Hudson Technologies Board of Directors Approves Increase to Company’s Share Repurchase Program

25 October 2024 - 11:30PM

Hudson Technologies, Inc. (NASDAQ: HDSN) announced that its board

of directors has approved an increase to the Company’s share

repurchase program. Hudson may now purchase up to $20 million in

shares of its common stock, consisting of up to $10 million in

shares during each of calendar year 2024 and 2025. The Company had

previously announced that its board had authorized the repurchase

of $10 million of outstanding common stock during 2024 and 2025.

Under the share repurchase program, Hudson may

purchase shares of its common stock on a discretionary basis from

time to time through open market repurchases or privately

negotiated transactions or through other means, including by

entering into Rule 10b5-1 trading plans, in each case, during an

“open window” and when the Company does not possess material

non-public information. The timing and actual number of shares

repurchased under the repurchase program will depend on a variety

of factors, including stock price, trading volume, market

conditions, corporate and regulatory requirements and other general

business considerations. The repurchase program may be modified,

suspended or discontinued at any time without prior notice.

Brian F. Coleman, President and Chief Executive

Officer of Hudson Technologies commented, “Our strengthened balance

sheet gives us the flexibility to invest in growth while also

effectively returning capital to shareholders. We believe the

board’s approval to increase the buyback program reflects its

confidence in Hudson’s ability to drive long-term growth and

reinforces our commitment to a disciplined capital allocation

strategy which includes business working capital needs,

acquisitions and share repurchases.”

About Hudson Technologies

Hudson Technologies, Inc. is a leading provider

of innovative and sustainable refrigerant products and services to

the Heating Ventilation Air Conditioning and Refrigeration

industry. For nearly three decades, we have demonstrated our

commitment to our customers and the environment by becoming one of

the first in the United States and largest refrigerant reclaimers

through multimillion dollar investments in the plants and advanced

separation technology required to recover a wide variety of

refrigerants and restoring them to Air-Conditioning, Heating, and

Refrigeration Institute standard for reuse as certified EMERALD

Refrigerants™. The Company's products and services are

primarily used in commercial air conditioning, industrial

processing and refrigeration systems, and include refrigerant and

industrial gas sales, refrigerant management services consisting

primarily of reclamation of refrigerants and RefrigerantSide®

Services performed at a customer's site, consisting of system

decontamination to remove moisture, oils and other contaminants.

The Company’s SmartEnergy OPS® service is a web-based real time

continuous monitoring service applicable to a facility’s

refrigeration systems and other energy systems. The Company’s

Chiller Chemistry® and Chill Smart® services are also predictive

and diagnostic service offerings. As a component of the Company’s

products and services, the Company also generates carbon offset

projects.

Safe Harbor Statement under the Private

Securities Litigation Reform Act of 1995

Statements contained herein which are not

historical facts constitute forward-looking statements. Such

forward-looking statements involve a number of known and unknown

risks, uncertainties and other factors which may cause the actual

results, performance or achievements of the Company to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements. Such factors include, but are not limited to,

changes in the laws and regulations affecting the industry, changes

in the demand and price for refrigerants (including unfavorable

market conditions adversely affecting the demand for, and the price

of, refrigerants), the Company's ability to source refrigerants,

regulatory and economic factors, seasonality, competition,

litigation, the nature of supplier or customer arrangements that

become available to the Company in the future, adverse weather

conditions, possible technological obsolescence of existing

products and services, possible reduction in the carrying value of

long-lived assets, estimates of the useful life of its assets,

potential environmental liability, customer concentration, the

ability to obtain financing, the ability to meet financial

covenants under its existing credit facility, any delays or

interruptions in bringing products and services to market, the

timely availability of any requisite permits and authorizations

from governmental entities and third parties as well as factors

relating to doing business outside the United States, including

changes in the laws, regulations, policies, and political,

financial and economic conditions, including inflation, interest

and currency exchange rates, of countries in which the Company may

seek to conduct business, the Company’s ability to successfully

integrate any assets it acquires from third parties into its

operations, and other risks detailed in the Company's 10-K for the

year ended December 31, 2023 and other subsequent filings with the

Securities and Exchange Commission. The words "believe",

"expect", "anticipate", "may", "plan", "should" and similar

expressions identify forward-looking statements. Readers are

cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date the statement was

made.

| Investor Relations

Contact:John Nesbett/Jennifer BelodeauIMS Investor

Relations (203) 972-9200jnesbett@imsinvestorrelations.com |

Company

Contact:Brian F. Coleman, President & CEOHudson

Technologies, Inc.(845) 735-6000bcoleman@hudsontech.com |

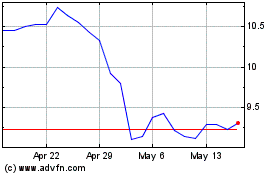

Hudson Technologies (NASDAQ:HDSN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Hudson Technologies (NASDAQ:HDSN)

Historical Stock Chart

From Nov 2023 to Nov 2024