As filed with the Securities and Exchange Commission

on September 7, 2023.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT

OF 1933

HUB CYBER SECURITY

LTD.

(Exact name of registrant

as specified in its charter)

| State of Israel | | 3576 |

(State or other jurisdiction of

incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) |

HUB Cyber Security Ltd.

17 Rothschild Blvd.

Tel Aviv, Israel 6688120

+972 (3) 924-4074

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Puglisi & Associates

850 Library Avenue

Newark, Delaware 19711

(302) 738-6680

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies of all correspondence

to:

Michael J. Rosenberg

Joshua G. Kiernan

Latham & Watkins LLP

99 Bishopsgate

London EC2M 3XF

United Kingdom

Tel: +44 (20) 7710-1000 |

|

Osher Partok-Rheinisch

HUB Cyber Security Ltd.

17 Rothschild Blvd.

Tel Aviv, Israel 6688120

Tel: +972 (3) 924-4074 |

|

Saul Adereth

Shibolet Law Firm

4 Yitzhak Sadeh St.

Tel Aviv, Israel 6777504

Tel: +972 (3) 307-5000 |

Approximate date of commencement of proposed

sale of the securities to the public:

If any of the securities being

registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check

the following box. ☒

If this form is filed to register

additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective

amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed

pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933. Emerging growth company ☒

If an emerging growth company

that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use

the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B)

of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay

its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall

thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall

become effective on such date as the Securities and Exchange Commission (the “SEC”), acting pursuant to said Section 8(a),

may determine.

The information

in this prospectus is not complete and may be changed. HUB Cyber Security Ltd. may not sell these securities until the registration statement

filed with the Securities and Exchange Commission, of which this proxy statement/prospectus is a part, is effective. This proxy statement/prospectus

is neither an offer to sell these securities, nor a solicitation of an offer to buy these securities, in any state or jurisdiction where

the offer or sale is not permitted. Any representation to the contrary is a criminal offense.

PRELIMINARY PROSPECTUS

— SUBJECT TO COMPLETION DATED SEPTEMBER 7, 2023

PRIMARY OFFERING OF

18,918,506 ORDINARY SHARES

SECONDARY OFFERING OF

87,807,052 ORDINARY SHARES,

535,989 WARRANTS

HUB CYBER SECURITY LTD.

This prospectus relates to the issuance from time

to time by HUB Cyber Security Ltd., a company organized under the laws of the State of Israel (“we,” “our,” the

“Company” or “HUB Security”) of up to 18,918,506 ordinary shares, no par value per share (the “ordinary

shares”), including (a) 11,630,882 ordinary shares issuable upon the exercise of 15,507,843 warrants of the Company that were issued

in exchange for the public warrants of Mount Rainier Acquisition Corp., a Delaware corporation (“RNER”) (the “public

warrants”), at the closing of the Business Combination (as defined herein), (b) 401,992 ordinary shares issuable upon the exercise

of 535,989 warrants that were issued in exchange for the private warrants of RNER (the “private warrants” and, together with

the public warrants, the “SPAC warrants”) at the closing of the Business Combination; and (c) 6,885,632 ordinary shares issuable

upon the exercise of warrants that were issued as part of an offering we conducted in Israel to institutional investors greater than

one year prior to the closing of the Business Combination (the “prior warrants”).

The public warrants of RNER were originally issued

in the initial public offering of units of RNER at a price of $10 per unit, with each unit consisting of one share of common stock of

RNER (the “RNER Shares”) and a warrant to purchase to purchase three-fourths (3/4) of a share of common stock of RNER. The

private warrants of RNER were originally issued as part of a private placement in connection with the initial public offering of RNER.

This prospectus also relates to the resale, from

time to time, by the selling securityholders named herein (the “Selling Securityholders”), or their pledgees, donees, transferees,

or other successors in interest, of (i) up to 87,807,052 ordinary shares (the “Offered Shares”) issued or issuable to certain

of the Selling Securityholders consisting of: (a) 7,500,000 ordinary shares issuable upon exercise of warrants (the “Lind warrants”)

which were issued or are issuable to Lind Global Asset Management VI, LLC (“Lind”) in connection with Lind’s funding

of up to $16.0 million under convertible securities (the “Lind Convertible Notes”) issued or issuable to Lind pursuant to

a Securities Purchase Agreement, dated May 4, 2023 (the “Lind Agreement”), between us and Lind in a private placement. The

Lind Warrants have an exercise price of $0.45 per ordinary share; (b) up to 20,000,000 ordinary shares issuable upon conversion of $9

million aggregate principal amount of the Lind Convertible Note, which is convertible at $0.45 per share; (c) up to 22,124,475 ordinary

shares issuable upon conversion of NIS 16.85 million (or approximately $4.4 million, using the USD/NIS exchange rate as of September

1, 2023) aggregate principal amount of Convertible Loan Agreements (the “Shayna Loans”) entered into between us and Shayna

LP (“Shayna”) in a private placement (the “Shayna Loan Agreements”), which is convertible at $0.20 per share;

(d) 13,130,252 ordinary shares issuable upon exercise of warrants (the “Shayna Warrants,” and together with the Lind warrants,

the SPAC warrants and the prior warrants, the “Warrants”) issuable under the Shayna Loan Agreements upon conversion of the

of the Shayna Loans. The Shayna warrants have an exercise price of $0.20; (e) 20,015,025 ordinary shares issuable upon conversion of approximately

$6.7 million aggregate principal amount and accrued interest and other damages of convertible notes entered into between us and A.G.P./Alliance

Global Partners on February 28, 2023 (the “A.G.P. Note” and, together with the Lind Convertible Notes and the Shayna Loans

the “Convertible Notes”)), assuming a conversion price of $0.32, which is equal to ninety three percent (93%) of the lowest

daily VWAP (as defined in the A.G.P. Note) of the Ordinary Shares during the five (5) consecutive Trading Day period ending on September

1, 2023; (f) 4,635,308 ordinary shares issued at the closing of the Business Combination in exchange for shares of RNER common stock

held by DC Rainier SPV LLC the “Sponsor”) and the directors and officers of RNER prior to the Business Combination and (g)

up to 401,992 ordinary shares that are issuable upon the exercise of the 535,989 private warrants (which were originally issued as part

of units in a private placement as part of the initial public offering of RNER at a price of $10.00 per unit) at an exercise price of

$12.79 per whole ordinary share by certain of the Selling Securityholders named in this prospectus and (ii) up to 535,989 private warrants

that were issued in exchange for warrants originally issued as part of units issued by RNER at a price of $10.0 per unit (with each unit

consisting of one share of common stock of RNER and one warrant to purchase three fourths of a share of common stock of RNER) by certain

of the Selling Securityholders named in this prospectus.

Additional information about the Lind Agreement,

the Shayna Loan Agreements and the A.G.P. Note and the respective issuances of the Warrants and the Convertible Notes in connection therewith

is provided in the section entitled “Prospectus Summary—Recent Developments—Funding Transactions” of this prospectus.

Each of the SPAC warrants entitles the holder

to purchase three-fourths (3/4) of an ordinary share at an exercise price of $12.79 per whole and will expire on February 28, 2028, at

5:00 p.m., New York City time, or earlier upon redemption of the public warrants or liquidation of the Company. We may redeem the outstanding

public warrants at a price of $0.01 per warrant if the last reported sales price of our ordinary shares equals or exceeds $18.00 per ordinary

share (subject to adjustment in accordance with the terms of the public warrants) for any 20 trading days within a 30-trading day period

ending on the third trading day prior to the date on which we send the notice of redemption to the warrant holders, as described herein.

The private warrants have terms and provisions that are identical to those of the public warrants, except as described herein.

The prior warrants were originally issued in Israel

in February 2022 to institutional investors in Israel as part of an offering not registered under the Securities Act of 1933 whereby we

offered to investors 6,885,632 units consisting of one ordinary share and one warrant to purchase an ordinary share at a purchase price

of NIS 6.78 ($2.10) per unit and have an exercise price of $2.03 per ordinary share.

Each Lind Warrant entitles the holder to purchase

one ordinary share at an exercise price of $0.45 per share and will expire as follows: (i) 5,000,000 of the Lind Warrants will expire

on May 8, 2028, at 11:59 p.m., New York City time and (ii) 2,500,000 of the Lind Warrants will expire on August 24, 2028.

When issued, each Shayna Warrant will entitle

the holder to purchase one ordinary share at an at an exercise price of $0.20 per share and will expire 36 months after the issuance date.

We are registering the Offered Shares for resale

by the Selling Securityholders named in this prospectus, or their transferees, pledgees, donees or assignees or other successors-in-interest

that receive any of the shares as a gift, distribution, or other non-sale related transfer.

We are registering the offer and sale of the Offered

Shares to satisfy certain registration rights we have granted. Our registration of the securities covered by this prospectus does not

mean that the Selling Securityholders will offer or sell any of the Offered Shares. The Selling Securityholders may offer and sell the

Offered Shares from time to time at fixed prices, at market prices or at negotiated prices, and may engage a broker, dealer or underwriter

to sell the securities. In connection with any sales of the Offered Shares offered hereunder, the Selling Securityholders, any underwriters,

agents, brokers or dealers participating in such sales may be deemed to be “underwriters” within the meaning of the Securities

Act. For additional information on the possible methods of sale that may be used by the Selling Securityholders, you should refer to

the section entitled “Plan of Distribution” elsewhere in this prospectus. We do not know when or in what amounts the

Selling Securityholders may offer the securities for sale. The Selling Securityholders may sell any, all or none of the Offered Shares

offered by this prospectus.

All of the Offered Shares

offered by the Selling Securityholders pursuant to this prospectus will be sold by the Selling Securityholders for their respective

accounts. We will not receive any proceeds from the sale of any Offered Shares by the Selling Securityholders. We will receive up to

an aggregate of $173,879,341.82 from the exercise of the Warrants, assuming the exercise in full of all the Warrants for cash (and the issuance in full of the Shayna Warrants). If

the Warrants are exercised pursuant to a cashless exercise feature, if applicable, we will not receive any cash from these

exercises. We expect to use the net proceeds from the exercise of the Warrants, if any, for general corporate purposes. We believe

the likelihood that Warrant holders will exercise their warrants, and therefore the amount of cash proceeds that we would receive,

is dependent upon the market price of our ordinary shares. If the market price for our ordinary shares is less than the respective

exercise prices of the Warrants, we believe Warrant holders will be unlikely to exercise their Warrants.

We will pay certain expenses associated with the

registration of the securities covered by this prospectus, as described in the section entitled “Plan of Distribution.”

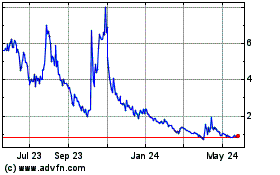

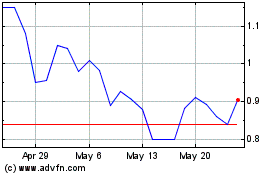

Our ordinary shares, SPAC warrants and prior warrants

are listed on the Nasdaq Stock Market LLC under the trading symbols “HUBC,” “HUBCW” and “HUBCZ,”

respectively. On September 1, 2023, the closing prices for our ordinary shares and warrants on the Nasdaq Stock Market LLC were $0.3510

per ordinary share and $0.394 and $0.400 per warrant, respectively.

In connection with the special meeting of stockholders

held by RNER on January 4, 2023 (the “RNER Special Meeting”), the holders of 2,580,435 RNER Shares properly exercised their

right to redeem their shares for cash at a redemption price of approximately $10.28 per share, for an aggregate redemption amount of

approximately $26,526,872. These share redemptions were in addition to the 14,535,798 RNER Shares that were tendered for redemption in

connection with the special meeting of RNER’s stockholders held on December 21, 2022 approving the extension of RNER’s expiration

date to March 1, 2023 at a redemption price of approximately $10.31 per share, for an aggregate redemption amount of approximately $149,864,077.

The total amount of RNER Shares redeemed prior to the closing of the Business Combination represented approximately 99.2% of the total

RNER Shares then outstanding and eligible for redemption.

The 87,807,052 ordinary shares being offered

for resale in this prospectus represents 47.19% of our total outstanding ordinary shares as of the date of

this prospectus (assuming, in each case, the conversion in full of all of the Convertible Notes and the exercise of all of the

Warrants). The sale of all the securities

being offered in this prospectus could result in a significant decline in the public trading price of our ordinary shares and/or

warrants and could impair our ability to raise capital through the sale of additional equity securities. We are unable

to predict the effect that such sales may have on the prevailing market price of our ordinary shares warrants. Despite such a decline in the public trading price, the Selling Securityholders and holders of Warrants may still

experience a positive rate of return on the securities they purchased due to the differences in the purchase prices of which they

purchased the ordinary shares and the Warrants described above.

We may amend or supplement this prospectus from

time to time by filing amendments or supplements as required. You should read this entire prospectus and any amendments or supplements

carefully before you make your investment decision.

We are an “emerging growth company,”

as defined in the Jumpstart Our Business Startups Act of 2012, or JOBS Act, and are subject to reduced public company reporting requirements.

Investing in our

securities involves a high degree of risk. See “Risk Factors” beginning on page 14 of this prospectus and other

risk factors contained in the documents incorporated by reference herein for a discussion of information that should be considered

in connection with an investment in our securities.

Neither the Securities and Exchange Commission,

the Israeli Securities Authority nor any state securities commission has approved or disapproved of these securities or determined if

this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2023.

TABLE OF CONTENTS

You should rely only on the information contained

or incorporated by reference in this prospectus or any supplement. Neither we nor the Selling Securityholders have authorized anyone

else to provide you with different information. The securities offered by this prospectus are being offered only in jurisdictions where

the offer is permitted. You should not assume that the information in this prospectus or any supplement is accurate as of any date other

than the date on the front of each document. Our business, financial condition, results of operations and prospects may have changed

since that date.

Except as otherwise set forth in this prospectus,

neither we nor the Selling Securityholders have taken any action to permit a public offering of these securities outside the United States

or to permit the possession or distribution of this prospectus outside the United States. Persons outside the United States who come

into possession of this prospectus must inform themselves about and observe any restrictions relating to the offering of these securities

and the distribution of this prospectus outside the United States.

ABOUT

THIS PROSPECTUS

This prospectus is part of a registration

statement on Form F-1 filed with the Securities Exchange Commission, or the SEC. The Selling Securityholders named in this

prospectus may, from time to time, sell the securities described in this prospectus in one or more offerings. This prospectus and

the documents incorporated by reference herein include important information about us, the ordinary shares being issued by us, the

securities being offered by the Selling Securityholders and other information you should know before investing. Any prospectus

supplement may also add, update, or change information in this prospectus. If there is any inconsistency between the information

contained in this prospectus and any prospectus supplement, you should rely on the information contained in that particular

prospectus supplement. This prospectus does not contain all of the information provided in the registration statement that we filed

with the SEC. You should read this prospectus together with the additional information about us described in the section below

entitled “Where You Can Find More Information; Incorporation of Information by Reference.” You should rely only on

information contained in, or incorporated by reference into, this prospectus. We have not, and the Selling Securityholders have not,

authorized anyone to provide you with information different from that contained in, or incorporated by reference into, this

prospectus. The information contained in this prospectus is accurate only as of the date on the front cover of the prospectus and

information we have incorporated by reference in this prospectus is accurate only as of the date of the document incorporated by

reference. You should not assume that the information contained in, or incorporated by reference into, this prospectus is accurate

as of any other date.

We and the Selling Securityholders may offer and

sell the securities directly to purchasers, through agents selected by us and/or the Selling Securityholders, or to or through underwriters

or dealers. A prospectus supplement, if required, may describe the terms of the plan of distribution and set forth the names of any agents,

underwriters or dealers involved in the sale of securities. See “Plan of Distribution.”

Unless otherwise indicated, all historical share-based

information in this prospectus has been adjusted to give retroactive effect to the Share Split described below.

INDUSTRY AND MARKET DATA

Unless otherwise indicated, information contained

in this prospectus concerning HUB Security’s industry and the regions in which it operates, including HUB Security’s general

expectations and market position, market opportunity, market share and other management estimates, is based on information obtained from

various independent publicly available sources and other industry publications, surveys and forecasts, which HUB Security believes to

be reliable based upon its management’s knowledge of the industry. We assume liability for the accuracy and completeness of such

information to the extent included in this prospectus.

Such assumptions and estimates of HUB Security’s

future performance and growth objectives and the future performance of its industry and the markets in which it operates are subject

to a high degree of uncertainty and risk due to a variety of factors, including those discussed under the headings “Risk Factors,”

“Cautionary Statement Regarding Forward-Looking Statements; Market, Ranking and Other Industry Data” in this prospectus

and in the headings “Risk Factors” and “Operating and Financial Review and Prospectus” in our Annual

Report on Form 20-F for the year ended December 31, 2022, or our 2022 Annual Report, incorporated by reference into this prospectus.

TRADEMARKS, TRADE NAMES AND SERVICE MARKS

This document contains references to trademarks,

trade names and service marks belonging to other entities. Solely for convenience, trademarks, trade names and service marks referred

to in this prospectus may appear without the ® or TM symbols, but such references are not intended to indicate, in any

way, that the applicable licensor will not assert, to the fullest extent under applicable law, its rights to these trademarks and trade

names. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship

with, or endorsement or sponsorship of us by, any other companies.

PROSPECTUS SUMMARY

This summary highlights, and is qualified in

its entirety by, the more detailed information included elsewhere in this prospectus. This summary does not contain all of the information

that may be important to you. You should read and carefully consider the entire prospectus, especially the “Risk Factors”

section of this prospectus and in our 2022 Annual Report, before deciding to invest in our ordinary shares. Unless the context otherwise

requires, we use the terms “company,” “we,” “us” and “our” in this prospectus to refer

to HUB Cyber Security Ltd. and subsidiaries.

HUB Security began operations in 1984 as A.L.D.

Advanced Logistics Development Ltd. (“ALD”) and is engaged in developing and marketing quality management software tools

and solutions. HUB Cyber Security TLV Ltd. (“HUB TLV”) was founded in 2017 by veterans of the elite Unit 8200 and Unit 81

of the Israeli Defense Forces, with deep experience and proven track records in setting up and commercializing start-ups in a multi-disciplinary

environment. On February 28, 2021, HUB TLV and ALD signed a share swap merger agreement, pursuant to which HUB Cyber Security Ltd. became

a wholly owned subsidiary of HUB Security (formally ALD following a name change) and the shareholders of HUB TLV owned 51% of HUB Security’s

issued and outstanding share capital (the “ALD Merger”). The ALD Merger was completed on June 21, 2021. Following the merger

with ALD, we have developed unique technology and products in the field of Confidential Computing, and we intend to be a significant

player in the industry by providing effective cybersecurity solutions for a broad range of government entities, enterprises and organizations.

We currently operate in several countries and provide innovative cybersecurity computing appliances as well as a wide range of cybersecurity

professional services. We are registered with the Israeli Registrar of Companies. Our registration number is 511029373. HUB Security

focuses on two symbiotic lines of business – Confidential Computing and Cyber Security Professional Services – a trusted

advisor to its customers. The symbiotic connection between the two offerings is deeply rooted in the company’s strategy.

Traditional Approaches to Cybersecurity

Traditional cybersecurity technologies operate

as a collection of unique purpose-built systems and components that mitigate different threats and risks within a network. All of these

systems are being operated by expanding costly IT and cyber teams within organizations. Most organizations today have sophisticated methods

for protecting data at rest (encrypted in storage), and data in transit (encrypted in transit). However, traditional approaches to cybersecurity

do not address vulnerabilities to data in use, (when applications and data are processed). As a result, most companies are exposed to

hacks by commercially available tools and techniques, even after investing heavily in perimeter defenses.

This common vulnerability of systems to exploit

by hackers has been exacerbated by the recent shift to remote work and the increase in cell phone access to networks. This shift allows

even simple devices such as phones, tablets and laptops to access networks and receive sensitive data. The connection of these simple

devices to a network has created a network perimeter that is almost indefensible by traditional cybersecurity systems.

Confidential Computing

Confidential Computing is emerging as the ultimate

solution for cyber protection as it assumes that a computer has already been infiltrated by hackers and that an administrator’s

credentials have been compromised. HUB’s zero trust Confidential Computing systems protect data and applications by running them

within secure enclaves that are governed by policies and managed with strict, rules-based filters to prevent unauthorized access to the

processor as well as by and between microservices. This unique approach ensures data security, regardless of the vulnerability of the

computing infrastructure.

Confidential Computing places the network system

into a “bunker” or trusted execution environment, and maintains strict control over how the system is accessed, and does

not require any changes in the network operations which would otherwise be required by traditional cybersecurity solutions. More importantly,

Confidential Computing allows data to remain encrypted at all times, even while in use and being processed. According to the Everest

Group, the Confidential Computing market is expected to grow by up to 90-95% each year through 2026 and will help to mitigate the threat

of data breaches.

The potential benefits of Confidential Computing

are immense, including data protection, ensuring security on data in use in the cloud, protecting intellectual property, allowing safe

collaboration with external organizations on cloud, eliminating concerns over selecting cloud providers and protecting data processes

for edge computing environments, such as IoT. HUB’s zero trust Confidential Computing has a key strength in that it can minimize

the vulnerability of data for all of these use cases by protecting data in use, that is, during processing or runtime.

Our Business

HUB was founded in 2017 by veterans of the elite

Unit 8200 and Unit 81 of the Israeli Defense Forces, with deep experiences and proven track records in setting up and commercializing

start-ups in a multi-disciplinary environment. HUB has developed unique technology and products in the field of Confidential Computing,

and it intends to be a significant market participant providing effective cybersecurity solutions for a broad range of government entities,

enterprises and organizations. On February 28, 2021, HUB and ALD, a leading provider of quality and reliability certification training

and services, signed a share swap merger agreement, pursuant to which HUB became a wholly owned subsidiary of ALD and the shareholders

of HUB owned 51% of ALD’s issued and outstanding share capital. The ALD-HUB Merger was completed on June 21, 2021 (ALD later changed

its name to HUB Cyber Security (Israel) Ltd. and later to HUB Cyber Security Ltd.)

Today, HUB operates in several countries providing

innovative cybersecurity computing solutions as well as a wide range of cybersecurity and reliability, availability, maintainability

and safety (RAMS) professional services. Its zero trust Confidential Computing product has received positive initial market feedback,

with detailed discussions held with interested parties in Israel, EMEA, APAC and the United States, including well established companies

in the telecommunications, insurance and technology sectors. HUB’s management team includes, amongst others, Major-General (Ret.)

Uzi Moskovich (CEO, former head of the Cyber Communications and Defense Division of the Israel Defense Forces), Andrey Iaremenko (founder

and Chief Technology Officer with over 13 years of experience in the elite Unit 8200 of the Israeli Defense Forces), Hugo Goldman (Chief

Financial Officer with over 25 years of experience as a Chief Financial Officer, including serving as CFO of several technology based

companies), Osher Partok Rheinisch (Chief Legal, Compliance and Data Protection Officer with over 20 years of experience), and Alon Saban

(EVP of Cybersecurity with 23 years’ experiences in national cybersecurity agencies)

For the years ended December 31, 2022 and 2021,

HUB and its divisions generated $80 million and $33 million of revenue, respectively, including one customer that contributed more than

10% of HUB’s total consolidated revenue in the year ended December 31, 2022. For the year ended December 31, 2022, the revenue

HUB generated from each of the geographic markets in which it operates (Israel, America, Europe and Asia Pacific) amounted to $76,127

thousand, $339 thousand, $2,983 thousand and $294 thousand, respectively. For the year ended December 31, 2021, the revenue HUB generated

from each of the geographic markets in which it operates (Israel, America, Europe and Asia Pacific) amounted to $31,049 thousand, $680

thousand, $755 thousand and $36 thousand, respectively.

HUB is a cybersecurity product company that also

offers complementary trusted advisory and professional service facilitating cyber risk assessment, cyber risk mitigation, cyber incident

response, quality reliability and safety of critical systems. HUB’s management believes that HUB has great potential for growth

and the ability to handle large and complex projects for governments and organizations by providing reliable cybersecurity solutions

for the sensitive data and critical infrastructure of these entities.

HUB will seek to capture a leading position in

the cybersecurity market, based on two major strategies:

| a) | Focus on continuing the development of HUB’s Confidential

Computing solutions to ensure HUB is able to meet the demands of an evolving and growing market. |

| b) | Achieve rapid growth and market penetration through industry

collaborations and mergers and acquisitions that can give HUB access to large clients and integration capabilities, in order to put HUB

at the top of the value chain. |

Since the start of 2021, HUB has completed two

acquisitions of cybersecurity consulting services and distribution companies. This has provided HUB with an established and trusted customer

base, including governmental agencies and enterprises that are prime targets for its Confidential Computing approach. As part of its

business strategy, HUB is also considering additional acquisition targets, particularly those in the United States.

HUB intends to leverage the acquired companies’

professional services, expert knowledge and understanding of customers’ need to upsell its cybersecurity solution. In addition,

HUB intends to use its technological abilities to transform the acquired companies’ services into products that can be sold widely,

thereby accelerating HUB’s revenue growth and increasing shareholder value.

Corporate Information

Our website address is www.hubsecurity.com. Information

contained on, or that can be accessed through, our website does not constitute a part of this prospectus and is not incorporated by reference

herein. We have included our website address in this prospectus solely for informational purposes. The SEC maintains an Internet site

that contains reports, proxy and information statements, and other information regarding issuers, such as we, that file electronically,

with the SEC at www.sec.gov.

The main address of our principal executive offices

is 17, Rothchild St., Tel Aviv, Israel and our telephone number is +972-3-924-4074. Our agent for service of process in the U.S. is Puglisi

& Associates, 850 Library Avenue, Newark, Delaware 19711. For a description of our principal capital expenditures and divestitures

for the two years ended December 31, 2022 and for those currently in progress, see Item 5. “Operating and Financial Review and

Prospects.”

Recent Developments

On February 28, 2023 (the “Closing Date”),

we consummated the previously announced business combination (the “Business Combination”) pursuant to the Business Combination

Agreement , dated March 23, 2022 (the “Business Combination Agreement”), by and among the Company, Mount Rainier Acquisition

Corp., a Delaware corporation (“RNER”) and Rover Merger Sub Inc., a Delaware corporation and wholly owned subsidiary of the

Company (“Merger Sub”).

On the Closing Date, the following transactions

occurred in connection with the closing of the Business Combination:

| ● | the Company effected a share split of each of our ordinary shares

into such number of ordinary shares, calculated in accordance with the terms of the Business

Combination Agreement, such that each of our ordinary shares was given the value of $10.00

per share after giving effect to such share split, which resulted in reverse split ratio

of 0.712434 (the “Share Split”); |

| ● | the Company adopted Amended and Restated Articles of Association

for HUB Cyber Security Ltd.; |

| ● | Merger Sub merged with and into RNER (the “Merger”),

with RNER being the surviving corporation in the Business Combination and becoming a wholly

owned subsidiary of the Company, with the shareholders of RNER becoming shareholders of the

Company; |

| ● | in connection with the special meeting of stockholders held by

RNER on January 4, 2023 (the “RNER Special Meeting”), the holders of 2,580,435

shares of common stock of RNER (the “RNER Common Stock” and each share of RNER

Common Stock, a “RNER Share”) properly exercised their right to redeem their

shares for cash at a redemption price of approximately $10.28 per share, for an aggregate

redemption amount of approximately $26,526,872. These share redemptions were in addition

to the 14,535,798 RNER Shares that were tendered for redemption in connection with the special

meeting of RNER’s stockholders held on December 21, 2022 approving the extension of

RNER’s expiration date to March 1, 2023 at a redemption price of approximately $10.31

per share, for an aggregate redemption amount of approximately $149,864,077; |

| ● | at the effective time of the Business Combination (the “Effective

Time”), each unit of RNER (a “RNER Unit”) issued and outstanding immediately

prior to the Effective Time automatically detached and the holder of each such RNER Unit

became deemed to hold one RNER Share and one warrant of RNER entitling the holder to purchase

three-fourths of one RNER Share per warrant at a price of $11.50 per whole share (exercisable

only for whole shares) (each, a “RNER Warrant”); and |

| ● | each RNER Share issued and outstanding immediately prior to the

Effective Time automatically converted into the right to receive 0.899 of our ordinary shares,

and each RNER Warrant issued and outstanding immediately prior to the Effective Time converted

into the right to receive 0.899 warrants of the Company (a “New Warrant”) subject

to downward adjustment to the next whole number in case of fractions of warrants. A total

of 16,043,862 New Warrants to purchase three-fourths of one HUB ordinary share were issued

to holders of the RNER warrants. As a result of this conversion the New Warrants’ exercise

price increased to $12.79 per whole share. |

Our ordinary shares and warrants began trading

on The Nasdaq Stock Market LLC on March under the symbol “HUBC” and “HUBCW” and “HUBCZ” respectively.

Funding Transactions

A.G.P. Note

On February 28, 2023, upon the closing of the

Business Combination, we entered into a convertible note agreement with A.G.P./Alliance Global Partners (“A.G.P.”), the representative

of the underwriters in RNER’s IPO and a stockholder of RNER, pursuant to which A.G.P. purchased convertible notes from the Company

in an aggregate principal amount of $5,219,319 (the “A.G.P. Note”). The proceeds from the A.G.P. Note were used to pay expenses

in connection with the closing of the Business Combination.

The A.G.P. Note bears interest at a rate of 6%

per annum (18% upon the A.G.P. Note being in default), has a maturity date of March 1, 2024 and is convertible for our ordinary shares

at A.G.P.’s option, at any time prior to the respective note being paid in full at a conversion price of $10. Additionally, under

certain conditions, rather than repaying the A.G.P. Note in cash, we can pay in the form of shares issuable upon conversion of the A.G.P.

Note, which shall be calculated by dividing the amount being repaid by the Alternate Conversion Price, which is equal to as of the date

of conversion, ninety three percent (93%) of the lowest daily VWAP (as defined in the A.G.P. Note) of our ordinary shares during the

five (5) consecutive trading day period ending on the trading day prior to delivery of the notice of conversion. In accordance with the

terms of the A.G.P. Note and related registration rights we granted. we are registering the resale of up to 20,015,025 ordinary shares,

which is the maximum amount of ordinary shares issuable upon conversion of the A.G.P. Note, based on an assumed conversion price of $0.32

which is equal to the Alternate Conversion Price as of the date of filing of this prospectus.

Shayna Loans

On each of February 23, 2023, June 11, 2023 and

July 9, 2023, we entered into Convertible Loan Agreements (together the “Shayna Loan Agreements”) with Shayna LP, a Cayman

Islands company (“Shayna”), in the amounts of NIS 10 million (approximately $2.8 million), NIS 5 million (approximately $1.4

million) and NIS 1.85 million (approximately $500,000) respectively (each a “Shayna Loan and, together, the “Shayna Loans”).

The Shayna Loans will not bear interest unless the Company defaults in making certain payments under the Shayna Loans. In the event that

the Company defaults on certain payments under the Shayna Loans, then Shayna Loans will bear interest at an annual rate of 8% until paid

in full.

The Shayna Loans will each be convertible at the

option of Shayna at a conversion price equal $0.20, following an amendment to the Shayna Loan Agreements fixing the conversion price as

such. Additionally, upon conversion of the principal amount Shayna Loan from February 23, 2023, we will also be required to issue a warrant

to purchase one ordinary share together with each share that we issue to Shayna upon conversion (the “Shayna Warrants”). We

are registering for resale hereunder up to 35,254,727 ordinary shares consisting of (i) 22,124,475 ordinary shares issuable upon conversion

in full of the Shayna Loans and (ii) 13,130,252 ordinary shares issuable upon exercise of the Shayna Warrants).

In addition, Shayna will not be allowed to convert

the Shayna Loans, and we will not issue shares in respect of a conversion notice, if the conversion would require the approval of our

shareholders in accordance with section 270(5) and section 274 of the Companies Law, and this conversion and allocation will be postponed

to the earliest date given in accordance with section 270(5) and Article 274 of the Companies Law.

If, at any point following the conversion of the

Loans, Shayna were to own 7% or more of our issued and outstanding shares, Shayna will be entitled to require us, to register for resale

all of the Company’s shares for resale by Shayna, as well as ordinary shares that may be allocated upon exercising warrants, which

Shayna will be entitled to as a result of the conversion of the Loans, on Form F-1 or Form F-3, as applicable, within 21 days after receiving

a written notice from Shayna. Additionally, pursuant to the Loan Agreements, Shayna will be entitled to standard “piggyback registration

rights” in any case that we submit a registration document to the SEC to register our shares for ourself or any other party and

will also be entitled to participate in any sale of shares under that registration statement.

In connection with the Shayna Loans, we agreed

to pay commission totaling NIS 467,500 (approximately $125,000) to an affiliate entity of Shayna. In addition, commencing on August 10,

2023, the Company agreed to pay to Shayna a consulting fee equal to $95,900 per month (plus value added tax) in 12 equal monthly payments,

totaling $1,150,800 for advisory services to be provided pursuant to the Loan Agreements. We also agreed to pay a commission equal to

NIS 375,000 (approximately $105,000) together with warrants to purchase our ordinary shares having a value equal to NIS 375,000 upon

the date of grant to A-Labs Finance and Advisory Ltd.

In order to guarantee Shayna’s rights under

the Shayna Loans and to receive the brokerage and consulting fees set forth above, each of Vizerion Ltd. A-Labs and Uzi Moskovich (together

the “Pledgors”), agreed to pledge all shares and warrants of the Company held by them in favor of Shayna. If the Company

fails to register the shares issuable upon conversion of the Shayna Loans within 90 days of the signing of the Loan Agreements, then

the Shayna may, at its sole option, foreclose on the shares, in proportion the holding of each of the Pledgors, in exchange for assigning

Shayna’s rights according to the Loan Agreement to the Pledgors for the allocation of shares in the same number that was exercised

by Shayna, and all other rights of Shayna under the Loan Agreements will remain in effect. If the registration of the shares is completed

and Shayna is paid in full for the consulting fee noted above, the pledges on the shares will be canceled.

Lind Financing

On May 4, 2023, we entered into a Securities Purchase

Agreement (the “Lind Agreement”) with Lind Global Asset Management VI LLC, an investment fund managed by The Lind Partners,

a New York based institutional fund manager (“Lind”). Pursuant to the Lind Agreement, we agreed to issue to Lind up to two

(2) secured convertible promissory notes in three tranches (the “Lind Convertible Notes”) for gross proceeds of up to $16,000,000

and warrants (the “Lind Warrants”) to purchase our ordinary shares (the “Lind Financing”). The closings of the

Lind Financing (the “Closings and each a “Closing”) will occur in tranches (each a “Tranche”): the Closing

of the first Tranche (the “First Closing”) occurred on May 8, 2023 and consisted of the issuance and sale to Lind of a note

with a purchase price of $6,000,000 a principal amount of $7,200,000 and the issuance to Lind of Warrants to acquire 2,458,210 ordinary

shares.

The purchase price for the initial Lind Convertible

Note consisted of two separate funding amounts. At the closing the initial funding amount of $4,500,000 was received by the Company and

the funding of the remaining $1,500,000 (the “Second Funding Amount”) was to occur within two (2) Business Days following

the filing of our 2022 Annual Report. On August 24, 2023, us and Lind entered into an amendment (the “Amendment”) to each

of the Lind Agreement, the Lind Convertible Note and the Lind warrant. Pursuant to the Amendment, the parties agreed to amend the definition

of “First Funding Amount” in the Lind Agreement such that Lind would fund the Company with $1 million, less the Commitment

Fee (as defined in the Purchase Agreement) immediately upon execution of the Amendment. In addition, Lind agreed to provide the Company

with an additional $500,000, less the Commitment Fee, within five (5) business days following the filing of this Registration Statement

and that there is no ongoing Event of Default or that no Event of Default will occur as a result of such additional funding.

As consideration for the amendments to the First

Funding Amount, we agreed to amend the outstanding Lind Convertible Note and increase the principal amount of the Lind Convertible Note

from $7.2 million to $9 million. Additionally, we agreed to amend the conversion price of the Lind Convertible Note to $0.45. Further,

as consideration for the Amendment, the Company agreed to amend the Warrant and issue to Lind additional warrants to purchase 2,541,790

of the Company’s ordinary shares bringing the total amount of shares that can be purchased under the outstanding Lind warrant to

5,000,000 ordinary shares. The Company also agreed to amend the exercise price of the Lind warrant to $0.45 per ordinary share.

In connection with the additional $1 million funding

pursuant to the Amendment, we agreed issue to Lind a new warrant to purchase 2,500,000 ordinary shares with an exercise price of $0.45

per ordinary share and under the same terms and conditions as the Lind warrant. Finally, upon receipt of the additional $500,000 funding

amount, we agreed to issue to Lind a new warrant to purchase a number of ordinary shares equal to $500,000 divided by $0.3590, the

closing price of the Company’s ordinary shares on the date prior to the filing of this Registration Statement, at an exercise price

equal to 1.25 multiplied by the average of the daily VWAPs (as defined in the Lind Agreement) during the five (5) trading days prior

to the filing of this Registration Statement.

So long as no Event of Default has occurred under

the Lind Convertible Note sold at the First Closing, the second closing (the “Second Closing), will consist of the issuance and

sale to Lind of a note with a purchase price of $10,000,000 and a principal amount of $12,000,000, and the issuance to Lind of additional

warrants to acquire ordinary shares. The Second Closing will occur sixty (60) days following the effectiveness of this Registration Statement

and is subject to certain conditions precedent as set forth in the Lind Agreement.

The amount of warrants to be issued upon the occurrence

of the Second Closing will be equal to 1/3 times the applicable purchase price of the relevant Lind Convertible Note divided by the lower

of (i) $0.6102 and (ii) the closing price of the Company’s ordinary shares on the trading day before the applicable closing date.

Pursuant to the Lind Agreement, upon the payment

of each funding amount, the Company agreed to pay Lind a commitment fee in an amount equal to 3.5% of the applicable funding amount being

funded by Lind at the applicable Closing.

The Lind Convertible Note issued in the First

Closing has a maturity date of May 8, 2025, and the Ling Convertible Note to be issued in the Second Closing will have a maturity date

of 2 years from the date of issuance (the “Maturity Date”).

Beginning on the date that is the earlier of (1)

this Registration Statement being declared effective and (2) 120 days from the issuance date of each Lind Convertible Note , we shall

repay the Lind Convertible Note in twelve (12) consecutive monthly installments, on such date and each one (1) month anniversary thereof

(each, a “Payment Date” and collectively the “Monthly Payments”) an amount equal to $600,000 (the “Repayment

Amount”), with the option of Lind to increase one Monthly Payment up to $1,500,000 by providing written notice to the Company. The

Company has the option to make the Monthly Payments (i) in cash in the amount equal to the product of Repayment Amount multiplied by 1.05

(ii) (ii) ordinary share, or (iii) a combination of cash and ordinary shares. The amount of ordinary shares to be issued upon repayment

shall be calculate by dividing the Repayment Amount being paid in ordinary shares by the Repayment Share Price. The “Repayment Share

Price” will be equal to ninety percent (90)% of the average of the lowest five (5) consecutive daily VWAPs during the twenty (20)

Trading Days prior to the Payment Date. Unless waived in writing in advance by Lind, the Company may only make payments in ordinary shares

unless such shares (A) may be immediately resold under Rule 144 without restriction on the number of shares to be sold or manner of sale,

or (B) are registered for resale under the 1933 Act and the registration statement is in effect and lawfully usable to effect immediate

sales of such shares by Lind.

The Lind Convertible Note outstanding has a conversion

price of $0.45 (following the Amendment). Any additional notes issued to Lind will be convertible at the option of Lind at a conversion

price equal to the lower of (i) $0.9763 and (ii) 1.6 times the closing price of the Company’s ordinary shares on the trading day

before the applicable closing date (the “Conversion Price”). Upon the occurrence and during the continuance of an Event of

Default (as defined in the Lind Convertible Note) Lind shall have the option to convert such note at the lower of (i) the then-current

Conversion Price and (ii) eighty-percent (80)% of the average of the three (3) lowest daily VWAPs during the twenty (20) Trading Days

prior to delivery of the applicable notice of conversion. The Conversion Price is also subject to certain adjustments as set forth in

the relevant note.

The Lind Convertible Notes will not bear interest

other than, in the event that if certain payments under the Lind Convertible Note as set forth therein are not timely made, the Lind Convertible

Notes will bear interest at the rate of 2% per month (prorated for partial months) until paid in full. We will have the right to prepay

the Lind Convertible Note under the terms set forth therein.

We have the right to prepay all, but not less

than all, of the applicable Lind Convertible Note following the date that is sixty (60) days after the earlier to occur of (a) the date

this Registration Statement is declared effective by the SEC or (b) the date that any shares issued pursuant to the applicable Lind Convertible

Note may be immediately resold under Rule 144 without restriction on the number of shares to be sold or manner of sale at an amount equal

to the outstanding principal amount of the Lind Convertible Note multiplied by 1.05.

Pursuant to the Lind Convertible Note, we agreed

that in the event that, at any time following the First Closing, the Company or its subsidiaries, issue any debt, including any subordinated

debt or convertible or any equity interests, other than Exempted Securities, as such term is defined in the Lind Agreement, in one or

more transactions for aggregate proceeds of more than $10,000,000 of cash proceeds being received by the Company, unless otherwise waived

in writing by and at the discretion of Lind, the Company will immediately utilize 20% of the proceeds of such issuance to repay the Lind

Convertible Notes issued to Lind pursuant to the Lind Agreement, until there remains no outstanding and unconverted principal amount due.

Lind will not have the right to convert the portion

of the Lind Convertible Note or exercise the portion of the Lind Warrants, if Lind together with its affiliates, would beneficially own

in excess of 4.99% (or 9.99% if Lind already owns greater than 4.99)% of the number of ordinary shares outstanding immediately after giving

effect to such conversion or exercise.

We are currently in default under the outstanding

Lind Convertible Note and Lind Agreement due to our failure to timely file our Annual Report as well as our failure to file the Registration

Statement within 30 days of the entry into the Lind Agreement as well as for certain prohibited issuances we made (including the entry

into the Shayna Loan Agreements). As a result of this default it is uncertain when, if at all, we may be able to receive the additional

amounts called for under the Lind Agreement as part of the Second Closing. We are currently in discussions with Lind as to solutions to

cure the default.

Liquidity and Capital Resources

Since

inception, HUB Security has incurred losses and generated negative cash flows from operations and has funded its operations, research

and development, capital expenditure and working capital requirements through revenue received from customers, bank loans and other debt

facilities and government grants, as well as equity contributions from shareholders.

We

expect our capital expenditures and working capital requirements to increase substantially in the near future, as it seeks to produce

the confidential computing products, develop and continue its research and development efforts. As of December 31, 2022, HUB’s

cash and cash equivalents were $4 million. The Company intends to finance operating costs over the next twelve months through a combination

of future issuances of equity and/or debt securities, reducing operating spend, and potentially divesting assets.

Our

future capital requirements will depend on many factors, including, but not limited to our growth, market acceptance of our offerings,

the timing and extent of spending to support our efforts to develop our platform, and the expansion of sales and marketing activities.

We are required to seek additional equity or debt financing. If additional financing is required from outside sources, we may not be

able to raise it on terms acceptable to us or at all. If we issue additional equity securities to raise additional funds, further dilution

to existing shareholders may occur. However, we cannot predict with certainty the outcome of our actions to generate liquidity, including

the availability of additional financing. If we are unable to raise additional capital when desired, our business, financial condition,

and results of operations could be adversely affected.

As

a result of liquidity and cash flow concerns that have arisen resulting from the Company’s business operations, together with our

internal investigation into misconduct by former senior officers and the delay in the filing of our 2022 Annual Report, we face significant

uncertainty regarding the adequacy of its liquidity and capital resources and its ability to repay its obligations as they become due.

The

significant uncertainty regarding our liquidity and capital resources, our ability to repay our obligations as they become due, provides

substantial doubt about our ability to continue as a going concern for the next twelve months from the date hereof. Our management is

closely monitoring the situation and has been attempting to alleviate the liquidity and capital resources concerns through workforce

reductions, interim financing facilities and other capital raising efforts.

We

are seeking obtain additional sources of debt and equity financing, together with additional revenues from new business opportunities

and has engaged with potential investors with regards to such financing alternatives. However, such opportunities remain uncertain and

are predicated upon events and circumstances which are outside the Company’s control. The inability to borrow or raise sufficient

funds on commercially reasonable terms, would have serious consequences to the Company’s financial condition and results of operations.

Additionally,

we will receive the proceeds from any exercise of any Warrants in cash. The aggregate amount of proceeds could be up to $173,879,341.82 million

if all Warrants are exercised for cash. We expect to use any such proceeds for general corporate and working capital purposes, which

would increase our liquidity, but our ability to fund our operations is not dependent upon receipt of cash proceeds from the exercise

of the warrants.

We

believe the likelihood that warrant holders will exercise their Warrants, and therefore the amount of cash proceeds that we would receive,

is dependent upon the market price of our ordinary shares. If the market price for our ordinary shares is less than the respective prices

of the Warrants, we believe Warrant holders will be unlikely to exercise their Warrants.

Summary Risk Factors

Investing in our ordinary

shares involves substantial risks, and our ability to successfully operate our business and execute our growth plan is subject to numerous

risks. You should consider all the information contained in this prospectus in deciding whether to invest in our ordinary shares. In

particular, you should consider the risk factors described under “Risk Factors” beginning on page 14 and in

the documents incorporated by reference into this prospectus. Such risks include, but are not limited to:

| ● | Our previously

disclosed internal investigation was initiated to review allegations of misappropriation

of Company funds and other potential fraudulent actions regarding the use of Company funds

by a former senior officer of the Company. As a result of or in connection with the matters

that were the subject of the investigation, we may become subject to certain regulatory scrutiny.

In addition, we have incurred and may continue to incur substantial costs in connection with

the internal investigation, which could have a material adverse effect on our business, financial

condition and results of operations. |

| ● | We are a company

with a history of net losses and anticipate that we may incur net losses for the foreseeable

future. Moreover, our independent registered public accounting firm’s report, contained

herein, includes an explanatory paragraph that expresses substantial doubt about our ability

to continue as a going concern, indicating the possibility that we may not be able to continue

to operate in the future. |

| ● | We have identified

material weaknesses in our internal control over financial reporting. If our remediation

of the material weaknesses is not effective, or we fail to develop and maintain effective

internal controls over financial reporting, our ability to produce timely and accurate financial

statements or comply with applicable laws and regulations could be impaired. |

| ● | The circumstances

that led to the failure to file our Annual Report on time, and our efforts to investigate,

assess and remediate those matters have caused and may continue to cause substantial delays

in our SEC filings. |

| ● | We are not currently

in compliance with the continued listing standards of Nasdaq and our failure to meet the

continued listing requirements of Nasdaq could result in a delisting of our securities. |

| ● | We have previously

financed our operations and certain capital needs through various debt, convertible debt

and equity issuances. Our existing and future debt obligations could impair our liquidity

and financial condition. We are currently in default under certain of our debt obligations.

If we are unable to negotiate a solution for the payment of our outstanding debt or otherwise

meet our debt obligations, the lenders could foreclose on our assets which could cause us

to curtail or cease operations or have an adverse impact on our business, results of operations

and financial condition and the price of our ordinary shares. |

| ● | We will likely

be required to raise additional funds in the near future in order to execute our business

plan and these funds may not be available to us when we need them. If we cannot raise additional

funds when we need them, our business, prospects, financial condition and operating results

could be negatively affected. |

| ● | An inability to

attract new customers, retain existing customers and sell additional services to customers

could adversely impact our revenue and results of operations. |

| ● | The termination

of, or material changes to, our relationships with key vendors could materially adversely

affect our business, financial condition and operating results, which could be exacerbated

due to our reliance on a small number of vendors for a significant portion of our distribution

and offerings in our Professional Services division. |

| ● | Actions that we

have taken to reduce costs and rebalance investments may not result in anticipated savings

or operational efficiencies, could result in total costs and expenses that are greater than

expected, and could disrupt our business. |

| ● | Our limited operating

history in the field of confidential computing makes it difficult to evaluate our business

and future prospects and increases the risk of your investment. |

| ● | The network security

market is rapidly evolving within the increasingly challenging cyber threat landscape. If

our solutions fail to adapt to market changes and demands, sales may not continue to grow

or may decline. |

| ● | Our reputation

and business could be harmed based on real or perceived shortcomings, defects or vulnerabilities

in our solutions or if our customers experience security breaches, which could have a material

adverse effect on our business, reputation and operating results. |

| ● | Our ability to

introduce new products, features, integrations and enhancements is dependent on adequate

research and development resources. |

| ● | We currently have

and target many customers that are large corporations and government entities, which are

subject to a number of challenges and risks, such as increased competitive pressures, administrative

delays and additional approval requirements. |

| ● | We may not be

able to convert our customer orders in backlog or pipeline into revenue. |

| ● | A shortage of

components or manufacturing capacity could cause a delay in our ability to fulfill orders

or increase our manufacturing costs. |

| ● | Our management

team has limited experience managing a U.S. listed public company. |

| ● | Our business relies

on the performance of, and we face stark competition for, highly skilled personnel, including

our management, other key employees and qualified employees, and the loss of one or more

of such personnel or of a significant number of our team members or the inability to attract

and retain executives and qualified employees we need to support our operations and growth,

could harm our business. |

| ● | Changes in tax

laws or exposure to additional income tax liabilities could affect our future profitability. |

| ● | As a cybersecurity

provider, if any of our systems, our customers’ cloud or on-premises environments,

or our internal systems are breached or if unauthorized access to customer or third-party

data is otherwise obtained, public perception of our business may be harmed, and we may lose

business and incur losses or liabilities. |

| ● | Undetected defects

and errors may increase our costs and impair the market acceptance of our products and solutions. |

| ● | We may not be

able to adequately protect or enforce our intellectual property rights or prevent unauthorized

parties from copying or reverse engineering our products or technology. Our efforts to protect

and enforce our intellectual property rights and prevent third parties from violating our

rights may be costly. |

| ● | The dynamic regulatory

environment around privacy and data protection may limit our offering or require modification

of our products and services, which could limit our ability to attract new customers and

support our existing customers and increase our operational expenses. We could also be subject

to investigations, litigation, or enforcement actions alleging that we fail to comply with

the regulatory requirements, which could harm our operating results and adversely affect

our business. |

| ● | Our actual or

perceived failure to adequately protect personal data could subject us to sanctions and damages

and could harm our reputation and business. |

| ● | We may be required

to indemnify our directors and officers in certain circumstances. |

| ● | A market for our

securities may not develop or be sustained, which would adversely affect the liquidity and

price of our securities. |

| ● | We are subject

to a number of securities class actions and other litigations and could be subject to additional

litigation in the United States, Israel or elsewhere that could negatively impact our business,

including resulting in substantial costs and liabilities. |

| ● | If our estimates

or judgments relating to our critical accounting policies are based on assumptions that change

or prove to be incorrect, our operating results could fall below expectations of securities

analysts and investors, resulting in a decline in our stock price. |

| ● | Provisions of

Israeli law and our articles of association may delay, prevent or make difficult an acquisition

of us, prevent a change of control, and negatively impact our share price. |

| ● | Our ordinary shares

and warrants may not continue to be listed on a national securities exchange, which could

limit investors’ ability to make transactions in such securities and subject us to

additional trading restrictions. |

| ● | If securities

or industry analysts do not publish or cease publishing research or reports about us, our

business, or our market, or if they change their recommendations regarding our ordinary shares

adversely, then the price and trading volume of our ordinary shares could decline. |

| ● | As we are a “foreign

private issuer” and intend to follow certain home country corporate governance practices,

our shareholders may not have the same protections afforded to shareholders of companies

that are subject to all Nasdaq corporate governance requirements. |

| ● | The listing of

our securities on Nasdaq did not benefit from the process undertaken in connection with an

underwritten initial public offering, which could result in diminished investor demand, inefficiencies

in pricing and a more volatile public price for our securities. |

| ● | Conditions in

Israel could materially and adversely affect our business. |

| ● | It may be difficult

to enforce a U.S. judgment against us, our officers and directors and any Israeli experts

in Israel or the United States, or to assert U.S. securities laws claims in Israel or serve

process on our officers and directors and these experts. |

| ● | We may issue additional

ordinary shares or other equity securities without seeking approval of our shareholders,

which would dilute the ownership interests represented by our ordinary shares and may depress

the market price of our ordinary shares |

Implications of Being

an Emerging Growth Company and a Foreign Private Issuer

We qualify as an “emerging

growth company” pursuant to the Jumpstart Our Business Startups Act of 2012, as amended (the “JOBS Act”). An emerging

growth company may take advantage of specified exemptions from various requirements that are otherwise applicable generally to U.S. public

companies. These provisions include:

| ● | an exemption that

allows the inclusion in an initial public offering registration statement of only two years

of audited financial statements and selected financial data and only two years of related

disclosure; |

| ● | reduced executive

compensation disclosure; |

| ● | exemptions from

the requirements of holding a non-binding advisory vote on executive compensation and any

golden parachute payments not previously approved; |

| ● | an exemption from

compliance with the requirement of the Public Company Accounting Oversight Board regarding

the communication of critical audit matters in the auditor’s report on the financial

statements; and |

| ● | an exemption from

the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (the

“Sarbanes-Oxley Act”) in the assessment of the emerging growth company’s

internal control over financial reporting. |

The JOBS Act also permits

an emerging growth company such as us to delay adopting new or revised accounting standards until such time as those standards are applicable

to private companies. We have elected to use this extended transition period to enable us to comply with certain new or revised accounting

standards that have different effective dates for public and private companies until the earlier of the date we (i) are no longer an

emerging growth company or (ii) affirmatively and irrevocably opt out of the extended transition period provided in the JOBS Act. As

a result, our financial statements may not be comparable to companies that comply with new or revised accounting pronouncements as of

public company effective dates. We may choose to take advantage of some but not all of these reduced reporting burdens.

We will remain an emerging growth company until

the earliest of:

| ● | the last day of

our fiscal year during which we have total annual revenue of at least $1.235 billion; |

| ● | the last day of

our fiscal year following the fifth anniversary of the closing of the Business Combination; |

| ● | the date on which

we have, during the previous three-year period, issued more than $1.0 billion in non-convertible

debt securities; or |

| ● | the date on which

we are deemed to be a “large accelerated filer” under the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), which would occur if the market

value of our Class A ordinary shares that are held by non-affiliates exceeds $700 million

as of the last business day of our most recently completed second fiscal quarter. |

In addition, we report

under the Exchange Act as a “foreign private issuer.” As a foreign private issuer, we may take advantage of certain provisions

under the rules that allow us to follow Israeli law for certain corporate governance matters. Even after we no longer qualify as an emerging

growth company, as long as we qualify as a foreign private issuer under the Exchange Act, we will be exempt from certain provisions of

the Exchange Act that are applicable to U.S. domestic public companies, including:

| ● | the sections of

the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect

of a security registered under the Exchange Act; |

| ● | the sections of

the Exchange Act requiring insiders to file public reports of their share ownership and trading

activities and liability for insiders who profit from trades made in a short period of time; |

| ● | the rules under

the Exchange Act requiring the filing with the U.S. Securities and Exchange Commission (the

“SEC”) of quarterly reports on Form 10-Q containing unaudited financial and other

specified information, or current reports on Form 8-K, upon the occurrence of specified significant

events; and |

| ● | Regulation Fair

Disclosure (“Regulation FD”), which regulates selective disclosures of material

information by issuers. |

Foreign private issuers,

like emerging growth companies, also are exempt from certain more stringent executive compensation disclosure rules. Thus, if we remain

a foreign private issuer, even if we no longer qualify as an emerging growth company, we will continue to be exempt from the more stringent

compensation disclosures required of public companies that are neither an emerging growth company nor a foreign private issuer.

We may take advantage

of these exemptions until such time as we are no longer a foreign private issuer. We are required to determine our status as a foreign

private issuer on an annual basis at the end of our second fiscal quarter. We would cease to be a foreign private issuer at such time

as more than 50% of our outstanding voting securities are held by U.S. residents and any of the following three circumstances applies:

| ● | the majority of

our executive officers or directors are U.S. citizens or residents; |

| ● | more than 50%

of our assets are located in the United States; or |

| ● | our business is

administered principally in the United States. |

THE OFFERING

| Ordinary shares issuable by us upon exercise of the SPAC warrants and the prior

warrants |

|

18,918,506 |

| |

|

|

| Ordinary shares that may be offered and sold from time to time by the Selling

Securityholders |

|

Up to 87,807,052 ordinary shares consisting of up to (a) 7,500,000

ordinary shares issuable upon exercise of the Lind Warrants; (b) 20,000,000 ordinary shares issuable upon conversion of the Lind Convertible

Note; (c) 22,124,475 ordinary shares issuable upon conversion of the Shayna Loan Agreements; (d) 13,130,252 ordinary shares issuable upon

exercise of the Shayna Warrants; (e) 20,015,026 ordinary shares issuable upon conversion of approximately $6.7 million aggregate principal

amount of the A.G.P. Note; (f) 4,635,308 ordinary shares issued at the closing of the Business Combination in exchange for shares of RNER

common stock held by the Sponsor and the directors and officers of RNER prior to the Business Combination; and (g) 401,992 ordinary shares

that are issuable upon the exercise of the 535,989 private warrants.

|

| |

|

|

| Warrants that may be offered and sold from time to time by the Selling

Securityholders |

|

535,989 private warrants |

| |

|

|

| Terms of Warrants |

|

Each of the outstanding SPAC warrants entitles the holder to purchase three fourths of one ordinary

share at a price of $12.79 per whole share. The SPAC warrants expire on February 28, 2028 at 5:00 p.m., New York City time. As

a result, a holder must exercise the SPAC warrants in multiples of two warrants, subject to adjustment, to validly exercise the SPAC

warrants. |

| |

|

|

| |

|

The prior warrants are exercisable for one ordinary share each, with an exercise price of $2.03

per ordinary share. The prior warrants were originally set to expire on August 22, 2023, but our Board approved an extension

to the prior warrants and their current expiration date is on August 22, 2025 at 5:00 p.m., New York City time. |

| |

|

|

| |

|

The Shayna Warrants that are issuable upon conversion of the Shayna Loans will be exercisable for

one ordinary share each and will have an exercise price of $0.20 per ordinary share. The Shayna warrants will have an

expiration date that is 36 months from their issuance date. |

| |

|

|