As

Filed Pursuant to Rule 424(b)(5)

Registration Statement No. 333-265244

PROSPECTUS

SUPPLEMENT

(To

prospectus dated June 6, 2022)

3,380,282

Shares

Harrow

Health, Inc.

Common

Stock

We

are selling 3,380,282 shares of our common stock, par value $0.001 per share, pursuant to this prospectus supplement and the accompanying

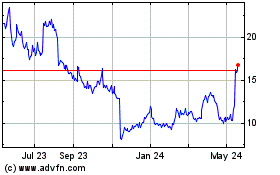

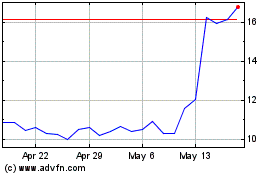

prospectus. Our common stock is traded on the Nasdaq Global Market (“Nasdaq”) under the symbol “HROW.” On July

17, 2023, the last reported sale price of our common stock on Nasdaq was $18.02 per share.

Investing

in our common stock involves a high degree of risk, and you should read this prospectus supplement, the accompanying prospectus and the

documents incorporated by reference herein before you make your investment decision. Before investing in our common stock, you should

carefully consider the risk factors described in the section titled “Risk Factors” beginning on page S-9 of this prospectus

supplement as well as the risks identified in our most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q, and any other

filings we make with the Securities and Exchange Commission (the “SEC”) from time to time, which are incorporated by reference

in this prospectus supplement.

Neither

the SEC nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement

or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | |

Per Share | | |

Total(1) | |

| Offering price | |

$ | 17.75 | | |

$ | 60,000,005.50 | |

| Underwriting discount(1) | |

$ | 1.065 | | |

$ | 3,600,000.33 | |

| Proceeds, before expenses, to us | |

$ | 16.685 | | |

$ | 56,400,005.17 | |

| (1) |

See

“Underwriting” on page S-19 of this prospectus supplement for a description of all underwriting compensation payable

in connection with this offering. |

We

have granted the underwriters an option to purchase up to an additional 507,042 shares of our common stock within 30 days from

the date of this prospectus supplement.

The

underwriters expect to deliver the shares of common stock to the purchasers on or about July 21, 2023.

Book-Running

Manager

B.

Riley Securities

Lead

Manager

Lake

Street

Co-Manager

Ladenburg

Thalmann

The

date of this prospectus supplement is July 18, 2023.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

prospectus supplement is a supplement to the accompanying prospectus. This prospectus supplement and the accompanying prospectus are

part of a registration statement that we filed with the SEC utilizing a shelf registration process. This prospectus supplement provides

you with specific information about this offering, including the risk of investing in our securities. The accompanying prospectus provides

more general information, some of which may not apply to this offering. This prospectus supplement also adds to, updates and changes

information contained in the accompanying prospectus. To the extent the information in this prospectus supplement is different from that

in the accompanying prospectus, you should rely on the information in this prospectus supplement. You should read this prospectus supplement,

the accompanying prospectus, and any related free writing prospectus together with the additional information described in the sections

entitled “Incorporation of Certain Documents by Reference” and “Where You Can Find More Information” of this

prospectus supplement.

We

have not, and the underwriters have not, authorized any person to provide you with any information other than that contained in or incorporated

by reference into this prospectus supplement and the accompanying prospectus or that is contained in any free writing prospectus issued

by or on behalf of us or to which we have referred you. Neither we nor any of the underwriters takes any responsibility for, and can

provide no assurances as to the reliability of, any other information that others may give to you. This prospectus supplement, the accompanying

prospectus and any applicable free writing prospectus is not an offer to sell, nor is it seeking an offer to buy, these securities in

any state where the offer or sale is not permitted. The information in this prospectus supplement and the accompanying prospectus is

complete and accurate as of the date on the front cover of this prospectus supplement, but the information and our business, cash flows,

condition (financial and otherwise), liquidity, prospects and results of operations may have changed since that date.

The

distribution of this prospectus supplement and the accompanying prospectus and the offering or sale of these securities in some jurisdictions

may be restricted by law. Persons outside of the United States who come into possession of this prospectus supplement and the accompanying

prospectus are required by us and the underwriters to inform themselves about and to observe any applicable restrictions. This prospectus

supplement and the accompanying prospectus may not be used for or in connection with an offer or solicitation by any person in any jurisdiction

in which that offer or solicitation is not authorized or to any person to whom it is unlawful to make that offer or solicitation.

You

should not consider any information in this prospectus supplement or the accompanying prospectus to be investment, legal or tax advice.

You should consult your own counsel, accountants and other advisers for legal, tax, business, financial and related advice regarding

investing in our securities.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus supplement and the accompanying prospectus contain and incorporate by reference “forward-looking statements” regarding

future events and our future performance. In some cases, you can identify forward-looking statements by terminology such as “will,”

“may,” “should,” “expects,” “plans,” “anticipates,” “believes,”

“estimates,” “predicts,” “forecasts,” “potential” or “continue” or the negative

of these terms or other comparable terminology. Generally, the words “anticipate,” “believe,” “continue,”

“expect,” “intend,” “estimate,” “project,” “plan” and similar expressions

identify forward-looking statements. In particular, statements about our expectations, beliefs, plans, objectives, assumptions or future

events or performance contain forward-looking statements.

We

have based these forward-looking statements on our current expectations, assumptions, estimates and projections. These forward-looking

statements involve risks and uncertainties and reflect only our current views, expectations and assumptions with respect to future events

and our future performance. If risks or uncertainties materialize or assumptions prove incorrect, actual results or events could differ

materially from those expressed or implied by such forward-looking statements. Risks that could

cause actual results to differ from those expressed or implied by the forward-looking statements we make include, among others, risks

related to: liquidity or results of operations; our ability to successfully implement our business plan, develop and commercialize our

products, product candidates and proprietary formulations in a timely manner or at all, identify and acquire additional products, manage

our pharmacy operations, service our debt, obtain financing necessary to operate our business, recruit and retain qualified personnel,

manage any growth we may experience and successfully realize the benefits of our previous acquisitions and any other acquisitions and

collaborative arrangements we may pursue; competition from pharmaceutical companies, outsourcing facilities and pharmacies; general economic

and business conditions, including inflation and supply chain challenges; regulatory and legal risks and uncertainties related to our

pharmacy operations and the pharmacy and pharmaceutical business in general; physician interest in and market acceptance of our current

and any future formulations and compounding pharmacies generally; and the other risks and uncertainties described under the heading “Risk

Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022 and Quarterly Report on Form 10-Q for the quarter

ended March 31, 2023, and other documents that we file from time to time with the SEC that are incorporated by reference in this prospectus

supplement and the accompanying prospectus.

This

list of risks and uncertainties, however, is only a summary of some of the most important factors and is not intended to be exhaustive.

Given these risks and uncertainties, you are cautioned not to place undue reliance on such forward-looking statements. These risks and

uncertainties may cause our actual future results to be materially different than those expressed in our forward-looking statements.

These forward-looking statements are made only as of the date of this prospectus supplement. Except as otherwise required by applicable

law, we do not undertake and expressly disclaim any obligation to update any such statements or to publicly announce the results of any

revisions to any such statements to reflect future events or developments. All subsequent written and oral forward-looking statements

attributable to us, or to persons acting on our behalf, are expressly qualified in their entirety by these cautionary statements.

PROSPECTUS

SUPPLEMENT SUMMARY

This

summary highlights selected information appearing elsewhere in or incorporated by reference in this prospectus supplement and the accompanying

prospectus. This summary is not complete and does not contain all of the information that you should consider when making your investment

decision. You should carefully read the entire prospectus supplement, the accompanying prospectus and the information incorporated herein

by reference, including the section entitled “Risk Factors” beginning on page S-9 of this prospectus supplement and the

“Risk Factors” section in the accompanying prospectus, in our Annual Report on Form 10-K for the year ended December 31,

2022 and Quarterly Report on Form 10-Q for the quarter ended March 31, 2023, and in our other reports that we file with the SEC that

are incorporated by reference into this prospectus supplement and the accompanying prospectus.

In

this prospectus supplement, unless the context requires otherwise, references to “Harrow,” the “Company,” “we,”

“us” and “our” refer to Harrow Health, Inc., together with its consolidated subsidiaries.

Overview

We

are an ophthalmic-focused pharmaceutical company. Our business specializes in the development, production, sale, and distribution of

innovative prescription medications that offer unique competitive advantages and serve unmet needs in the marketplace through our subsidiaries

and deconsolidated companies. We serve ophthalmologists and optometrists by providing FDA-approved branded ophthalmic pharmaceuticals

and innovative compounded prescription medicines that are accessible and affordable. We own the U.S. commercial rights to ten branded

ophthalmic pharmaceutical products, including IHEEZO™, IOPIDINE® (both approved concentrations), MAXITROL® eye drops, MOXEZA®,

ILEVRO®, NEVANAC®, VIGAMOX®, MAXIDEX®, and TRIESENCE®. We own and operate ImprimisRx, one of the nation’s leading

ophthalmology-focused pharmaceutical-compounding businesses, and our branded drugs are marketed under our Harrow name. In addition, we

also have non-controlling equity positions in Surface Ophthalmics, Inc. (“Surface”) and Melt Pharmaceuticals, Inc. (“Melt”),

both companies that began as subsidiaries of Harrow and were subsequently carved-out of our corporate structure and deconsolidated from

our financial statements. We also own royalty rights in certain drug candidates being developed by Surface and Melt.

ImprimisRx

ImprimisRx

is our ophthalmology-focused pharmaceutical compounding businesses. From its inception in 2014, ImprimisRx, whose business consists of

integrated pharmaceutical research and development capabilities, production, dispensing/distribution, sales, marketing, and customer-service

infrastructure, has offered physician customers and their patients access to critical medicines to meet their clinical needs. ImprimisRx

has built a national brand by focusing exclusively on compounded ophthalmic medications to serve needs unmet by commercially available

drugs. Our compounded medications include various combinations of drugs formulated into one bottle and numerous preservative-free formulations.

Depending on the formulation, the regulations of a specific state, and ultimately the needs of the patient, ImprimisRx products may be

dispensed as patient-specific medications from our 503A pharmacy, or for in-office use, made according to current good manufacturing

practices (“cGMPs”) or other guidance documents from the U.S. Food and Drug Administration (the “FDA”), in our

FDA-registered New Jersey outsourcing facility. Our current ophthalmology formulary includes over 30 compounded formulations, many of

which are patented or patent-pending, that are customizable for the specific needs of a patient. We make our formulations available at

prices that are, in most cases, lower than non-customized commercial drugs. ImprimisRx’s customer base has grown to include more

than 10,000 U.S. eyecare-dedicated prescribers and institutions.

Branded

Pharmaceuticals and Drug Candidates

Over

the past three years, to serve the needs of our growing customer base more fully, we have invested in broadening our product portfolio

to include FDA-approved products. Our investments in this regard have led to the pursuit and completion of several announced transactions,

and others we are continuing to pursue, all of which are focused on eyecare pharmaceuticals. We believe that our continued investments

in these and other products will result in our ability to provide more physician prescribers and their patients with access to a complete

portfolio of affordable eyecare pharmaceuticals to address their clinical needs.

Acquisition

of ILEVRO, NEVANAC, VIGAMOX, MAXIDEX and TRIESENCE

In

December 2022, we entered into an Asset Purchase Agreement (the “Purchase Agreement”) with Novartis Technology, LLC and Novartis

Innovative Therapies AG (together, “Novartis”), pursuant to which the Company agreed to purchase from Novartis the exclusive

commercial rights to assets associated with the following ophthalmic products (collectively, the “Fab 5 Products”) in the

U.S. (the “Fab 5 Acquisition”):

| |

● |

ILEVRO® (nepafenac ophthalmic suspension) 0.3%, a non-steroidal, anti-inflammatory eye drop indicated for pain and inflammation

associated with cataract surgery. |

| |

|

|

| |

● |

NEVANAC® (nepafenac ophthalmic suspension) 0.1%, a

non-steroidal, anti-inflammatory eye drop indicated for pain and inflammation associated with cataract surgery. |

| |

|

|

| |

● |

VIGAMOX® (moxifloxacin hydrochloride ophthalmic solution)

0.5%, a fluoroquinolone antibiotic eye drop for the treatment of bacterial conjunctivitis caused by susceptible strains of organisms. |

| |

|

|

| |

● |

MAXIDEX® (dexamethasone ophthalmic suspension) 0.1%,

a steroid eye drop for steroid-responsive inflammatory conditions of the palpebral and bulbar conjunctiva, cornea, and anterior segment

of the globe. |

| |

|

|

| |

● |

TRIESENCE® (triamcinolone acetonide injectable suspension)

40 mg/ml, a steroid injection for the treatment of certain ophthalmic diseases and for visualization during vitrectomy. |

We

closed the Fab 5 Acquisition on January 20, 2023. Under the terms of the Purchase Agreement, we made a one-time payment of $130,000,000

at closing, with up to another $45,000,000 due in a milestone payment related to the timing of the commercial availability of TRIESENCE.

Pursuant to and subject to certain conditions in the Purchase Agreement and various ancillary agreements, for a period beginning immediately

following the closing and ending prior to the transfer of the Fab 5 Products new drug applications (the “NDAs”) to us, Novartis

will continue to sell the Products on our behalf and transfer the net profit from the sale of the Products to us. Novartis has agreed

to supply certain Products to the Company for a period of time after the NDAs are transferred to us and to assist with technology transfer

of the Products manufacturing to other third-party manufacturers, if needed.

On

April 28, 2023, we transferred the NDAs for ILEVRO, NEVANAC and MAXIDEX. We expect to transfer the NDA for VIGAMOX in the second half

of 2023, and the NDA for TRIESENCE around the timing of its commercial availability.

IOPIDINE®,

MAXITROL® EYE DROPS, MOXEZA®

In

December 2021, we acquired U.S. commercial rights to four FDA-approved ophthalmic medicines: IOPIDINE 1% and 0.5% (apraclonidine hydrochloride);

MAXITROL (neomycin/polymyxin B/dexamethasone) ophthalmic suspension; and MOXEZA (moxifloxacin hydrochloride). We believe by expanding

our product portfolio to include branded FDA-approved products, we will be uniquely positioned to leverage our commercial platform to

introduce unique lifecycle management strategies that could grow sales and address needs of our customers that we are unable to meet

with our other compounded product offerings.

At

the time of closing the acquisition of the four products, we agreed to a transition period with the seller, which lasted six months following

the closing of the transaction. During the transition period, the seller continued to sell the products and transferred the net profit

from those sales to us. Following the transition period which ended in June 2022, we made IOPIDINE 1% and MAXITROL commercially available,

and expect to re-launch MOXEZA at a later date.

IHEEZOTM

In

July 2021, we acquired the exclusive U.S. and Canadian marketing and supply rights to IHEEZO (chloroprocaine hydrochloride ophthalmic

gel) 3% from Sintetica S.A. (“Sintetica”). The FDA approved IHEEZO for ocular surface anesthesia in September 2022. We commercially

launched IHEEZO in the U.S. market in May 2023.

We

expect our commercial focus of IHEEZO to be on ophthalmic procedures that traditionally require the eye to be anesthetized, including

intravitreal injections and lens replacement procedures, which in aggregate we estimate to be over 11 million instances annually in the

U.S.

IHEEZO

is protected by one issued, Orange Book listed patent and another patent-pending. The issued patent includes composition of matter and

method of use claims and could provide protection for IHEEZO into 2037.

MAQ-100

In

August 2021, we acquired exclusive marketing rights to MAQ-100 in the U.S. and Canada from Wakamoto Pharmaceutical Co., Ltd. (“Wakamoto”).

MAQ-100 is a preservative-free triamcinolone acetonide ophthalmic injection drug candidate. MAQ-100 is marketed and sold by Wakamoto

in Japan as MaQaid®. Following Japan’s Ministry of Health Labor and Welfare (“MHLW”) approval, MaQaid was launched

in Japan in 2010, indicated as an intravitreal injection for visualization for vitrectomy. Since its initial MHLW approval, the indication

for MaQaid was expanded to include (a) treatments for alleviation of diabetic macular edema, (b) macular edema associated with retinal

vein occlusion (or RVO), and (c) non-infectious uveitis. We are currently working with Wakamoto to assess a clinical pathway for MaQaid.

We

are currently evaluating several programs to internally develop product candidates based on technology and know-how we own. We also expect

to continue to acquire and/or develop additional FDA-approved/approvable ophthalmic products and product candidates that will allow us

to leverage our commercial infrastructure to promote, sell, and ultimately bring these products to market.

Carved-Out

Businesses (De-Consolidated Businesses)

We

have ownership interests in Surface, Melt, and Eton Pharmaceuticals, Inc. (“Eton”) and hold royalty interests in some of

Surface’s and Melt’s drug candidates. These companies are pursuing market approval for their drug candidates under the Federal

Food, Drug, and Cosmetic Act, including in some instances under the abbreviated pathway described in Section 505(b)(2), which permits

the submission of an NDA where at least some of the information required for approval comes from studies not conducted by or for the

applicant and for which the applicant has not obtained a right of reference.

Noncontrolling

Equity Interests

Melt

Pharmaceuticals, Inc.

Melt

is a clinical-stage pharmaceutical company focused on the development and commercialization of proprietary non-intravenous, sedation

and anesthesia therapeutics for human medical procedures in hospital, outpatient, and in-office settings. Melt is seeking regulatory

approval for its proprietary technologies, where possible. In December 2018, we entered into an Asset Purchase Agreement with Melt (the

“Melt Asset Purchase Agreement”), pursuant to which Harrow assigned to Melt the underlying intellectual property for Melt’s

current pipeline, including its lead drug candidate MELT-300. The core intellectual property Melt owns is a patented series of combination

non-opioid sedation drug formulations that we estimate to have multitudinous applications.

MELT-300

is a novel, sublingually delivered, non-IV, opioid-free drug candidate being developed for procedural sedation. In February 2021, Melt

announced data from, and the successful completion of, its Phase 1 study. In December 2022, Melt announced topline data from its Phase

2 study for MELT-300:

|

● |

In

a study of more than 300 patients, at nine study sites, all undergoing cataract surgery, MELT-300 achieved its primary procedural

sedation endpoint, demonstrating statistical superiority for procedural sedation compared to all comparator treatment arms, including

midazolam 3mg (P=0.0129) and ketamine 50mg (P=0.0096). |

| |

|

|

| |

● |

Using

the validated Ramsey Sedation Scale (RSS), MELT-300 treatment arm patients were 50% less likely to require rescue sedation compared

to midazolam 3mg (P=0.0198). |

| |

|

|

| |

● |

Using

the RSS, MELT-300 treatment arm patients were 66% less likely to require rescue sedation pre-operatively compared to the midazolam

3mg treatment arm. |

| |

|

|

| |

● |

MELT-300’s

safety profile was generally comparable to the placebo arm. |

In

January 2019, Melt closed an offering of its Series A Preferred Stock. At that time, we gave up our controlling interest and deconsolidated

Melt from our consolidated financial statements. We own 3,500,000 shares of Melt common stock, which was approximately 46% of Melt’s

equity and voting interests issued and outstanding as of March 31, 2023. In September 2021, we provided Melt with a senior secured loan

with a principal amount of $13,500,000, which was used to fund the Phase 2 program of MELT-300.

Melt

is required to make mid-single digit royalty payments to the Company on net sales of MELT-300, while any patent rights remain outstanding,

subject to other conditions. Melt can require the Company to cease compounding like products at the time of FDA approval of MELT-300.

If approved, we do not expect a cessation of compounding like products to have a material impact on our operations and financial performance.

Surface

Opthalmics, Inc.

Surface

is a clinical-stage pharmaceutical company focused on the development and commercialization of innovative therapeutics for ocular surface

diseases.

| ● |

SURF-100

for Chronic Dry Eye Disease: Surface completed its 350-patient Phase 2 clinical trial, comparing five active arms of SURF-100

study drugs with the current market-leading prescription chronic dry eye treatments. According to Surface, the SURF-100 Phase 2 clinical

trial achieved superiority for both signs and symptoms of chronic dry eye disease compared to market leading incumbents, as well

as generating positive data on onset and duration of action. |

| |

|

| ● |

SURF-200

for Acute Dry Eye: Surface has completed enrollment of its Phase 2 clinical trial for SURF-200 and expects to announce top-line

results in 2023. |

| |

|

| ● |

SURF-201

for Pain and Inflammation Following Ocular Surgery: According to the Surface results, SURF-201 was dosed twice daily, met its

primary endpoints of absence of inflammation at both Day 8 and Day 15 and was found to be safe and well-tolerated by the patient

group. In addition, a secondary endpoint showed almost 90% of patients given SURF-201 were pain free at Day 15. |

In

2018, Surface closed an offering of its Series A Preferred Stock. At that time, we lost our controlling interest and deconsolidated Surface

from our consolidated financial statements. During May, June and July of 2021, Surface closed an offering of its preferred stock at a

purchase price of $4.50 per share resulting in gross proceeds to Surface of approximately $25,000,000 (the “Surface Series B Offering”).

We own 3,500,000 shares of Surface common stock, which was approximately 20% of Surface’s equity and voting interests as of March

31, 2023. Harrow owns mid-single digit royalty rights on net sales of SURF-100, SURF-200 and SURF-201.

Eton

Pharmaceuticals, Inc.

Eton

is an innovative pharmaceutical company focused on developing, acquiring, and commercializing treatments for rare diseases. Eton currently

commercializes ALKINDI SPRINKLE® and Carglumic Acid tablets and has additional rare disease products under development, including

dehydrated alcohol injection and the ZENEO® hydrocortisone autoinjector. In May 2017, we gave up our controlling interest in Eton.

We own 1,982,000 shares of Eton common stock, which represented less than 10% of Eton’s equity and voting interests issued and

outstanding as of March 31, 2023.

Recent

Developments

Acquisition

of VEVYETM U.S. and Canadian Commercial Rights

On

July 18, 2023, we announced that we had acquired commercial rights of VEVYE (cyclosporine ophthalmic solution) 0.1%, an ophthalmic

drug product, for the U.S. and Canadian markets (the “VEVYE Acquisition”). VEVYE, which is dispensed topically in

a unique ten microliter per one drop and is labeled for twice-daily (BID) dosing, is the first and only cyclosporine-based product

indicated for the treatment of both signs and symptoms of dry eye disease (DED). VEVYE was approved on May 30, 2023 by the FDA. We acquired

the commercial rights to VEVYE by entering into a license agreement with Novaliq GmbH (“Novaliq”). As consideration,

we will make initial payments to Novaliq totaling $8,000,000 and will pay low double-digit royalties on net sales of VEVYE along with

potential commercial milestone payments.

Acquisition

of Certain U.S. and Canadian Commercial Rights to Santen and Eyevance Products

On

July 18, 2023, we entered into an Asset Purchase Agreement with Eyevance Pharmaceuticals, LLC and a License Agreement with Santen

S.A.S. (collectively, the “Santen Agreements”), each a subsidiary of Santen Pharmaceuticals Co., Ltd. (collectively, “Santen”).

Pursuant to the Santen Agreements, we will be acquiring the exclusive commercial rights to assets associated with the following ophthalmic

products (collectively, the “Santen Products”):

In

the U.S.:

| ● | FLAREX®

(fluorometholone acetate ophthalmic suspension) 0.1%, a corticosteroid prepared as a sterile

topical ophthalmic suspension indicated for use in the treatment of steroid-responsive inflammatory

conditions of the palpebral and bulbar conjunctiva, cornea, and anterior segment of the eye. |

| ● | NATACYN®

(natamycin ophthalmic suspension) 5%, a sterile, antifungal drug for the treatment of fungal

blepharitis, conjunctivitis, and keratitis caused by susceptible organisms, including Fusarium

solani keratitis. |

| ● | TOBRADEX®

ST (tobramycin and dexamethasone ophthalmic suspension) 0.3%/0.05%, a topical antibiotic

and corticosteroid combination for steroid-responsive inflammatory ocular conditions for

which a corticosteroid is indicated and where superficial bacterial ocular infection or a

risk of bacterial ocular infection exists. |

| ● | ZERVIATE®

(cetirizine ophthalmic solution) 0.24%, a histamine-1 (H1) receptor antagonist indicated

for treatment of ocular itching associated with allergic conjunctivitis. |

| ● | FRESHKOTE®,

a preservative-free formulation for temporary relief of symptoms of dry eye. |

In

the U.S. and Canada:

| ● | VERKAZIA®

(cyclosporine ophthalmic emulsion) 0.1%, an orphan designated drug that is a calcineurin

inhibitor immunosuppressant indicated for the treatment of vernal keratoconjunctivitis. |

In

Canada:

| ● | CATIONORM®

PLUS, a preservative-free formulation for dry eye or allergy relief. |

The

transactions pursuant to the Santen Agreements are referred to in this prospectus as the “Santen Products Acquisition.”

Under

the terms of the Santen Agreements, we are required to make an initial one-time payment of $8,000,000. In addition, the agreements provide

for various one-time milestone payments associated with certain manufacturing-related events as well as low-double digit royalty payments

on net sales of Verkazia and high-single digit royalty payments on net sales of Cationorm Plus. Under the Santen Agreements, we also

assumed certain obligations associated with other third parties that require mid-single digit royalties on sales of Freshkote and Zerviate.

Immediately following the closing and subject to certain conditions, for a period that we expect to last approximately four months, and

prior to the transfer of the Santen Product NDAs and other marketing authorizations to us, Santen will continue to sell the Santen Products

on our behalf and transfer the net profit from the sale of the Santen Products to us.

Oaktree

Credit Agreement Amendment

On

July 18, 2023, we entered into the First Amendment to Credit Agreement and Guaranty and Consent (the “Oaktree

Amendment”) to the Credit Agreement and Guaranty (the “Oaktree Loan”) originally entered into on March 27, 2023,

with the lenders from time to time party thereto and Oaktree Fund Administration, LLC, as administrative agent for the lenders

(together, “Oaktree”). Under the Oaktree Amendment, the overall credit facility size was increased from $100,000,000 to

$112,500,000, and we made other changes related to the Santen Products Acquisition. Upon satisfaction of certain conditions to

funding, we will draw down a principal amount of $12,500,000 (the “Loan Increase”) to fund the initial one-time

payment associated with the Santen Product Acquisition and for other working capital and general corporate purposes. No other

material changes to the Oaktree Loan were provided in the Oaktree Amendment. Following entry into the Oaktree Amendment and the

funding of the Loan Increase upon closing of the Santen Products Acquisition, we have drawn down a total principal loan amount of

$77,500,000 under the Oaktree Loan and an additional principal loan amount of up to $35,000,000 remains available to us upon the

commercialization of TRIESENCE.

Financial

Guidance for the Three Months Ended June 30, 2023

We

expect to record over $31,000,000 of total revenues and over $9,300,000 of Adjusted EBITDA (a non-GAAP (as defined below) measure)

for the three-month period ended June 30, 2023.

Management

utilizes Adjusted EBITDA, an unaudited financial measure that is not calculated in accordance with generally accepted accounting principles

in the United States (“GAAP”), to evaluate the Company’s financial results and performance and to plan and forecast

future periods. Investors are encouraged to review the Company’s complete results of operations and additional information provided

in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 and Quarterly Report on Form 10-Q for the quarter

ended March 31, 2023, which are incorporated by reference into this prospectus supplement. Management believes that Adjusted EBITDA reflects

an additional way of viewing aspects of the Company’s operations that, when viewed in conjunction with GAAP results, provides a

more complete understanding of the Company’s results of operations and the factors and trends affecting its business.

Although

we are providing management guidance on anticipated Adjusted EBITDA, we are unable to determine with reasonable certainty the ultimate

outcome of certain items necessary to calculate net income, the most directly comparable GAAP measure, without unreasonable effort. These

items include, but are not limited to, final calculation of investment related gains/losses, inventory reserves, profit transfers, revenue

discounts, returns, chargebacks and stock-based compensation. These items are uncertain, depend on various factors, and could have a

material impact on the GAAP reported results for the period. Accordingly, net income is not accessible on a forward-looking basis.

All

estimates presented are subject to completion of the applicable quarter-end closing procedures. Our actual results for such period will

not be available until after this offering is completed and may vary from these estimates. In addition, estimated financial information

is necessarily speculative in nature, and it can be expected that some or all of the assumptions underlying the estimated financial information

described above will not materialize or will vary significantly from actual results. Accordingly, undue reliance should not be placed

on this estimated financial information. The preliminary estimates are not necessarily indicative of any future period

and should be read together with the sections titled “Risk Factors” and “Special Note Regarding Forward-Looking Statements,”

and under similar headings in the documents incorporated by reference into this prospectus supplement and the accompanying prospectus

as well as our financial statements, related notes and other financial information incorporated by reference in this prospectus supplement.

The

foregoing guidance on anticipated results for the three months ended June 30, 2023 has not been reviewed by our auditors, is based on

preliminary information as of the date hereof and is subject to material changes following completion of the quarter-end review process

and other adjustments that may be made before our financial results are finalized. In addition, these preliminary unaudited results are

not comprehensive financial results for the quarter ended June 30, 2023, should not be viewed as a substitute for complete GAAP financial

statements or more comprehensive financial information, and are not indicative of the results for any future period.

Settlement

of Performance Vesting Restricted Stock Units

Effective

as of July 18, 2023, we settled approximately 1,567,913 outstanding performance vesting restricted stock units as a result of the achievement

of the stock price targets set forth in equity incentive awards previously issued to members of our management team in 2021 (the “2021

Awards”). In connection with the settlement of the 2021 Awards, an aggregate of approximately 630,000 shares are being withheld

by Harrow for tax withholding from the shares otherwise issuable to the holders of the 2021 Awards and will be canceled. We intend to

fund the tax withholding obligations in connection with the settlement of the 2021 Awards using a portion of the proceeds of this offering.

Company

Information

We

were incorporated in Delaware in January 2006 as Bywater Resources, Inc. In September 2007, we closed a merger transaction with Transdel

Pharmaceuticals Holdings, Inc. and changed our name to Transdel Pharmaceuticals, Inc. We changed our name to Imprimis Pharmaceuticals,

Inc. in February 2012. We changed the name of our company to Harrow Health, Inc. in December 2018.

On

June 26, 2011, we suspended our operations and filed a voluntary petition for reorganization relief under Chapter 11 of the United States

Bankruptcy Code in the United States Bankruptcy Court for the Southern District of California, Case No. 11-10497-11. On December 8, 2011,

in connection with our entry into a line of credit agreement and securities purchase agreement with a third party, our voluntary petition

for reorganization relief was dismissed.

Our

corporate headquarters are located at 102 Woodmont Blvd., Suite 610, Nashville, Tennessee, 37205, and our telephone number at such office

is (615) 733-4730. Our website address is www.harrowinc.com. Information contained on our website is not deemed part of this prospectus

supplement or the accompanying prospectus and is not incorporated in this prospectus supplement, the accompanying prospectus or any other

document that we file with the SEC by reference.

The

Offering

| Issuer: |

|

Harrow

Health, Inc. |

| |

|

|

| Common

Stock Offered by us: |

|

3,380,282

shares of our common stock, $0.001 par value

per share. |

| |

|

|

| Underwriters’

Option to Purchase Additional Shares of Common Stock from us: |

|

The

underwriters have been granted an option to purchase up to an additional 507,042 shares of our common stock, which they may

exercise, in whole or in part, for a period of 30 days from the date of this prospectus supplement. |

| |

|

|

| Common

Stock to be Outstanding After this Offering: |

|

33,436,652

shares of our common stock (or 33,943,694

shares if the underwriters exercise their option to purchase additional shares in full), $0.001 par value per share. |

| |

|

|

| Use

of Proceeds: |

|

We

estimate that the net proceeds from this offering will be approximately $56,050,005 (or approximately $64,510,001

if the underwriters exercise their option to purchase additional shares of common stock in full), after deducting underwriting

discounts and commissions and offering expenses payable by us.

We

intend to use the net proceeds of this offering of common stock to fund the initial payment for the VEVYE Acquisition, with

the remaining net proceeds available for general corporate purposes, including funding future strategic product acquisitions and

related investments, making capital expenditures and funding working capital and other cash needs such as tax withholding obligations

in connection with settlement of the 2021 Awards. Pending such use, we may invest the remaining net proceeds in short-term interest-bearing

accounts, securities, or similar investments. See “Use of Proceeds” on page S-11 of this prospectus supplement. |

| |

|

|

| Listing: |

|

Our

common stock is listed on Nasdaq under the symbol “HROW.” |

| |

|

|

| Transfer

Agent and Registrar: |

|

Securities

Transfer Corporation. |

| |

|

|

| Risk

Factors: |

|

Investing

in our common stock involves risks. You should carefully consider the information set forth in the section of this prospectus supplement

entitled “Risk Factors” beginning on page S-9 of this prospectus supplement, as well as the other information

included in or incorporated by reference into this prospectus supplement and the accompanying prospectus before deciding whether

to invest in our common stock. |

The

number of shares of our common stock to be outstanding immediately after this offering is based on 30,056,370 shares of our common stock

outstanding as of March 31, 2023 and excludes:

| |

● |

2,145,767

shares of common stock available for award under the Company’s 2017 Incentive Stock and Awards Plan (the “Plan) as of

March 31, 2023; |

| |

|

|

| |

● |

2,891,026

shares of common stock issuable upon the exercise of stock options outstanding as of March 31, 2023, having a weighted average exercise

price of $6.03 per share; |

| |

|

|

| |

● |

1,859,314

shares of common stock issuable upon the vesting of outstanding restricted stock units (inclusive of the 2021 Awards) as of March

31, 2023; and |

| |

|

|

| |

● |

336,264

restricted stock units awarded to directors of the Company, but issuance and delivery of the underlying shares of common stock are

deferred until the director resigns. |

| |

|

|

Except

as otherwise indicated, all information in this prospectus supplement assumes no exercise of the outstanding stock options and warrants

or vesting or settlement of outstanding restricted stock units described above, and no exercise by the underwriters of their option to

purchase up to an additional 507,042 shares of our common stock.

RISK

FACTORS

Investing

in our common stock involves significant risks, including the risks described below. Before making an investment in our common stock,

you should carefully consider, among other factors, the risks identified under “Risk Factors” in our Annual Report on Form

10-K for the fiscal year ended December 31, 2022 and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2023. Please also

refer to the section above entitled “Special Note Regarding Forward-Looking Statements.” Please also see “Forward-Looking

Statements” in the accompanying prospectus and the risks described in the documents incorporated by reference in this prospectus

supplement and in our other filings. The risks described in the documents incorporated by reference in this prospectus supplement are

not the only ones we face. Additional risks not presently known or that we currently deem immaterial could also materially and adversely

affect our financial condition, results of operations, business and prospects. You should consult your own financial and legal advisors

as to the risks entailed by an investment in the common stock and the suitability of investing in the common stock in light of your particular

circumstances. Our business, financial condition and results of operations could be materially adversely affected by the materialization

of any of these risks. The materialization of any of these risks could also result in a complete loss of your investment.

Risks

Related to this Offering

Our

stock price may be volatile.

The

market price of our common stock is likely to be highly volatile and could fluctuate widely in response to various factors, many of which

are beyond our control, including our ability to execute our business plan; operating results that fall below expectations; industry

or regulatory developments; investor perception of our industry or our prospects; economic and other external factors; and the other

risk factors discussed in this “Risk Factors” section or the “Risk Factors” sections included in our other filings

with the SEC that are incorporated by referenced into this prospectus supplement.

In

addition, the securities markets have from time to time experienced significant price and volume fluctuations that are unrelated to the

operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of

our common stock.

Unstable

market and economic conditions may have serious adverse consequences on our business, financial condition and stock price.

From

time to time, global credit and financial markets have experienced extreme volatility and disruptions, including severely diminished

liquidity and credit availability, declines in consumer confidence, declines in economic growth, increases in unemployment rates and

uncertainty about economic stability. Our general business strategy may be adversely affected by any such economic downturn, volatile

business environment and continued unpredictable and unstable market conditions. If the equity and credit markets deteriorate, it may

make any debt or equity financing more difficult to complete, more costly, and more dilutive. In the event the Company or one of its

subsidiaries needed to access additional capital, failure to secure financing in a timely manner and on favorable terms could have a

material adverse effect on our growth strategy, financial performance and stock price and could require us to delay or abandon development

plans. In addition, there is a risk that one or more of our current service providers, manufacturers and other partners may not survive

an economic downturn, which could directly affect our ability to attain our operating goals on schedule and on budget.

Downgrades

in our credit ratings may increase our future borrowing costs, limit our ability to raise capital, cause our stock price to decline or

reduce analyst coverage, any of which could have a material adverse impact on our business.

Credit

rating agencies review their ratings periodically and, therefore, the credit rating assigned to us by any of the rating agencies may

be subject to revision at any time. Factors that can affect our credit ratings include changes in our operating performance, the economic

environment, our financial position, conditions in and periods of disruption in any of our principal markets and changes in our business

strategy. If weak financial market conditions or competitive dynamics cause any of these factors to deteriorate, we could see a reduction

in our corporate credit rating. Since investors, analysts and financial institutions often rely on credit ratings to assess a company’s

creditworthiness and risk profile, make investment decisions and establish threshold requirements for investment guidelines, our ability

to raise capital, our access to external financing, our stock price and analyst coverage of our stock could be negatively impacted by

a downgrade to our credit rating.

A

consistently active trading market for shares of our common stock may not be sustained.

Historically,

trading in our common stock has been sporadic and volatile and our common stock has been “thinly-traded.” There have been,

and may in the future be, extended periods when trading activity in our shares is minimal, compared to a seasoned issuer with a large

and steady volume of trading activity. The market for our common stock is also characterized by significant price volatility compared

to seasoned issuers, and we expect that such volatility may continue. As a result, the trading of relatively small quantities of shares

may disproportionately influence the market price of our common stock. A consistently active and liquid trading market in our common

stock may never develop or be sustained.

Offers

or availability for sale of a substantial number of shares of our common stock may cause the price of our common stock to decline.

The

sale of substantial amounts of our common stock in the public market, or the perception that sales could occur, may cause the market

price of our common stock to fall. Sales could occur upon the expiration of any statutory holding period, such as under Rule 144 under

the Securities Act of 1933, as amended (the “Securities Act”), applicable to outstanding shares, upon expiration of any lock-up

periods applicable to outstanding shares, upon our issuance of shares upon the exercise of outstanding options or warrants, or upon our

issuance of shares pursuant offerings of our equity securities. The availability for sale of a substantial number of shares of our common

stock, whether or not sales have occurred or are occurring, also could make it more difficult for us to raise additional financing through

the sale of equity or equity-related securities in the future, when needed, on acceptable terms or at all.

You

may experience immediate and substantial dilution in the book value per share of the common stock you purchase.

Because

the price per share of our common stock being offered in this offering may be substantially higher than the book value per share of our

common stock, you will experience immediate and substantial dilution in the net tangible book value of the common stock you purchase

in this offering. As a result, investors purchasing shares of common stock in this offering will incur immediate dilution of $19.99 per share, based on an offering price of $17.75 per share and our pro forma net tangible book value as of March

31, 2023, after giving effect to this offering. For a further description of the dilution that you will experience immediately after

this offering, see the section of this prospectus supplement entitled “Dilution” on page S-13 of this prospectus supplement.

Existing

indebtedness and offerings of debt securities or preferred equity securities, which would be senior to our common stock, may adversely

affect the market price of our common stock.

As

of March 31, 2023, we had outstanding $40,250,000 aggregate principal amount of 11.875% senior notes due December 2027 and $75,000,000

aggregate principal amount of 8.625% senior notes due April 2026. In addition, we had outstanding $65,000,000 under our senior secured

term loan facility with Oaktree Fund Administration, LLC, as administrative agent for the lenders as of March 31, 2023. Following the

additional draw pursuant to the Oaktree Amendment, we will have outstanding $77,500,000 under the Oaktree Loan. We may also conduct additional

debt or preferred stock offerings or incur other indebtedness in the future.

In

addition, we are authorized to issue 5,000,000 shares of “blank check” preferred stock, with such rights, preferences and

privileges as may be determined from time to time by our board of directors. Our board of directors is empowered, without stockholder

approval, to issue preferred stock at any time in one or more series and to fix the dividend rights, dissolution or liquidation preferences,

redemption prices, conversion rights, voting rights and other rights, preferences and privileges for any series of our preferred stock

that may be issued. The issuance of shares of preferred stock, depending on the rights, preferences and privileges attributable to the

preferred stock, could reduce the voting rights and powers of our common stockholders and the portion of our assets allocated for distribution

to our common stockholders in a liquidation event, and could also result in dilution to the book value per share of our common stock.

The preferred stock could also be utilized, under certain circumstances, as a method for raising additional capital or discouraging,

delaying or preventing a change in control of our Company.

We

have not paid dividends in the past and do not expect to pay dividends in the future. Any return on an investment will be limited to

any appreciation in the value of our common stock.

We

have never paid cash dividends on our common stock and do not anticipate doing so in the foreseeable future. Any payment of dividends

on our common stock would depend on contractual restrictions, as well as our earnings, financial condition and other business and economic

factors as our board of directors may consider relevant. If we do not pay dividends, our common stock may be less valuable because a

return on your investment will only occur if our stock price appreciates.

Risks

Related to Acquisitions

We

may fail to realize the anticipated benefits of the Santen Products Acquisition, the VEVYE Acquisition and any other acquisitions we

make in the future.

The

success of the Santen Products Acquisition and the VEVYE Acquisition will depend on, among other things, our ability to successfully

integrate the products into our commercial platform, transfer the products’ NDAs, obtain and maintain payer reimbursement coverage,

maintain an adequate supply of the products and market the products to our existing customers. We intend to pursue other product and

product candidate acquisitions in the future. It is possible that we may not achieve the anticipated benefits of the Santen Products

Acquisition, the VEVYE Acquisition or any future acquisitions. If we experience difficulties with the implementation of plans with respect

to the recent acquisitions or any future acquisitions, the anticipated benefits of the recent acquisitions and any future acquisitions

may not be realized fully or at all, or may take longer to realize than expected. Integration efforts will also divert management attention

and resources. These matters could have an adverse effect during the transition period for the Santen Products Acquisition, the VEVYE

Acquisition or any future acquisitions and for an undetermined period after completion of such acquisitions.

USE

OF PROCEEDS

The

net proceeds to be received by us from the sale of the common stock in this offering, after deducting underwriting discounts, commissions

and other offering expenses payable by us, are estimated to be approximately $56,050,005 (or $64,510,001 if the underwriters’

option to purchase 507,042 additional shares of common stock is exercised in full).

We

intend to use the net proceeds of this offering of common stock to fund the initial payment for the VEVYE Acquisition, with the remaining

net proceeds available for general corporate purposes, including funding future strategic product acquisitions and related investments,

making capital expenditures and funding working capital and other cash needs such as tax withholding obligations in connection with settlement

of the 2021 Awards.

The

expected use of the net proceeds from this offering represents our intentions based upon our current plans and business conditions, which

could change in the future as our plans and business conditions evolve. The amounts and timing of our actual expenditures will depend

on numerous factors, including the factors described under “Risk Factors” in this prospectus supplement and in the documents

incorporated by reference herein, as well as the amount of cash used in our operations. We may find it necessary or advisable to use

the net proceeds for other purposes, and we will have broad discretion in the application of the net proceeds. Pending such use, we may

invest the remaining net proceeds in short-term interest-bearing accounts, securities, or similar investments. See “Capitalization.”

CAPITALIZATION

The

table below sets forth our cash and cash equivalents and our consolidated capitalization as of March 31, 2023:

| |

● |

on

an actual basis; and |

| |

|

|

| |

● |

on

a pro forma basis, after giving effect to the Oaktree Amendment and net proceeds received from it; |

| |

|

|

| |

● |

on

a pro forma as adjusted basis, after giving effect to the sale of the common stock in this offering (assuming no exercise of the

underwriters’ option to purchase additional shares of common stock), at the offering price of $17.75, after deducting

underwriting discounts and commissions and estimated offering expenses payable by us. |

The

table below does not give effect to the Santen Products Acquisition or VEVYE Acquisition.

You

should read this table in conjunction with our consolidated financial statements and related notes incorporated by reference in this

prospectus supplement.

| | |

As of March 31, 2023 | |

| | |

Actual | | |

Pro Forma | | |

Pro Forma as Adjusted | |

| | |

(unaudited) | | |

| |

| Cash and cash equivalents | |

$ | 19,248,000 | | |

$ | 31,335,000 | | |

$ | 87,385,000 | |

| Long-term debt: | |

| | | |

| | | |

| | |

| Oaktree Credit and Guaranty Agreement | |

| 65,000,000 | | |

| 77,500,000 | | |

| 77,500,000 | |

| 11.875% Senior Notes due December 2027 | |

| 40,250,000 | | |

| 40,250,000 | | |

| 40,250,000 | |

| 8.625% Senior Notes due April 2026 | |

| 75,000,000 | | |

| 75,000,000 | | |

| 75,000,000 | |

| Notes payable, gross | |

| 180,250,000 | | |

| 192,750,000 | | |

| 192,750,000 | |

| Less: unamortized discounts, net of premium | |

| (11,400,000 | ) | |

| (11,813,000 | ) | |

| (11,813,000 | ) |

| Total long-term debt, net | |

| 168,850,000 | | |

| 180,937,000 | | |

| 180,937,000 | |

| STOCKHOLDERS’ EQUITY: | |

| | | |

| | | |

| | |

| Common stock, $0.001 par value, 50,000,000 shares authorized, 30,056,370 shares

issued and outstanding at March 31, 2023, actual and pro forma; 33,436,652 shares issued and outstanding, pro forma as adjusted | |

| 30,000 | | |

| 30,000 | | |

| 33,000 | |

| Additional paid-in capital | |

| 137,989,000 | | |

| 137,989,000 | | |

| 194,036,000 | |

| Accumulated deficit | |

| (116,136,000 | ) | |

| (116,136,000 | ) | |

| (116,136,000 | ) |

| TOTAL HARROW HEALTH STOCKHOLDERS’ EQUITY | |

| 21,883,000 | | |

| 21,883,000 | | |

| 77,933,000 | |

| Noncontrolling interests | |

| (355,000 | ) | |

| (355,000 | ) | |

| (355,000 | ) |

| TOTAL STOCKHOLDERS’ EQUITY | |

| 21,528,000 | | |

| 21,528,000 | | |

| 77,578,000 | |

| TOTAL CAPITALIZATION | |

$ | 190,378,000 | | |

$ | 202,465,000 | | |

$ | 258,515,000 | |

The

number of shares of our common stock to be outstanding immediately after this offering is based on 30,056,370 shares of our common stock

outstanding as of March 31, 2023 and excludes:

| |

● |

2,145,767

shares of common stock available for award under the Plan as of March 31, 2023; |

| |

|

|

| |

● |

2,891,026

shares of common stock issuable upon the exercise of stock options outstanding as of March 31, 2023, having a weighted average exercise

price of $6.03 per share; |

| |

|

|

| |

● |

1,859,314

shares of common stock issuable upon the vesting of outstanding restricted stock units (inclusive of the 2021 Awards) as of March

31, 2023; and |

| |

|

|

| |

● |

336,264

restricted stock units awarded to directors of the Company, but issuance and delivery of the underlying shares of common stock are

deferred until the director resigns. |

Except

as otherwise indicated, all information in this prospectus supplement assumes no exercise of the outstanding stock options and warrants

or vesting or settlement of outstanding restricted stock units described above.

DILUTION

If

you invest in our common stock, your interest will be diluted to the extent of the difference between the price per share you pay in

this offering and the net tangible book value per share of our common stock immediately after this offering.

Our

historical net tangible book value deficit as of March 31, 2023 was $130.8 million, or $(4.35) per share of common stock. Historical

net tangible book value deficit per share represents the amount of our total tangible assets less our total liabilities, divided by

the number of shares of our common stock outstanding on March 31, 2023.

After

giving effect to the sale of shares of our common stock in this offering (assuming no exercise of the underwriters’ option to purchase

additional shares of common stock) at an offering price of $17.75 per share, and after deducting estimated offering expenses payable

by us, our pro forma net tangible book value as of March 31, 2023 would have been $(74.7) million, or $(2.24) per

share of common stock based on 33,436,652 shares of common stock outstanding on a pro forma basis at that time. This represents

an immediate increase in net tangible book value of $2.11 per share to our existing stockholders and an immediate dilution in

net tangible book value of $19.99 per share to new investors in this offering.

| Offering price per share | |

| | | |

$ | 17.75 | |

| Net tangible book value deficit per share as of March 31, 2023 | |

$ | (4.35 | ) | |

| | |

| Pro forma increase in net tangible book value per share as of March 31, 2023 attributable to the pro forma transaction described above | |

$ | 2.11 | | |

| | |

| Pro forma net tangible book deficit per share as of March 31, 2023 | |

| | | |

$ | (2.24 | ) |

| Dilution in net tangible book value per share to new investors | |

| | | |

$ | 19.99 | |

The

number of shares of our common stock to be outstanding immediately after this offering is based on 30,056,370 shares of our common stock

outstanding as of March 31, 2023 and excludes:

| |

● |

2,145,767

shares of common stock available for award under the Plan as of March 31, 2023; |

| |

|

|

| |

● |

2,891,026

shares of common stock issuable upon the exercise of stock options outstanding as of March 31, 2023, having a weighted average exercise

price of $6.03 per share; |

| |

|

|

| |

● |

1,859,314

shares of common stock issuable upon the vesting of outstanding restricted stock units (inclusive of the 2021 Awards) as of March

31, 2023; and |

| |

|

|

| |

● |

336,264

restricted stock units awarded to directors of the Company, but issuance and delivery of the underlying shares of common stock are

deferred until the director resigns. |

| |

|

|

The

above illustration of dilution per share to investors participating in this offering assumes no exercise of outstanding options, vesting

and settlement of outstanding restricted stock units or issuance of new shares at per share prices below the price to investors in this

offering. To the extent that any outstanding options are exercised or outstanding restricted stock units are vested and settled, there

will be no further dilution to new investors.

DIVIDEND

POLICY

We

have never paid cash dividends on our common stock and do not anticipate doing so in the foreseeable future. Any payment of dividends

on our common stock would depend on contractual restrictions, as well as our earnings, financial condition and other business and economic

factors as our board of directors may consider relevant. If we do not pay dividends, our common stock may be less valuable because a

return on your investment will only occur if our stock price appreciates.

MATERIAL

U.S. FEDERAL INCOME TAX CONSIDERATIONS FOR NON-U.S. HOLDERS OF COMMON STOCK

Overview

The

following is a summary of the material U.S. federal income tax considerations with respect to the purchase, ownership and disposition

of our common stock to a non-U.S. holder that purchases shares of our common stock in this offering and holds such shares as a capital

asset (generally, property held for investment) within the meaning of Section 1221 of the Internal Revenue Code of 1986, as amended (the

“Code”). This summary does not apply to any persons holding equity interests other than our common stock. For purposes of

this summary, a “non-U.S. holder” means a beneficial owner of our common stock that is neither a U.S. person nor a partnership

for U.S. federal income tax purposes. A “U.S. person” is any of the following:

| |

● |

an

individual who is a citizen or resident of the United States; |

| |

|

|

| |

● |

a

corporation (or other entity treated as a corporation for U.S. federal income tax purposes) created or organized under the laws of

the United States, any state thereof or the District of Columbia; |

| |

|

|

| |

● |

an

estate, the income of which is subject to U.S. federal income tax regardless of its source; or |

| |

|

|

| |

● |

a

trust (i) whose administration is subject to the primary supervision of a U.S. court and which has one or more U.S. persons who have

the authority to control all substantial decisions of the trust, or (ii) that has a valid election in effect under applicable Treasury

regulations to be treated as a U.S. person for U.S. federal income tax purposes. |

If

a partnership or other pass-through entity for U.S. federal income tax purposes holds common stock, the tax treatment of a partner in

such partnership or member of such other pass-through entity generally will depend upon the status of the partner or member and the activities

of the partnership or other pass-through entity. Partnerships and other pass-through entities holding common stock, and any person who

is a partner or member of such entity, should consult their own tax advisor.

This

summary is based upon current provisions of the Code, existing and temporary Treasury Regulations promulgated thereunder and administrative

pronouncements and judicial decisions thereof, all in effect on the date hereof and all of which are subject to change or differing interpretations.

Those authorities may be changed, perhaps retroactively, so as to result in U.S. federal income tax consequences different from those

summarized below. We cannot assure you that a change in law, possibly with retroactive application, will not alter significantly the

tax consequences described in this summary. This discussion may not apply, in whole or in part, to particular non-U.S. holders in light

of their individual circumstances or to holders subject to special treatment under the U.S. federal income tax laws (such as insurance

companies, tax-exempt organizations, financial institutions, private foundations, brokers or dealers in securities, “controlled

foreign corporations,” “passive foreign investment companies,” corporations that accumulate earnings to avoid U.S.

federal income tax, non-U.S. holders that hold our common stock as part of a straddle, hedge, conversion transaction or other integrated

investment and certain U.S. expatriates). In addition, this summary does not address the alternative minimum tax provisions of the Code,

the U.S. federal estate or gift tax consequences, the consequences of the 3.8% Medicare tax on certain net investment income, or the

consequences of holding or disposing common stock under state, local or non-U.S. tax laws. We have not sought and do not plan to seek

a ruling from the IRS, with respect to the statements and conclusions set forth in the following summary, and there can be no assurance

that the IRS or a court would agree with such statements and conclusions.

THIS

SUMMARY IS FOR GENERAL INFORMATION ONLY AND IS NOT INTENDED TO CONSTITUTE A COMPLETE DESCRIPTION OF ALL TAX CONSEQUENCES FOR NON-U.S.

HOLDERS RELATING TO THE OWNERSHIP AND DISPOSITION OF COMMON STOCK. PROSPECTIVE HOLDERS OF COMMON STOCK SHOULD CONSULT WITH THEIR TAX

ADVISORS REGARDING THE TAX CONSEQUENCES TO THEM (INCLUDING THE APPLICATION AND EFFECT OF ANY STATE, LOCAL, NON-U.S. INCOME AND OTHER

TAX LAWS) OF THE OWNERSHIP AND DISPOSITION OF COMMON STOCK.

Dividends

If

we make a distribution of cash or property with respect to our common stock (or complete a redemption that is treated as a distribution

with respect to our common stock), such distribution would be treated as a dividend for U.S. federal income tax purposes to the extent

paid from our current or accumulated earnings and profits, if any (as determined under U.S. federal income tax principles). Dividends

paid to you generally would be subject to withholding of U.S. federal income tax at a rate of 30% of the gross amount of the dividends,

unless you are eligible for a reduced rate of withholding tax under an applicable tax treaty and provide proper certification of your

eligibility for such reduced rate. However, dividends that are effectively connected with the conduct of a trade or business by you within

the United States (and, if required by an applicable tax treaty, are attributable to a U.S. permanent establishment maintained by you)

would not be subject to the withholding tax, as described below, if you comply with the applicable certification and disclosure requirements.

Instead, such dividends would be subject to the regular U.S. federal income tax on net taxable income at applicable graduated individual

or corporate rates in the same manner as if you were a U.S. person. Any such effectively connected dividends received by a foreign corporation

might also be subject to a “branch profits tax” at a rate of 30% (or such lower rate as may be specified by an applicable

income tax treaty). Non-U.S. holders should consult their tax advisors regarding applicable tax treaties that may provide for different

rules.

If

the amount of a distribution paid on our common stock were to exceed our current and accumulated earnings and profits, such excess would

be allocated ratably among each share of common stock with respect to which the distribution was paid. Any such excess allocated to the

shares held by you would be treated first as a tax-free return of capital to the extent of your adjusted tax basis in each such share,

and thereafter as capital gain from a sale or other taxable disposition of such share of common stock that is taxed to you as described

below under “Gain on disposition of common stock.” Your adjusted tax basis in a share of our common stock generally would

be the amount of cash contributed in exchange for such share, reduced by the amount of any such tax-free returns of capital.

If

you wish to claim the benefit of an applicable income tax treaty to avoid or reduce withholding of U.S. federal income tax on dividends,

then you must (i) provide the withholding agent with a properly completed IRS Form W-8BEN or W-8BEN-E (or other applicable form) and

certify under penalties of perjury that you are not a U.S. person and are eligible for treaty benefits or (ii) if you hold our common

stock through certain foreign intermediaries (including partnerships), satisfy the relevant certification requirements of applicable

U.S. Treasury regulations by providing appropriate documentation to the intermediaries (which then will be required to provide certification

to the applicable withholding agent, either directly or through other intermediaries).

If

you do not timely provide us or another applicable withholding agent with the required certification, but you are eligible for a reduced

rate of U.S. federal income tax pursuant to an income tax treaty, then you may obtain a refund or credit of any excess amounts withheld

by timely filing an appropriate claim with the IRS. You should consult your tax advisor regarding your entitlement to benefits under

any applicable income tax treaty

Gain

on Disposition of Common Stock

Subject

to the discussion below under “Additional withholding tax,” you generally will not be subject to U.S. federal income tax

with respect to gain realized on the sale or other taxable disposition of our common stock (other than a redemption that is treated as

a dividend for U.S. federal income tax purposes and taxed as described above), unless:

| |

● |

the

gain is effectively connected with a trade or business you conduct in the United States (and, if required by an applicable tax treaty,

is attributable to a U.S. permanent establishment maintained by you); |

| |

● |

if

you are an individual, you are present in the United States for 183 days or more in the taxable year of the sale or other taxable

disposition and certain other conditions are met; or |

| |

● |

we

are or have been a “U.S. real property holding corporation” for U.S. federal income tax purposes at any time within the

shorter of (i) the five-year period ending on the date of the sale or other taxable disposition of our common stock and (ii) your

holding period for our common stock and certain other requirements are met. |

If

you are a non-U.S. holder described in the first bullet point above (or so treated), you generally would be subject to tax on the net

gain derived from the disposition under regular graduated U.S. federal income tax rates, subject to an applicable income tax treaty providing

otherwise. If you are a foreign corporation described in the first bullet point above, you may also, under certain circumstances, be

subject to a branch profits tax equal to 30% of your effectively connected earnings and profits (or such lower rate as may be specified

by an applicable income tax treaty).

If

you are an individual described in the second bullet point above, you generally would be subject to a flat 30% tax (or such lower rate

as may be specified by an applicable income tax treaty), on the amount by which your capital gains allocable to U.S. sources exceed capital

losses allocable to U.S. sources during the taxable year of disposition.

With

respect to the third bullet point above, we believe that we are not currently, and we do not anticipate becoming, a U.S. real property

holding corporation. In general, we would be a U.S. real property holding corporation if our U.S. real property interests comprised at

least 50% of the fair market value of our worldwide real property interests and assets used or held for use in a trade or business. However,

because the determination of whether we are a U.S. real property holding corporation depends on the fair market value of our United States

real property interests relative to the fair market value of our global real property interests and other business assets, there can

be no assurance that we have not been a United States property holding corporation or will not become one in the future. In the event

we do become a U.S. real property holding corporation, you would not be subject to U.S. federal income tax on a sale or other disposition

of our common stock as long as our common stock is regularly traded on an established securities market at any time during the calendar

year in which the disposition occurs (within the meaning of the applicable Treasury Regulations) and you do not actually or constructively

hold more than 5% of our common stock at any time during the shorter of (i) the five-year period ending on the date of the sale or disposition

of our common stock or (ii) your holding period for our common stock. If gain on the sale or other taxable disposition of our common

stock were subject to taxation under the third bullet point above, you would be subject to regular U.S. federal income tax with respect

to such gain in generally the same manner as a U.S. person and a 15% withholding tax would apply to the gross proceeds from such sale

or other taxable disposition.

You

should consult your tax advisor regarding potentially applicable income tax treaties that provide for different rules and the possible

consequences if we are, or were to become, a U.S. real property holding corporation.

Information

Reporting and Backup Withholding Tax

In

general, information returns will be filed annually with the IRS and provided to each shareholder in connection with any dividends paid

to you and the amount of tax, if any, withheld with respect to such dividends. These reporting requirements apply regardless of whether