Hyperfine, Inc. Reports Second Quarter 2023 Financial Results

15 August 2023 - 6:05AM

Hyperfine, Inc. (Nasdaq: HYPR), the groundbreaking medical device

company that created the Swoop® system, the world's first

FDA-cleared portable, point-of-care MRI system, today announced

second quarter 2023 financial results and provided a business

update.

“We made solid progress at Hyperfine in the second quarter of

2023 and delivered record revenue of over $3.3 million. We remained

focused on our three strategic pillars of innovation, clinical

evidence, and commercial expansion, including the initiation of our

ACTION PMR observational study to examine the integration of the

Swoop® system into stroke diagnosis and treatment workflow, while

continuing to execute with strong spending discipline,” said Maria

Sainz, Chief Executive Officer and President of Hyperfine, Inc. “We

are excited and committed to expanding access to timely,

clinically-relevant brain imaging for clinicians and their patients

across multiple care settings globally.”

Second Quarter 2023 Financial Results

- Revenues for the second quarter of 2023

were $3.38 million, compared to $1.53 million in the second quarter

of 2022.

- Hyperfine, Inc. sold 14 commercial

Swoop® systems in the second quarter of 2023.

- Gross margin for the second quarter of

2023 was $1.44 million, compared to $(0.17) million in the second

quarter of 2022.

- Research and development expenses for

the second quarter of 2023 were $5.33 million, compared to $7.27

million in the second quarter of 2022.

- Sales, general, and administrative

expenses for the second quarter of 2023 were $7.81 million,

compared to $15.76 million in the second quarter of 2022.

- Net loss for the second quarter of 2023

was $10.64 million, equating to a net loss of $0.15 per share, as

compared to a net loss of $23.16 million, or a net loss of $0.33

per share, for the second quarter of 2022.

Six Months Financial Results

- Revenues for the six months ended June

30, 2023 were $6.02 million, compared to $3.04 million in the six

months ended June 30, 2022.

- Gross margin for the six months ended

June 30, 2023 was $2.60 million, compared to $(0.08) million in the

six months ended June 30, 2022.

- Research and development expenses for

the six months ended June 30, 2023 were $10.79 million, compared to

$15.60 million in the six months ended June 30, 2022.

- Sales, marketing, general, and

administrative expenses for the six months ended June 30, 2023 were

$16.53 million, compared to $31.28 million in the six months ended

June 30, 2022.

- Net loss for the six months ended June

30, 2023 was $22.80 million, equating to a net loss of $0.32 per

share, as compared to a net loss of $46.93 million, or a net loss

of $0.67 per share, for the six months ended June 30, 2022.

2023 Financial Guidance

- Management expects revenue for the full

year 2023 to be $10 to $14 million.

- Management expects cash burn for the

full year 2023 to be $40 to $45 million.

Conference Call

Hyperfine, Inc. will host a conference call at 1:30 p.m. PT/

4:30 p.m. ET on Monday, August 14, 2023, to discuss its second

quarter 2023 financial results and provide a business update. Those

interested in listening should register online by visiting

https://investors.hyperfine.io/. and clicking on News & Events.

Participants are encouraged to register more than 15 minutes before

the start of the call. A live and archived audio webcast will be

available through the Investors page of Hyperfine, Inc.’s corporate

website at https://investors.hyperfine.io/.

About Hyperfine, Inc. and the Swoop® Portable MR

Imaging® System

Hyperfine, Inc. (Nasdaq: HYPR) is the groundbreaking medical

technology company that created the Swoop® system, the world’s

first FDA-cleared portable magnetic resonance imaging (MRI) system

capable of providing neuroimaging at the point of care. The Swoop®

system received initial U.S. Food and Drug Administration (FDA)

clearance in 2020 as a bedside magnetic resonance imaging device

for producing images that display the internal structure of the

head where full diagnostic examination is not clinically practical.

When interpreted by a trained physician, these images provide

information that can be useful in determining a diagnosis. The

Swoop® system has been approved for brain imaging in several

countries, including Canada and Australia, has UKCA certification

in the United Kingdom, has CE certification in the European Union,

and is also available in New Zealand.

The mission of Hyperfine, Inc. is to revolutionize patient care

globally through transformational, accessible, clinically relevant

diagnostic imaging, and data solutions. Founded by Dr. Jonathan

Rothberg in a technology-based incubator called 4Catalyzer,

Hyperfine, Inc. scientists, engineers, and physicists developed the

Swoop® system out of a passion for redefining brain imaging

methodology and how clinicians can apply accessible diagnostic

imaging to patient care. Traditionally, access to costly,

stationary, conventional MRI technology can be inconvenient or not

available when needed most. With the portable, ultra-low-field

Swoop® system, Hyperfine, Inc. is redefining the neuroimaging

workflow by bringing brain imaging to the patient’s bedside. For

more information, visit hyperfine.io.

Hyperfine, Swoop, and Portable MR Imaging are registered

trademarks of Hyperfine, Inc.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995. Actual results of

Hyperfine, Inc. (the "Company”) may differ from its expectations,

estimates and projections and consequently, you should not rely on

these forward-looking statements as predictions of future events.

Words such as “expect,” “estimate,” “project,” “budget,”

“forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,”

“should,” “believes,” “predicts,” “potential,” “continue,” and

similar expressions (or the negative versions of such words or

expressions) are intended to identify such forward-looking

statements. These forward-looking statements include, without

limitation, expectations about the Company’s financial and

operating results, the Company’s goals and commercial plans, the

Company’s ACTION PMR observational study, the benefits of the

Company’s products and services, and the Company’s future

performance and its ability to implement its strategy. These

forward-looking statements involve significant risks and

uncertainties that could cause the actual results to differ

materially from the expected results. Most of these factors are

outside of the Company’s control and are difficult to predict.

Factors that may cause such differences include, but are not

limited to: the success, cost and timing of the Company’s product

development and commercialization activities, including the degree

that the Swoop® system is accepted and used by healthcare

professionals; the inability to maintain the listing of the

Company’s Class A common stock on the Nasdaq Stock Market LLC; the

Company’s inability to grow and manage growth profitably and retain

its key employees; changes in applicable laws or regulations; the

inability of the Company to raise financing in the future; the

inability of the Company to obtain and maintain regulatory

clearance or approval for its products, and any related

restrictions and limitations of any cleared or approved product;

the inability of the Company to identify, in-license or acquire

additional technology; the inability of the Company to maintain its

existing or future license, manufacturing, supply and distribution

agreements and to obtain adequate supply of its products; the

inability of the Company to compete with other companies currently

marketing or engaged in the development of products and services

that the Company is currently marketing or developing; the size and

growth potential of the markets for the Company’s products and

services, and its ability to serve those markets, either alone or

in partnership with others; the pricing of the Company’s products

and services and reimbursement for medical procedures conducted

using the Company’s products and services; the Company’s inability

to successfully complete and generate positive data from the ACTION

PMR study; the Company’s estimates regarding expenses, revenue,

capital requirements and needs for additional financing; the

Company’s financial performance; and other risks and uncertainties

indicated from time to time in Company’s filings with the

Securities and Exchange Commission, including those under “Risk

Factors” therein. The Company cautions readers that the foregoing

list of factors is not exclusive and that readers should not place

undue reliance upon any forward-looking statements which speak only

as of the date made. The Company does not undertake or accept any

obligation or undertaking to release publicly any updates or

revisions to any forward-looking statements to reflect any change

in its expectations or any change in events, conditions or

circumstances on which any such statement is based.

Investor ContactMarissa BychGilmartin Group

LLCmarissa@gilmartinir.com

|

HYPERFINE, INC. AND SUBSIDIARIES CONDENSED

CONSOLIDATED BALANCE SHEETS(in thousands,

except share and per share amounts)(Unaudited) |

|

| |

|

| |

|

June 30, 2023 |

|

|

December 31, 2022 |

|

| ASSETS |

|

|

|

|

|

|

| CURRENT ASSETS: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

93,948 |

|

|

$ |

117,472 |

|

|

Restricted cash |

|

|

969 |

|

|

|

771 |

|

|

Accounts receivable, less allowance of $175 and $180 as of June 30,

2023 and December 31, 2022, respectively |

|

|

3,948 |

|

|

|

2,103 |

|

|

Unbilled receivables |

|

|

663 |

|

|

|

454 |

|

|

Inventory |

|

|

5,983 |

|

|

|

4,622 |

|

|

Prepaid expenses and other current assets |

|

|

2,312 |

|

|

|

3,194 |

|

|

Due from related parties |

|

|

— |

|

|

|

48 |

|

| Total current assets |

|

|

107,823 |

|

|

|

128,664 |

|

|

Property and equipment, net |

|

|

3,058 |

|

|

|

3,248 |

|

|

Other long term assets |

|

|

1,725 |

|

|

|

2,139 |

|

| Total

assets |

|

$ |

112,606 |

|

|

$ |

134,051 |

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

| CURRENT LIABILITIES: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

1,372 |

|

|

$ |

678 |

|

|

Deferred grant funding |

|

|

969 |

|

|

|

771 |

|

|

Deferred revenue |

|

|

1,490 |

|

|

|

1,378 |

|

|

Due to related parties |

|

|

45 |

|

|

|

— |

|

|

Accrued expenses and other current liabilities |

|

|

4,159 |

|

|

|

5,976 |

|

| Total current liabilities |

|

|

8,035 |

|

|

|

8,803 |

|

|

Long term deferred revenue |

|

|

1,280 |

|

|

|

1,526 |

|

| Total

liabilities |

|

|

9,315 |

|

|

|

10,329 |

|

| COMMITMENTS AND

CONTINGENCIES (NOTE 12) |

|

|

|

|

|

|

| STOCKHOLDERS'

EQUITY |

|

|

|

|

|

|

|

Class A Common stock, $.0001 par value; 600,000,000 shares

authorized; 56,284,538 and 55,622,488 shares issued and outstanding

at June 30, 2023 and December 31, 2022, respectively |

|

|

5 |

|

|

|

5 |

|

|

Class B Common stock, $.0001 par value; 27,000,000 shares

authorized; 15,055,288 shares issued and outstanding at June 30,

2023 and December 31, 2022, respectively |

|

|

2 |

|

|

|

2 |

|

|

Additional paid-in capital |

|

|

335,565 |

|

|

|

333,199 |

|

|

Accumulated deficit |

|

|

(232,281 |

) |

|

|

(209,484 |

) |

| Total stockholders'

equity |

|

|

103,291 |

|

|

|

123,722 |

|

| TOTAL LIABILITIES AND

STOCKHOLDERS' EQUITY |

|

$ |

112,606 |

|

|

$ |

134,051 |

|

|

HYPERFINE, INC. AND SUBSIDIARIES CONDENSED

CONSOLIDATED STATEMENT OF OPERATIONS AND COMPREHENSIVE

LOSS(in thousands, except share and per share

amounts)(Unaudited) |

|

|

|

|

| |

|

Three Months Ended

June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

Device |

|

$ |

2,810 |

|

|

$ |

1,168 |

|

|

$ |

4,942 |

|

|

$ |

2,360 |

|

|

Service |

|

|

571 |

|

|

|

365 |

|

|

|

1,074 |

|

|

|

682 |

|

|

Total sales |

|

|

3,381 |

|

|

|

1,533 |

|

|

$ |

6,016 |

|

|

$ |

3,042 |

|

| Cost of sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

Device |

|

|

1,549 |

|

|

|

1,259 |

|

|

|

2,620 |

|

|

|

2,296 |

|

|

Service |

|

|

388 |

|

|

|

439 |

|

|

|

797 |

|

|

|

827 |

|

|

Total cost of sales |

|

|

1,937 |

|

|

|

1,698 |

|

|

$ |

3,417 |

|

|

$ |

3,123 |

|

| Gross

margin |

|

|

1,444 |

|

|

|

(165 |

) |

|

|

2,599 |

|

|

|

(81 |

) |

| Operating Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

5,331 |

|

|

|

7,265 |

|

|

$ |

10,792 |

|

|

$ |

15,599 |

|

|

General and administrative |

|

|

5,306 |

|

|

|

12,012 |

|

|

|

11,488 |

|

|

|

23,372 |

|

|

Sales and marketing |

|

|

2,499 |

|

|

|

3,750 |

|

|

|

5,046 |

|

|

|

7,911 |

|

| Total operating

expenses |

|

|

13,136 |

|

|

|

23,027 |

|

|

|

27,326 |

|

|

|

46,882 |

|

| Loss from

operations |

|

|

(11,692 |

) |

|

|

(23,192 |

) |

|

$ |

(24,727 |

) |

|

$ |

(46,963 |

) |

|

Interest income |

|

|

1,030 |

|

|

|

32 |

|

|

$ |

1,899 |

|

|

$ |

33 |

|

|

Other income (expense), net |

|

|

25 |

|

|

|

1 |

|

|

|

31 |

|

|

|

(4 |

) |

| Loss before provision for

income taxes |

|

|

(10,637 |

) |

|

|

(23,159 |

) |

|

$ |

(22,797 |

) |

|

$ |

(46,934 |

) |

| Provision for income taxes |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Net loss and

comprehensive loss |

|

$ |

(10,637 |

) |

|

$ |

(23,159 |

) |

|

$ |

(22,797 |

) |

|

$ |

(46,934 |

) |

|

Net loss per common share attributable to common stockholders,

basic and diluted |

|

$ |

(0.15 |

) |

|

$ |

(0.33 |

) |

|

$ |

(0.32 |

) |

|

$ |

(0.67 |

) |

|

Weighted-average shares used to compute net loss per share

attributable to common stockholders, basic and diluted |

|

|

71,201,170 |

|

|

|

70,350,178 |

|

|

|

71,033,629 |

|

|

|

70,341,411 |

|

|

HYPERFINE, INC. AND

SUBSIDIARIESCONDENSEDCONSOLIDATED STATEMENT OF

CASH FLOWS(in thousands)(Unaudited) |

|

|

|

|

|

|

|

Six Months EndedJune 30, |

|

|

|

|

2023 |

|

|

2022 |

|

| Cash flows from operating

activities: |

|

|

|

|

|

|

|

Net loss |

|

$ |

(22,797 |

) |

|

$ |

(46,934 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

|

|

Depreciation |

|

|

513 |

|

|

|

516 |

|

|

Stock-based compensation expense |

|

|

2,259 |

|

|

|

11,213 |

|

|

Loss on disposal of property and equipment |

|

|

100 |

|

|

|

— |

|

|

Payments received on net investment in lease |

|

|

4 |

|

|

|

4 |

|

|

Changes in assets and liabilities: |

|

|

|

|

|

|

|

Accounts receivable |

|

|

(1,845 |

) |

|

|

(1,434 |

) |

|

Unbilled receivables |

|

|

(209 |

) |

|

|

(1,027 |

) |

|

Inventory |

|

|

(1,537 |

) |

|

|

(336 |

) |

|

Prepaid expenses and other current assets |

|

|

946 |

|

|

|

(1,213 |

) |

|

Due from related parties |

|

|

48 |

|

|

|

12 |

|

|

Prepaid inventory |

|

|

281 |

|

|

|

— |

|

|

Other long term assets |

|

|

129 |

|

|

|

52 |

|

|

Accounts payable |

|

|

666 |

|

|

|

(551 |

) |

|

Deferred grant funding |

|

|

198 |

|

|

|

(1,058 |

) |

|

Deferred revenue |

|

|

(134 |

) |

|

|

469 |

|

|

Due to related parties |

|

|

45 |

|

|

|

(1,900 |

) |

|

Accrued expenses and other current liabilities |

|

|

(1,817 |

) |

|

|

(2,013 |

) |

|

Net cash used in operating activities |

|

|

(23,150 |

) |

|

|

(44,200 |

) |

| Cash flows from investing

activities: |

|

|

|

|

|

|

|

Purchases of property and equipment |

|

|

(283 |

) |

|

|

(254 |

) |

|

Net cash used in investing activities |

|

|

(283 |

) |

|

|

(254 |

) |

| Cash flows from financing

activities: |

|

|

|

|

|

|

|

Proceeds from exercise of stock options |

|

|

107 |

|

|

|

2 |

|

|

Net cash provided by financing activities |

|

|

107 |

|

|

|

2 |

|

| Net decrease in cash and

cash equivalents and restricted cash |

|

|

(23,326 |

) |

|

|

(44,452 |

) |

| Cash, cash equivalents and

restricted cash, beginning of period |

|

|

118,243 |

|

|

|

191,160 |

|

| Cash, cash equivalents

and restricted cash, end of period |

|

|

94,917 |

|

|

|

146,708 |

|

| Reconciliation of cash,

cash equivalents, and restricted cash reported in the balance

sheets |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

93,948 |

|

|

|

145,104 |

|

|

Restricted cash |

|

|

969 |

|

|

|

1,604 |

|

| Total cash, cash

equivalents and restricted cash |

|

$ |

94,917 |

|

|

$ |

146,708 |

|

| Supplemental disclosure of

noncash information: |

|

|

|

|

|

|

|

Noncash acquisition of fixed assets |

|

$ |

28 |

|

|

$ |

— |

|

|

Write-off of notes receivable |

|

$ |

— |

|

|

$ |

90 |

|

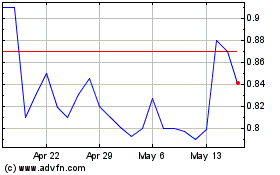

Hyperfine (NASDAQ:HYPR)

Historical Stock Chart

From Nov 2024 to Dec 2024

Hyperfine (NASDAQ:HYPR)

Historical Stock Chart

From Dec 2023 to Dec 2024