Horizon Technology Finance Provides $10 Million Venture Loan Facility to Finexio

18 December 2024 - 1:45AM

Business Wire

Horizon Technology Finance Corporation (NASDAQ: HRZN) (“Horizon”

or the “Company”), an affiliate of Monroe Capital, and a leading

specialty finance company that provides capital in the form of

secured loans to venture capital-backed companies in the

technology, life science, healthcare information and services, and

sustainability industries, today announced it has provided a $10

million venture loan facility to OneNetwork, Inc. dba Finexio, of

which $5 million has been initially funded.

Finexio, a leader in the B2B payments industry, delivers

“Accounts Payable (AP) Payments as a Service”, a fully-managed AP

payments solution that leverages AI to optimize, monetize, and

secure the entire payment lifecycle. Finexio’s platform automates

and digitizes payments, seamlessly integrating with existing AP and

Procurement systems through methods including ACH, virtual credit

cards, and checks. Finexio is backed by top-tier investors

including JP Morgan and Mendon Venture Partners. The company will

use the loan proceeds for general growth and working capital

purposes.

“Finexio’s platform exemplifies the future of payments through

its ease of adoption and comprehensive digital capabilities,

leveraging predictive analytics to help clients optimize payment

timing, and cash flow, while providing a high level of fraud

prevention,” said Gerald A. Michaud, President of Horizon. “We are

pleased to support Finexio’s growth as it pioneers the payment

industry's evolution.”

“We are excited to have Horizon’s support as we continue to

empower our customers and partners with our best-in-class

technology,” said Ernest Rolfson, CEO of Finexio. “Their support

strengthens our ability to provide solutions that reduce costs and

make electronic payments faster, seamless and

value-generating.”

About Horizon Technology Finance

Horizon Technology Finance Corporation (NASDAQ: HRZN),

externally managed by Horizon Technology Finance Management LLC, an

affiliate of Monroe Capital, is a leading specialty finance company

that provides capital in the form of secured loans to venture

capital backed companies in the technology, life science,

healthcare information and services, and sustainability industries.

The investment objective of Horizon is to maximize its investment

portfolio’s return by generating current income from the debt

investments it makes and capital appreciation from the warrants it

receives when making such debt investments. Horizon is

headquartered in Farmington, Connecticut, with a regional office in

Pleasanton, California, and investment professionals located

throughout the U.S. Monroe Capital is a $19.5 billion asset

management firm specializing in private credit markets across

various strategies, including direct lending, technology finance,

venture debt, opportunistic, structured credit, real estate and

equity. To learn more, please visit horizontechfinance.com.

About Finexio

Finexio is a trailblazer in the B2B payments industry,

pioneering an innovative Accounts Payable Payments Infrastructure

as a Service model. Embedded within the world's leading

Procure-to-Pay software suites, Finexio's platform delivers a fully

managed, AI-powered solution that optimizes, monetizes, and secures

the entire payment lifecycle. Our comprehensive infrastructure

seamlessly orchestrates payment delivery, streamlines supplier

management, prevents fraud, enables payment monetization, and

provides robust analytics and reporting. This unique approach

transforms AP from a traditional cost center into a strategic

revenue generator. Learn more at Finexio.com and follow us on

LinkedIn.

Forward-Looking Statements

Statements included herein may constitute “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. Statements other than statements of historical

facts included in this press release may constitute forward-looking

statements and are not guarantees of future performance, condition

or results and involve a number of risks and uncertainties. Actual

results may differ materially from those in the forward-looking

statements as a result of a number of factors, including those

described from time to time in the Company’s filings with the

Securities and Exchange Commission. Horizon undertakes no duty to

update any forward-looking statement made herein. All

forward-looking statements speak only as of the date of this press

release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241216064819/en/

Investor Relations: ICR Garrett Edson ir@horizontechfinance.com

(860) 284-6450

Media Relations: ICR Chris Gillick HorizonPR@icrinc.com (646)

677-1819

For Finexio: Steve Greene Steve.green@finexio.com (207)

266-4200

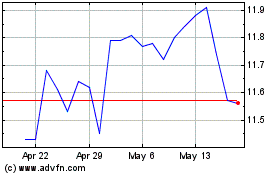

Horizon Technology Finance (NASDAQ:HRZN)

Historical Stock Chart

From Nov 2024 to Dec 2024

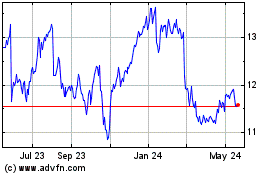

Horizon Technology Finance (NASDAQ:HRZN)

Historical Stock Chart

From Dec 2023 to Dec 2024