UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE

13A-16 OR 15D-16 OF THE SECURITIES

EXCHANGE ACT OF 1934

For the month of July 2023

Commission File Number 001-38440

Grindrod Shipping

Holdings Ltd.

#03-01 Southpoint

200 Cantonment Road

Singapore 089763

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x

Form 40-F ¨

Indicate by check

mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨.

INFORMATION

CONTAINED IN THIS FORM 6-K REPORT

Grindrod

Shipping Holdings Ltd. (the “Company”) announces its intent to hold an Extraordinary General Meeting of Shareholders

on August 10, 2023 at 18:00 Singapore Standard Time (the “EGM”). The notice of the EGM is attached hereto as Exhibit

99.1.

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

GRINDROD SHIPPING HOLDINGS LTD. |

| |

|

| Dated: July 13, 2023 |

/s/ Edward Buttery |

| |

Name: Edward Buttery |

| |

Title: Chief Executive Officer |

Exhibit 99.1

Grindrod shipping Holding Ltd.

(Incorporated in Singapore)

(Registration number: 201731497H)

Primary listing on the NASDAQ Global Select Market

Secondary listing on the JSE Main Board

NASDAQ Share code: GRIN and SEC CIK Number: CIK0001725293

JSE Share code: GSH and ISIN: SG9999019087

("GRIN" or “the Company")

NOTICE OF EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON AUGUST 10, 2023

|

1 |

Notice of Extraordinary General Meeting (this “Notice”) |

NOTICE IS HEREBY GIVEN THAT an

EXTRAORDINARY GENERAL MEETING of the shareholders of the Company (the “Shareholders”) will be held on August 10, 2023

at 18:00 Singapore Standard Time (12:00 South Africa Standard Time, 06:00 United States Eastern Daylight Time) (the “EGM”).

The EGM will be conducted by way of

electronic means. A shareholder entitled and wishing to vote on the matters to be considered at the EGM must complete the form of proxy

and voting instructions (attached) to appoint the Chairman of the EGM as his / her / its proxy to vote in his / her / its stead. A shareholder

wishing to attend the EGM by electronic means is required to pre-register at our website. Please refer to the information contained in

this Notice for details on how to vote and how to attend via electronic means.

This Notice is distributed to Shareholders

of Record recorded in the register of members of the Company and Beneficial Shareholders recorded in the records of the relevant securities

depository on July 7, 2023. This Notice (including the Solvency Statements appended as Annex A) is available on our website at https://www.grinshipping.com/Content/EventsPresentationsAndNotices.

The purpose of the EGM is for the shareholders

of the Company to consider and, if thought fit, pass, with or without modifications, the following special resolutions:

| 2 | Special Resolution: Proposed Capital Reduction and Proposed Cash Distributions |

| 2.1 | IT IS NOTED THAT pursuant to Regulation 56 of the Constitution of the Company and subject to Section

78A read with Section 78C of the Companies Act 1967 of Singapore (the “Companies Act”), the Company intends to reduce

its issued and fully paid-up share capital (the “Proposed Capital Reduction”) in the following manner: |

| (a) | reducing the fully paid-up share capital of the Company by up to a maximum amount of USD45,000,000

(the “Reduction Amount”); and |

| (b) | distributing in aggregate up to the Reduction Amount to the Shareholders, which shall be effected by paying

an amount in cash for each issued share of the Company (a “Share”) (excluding Shares held in treasury) held by a Shareholder

as at the relevant Record Date of each distribution, subject to such amount per Share and number of distributions as the directors of

the Company (the “Directors”) may determine in their absolute discretion (the “Proposed Cash Distributions”).

The “Record Date” shall mean such times and dates as may be determined by the Directors in their absolute discretion

and is tentatively set as October 20, 2023, at and on which the Register of Members will be closed for the purpose of determining the

entitlements of Shareholders to the Proposed Cash Distributions pursuant to the Proposed Capital Reduction (such entitled shareholders

being referred to hereinafter as “Entitled Shareholders”). A further announcement will be filed to confirm the Record

Date and the cash distribution payment date, tentatively set as October 30, 2023. |

RESOLVED THAT pursuant to Regulation

56 of the Constitution of the Company and subject to Section 78A read with Section 78C of the Companies Act 1967, and subject to the Proposed

Cash Distributions being approved by the Financial Surveilance Department of the South African Reserve Bank (“SARB”):

| (a) | approval be and is hereby given: |

| (i) | for the Proposed Capital Reduction, where the fully paid-up share capital of the Company shall be reduced

by up to a maximum amount of USD45,000,000; and |

| (ii) | for such reduction to be effected by way of the Proposed Cash Distributions; and |

| (b) | each Director be and is hereby authorised and empowered to complete, do and execute all such acts and

things as they or he may consider necessary or expedient to give effect to the foregoing resolution, with such modifications (if any)

as they or he shall think fit in the interests of the Company. |

| 2.3 | Documents Available for Inspection |

The solvency statements given by the Directors

as required under Section 78C of the Companies Act for the purpose of the Proposed Capital Reduction (the “Solvency Statements”)

are attached hereto as Annex A. Copies of the Solvency Statements will also be made available for inspection at the registered

office of the Company for a period of six (6) weeks beginning with the date of the EGM.

Further information on the Proposed Capital

Reduction and the Proposed Cash Distributions are set out at paragraph 3 below.

| 3 | PROPOSED CAPITAL REDUCTION AND PROPOSED CASH DISTRIBUTIONS |

Overview

The Company is proposing to undertake

the Proposed Capital Reduction pursuant to Section 78A read with Section 78C of the Companies Act. Section 78C of the Companies Act requires

that a public company proposing to undertake a capital reduction exercise should, inter alia, obtain the approval of its shareholders

at a general meeting by way of a special resolution to be tabled at such general meeting.

The Proposed Capital Reduction will involve

a reduction of the fully paid-up share capital of the Company by up to a maximum amount of USD45,000,000, being the Reduction Amount.

Accordingly, the actual amount to be returned

to Entitled Shareholders per Share pursuant to the Proposed Cash Distributions will be based on the issued and paid-up share capital of

the Company as at each Record Date.

The aggregate amount of cash to be paid

to each Entitled Shareholder pursuant to the Proposed Capital Reduction and Proposed Cash Distributions will be adjusted by rounding down

any fractions of a cent to the nearest cent, where applicable.

The Proposed Cash Distributions require

the approval of the SARB and such approval has been granted by SARB on 11 July 2023.

The Proposed Capital Reduction and

Proposed Cash Distributions will not result in a cancellation of Shares, or a change in the number of Shares issued by the Company. Accordingly,

the shareholding of each Shareholder in the Company will not be changed by reason of the Proposed Capital Reduction and Proposed Cash

Distributions.

Illustration of Proposed Cash Distribution

For illustrative purposes only, assuming

that the Reduction Amount is USD45,000,000 and the Directors determine that such entire amount should be distributed in a single

distribution, the position of an Entitled Shareholder who holds 100 fully-paid up Shares as at the Record Date immediately before and

after the Proposed Capital Reduction and the Proposed Cash Distribution is as follows:

Position before the Proposed

Capital Reduction and the Proposed Cash Distribution

| Number of Shares held |

: |

100 Shares |

Position after the Proposed

Capital Reduction and the Proposed Cash Distribution

| Number of Shares held |

: |

100 Shares |

| Amount of cash distribution received |

: |

USD231 in aggregate (being USD2.31 per Share)(1) |

|

Note:

(1) As at July 7, 2023 (being the latest practicable

date prior to the despatch of this Notice) (the “Latest Practicable Date”), based on records maintained by the Accounting

and Corporate Regulatory Authority of Singapore (“ACRA”), the Company has 19,472,008 issued Shares (excluding Shares

held in treasury). The amount of cash distribution per Share is calculated by dividing the illustrative amount of USD45,000,000 by 19,472,008

Shares. |

Rational for Proposed Capital Reduction

As previously disclosed (and as summarised

on the announcements made by the Company on 26 April 2023 and 17 May 2023), the Company has completed the sale of the following vessels

in H1 2023 (the “Vessel Sales”):

| (a) | the sale of the 2015-built ultramax bulk carrier, IVS Hirono for a price of US$23.8 million (before costs).

Approximately US$10.5 million debt was repaid on the Company’s $114.1 million senior secured credit facility, and the sale generated

net proceeds to the Company of US$13.3 million after the debt repayment; |

| (b) | the sale of the 2010-built handysize bulk carrier, IVS Sentosa for a price of US$10.9 million (before

costs). Approximately US$1.6 million debt was repaid on the Company’s US$100.0 million senior secured credit facility, and the sale

generated net proceeds to the Company of US$8.9 million after the debt repayment; |

| (c) | the sale of the 2015-built supramax bulk carrier, IVS Pinehurst for US$23.3 million (before costs). This

vessel was unencumbered; |

| (d) | the sale of the 2014-built handysize bulk carrier, IVS Kestrel for US$17.3 million (before costs). Approximately

US$6.8 million was repaid on the Company’s US$114.1 million senior secured credit facility. |

Following the completion of the Vessel

Sales, the Directors are of the view that the Proposed Capital Reduction and Proposed Cash Distribution are in the best interests of the

Company as it will allow the Company to distribute to Shareholders, part of the net proceeds from the Vessel Sales, which is in excess

of the needs of the Company and its subsidiaries. The Proposed Capital Reduction and Proposed Cash Distribution will thus result in the

Company having a more efficient capital structure, thereby also improving Shareholders’ return on equity.

Conditions for Proposed Capital Reduction

The Proposed Capital Reduction is subject

to the satisfaction of the conditions set out in Section 78C of the Companies Act, including the approval of Shareholders at the EGM.

Following the satisfaction of such conditions, the Company will lodge with ACRA a notice containing the text of the special resolution

relating to the Proposed Capital Reduction. If (a) no creditor of the Company objects to, and applies to the High Court of Singapore for

the cancellation of, the special resolution relating to the Proposed Capital Reduction, and (b) the SARB grants its approval of the Proposed

Cash Distributions, the Company will lodge further requisite documents with ACRA as provided under Section 78E(2) of the Companies Act

after the end of six weeks, and before the end of eight weeks, beginning with the date of the special resolution relating to the Proposed

Capital Reduction whereupon the Proposed Capital Reduction will take effect. With regards to (b), the SARB has granted its approval for the Proposed Cash Distributions on 11 July 2023.

Effective Date of Proposed Capital

Reduction

The Company will publicly announce and

notify Shareholders of the Effective Date of the Proposed Capital Reduction through a Form 6-K filed publicly in the United States through

the United States Securities and Exchange Commission’s EDGAR system, the Johannesburg Stock Exchange News Services (SENS) in South

Africa, and via the GlobeNewswire press release distribution .

| 4 | Administrative Procedures for the Proposed Cash Distributions |

Our transfer agent, Continental Stock

Transfer & Trust Company will act as our disbursing agent for the cash distribution to our shareholders at NASDAQ and Computershare

Investor Services (Pty) Ltd., our South African Administrative Depository Agent, will disburse the cash distribution to our shareholders

at JSE.

Shareholders should note that the following

statements are not to be regarded as advice on the tax position of any Shareholder or any tax implication arising from the Proposed Capital

Reduction and Proposed Cash Distributions. Shareholders who are in doubt as to their respective tax positions or such tax implications

or who may be subject to tax in a jurisdiction outside Singapore should consult their own tax advisers or other independent advisers.

U.S.

U.S. Federal Income Taxation of U.S.

Holders

For U.S. federal income tax purposes,

the Proposed Cash Distributions will be considered cash distributions with respect to the Company’s ordinary shares and will be

subject to the U.S. federal income tax consequences described in the Company’s Annual Report on Form 20-F for the fiscal year ended

December 31, 2022, under the heading “Item 10. Additional Information—Taxation—Material U.S. Federal Income Tax Considerations”.

South Africa

For South African tax resident shareholders,

the distribution will be subject to Corporate Income tax and Dividends Tax as described in the Company’s Annual Report on Form 20-F

for the fiscal year ended December 31, 2022, under the heading “Item 10. Additional Information—Taxation—South African

Tax Considerations”.

Singapore

In Singapore, dividends paid by a Singapore

tax resident company will be income tax exempt the hands of a shareholder as described in the Company’s Annual Report on Form 20-F

for the fiscal year ended December 31, 2022, under the heading “Item 10. Additional Information—Taxation—Singapore Tax

Considerations”.

| 6 | Meeting to be held by Electronic Means |

The EGM will be held by electronic means

pursuant to the Companies, Business Trusts and Other Bodies (Miscellaneous Amendments) Act 2023 which enables the Minister for Law by

order to prescribe arrangements for listed companies in Singapore to, inter alia, conduct extraordinary general meetings, by electronic

communication, video conferencing, tele-conferencing or other electronic means.

For purposes of this Notice (including

the Form of Proxy and Voting Instruction) the following definitions are used.

Beneficial Shareholders: are persons

or entities holding their interests in the Company’s shares as, or through, a participant in the Depository Trust Company, or DTC,

in book entry form at a broker, dealer, securities depository or other intermediary and who are reflected in the books of such intermediary;

also commonly referred to in the United States as “street name holders”.

Shareholder of Record: a person

or entity whose name is reflected in the Company’s register of members, and who is not necessarily a Beneficial Shareholder.

South African Shareholders: are

Beneficial Shareholders whose interests are reflected on the South African administrative depository register. In general terms, this

reflects the shareholders who trade on the JSE.

International Shareholders: are

Beneficial Shareholders, other than South African Shareholders.

| 8 | General Matters relating to the EGM |

The quorum required to transact business

at the EGM is representation of at least 15% of the total number of issued and fully paid shares (excluding treasury shares) in the capital

of the Company for the time being. Shares represented at the meeting for which an abstention from voting has been recorded are counted

towards the quorum.

Votes shall be taken on a poll with one

vote for each share. In order for the special resolution to be passed more than 75% of the eligible votes cast on the resolution must

be in favour of the resolution. Whilst shares for which an abstention from voting has been recorded are counted toward the quorum of the

meeting, the calculation of the percentage of votes cast in favour of the resolution disregards abstained votes. A person entitled to

more than one vote need not use all his votes or cast all the votes he uses in the same way.

| 8.3 | Identification of shareholders and their representatives |

Before any person may participate in the

EGM, the Chairman of the EGM must be reasonably satisfied that the right of the person to participate at the EGM has been reasonably verified.

| 9 | Record Date for determining Beneficial Shareholders’ Eligibility to Vote at the EGM |

Only those Beneficial Shareholders recorded

in the records of the relevant securities depository on July 7, 2023 are eligible to vote.

An eligible Beneficial Shareholder may

only cast his / her/ its vote by completing a “From of Proxy and Voting Instruction” (as attached) in accordance with the

instructions it contains. The duly completed form must be submitted by South African shareholders, by August 7, 2023 at 12:00 South Africa

Standard Time, to your broker, dealer, securities depository or other intermediary and by International Shareholders, by August 7, 2023

at 06:00 United States Eastern Daylight Time, to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. Please refer to

the “Form of Proxy and Voting Instruction” for further instructions.

An eligible Shareholder of Record may

only cast his /her /its vote by completing a “Form of Proxy and Voting Instruction” and emailing it back to proxy@continentalstock.com

or by posting it to 1 State Street, 30th Floor, New York, NY10004-1561.

If you wish to revoke a form of proxy

and voting instruction, a Beneficial Shareholder must send an email to notify this to the relevant broker, dealer, securities depository

or other intermediary and a Shareholder of Record must send an email to notify this to Continental Stock Transfer & Trust Company,

in each case, by August 7, 2023.

| 11 | Shareholder Participation in the EGM |

A live audio-visual webcast and a live

audio-only stream will allow shareholders to view and/or listen to the EGM proceedings. Shareholders will not be able to ask questions

during the course of the EGM but can submit their questions in advance. Pre-registration, which includes a verification process, is required

in such cases, as further discussed below.

| 11.1 | How to submit questions to be raised at the EGM, watch the live audio-visual webcast or listen to the

audio-only live stream of the EGM proceedings |

In order to be able to submit questions

to be raised at the EGM, watch the live audio-visual webcast or listen to the audio-only live stream of the EGM proceedings, a shareholder

(whether a Beneficial Shareholder or a Shareholder of Record) is required to pre-register with the Company. You can pre-register at our

website http://www.grinshipping.com/EGMRegistration2023.

At the time of pre-registering, Shareholders

will be required to make certain elections and provide certain information, including (a) indicating participation at the EGM either by

“Audio-visual” or “Audio-only”; (b) your name; (c) your email address; (d) your telephone or mobile number; (e)

the number of shares held; (f) whether you are a South African Shareholder or an International Shareholder or a Shareholder of Record

(refer to the definitions above); and (g) name of brokerage firm.

In addition, as part of the pre-registration

and authentication process, Beneficial Shareholders are required to ensure that a legal proxy or letter of representation is submitted

to the Company. You should contact your broker, dealer, securities depository or other intermediary through which your shares are held

to request the necessary legal proxy or letter of representation. It is not necessary that you, as the Beneficial Shareholder, be the

person that submits questions to be raised at the EGM, watches the live audio-visual webcast or listens to the audio-only live stream

of the EGM proceedings. You are able to nominate another person to perform such actions on your behalf and you should make this known

to your broker, dealer, securities depository or other intermediary when requesting your legal proxy or letter of representation. Your

broker, dealer, securities depository or other intermediary will advise you of the documentation they require in order to provide a legal

proxy or letter of representation.

The legal proxy or letter of representation

is required to be uploaded via the website http://www.grinshipping.com/EGMRegistration2023 or emailed to EGM2023@grindrodshipping.com.

Simultaneously with the submission of

the pre-registration information and supporting documentation, Shareholders are able to submit questions to be raised at the EGM through

the website http://www.grinshipping.com/EGMRegistration2023. In addition, Shareholders of Record are able to submit their questions

to the Company by post to 200 Cantonment Road, #03-01 Southpoint, Singapore 089763.

| 11.2 | Authentication process |

Once the pre-registration and relevant

supporting documentation has been provided to the Company, the Company will authenticate the pre-registration particulars. Authenticated

shareholders will receive a confirmation email by which contains details to participate in the live webcast (for those who opted for audio-visual

at pre-registration) or a local dial-in number and conference code to access the audio only stream (for those who opted for audio-only

only).

If we are unable to verify your shareholder

status, we will notify you via email that you will not be able to access the EGM proceedings.

| 11.3 | Questions related to pre-registration |

For any questions related to the pre-registration

for the EGM, please email to EGM2023@grindrodshipping.com

| 12.1 | Submission of votes on a “Form of Proxy and Voting Instruction” |

For submission of your “Form of

Proxy and Voting Instruction” – August 7, 2023 at 06:00 United States Eastern Daylight Time/12:00 South Africa Standard Time,

as appropriate.

| 12.2 | Pre-registration by Shareholder |

For submission to the Company of the pre-registration

and supporting documentation, including the legal proxy or letter of representation – August 7, 2023 at 06:00 United States Eastern

Daylight Time and 12:00 South Africa Standard Time. You should be aware that it will take some time for your broker, dealer, securities

depository or other intermediary to process your request for a legal proxy or letter of representation and you will need to make the necessary

arrangements allowing sufficient time for this.

| 12.3 | Submission of questions to the Company |

For submission, whether by email or by post,

to the Company of questions to be raised at the EGM – August 7, 2023 at 06:00 United States Eastern Daylight Time and 12:00 South

Africa Standard Time.

| 12.4 | Confirmation from Company |

For receipt from the Company of a confirmation

e-mail with details of how to connect to the audio/video streams – August 9, 2023 at 06:00 United States Eastern Daylight Time and

12:00 South Africa Standard Time.

| 13 | Information for Brokers, Dealers, Other Intermediaries, and Securities Depositories |

The cut-off time

for acceptance of the completed “Form of Proxy and Voting Instruction” and the appointment of legal proxies and the issue

of letters of representation is August 7, 2023 at 06:00 United States Eastern Daylight Time and 12:00 South Africa Standard Time. If the

“Form of Proxy and Voting Instruction” does not indicate how the votes are to be dealt with, the votes of the relevant shares

are to be regarded as having been abstained.

By participating in the EGM (through pre-registration,

attendance or the submission of any questions to be raised at the EGM) and/or any adjournment thereof, submitting an instrument appointing

a proxy and/or any adjournment thereof or submitting any details of the shareholder’s representative(s) in connection with the EGM,

a shareholder of the Company (whether a Beneficial Shareholder or a Shareholder of Record) (i) consents to the collection, use and disclosure

of the shareholder’s personal data by the Company (or its agents) for the purpose of the processing and administration by the Company

(or its agents) of proxies and representatives appointed for the EGM (including any adjournment thereof) and the preparation and compilation

of the attendance lists, minutes and other documents relating to the EGM (including any adjournment thereof), and in order for the Company

(or its agents) to comply with any applicable laws, listing rules, regulations and/or guidelines (collectively, the “Purposes”),

(ii) warrants that where the shareholder discloses the personal data of the shareholder’s representative(s) to the Company (or its

agents), the shareholder has obtained the prior consent of representative(s) for the collection, use and disclosure by the Company (or

its agents) of the personal data of such representative(s) for the Purposes, and (iii) agrees that the shareholder will indemnify the

Company in respect of any penalties, liabilities, claims, demands, losses and damages as a result of the shareholder’s breach of

warranty.

| 15 | Forward-Looking Statements |

This notice contains forward-looking statements

concerning future events. These forward-looking statements are necessarily estimates and involve a number of risks and uncertainties that

could cause actual results to differ materially from those suggested by the forward-looking statements. As a consequence, these forward-looking

statements should be considered in light of various important factors. Words such as “may,” “expects,” “intends,”

“plans,” “believes,” “anticipates,” “hopes,” “estimates,” and variations of

such words and similar expressions are intended to identify forward-looking statements. These forward-looking statements are based on

the information available to, and the expectations and assumptions deemed reasonable by the Company at the time these statements were

made. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, no assurance can

be given that such expectations will prove to have been correct. These statements involve known and unknown risks and are based upon a

number of assumptions and estimates which are inherently subject to significant uncertainties and contingencies, many of which are beyond

the Company’s control. Actual results may differ materially from those expressed or implied by such forward-looking statements.

Important factors that could cause actual

results to differ materially from estimates or projections contained in the forward-looking statements include the factors set out in

the Company’s filings with the SEC. The Company undertakes no obligation to update publicly or release any revisions to these forward-looking

statements to reflect events or circumstances after the date of this notice or to reflect the occurrence of unanticipated events.

BY ORDER OF THE BOARD

Grindrod Shipping Holdings Ltd.

Mr Edward Buttery, Chief Executive Officer

(Company Registration No. 201731497H)

July 13, 2023

ANNEX A – SOLVENCY STATEMENTS

GRINDROD SHIPPING HOLDINGS LTD.

Company Registration Number 201731497H

(the “Company”)

(Incorporated in Singapore)

SOLVENCY STATEMENT PURSUANT TO SECTIONS 7A AND

78C

OF THE COMPANIES ACT 1967 OF SINGAPORE

I, Charles Goodson Maltby (Passport No.

___________) of _________________________,

being a director of the Company, do declare as follows:

| 1. | In respect of the proposed capital reduction exercise to be carried out by the Company pursuant to Regulation

56 of the Constitution of the Company and subject to Section 78A read with Section 78C of the Companies Act 1967 of Singapore (the “Companies

Act”) by (the “Proposed Capital Reduction”): |

| (i) | reducing the fully paid-up share capital of the Company by up to a maximum amount of USD45,000,000

(the “Reduction Amount”); and |

| (ii) | distributing the Reduction Amount (being an amount in excess of the needs of the Company) to the Shareholders

in cash; |

| 2. | taking into account all liabilities of the Company (including contingent liabilities); and |

| (i) | the most recent financial statements of the Company that comply with sections 201(2) and 201(5) of the

Companies Act; and |

| (ii) | all other circumstances that, to the best of our knowledge, affect, or may affect, the value of the Company’s

assets and the value of the Company’s liabilities (including contingent liabilities), |

I am of the opinion that:

| 4. | as regards the Company's situation at the date of this statement, there is no ground on which the Company

could be found to be unable to pay its debts; |

| 5. | the Company will be able to pay its debts as they fall due during the period of 12 months immediately

after the date of this statement; and |

| 6. | the value of the Company's assets is not less than the value of its liabilities (including contingent

liabilities) and such value will not, after the Proposed Capital Reduction (details of which are set out in the written resolution of

the directors of the Company passed on 12 July 2023) become less than the value of its liabilities (including contingent liabilities). |

Declared at this 12th day of July 2023

| |

/s/ Charles Goodson Maltby |

| |

Charles Goodson Maltby |

GRINDROD SHIPPING HOLDINGS LTD.

Company Registration Number 201731497H

(the “Company”)

(Incorporated in Singapore)

SOLVENCY STATEMENT PURSUANT TO SECTIONS 7A AND

78C

OF THE COMPANIES ACT 1967 OF SINGAPORE

I, Alan Ian Hatton (Identification No.

___________) of __________________________,

being a director of the Company, do declare as follows:

| 1. | In respect of the proposed capital reduction exercise to be carried out by the Company pursuant to Regulation

56 of the Constitution of the Company and subject to Section 78A read with Section 78C of the Companies Act 1967 of Singapore (the “Companies

Act”) by (the “Proposed Capital Reduction”): |

| (i) | reducing the fully paid-up share capital of the Company by up to a maximum amount of USD45,000,000

(the “Reduction Amount”); and |

| (ii) | distributing the Reduction Amount (being an amount in excess of the needs of the Company) to the Shareholders

in cash; |

| 2. | taking into account all liabilities of the Company (including contingent liabilities); and |

| (i) | the most recent financial statements of the Company that comply with sections 201(2) and 201(5) of the

Companies Act; and |

| (ii) | all other circumstances that, to the best of our knowledge, affect, or may affect, the value of the Company’s

assets and the value of the Company’s liabilities (including contingent liabilities), |

I am of the opinion that:

| 4. | as regards the Company's situation at the date of this statement, there is no ground on which the Company

could be found to be unable to pay its debts; |

| 5. | the Company will be able to pay its debts as they fall due during the period of 12 months immediately

after the date of this statement; and |

| 6. | the value of the Company's assets is not less than the value of its liabilities (including contingent

liabilities) and such value will not, after the Proposed Capital Reduction (details of which are set out in the written resolution of

the directors of the Company passed on 12 July 2023) become less than the value of its liabilities (including contingent liabilities). |

Declared at this 12th day of July 2023

| |

/s/ Alan Ian Hatton |

| |

Alan Ian Hatton |

GRINDROD SHIPPING HOLDINGS LTD.

Company Registration Number 201731497H

(the “Company”)

(Incorporated in Singapore)

SOLVENCY STATEMENT PURSUANT TO SECTIONS 7A AND

78C

OF THE COMPANIES ACT 1967 OF SINGAPORE

I, Kurt Ernst Moritz Klemme (Passport

No. __________) of ______________________________________,

being a director of the Company, do declare as follows:

| 1. | In respect of the proposed capital reduction exercise to be carried out by the Company pursuant to Regulation

56 of the Constitution of the Company and subject to Section 78A read with Section 78C of the Companies Act 1967 of Singapore (the “Companies

Act”) by (the “Proposed Capital Reduction”): |

| (i) | reducing the fully paid-up share capital of the Company by up to a maximum amount of USD45,000,000

(the “Reduction Amount”); and |

| (ii) | distributing the Reduction Amount (being an amount in excess of the needs of the Company) to the Shareholders

in cash; |

| 2. | taking into account all liabilities of the Company (including contingent liabilities); and |

| (i) | the most recent financial statements of the Company that comply with sections 201(2) and 201(5) of the

Companies Act; and |

| (ii) | all other circumstances that, to the best of our knowledge, affect, or may affect, the value of the Company’s

assets and the value of the Company’s liabilities (including contingent liabilities), |

I am of the opinion that:

| 4. | as regards the Company's situation at the date of this statement, there is no ground on which the Company

could be found to be unable to pay its debts; |

| 5. | the Company will be able to pay its debts as they fall due during the period of 12 months immediately

after the date of this statement; and |

| 6. | the value of the Company's assets is not less than the value of its liabilities (including contingent

liabilities) and such value will not, after the Proposed Capital Reduction (details of which are set out in the written resolution of

the directors of the Company passed on 12 July 2023) become less than the value of its

liabilities (including contingent liabilities). |

Declared at this 12th day of July 2023

| |

/s/ Kurt Ernst Moritz Klemme |

| |

Kurt Ernst Moritz Klemme |

GRINDROD SHIPPING HOLDINGS LTD.

Company Registration Number 201731497H

(the “Company”)

(Incorporated in Singapore)

SOLVENCY STATEMENT PURSUANT TO SECTIONS 7A AND

78C

OF THE COMPANIES ACT 1967 OF SINGAPORE

I, Gordon William French (Passport No.

___________) of ________________________________________,

being a director of the Company, do declare as follows:

| 1. | In respect of the proposed capital reduction exercise to be carried out by the Company pursuant to Regulation

56 of the Constitution of the Company and subject to Section 78A read with Section 78C of the Companies Act 1967 of Singapore (the “Companies

Act”) by (the “Proposed Capital Reduction”): |

| (i) | reducing the fully paid-up share capital of the Company by up to a maximum amount of USD45,000,000

(the “Reduction Amount”); and |

| (ii) | distributing the Reduction Amount (being an amount in excess of the needs of the Company) to the Shareholders

in cash; |

| 2. | taking into account all liabilities of the Company (including contingent liabilities); and |

| (i) | the most recent financial statements of the Company that comply with sections 201(2) and 201(5) of the

Companies Act; and |

| (ii) | all other circumstances that, to the best of our knowledge, affect, or may affect, the value of the Company’s

assets and the value of the Company’s liabilities (including contingent liabilities), |

I am of the opinion that:

| 4. | as regards the Company's situation at the date of this statement, there is no ground on which the Company

could be found to be unable to pay its debts; |

| 5. | the Company will be able to pay its debts as they fall due during the period of 12 months immediately

after the date of this statement; and |

| 6. | the value of the Company's assets is not less than the value of its liabilities (including contingent

liabilities) and such value will not, after the Proposed Capital Reduction (details of which are set out in the written resolution of

the directors of the Company passed on 12 July 2023) become less than the value of its liabilities (including contingent liabilities). |

Declared at this 12th day of July 2023

| |

/s/ Gordon William French |

| |

Gordon William French |

GRINDROD SHIPPING HOLDINGS LTD.

Company Registration Number 201731497H

(the “Company”)

(Incorporated in Singapore)

SOLVENCY STATEMENT PURSUANT TO SECTIONS 7A AND

78C

OF THE COMPANIES ACT 1967 OF SINGAPORE

I, Paul Charles Over (Passport No. ___________)

of _______________________________, being a director of the Company, do declare as follows:

| 1. | In respect of the proposed capital reduction exercise to be carried out by the Company pursuant to Regulation

56 of the Constitution of the Company and subject to Section 78A read with Section 78C of the Companies Act 1967 of Singapore (the “Companies

Act”) by (the “Proposed Capital Reduction”): |

| (i) | reducing the fully paid-up share capital of the Company by up to a maximum amount of USD45,000,000

(the “Reduction Amount”); and |

| (ii) | distributing the Reduction Amount (being an amount in excess of the needs of the Company) to the Shareholders

in cash; |

| 2. | taking into account all liabilities of the Company (including contingent liabilities); and |

| (i) | the most recent financial statements of the Company that comply with sections 201(2) and 201(5) of the

Companies Act; and |

| (ii) | all other circumstances that, to the best of our knowledge, affect, or may affect, the value of the Company’s

assets and the value of the Company’s liabilities (including contingent liabilities), |

I am of the opinion that:

| 4. | as regards the Company's situation at the date of this statement, there is no ground on which the Company

could be found to be unable to pay its debts; |

| 5. | the Company will be able to pay its debts as they fall due during the period of 12 months immediately

after the date of this statement; and |

| 6. | the value of the Company's assets is not less than the value of its liabilities (including contingent

liabilities) and such value will not, after the Proposed Capital Reduction (details of which are set out in the written resolution of

the directors of the Company passed on 12 July 2023) become less than the value of its liabilities (including contingent liabilities). |

Declared at this 12th day of July 2023

| |

/s/ Paul Charles Over |

| |

Paul Charles Over |

GRINDROD SHIPPING HOLDINGS LTD.

Company Registration Number 201731497H

(the “Company”)

(Incorporated in Singapore)

SOLVENCY STATEMENT PURSUANT TO SECTIONS 7A AND

78C

OF THE COMPANIES ACT 1967 OF SINGAPORE

I, Rebecca Brosnan (Passport No _________)

of ____________________________________________, being a director of the Company, do declare

as follows:

| 1. | In respect of the proposed capital reduction exercise to be carried out by the Company pursuant to Regulation

56 of the Constitution of the Company and subject to Section 78A read with Section 78C of the Companies Act 1967 of Singapore (the “Companies

Act”) by (the “Proposed Capital Reduction”): |

| (i) | reducing the fully paid-up share capital of the Company by up to a maximum amount of USD45,000,000

(the “Reduction Amount”); and |

| (ii) | distributing the Reduction Amount (being an amount in excess of the needs of the Company) to the Shareholders

in cash; |

| 2. | taking into account all liabilities of the Company (including contingent liabilities); and |

| (i) | the most recent financial statements of the Company that comply with sections 201(2) and 201(5) of the

Companies Act; and |

| (ii) | all other circumstances that, to the best of our knowledge, affect, or may affect, the value of the Company’s

assets and the value of the Company’s liabilities (including contingent liabilities), |

I am of the opinion that:

| 4. | as regards the Company's situation at the date of this statement, there is no ground on which the Company

could be found to be unable to pay its debts; |

| 5. | the Company will be able to pay its debts as they fall due during the period of 12 months immediately

after the date of this statement; and |

| 6. | the value of the Company's assets is not less than the value of its liabilities (including contingent

liabilities) and such value will not, after the Proposed Capital Reduction (details of which are set out in the written resolution of

the directors of the Company passed on 12 July 2023) become less than the value of its liabilities (including contingent liabilities). |

Declared at this 12th day of July 2023

| |

/s/ Rebecca Brosnan |

| |

Rebecca Brosnan |

GRINDROD SHIPPING HOLDINGS LTD.

Company Registration Number 201731497H

(the “Company”)

(Incorporated in Singapore)

SOLVENCY STATEMENT PURSUANT TO SECTIONS 7A AND

78C

OF THE COMPANIES ACT 1967 OF SINGAPORE

I, Cullen Michael Schaar (Passport No.

____________) of __________________________________,

being a director of the Company, do declare as follows:

| 1. | In respect of the proposed capital reduction exercise to be carried out by the Company pursuant to Regulation

56 of the Constitution of the Company and subject to Section 78A read with Section 78C of the Companies Act 1967 of Singapore (the “Companies

Act”) by (the “Proposed Capital Reduction”): |

| (i) | reducing the fully paid-up share capital of the Company by up to a maximum amount of USD45,000,000

(the “Reduction Amount”); and |

| (ii) | distributing the Reduction Amount (being an amount in excess of the needs of the Company) to the Shareholders

in cash; |

| 2. | taking into account all liabilities of the Company (including contingent liabilities); and |

| (i) | the most recent financial statements of the Company that comply with sections 201(2) and 201(5) of the

Companies Act; and |

| (ii) | all other circumstances that, to the best of our knowledge, affect, or may affect, the value of the Company’s

assets and the value of the Company’s liabilities (including contingent liabilities), |

I am of the opinion that:

| 4. | as regards the Company's situation at the date of this statement, there is no ground on which the Company

could be found to be unable to pay its debts; |

| 5. | the Company will be able to pay its debts as they fall due during the period of 12 months immediately

after the date of this statement; and |

| 6. | the value of the Company's assets is not less than the value of its liabilities (including contingent

liabilities) and such value will not, after the Proposed Capital Reduction (details of which are set out in the written resolution of

the directors of the Company passed on 12 July 2023) become

less than the value of its liabilities (including contingent liabilities). |

Declared at this 12th day of July 2023

| |

/s/ Cullen Michael Schaar |

| |

Cullen Michael Schaar |

GRINDROD SHIPPING HOLDINGS LTD.

Company Registration Number 201731497H

(the “Company”)

(Incorporated in Singapore)

SOLVENCY STATEMENT PURSUANT TO SECTIONS 7A AND

78C

OF THE COMPANIES ACT 1967 OF SINGAPORE

I, Edward David Christopher Buttery (Passport

No. __________) of ________________________________________,

being a director of the Company, do declare as follows:

| 1. | In respect of the proposed capital reduction exercise to be carried out by the Company pursuant to Regulation

56 of the Constitution of the Company and subject to Section 78A read with Section 78C of the Companies Act 1967 of Singapore (the “Companies

Act”) by (the “Proposed Capital Reduction”): |

| (i) | reducing the fully paid-up share capital of the Company by up to a maximum amount of USD45,000,000

(the “Reduction Amount”); and |

| (ii) | distributing the Reduction Amount (being an amount in excess of the needs of the Company) to the Shareholders

in cash; |

| 2. | taking into account all liabilities of the Company (including contingent liabilities); and |

| (i) | the most recent financial statements of the Company that comply with sections 201(2) and 201(5) of the

Companies Act; and |

| (ii) | all other circumstances that, to the best of our knowledge, affect, or may affect, the value of the Company’s

assets and the value of the Company’s liabilities (including contingent liabilities), |

I am of the opinion that:

| 4. | as regards the Company's situation at the date of this statement, there is no ground on which the Company

could be found to be unable to pay its debts; |

| 5. | the Company will be able to pay its debts as they fall due during the period of 12 months immediately

after the date of this statement; and |

| 6. | the value of the Company's assets is not less than the value of its liabilities (including contingent

liabilities) and such value will not, after the Proposed Capital Reduction (details of which are set out in the written resolution of

the directors of the Company passed on 12 July 2023) become less than the value of its liabilities (including contingent liabilities). |

Declared at this 12th day of July 2023

| |

/s/ Edward David Christopher Buttery |

| |

Edward David Christopher Buttery |

CORPORATE

INFORMATION

|

Grindrod Shipping Holdings Ltd.

(Registration number: 201731497H)

Registered Office

As at the date hereof up to 16 July 2023:

200 Cantonment Road,

#03-01 Southpoint,

Singapore 089763

With effect from 17 July 2023:

1 Temasek Avenue,

#10-02 Millenia Tower,

Singapore 039192

Place of incorporation: Singapore

Date of incorporation: 2 November

2017

Website: www.grinshipping.com

Transfer Agent

Continental Stock Transfer & Trust Company

Physical:

1 State Street, 30th Floor,

New York NY 10004-1561, USA

Tel: +1 (212) 509 4000

Fax: +1 (212) 509 5152

Email: proxy@continentalstock.com |

Company Secretary

Sharon Ting

As at the date hereof up to 16 July 2023:

200 Cantonment Road,

#03-01 Southpoint,

Singapore 089763

With effect from 17 July 2023:

1 Temasek Avenue,

#10-02 Millenia Tower,

Singapore 039192

Email: SharonT@grindrodshipping.com

Corporate Sponsor

Grindrod Bank

4th Floor, Grindrod Tower,

8A Protea Place, Sandton, 2196

Tel: +27 (11) 459 1890

Email: AnnerieB@grindrodbank.co.za

South African Administrative Depository

Agent

Computershare Investor Services (Pty) Ltd

Postal:

PO Box 61051, Marshalltown, 2107 South Africa

Physical:

Rosebank Towers, 15 Biermann Avenue, Rosebank

2196, South Africa

Tel: +27 (11) 370 5000

Fax: +27 (11) 688 5238

Email: proxy@computershare.co.za

Central Securities Depository South Africa

Strate (Pty) Ltd.

1st Floor, 9 Fricker Road,

Illovo Boulevard,

Illovo Sandton, 2196

Email: CorporateActions@strate.co.za

|

Grindrod Shipping Holdings Ltd.

(Incorporated in Singapore)

(Registration number: 201731497H)

Primary listing on the NASDAQ Global Select Market

Secondary listing on the JSE Main Board

NASDAQ Share code: GRIN and SEC CIK Number: CIK0001725293

JSE Share code: GSH and ISIN: SG9999019087

("GRIN" or “the Company")

FORM

OF PROXY AND VOTING INSTRUCTION

For use at the extraordinary general meeting

to be held at 18:00 Singapore Standard Time (12:00 South Africa Standard Time, 06:00 United States Eastern Daylight Time) by way of electronic

means on Thursday, August 10, 2023, and/or each adjournment thereof (the “EGM”).

A shareholder will not be able to physically attend

the EGM. Beneficial Shareholders and Shareholders of Record who wish to vote must appoint the Chairman of the EGM as their proxy to vote

on their behalf at the EGM, and must complete and return this form of proxy and voting instruction in accordance with the instructions

contained herein.

This form must be completed and delivered:

| 1- | by International Shareholders to Vote Processing, c/o BROADRIDGE at 51 Mercedes Way, Edgewood, NY 11717,

by 06:00 United States Eastern Daylight Time on Monday, August 7, 2023; |

| 2- | by South African Shareholders to your broker, dealer, securities depository or other intermediary through

which your interests are held, by 12:00 South Africa Standard Time on Monday, August 7, 2023; and |

| 3- | by Shareholders of Record to Continental Stock Transfer & Trust Company via email to proxy@

continentalstock.com or by post to 1 State Street, 30th Floor, New York, NY10004-1561,

by 06:00 United States Eastern Daylight Time on Monday, August 7, 2023. |

By submitting this form, you accept and agree to

the personal data privacy terms set out in the notice of EGM to which this form is attached.

If you do not indicate how your votes are to be

dealt with you will be deemed to have abstained from voting.

Please refer to the notes and instructions overleaf

regarding completion of this form.

Shareholder of Record / Beneficial Shareholder

details

| I/We (Please print full names) |

|

|

| |

|

|

| of (address) |

|

|

| |

|

|

| telephone number______________________________ |

cell phone number_______________________ |

|

| |

|

|

| e-mail address |

|

|

being the Shareholder(s) of Record / Beneficial Shareholder(s)

of __________________[see Note 1] ordinary shares in the Company wish to appoint the Chairman of the EGM to vote as my / our proxy in

accordance with the following instruction.

| Special resolution |

FOR |

AGAINST |

ABSTAIN |

| Proposed Capital Reduction and Proposed Cash Distributions |

|

|

|

Note: Mark with an "X", where all the

shares represented in this form of proxy are to be counted, or alternatively insert the relevant number of shares, in the applicable space,

to indicate how you wish your votes to be cast. If no specific direction as to voting is given, the proxy/proxies will vote or abstain

from voting at his/their discretion, as he/she/they will on any other matter arising at the EGM and at any adjournment thereof.

Signature of Shareholder(s) or Common Seal [see notes

4 and 5]

And, only in the case of a minor, assisted by [see

note 6]

NOTES TO THE FORM OF PROXY AND VOTING INSTRUCTION

FORM

| 1. | Please insert the relevant number of those shares owned by you that is to be represented in this form

of proxy and voting instruction. You are not obliged to vote all your shares or to vote all your shares in the same manner. |

| 2. | If you wish to split your votes across the voting options or to cast your votes in respect of a lesser

number of shares than you own in the Company insert the relevant number of shares in respect of which you wish to vote in the relevant

space under the columns headed For, Against, Abstain, as appropriate. A shareholder is not obliged to use all the votes exercisable by

the shareholder, but the total of the votes cast and in respect of which abstention is recorded may not exceed the total of the votes

exercisable by the shareholder. If you wish to cast all of the votes of those shares owned by you that are represented in this form of

proxy and voting instruction in the same way in respect of a particular resolution, you need not fill in such number of shares but you

must indicate your vote as either For, Against or Abstain by placing a tick or cross in the relevant space. |

| 3. | Any deletions, alterations or corrections made to this form must be initialled by the shareholder. |

| 4. | In the case of joint shareholders, all holders must sign this form. |

| 5. | This form must be executed by the shareholder or his attorney, or if such shareholder is a corporation,

under its common seal or under the hand of its officer or attorney, duly authorised in writing. Where this form is executed by an attorney,

the power of attorney or a duly certified copy thereof must be lodged with this form (failing previous registration with the Company,

the Transfer Agent or the South African Administrative Depository Agent or waiver of this requirement by the Chairman of the EGM), failing

which this form may be treated as invalid and disregarded. |

| 6. | A minor must be assisted by his/her parent or guardian unless the relevant documents establishing his/her

legal capacity are produced or have been previously registered with the Company, the Transfer Agent or the South African Administrative

Depository Agent or unless this requirement is waived by the Chairman of the EGM. |

| 7. | The Chairman of the EGM may accept any voting instruction submitted other than in accordance with these

notes if he is satisfied as to the manner in which the shareholder wishes to vote. |

| 8. | Any form that is incomplete, improperly completed or illegible or where the true intentions of the person

executing the form are not ascertainable may be rejected. |

| 9. | This form must be completed and delivered: |

| (i) | by International Shareholders to Vote Processing, c/o BROADRIDGE at 51 Mercedes Way, Edgewood, NY 11717,

by 06:00 United States Eastern Daylight Time on Monday, August 7, 2023; |

| (ii) | by South African Shareholders to your broker, dealer, securities depository or other intermediary through

which your interests are held by 12:00 South Africa Standard Time on Monday, August 7, 2023; and |

| (iii) | by Shareholders of Record to Continental Stock Transfer & Trust Company via email to proxy@ continentalstock.com

or by post to 1 State Street, 30th Floor, New York, NY10004-1561, by 06:00 United States

Eastern Daylight Time on Monday, August 7, 2023. |

| 10. | If you wish to revoke this form of proxy and voting instruction, a Beneficial Shareholder must send an

email to notify this to the relevant broker, dealer, securities depository or other intermediary and a Shareholder of Record must send

an email to notify this to Continental Stock Transfer & Trust Company, in each case, by August 7, 2023. |

| 11. | In any case where a Shareholder of Record is a securities depository whose name or whose nominee’s

name is entered as a member in the register of members of the Company in respect of book-entry securities in the Company (“Depository”),

the Company shall be entitled and bound: |

| (i) | to reject any instrument of proxy lodged if a person who has an account directly with the Depository,

which account is credited with book-entry securities in the Company, (“Depositor”) is not shown to have any shares entered

against his name in the register maintained by the Depository in respect of book-entry securities in the Company (“Depository Register”)

as at 72 hours before the time of the EGM as certified by the Depository to the Company; and |

| (ii) | to accept as the maximum number of votes which in aggregate the proxy appointed by the Depositor is or

are able to cast on a poll a number which is the number of shares entered against the name of that Depositor in the Depository Register

as at 72 hours before the time of the EGM as certified by the Depository to the Company, whether that number is greater or smaller than

the number specified in any instrument of proxy executed by or on behalf of that Depositor. If that number is smaller than the number

specified in the instrument of proxy, the maximum number of votes “for”, “against” or “abstain” shall

be accepted in (as nearly as may be) the respective proportions set out in the instrument of proxy. |

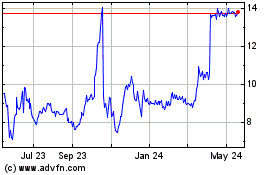

Grindrod Shipping (NASDAQ:GRIN)

Historical Stock Chart

From Feb 2025 to Mar 2025

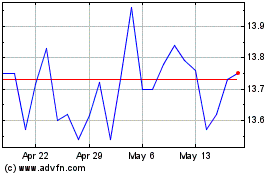

Grindrod Shipping (NASDAQ:GRIN)

Historical Stock Chart

From Mar 2024 to Mar 2025