Filed Pursuant to Rule 424(b)(5)

Registration No. 333-276209

PROSPECTUS SUPPLEMENT

(To Prospectus dated February 2, 2024)

3,000,000 Common Shares

GreenPower Motor Company Inc.

We are offering 3,000,000 common shares of GreenPower Motor Company Inc. at an offering price of US$1.00 per share, pursuant to this prospectus supplement and the accompanying prospectus.

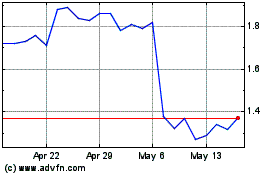

Our common shares are listed for trading on the Nasdaq Capital Market under the symbol "GP" and the TSX Venture Exchange in Canada under the symbol "GPV".

As of October 25, 2024, the aggregate market value of our outstanding common shares held by non-affiliates, or public float, was approximately US$32.4 million based on 26,491,162 common shares outstanding, of which 6,591,302 shares were held by affiliates as of such date, and a price of US$1.63 per share, which was the highest reported closing sale price of our common shares on the Nasdaq in the 60 days prior to such date. Accordingly, we are subject to the limitations set forth in General Instruction I.B.5 of Form F-3. During the 12-month period prior to and including the date of this prospectus supplement, we have offered or sold US$4,892,250 of securities pursuant to General Instruction I.B.5 of Form F-3. Pursuant to General Instruction I.B.5. of Form F-3, in no event will we sell securities registered on the registration statement to which this prospectus supplement forms a part in a public primary offering with a value exceeding more than one-third of our public float in any 12-month period so long as our public float remains below US$75 million. As a result, we may sell up to US$5,920,007 of our common shares hereunder as of October 25, 2024.

Investing in our securities involves significant risks. Please read the information contained in or incorporated by reference under the heading "Risk Factors" beginning on page S-8 of this prospectus supplement, the accompanying prospectus, and under similar headings in other documents filed after the date hereof and incorporated by reference into this prospectus supplement and the accompanying prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The securities offered by this prospectus supplement and the accompanying prospectus have not been and will not be qualified for sale under the securities laws of any province or territory of Canada or to any resident of Canada and may not be offered or sold, directly or indirectly, in Canada, or to or for the account of any resident of Canada. This prospectus supplement and the accompanying prospectus have not been filed to qualify, and will not qualify, any distribution of these securities in any province or territory of Canada.

| |

|

Per Share |

|

| Public offering price |

|

US$ |

1.00 |

|

| Underwriting discount and commissions (1) |

|

US$ |

0.07 |

|

| Proceeds to us, before expenses |

|

US$ |

0.93 |

|

(1) See "Underwriting" for additional information regarding underwriter compensation.

We have granted a 45-day option to the representatives of the underwriters to purchase up to 450,000 additional common shares, solely to cover over-allotments, if any.

The underwriters expect to deliver the securities to purchasers on or about October 30, 2024.

ThinkEquity

The date of this prospectus supplement is October 28, 2024

Table of Contents

About This Prospectus Supplement

This document is in two parts. The first part is this prospectus supplement, including the documents incorporated by reference herein, which describes the specific terms of this offering and certain matters relating to us. The second part, the accompanying prospectus, including the documents incorporated by reference therein, provides more general information, some of which may not apply to this offering. This prospectus supplement is deemed to be incorporated by reference into the prospectus solely for purposes of this offering.

Owning securities may subject you to tax consequences in the U.S. and/or Canada. This prospectus supplement and the accompanying prospectus may not describe these tax consequences fully. You should read the tax discussion in this prospectus supplement and the accompanying prospectus and consult your own tax advisor with respect to your own particular circumstances.

You should rely only on the information contained in or incorporated by reference into this prospectus supplement or in the accompanying prospectus or in any free writing prospectus that we have prepared. We have not authorized, and the underwriters have not authorized, anyone to provide you with information in addition to or different from that contained in this prospectus supplement, the prospectus or in any free writing prospectus that we have prepared. We are not making an offer to sell or soliciting an offer to buy these securities in any jurisdiction in which the offer or solicitation is not authorized or in which the person making the offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make the offer or solicitation. You should assume that the information contained in this prospectus supplement, the accompanying prospectus and in any applicable free writing prospectus is accurate only as of the date on the front cover of this prospectus supplement, the prospectus or any applicable free writing prospectus, as applicable, and the information incorporated by reference into this prospectus supplement, the prospectus or any applicable free writing prospectus is accurate only as of the date of the document incorporated by reference. Our business, financial condition, results of operations and prospects may have changed since those dates. Information in this prospectus supplement updates and modifies the information in the prospectus and the information incorporated by reference herein and therein.

The registration statement of which this prospectus supplement and the accompanying prospectus form a part, including the exhibits to the registration statement, contains additional information about us and the securities offered under this prospectus supplement. You can find the registration statement at the U.S. Securities and Exchange Commission's (the "SEC") website or at the SEC office mentioned under the heading "Where You Can Find More Information."

Financial statements included or incorporated by reference into this prospectus supplement and the accompanying prospectus have been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board, which we refer to as IFRS, and may be subject to foreign auditing and auditor independence standards, and thus may not be comparable to financial statements of United States companies.

Unless otherwise noted or the context otherwise indicates, the terms "us," "we," "our," "GreenPower" and the "Company" refer to GreenPower Motor Company Inc. and its subsidiaries.

All trademarks, trade names and service marks appearing in this prospectus supplement and the accompanying prospectus, including the documents incorporated by reference herein or therein and any applicable free writing prospectus, are the property of their respective owners. Use or display by us of other parties' trademarks, trade dress or products is not intended to and does not imply a relationship with, or endorsements or sponsorship of, us by the trademark or trade dress owner. Solely for convenience, trademarks and tradenames referred to in this prospectus supplement and the accompanying prospectus appear without the ® and ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or that the applicable owner will not assert its rights, to these trademarks and trade names.

Unless stated otherwise or as the context otherwise requires, all references to dollar amounts in this prospectus supplement and the accompanying prospectus are references to U.S. dollars. References to "$," "US$" or "USD$" are to U.S. dollars and references to "CDN$" or "C$" are to Canadian dollars.

Prospectus Supplement Summary

This summary description about us and our business highlights selected information contained elsewhere in this prospectus supplement or in the accompanying prospectus or incorporated by reference into this prospectus supplement and the accompanying prospectus. This summary does not contain all of the information you should consider before buying securities in this offering. You should carefully read this entire prospectus supplement and the accompanying prospectus, including each of the documents incorporated herein or therein by reference, before making an investment decision.

Our Business

We design, build and distribute a full suite of high-floor and low-floor all-electric medium and heavy-duty vehicles, including transit buses, school buses, shuttles, a cargo van and a cab and chassis. We employ a clean-sheet design to manufacture all-electric buses that are purpose built to be battery powered with zero emissions while integrating global suppliers for key components. This original equipment manufacturer ("OEM") platform allows us to meet the specifications of various operators while providing standard parts for ease of maintenance and accessibility for warranty requirements. GreenPower was founded in Vancouver, Canada and operates in the United States out of facilities in southern California and West Virginia.

We believe our battery-electric commercial vehicles offer fleet operators significant benefits, which include:

• low total cost-of-ownership vs. conventional gas or diesel-powered vehicles;

• lower maintenance costs;

• reduced fuel expenses;

• satisfaction of government mandates to move to zero-emission vehicles; and

• decreased vehicle emissions and reduction in carbon footprint.

We currently sell and lease our vehicles to customers directly and through a network of dealers in different regions of the United States, and directly to customers in Canada. Our all-electric zero-emission vehicles are eligible for various funding programs, vouchers and incentives, including:

• the California Hybrid and Zero-Emission Truck and Bus Voucher Incentive Project ("HVIP") Program;

• the California Zero Emission School Bus Initiative ("ZESBI") Program;

• the CleanBC Go Electric Rebates Program;

• the Transport Canada iMHZEV Program;

• the New York State Voucher Program;

• the New Jersey Zero Emission Program;

• the EPA's Clean School Bus Program;

• the VW Mitigation Trust Fund;

• CARES ACT United States federal funding; and

• California Air Quality Management District funding.

Corporate Information

We are a corporation incorporated under the Business Corporations Act (British Columbia) in British Columbia, Canada under the name "GreenPower Motor Company Inc." with an authorized share structure of unlimited number of common shares without par value and unlimited number of preferred shares without par value.

Our principal executive offices are located at Suite 240 - 209 Carrall Street, Vancouver, British Columbia V6J 2B2, Canada and our telephone number is (604) 563-4144.

Our registered and records office is located at 800 - 885 West Georgia Street, Vancouver, British Columbia V6C 3H1, Canada and its telephone number is (604) 687-5700. Our agent for service in the United States is GKL Corporate/Search, Inc., located at One Capitol Mall, Suite 660, Sacramento, California 95814 and its telephone number is (800) 446-5455.

Our corporate website is www.greenpowermotor.com. Information contained on our corporate website or that can be accessed through our corporate website is not incorporated by reference into this prospectus supplement and the accompanying prospectus.

Recent Developments

In February 2024, we entered into a $5,000,000 revolving loan facility from Export Development Canada ("EDC"). The loan is being used to finance working capital investments to deliver all-electric vehicles to customers under purchase orders approved by EDC. The loan allows advances over a 24-month period, has a term of 36 months, and bears interest at a floating rate of US Prime + 5% per annum. The Company has granted EDC a first and second ranking security interest over property of the Company and certain subsidiaries, and the Company and certain subsidiaries have provided guarantees to EDC. As of the date of this prospectus supplement, we've drawn approximately $4.14 million on the revolving loan facility. There is approximately $112,000 principal repayment owing on this facility at the end of October 2024 and interest has been paid up to September 20, 2024.

On April 22, 2024, we announced the appointment of Paul Start, age 59, as our Vice President Sales - School Bus Group. Mr. Start will lead the school bus sales team to generate new business opportunities, support existing sales functions, manage dealers and serve as a liaison between the sales department and other internal departments for vehicle production, finance, service, support and parts sales. Mr. Start brings more than 35 years of school bus expertise in North America to the team at GreenPower. Most recently he served as the Dealer Development Manager for Thomas Built Buses where he worked for nearly 20 years. Prior to that he was with Macnab Transit Sales Corp., for almost 14 years initially as a sales representative and then as Sales Manager. He started his career in the industry as a sales and marketing administrator for a school bus OEM.

On May 9, 2024, we completed an underwritten offering of 1,500,000 common shares and warrants to purchase 1,575,000 common shares for gross proceeds of $2,325,750 before deducting underwriting discounts and offering expenses. The warrants have an exercise price of $1.82 per share and a three-year term.

On July 25, 2024, we signed a term sheet pursuant to which the credit limit on our line of credit was reduced from $8,000,000 to $7,400,000, with further reductions of $200,000 per month until the credit limit reaches $6,000,000 on January 25, 2025. In addition, the line of credit margin will increase from 2.0% to 2.25%. As of the date of this prospectus supplement the credit limit on our operating line of credit is $7,000,000 with further reductions of $200,000 per month continuing each month and the line of credit margin will increase to 5.5%.

Intercorporate Structure

| Name of Subsidiary |

Country of Incorporation |

Ownership |

Principal Activity |

| GP GreenPower Industries Inc. |

Canada |

100% |

Holding company |

| GreenPower Motor Company, Inc. |

United States |

100% |

Electric vehicle manufacturing and distribution |

| 0939181 B.C. Ltd. |

Canada |

100% |

Electric vehicle sales and leasing |

| San Joaquin Valley Equipment Leasing Inc. |

United States |

100% |

Electric vehicle leasing |

| 0999314 B.C. Ltd. |

Canada |

100% |

Inactive |

| Electric Vehicle Logistics Inc. |

United States |

100% |

Vehicle transportation |

| GreenPower Manufacturing WV, Inc. |

United States |

100% |

Electric vehicle manufacturing and distribution |

| Lion Truck Body Incorporated |

United States |

100% |

Truck body manufacturing |

| Gerui New Energy Vehicle (Nanjing) Co. Ltd. |

China |

100% |

Dormant |

| EA Green-Power Private Ltd. |

India |

100% |

Electric vehicle manufacturing and distribution |

| GP Truck Body Inc. |

United States |

100% |

Truck body manufacturing |

The Offering

| Issuer |

GreenPower Motor Company Inc., a corporation existing under the laws of the Province of British Columbia, Canada. |

| |

|

| Common Shares to be Offered by Us |

3,000,000 common shares (or up to 3,450,000 shares if the underwriters' over-allotment option is exercised in full). |

| |

|

| |

|

| Common Shares to be Outstanding After this Offering |

29,491,162 common shares (or up to 29,941,162 shares if the underwriters' over-allotment option is exercised in full). |

| |

|

| Underwriters' Over-Allotment Option |

We have granted a 45-day option to the representative of the underwriters to purchase up to an additional 450,000 common shares, representing 15% of the common shares sold in the offering, solely to cover over-allotments, if any.

The over-allotment option purchase price to be paid per additional common share by the underwriters shall be equal to the public offering price of one common share, less the underwriting discount. |

| |

|

| Reasons for the Offer and Use of Proceeds |

We estimate that the net proceeds from this offering will be approximately $2,655,000 after deducting underwriting discounts and commissions and estimated offering expenses payable by us (or approximately $3,073,500 if the underwriters' over-allotment option is exercised in full).

We intend to use the net proceeds from this offering for the production of all-electric vehicles, including BEAST school buses and EV Star commercial vehicles, as well as for product development, with the remainder, if any, for general corporate purposes. See "Reasons for the Offer and Use of Proceeds." |

| Risk Factors |

See "Risk Factors" on page S-8 and the other information included or incorporated by reference in this prospectus supplement and the accompanying prospectus for a discussion of factors you should consider carefully before deciding to invest in our securities. |

| |

|

| Trading Symbols |

Our common shares are listed for trading on the Nasdaq Capital Market under the symbol "GP" and on the TSX Venture Exchange in Canada under the symbol "GPV". |

The number of common shares to be outstanding after this offering as shown above is based on 26,491,162 common shares outstanding as of October 28, 2024, and excludes the following as of that date:

• 2,313,483 common shares issuable upon exercise of outstanding stock options at a weighted average exercise price of CDN$7.70 per share;

• 1,575,000 common shares issuable upon exercise of outstanding warrants at a weighted average exercise price of $1.82 per share;

• Up to 150,000 common shares issuable upon the exercise of the Representative's Warrants (as defined below), or up to 172,500 common shares if the underwriters' over-allotment option is exercised in full.

Unless otherwise noted, the information in this prospectus supplement, including the summary above, assumes no exercise of (a) our outstanding stock options or warrants and (b) the underwriters' over-allotment option to purchase additional common shares.

Risk Factors

An investment in our securities involves a number of very significant risks. You should carefully consider the following risks and uncertainties in addition to other information contained in or incorporated by reference in this prospectus supplement and accompanying prospectus in evaluating our company and our business before making an investment decision about our company. Our business, operating results and financial condition could be seriously harmed as a result of the occurrence of any of the following risks. You could lose all or part of your investment due to any of these risks.

Risks Related to This Offering

The sale of a substantial amount of our common shares could adversely affect the prevailing market price of our common shares.

We are offering 3,000,000 common shares and up to 450,000 common shares issuable upon the exercise of the over-allotment option. Sales of substantial amounts of our common shares in the public market, or the perception that such sales might occur, could adversely affect the market price of our common shares. Furthermore, in the future, we may issue additional common shares or other equity or debt securities convertible into common shares. Any such issuance could result in substantial dilution to our existing shareholders and could cause our share price to decline

Our management will have broad discretion over the use of proceeds from this offering.

We currently intend to allocate the net proceeds received from this offering as described under "Reasons for the Offer and Use of Proceeds"; however, our management will have broad discretion in the application of the net proceeds from this offering pursuant to this prospectus supplement and the accompanying prospectus, as well as the timing of their expenditures. Given the broad discretion given to our management in the actual application of any net proceeds received from this offering, we may elect to allocate proceeds differently from that described in "Reasons for the Offer and Use of Proceeds" if we believe it would be in our best interests to do so, which may be in ways that an investor may not consider desirable. The failure by our management to apply any funds received effectively could have a material adverse effect on our business and results of operations. The results and the effectiveness of the application of any net proceeds are uncertain. If the net proceeds received from this offering are not applied effectively, our business, financial condition and results of operations may suffer, which could adversely affect the price of our common shares on the open market.

You will experience immediate and substantial dilution as a result of this offering.

You will incur immediate and substantial dilution as a result of this offering. After giving effect to the sale by us of 3,000,000 common shares offered in this offering at a public offering price of $1.00 for each common share, and after deducting any underwriter discounts and commissions and estimated offering expenses payable by us, based on our net tangible book value as of June 30, 2024, investors in this offering can expect to experience immediate dilution of $0.62 per common share (assuming no exercise of the over-allotment option). We may also issue additional common shares, warrants or other securities convertible into common shares in the future, which may further dilute an existing shareholder's equity interest in us. We cannot assure you that we will be able to sell common shares, warrants or other securities in any other offering at a price per share that is equal to or greater than the price per share paid by investors in this offering, and investors purchasing shares, warrants or other securities in the future could have rights superior to existing shareholders, including investors who purchase our securities in this offering. The price at which we sell additional common shares, warrants or other securities convertible into common shares in future transactions may be higher or lower than the price of our securities in this offering. As a result, purchasers of our securities, as well as our existing shareholders, will experience significant dilution if we sell at prices significantly below the price at which they invested.

Risks Related to Our Business

We have not reached profitability and currently have negative operating cash flows.

For the fiscal year ended March 31, 2024, we generated a loss of $(18,313,249) and for the three months ended June 30, 2024, we generated a loss of $(5,299,753) bringing our accumulated deficit to $(84,277,672). We expect significant increases in costs and expenses as we invest in expanding our production and operations. Even if we are successful in increasing revenues from sales of our products, we may be unable to achieve positive cash flow or profitability for a number of reasons, including but not limited to, an inability to control production costs, increases or inflation in our selling general and administrative expenses, and a reduction in our product sales price due to competitive or other factors. An inability to generate positive cash flow and profitability until we reach a sufficient level of sales with positive gross margins that cover operating expenses, or an inability to raise additional capital on reasonable terms, will adversely affect our viability as an operating business. Based on these factors, our ability to achieve our business objectives is subject to material uncertainty which casts substantial doubt upon our ability to continue as a going concern.

We operate in a capital-intensive industry and will require a significant amount of capital to continue operations.

If the revenue from the sale of our electric buses is not sufficient to cover our cash requirements, we will need to raise additional funds through the sale of equity or other securities, or the issuance of additional debt. Financing may not be available at terms that are acceptable to us, if at all.

Our ability to obtain the necessary financing for our business is subject to a number of factors, including general market conditions and investor acceptance of our business plan. These factors may make the timing, amount, terms and conditions of such financing unattractive or unavailable to us. If we are unable to raise sufficient funds, we will have to significantly reduce our spending, delay or cancel our planned activities, or substantially change our current operations and plans in order to reduce our cost structure. Our competitors, many of which have raised or who have access to significant capital, may be able to compete more effectively in our markets given their access to capital, if our access to capital does not improve or is further limited. We might not be able to obtain any funding, and we might not have sufficient resources to conduct our business as projected, both of which could mean that we would be forced to curtail or discontinue our operations.

There is uncertainty about our ability to continue as a "going concern".

There is substantial doubt about our ability to continue as a going concern. If we are unable to raise sufficient capital when needed, our business, financial condition and results of operations will be materially and adversely affected, and we will need to significantly modify our operational plans to continue as a going concern. If we are unable to continue as a going concern, we might have to liquidate our assets and the values we receive for our assets in liquidation or dissolution could be significantly lower than the values reflected in our consolidated financial statements. Our potential inability to continue as a going concern may materially adversely affect our share price and our ability to raise new capital or to enter into critical contractual relations with third parties.

We have outstanding secured indebtedness, which could limit our financial flexibility.

Our outstanding secured indebtedness could have significant negative consequences including:

• increasing our vulnerability to general adverse economic and industry conditions;

• limiting our ability to obtain additional financing;

• violating a financial covenant, resulting in the indebtedness to be paid back immediately and thus negatively impacting our liquidity;

• requiring additional financial covenant measurement consents or default waivers without enhanced financial performance in the short term;

• requiring the use of a substantial portion of any cash flow from operations to service indebtedness, thereby reducing the amount of cash flow available for other purposes, including capital expenditures;

• limiting our flexibility in planning for, or reacting to, changes in our business and the industry in which it competes, including by virtue of the requirement that we remain in compliance with certain negative operating covenants included in the credit arrangements under which we will be obligated as well as meeting certain reporting requirements; and

• placing us at a possible competitive disadvantage to less leveraged competitors that are larger and may have better access to capital resources.

The reduction or elimination of government and economic incentives, funding approval or the delay in the timing of advancing funding that has been approved, in particular in the state of California, could have a material adverse effect on our business, financial condition, operating results and prospects.

Any reduction, elimination or discriminatory application of government subsidies and economic incentives because of policy changes, the reduced need for such subsidies and incentives for electric vehicles may result in the diminished competitiveness of the alternative fuel vehicle industry generally or our electric vehicles in particular. This could materially and adversely affect the growth of the alternative fuel automobile markets and our business, prospects, financial condition and operating results.

Our vehicles are eligible for vouchers from specific government programs, including but not limited to the HVIP from the California Air Resources Board in partnership with Calstart, the New Jersey Zero-Emission Incentive program, the New York Truck Voucher Incentive Program, or the Specialty-Use Vehicle Incentive Program funded by the Province of British Columbia, Canada. The ability for potential purchasers to receive funding from these programs is subject to the risk of the programs being funded by governments, and the risk of the delay in the timing of advancing funds to the specific programs. To the extent that program funding is not approved, or if the funding is approved but timing of advancing of funds is delayed, subject to cancellation, or otherwise uncertain, this could have a material adverse effect on our business, financial condition, operating results and prospects.

To date the vast majority of our electric vehicle sales have been in the state of California, in part due to subsidies and grants for electric vehicles and electric charging infrastructure available from the California state government. In some cases these grants or subsidies have covered the entire vehicle cost, and in many cases the grants or subsidies have reduced the net cost to our customers to a point that the vehicle is less expensive than purchasing a comparable diesel powered vehicle. Any reduction or elimination of the grants or incentives in the state of California would have a material negative impact on our business, financial condition, operating results and prospects.

We may be involved in litigation or legal proceedings that are deemed to be material and may require recognition as a provision or a contingent liability on our consolidated financial statements.

We may in the future be involved in litigation or legal proceedings that are material and may require recognition as a provision or contingent liability on our consolidated financial statements. We have filed a civil claim against the prior CEO and a director of our company in the Province of British Columbia, and he has filed a response with a counterclaim for wrongful dismissal in the Province of British Columbia. He has also filed a similar claim in the state of California in regards to this matter, and this claim has been stayed pending the outcome of the claim in British Columbia. In addition, a company owned and controlled by a former employee who provided services to a subsidiary company of GreenPower until August 2013 filed a claim for breach of confidence against GreenPower in July 2020. During April 2023, we repossessed 27 EV Stars and 10 EV Star CC's which were previously on lease, after the leases were terminated following a notice of default that was not cured. In addition, we repossessed 1 EV Star from the same customer due to nonpayment. During May 2023, this customer filed a claim in the state of California against us and one of our subsidiaries to which we have filed a response. We do not expect the outcomes of our claims, or the claims filed against us, to be material, and as of the date of this prospectus supplement the resolution of these claims, including the potential timing or financial impact of these claims is inherently uncertain. However, we may in the future determine that these claims become material or we may be subject to other claims that alone or in addition to other claims are considered to be material, and require recognition as a provision or contingent liability on our consolidated financial statements.

We may be materially adversely affected by cybersecurity risks.

Significant disruptions of our information technology systems or breaches of our data security could adversely affect our business. Our business and operations may be materially adversely affected in the event of computer system failures or security or breaches due to cyber-attacks or cyber intrusions, including ransomware, phishing attacks and other malicious intrusions.

The majority of our manufacturing is currently contracted out to third party manufacturers and we are dependent on these manufacturers to operate competitively.

We currently contract out the majority of the manufacturing of our vehicles to third party manufacturers in Asia, with final assembly performed by our employees in North America. As a result, we are dependent on third party manufacturers to manufacture our vehicles according to our specifications and quality, at a competitive cost and within agreed upon timeframes. If our chosen manufacturing vendors are unable or unwilling to perform these functions then our financial results and reputation may suffer, which may prevent us from being able to continue as a going concern. In addition, we are subject to inherent risks involved in shipping our vehicles from these primary manufacturers to our facilities in North America. During the shipping process our vehicles are subject to theft, loss or damage due to a number of factors, some of which we may be unable to insure cost-effectively, if at all.

Developments in alternative technologies or improvements in the internal combustion engine may materially adversely affect the demand for our electric vehicles.

Significant developments in alternative technologies, such as advanced diesel, ethanol, fuel cells or compressed natural gas, or improvements in the fuel economy of the internal combustion engine, may materially and adversely affect our business and prospects in ways we do not currently anticipate. For example, fuel which is abundant and relatively inexpensive in North America, such as compressed natural gas, may emerge as consumers' preferred alternative to petroleum-based propulsion. Any failure by us to develop new or enhanced technologies or processes, or to react to changes in existing technologies, could materially delay our development and introduction of new and enhanced electric vehicles, which could result in the loss of competitiveness of our vehicles, decreased revenue and a loss of market share to competitors.

If we are unable to keep up with advances in electric vehicle technology, we may suffer a decline in our competitive position.

We may be unable to keep up with changes in electric vehicle technology and, as a result, may suffer a decline in our competitive position. Any failure to keep up with advances in electric vehicle technology would result in a decline in our competitive position which would materially and adversely affect our business, prospects, operating results and financial condition. Our research and development efforts may not be sufficient to adapt to changes in electric vehicle technology. As technologies change, we plan to upgrade or adapt our vehicles and introduce new models to continue to provide vehicles with the latest technology. However, our vehicles may not compete effectively with alternative vehicles if we are not able to source and integrate the latest technology into our vehicles at a competitive price. For example, we do not manufacture battery cells or drive motors which makes us dependent upon suppliers of these products for our vehicles.

We may need to defend ourselves against intellectual property infringement claims, which may be time-consuming and could cause us to incur substantial costs.

Others, including our competitors, may hold or obtain patents, copyrights, trademarks or other proprietary rights that could prevent, limit or interfere with our ability to make, use, develop, sell or market our products and services, which could make it more difficult for us to operate our business. From time to time, the holders of such intellectual property rights may assert their rights and urge us to take licenses, and/or may bring suits alleging infringement or misappropriation of such rights. We may consider the entering into licensing agreements with respect to such rights, although no assurance can be given that such licenses can be obtained on acceptable terms or that litigation will not occur, and such licenses could significantly increase our operating expenses. In addition, if we are determined to have infringed upon a third party's intellectual property rights, we may be required to cease making, selling or incorporating certain components or intellectual property into the goods and services we offer, to pay substantial damages and/or license royalties, to redesign our products and services, and/or to establish and maintain alternative branding for our products and services. In the event that we were required to take one or more such actions, our business, prospects, operating results and financial condition could be materially adversely affected. In addition, any litigation or claims, whether or not valid, could result in substantial costs, negative publicity and diversion of resources and management attention.

We depend on certain key personnel, and our success will depend on our continued ability to retain and attract such qualified personnel.

Our success depends on the efforts, abilities and continued service of our executive officers and management. A number of these key employees have significant experience in the electric vehicle industry, and valuable relationships with our suppliers, customers, and other industry participants. A loss of service from any one of these individuals may adversely affect our operations, and we may have difficulty or may be unable to locate and hire a suitable replacement. We have not obtained any "key person" insurance on any of our executives or managers.

We are subject to numerous environmental and health and safety laws and any breach of such laws may have a material adverse effect on our business and operating results.

We are subject to numerous environmental and health and safety laws, including statutes, regulations, bylaws and other legal requirements. These laws relate to the generation, use, handling, storage, transportation and disposal of regulated substances, including hazardous substances (such as batteries), dangerous goods and waste, emissions or discharges into soil, water and air, including noise and odors (which could result in remediation obligations), and occupational health and safety matters, including indoor air quality. These legal requirements vary by location and can arise under federal, provincial, state or municipal laws. Any breach of such laws, regulations or requirements could have a material adverse effect on our company and its operating results.

Our vehicles are subject to motor vehicle standards and the failure to satisfy such mandated safety standards would have a material adverse effect on our business and operating results.

All vehicles sold must comply with federal, state and provincial motor vehicle safety standards. In both Canada and the United States, vehicles that meet or exceed all federally mandated safety standards are certified under the federal regulations. In this regard, Canadian and U.S. motor vehicle safety standards are substantially the same. Rigorous testing and the use of approved materials and equipment are among the requirements for achieving federal certification. Failure by us to have our current or future electric vehicles satisfy motor vehicle standards would have a material adverse effect on our business and operating results.

If our vehicles fail to perform as expected, our ability to continue to develop, market and sell our electric vehicles could be harmed.

Our vehicles may contain defects in design and manufacture that may cause them not to perform as expected or that may require repair. For example, our vehicles use technologically complex battery management software to operate. Given the inherent complexity of this software, it may contain defects and errors which would adversely impact the operation of our vehicles. While we have performed extensive testing of our vehicles, we currently have a limited frame of reference to evaluate the performance of our vehicles in the hands of our customers under a range of operating conditions.

We may not succeed in establishing, maintaining and strengthening the GreenPower brand, which would materially and adversely affect customer acceptance of our vehicles and components and our business, revenues and prospects.

Our business and prospects heavily depend on our ability to develop, maintain and strengthen the GreenPower brand. Any failure to develop, maintain and strengthen our brand may materially and adversely affect our ability to sell our planned electric vehicles. If we are not able to establish, maintain and strengthen our brand, we may lose the opportunity to expand our customer base. Promoting and positioning our brand will depend significantly on our ability to provide high quality electric vehicles and maintenance and repair services, and we have limited experience in these areas. In addition, we expect that our ability to develop, maintain and strengthen the GreenPower brand will also depend heavily on the success of our marketing efforts. To date, we have limited experience with marketing activities as we have relied primarily on the internet, word of mouth and attendance at industry trade shows to promote our brand. To further promote our brand, we may be required to change our marketing practices, which could result in substantially increased advertising expenses. We operate in a competitive industry, and we may not be successful in building, maintaining and strengthening our brand. Many of our current and potential competitors, particularly automobile manufacturers headquartered in the United States, Japan and the European Union have greater name recognition, broader customer relationships and substantially greater marketing resources than we do. If we do not develop and maintain a strong brand, our business, prospects, financial condition and operating results will be materially and adversely impacted.

We are dependent on our suppliers, many of which are single-source suppliers, and the inability of these suppliers to deliver necessary components of our products according to our schedule and at prices, quality levels and volumes acceptable to us, or our inability to efficiently manage these components, could have a material adverse effect on our financial condition and operating results.

Our products contain numerous purchased parts which we source globally directly from suppliers, many of which are single-source suppliers, although we attempt to qualify and obtain components from multiple sources whenever feasible. Any significant increases in our production may require us to procure additional components in a short amount of time, and in the past we have also replaced certain suppliers because of their failure to provide components that met our quality control standards or our timing requirements. If any of our single source suppliers is unable to deliver components to us there is no assurance that we will be able to secure additional or alternate sources of supply for our components or develop our own replacements in a timely manner, if at all. If we encounter unexpected difficulties with key suppliers, and if we are unable to fill these needs from other suppliers, we could experience production delays and potential loss of access to important technology and parts for producing, servicing and supporting our products.

This limited, and in many cases single source, supply chain exposes us to multiple potential sources of delivery failure or component shortages for production of our products. Furthermore, unexpected changes in business conditions, materials pricing, labor issues, wars, governmental changes, and natural disasters could also affect our suppliers' ability to deliver components to us on a timely basis. The loss of any single or limited source supplier or the disruption in the supply of components from these suppliers could lead to product design changes and delays in product deliveries to our customers, which could hurt our relationships with our customers and result in negative publicity, damage to our brand and a material and adverse effect on our business, prospects, financial condition and operating results.

Changes in our supply chain may lead to an increased cost for our products. We have also experienced cost increases from certain of our suppliers in order to meet our quality targets and timelines as well as due to our design changes, and we may experience similar cost increases in the future. Certain suppliers have sought to renegotiate the terms of supply arrangements. Additionally, we are negotiating with existing suppliers for cost reductions and are seeking new and less expensive suppliers for certain parts. If we are unsuccessful in our efforts to control and reduce supplier costs, our operating results will suffer.

There is no assurance that our suppliers will be able to sustainably and timely meet our cost, quality and volume needs. Furthermore, if the scale of our vehicle production increases, we will need to accurately forecast, purchase, warehouse and transport to our manufacturing facilities components at much higher volumes. If we are unable to accurately match the timing and quantities of component purchases to our actual needs, or successfully manage our inventory to accommodate the increased complexity in our supply chain, we may incur unexpected production disruption, storage, transportation and write-off costs, which could have a material adverse effect on our financial condition and operating results.

If we fail to manage future growth effectively, we may not be able to market and sell our vehicles successfully.

Any failure to manage our growth effectively could materially and adversely affect our business, prospects, operating results and financial condition. We are expecting significant growth in sales, and are currently expanding our employees, facilities and infrastructure in order to accommodate this growth. Our future operating results depend to a large extent on our ability to manage this expansion and growth successfully. Risks that we face in undertaking this expansion include:

• training new personnel;

• forecasting production and revenue;

• controlling expenses and investments in anticipation of expanded operations;

• establishing or expanding manufacturing, sales and service facilities;

• implementing and enhancing administrative infrastructure, systems and processes;

• addressing new markets; and

• establishing international operations.

We intend to continue to hire a number of additional personnel, including manufacturing personnel and service technicians for our electric vehicles. There is significant competition for individuals with experience manufacturing and servicing electric vehicles, and we may not be able to attract, assimilate, train or retain additional highly qualified personnel in the future. The failure to attract, integrate, train, motivate and retain these additional employees could seriously harm our business and prospects.

Our business may be adversely affected by labor and union activities.

Although none of our employees are currently represented by a labor union, it is common throughout the automobile industry for employees to belong to a union. Having a unionized workforce may result in higher employee costs and increased risk of work stoppages. Additionally, we are in the process of expanding our in-house manufacturing capabilities and increasing the number of employees in this area. If our employees engaged in manufacturing were to unionize, this may increase our future production costs and negatively impact our gross margins and financial results.

We also directly and indirectly depend upon other companies with unionized work forces, such as parts suppliers and trucking and freight companies, and work stoppages or strikes organized by such unions could have a material adverse impact on our business, financial condition or operating results. If a work stoppage occurs within our business or in one of our key suppliers, it could delay the manufacture and sale of our electric vehicles and have a material adverse effect on our business, prospects, operating results and financial condition.

We may become subject to product liability or warranty claims, which could harm our financial condition and liquidity if we are not able to successfully defend or insure against such claims.

We may become subject to product liability or warranty claims, which could harm our business, prospects, operating results and financial condition. The automobile industry experiences significant product liability claims and we face inherent risk of exposure to claims in the event our vehicles do not perform as expected or malfunction resulting in personal injury or death. Our risks in this area are particularly pronounced given our vehicles have only been operating for a short period of time. A successful product liability claim against us could require us to pay a substantial monetary award. Moreover, a product liability claim could generate substantial negative publicity about our vehicles and business which would have a material adverse effect on our brand, business, prospects and operating results.

Global economic conditions could materially adversely impact demand for our products and services.

Our operations and performance depend significantly on economic conditions. Uncertainty about global economic conditions could result in customers postponing purchases of our products and services in response to tighter credit, unemployment, negative financial news and/or declines in income or asset values and other macroeconomic factors, which could have a material negative effect on demand for our products and services and, accordingly, on our business, results of operations or financial condition.

Goods imported to the U.S. from China are subject to significant import tariffs, and these tariffs negatively impact our financial performance, financial position, and financial results.

We source components and parts to build our all-electric vehicles from suppliers globally, utilizes contract manufacturers located outside of North America for a portion of our all-electric vehicle production, and the importation of these parts, components and vehicles to North America are subject to tariffs which have recently increased and may increase further in the future. In particular, electric vehicles and electric vehicle batteries that are imported from China to the United States became subject to a 100% and 25% tariff, respectively, as of September 27, 2024, while increases to tariff rates for semiconductors imported from China to the United States are planned within the next two years. We have suppliers and contract manufacturers located in China, and the increase in these tariffs will increase our costs and negatively impact the financial results of our company. While our management is taking steps to mitigate the impact of tariff increases, including sourcing new manufacturers and contract manufacturers for certain products, this transition will take time, is subject to a number of risks, and we may not be able to mitigate the impact of any change in tariffs due to these risks.

We rely on global shipping for our vehicles that are produced at contract manufacturers, and for certain parts and components sourced from our global network of suppliers. We have experienced increased shipping costs and have experienced shipping constraints which increased our costs and prevented us from delivering vehicles to customers on a timely basis. A continuation or escalation of these trends may negatively impact our financial results and ability to grow our business.

We rely on global shipping for vehicles that we produce at contract manufacturers, and for certain parts and components sourced from our global network of suppliers. We have experienced an increase in shipping costs and have previously, and may again in the future, experienced delays of deliveries of parts and components from our global suppliers, and on vehicles arriving from our contract manufacturers. While these delays and shipping costs are not currently at a level that they have caused a material disruption or negative impact to our profitability, future delays and costs may increase to a point that they may negatively impact our financial results and ability to grow our business.

Our line of credit and our term loan facility contain covenant restrictions that may limit our ability to access funds on the line of credit and on the term loan facility, or engage in other commercial activities.

The terms of our line of credit and our term loan facility contain, and future debt agreements we enter into may contain, covenant restrictions that limit our ability to incur additional debt or issue guarantees, create liens, and make certain dispositions of property or assets. As a result of these covenants, our ability to respond to changes in business and economic conditions and engage in beneficial transactions, including obtaining additional financing as needed, may be restricted. Furthermore, our failure to comply with our debt covenants could result in a default under our line of credit, which would permit the lender to demand repayment.

The demand for commercial zero-emission electric vehicles depends, in part, on the continuation of current trends resulting from historical dependence on fossil fuels. Extended periods of low diesel or other petroleum-based fuel prices could adversely affect demand for electric vehicles, which could adversely affect our business, prospects, financial condition and operating results.

We believe that much of the present and projected demand for commercial zero-emission electric vehicles results from concerns about volatility in the cost of petroleum-based fuel, the dependency of the United States on oil from unstable or hostile countries, government regulations and economic incentives promoting fuel efficiency and alternative forms of energy, as well as the belief that poor air quality and climate change results in part from the burning of fossil fuels. If the cost of petroleum-based fuel decreased significantly, or the long-term supply of oil in the United States improved, the government may eliminate or modify its regulations or economic incentives related to fuel efficiency and alternative forms of energy. If there is a change in the perception that the burning of fossil fuels does not negatively impact the environment, the demand for commercial zero-emission electric vehicles could be reduced, and our business and revenue may be harmed. Diesel and other petroleum-based fuel prices have been extremely volatile, and we believe this continuing volatility will persist. Lower diesel or other petroleum-based fuel prices over extended periods of time may lower the current perception in government and the private sector that cheaper, more readily available energy alternatives should be developed and produced. If diesel or other petroleum-based fuel prices remain at deflated levels for extended periods of time, the demand for commercial electric vehicles may decrease, which could have an adverse effect on our business, prospects, financial condition and operating results.

We may be compelled to undertake product recalls.

Any product recall in the future may result in adverse publicity, damage to our brand and may adversely affect our business, prospects, operating results and financial condition. We may at various times, voluntarily or involuntarily, initiate a recall if any of our electric vehicle components prove to be defective. Such recalls, voluntary or involuntary, involve significant expense and diversion of management attention and other resources, which would adversely affect our brand image in our target markets and could adversely affect our business, prospects, financial condition and results of operations.

Security breaches and other disruptions to our information technology networks and systems could substantially interfere with our operations and could compromise the confidentiality of our proprietary information, notwithstanding the fact that no such breaches or disruptions have materially impacted us to date.

We rely upon information technology systems and networks, some of which are managed by third-parties, to process, transmit and store electronic information, and to manage or support a variety of business processes and activities, including supply chain management, manufacturing, invoicing and collection of payments from our customers. Additionally, we collect and store sensitive data, including intellectual property, proprietary business information, the proprietary business information of our suppliers, as well as personally identifiable information of our employees, in data centers and on information technology systems. The secure operation of these information technology systems, and the processing and maintenance of this information, is critical to our business operations and strategy. Despite security measures and business continuity plans, our information technology systems and networks may be vulnerable to damage, disruptions or shutdowns due to attacks by hackers or breaches due to errors or malfeasance by employees, contractors and others who have access to our networks and systems, or other disruptions during the process of upgrading or replacing computer software or hardware, hardware failures, software errors, third-party service provider outages, power outages, computer viruses, telecommunication or utility failures or natural disasters or other catastrophic events. The occurrence of any of these events could compromise our systems and the information stored there could be accessed, publicly disclosed, lost or stolen. Any such access, disclosure or other loss of information could result in legal claims or proceedings, liability or regulatory penalties under laws protecting the privacy of personal information, disrupt operations and reduce the competitive advantage we hope to derive from our investment in technology. Our insurance coverage may not be available or adequate to cover all the costs related to significant security attacks or disruptions resulting from such attacks.

Our electric vehicles make use of lithium-ion battery cells, which, if not appropriately managed and controlled, have occasionally been observed to catch fire or vent smoke and flames. If such events occur in our electric vehicles, we could face liability associated with our warranty, for damage or injury, adverse publicity and a potential safety recall, any of which would adversely affect our business, prospects, financial condition and operating results.

The battery packs in our electric vehicles use lithium-ion cells, which have been used for years in laptop computers and cell phones. Highly publicized incidents of laptop computers and cell phones bursting into flames have focused consumer attention on the safety of these cells. These events also have raised questions about the suitability of these lithium-ion cells for automotive applications. There can be no assurance that a field failure of our battery packs will not occur, which would damage the vehicle or lead to personal injury or death and may subject us to lawsuits. Furthermore, there is some risk of electrocution if individuals who attempt to repair battery packs on our vehicles do not follow applicable maintenance and repair protocols. Any such damage or injury would likely lead to adverse publicity and potentially a safety recall. Any such adverse publicity could adversely affect our business, prospects, financial condition and operating results.

Risks Related to Our Securities

Because we can issue additional common shares or preferred shares, our shareholders may experience dilution in the future.

We are authorized to issue an unlimited number of common shares without par value and an unlimited number of preferred shares without par value. Our board of directors has the authority to cause us to issue additional common shares or preferred shares and to determine the special rights and restrictions of the shares of one or more series of our preferred shares, without consent of our shareholders. The issuance of any such securities may result in a reduction of the book value or market price of our common shares. Given the fact that we have not achieved profitability or generated positive cash flow historically, and we operate in a capital intensive industry with significant working capital requirements, we may be required to issue additional common equity or securities that are dilutive to existing common shares in the future in order to continue its operations. Our efforts to fund our intended business plan may result in dilution to existing shareholders. Further, any such issuances could result in a change of control or a reduction in the market price for our common shares.

The market price of our common shares may be volatile and may fluctuate in a way that is disproportionate to our operating performance.

Our common shares are listed on the Nasdaq Capital Market and the TSX Venture Exchange. Trading of our common shares on the Nasdaq Capital Market or the TSX Venture Exchange is often characterized by wide fluctuations in trading prices, due to many factors that may have little to do with our operations or business prospects.

The price of our common shares has fluctuated significantly. This volatility could depress the market price of our common shares for reasons unrelated to operating performance. The market price of our common shares could decline due to the impact of any of the following factors upon the market price of our common shares:

• sales or potential sales of substantial amounts of our common shares;

• announcements about us or about our competitors;

• litigation and other developments relating to our company or those of our suppliers or our competitors;

• conditions in the automobile industry;

• governmental regulation and legislation;

• variations in our anticipated or actual operating results;

• change in securities analysts' estimates of our performance, or our failure to meet analysts' expectations;

• change in general economic conditions or trends;

• changes in capital market conditions or in the level of interest rates; and

• investor perception of our industry or our prospects.

Many of these factors are beyond our control. The stock markets in general, and the market price of common shares of vehicle companies in particular, have historically experienced extreme price and volume fluctuations. These fluctuations often have been unrelated or disproportionate to the operating performance of these companies. These broad market and industry factors could reduce the market price of our common shares, regardless of our actual operating performance.

Volatility in our common share price may subject us to securities litigation.

The market for our common shares may have, when compared to seasoned issuers, significant price volatility, and we expect that our share price may continue to be more volatile than that of a seasoned issuer for the foreseeable future. In the past, plaintiffs have often initiated securities class action litigation against a company following periods of volatility in the market price of its securities. We may, in the future, be the target of similar litigation. Securities litigation could result in substantial costs and liabilities and could divert management's attention and resources away from the day to day business operations.

A prolonged and substantial decline in the price of our common shares could affect our ability to raise further working capital, thereby adversely impacting our ability to continue operations.

A prolonged and substantial decline in the price of our common shares could result in a reduction in the liquidity of our common shares and a reduction in our ability to raise capital. Because we plan to acquire a significant portion of the funds we need in order to conduct our planned operations through the sale of equity securities, a decline in the price of our common shares could be detrimental to our liquidity and our operations because the decline may cause investors not to choose to invest in our shares. If we are unable to raise the funds we require for all our planned operations and to meet our existing and future financial obligations, we may be forced to reallocate funds from other planned uses and may suffer a significant negative effect on our business plan and operations, including our ability to develop new products and continue our current operations. As a result, our business may suffer, and we may go out of business.

Because we do not intend to pay any cash dividends on our common shares in the near future, our shareholders will not be able to receive a return on their shares unless they sell them.

We intend to retain any future earnings to finance the development and expansion of our business. We do not anticipate paying any cash dividends on our common shares in the near future. The declaration, payment and amount of any future dividends will be made at the discretion of our board of directors, and will depend upon, among other things, the results of operations, cash flows and financial condition, operating and capital requirements, and other factors as the board of directors considers relevant. There is no assurance that future dividends will be paid, and if dividends are paid, there is no assurance with respect to the amount of any such dividend. Unless we pay dividends, our shareholders will not be able to receive a return on their shares unless they sell them.

Investors may not be able to obtain enforcement of civil liabilities against us.

The enforcement by investors of civil liabilities under the United States federal or state securities laws may be adversely affected by the fact that we are governed by the Business Corporations Act (British Columbia), that several of our officers and directors are residents of Canada and that all, or a substantial portion, of their assets and a portion of our assets are located outside the United States. It may not be possible for an investor to effect service of process within the United States on, or enforce judgments obtained in the United States courts against, us or certain of our directors and officers based upon the civil liability provisions of United States federal securities laws or the securities laws of any state of the United States.

In light of the above, there is doubt as to whether (i) a judgment of a United States court based solely upon the civil liability provisions of United States federal or state securities laws would be enforceable in Canada against us or our directors and officers and (ii) an original action could be brought in Canada (or otherwise outside the United States) against us or our directors and officers to enforce liabilities based solely upon United States federal or state securities laws.

We may be classified as a "passive foreign investment company," which may have adverse U.S. federal income tax consequences for U.S. shareholders.

We will be a "passive foreign investment company," or "PFIC," if, in any particular taxable year, either (a) 75% or more of our gross income for such year consists of certain types of "passive" income or (b) 50% or more of the average quarterly value of our assets (as determined on the basis of fair market value) during such year produce or are held for the production of passive income (the "asset test"). In determining whether we are a PFIC, we are permitted to take into account the assets and income of our wholly owned subsidiaries because we own 100% of their stock. However, even if we take into account the assets and income of our subsidiaries, we may still be considered a PFIC for this year and possibly later years, depending on a number of factors, including the composition of our income and assets, how quickly we use our liquid assets, including the cash raised pursuant to this offering (if we determine not to, or are unable to, deploy significant amounts of cash for active purposes our risk of being a PFIC will substantially increase), the market price of our common shares, and fluctuations in that price. Because there are uncertainties in the application of the relevant rules and PFIC status is a factual determination made annually after the close of each taxable year, there can be no assurance that we will not be a PFIC for this year or any future taxable year. Please refer to the paragraph titled "Certain United States Federal Income Tax Considerations".

If we are a PFIC in any taxable year, a U.S. holder may incur significantly increased United States income tax on gain recognized on the sale or other disposition of the common shares and on the receipt of distributions on the common shares to the extent such gain or distribution is treated as an "excess distribution" under the United States federal income tax rules. A U.S. holder may also be subject to burdensome reporting requirements. Further, if we are a PFIC for any year during which a U.S. holder holds our common shares, we generally will continue to be treated as a PFIC with respect to that U.S. Holder for all succeeding years during which such U.S. holder holds our common shares. Please refer to the paragraph titled "Certain United States Federal Income Tax Considerations".

Forward-Looking Statements

This prospectus supplement, the accompanying prospectus and the information and documents incorporated by reference into this prospectus supplement contain or will contain forward-looking statements which relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as "may", "should", "expect", "plan", "anticipate", "believe", "estimate", "predict", "potential" or "continue" or the negative of these terms or other comparable terminology. The forward-looking statements may include estimates, plans, expectations, opinions, forecasts, projections, targets, guidance and other statements that are not statements of fact. The forward‐looking statements are made only as of the date of this prospectus supplement, the accompanying prospectus or the documents incorporated by reference into this prospectus supplement, as applicable. The forward‐looking statements include, but are not limited to, statements with respect to:

• our intentions, plans and future actions;

• statements relating to our business and future activities;

• anticipated developments in our operations;

• our market position, ability to compete and future financial or operating performance;

• the timing and amount of funding required to execute our business plans;

• capital expenditures;

• the effect of any changes to existing or new legislation or policy or government regulation to our company;

• the availability of labour;

• requirements for additional capital;

• goals, strategies and future growth;

• the adequacy of financial resources; and

• expectations regarding revenues, expenses and anticipated cash needs.

Our actual results, performance or achievements could differ materially from those anticipated in the forward-looking statements as a result of the risk factors set forth under the heading "Risk Factors", including, but not limited to, risks related to: (i) our ability to generate sufficient cash flow from operations and obtain financing, if needed, on acceptable terms or at all; (ii) general economic, financial market and regulatory conditions in which we operate; (iii) the yield from our operations; (iv) consumer interest in our products; (v) competition; (vi) anticipated and unanticipated costs; (vii) government regulation of our products and operations; (viii) the timely receipt of any required regulatory approvals; (ix) our ability to obtain qualified staff, equipment and services in a timely and cost efficient manner; (x) our ability to conduct operations in a safe, efficient and effective manner; and (xi) our plans and timeframe for completion of such plans.

While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. We caution you not to place undue reliance on any such forward-looking statements, which speak only as of the date made. Except as required by applicable law, including the securities laws of the United States and Canada, we disclaim any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

Reasons for the Offer and Use of Proceeds

We estimate that the net proceeds from the sale of our common shares in this offering will be approximately $2,655,000 after deducting underwriting discounts and commissions and estimated offering expenses payable by us (or approximately $3,073,500 if the underwriters' over-allotment option is exercised in full).

We intend to use the net proceeds from this offering for the production of all-electric vehicles, including BEAST school buses and EV Star commercial vehicles, as well as for product development, with the remainder, if any, for general corporate purposes.

While we intend to spend the net proceeds of this offering as stated above, there may be circumstances where, for sound business reasons, a re-allocation of funds may be necessary or advisable. The actual amount that we spend in connection with each of the intended uses of proceeds may vary significantly from the amounts specified above, and will depend on a number of factors, including those listed under the heading "Risk Factors" in this prospectus supplement, the prospectus and the documents incorporated by reference herein and therein.

Dilution

If you invest in our common shares in this offering, you will experience dilution to the extent of the difference between the public offering price per common share you will pay in this offering and the as adjusted net tangible book value per common share after giving effect to this offering.

Our historical net tangible book value on June 30, 2024 was $8,600,047 or $0.32 per common share. "Net tangible book value" represents our total assets minus the sum of liabilities and intangible assets. "Net tangible book value per share" is net tangible book value divided by the total number of common shares outstanding. Dilution in net tangible book value per share represents the difference between the amount per share paid by purchasers of our common shares in this offering and the net tangible book value per share of our common shares immediately after completion of this offering.

After giving effect to the sale of 3,000,000 common shares in this offering at the public offering price of $1.00 per common share, and after deducting any underwriting discounts, commissions and estimated offering expenses payable by us, our net tangible book value as of June 30, 2024, as adjusted, would have been approximately $11,255,047 or approximately $0.38 per common share, assuming the over-allotment option is not exercised. This represents an immediate increase in the as adjusted net tangible book value of $0.06 per share to our existing shareholders and an immediate dilution of approximately $0.62 per share to the investors in this offering. The following table illustrates this calculation on a per share basis in U.S. dollars.

| Public offering price per common share |

|

|

|

$ |

1.00 |

|

| Historical net tangible book value per common share as of June 30, 2024 |

$ |

0.32 |

|

|

|

|

| Increase in as adjusted net tangible book value per share attributable to this offering |

$ |

0.06 |

|

|

|

|

| As adjusted net tangible book value per share after giving effect to this offering |

|

|

|

$ |

0.38 |

|

| Dilution per share to new investors in this offering |

|

|

|

$ |

0.62 |

|

The above discussion and table are based on 26,491,162 common shares (29,491,162 common shares on an as adjusted basis) outstanding as of June 30, 2024, and excludes as of such date:

• 2,313,483 common shares issuable upon exercise of outstanding stock options at a weighted average exercise price of CDN$7.70 per share;

• 1,575,000 common shares issuable upon exercise of outstanding warrants, as of that date, at a weighted average exercise price of $1.82 per share;

• Up to 450,000 common shares issuable upon the exercise of the over-allotment option; and

• Up to 150,000 common shares issuable upon the exercise of the Representative's Warrants (as defined below), or up to 172,500 common shares if the underwriters' over-allotment option is exercised in full.

In addition, the above discussion assumes no exercise by the underwriters of the over-allotment option. If the underwriters exercise their over-allotment option, the as adjusted net tangible book value per share after this offering would be approximately $0.39 per share, representing an increase in net tangible book value per share attributable to this offering of approximately $0.07 and dilution in net tangible book value per share to investors in this offering of approximately $0.61, in each case based on a public offering price of $1.00 per share.