UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16

UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of October 2024

Commission

File Number: 001-41448

Gorilla

Technology Group Inc.

(Translation

of registrant’s name into English)

Meridien

House

42

Upper Berkeley Street

Marble

Arch

London,

United Kingdom W1H 5QJ

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form

20-F ☒ Form 40-F ☐

Explanatory

Note

On

October 29, 2024, Gorilla Technology Group Inc., a Cayman Islands exempted company (the “Company”), issued a press release

announcing guidance for fiscal years 2024 and 2025. The press release is furnished as Exhibit 99.1 to this Report of Foreign Private

Issuer on Form 6-K.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

Gorilla

Technology Group Inc. |

| |

|

|

| Date:

October 29, 2024 |

By: |

/s/

Jayesh Chandan |

| |

Name: |

Jayesh

Chandan |

| |

Title: |

Chief

Executive Officer

(Principal

Executive Officer) |

Exhibit Index

3

Exhibit 99.1

Gorilla Announces Strong Outlook for 2024 and

sets Breakthrough Growth for 2025

LONDON, October 29, 2024 (NEWSFILE) – Gorilla

Technology Group Inc. (“Gorilla” or the “Company”) (NASDAQ: GRRR), today announced its guidance for fiscal years

2024 and 2025, highlighting strong revenue growth, major new contract wins and continued global expansion across key regions.

Following the company’s recent webinar (GRRR

WEBINAR OCT 24), Gorilla has reaffirmed its robust outlook for 2024, while projecting even stronger growth in 2025, driven by new contracts

and significant strategic partnerships in Asia, MENA and Latin America.

2024 Projections and Strong Financial Position

Gorilla projects 2024 revenues to reach

$72 million, with an EBITDA margin of over 20%, and net income of over $10 million. This builds on the momentum of

2023 and H1 2024, where Gorilla achieved a 222% increase in revenue and 456% growth in gross profit. Gorilla’s backlog

(i.e. signed contracts) going into 2025 now stands at $93 million, providing a solid foundation for sustained growth.

Looking ahead to 2025, Gorilla projects

revenues to surpass $90 million, with net income exceeding $15 million. The company is targeting EBITDA margins of 20-25%,

further solidifying its financial stability and long-term profitability.

Our projections do not account for any impact

from additional large-scale contracts. Following the Company’s transformative MENA project win in 2023, we are pursuing additional

projects in the AI-powered analytics, cybersecurity and smart city sectors. Some of these contracts are in advanced stages of discussions

and valued in the hundreds of millions. While not all of our contract wins will receive separate announcements, we will of course

keep our investors apprised of new projects, that will continue to propel Gorilla’s leadership in these sectors and continue our

financial performance.

Innovation and Product Development

The Gorilla Intelligent Network Director, launched

in October 2024, is already seeing strong market demand and is poised to make a significant impact, with its full release set for mid-2025.

This platform leverages our partnerships with industry leaders, including Intel and Red Hat, to integrate advanced security features and

real-time intelligence into SD-WAN solutions tailored for enterprises of all sizes. Developed to meet the needs of businesses facing rapidly

evolving security and connectivity challenges, the Intelligent Network Director allows for seamless scalability across diverse environments,

from on-premise to cloud-based networks.

This innovative platform positions Gorilla to

capture a substantial share of the growing $40 billion SD-WAN market. Furthermore, revenue from early-stage sales and market adoption

of the Intelligent Network Director are not yet reflected in our 2025 projections, meaning these earnings represent significant upside

potential.

Share Repurchase and Stock Price Valuation

Gorilla remains actively engaged in its share

repurchase programme, having acquired 1.1 million shares in September 2024. With $3.8 million of the $6 million authorised already utilised,

the company is committed to continuing the buyback, confident that the current stock price does not reflect its true value, especially

given its strong cash reserves exceeding $40 million and solid growth outlook.

“We are on a relentless growth path,”

said Jay Chandan, Chairman and CEO of Gorilla. “The momentum we have built in 2023 and 2024 is only the beginning. With massive

contracts on the horizon and a global footprint that continues to expand, Gorilla is poised to become a global leader in AI-powered solutions

by 2027.”

About Gorilla Technology Group Inc.

Headquartered in London U.K., Gorilla is a global

solution provider in Security Intelligence, Network Intelligence, Business Intelligence and IoT technology. We provide a wide range of

solutions, including, Smart City, Network, Video, Security Convergence and IoT, across select verticals of Government & Public Services,

Manufacturing, Telecom, Retail, Transportation & Logistics, Healthcare and Education, by using AI and Deep Learning Technologies.

Our expertise lies in revolutionizing urban operations,

bolstering security and enhancing resilience. We deliver pioneering products that harness the power of AI in intelligent video surveillance,

facial recognition, license plate recognition, edge computing, post-event analytics and advanced cybersecurity technologies. By integrating

these AI-driven technologies, we empower Smart Cities to enhance efficiency, safety and cybersecurity measures, ultimately improving the

quality of life for residents.

Forward-Looking Statements

This press release contains “forward-looking

statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995.

Gorilla’s actual results may differ from its expectations, estimates and projections and consequently, you should not rely on these

forward-looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,”

“budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,”

“could,” “should,” “believes,” “predicts,” “potential,” “might”

and “continues,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements

include, without limitation, statements regarding our beliefs about future revenues, our ability to attract the attention of customers

and investors alike, Gorilla’s largest projects and ability to win additional projects and execute definitive contracts related

thereto, along with those other risks described under the heading “Risk Factors” in the Form 20-F Gorilla filed with the Securities

and Exchange Commission (the “SEC”) on May 15, 2024 and those that are included in any of Gorilla’s future filings with

the SEC. These forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially

from expected results. Most of these factors are outside of the control of Gorilla and are difficult to predict. Should one or more of

these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those

indicated or anticipated by such forward-looking statements. Readers are cautioned not to place undue reliance upon any forward-looking

statements, which speak only as of the date made. Gorilla undertakes no obligation to update forward-looking statements to reflect events

or circumstances after the date they were made except as required by law or applicable regulation.

Investor Relations Contact:

Dave Gentry

RedChip Companies, Inc.

1-407-644-4256

GRRR@redchip.com

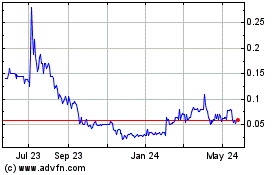

Gorilla Technology (NASDAQ:GRRRW)

Historical Stock Chart

From Nov 2024 to Dec 2024

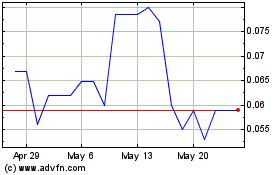

Gorilla Technology (NASDAQ:GRRRW)

Historical Stock Chart

From Dec 2023 to Dec 2024