforms for entrepreneurs.

The

proposed business combination will be at an indicative equity value of United States Dollars (“USD”) 1 billion based on an

independent valuation of the AirAsia Brand.

CEO

of Capital A, Tony Fernandes said, “This is a coming-of-age moment for Capital A, which has morphed from AirAsia into a low-cost,

value driven aviation and travel services group in five entities, the first of which that’s coming to the public market would be

Capital A International. We are taking the first step to venture out of our home ground, which is ASEAN, and exploring listing on the

pinnacle of markets in terms of capital raising. We are confident that the exposure of the U.S. financial markets and Nasdaq listing

would help us accelerate the delivery of our strategy as we improve access to capital, broaden our shareholder base and meaningfully

raise our profile globally.

“Our

proposed business combination with Aetherium serves as a testament to the growth opportunity ahead. The ASEAN region in recent years

has emerged as one of the world’s most dynamic and fastest growing economic hubs. Yet, there are limited vehicles for which global

investors can participate in the vibrancy of this pivotal market. Leveraging the strength and reach of the AirAsia brand, Capital A International

will offer an exceptional opportunity to harness the investment potential of the region.”

Jonathan

Chan, CEO of Aetherium Acquisition Corp said, “It is a privilege to be working with a storied entrepreneur such as Tony Fernandes

to help bring Capital A International to the U.S. capital markets. AirAsia has had a transformative impact on the lives of tens of millions

of people across Southeast Asia, making affordable air travel a reality. The AirAsia brand is associated with innovation, convenience,

adventure, and value. This new entity will present investors with the opportunity to tap into the growth of the ASEAN region with a high-quality

profitable asset and exceptional management team. We look forward to finalising the business combination agreement in the weeks to come.”

Under

the terms of the LOI, Capital A plans to divest all issued and outstanding share capital of Capital A International. The LOI with Aetherium

Acquisition Corp reflects a mutual interest in the potential collaboration, subject to necessary regulatory approvals and conditions

from Bursa Securities, the Central Bank of Malaysia and other relevant authorities. Capital A remains committed to complying with all

regulatory requirements and is optimistic about the potential benefits of the proposed business combination.

A

detailed announcement will be made upon the signing of a definitive agreement for the Proposed Business Combination.

***ENDS***

About

Capital A

Capital

A (formerly known as AirAsia Group) is an investment holding company with a portfolio of synergistic travel and lifestyle businesses

that leverage data and technology, including the world’s leading low-cost carrier AirAsia, an aviation services group, airasia

Superapp and fintech BigPay as well as logistics venture Teleport. Capital A’s vision is to create and deliver products and services

that focus on offering the best value at the lowest cost, underpinned by robust data accumulated over 20 years in operation and one of

Asia’s leading brands that remains committed to serving the underserved in ASEAN and beyond.

About

Aetherium Acquisition Corp

Aetherium

Acquisition Corp is a blank check company, also commonly referred to as a special purpose acquisition company, or SPAC, formed for the

purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization, or other similar business combination

with one or more businesses. The Company’s efforts to identify a prospective target business will not be limited to a particular

business, industry, sector, or geographical region.

Capital

A Contacts

Investors

Joanna Ibrahim

joannaibrahim@airasia.com

Media

Maryanna

Kim

maryannakim@airasia.com

US

Julia

Fisher

Julia.Fisher@edelmansmithfield.com

Europe

John

Kiely

John.Kiely@edelmansmithfield.com

Aetherium

Acquisition Corp Contact

info@aetheriumcapital.com

v3.23.3

Cover

|

Nov. 01, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 01, 2023

|

| Entity File Number |

001-41189

|

| Entity Registrant Name |

Aetherium

Acquisition Corp.

|

| Entity Central Index Key |

0001866547

|

| Entity Tax Identification Number |

86-3449713

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

79B

Pemberwick Rd.

|

| Entity Address, City or Town |

Greenwich

|

| Entity Address, State or Province |

CT

|

| Entity Address, Postal Zip Code |

06831

|

| City Area Code |

(650)

|

| Local Phone Number |

450-6836

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Units, each consisting of one share of Class A Common Stock and one Redeemable Warrant |

|

| Title of 12(b) Security |

Units,

each consisting of one share of Class A Common Stock and one Redeemable Warrant

|

| Trading Symbol |

GMFIU

|

| Security Exchange Name |

NASDAQ

|

| Class A Common Stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Class

A Common Stock, par value $0.0001 per share

|

| Trading Symbol |

GMFI

|

| Security Exchange Name |

NASDAQ

|

| Warrants |

|

| Title of 12(b) Security |

Warrants

|

| Trading Symbol |

GMFIW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=GMFI_UnitsEachConsistingOfOneShareOfClassCommonStockAndOneRedeemableWarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=GMFI_ClassCommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=GMFI_WarrantsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

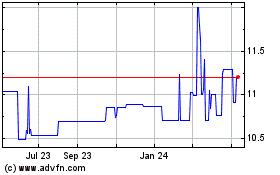

Aetherium Acquisition (NASDAQ:GMFIU)

Historical Stock Chart

From Jan 2025 to Feb 2025

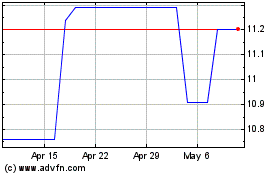

Aetherium Acquisition (NASDAQ:GMFIU)

Historical Stock Chart

From Feb 2024 to Feb 2025