UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of July, 2023

Commission File Number: 001-40398

HIVE Blockchain Technologies Ltd.

(Translation of registrant's name into English)

British Columbia, Canada

(Jurisdiction of incorporation or organization)

Suite 855 -789 West Pender Street

Vancouver, BC

V6C 1H2

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

[ ] Form 20-F [X] Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

HIVE BLOCKCHAIN TECHNOLOGIES LTD. |

| |

|

|

| |

By: |

/s/ Darcy Daubaras |

| |

|

Name: Darcy Daubaras |

| |

|

Title: Chief Financial Officer |

Dated: July 10, 2023

HIVE Blockchain Announces Rebranding and Name Change to HIVE Digital Technologies Ltd. to Reflect our HPC Strategy and Updates Bitcoin Equivalent for Fiscal 2023

This news release constitutes a "designated news release" for the purposes of the Company's

prospectus supplement dated May 10, 2023 to its short form base shelf prospectus dated May 1, 2023.

Vancouver, British Columbia--(Newsfile Corp. - July 6, 2023) - HIVE Blockchain Technologies Ltd. (TSXV: HIVE) (NASDAQ: HIVE) (FSE: HBFA) (the Company" or "HIVE") a global leader in blockchain technology, today announces its intent to undergo a strategic rebranding including a name change to "HIVE Digital Technologies Ltd." (the "Name Change") to better reflect the Company's evolving expansion into fast tracking our HPC data centres by utilizing our Nvidia high performance Graphics Processing Unit ("GPU") chips for the mass adoption trend in Artificial Intelligence ("AI"). HIVE has been a pioneering force in the cryptocurrency mining sector since 2017. The intent of the name change signals a significant strategic expansion to harness the potential of our green energy data centres and of GPU Cloud compute technology, a vital tool in the world of AI, machine learning, and advanced data analysis since the launch of ChatGPT.

Currently, the common shares ("Shares") of the Company trade on the TSX Venture Exchange ("TSXV") under the symbol "HIVE" and on the Nasdaq Capital Market ("Nasdaq") under the symbol "HIVE". Certain common share purchase warrants of the Company (the "Warrants"), which were issued pursuant to the automatic exercise on January 11, 2022, of the 19,170,500 special warrants previously issued on November 30, 2021, are currently listed for trading on the TSXV under the symbol "HIVE.WT". The Company will not be changing any of its trading symbols and it will not be undertaking any consolidation of share capital in connection with the Name Change. The Company expects that the Name Change will be effective on or about July 12, 2023 and that the Shares and the Warrants will commence trading under its new name on the TSXV and Nasdaq shortly after that. Completion of the Name Change is subject to the receipt of all regulatory approvals including the approval of the TSXV.

The Name Change does not affect the Company's Share or Warrant structure or the rights of the Company's securityholders, and no further action is required by existing securityholders. Each current Share certificate or Warrant certificate evidencing Shares or Warrants, as applicable, of HIVE will continue to evidence the Shares or Warrants, as applicable, of HIVE Digital Technologies Ltd. without further action by holders of Shares or Warrants, as applicable, after the Name Change.

Correction to June 30, 2023, News Release

In the Company's June 30, 2023, news release, there was an understatement of the number of Bitcoin equivalent mined during the year by 792. HIVE stated that "In this fiscal year, the Company mined 3,258 Bitcoin from ASICs and 3,503 Bitcoin equivalent when including digital assets mined form GPUs." The correct figures for Bitcoin equivalent should have been 4,295 and not 3,503.

Option Grant

The Company announced that the Board of Directors has approved the grant 620,000 incentive stock options ("Stock Options") exercisable into the equivalent amount of common shares of the Company at a price of C$6.86 per share for a period of five years. The grants were made to employees, officers and consultants of the Company and are subject certain vesting requirements.

All grants of Stock Options are subject to the Company's Stock Option Plan which was re-approved by shareholders at HIVE's 2022 annual meeting of shareholders on December 20, 2022.

Further updates on the rebranding and name change will be provided as they become available.

About HIVE Blockchain Technologies Ltd.

HIVE Blockchain Technologies Ltd. went public in 2017 as the first cryptocurrency mining company listed for trading on the TSX Venture Exchange with a sustainable green energy focus.

HIVE is a growth-oriented technology stock in the emergent blockchain industry. As a company whose shares trade on a major stock exchange, we are building a bridge between the digital currency and blockchain sector and traditional capital markets. HIVE owns state-of-the-art, green energy-powered data center facilities in Canada, Sweden, and Iceland, where we endeavor to source green energy to mine digital assets such as Bitcoin on the cloud. Since the beginning of 2021, HIVE has held in secure storage the majority of its treasury of ETH and BTC derived from mining rewards. Our shares provide investors with exposure to the operating margins of digital currency mining, as well as a portfolio of Bitcoin. Because HIVE also owns hard assets such as data centers and advanced multi-use servers, we believe our shares offer investors an attractive way to gain exposure to the cryptocurrency space.

For more information and to register for HIVE's mailing list, please visit www.HIVEblockchain.com. Follow @HIVE_HPC on Twitter and subscribe to HIVE's YouTube channel.

On Behalf of HIVE Blockchain Technologies Ltd.

"Frank Holmes"

Executive Chairman

For further information please contact:

Frank Holmes

Tel: (604) 664-1078

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release

Forward-Looking Information

Except for the statements of historical fact, this news release contains "forward-looking information" within the meaning of the applicable Canadian and United States securities legislation and regulations that is based on expectations, estimates and projections as at the date of this news release. "Forward-looking information" in this news release includes, but is not limited to: business goals and objectives of the Company; the acquisition, deployment and optimization of the mining fleet and equipment; the continued viability of its existing Bitcoin mining operations; and other forward-looking information concerning the intentions, plans and future actions of the parties to the transactions described herein and the terms thereon.

Factors that could cause actual results to differ materially from those described in such forward looking information include, but are not limited to, the volatility of the digital currency market; the Company's ability to successfully mine digital currency; the Company may not be able to profitably liquidate its current digital currency inventory as required, or at all; a material decline in digital currency prices may have a significant negative impact on the Company's operations; the regulatory environment for cryptocurrency in Canada, the United States and the countries where our mining facilities are located; economic dependence on regulated terms of service and electricity rates; the speculative and competitive nature of the technology sector; dependency on continued growth in blockchain and cryptocurrency usage; lawsuits and other legal proceedings and challenges; government regulations; the global economic climate; dilution; future capital needs and uncertainty of additional financing, including the Company's ability to utilize the Company's at-the-market equity offering program (the "ATM Program") and the prices at which the Company may sell Common Shares in the ATM Program, as well as capital market conditions in general; risks relating to the strategy of maintaining and increasing Bitcoin holdings and the impact of depreciating Bitcoin prices on working capital; the competitive nature of the industry; currency exchange risks; the need for the Company to manage its planned growth and expansion; the effects of product development and need for continued technology change; the ability to maintain reliable and economical sources of power to run its cryptocurrency mining assets; the impact of energy curtailment or regulatory changes in the energy regimes in the jurisdictions in which the Company operates; protection of proprietary rights; the effect of government regulation and compliance on the Company and the industry; network security risks; the ability of the Company to maintain properly working systems; reliance on key personnel; global economic and financial market deterioration impeding access to capital or increasing the cost of capital; share dilution resulting from the ATM Program and from other equity issuances; the construction and operation of facilities may not occur as currently planned, or at all; expansion may not materialize as currently anticipated, or at all; the digital currency market; the ability to successfully mine digital currency; revenue may not increase as currently anticipated, or at all; it may not be possible to profitably liquidate the current digital currency inventory, or at all; a decline in digital currency prices may have a significant negative impact on operations; an increase in network difficulty may have a significant negative impact on operations; the volatility of digital currency prices; the anticipated growth and sustainability of electricity for the purposes of cryptocurrency mining in the applicable jurisdictions; the inability to maintain reliable and economical sources of power for the Company to operate cryptocurrency mining assets; the risks of an increase in the Company's electricity costs, cost of natural gas, changes in currency exchange rates, energy curtailment or regulatory changes in the energy regimes in the jurisdictions in which the Company operates and the adverse impact on the Company's profitability; the ability to complete current and future financings, any regulations or laws that will prevent the Company from operating its business; historical prices of digital currencies and the ability to mine digital currencies that will be consistent with historical prices; an inability to predict and counteract the effects of COVID-19 on the business of the Company, including but not limited to the effects of COVID-19 on the price of digital currencies, capital market conditions, restriction on labour and international travel and supply chains; and, the adoption or expansion of any regulation or lawthat will prevent the Company from operating its business, or make it more costly to do so; and other related risks as more fully set out in the Company's disclosure documents under the Company's filings at www.sec.gov/EDGAR and www.sedar.com.

The forward-looking information in this news release reflects the current expectations, assumptions and/or beliefs of the Company based on information currently available to the Company. In connection with the forward-looking information contained in this news release, the Company has made assumptions about the Company's objectives, goals or future plans, the timing thereof and related matters. The Company has also assumed that no significant events occur outside of the Company's normal course of business. Although the Company believes that the assumptions inherent in the forward-looking information are reasonable, forward-looking information is not a guarantee of future performance and accordingly undue reliance should not be put on such information due to its inherent uncertainty. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of newinformation, future events or otherwise, other than as required by law.

To view the source version of this press release, please visit

https://www.newsfilecorp.com/release/172492

FORM 51-102F3

Material Change Report

Item 1 Name and Address of Company

HIVE Blockchain Technologies Ltd. ("HIVE" or the "Company")

# 855 - 789 West Pender Street

Vancouver, BC V6C 1H2

Item 2 Date of Material Change

July 6, 2023.

Item 3 News Release

The press release attached as Schedule "A" was disseminated through a newswire company in Canada on July 6, 2023.

Item 4 Summary of Material Change

The material change is described in the press release attached as Schedule "A".

Item 5 Full Description of Material Change

The material change is described in the press release attached as Schedule "A".

Item 6 Reliance on subsection 7.1(2) of National Instrument 51-102 Not applicable.

Item 7 Omitted Information

Not applicable.

Item 8 Executive Officer

Darcy Daubaras

Chief Financial Officer

T: 604-664-1078

Item 9 Date of Report

July 6, 2023.

Schedule "A"

HIVE Blockchain Announces Rebranding and Name Change to HIVE Digital Technologies Ltd. to Reflect our HPC Strategy and Updates Bitcoin Equivalent for Fiscal 2023

This news release constitutes a "designated news release" for the purposes of the Company's

prospectus supplement dated May 10, 2023 to its short form base shelf prospectus dated May 1, 2023.

Vancouver, British Columbia--(Newsfile Corp. - July 6, 2023) - HIVE Blockchain Technologies Ltd. (TSXV: HIVE) (NASDAQ: HIVE) (FSE: HBFA) (the Company" or "HIVE") a global leader in blockchain technology, today announces its intent to undergo a strategic rebranding including a name change to "HIVE Digital Technologies Ltd." (the "Name Change") to better reflect the Company's evolving expansion into fast tracking our HPC data centres by utilizing our Nvidia high performance Graphics Processing Unit ("GPU") chips for the mass adoption trend in Artificial Intelligence ("AI"). HIVE has been a pioneering force in the cryptocurrency mining sector since 2017. The intent of the name change signals a significant strategic expansion to harness the potential of our green energy data centres and of GPU Cloud compute technology, a vital tool in the world of AI, machine learning, and advanced data analysis since the launch of ChatGPT.

Currently, the common shares ("Shares") of the Company trade on the TSX Venture Exchange ("TSXV") under the symbol "HIVE" and on the Nasdaq Capital Market ("Nasdaq") under the symbol "HIVE". Certain common share purchase warrants of the Company (the "Warrants"), which were issued pursuant to the automatic exercise on January 11, 2022, of the 19,170,500 special warrants previously issued on November 30, 2021, are currently listed for trading on the TSXV under the symbol "HIVE.WT". The Company will not be changing any of its trading symbols and it will not be undertaking any consolidation of share capital in connection with the Name Change. The Company expects that the Name Change will be effective on or about July 12, 2023 and that the Shares and the Warrants will commence trading under its new name on the TSXV and Nasdaq shortly after that. Completion of the Name Change is subject to the receipt of all regulatory approvals including the approval of the TSXV.

The Name Change does not affect the Company's Share or Warrant structure or the rights of the Company's securityholders, and no further action is required by existing securityholders. Each current Share certificate or Warrant certificate evidencing Shares or Warrants, as applicable, of HIVE will continue to evidence the Shares or Warrants, as applicable, of HIVE Digital Technologies Ltd. without further action by holders of Shares or Warrants, as applicable, after the Name Change.

Correction to June 30, 2023, News Release

In the Company's June 30, 2023, news release, there was an understatement of the number of Bitcoin equivalent mined during the year by 792. HIVE stated that "In this fiscal year, the Company mined 3,258 Bitcoin from ASICs and 3,503 Bitcoin equivalent when including digital assets mined form GPUs." The correct figures for Bitcoin equivalent should have been 4,295 and not 3,503.

Option Grant

The Company announced that the Board of Directors has approved the grant 620,000 incentive stock options ("Stock Options") exercisable into the equivalent amount of common shares of the Company at a price of C$6.86 per share for a period of five years. The grants were made to employees, officers and consultants of the Company and are subject certain vesting requirements.

All grants of Stock Options are subject to the Company's Stock Option Plan which was re-approved by shareholders at HIVE's 2022 annual meeting of shareholders on December 20, 2022.

Further updates on the rebranding and name change will be provided as they become available.

About HIVE Blockchain Technologies Ltd.

HIVE Blockchain Technologies Ltd. went public in 2017 as the first cryptocurrency mining company listed for trading on the TSX Venture Exchange with a sustainable green energy focus.

HIVE is a growth-oriented technology stock in the emergent blockchain industry. As a company whose shares trade on a major stock exchange, we are building a bridge between the digital currency and blockchain sector and traditional capital markets. HIVE owns state-of-the-art, green energy-powered data center facilities in Canada, Sweden, and Iceland, where we endeavor to source green energy to mine digital assets such as Bitcoin on the cloud. Since the beginning of 2021, HIVE has held in secure storage the majority of its treasury of ETH and BTC derived from mining rewards. Our shares provide investors with exposure to the operating margins of digital currency mining, as well as a portfolio of Bitcoin. Because HIVE also owns hard assets such as data centers and advanced multi-use servers, we believe our shares offer investors an attractive way to gain exposure to the cryptocurrency space.

For more information and to register for HIVE's mailing list, please visit www.HIVEblockchain.com. Follow @HIVE_HPC on Twitter and subscribe to HIVE's YouTube channel.

On Behalf of HIVE Blockchain Technologies Ltd.

"Frank Holmes"

Executive Chairman

For further information please contact:

Frank Holmes

Tel: (604) 664-1078

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release

Forward-Looking Information

Except for the statements of historical fact, this news release contains "forward-looking information" within the meaning of the applicable Canadian and United States securities legislation and regulations that is based on expectations, estimates and projections as at the date of this news release. "Forward-looking information" in this news release includes, but is not limited to: business goals and objectives of the Company; the acquisition, deployment and optimization of the mining fleet and equipment; the continued viability of its existing Bitcoin mining operations; and other forward-looking information concerning the intentions, plans and future actions of the parties to the transactions described herein and the terms thereon.

Factors that could cause actual results to differ materially from those described in such forward looking information include, but are not limited to, the volatility of the digital currency market; the Company's ability to successfully mine digital currency; the Company may not be able to profitably liquidate its current digital currency inventory as required, or at all; a material decline in digital currency prices may have a significant negative impact on the Company's operations; the regulatory environment for cryptocurrency in Canada, the United States and the countries where our mining facilities are located; economic dependence on regulated terms of service and electricity rates; the speculative and competitive nature of the technology sector; dependency on continued growth in blockchain and cryptocurrency usage; lawsuits and other legal proceedings and challenges; government regulations; the global economic climate; dilution; future capital needs and uncertainty of additional financing, including the Company's ability to utilize the Company's at-the-market equity offering program (the "ATM Program") and the prices at which the Company may sell Common Shares in the ATM Program, as well as capital market conditions in general; risks relating to the strategy of maintaining and increasing Bitcoin holdings and the impact of depreciating Bitcoin prices on working capital; the competitive nature of the industry; currency exchange risks; the need for the Company to manage its planned growth and expansion; the effects of product development and need for continued technology change; the ability to maintain reliable and economical sources of power to run its cryptocurrency mining assets; the impact of energy curtailment or regulatory changes in the energy regimes in the jurisdictions in which the Company operates; protection of proprietary rights; the effect of government regulation and compliance on the Company and the industry; network security risks; the ability of the Company to maintain properly working systems; reliance on key personnel; global economic and financial market deterioration impeding access to capital or increasing the cost of capital; share dilution resulting from the ATM Program and from other equity issuances; the construction and operation of facilities may not occur as currently planned, or at all; expansion may not materialize as currently anticipated, or at all; the digital currency market; the ability to successfully mine digital currency; revenue may not increase as currently anticipated, or at all; it may not be possible to profitably liquidate the current digital currency inventory, or at all; a decline in digital currency prices may have a significant negative impact on operations; an increase in network difficulty may have a significant negative impact on operations; the volatility of digital currency prices; the anticipated growth and sustainability of electricity for the purposes of cryptocurrency mining in the applicable jurisdictions; the inability to maintain reliable and economical sources of power for the Company to operate cryptocurrency mining assets; the risks of an increase in the Company's electricity costs, cost of natural gas, changes in currency exchange rates, energy curtailment or regulatory changes in the energy regimes in the jurisdictions in which the Company operates and the adverse impact on the Company's profitability; the ability to complete current and future financings, any regulations or laws that will prevent the Company from operating its business; historical prices of digital currencies and the ability to mine digital currencies that will be consistent with historical prices; an inability to predict and counteract the effects of COVID-19 on the business of the Company, including but not limited to the effects of COVID-19 on the price of digital currencies, capital market conditions, restriction on labour and international travel and supply chains; and, the adoption or expansion of any regulation or lawthat will prevent the Company from operating its business, or make it more costly to do so; and other related risks as more fully set out in the Company's disclosure documents under the Company's filings at www.sec.gov/EDGAR and www.sedar.com.

The forward-looking information in this news release reflects the current expectations, assumptions and/or beliefs of the Company based on information currently available to the Company. In connection with the forward-looking information contained in this news release, the Company has made assumptions about the Company's objectives, goals or future plans, the timing thereof and related matters. The Company has also assumed that no significant events occur outside of the Company's normal course of business. Although the Company believes that the assumptions inherent in the forward-looking information are reasonable, forward-looking information is not a guarantee of future performance and accordingly undue reliance should not be put on such information due to its inherent uncertainty. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of newinformation, future events or otherwise, other than as required by law.

To view the source version of this press release, please visit

https://www.newsfilecorp.com/release/172492

HIVE Blockchain Provides June 2023 Production Update

This news release constitutes a "designated news release" for the purposes of the Company's

prospectus supplement dated May 10, 2023, to its short form base shelf prospectus dated May 1, 2023.

Vancouver, British Columbia--(Newsfile Corp. - July 10, 2023) - HIVE Blockchain Technologies Ltd. (TSXV: HIVE) (NASDAQ: HIVE) (FSE: HBFA) (the "Company" or "HIVE") is pleased to announce the unaudited production figures from the Company's global Bitcoin operations for the month of June 2023, with 259 Bitcoin produced in June, and a current BTC HODL balance of approximately 1,957 (As of July

1st). The Company has maintained over 3.3 Exahash ("EH/s") of Bitcoin mining capacity on average for June 2023, including ASIC and GPU BTC hashrate (all amounts in US dollars, unless otherwise indicated).

Summary Overview:

- HIVE produced 259 Bitcoin in the month of June, from ASIC and GPU mining operations, representing an average of 76.6 Bitcoin Per Exahash, with an average hashrate of 3.38 EH/s for the month of June 2023;

- HIVE produced an average of 8.6 BTC per day in June 2023;

- HIVE ended the month with 3.48 EH/s of mining capacity, including ASIC and GPU BTC hashrate.

June 2023 Production Figures

Aydin Kilic, President & CEO of HIVE noted, "Since our June month end, our ASIC hashrate reached 3.4 EH/s in the first week of July, and is expected to continue to grow this month, as the majority of our 1.26 EH/s of ASICs which were previously announced, have been shipped, and we are continuing to install them in our data centers upon delivery. We expect to provide updates on our growing hashrate capacity as we work towards our interim goal of 4 EH/s, and moreover, we are actively evaluating opportunities in the market for our year end goal of 6 EH/s."

The Company's total Bitcoin production in June 2023 was:

- 246 BTC produced from ASICs from an average hashrate of 3.2 EH/s from ASICs in June;

- 8.2 BTC produced per day on average from ASICs, and 76.6 BTC/EH from ASICs in June;

- 3.48 EH/s of BTC month end Hashrate as of June 30, comprised of 3.316 EH/s of ASIC BTC hashrate and 0.166 EH/s of GPU BTC Hashrate;

- Monthly average of 3.38 EH/s, comprised of an average of 3.212 EH/s of ASIC mining capacity and average of 167 PH/s of Bitcoin GPU mining capacity during the month of June;

- This represents a 4.6% month over month end increase in BTC ASIC hashrate (May 30 month end was 3.17 EH/s hashrate), and a 3% month over month average increase in BTC hashrate from ASICs and GPUs combined (May average BTC hashrate was 3.3 EH/s).

Bitcoin Global Network Mining Difficulty Is Volatile

Network difficulty factors are a significant variable in the Company's gross profit margins. The Bitcoin network difficulty was 51.23 T as of June 1, and reached a new all-time high of 52.35 T during the month before ending at 50.65 T on June 30. Accordingly, Bitcoin mining difficulty ended the month about 1 % lower than the beginning of the month.

The Bitcoin Network Difficulty is a publicly available statistic, which reflects the total number of Bitcoin miners online and is important in analyzing a company's gross profit margins, and number of Bitcoin produced. This data is available on many websites, here is one citation:

https://www.blockchain.com/explorer/charts/difficulty.

As more people mine Bitcoin (difficulty increases), the daily Bitcoin block reward which presently is fixed at 900 Bitcoin per day, gets split amongst more miners; thus each miner receives a smaller portion of the block reward. Conversely, as Bitcoin prices fall, many miners may lose money, and power down, thus taking their hashrate off the network, causing Network Difficulty to decrease.

Those miners with the lowest costs of production, by virtue of having more efficient machines and/or lower energy costs, are able to continue their production during these volatile cycles. Not all miners will continuously mine during the month, as a result some miners will produce less Bitcoin than expected, relative to their advertised hashrate. For the foregoing reasons, HIVE will self-curtail part of its operations if the unhedged spot energy prices are uneconomical, thereby leaving part of its total gross hashrate unutilized.

All Bitcoin miners are striving to use the most efficient Bitcoin ASIC chips, and we are happy that we have been able to upgrade our global fleet during this crypto market downturn.

About HIVE Blockchain Technologies Ltd.

HIVE Blockchain Technologies Ltd. went public in 2017 as the first cryptocurrency mining company listed for trading on the TSX Venture Exchange with a sustainable green energy focus.

HIVE is a growth-oriented technology stock in the emergent blockchain industry. As a company whose shares trade on a major stock exchange, we are building a bridge between the digital currency and blockchain sector and traditional capital markets. HIVE owns state-of-the-art, green energy-powered data centre facilities in Canada, Sweden, and Iceland, where we endeavour to source green energy to mine digital assets such as Bitcoin on the cloud. Since the beginning of 2021, HIVE has held in secure storage the majority of its treasury of ETH and BTC derived from mining rewards. Our shares provide investors with exposure to the operating margins of digital currency mining, as well as a portfolio of Bitcoin. Because HIVE also owns hard assets such as data centers and advanced multi-use servers, we believe our shares offer investors an attractive way to gain exposure to the cryptocurrency space.

We encourage you to visit HIVE's YouTube channel here to learn more about HIVE.

For more information and to register to HIVE's mailing list, please visit www.HIVEblockchain.com. Follow @HIVE_HPC on Twitter and subscribe to HIVE's YouTube channel.

On Behalf of HIVE Blockchain Technologies Ltd.

"Frank Holmes"

Executive Chairman

For further information please contact:

Frank Holmes

Tel: (604) 664-1078

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release

Forward-Looking Information

Except for the statements of historical fact, this news release contains "forward-looking information" within the meaning of the applicable Canadian and United States securities legislation and regulations that is based on expectations, estimates and projections as at the date of this news release. "Forward-looking information" in this news release includes, but is not limited to: business goals and objectives of the Company; the results of operations for June 2023; the acquisition, deployment and optimization of the mining fleet and equipment; the continued viability of its existing Bitcoin mining operations; and other forward-looking information concerning the intentions, plans and future actions of the parties to the transactions described herein and the terms thereon.

Factors that could cause actual results to differ materially from those described in such forward looking information include, but are not limited to, the volatility of the digital currency market; the Company's ability to successfully mine digital currency; the Company may not be able to profitably liquidate its current digital currency inventory as required, or at all; a material decline in digital currency prices may have a significant negative impact on the Company's operations; the regulatory environment for cryptocurrency in Canada, the United States and the countries where our mining facilities are located; economic dependence on regulated terms of service and electricity rates; the speculative and competitive nature of the technology sector; dependency on continued growth in blockchain and cryptocurrency usage; lawsuits and other legal proceedings and challenges; government regulations; the global economic climate; dilution; future capital needs and uncertainty of additional financing, including the Company's ability to utilize the Company's at-the-market equity offering program (the "ATM Program") and the prices at which the Company may sell Common Shares in the ATM Program, as well as capital market conditions in general; risks relating to the strategy of maintaining and increasing Bitcoin holdings and the impact of depreciating Bitcoin prices on working capital; the competitive nature of the industry; currency exchange risks; the need for the Company to manage its planned growth and expansion; the effects of product development and need for continued technology change; the ability to maintain reliable and economical sources of power to run its cryptocurrency mining assets; the impact of energy curtailment or regulatory changes in the energy regimes in the jurisdictions in which the Company operates; protection of proprietary rights; the effect of government regulation and compliance on the Company and the industry; network security risks; the ability of the Company to maintain properly working systems; reliance on key personnel; global economic and financial market deterioration impeding access to capital or increasing the cost of capital; share dilution resulting from the ATM Program and from other equity issuances; the construction and operation of facilities may not occur as currently planned, or at all; expansion may not materialize as currently anticipated, or at all; the digital currency market; the ability to successfully mine digital currency; revenue may not increase as currently anticipated, or at all; it may not be possible to profitably liquidate the current digital currency inventory, or at all; a decline in digital currency prices may have a significant negative impact on operations; an increase in network difficulty may have a significant negative impact on operations; the volatility of digital currency prices; the anticipated growth and sustainability of electricity for the purposes of cryptocurrency mining in the applicable jurisdictions; the inability to maintain reliable and economical sources of power for the Company to operate cryptocurrency mining assets; the risks of an increase in the Company's electricity costs, cost of natural gas, changes in currency exchange rates, energy curtailment or regulatory changes in the energy regimes in the jurisdictions in which the Company operates and the adverse impact on the Company's profitability; the ability to complete current and future financings, any regulations or laws that will prevent the Company from operating its business; historical prices of digital currencies and the ability to mine digital currencies that will be consistent with historical prices; an inability to predict and counteract the effects of COVID-19 on the business of the Company, including but not limited to the effects of COVID-19 on the price of digital currencies, capital market conditions, restriction on labour and international travel and supply chains; and, the adoption or expansion of any regulation or lawthat will prevent the Company from operating its business, or make it more costly to do so; and other related risks as more fully set out in the Company's disclosure documents under the Company's filings at www.sec.gov/EDGAR and www.sedar.com.

The forward-looking information in this news release reflects the current expectations, assumptions and/or beliefs of the Company based on information currently available to the Company. In connection with the forward-looking information contained in this news release, the Company has made assumptions about the Company's objectives, goals or future plans, the timing thereof and related matters. The Company has also assumed that no significant events occur outside of the Company's normal course of business. Although the Company believes that the assumptions inherent in the forward-looking information are reasonable, forward-looking information is not a guarantee of future performance and accordingly undue reliance should not be put on such information due to its inherent uncertainty. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of newinformation, future events or otherwise, other than as required by law.

To view the source version of this press release, please visit

https://www.newsfilecorp.com/release/172910

FORM 51-102F3

Material Change Report

Item 1 Name and Address of Company

HIVE Blockchain Technologies Ltd. ("HIVE" or the "Company")

# 855 - 789 West Pender Street

Vancouver, BC V6C 1H2

Item 2 Date of Material Change

July 10, 2023.

Item 3 News Release

The press release attached as Schedule "A" was disseminated through a newswire company in Canada on July 10, 2023.

Item 4 Summary of Material Change

The material change is described in the press release attached as Schedule "A".

Item 5 Full Description of Material Change

The material change is described in the press release attached as Schedule "A".

Item 6 Reliance on subsection 7.1(2) of National Instrument 51-102

Not applicable.

Item 7 Omitted Information

Not applicable.

Item 8 Executive Officer

Darcy Daubaras

Chief Financial Officer

T: 604-664-1078

Item 9 Date of Report

July 10, 2023.

Schedule "A"

HIVE Blockchain Provides June 2023 Production Update

This news release constitutes a "designated news release" for the purposes of the Company's

prospectus supplement dated May 10, 2023, to its short form base shelf prospectus dated May 1,

2023.

Vancouver, British Columbia--(Newsfile Corp. - July 10, 2023) - HIVE Blockchain Technologies Ltd. (TSXV: HIVE) (NASDAQ: HIVE) (FSE: HBFA) (the "Company" or "HIVE") is pleased to announce the unaudited production figures from the Company's global Bitcoin operations for the month of June 2023, with 259 Bitcoin produced in June, and a current BTC HODL balance of approximately 1,957 (As of July 1st). The Company has maintained over 3.3 Exahash ("EH/s") of Bitcoin mining capacity on average for June 2023, including ASIC and GPU BTC hashrate (all amounts in US dollars, unless otherwise indicated).

Summary Overview:

- HIVE produced 259 Bitcoin in the month of June, from ASIC and GPU mining operations, representing an average of 76.6 Bitcoin Per Exahash, with an average hashrate of 3.38 EH/s for the month of June 2023;

- HIVE produced an average of 8.6 BTC per day in June 2023;

- HIVE ended the month with 3.48 EH/s of mining capacity, including ASIC and GPU BTC hashrate.

June 2023 Production Figures

Aydin Kilic, President & CEO of HIVE noted, "Since our June month end, our ASIC hashrate reached 3.4 EH/s in the first week of July, and is expected to continue to grow this month, as the majority of our 1.26 EH/s of ASICs which were previously announced, have been shipped, and we are continuing to install them in our data centers upon delivery. We expect to provide updates on our growing hashrate capacity as we work towards our interim goal of 4 EH/s, and moreover, we are actively evaluating opportunities in the market for our year end goal of 6 EH/s."

The Company's total Bitcoin production in June 2023 was:

- 246 BTC produced from ASICs from an average hashrate of 3.2 EH/s from ASICs in June;

- 8.2 BTC produced per day on average from ASICs, and 76.6 BTC/EH from ASICs in June;

- 3.48 EH/s of BTC month end Hashrate as of June 30, comprised of 3.316 EH/s of ASIC BTC hashrate and 0.166 EH/s of GPU BTC Hashrate;

- Monthly average of 3.38 EH/s, comprised of an average of 3.212 EH/s of ASIC mining capacity and average of 167 PH/s of Bitcoin GPU mining capacity during the month of June;

- This represents a 4.6% month over month end increase in BTC ASIC hashrate (May 30 month end was 3.17 EH/s hashrate), and a 3% month over month average increase in BTC hashrate from ASICs and GPUs combined (May average BTC hashrate was 3.3 EH/s).

Bitcoin Global Network Mining Difficulty Is Volatile

Network difficulty factors are a significant variable in the Company's gross profit margins. The Bitcoin network difficulty was 51.23 T as of June 1, and reached a new all-time high of 52.35 T during the month before ending at 50.65 T on June 30. Accordingly, Bitcoin mining difficulty ended the month about 1 % lower than the beginning of the month.

The Bitcoin Network Difficulty is a publicly available statistic, which reflects the total number of Bitcoin miners online and is important in analyzing a company's gross profit margins, and number of Bitcoin produced. This data is available on many websites, here is one citation:

https://www.blockchain.com/explorer/charts/difficulty.

As more people mine Bitcoin (difficulty increases), the daily Bitcoin block reward which presently is fixed at 900 Bitcoin per day, gets split amongst more miners; thus each miner receives a smaller portion of the block reward. Conversely, as Bitcoin prices fall, many miners may lose money, and power down, thus taking their hashrate off the network, causing Network Difficulty to decrease.

Those miners with the lowest costs of production, by virtue of having more efficient machines and/or lower energy costs, are able to continue their production during these volatile cycles. Not all miners will continuously mine during the month, as a result some miners will produce less Bitcoin than expected, relative to their advertised hashrate. For the foregoing reasons, HIVE will self-curtail part of its operations if the unhedged spot energy prices are uneconomical, thereby leaving part of its total gross hashrate unutilized.

All Bitcoin miners are striving to use the most efficient Bitcoin ASIC chips, and we are happy that we have been able to upgrade our global fleet during this crypto market downturn.

About HIVE Blockchain Technologies Ltd.

HIVE Blockchain Technologies Ltd. went public in 2017 as the first cryptocurrency mining company listed for trading on the TSX Venture Exchange with a sustainable green energy focus.

HIVE is a growth-oriented technology stock in the emergent blockchain industry. As a company whose shares trade on a major stock exchange, we are building a bridge between the digital currency and blockchain sector and traditional capital markets. HIVE owns state-of-the-art, green energy-powered data centre facilities in Canada, Sweden, and Iceland, where we endeavour to source green energy to mine digital assets such as Bitcoin on the cloud. Since the beginning of 2021, HIVE has held in secure storage the majority of its treasury of ETH and BTC derived from mining rewards. Our shares provide investors with exposure to the operating margins of digital currency mining, as well as a portfolio of Bitcoin. Because HIVE also owns hard assets such as data centers and advanced multi-use servers, we believe our shares offer investors an attractive way to gain exposure to the cryptocurrency space.

We encourage you to visit HIVE's YouTube channel here to learn more about HIVE.

For more information and to register to HIVE's mailing list, please visit www.HIVEblockchain.com. Follow @HIVE_HPC on Twitter and subscribe to HIVE's YouTube channel.

On Behalf of HIVE Blockchain Technologies Ltd.

"Frank Holmes"

Executive Chairman

For further information please contact:

Frank Holmes

Tel: (604) 664-1078

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release

Forward-Looking Information

Except for the statements of historical fact, this news release contains "forward-looking information" within the meaning of the applicable Canadian and United States securities legislation and regulations that is based on expectations, estimates and projections as at the date of this news release. "Forward-looking information" in this news release includes, but is not limited to: business goals and objectives of the Company; the results of operations for June 2023; the acquisition, deployment and optimization of the mining fleet and equipment; the continued viability of its existing Bitcoin mining operations; and other forward-looking information concerning the intentions, plans and future actions of the parties to the transactions described herein and the terms thereon.

Factors that could cause actual results to differ materially from those described in such forward looking information include, but are not limited to, the volatility of the digital currency market; the Company's ability to successfully mine digital currency; the Company may not be able to profitably liquidate its current digital currency inventory as required, or at all; a material decline in digital currency prices may have a significant negative impact on the Company's operations; the regulatory environment for cryptocurrency in Canada, the United States and the countries where our mining facilities are located; economic dependence on regulated terms of service and electricity rates; the speculative and competitive nature of the technology sector; dependency on continued growth in blockchain and cryptocurrency usage; lawsuits and other legal proceedings and challenges; government regulations; the global economic climate; dilution; future capital needs and uncertainty of additional financing, including the Company's ability to utilize the Company's at-the-market equity offering program (the "ATM Program") and the prices at which the Company may sell Common Shares in the ATM Program, as well as capital market conditions in general; risks relating to the strategy of maintaining and increasing Bitcoin holdings and the impact of depreciating Bitcoin prices on working capital; the competitive nature of the industry; currency exchange risks; the need for the Company to manage its planned growth and expansion; the effects of product development and need for continued technology change; the ability to maintain reliable and economical sources of power to run its cryptocurrency mining assets; the impact of energy curtailment or regulatory changes in the energy regimes in the jurisdictions in which the Company operates; protection of proprietary rights; the effect of government regulation and compliance on the Company and the industry; network security risks; the ability of the Company to maintain properly working systems; reliance on key personnel; global economic and financial market deterioration impeding access to capital or increasing the cost of capital; share dilution resulting from the ATM Program and from other equity issuances; the construction and operation of facilities may not occur as currently planned, or at all; expansion may not materialize as currently anticipated, or at all; the digital currency market; the ability to successfully mine digital currency; revenue may not increase as currently anticipated, or at all; it may not be possible to profitably liquidate the current digital currency inventory, or at all; a decline in digital currency prices may have a significant negative impact on operations; an increase in network difficulty may have a significant negative impact on operations; the volatility of digital currency prices; the anticipated growth and sustainability of electricity for the purposes of cryptocurrency mining in the applicable jurisdictions; the inability to maintain reliable and economical sources of power for the Company to operate cryptocurrency mining assets; the risks of an increase in the Company's electricity costs, cost of natural gas, changes in currency exchange rates, energy curtailment or regulatory changes in the energy regimes in the jurisdictions in which the Company operates and the adverse impact on the Company's profitability; the ability to complete current and future financings, any regulations or laws that will prevent the Company from operating its business; historical prices of digital currencies and the ability to mine digital currencies that will be consistent with historical prices; an inability to predict and counteract the effects of COVID-19 on the business of the Company, including but not limited to the effects of COVID-19 on the price of digital currencies, capital market conditions, restriction on labour and international travel and supply chains; and, the adoption or expansion of any regulation or lawthat will prevent the Company from operating its business, or make it more costly to do so; and other related risks as more fully set out in the Company's disclosure documents under the Company's filings at www.sec.gov/EDGAR and www.sedar.com.

The forward-looking information in this news release reflects the current expectations, assumptions and/or beliefs of the Company based on information currently available to the Company. In connection with the forward-looking information contained in this news release, the Company has made assumptions about the Company's objectives, goals or future plans, the timing thereof and related matters. The Company has also assumed that no significant events occur outside of the Company's normal course of business. Although the Company believes that the assumptions inherent in the forward-looking information are reasonable, forward-looking information is not a guarantee of future performance and accordingly undue reliance should not be put on such information due to its inherent uncertainty. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of newinformation, future events or otherwise, other than as required by law.

To view the source version of this press release, please visit

https://www.newsfilecorp.com/release/172910

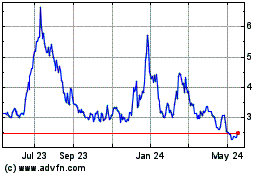

HIVE Digital Technologies (NASDAQ:HIVE)

Historical Stock Chart

From Nov 2024 to Dec 2024

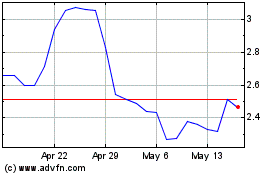

HIVE Digital Technologies (NASDAQ:HIVE)

Historical Stock Chart

From Dec 2023 to Dec 2024