Galera Reports First Quarter 2024 Financial Results and Recent Corporate Updates

13 May 2024 - 9:00PM

Galera Therapeutics, Inc. (Nasdaq: GRTX), a clinical-stage

biopharmaceutical company focused on developing a pipeline of

novel, proprietary therapeutics that have the potential to

transform radiotherapy in cancer, today announced financial results

for the first quarter ended March 31, 2024, and provided recent

corporate updates.

"Our review of strategic options continues, as we strive to

maximize value for our stockholders," said Mel Sorensen, M.D.,

Galera’s President and CEO. “Potential options may include mergers,

asset sales, divestiture, licensing arrangements, or other

strategic transactions and may encompass a potential development

path for avasopasem. The process could ultimately culminate in the

dissolution of the Company.”

General Corporate Updates

- Galera remains actively engaged with Stifel, Nicolaus &

Company, Inc. to undertake a comprehensive review of strategic

alternatives for both the Company and its portfolio of dismutase

mimetics. The Company has not set a fixed timeline for completing

this evaluation process and does not intend to disclose further

updates unless and until it is determined that further disclosure

is appropriate or necessary.

- On May 3, 2024, the Company announced that its Board of

Directors (the “Board”) unanimously resolved to adopt a limited

duration stockholder rights agreement (the “Rights Agreement”) to

protect stockholder interests. The Board resolved to adopt the

Rights Agreement in response to recent accumulations of the

Company’s common stock, and the Rights Agreement is intended to

enable all Galera stockholders to realize the full potential value

of their investment in Galera and to protect the interests of the

Company and its stockholders by reducing the likelihood that any

person or group gains control of Galera without paying an

appropriate control premium. In addition, the Rights Agreement

provides the Board with time to make informed decisions that are in

the best long-term interests of Galera and its stockholders. It

does not deter the Board from considering any offer or proposal

that is fair and otherwise in the best interest of Galera

stockholders.

First Quarter 2024 Financial Highlights

- Research and development expenses were $1.5 million in the

first quarter of 2024, compared to $7.3 million for the same period

in 2023. The decrease was primarily attributable to a decrease in

avasopasem and rucosopasem development costs. The Company has

ceased all clinical trial activity and suspended the clinical

development of its product candidates as it explores potential

strategic alternatives.

- General and administrative expenses were $3.1 million in the

first quarter of 2024, compared to $6.6 million for the same period

in 2023. The decrease was primarily attributable to the cessation

of avasopasem commercial preparations and medical affairs

activities and reduced personnel-related expenses due to the

workforce reduction announced in August 2023.

- Galera reported a net loss of $(4.4) million, or $(0.08) per

share, for the first quarter of 2024, compared to a net loss of

$(17.7) million, or $(0.50) per share, for the same period in

2023.

- As of March 31, 2024, Galera had cash and cash equivalents of

$13.5 million. Galera expects that its existing cash and cash

equivalents will enable Galera to fund its operating expenses and

capital expenditure requirements into the third quarter of

2025.

About Galera Therapeutics

Galera Therapeutics, Inc. is a biopharmaceutical company that

was historically focused on developing a pipeline of novel,

proprietary therapeutic candidates that have the potential to

transform radiotherapy in cancer. Galera’s selective dismutase

mimetic product candidate avasopasem manganese (avasopasem) was

being developed for radiation-induced and cisplatin-related

toxicities. The FDA has granted Fast Track and Breakthrough Therapy

designations to avasopasem for the reduction of severe oral

mucositis induced by radiotherapy. The Company’s second product

candidate, rucosopasem manganese (rucosopasem), was being developed

to augment the anti-cancer efficacy of stereotactic body radiation

therapy in patients with non-small cell lung cancer and locally

advanced pancreatic cancer. Rucosopasem has been granted orphan

drug designation and orphan medicinal product designation by the

FDA and EMA, respectively, for the treatment of pancreatic cancer.

Galera is headquartered in Malvern, PA.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. All statements contained in this press release that do not

relate to matters of historical fact should be considered

forward-looking statements, including without limitation statements

regarding: Galera’s pursuit of strategic alternatives and the

ability of any such strategic alternative to provide stockholder

value, including a potential development path for avasopasem; the

potential safety and efficacy of Galera’s product candidates and

their regulatory and clinical development; Galera’s ability to fund

its operating expenses and capital expenditure requirements into

the third quarter of 2025; and Galera’s ability to achieve its goal

of transforming radiotherapy in cancer treatment with its selective

dismutase mimetics. These forward-looking statements are based on

management’s current expectations. These statements are neither

promises nor guarantees, but involve known and unknown risks,

uncertainties and other important factors that may cause Galera’s

actual results, performance or achievements to be materially

different from any future results, performance or achievements

expressed or implied by the forward-looking statements, including,

but not limited to, the following: Galera’s limited operating

history; anticipating continued losses for the foreseeable future;

needing substantial funding and the ability to raise capital;

Galera’s dependence on avasopasem manganese (GC4419); uncertainties

inherent in the conduct of clinical trials; difficulties or delays

enrolling patients in clinical trials; the FDA’s acceptance of data

from clinical trials outside the United States; undesirable side

effects from Galera’s product candidates; risks relating to the

regulatory approval process; failure to capitalize on more

profitable product candidates or indications; ability to receive or

maintain Breakthrough Therapy, Orphan Drug or Fast Track

Designations for product candidates; failure to obtain regulatory

approval of product candidates in the United States or other

jurisdictions; ongoing regulatory obligations and continued

regulatory review; risks related to commercialization; risks

related to competition; ability to retain key employees; risks

related to intellectual property; inability to maintain

collaborations or the failure of these collaborations; Galera’s

reliance on third parties; the possibility of system failures or

security breaches; liability related to the privacy of health

information obtained from clinical trials and product liability

lawsuits; environmental, health and safety laws and regulations;

Galera may not be able to enter into any desired strategic

alternative or partnership on a timely basis, on acceptable terms,

or at all; if Galera is unable to secure additional funding or

enter into any desired strategic alternative or partnership, it may

need to cease operations; risks related to ownership of Galera’s

common stock; the possibility of Galera’s common stock being

delisted from The Nasdaq Global Market; and significant costs as a

result of operating as a public company. These and other important

factors discussed under the caption “Risk Factors” in Galera’s

Annual Report on Form 10-K for the year ended December 31, 2023

filed with the U.S. Securities and Exchange Commission (SEC) and

Galera’s other filings with the SEC could cause actual results to

differ materially from those indicated by the forward-looking

statements made in this press release. Any forward-looking

statements speak only as of the date of this press release and are

based on information available to Galera as of the date of this

release, and Galera assumes no obligation to, and does not intend

to, update any forward-looking statements, whether as a result of

new information, future events or otherwise.

| Galera

Therapeutics, Inc. |

| Consolidated

Statements of Operations |

| (unaudited,

in thousands except share and per share data) |

| |

|

|

|

| |

Three Months Ended March 31, |

| |

|

2024 |

|

|

|

2023 |

|

| Operating

expenses: |

|

|

|

|

Research and development |

$ |

1,488 |

|

|

$ |

7,272 |

|

|

General and administrative |

|

3,089 |

|

|

|

6,609 |

|

| Loss from

operations |

|

(4,577 |

) |

|

|

(13,881 |

) |

|

Other income (expense), net |

|

196 |

|

|

|

(3,829 |

) |

| Net

loss |

$ |

(4,381 |

) |

|

$ |

(17,710 |

) |

| |

|

|

|

|

Net loss per share of common stock, basic and diluted |

$ |

(0.08 |

) |

|

$ |

(0.50 |

) |

|

Weighed average common shares outstanding, basic and diluted |

|

54,392,170 |

|

|

|

35,196,134 |

|

|

|

|

|

|

| Galera

Therapeutics, Inc. |

| Selected

Consolidated Balance Sheet Data |

| (unaudited,

in thousands) |

| |

|

|

|

| |

March

31, |

|

December

31, |

| |

|

2024 |

|

|

|

2023 |

|

| |

|

|

|

| Cash and

cash equivalents |

$ |

13,466 |

|

|

$ |

18,257 |

|

| Total

assets |

|

19,651 |

|

|

|

26,141 |

|

| Total

current liabilities |

|

2,013 |

|

|

|

4,957 |

|

| Total

liabilities |

|

154,342 |

|

|

|

157,326 |

|

| Total

stockholders' deficit |

|

(134,691 |

) |

|

|

(131,185 |

) |

| |

|

|

|

Investor Contacts:Christopher DegnanGalera

Therapeutics, Inc.610-725-1500cdegnan@galeratx.com

William WindhamSolebury Strategic

Communications646-378-2946wwindham@soleburystrat.com

Media Contact:Timothy BibaSolebury Strategic

Communications646-378-2927tbiba@soleburystrat.com

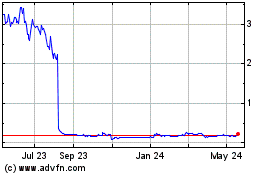

Galera Therapeutics (NASDAQ:GRTX)

Historical Stock Chart

From Dec 2024 to Jan 2025

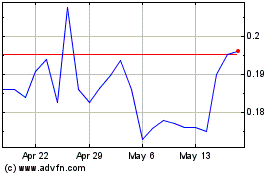

Galera Therapeutics (NASDAQ:GRTX)

Historical Stock Chart

From Jan 2024 to Jan 2025