Filed by Global Partner

Acquisition Corp II pursuant to

Rule 425 under the Securities

Act of 1933, as amended,

and deemed filed pursuant

to Rule 14a-12 under

the Securities Exchange

Act of 1934, as amended.

Subject Company: Global

Partner Acquisition Corp II

Commission File No. 001-39875

Stardust Power to build lithium refinery in

Oklahoma, US: CEO | Hotter Commodities

On January 16, 2024, Fastmarkets published

the following article that includes an interview with Roshan Pujari, Co-Founder and CEO of Stardust Power:

Stardust Power Inc is to build a battery-grade

lithium refinery in Oklahoma in the United States, with major construction starting later in 2024, the US-based company’s founder

and chief executive officer told Fastmarkets

The lithium refinery, which will be located in

the Southside Industrial Park in Muskogee, will focus on the use of lithium brines for its feedstock, Roshan Pujari said on Thursday,

January 11.

“We’re building a large, centrally

located refinery optimized for multiple sources of brine input. We’re focused on brine over hard rock because brine is more sustainable,

has a lower carbon footprint and is easier to permit in the US,” he said in an interview.

Pujari noted that the US has many available sources

of lithium brine, particularly given the country’s strong oil and gas industry, where brines are already in production via hydraulic

fracturing.

The company will use direct lithium extraction

(DLE) technology, Pujari said, using its attributes to create a sustainable product.

“We match technology with the composition

of the brine, so it’s hard to pick one DLE technology that suits everything. As a result, we work with preferred vendors based on

the application of their technology to the specific brine,” he added.

The company plans to have a diversified pipeline

of brine sources for the refinery, Pujari said.

“We are working with oil and gas producers,

as well as lithium asset developers, and we’re also investing in developing assets ourselves. As we continue to move forward, we

can vertically integrate,” he noted.

“These sources are in the US and Canada,

although Stardust Power would consider a higher grade or technical grade from Argentina if needed. But we’re really focused on North

American sources and, most importantly, Inflation Reduction Act-compliant sources,” he added.

The company is expected to be eligible to receive

up to $257 million in state and federal economic incentives for the facility build-out. Stardust Power may also be eligible for further

federal grants and or incentives offered by the Department of Energy and the Department of Defense, Pujari noted.

“Legislation like the IRA is jump-starting

the creation of a resilient American supply chain,” he added.

Stardust Power selected the site in Oklahoma because

of the state’s central US location, facilitating the delivery of lithium inputs and shipments of battery-grade lithium products

over multiple transportation routes to support the company’s refining operations.

The area’s intermodal freight transport

options, as well as a highly skilled workforce trained in oil and gas engineering, were other key factors, Pujari noted.

Additionally, Oklahoma is recognized as an emerging

national leader in sustainable power, including solar and wind, supporting Stardust Power’s commitment to limit its carbon footprint,

he said.

Capacity shortfall

The rationale for the move into lithium refining

dovetailed with the company’s recognition that the lack of domestic US lithium production used to build batteries for electric vehicles

(EV) was creating a bottleneck, Pujari told Fastmarkets.

According to Pujari, while demand for lithium-ion

batteries continues to increase, the need for a diversified supply of lithium becomes increasingly important. The company determined that

the critical gap in the battery materials supply chain was lithium refining, which is dominated by China, Pujari noted.

Fastmarkets data indicates that China had a 66%

market share of refined lithium in 2023, a figure that is expected to remain relatively steady at 59% by 2033 despite capacity growth

in the rest of the world. The US produced just 53,000 tonnes of refined lithium in 2033, versus demand of 637,000 tonnes, Fastmarkets

estimates.

Jordan Roberts, Fastmarkets’ battery raw

materials analyst, noted that even with the capacity announcements from both integrated and non-integrated refineries in the US, there

is likely to be a shortfall in domestic processing capacity in the long term. This is due to the difficulty in bringing projects online,

especially those that include raw material extraction and typically face permitting difficulties, he said.

Developing lithium refinery capacity in the US

will also support the growth of the domestic EV industry, Pujari told Fastmarkets. To this end, Stardust Power is focused on supplying

EV manufacturers, specifically automakers.

“We’re in advanced discussions with

multiple manufacturers, and it’s all about finding the right partner, not the biggest check. This could mean a stake, pre-payment,

or something else; we’re open to options depending on who is the right long-term fit,” he said.

“Capital isn’t the biggest consideration;

it’s culture and strategic partnership,” he added.

The company expects to break ground on the facility

in the coming months and aims to start major construction work by the end of the year.

Forward-Looking Statements

The information included herein and in any oral

statements made in connection herewith include “forward-looking statements” within the meaning of Section 27A of the Securities

Act of 1933, as amended (the “Securities Act” and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”). All statements, other than statements of present or historical fact included herein, regarding the proposed business combination,

Global Partner Acquisition Corp II’s (“GPAC II”) and Stardust Power Inc.’s (the “Company”) ability

to consummate the transaction, the benefits of the transaction, GPAC II’s and the Company’s future financial performance following

the transaction, as well as GPAC II’s and the Company’s strategy, future operations, financial position, estimated revenues

and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. When used herein, including

any oral statements made in connection herewith, the words “could,” “should,” “will,” “may,”

“believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,”

the negative of such terms and other similar expressions are intended to identify forward-looking statements, although not all forward-looking

statements contain such identifying words.

These forward-looking statements are based on

GPAC II’s and the Company’s management’s current expectations and assumptions about future events and are based on currently

available information as to the outcome and timing of future events. GPAC II and the Company caution you that these forward-looking statements

are subject to risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of GPAC II and

the Company. These risks include, but are not limited to, (i) the risk that the proposed business combination may not be completed in

a timely manner or at all, which may adversely affect the price of GPAC II securities; (ii) the risk that the proposed business combination

may not be completed by GPAC II’s business combination deadline and the potential failure to obtain an extension of the business

combination deadline if sought by GPAC II; (iii) the failure to satisfy the conditions to the consummation of the proposed business combination,

including the approval of the proposed business combination by GPAC II’s shareholders and the Company’s stockholders, the

satisfaction of the minimum trust account amount following redemptions by GPAC II’s public shareholders and the receipt of certain

governmental and regulatory approvals; (iv) the effect of the announcement or pendency of the proposed business combination on the Company’s

business relationships, performance, and business generally; (v) risks that the proposed business combination disrupts current plans of

the Company and potential difficulties in the Company’s employee retention as a result of the proposed business combination; (vi)

the outcome of any legal proceedings that may be instituted against GPAC II or the Company related to the agreement and the proposed business

combination; (vii) changes to the proposed structure of the business combination that may be required or appropriate as a result of applicable

laws or regulations or as a condition to obtaining regulatory approval of the business combination (viii) the ability to maintain the

listing of GPAC II’s securities on the Nasdaq; (ix) the price of GPAC II’s securities, including volatility resulting from

changes in the competitive and highly regulated industries in which the Company plans to operate, variations in performance across competitors,

changes in laws and regulations affecting the Company’s business and changes in the combined capital structure; (x) the ability

to implement business plans, forecasts, and other expectations after the completion of the proposed business combination, and identify

and realize additional opportunities; (xi) the impact of the global COVID-19 pandemic and (xii) other risks and uncertainties related

to the transaction set forth in the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking

Statements” in GPAC II’s prospectus relating to its initial public offering (File No. 333-351558) declared effective by the

U.S. Securities and Exchange Commission (the “SEC”) on January 11, 2021 and other documents filed, or to be filed with the

SEC by GPAC II, including GPAC II’s periodic filings with the SEC, including GPAC II’s Annual Report on Form 10-K filed with

the SEC on March 31, 2023 and any subsequently filed Quarterly Report on Form 10-Q. GPAC II’s SEC filings are available publicly

on the SEC’s website at http://www.sec.gov.

The foregoing list of factors is not exhaustive.

There may be additional risks that neither GPAC II nor the Company presently know or that GPAC II or the Company currently believe are

immaterial that could also cause actual results to differ from those contained in the forward-looking statements. You should carefully

consider the foregoing factors and the other risks and uncertainties described in GPAC II’s proxy statement contained in the registration

statement on Form S-4 (File No. 333-276510) filed with the SEC on January 12, 2024 (the “Registration Statement”), including

those under “Risk Factors” therein, and other documents filed by GPAC II from time to time with the SEC. These filings identify

and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained

in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put

undue reliance on forward-looking statements, and GPAC II and the Company assume no obligation and, except as required by law, do not

intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither

GPAC II nor the Company gives any assurance that either GPAC II or the Company will achieve its expectations.

Important Information About the Business Combination

and Where to Find It

In connection with the proposed business combination,

GPAC II has filed a Registration Statement with the SEC that includes a preliminary prospectus with respect to GPAC II’s securities

to be issued in connection with the proposed transactions and a preliminary proxy statement with respect to the shareholder meeting of

GPAC II to vote on the proposed transactions (the “proxy statement/prospectus”). GPAC II may also file other documents regarding

the proposed business combination with the SEC. The proxy statement/ prospectus will contain important information about the proposed

business combination and the other matters to be voted upon at an extraordinary general meeting of GPAC II’s shareholders to be

held to approve the proposed business combination and other matters and may contain information that an investor may consider important

in making a decision regarding an investment in GPAC II’s securities. BEFORE MAKING ANY VOTING DECISION, SHAREHOLDERS OF GPAC II

AND OTHER INTERESTED PARTIES ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS

AND SUPPLEMENTS THERETO) AND ALL RELEVANT DOCUMENTS RELATING TO THE PROPOSED BUSINESS COMBINATION FILED OR THAT WILL BE FILED WITH THE

SEC CAREFULLY AND IN THEIR ENTIRETY AS THEY BECOME AVAILABLE BECAUSE THEY CONTAIN, OR WILL CONTAIN, IMPORTANT INFORMATION ABOUT GPAC II,

THE COMPANY AND THE PROPOSED BUSINESS COMBINATION.

The Registration Statement is not yet effective.

After the Registration Statement is declared effective, the definitive proxy statement/prospectus included in the Registration Statement

will be mailed to shareholders of GPAC II as of a record date to be established for voting on the proposed transactions. Shareholders

of GPAC II are able to obtain free copies of the Registration Statement and, once available, will also be able to obtain free copies of

the definitive proxy statement/ prospectus and all other relevant documents containing important information about GPAC II and the Company

filed or that will be filed with the SEC by GPAC II through the website maintained by the SEC at http://www.sec.gov, or by directing a

request to Global Partner Acquisition Corp II, 200 Park Avenue 32nd Floor, New York, New York 10166, attention: Global Partner Sponsor

II LLC or by contacting Morrow Sodali LLC, GPAC II’s proxy solicitor, for help, toll-free at (800) 662-5200 (banks and brokers can

call collect at (203) 658-9400).

INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED

OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR

THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Participants in the Solicitation

GPAC II, the Company and certain of their respective

directors and executive officers may be deemed participants in the solicitation of proxies from GPAC II’s shareholders with respect

to the proposed business combination. A list of the names of those directors and executive officers of GPAC II and a description of their

interests in GPAC II is set forth in GPAC II’s filings with the SEC (including GPAC II’s prospectus relating to its initial

public offering (File No. 333-251558) declared effective by the SEC on January 11, 2021, GPAC II’s Annual Report on Form 10-K filed

with the SEC on March 31, 2023 and subsequent filings on Form 10-Q and Form 4). Additional information regarding the interests of those

persons and other persons who may be deemed participants in the proposed business combination may be obtained by reading the Registration

Statement. The documents described in this paragraph are available free of charge at the SEC’s website at www.sec.gov, or by directing

a request to Global Partner Acquisition Corp II, 200 Park Avenue 32nd Floor, New York, New York 10166, attention: Global Partner Sponsor

II LLC. Additional information regarding the names and interests of such participants will be contained in the Registration Statement

for the proposed business combination when available.

No Offer or Solicitation

This communication is not a proxy statement or

solicitation of a proxy, consent or authorization with respect to any securities or in respect of the potential transaction and shall

not constitute an offer to sell or a solicitation of an offer to buy the securities of GPAC II, the Company or the combined company, nor

shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful

prior to registration or qualification under the securities laws of such state or jurisdiction. No offer of securities shall be made except

by means of a prospectus meeting the requirements of Section 10 of the Securities Act.

4

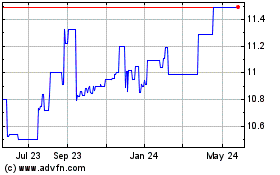

Global Partner Acqusitio... (NASDAQ:GPACU)

Historical Stock Chart

From Apr 2024 to May 2024

Global Partner Acqusitio... (NASDAQ:GPACU)

Historical Stock Chart

From May 2023 to May 2024