Filed by Global Partner

Acquisition Corp II pursuant to

Rule 425 under the Securities

Act of 1933, as amended,

and deemed filed pursuant

to Rule 14a-12 under

the Securities Exchange

Act of 1934, as amended.

Subject Company: Global

Partner Acquisition Corp II

Commission File No. 001-39875

Date: February 22, 2024

Stardust Power Co-Founder and Chief Executive

Officer Roshan Pujari, Mining Magazine – February 22, 2024

The following is a full transcript of an interview

made available at:

https://www.youtube.com/watch?v=7B06kTSr0PI

Georgia Williams: I'm Georgia Williams

with Mining magazine. And joining me today is Roshan Pujari of Stardust Power. Nice to meet you today.

Roshan Pujari: Nice to meet you, Georgia.

Thank you for having me on.

Georgia Williams: It's a pleasure. And,

you know, stardust Lithium. I'm sorry, Stardust Power is in the lithium space doing some really exciting stuff. So I was wondering if

you could give us a little overview of the company and tell us what you're currently working on.

Roshan Pujari: Sure, happy to. At Stardust

Power, we're developing America's largest lithium refinery, what we see as the critical gap in the American supply chain is refinery capacity.

Lots of assets being developed all over the country, America has been producing lithium brine through produce water from oil and gas production,

but what we lack importantly, is refinery capacity. So at Stardust Power, our strategy is to build a really big lithium refinery right

in the middle of the country in Oklahoma. And our novel approach is to optimize it from multiple sources of lithium brine so we can scale

production of battery-grade lithium products faster and more efficient.

Georgia Williams: That's amazing, and you

were saying that you had chose Oklahoma due to its centralized location. So what are some of the other benefits that Oklahoma offers?

Roshan Pujari: Yeah, great question. We

like Oklahoma for a variety of reasons. Obviously, its geographic location being in the center of the country, the site is well connected

for highways, for rails, but also the largest inland waterways system in the United States, and so very effective for our hub and spoke

model. Oklahoma as a legacy energy producer is very accustomed to energy and industry-friendly. In fact, we have a great partnership with

the state of Oklahoma and have secured up to a $257 million incentive package to develop our refinery there. And but also and maybe most

importantly, Oklahoma has a strong, skilled workforce trained in oil and gas engineering, which can be utilized for lithium as well.

Georgia Williams: I know you touched on

it a little bit at the beginning, but why is it so important that we develop a North American lithium supply chain, you know, amidst the

sort of resource nationalism that we're seeing around the globe and some of the other supply chain issues that have, you know, risen since

the pandemic?

Roshan Pujari: Lithium, battery-grade lithium

is a national security priority for the United States. As we all know, China dominates the market up to 66% of the lithium market, but

up to 85% for the refinery market. Growing geopolitical tensions have created a necessity to start creating resilient American supply

chains. We've already seen China limiting export and creating restrictions on critical material minerals such as graphite. So from a national

security perspective, it is important we're able to produce battery grade lithium in the United States.

Georgia Williams: Right. And just to be

clear, you guys aren't going to be mining for lithium, but you'll be refining it.

Roshan Pujari: Yes, so, you know, from

an upstream perspective, we're working with oil and gas producers on extracting lithium from produce water. We're also investing upstream

and to secure offtake agreement from lithium developers, and we'll also be developing our own assets to have a vertically integrated approach.

Georgia Williams: Now, Roshan, is this

a unique technology that you're going to be using, is it DLE or what type of extraction technologies are you guys planning on implementing?

Roshan Pujari: From an upstream perspective,

we're working with the right DLE technologies based on the chemistry of the brine. So for produced water, we have preferred vendors for

geothermal and others. From a midstream perspective, our conversion technology at the refinery is based on proven and established technologies

for chemical conversion. So limited technology risk on the refinery portion.

Georgia Williams: Lovely, and would Stardust

only supply the North American market or would you look to expand past that once you were able to sort of meet that demand?

Roshan Pujari: Our focus currently is on

the North American market, but we're happy to work with friends and allies and RAA compliant jurisdictions such as Japan.

Georgia Williams: Lovely. And can you tell

me about some of the plans on using wastewater like, for somebody who isn't familiar with, you know, extracting lithium from boiled water.

Roshan Pujari: Sure. So, you know, oil

and gas producers, especially in certain shales, have produced a lot of water in their oil and gas production. And currently, they're

either spending the money to re-inject the water or they're using it for other purposes as fracking. In certain areas of this produced

water created by the oil and gas producers can be rich in lithium. So here's an example where stardust can take a wastewater and recycle

it into lithium feedstock. We can access their water infrastructure at a central point and do the DLE extraction and then return the water

to the oil and gas producer, creating a closed loop economy. We see this as a great example of recycling.

Georgia Williams: Absolutely. And it has

such a great environmental benefit as well.

Roshan Pujari: You're right about that.

And, you know, that's one of the reasons we have chosen brine over hard rock, rather than open pit mines, we like brine, which has a smaller

environmental and carbon footprint, and then even going to a midstream perspective, we think about sustainability at every step of our

process. Oklahoma has a large amount of sustainable power through wind and solar. Our facility is designed to be low emissions using largely

electric circuits, and also it's being designed for a zero liquid waste. So we are sustainable throughout our entire process.

Georgia Williams: Fabulous. And, you know,

integrating renewable energy isn't always the easiest thing, like you were just talking about Oklahoma has a really great power grid.

So, you know, in terms of refining it, how much, you know, time or energy are you looking to spend on the actual collecting of the lithium

refining?

Roshan Pujari: So we have multiple models

we’ll work hand in hand with lithium producers or will also invest in develop our own assets. So we're happy to work in partnership

with other producers, partnership with oil and gas producers, and in some cases, Stardust will do the heavy lifting and develop proprietary

assets.

Georgia Williams: Fabulous, and last year,

there was a lot of news reports about, you know, the U.S. government investing in critical metals. You know, lithium is obviously on that

list. Have you been able to get support from the federal government?

Roshan Pujari: The federal government and

state government support for this critical sector has been unbelievable. The DOE recently came out with a new grant. The BIL, which is

a $3.5 billion grant, focused on lithium and as well as Department of Defense grants that are available and DOE LPO ATVM financing for

project finance. So there is an array of government support available for Stardust.

Georgia Williams: Fabulous. And where are

you in the construction process?

Roshan Pujari: So we have largely completed

the technical due diligence to make sure that our site is ideal for lithium refinery. We are completing our second engineering study.

We seek to break ground later this year and ideally start major construction in Q4.

Georgia Williams: That's exciting. What

other news items is on Stardust's radar right now?

Roshan Pujari: Well, we're excited to soon

share some upcoming news about some of the partnerships we're doing upstream and working with our partners across the supply chain and

I look forward to sharing that news with you and Mining magazine as soon as we're ready.

Georgia Williams: We'd love to hear it.

Those are all of the questions I had for you today, Roshan. Was there anything else you'd like to the people to know about Stardust Power?

Roshan Pujari: No, I think that was pretty

comprehensive. But you know what I think it requires to move America forward in the energy transition is a collaborative ecosystem. So

we appreciate the support of the government, of OEMs, of important publications like yours. And together, we can build resilient American

supply chains.

Georgia Williams: Fabulous. Thank you very

much for your time.

Forward-Looking Statements

The information included herein and in any oral

statements made in connection herewith include “forward-looking statements” within the meaning of Section 27A of the Securities

Act of 1933, as amended (the “Securities Act” and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”). All statements, other than statements of present or historical fact included herein, regarding the proposed business combination,

Global Partner Acquisition Corp II’s (“GPAC II”) and Stardust Power Inc.’s (the “Company”) ability

to consummate the transaction, the benefits of the transaction, GPAC II’s and the Company’s future financial performance following

the transaction, as well as GPAC II’s and the Company’s strategy, future operations, financial position, estimated revenues

and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. When used herein, including

any oral statements made in connection herewith, the words “could,” “should,” “will,” “may,”

“believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,”

the negative of such terms and other similar expressions are intended to identify forward-looking statements, although not all forward-looking

statements contain such identifying words.

These forward-looking statements are based on

GPAC II’s and the Company’s management’s current expectations and assumptions about future events and are based on currently

available information as to the outcome and timing of future events. GPAC II and the Company caution you that these forward-looking statements

are subject to risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of GPAC II and

the Company. These risks include, but are not limited to, (i) the risk that the proposed business combination may not be completed in

a timely manner or at all, which may adversely affect the price of GPAC II securities; (ii) the risk that the proposed business combination

may not be completed by GPAC II’s business combination deadline and the potential failure to obtain an extension of the business

combination deadline if sought by GPAC II; (iii) the failure to satisfy the conditions to the consummation of the proposed business combination,

including the approval of the proposed business combination by GPAC II’s shareholders and the Company’s stockholders, the

satisfaction of the minimum trust account amount following redemptions by GPAC II’s public shareholders and the receipt of certain

governmental and regulatory approvals; (iv) the effect of the announcement or pendency of the proposed business combination on the Company’s

business relationships, performance, and business generally; (v) risks that the proposed business combination disrupts current plans of

the Company and potential difficulties in the Company’s employee retention as a result of the proposed business combination; (vi)

the outcome of any legal proceedings that may be instituted against GPAC II or the Company related to the agreement and the proposed business

combination; (vii) changes to the proposed structure of the business combination that may be required or appropriate as a result of applicable

laws or regulations or as a condition to obtaining regulatory approval of the business combination (viii) the ability to maintain the

listing of GPAC II’s securities on the Nasdaq; (ix) the price of GPAC II’s securities, including volatility resulting from

changes in the competitive and highly regulated industries in which the Company plans to operate, variations in performance across competitors,

changes in laws and regulations affecting the Company’s business and changes in the combined capital structure; (x) the ability

to implement business plans, forecasts, and other expectations after the completion of the proposed business combination, and identify

and realize additional opportunities; (xi) the impact of the global COVID-19 pandemic and (xii) other risks and uncertainties related

to the transaction set forth in the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking

Statements” in GPAC II’s prospectus relating to its initial public offering (File No. 333-351558) declared effective by the

U.S. Securities and Exchange Commission (the “SEC”) on January 11, 2021 and other documents filed, or to be filed with the

SEC by GPAC II, including GPAC II’s periodic filings with the SEC, including GPAC II’s Annual Report on Form 10-K filed with

the SEC on March 31, 2023 and any subsequently filed Quarterly Report on Form 10-Q. GPAC II’s SEC filings are available publicly

on the SEC’s website at http://www.sec.gov.

The foregoing list of factors is not exhaustive.

There may be additional risks that neither GPAC II nor the Company presently know or that GPAC II or the Company currently believe are

immaterial that could also cause actual results to differ from those contained in the forward-looking statements. You should carefully

consider the foregoing factors and the other risks and uncertainties described in GPAC II’s proxy statement contained in the registration

statement on Form S-4 (File No. 333-276510) filed with the SEC on January 12, 2024 (the “Registration Statement”), including

those under “Risk Factors” therein, and other documents filed by GPAC II from time to time with the SEC. These filings identify

and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained

in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put

undue reliance on forward-looking statements, and GPAC II and the Company assume no obligation and, except as required by law, do not

intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither

GPAC II nor the Company gives any assurance that either GPAC II or the Company will achieve its expectations.

Important Information About the Business Combination

and Where to Find It

In connection with the proposed business combination,

GPAC II has filed a Registration Statement with the SEC that includes a preliminary prospectus with respect to GPAC II’s securities

to be issued in connection with the proposed transactions and a preliminary proxy statement with respect to the shareholder meeting of

GPAC II to vote on the proposed transactions (the “proxy statement/prospectus”). GPAC II may also file other documents regarding

the proposed business combination with the SEC. The proxy statement/ prospectus will contain important information about the proposed

business combination and the other matters to be voted upon at an extraordinary general meeting of GPAC II’s shareholders to be

held to approve the proposed business combination and other matters and may contain information that an investor may consider important

in making a decision regarding an investment in GPAC II’s securities. BEFORE MAKING ANY VOTING DECISION, SHAREHOLDERS OF GPAC II

AND OTHER INTERESTED PARTIES ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS

AND SUPPLEMENTS THERETO) AND ALL RELEVANT DOCUMENTS RELATING TO THE PROPOSED BUSINESS COMBINATION FILED OR THAT WILL BE FILED WITH THE

SEC CAREFULLY AND IN THEIR ENTIRETY AS THEY BECOME AVAILABLE BECAUSE THEY CONTAIN, OR WILL CONTAIN, IMPORTANT INFORMATION ABOUT GPAC II,

THE COMPANY AND THE PROPOSED BUSINESS COMBINATION.

The Registration Statement is not yet effective.

After the Registration Statement is declared effective, the definitive proxy statement/prospectus included in the Registration Statement

will be mailed to shareholders of GPAC II as of a record date to be established for voting on the proposed transactions. Shareholders

of GPAC II are able to obtain free copies of the Registration Statement and, once available, will also be able to obtain free copies of

the definitive proxy statement/ prospectus and all other relevant documents containing important information about GPAC II and the Company

filed or that will be filed with the SEC by GPAC II through the website maintained by the SEC at http://www.sec.gov, or by directing a

request to Global Partner Acquisition Corp II, 200 Park Avenue 32nd Floor, New York, New York 10166, attention: Global Partner Sponsor

II LLC or by contacting Morrow Sodali LLC, GPAC II’s proxy solicitor, for help, toll-free at (800) 662-5200 (banks and brokers can

call collect at (203) 658-9400).

INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN

HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS

OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Participants in the Solicitation

GPAC II, the Company and certain of their respective

directors and executive officers may be deemed participants in the solicitation of proxies from GPAC II’s shareholders with respect

to the proposed business combination. A list of the names of those directors and executive officers of GPAC II and a description of their

interests in GPAC II is set forth in GPAC II’s filings with the SEC (including GPAC II’s prospectus relating to its initial

public offering (File No. 333-251558) declared effective by the SEC on January 11, 2021, GPAC II’s Annual Report on Form 10-K filed

with the SEC on March 31, 2023 and subsequent filings on Form 10-Q and Form 4). Additional information regarding the interests of those

persons and other persons who may be deemed participants in the proposed business combination may be obtained by reading the Registration

Statement. The documents described in this paragraph are available free of charge at the SEC’s website at www.sec.gov, or by directing

a request to Global Partner Acquisition Corp II, 200 Park Avenue 32nd Floor, New York, New York 10166, attention: Global Partner Sponsor

II LLC. Additional information regarding the names and interests of such participants will be contained in the Registration Statement

for the proposed business combination when available.

No Offer or Solicitation

This communication is not a proxy statement or

solicitation of a proxy, consent or authorization with respect to any securities or in respect of the potential transaction and shall

not constitute an offer to sell or a solicitation of an offer to buy the securities of GPAC II, the Company or the combined company, nor

shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful

prior to registration or qualification under the securities laws of such state or jurisdiction. No offer of securities shall be made except

by means of a prospectus meeting the requirements of Section 10 of the Securities Act.

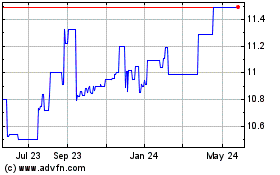

Global Partner Acqusitio... (NASDAQ:GPACU)

Historical Stock Chart

From Apr 2024 to May 2024

Global Partner Acqusitio... (NASDAQ:GPACU)

Historical Stock Chart

From May 2023 to May 2024