UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2024

Commission File Number: 001-41448

Gorilla Technology Group Inc.

(Translation of registrant’s name into English)

Meridien House

42 Upper Berkeley Street

Marble Arch

London, United Kingdom W1H 5QJ

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒

Form 40-F ☐

Explanatory Note

On September 30, 2024, Gorilla Technology Group

Inc., a Cayman Islands exempted company (the “Company”), issued a press release announcing earnings for the first six months

of fiscal year 2024. The press release is furnished as Exhibit 99.1 to this Report of Foreign Private Issuer on Form 6-K.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Gorilla Technology Group Inc. |

| |

|

|

| Date: September 30, 2024 |

By: |

/s/ Jayesh Chandan |

| |

Name: |

Jayesh Chandan |

| |

Title: |

Chief Executive Officer

(Principal Executive Officer) |

Exhibit Index

Exhibit

99.1

Gorilla Technology Group Achieves Explosive

Growth in H1 2024; Sales Surge by 222%, as Company Delivers Record Profits and Strengthens Market Position

LONDON,

September 30, 2024 (GLOBE NEWSWIRE & NEWSFILE) – Gorilla Technology Group Inc. (“Gorilla” or the “Company”)

(NASDAQ: GRRR) today announced its financial results for the first half of 2024, showcasing a remarkable period of unprecedented growth

and profitability. This outstanding performance underscores Gorilla’s rapid ascent as a leading AI-driven enterprise, delivering

transformative technology solutions across global markets.

Key

Financial Highlights (Jan-Jun 2024):

| ● | Revenue:

Gorilla Technology Group recorded $20.67 million in revenue, marking an impressive

222% increase from $6.43 million in H1 2023, reflecting significant market penetration

and accelerated demand for its cutting-edge AI-driven solutions. |

| ● | Gross

Profit: Gorilla’s gross profit surged to $17.68 million, up an extraordinary 456%

from $3.18 million in H1 2023. This sharp increase is the result of cost reduction initiatives

and higher-margin projects that have significantly boosted profitability. |

| ● | Operating

Profit: The company achieved a remarkable turnaround, posting an operating profit

of $1.77 million, a substantial improvement from the $7.29 million loss recorded in H1 2023.

This transformative shift underscores the success of Gorilla’s strategic realignment and

its focus on profitable growth. |

| ● | Net Profit: Gorilla delivered $1.61

million in net profit, a major improvement over the $7.27 million net loss reported in H1 2023, signifying the company’s impressive

rebound and continued strong performance in 2024. |

| ● | Total

Overheads: Gorilla reduced its overheads by 27.55%, from $11.32 million in H1 2023 to $8.20

million in H1 2024, reflecting its commitment to operational efficiency and prudent financial

management. |

| ● | Earnings

Before Interest, Tax, Depreciation & Amortization (EBITDA): EBITDA increased significantly,

from a $6.56 million loss in H1 2023 to a positive $2.49 million in H1 2024, showcasing

operational resilience and enhanced profitability. |

| ● | Adjusted

EBITDA: Adjusted EBITDA rose by an astounding margin, reaching $2.65 million, up from

a $3.47 million loss in H1 2023, driven by strong underlying business performance and

growth in key sectors. |

First

Half 2024 Results

Unless noted otherwise, all figures are

for the six months ended June 30, 2024, and all comparisons are with the corresponding period of 2023 The following table summarizes

financial results (unaudited):

| | |

Six months ended

June 30 | |

| Items | |

2024 | | |

2023 | |

| | |

(dollars in thousands) | |

| Revenue | |

$ | 20,675 | | |

$ | 6,429 | |

| Cost of revenue | |

| (2,996 | ) | |

| (3,250 | ) |

| Gross margin | |

| 17,679 | | |

| 3,179 | |

| Operating expense | |

| 15,905 | | |

| 10,470 | |

| Operating income (loss) | |

| 1,774 | | |

| (7,292 | ) |

| Net profit (loss) | |

$ | 1,612 | | |

$ | (7,270 | ) |

| Number of contract of sales | |

| 61 | | |

| 81 | |

The following table shows our EBIT, EBITDA,

and adjusted EBITDA, together reconciled to the income (loss) for the six months period ended June 30, 2024, and 2023 (unaudited).

| | |

Six Months Ended

June 30 | |

| | |

2024 | | |

2023 | |

| | |

(dollars in thousands) | |

| Profit (loss) for the period | |

$ | 1,612 | | |

$ | (7,270 | ) |

| Income tax expense | |

| 138 | | |

| 2 | |

| Interest and finance income (expense), net | |

| 24 | | |

| (24 | ) |

| EBIT (LBIT) | |

$ | 1,774 | | |

| (7,292 | ) |

| Depreciation expense | |

| 276 | | |

| 322 | |

| Amortization expense | |

| 442 | | |

| 407 | |

| EBITDA (LBITDA) | |

$ | 2,492 | | |

$ | (6,563 | ) |

| Transaction costs(1) | |

| 162 | | |

| 3,098 | |

| Adjusted EBITDA (LBITDA) | |

$ | 2,654 | | |

$ | (3,465 | ) |

| (1) | Transaction

costs are one-off expenses for one-time employee expenses and professional services related to asset acquisition, professional services

for one-time project which are considered as one-off corporate development events and added back for calculation of adjusted EBITDA. |

Jay

Chandan, Chairman & CEO of Gorilla Technology Group, commented: “The first half of 2024 has been nothing short of exceptional.

These results reflect our strategic focus on operational excellence, market expansion and the powerful role AI continues to play in driving

our growth. We have significantly strengthened our balance sheet, pivoted towards higher-margin solutions, and optimised our cost structure.

This has enabled us to deliver record profits and further solidify our position as an innovative leader in the global technology landscape.”

Jay

added: “As we look ahead, we remain laser-focused on scaling our AI-driven offerings and executing on our long-term vision.

We are on track to deliver our best year yet, with strong indications that our year-end results will surpass the Company’s expectations

across all key metrics. Gorilla is poised to lead the charge in the rapidly evolving AI and technology space.”

Bruce

Bower, Interim Chief Financial Officer of Gorilla Technology Group, added:

“Our

financial performance in the first half of 2024 is a testament to the strength and agility of our business model. We have successfully

realigned our cost structure while driving exceptional top-line growth. The sharp reduction in our cost of sales, coupled with our ability

to generate substantial gross and operating profits, demonstrates the operational efficiencies we’ve embedded across the organisation.

“Looking

ahead, we are confident that our strategic investments and prudent financial management will continue to yield strong returns. We have

laid a solid foundation for sustainable, profitable growth and are well positioned to exceed our full-year financial targets. Gorilla

is not only delivering on its promise of innovation but also creating real, tangible value for our shareholders.”

Forward

Momentum into H2 2024 and Beyond

Gorilla

is not resting on its laurels. The company is aggressively pursuing new larger deals and expanding its global footprint and is set for

an even more impactful second half of 2024, underpinned by a rapidly expanding pipeline of potential project and accelerated market penetration.

Our pipeline continues to grow larger than previously projected, reflecting the increasing interest in Gorilla’s AI-driven solutions

across our core regions.

Full-year

projections remain highly optimistic, with revenues on track to surpass $72 million, driven by both existing and anticipated

contracts in key markets such as MENA, Southeast Asia, East Asia, South America and the United Kingdom. The company expects

significant profit growth over fiscal 2023 as operational efficiencies and product innovations continue to drive higher margins.

About

Gorilla Technology Group Inc.

Headquartered

in London U.K., Gorilla is a global solution provider in Security Intelligence, Network Intelligence, Business Intelligence and IoT technology.

We provide a wide range of solutions, including, Smart City, Network, Video, Security Convergence and IoT, across select verticals of

Government & Public Services, Manufacturing, Telecom, Retail, Transportation & Logistics, Healthcare and Education, by using

AI and Deep Learning Technologies.

Our

expertise lies in revolutionizing urban operations, bolstering security and enhancing resilience. We deliver pioneering products that

harness the power of AI in intelligent video surveillance, facial recognition, license plate recognition, edge computing, post-event

analytics and advanced cybersecurity technologies. By integrating these AI-driven technologies, we empower Smart Cities to enhance efficiency,

safety and cybersecurity measures, ultimately improving the quality of life for residents.

Forward-Looking

Statements

This

press release contains “forward-looking statements” within the meaning of the “safe harbor” provisions of the

Private Securities Litigation Reform Act of 1995. Gorilla’s actual results may differ from its expectations, estimates and projections

and consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect,”

“estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,”

“plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,”

“potential,” “might” and “continues,” and similar expressions are intended to identify such forward-looking

statements. These forward-looking statements include, without limitation, statements regarding our beliefs about future revenues, our

ability to attract the attention of customers and investors alike, Gorilla’s largest projects and ability to win additional projects

and execute definitive contracts related thereto, along with those other risks described under the heading “Risk Factors”

in the Form 20-F Gorilla filed with the Securities and Exchange Commission (the “SEC”) on May 15, 2024 and those that are

included in any of Gorilla’s future filings with the SEC. These forward-looking statements involve significant risks and uncertainties

that could cause actual results to differ materially from expected results. Most of these factors are outside of the control of Gorilla

and are difficult to predict. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove

incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking statements. Readers are cautioned

not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Gorilla undertakes no obligation

to update forward-looking statements to reflect events or circumstances after the date they were made except as required by law or applicable

regulation.

Investor

Relations Contact:

Dave Gentry

RedChip

Companies, Inc.

1-407-644-4256

GRRR@redchip.com

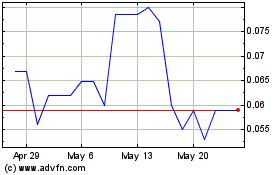

Gorilla Technology (NASDAQ:GRRRW)

Historical Stock Chart

From Nov 2024 to Dec 2024

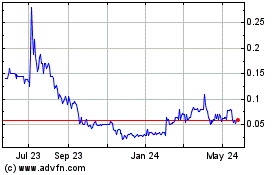

Gorilla Technology (NASDAQ:GRRRW)

Historical Stock Chart

From Dec 2023 to Dec 2024