Grocery Outlet Holding Corp. (NASDAQ: GO) (“Grocery Outlet”

or the “Company”) today announced that Eric Lindberg, current

Chairman of the Board, has been appointed Interim President and

CEO, effective immediately. Lindberg replaces RJ Sheedy, who has

stepped down from his position and resigned from the Company’s

Board of Directors. The Board has engaged a leading global

executive search firm to begin the process of identifying a

permanent CEO.

With more than three decades of leadership experience at the

Company, Lindberg is a Grocery Outlet veteran with a deep knowledge

of its operations and strategy. He previously served as CEO or

co-CEO from January 2006 through December 2022, during which time

he led Grocery Outlet’s transformation from a closely-held

family-owned business to a sponsor-backed private company, taking

on significant outside capital from Berkshire Partners and Hellman

& Friedman, and then ultimately to a publicly-traded company in

2019. Under Lindberg’s leadership, Grocery Outlet increased its

store count more than 250% and its net sales nearly 500%, expanding

to markets across the country. Lindberg has served as a Director

since January 2006 and as Chairman of the Board since January

2023.

“On behalf of the Board, I want to express my deep appreciation

to RJ for his contributions to Grocery Outlet over the past 12

years,” said Lindberg. “RJ played a critical role in scaling and

evolving our business and has set the stage for continued strong

growth in the future.

“The fundamentals of our business – the significant value and

treasure hunt shopping experience we bring to customers – remain

strong and the runway in front of us is substantial,” continued

Lindberg. “I look forward to working with our employees,

independent operators and supplier partners to deliver outstanding

execution on our strategy and unlock Grocery Outlet’s earnings

potential.”

“Grocery Outlet is an exceptional business with an almost

80-year track record of generating outsized growth and returns

through its highly differentiated business model,” said Erik

Ragatz, Lead Independent Director. “We are fortunate to have a

leader of Eric’s quality and experience to shepherd this

transition. The Board looks forward to working with Eric to drive

the business as we search for our next leader who will guide our

mission of ‘Touching Lives for the Better,’ delivering Grocery

Outlet’s unique offering to millions of existing and new customers

and, in the process, producing outstanding returns for our

shareholders.”

Financial Update

In connection with today's announcement, the Company is also

providing a third quarter financial update based on its preliminary

financial results. The Company expects net sales for the third

quarter to be $1.1 billion, a 10.4% increase versus the prior year

period, with comparable store sales increasing 1.2%. The Company

expects to meet previously discussed third quarter earnings

guidance.

The Company is in the process of reassessing its full year

guidance. Although the Company expects to exceed the high end of

the range of its full year net sales guidance of $4.30 to $4.35

billion, the Company expects to reduce its full year adjusted

EBITDA guidance to below the low end of the previously disclosed

range of $252.0 to $260.0 million. As previously announced, the

Company will update full year guidance, along with issuing final

third quarter 2024 earnings results, on Tuesday, November 5,

2024.

The Company's unaudited preliminary financial and operational

results for the third quarter are based on current estimates of its

results and remain subject to change based on the completion of our

closing and review procedures and the execution of the Company's

internal control over financial reporting. This preliminary

financial and operational information should not be viewed as a

substitute for full financial statements prepared in accordance

with accounting principles generally accepted in the United States

("GAAP").

The Company has not reconciled the non-GAAP adjusted EBITDA and

adjusted diluted earnings per share forward-looking guidance

alluded to in this release to the most directly comparable GAAP

measures because this cannot be done without unreasonable effort

due to the variability and low visibility with respect to taxes and

non-recurring items, which are potential adjustments to future

earnings. The Company expects the variability of these items to

have a potentially unpredictable, and a potentially significant,

impact on the Company's future GAAP financial results.

Non-GAAP Financial Information

In addition to reporting financial results in accordance with

GAAP, management and the Board of Directors use EBITDA, adjusted

EBITDA, adjusted net income and adjusted earnings per share as

supplemental key metrics to assess the Company's financial

performance. These non-GAAP financial measures are also frequently

used by analysts, investors and other interested parties to

evaluate the Company and other companies in the Company's industry.

Management believes it is useful to investors and analysts to

evaluate these non-GAAP measures on the same basis as management

uses to evaluate the Company's operating results. Management uses

these non-GAAP measures to supplement GAAP measures of performance

to evaluate the effectiveness of the Company's business strategies,

to make budgeting decisions and to compare the Company's

performance against that of other peer companies using similar

measures. In addition, the Company uses adjusted EBITDA to

supplement GAAP measures of performance to evaluate performance in

connection with compensation decisions. Management believes that

excluding items from operating income, net income and net income

per diluted share that may not be indicative of, or are unrelated

to, the Company's core operating results, and that may vary in

frequency or magnitude, enhances the comparability of the Company's

results and provides additional information for analyzing trends in

the Company's business.

Management defines EBITDA as net income before net interest

expense, income taxes and depreciation and amortization expenses.

Adjusted EBITDA represents EBITDA adjusted to exclude share-based

compensation expense, loss on debt extinguishment and modification,

asset impairment and gain or loss on disposition, acquisition and

integration costs, costs related to the amortization of inventory

purchase accounting asset step-ups and certain other expenses that

may not be indicative of, or are unrelated to, the Company's core

operating results, and that may vary in frequency or magnitude.

Adjusted net income represents net income adjusted for the

previously mentioned adjusted EBITDA adjustments, further adjusted

for the amortization of property and equipment purchase accounting

asset step-ups and deferred financing costs, tax adjustment to

normalize the effective tax rate, and tax effect of total

adjustments. Basic adjusted earnings per share is calculated using

adjusted net income, as defined above, and basic weighted average

shares outstanding. Diluted adjusted earnings per share is

calculated using adjusted net income, as defined above, and diluted

weighted average shares outstanding.

These non-GAAP measures may not be comparable to similar

measures reported by other companies and have limitations as

analytical tools, and you should not consider them in isolation or

as a substitute for analysis of the Company's results as reported

under GAAP. The Company addresses the limitations of the non-GAAP

measures through the use of various GAAP measures. In the future

the Company will incur expenses or charges such as those added back

to calculate adjusted EBITDA or adjusted net income. The

presentation of these non-GAAP measures should not be construed as

an inference that future results will be unaffected by the

adjustments used to derive such non-GAAP measures.

Forward-Looking Statements

This news release includes forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

All statements contained in this release other than statements of

historical fact, including statements regarding the Company's

future operating results and financial position, including expected

results for the fiscal 2024 third quarter and full year, the

Company’s CEO search process, the Company's business strategy and

plans and shareholder returns may constitute forward-looking

statements. Words such as "anticipate," "believe," "estimate,"

"expect," "intend," "may," "outlook," "plan," "project," "seek,"

"will," and similar expressions, are intended to identify such

forward-looking statements. These forward-looking statements are

subject to a number of risks, uncertainties and assumptions that

may cause actual results to differ materially from those expressed

or implied by any forward-looking statements, including the

following: failure of suppliers to consistently supply the Company

with opportunistic products at attractive pricing; inability to

successfully identify trends and maintain a consistent level of

opportunistic products; failure to maintain or increase comparable

store sales; loss of key personnel or inability to attract, train

and retain highly qualified personnel, including the ongoing

recruitment for a permanent CEO and CFO; any significant disruption

to the Company's distribution network, the operations of its

distributions centers and timely receipt of inventory; inflation

and other changes affecting the market prices of the products the

Company sells; risks associated with newly opened or acquired

stores; failure to open, relocate or remodel stores on schedule and

on budget; costs and successful implementation of marketing,

advertising and promotions; failure to maintain the Company's

reputation and the value of its brand, including protecting

intellectual property; inability to maintain sufficient levels of

cash flow from operations; risks associated with leasing

substantial amounts of space; failure to properly integrate any

acquired businesses; natural or man-made disasters, climate change,

power outages, major health epidemics, pandemic outbreaks,

terrorist acts, global political events or other serious

catastrophic events and the concentration of the Company's business

operations; failure to participate effectively in the growing

online retail marketplace; unexpected costs and negative effects if

the Company incurs losses not covered by insurance; difficulties

associated with labor relations and shortages; failure to remediate

material weakness in the Company's internal control over financial

reporting; risks associated with economic conditions; competition

in the retail food industry; movement of consumer trends toward

private labels and away from name-brand products; risks associated

with deploying the Company's own private label brands; inability to

attract and retain qualified independent operators of the Company

("IOs"); failure of the IOs to successfully manage their business;

failure of the IOs to repay notes outstanding to the Company;

inability of the IOs to avoid excess inventory shrink; any loss or

changeover of an IO; legal proceedings initiated against the IOs;

legal challenges to the IO/independent contractor business model;

failure to maintain positive relationships with the IOs; risks

associated with actions the IOs could take that could harm the

Company's business; material disruption to information technology

systems, including risks associated with any continued impact from

the Company's systems transition; failure to maintain the security

of information relating to personal information or payment card

data of customers, employees and suppliers; risks associated with

products the Company and its IOs sell; risks associated with laws

and regulations generally applicable to retailers; legal or

regulatory proceedings; the Company's substantial indebtedness

could affect its ability to operate its business, react to changes

in the economy or industry or pay debts and meet obligations;

restrictive covenants in the Company's debt agreements may restrict

its ability to pursue its business strategies, and failure to

comply with any of these restrictions could result in acceleration

of the Company's debt; risks associated with tax matters; changes

in accounting standards and subjective assumptions, estimates and

judgments by management related to complex accounting matters; and

the other factors discussed under "Risk Factors" in the Company's

most recent annual report on Form 10-K and in other subsequent

reports the Company files with the United States Securities and

Exchange Commission (the "SEC"). The Company's periodic filings are

accessible on the SEC's website at www.sec.gov.

Moreover, the Company operates in a very competitive and rapidly

changing environment, and new risks emerge from time to time.

Although the Company believes that the expectations reflected in

the forward-looking statements are reasonable, and the Company's

expectations based on third-party information and projections are

from sources that management believes to be reputable, the Company

cannot guarantee that future results, levels of activity,

performance or achievements. These forward-looking statements are

made as of the date of this release or as of the date specified

herein and the Company has based these forward-looking statements

on current expectations and projections about future events and

trends. Except as required by law, the Company does not undertake

any duty to update any of these forward-looking statements after

the date of this release or to conform these statements to actual

results or revised expectations.

About Grocery Outlet

Based in Emeryville, California, Grocery Outlet is a

high-growth, extreme value retailer of quality, name-brand

consumables and fresh products sold primarily through a network of

independently operated stores. Grocery Outlet and its subsidiaries

have more than 520 stores in California, Washington, Oregon,

Pennsylvania, Tennessee, Idaho, Nevada, Maryland, North Carolina,

New Jersey, Georgia, Ohio, Alabama, Delaware, Kentucky and

Virginia.

INVESTOR RELATIONS CONTACTS:

Christine Chen(510) 877-3192cchen@cfgo.com

John Rouleau(203) 682-4810John.Rouleau@icrinc.com

MEDIA CONTACT:Layla Kasha(510) 379-2176lkasha@cfgo.com

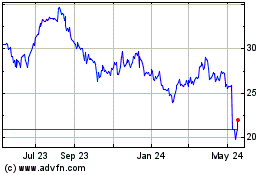

Grocery Outlet (NASDAQ:GO)

Historical Stock Chart

From Dec 2024 to Jan 2025

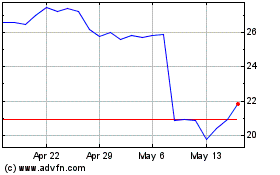

Grocery Outlet (NASDAQ:GO)

Historical Stock Chart

From Jan 2024 to Jan 2025