IES Holdings, Inc. (or “IES” or the “Company”) (NASDAQ: IESC) today

announced financial results for the quarter ended March 31, 2024.

Second Quarter

2024 Highlights and Recent

Developments

-

Revenue of $706 million for the second quarter of fiscal 2024, an

increase of 24% compared with $569 million for the same quarter of

fiscal 2023

- Operating income of

$77.7 million for the second quarter of fiscal 2024, an increase of

146% compared with $31.6 million for the same quarter of fiscal

2023

- Net income

attributable to IES of $52.9 million for the second quarter of

fiscal 2024, an increase of 146% compared with $21.6 million for

the same quarter of fiscal 2023, and diluted earnings per share

attributable to common stockholders of $2.29 for the second quarter

of fiscal 2024, compared with $0.92 for the same quarter of fiscal

2023

- Adjusted net income

attributable to IES (a non-GAAP financial measure, as defined

below) of $52.9 million for the second quarter of fiscal 2024,

an increase of 115% compared with $24.6 million for the same

quarter of fiscal 2023, and diluted adjusted earnings per share

attributable to common stockholders of $2.29 for the second quarter

of fiscal 2024, compared with $1.07 for the same quarter of fiscal

2023

- Remaining

performance obligations, a GAAP measure of future revenue to be

recognized from current contracts with customers, of approximately

$1.1 billion as of March 31, 2024

- Backlog (a non-GAAP financial measure,

as defined below) of approximately $1.4 billion as of March

31, 2024

- Subsequent to quarter end, completed

the acquisition of Greiner Industries, expanding the product

offerings, capacity and geographic reach of our Infrastructure

Solutions business

Overview of Results

“We are pleased with our financial performance in

the second quarter of fiscal 2024 as the investments we have made

to support the organic growth of our businesses positioned us to

take advantage of continued strength across our end markets," said

Jeff Gendell, Chairman and Chief Executive Officer. "Despite

elevated interest rates, demand for residential housing has

remained firm, which benefited our Residential segment, while

strength in the data center market positively impacted our

Communications, Infrastructure Solutions, and Commercial &

Industrial segments. Our margins continued to benefit from process

improvements, operating leverage from our increased scale and

strong project execution across all four segments. We expect

continued strong performance across our four segments for the

remainder of this fiscal year, while continuing to monitor our

housing markets for any signs of slowing activity.

"Our strong financial position has enabled us to

pursue both organic growth opportunities and strategic

acquisitions. On April 1, 2024, we completed the acquisition of

Greiner Industries, based in Mount Joy, Pennsylvania, which both

adds new product offerings and expands capacity for our existing

Infrastructure Solutions business. Further, during the second

quarter of fiscal 2024, we leased a fabrication facility in Rock

Hill, South Carolina to provide additional capacity to support our

Infrastructure Solutions segment. Together, these actions reflect

our strategy of expanding the geographic footprint of our custom

power solutions products to better serve our customers."

Our Communications segment’s revenue was

$193.6 million in the second quarter of fiscal 2024, an

increase of 37% compared with the second quarter of fiscal 2023.

Increased demand across the business, particularly in the data

center end market, drove the growth. The segment's operating income

increased to $21.9 million for the second quarter of fiscal

2024, compared with $11.8 million for the second quarter of

fiscal 2023, as we benefited from increased volumes, improved

project execution and pricing, and a more disciplined bidding

process.

Our Residential segment’s revenue was

$339.3 million in the second quarter of fiscal 2024, an

increase of 11% compared with the second quarter of fiscal 2023.

Our single-family business benefited from strong demand, while

successful execution of its backlog contributed to revenue growth

in our multi-family business. While the outlook in the multi-family

market suggests new project activity may slow over the coming year,

we expect that continued expansion of our plumbing and HVAC

offerings will provide additional growth opportunities for our

business. The Residential segment’s operating income increased to

$34.7 million for the second quarter of fiscal 2024, compared

with $16.8 million for the second quarter of fiscal 2023.

Margins increased year over year as a result of favorable purchases

of certain materials, improved project execution in our

multi-family business, and improved procurement and other processes

that were implemented as part of the reorganization of our

Residential segment we began in April 2023.

Our Infrastructure Solutions segment’s revenue was

$75.8 million in the second quarter of fiscal 2024, an

increase of 44% compared with the second quarter of fiscal 2023,

driven by continued strong demand in our custom power solutions

business, including generator enclosures, primarily for the data

center end market. Operating income for the second quarter of

fiscal 2024 was $16.1 million, compared with $8.2 million

for the second quarter of fiscal 2023. The year-over-year profit

improvement was driven by higher volumes, improved pricing and

operating efficiencies at our facilities as well as the impact of

investments to increase capacity we have made over the last several

years.

Our Commercial & Industrial segment’s revenue

was $97.0 million in the second quarter of fiscal 2024, an

increase of 41% compared with $69.0 million in the second

quarter of fiscal 2023, while segment operating income for the

second quarter of fiscal 2024 was $11.7 million, compared with

$0.4 million for the second quarter of fiscal 2023. The

improved results for the second quarter of fiscal 2024 largely

reflect a strong contribution from a large data center project

where our performance exceeded estimates. We also benefited from

solid execution and improved bid margins across the business,

driven by a strategy implemented in the prior year to improve

project selection and contract terms through a more disciplined

bidding process.

Matt Simmes, President and Chief Operating Officer,

commented, “Our focus on improving procurement and other processes

has contributed to improved margins in all of our businesses,

particularly in our Infrastructure Solutions and Commercial &

Industrial segments. At the same time, our investments in upgrading

and expanding capacity in our Infrastructure Solutions business

have allowed us to materially increase capacity while adding new

product offerings. Our Commercial & Industrial segment will

continue to pursue margin expansion through improved contract

terms, material purchasing, and labor management processes while

managing contract risk. As our Residential segment nears the

completion of the reorganization started a year ago, it now will

refocus efforts on profitable growth, including through the organic

expansion of the HVAC and plumbing trades.”

“We delivered strong year-over-year revenue and

profitability growth, resulting in a cash balance of $106.0 million

and no debt at the end of the second quarter of fiscal 2024,” added

Tracy McLauchlin, Chief Financial Officer. “Our second quarter

results include the benefit from larger than expected gains on

certain projects across our business, particularly in our

Commercial & Industrial segment, as well as the favorable

impact resulting from certain material purchases. We took advantage

of our strong financial position to purchase Greiner Industries

subsequent to the end of the quarter. We expect to continue to

generate significant cash flow for the remainder of fiscal 2024,

which will be available to fund both organic expansion and

acquisitions, as well as provide capital for stock repurchases or

other investments. As a reminder, we substantially utilized our

federal tax net operating loss carryforwards during fiscal 2023,

and as a result, we will have a higher cash tax rate in fiscal

2024.”

Stock Buyback Plan

In December 2022, the Company’s Board of Directors

authorized and announced a stock repurchase program for purchasing

up to $40 million of our common stock from time to time, which

replaced the Company's previous program. During the quarter ended

March 31, 2024, the Company did not repurchase any shares under its

repurchase program. The Company had $37.6 million remaining under

its stock repurchase authorization at March 31, 2024.

Non-GAAP Financial Measures and Other

Adjustments

This press release includes adjusted net income

attributable to IES, adjusted diluted earnings per share

attributable to common stockholders, and backlog, and, in the

non-GAAP reconciliation tables included herein, adjusted net income

attributable to common stockholders, adjusted EBITDA and adjusted

net income before taxes, each of which is a financial measure not

calculated in accordance with generally accepted accounting

principles in the U.S. (“GAAP”). Management believes that these

measures provide useful information to our investors by, in the

case of adjusted net income attributable to common stockholders,

adjusted earnings per share attributable to common stockholders,

adjusted EBITDA and adjusted net income before taxes,

distinguishing certain nonrecurring events such as litigation

settlements, significant expenses associated with leadership

changes, or gains or losses from the sale of a business, or noncash

events, such as impairment charges or our valuation allowances

release and write-down of our deferred tax assets, or, in the case

of backlog, providing a common measurement used in IES's industry,

as described further below, and that these measures, when

reconciled to the most directly comparable GAAP measures, help our

investors to better identify underlying trends in the operations of

our business and facilitate easier comparisons of our financial

performance with prior and future periods and to our peers.

Non-GAAP financial measures should not be considered in isolation

from, or as a substitute for, financial information calculated in

accordance with GAAP. Investors are encouraged to review the

reconciliation of these non-GAAP measures to their most directly

comparable GAAP financial measures, which has been provided in the

financial tables included in this press release.

Remaining performance obligations represent the

unrecognized revenue value of our contract commitments. While

backlog is not a defined term under GAAP, it is a common

measurement used in IES’s industry and IES believes this non-GAAP

measure enables it to more effectively forecast its future results

and better identify future operating trends that may not otherwise

be apparent. IES’s remaining performance obligations are a

component of IES’s backlog calculation, which also includes signed

agreements and letters of intent which we do not have a legal right

to enforce prior to work starting. These arrangements are excluded

from remaining performance obligations until work begins. IES’s

methodology for determining backlog may not be comparable to the

methodologies used by other companies.

For further details on the Company’s financial

results, please refer to the Company’s quarterly report on Form

10-Q for the fiscal quarter ended March 31, 2024, to be filed with

the Securities and Exchange Commission ("SEC") by May 3, 2024,

and any amendments thereto.

About IES Holdings, Inc.

IES designs and installs integrated electrical and

technology systems and provides infrastructure products and

services to a variety of end markets, including data centers,

residential housing, and commercial and industrial facilities. Our

more than 8,000 employees serve clients in the United States. For

more information about IES, please visit www.ies-co.com.

Company Contact:

Tracy McLauchlinChief Financial OfficerIES

Holdings, Inc.(713) 860-1500

Investor Relations Contact:

Robert Winters or Stephen PoeAlpha IR

Group312-445-2870IESC@alpha-ir.com

Certain statements in this release may be deemed

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934, all of which are based upon various estimates

and assumptions that the Company believes to be reasonable as of

the date hereof. In some cases, you can identify forward-looking

statements by terminology such as “may,” “will,” “could,” “should,”

“expect,” “plan,” “project,” “intend,” “anticipate,” “believe,”

“seek,” “estimate,” “predict,” “potential,” “pursue,” “target,”

“continue,” the negative of such terms or other comparable

terminology. These statements involve risks and uncertainties that

could cause the Company’s actual future outcomes to differ

materially from those set forth in such statements. Such risks and

uncertainties include, but are not limited to, the impact of the

COVID-19 outbreak or future pandemics on our business, including

the potential for job site closures or work stoppages, supply chain

disruptions, delays in awarding new projects, construction delays,

reduced demand for our services, delays in our ability to collect

from our customers, the impact of third party vaccine mandates on

employee recruiting and retention, or illness of management or

other employees; the ability of our controlling shareholder to take

action not aligned with other shareholders; the potential

recognition of valuation allowances or write-downs on deferred tax

assets; the inability to carry out plans and strategies as

expected, including our inability to identify and complete

acquisitions that meet our investment criteria in furtherance of

our corporate strategy, or the subsequent underperformance of those

acquisitions; competition in the industries in which we operate,

both from third parties and former employees, which could result in

the loss of one or more customers or lead to lower margins on new

projects; fluctuations in operating activity due to downturns in

levels of construction or the housing market, seasonality and

differing regional economic conditions; the possibility of

inaccurate estimates used when entering into fixed-price contracts

and our ability to successfully manage projects, as well as other

risk factors discussed in this document, in the Company’s annual

report on Form 10-K for the year ended September 30, 2023 and in

the Company’s other reports on file with the SEC. You should

understand that such risk factors could cause future outcomes to

differ materially from those experienced previously or those

expressed in such forward-looking statements. The Company

undertakes no obligation to publicly update or revise any

information, including information concerning its controlling

shareholder, deferred tax assets, borrowing availability, or cash

position, or any forward-looking statements to reflect events or

circumstances that may arise after the date of this release.

Forward-looking statements are provided in this

press release pursuant to the safe harbor established under the

Private Securities Litigation Reform Act of 1995 and should be

evaluated in the context of the estimates, assumptions,

uncertainties, and risks described herein.

General information about IES Holdings, Inc. can

be found at http://www.ies-co.com under "Investor Relations." The

Company's annual report on Form 10-K, quarterly reports on Form

10-Q and current reports on Form 8-K, as well as any amendments to

those reports, are available free of charge through the Company's

website as soon as reasonably practicable after they are filed

with, or furnished to, the SEC.

|

IES HOLDINGS, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENT OF

OPERATIONS(DOLLARS IN MILLIONS, EXCEPT PER SHARE

DATA)(UNAUDITED) |

| |

| |

|

Three Months Ended |

|

Six Months Ended |

| |

|

March 31, |

|

March 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Revenues |

$ |

705.8 |

|

|

$ |

568.9 |

|

|

$ |

1,340.2 |

|

|

$ |

1,143.8 |

|

|

Cost of services |

|

534.2 |

|

|

|

468.0 |

|

|

|

1,024.8 |

|

|

|

947.4 |

|

| |

Gross profit |

|

171.6 |

|

|

|

100.9 |

|

|

|

315.4 |

|

|

|

196.4 |

|

|

Selling, general and administrative expenses |

|

95.3 |

|

|

|

69.3 |

|

|

|

181.1 |

|

|

|

137.1 |

|

|

Contingent consideration |

|

— |

|

|

|

0.1 |

|

|

|

— |

|

|

|

0.1 |

|

|

Gain on sale of assets |

|

(1.3 |

) |

|

|

(0.1 |

) |

|

|

(1.4 |

) |

|

|

(13.2 |

) |

| |

Operating income |

|

77.7 |

|

|

|

31.6 |

|

|

|

135.7 |

|

|

|

72.3 |

|

|

Interest expense |

|

0.4 |

|

|

|

1.0 |

|

|

|

0.8 |

|

|

|

2.2 |

|

|

Other (income) expense, net |

|

1.1 |

|

|

|

(1.8 |

) |

|

|

(0.3 |

) |

|

|

(1.1 |

) |

| |

Income from operations before income taxes |

|

76.2 |

|

|

|

32.3 |

|

|

|

135.2 |

|

|

|

71.1 |

|

|

Provision for income taxes |

|

19.4 |

|

|

|

8.2 |

|

|

|

34.8 |

|

|

|

18.2 |

|

| |

Net income |

|

56.8 |

|

|

|

24.2 |

|

|

|

100.4 |

|

|

|

52.9 |

|

|

Net income attributable to noncontrolling interest |

|

(3.9 |

) |

|

|

(2.6 |

) |

|

|

(6.5 |

) |

|

|

(5.0 |

) |

| |

Net income attributable to IES Holdings, Inc. |

$ |

52.9 |

|

|

$ |

21.6 |

|

|

$ |

93.9 |

|

|

$ |

48.0 |

|

| |

|

|

|

|

|

|

|

|

|

Computation of earnings per share: |

|

|

|

|

|

|

|

|

Net income attributable to IES Holdings, Inc. |

$ |

52.9 |

|

|

$ |

21.6 |

|

|

$ |

93.9 |

|

|

$ |

48.0 |

|

|

Increase in noncontrolling interest |

|

(5.9 |

) |

|

|

(2.8 |

) |

|

|

(8.7 |

) |

|

|

(5.8 |

) |

|

Net income attributable to common stockholders of IES Holdings,

Inc. |

$ |

47.0 |

|

|

$ |

18.8 |

|

|

$ |

85.2 |

|

|

$ |

42.1 |

|

| |

|

|

|

|

|

|

|

|

|

Earnings per share attributable to common stockholders: |

|

|

|

|

|

|

|

| |

Basic |

$ |

2.32 |

|

|

$ |

0.93 |

|

|

$ |

4.21 |

|

|

$ |

2.08 |

|

| |

Diluted |

$ |

2.29 |

|

|

$ |

0.92 |

|

|

$ |

4.16 |

|

|

$ |

2.06 |

|

| |

|

|

|

|

|

|

|

|

|

Shares used in the computation of earnings per share: |

|

|

|

|

|

|

|

| |

Basic (in thousands) |

|

20,227 |

|

|

|

20,171 |

|

|

|

20,213 |

|

|

|

20,207 |

|

| |

Diluted (in thousands) |

|

20,480 |

|

|

|

20,388 |

|

|

|

20,450 |

|

|

|

20,414 |

|

|

IES HOLDINGS, INC. AND

SUBSIDIARIESNON-GAAP RECONCILIATION OF ADJUSTED

NET INCOME ATTRIBUTABLETO IES HOLDINGS, INC. AND

ADJUSTED EARNINGS PER SHAREATTRIBUTABLE TO COMMON

STOCKHOLDERS(DOLLARS IN MILLIONS, EXCEPT PER SHARE

DATA)(UNAUDITED) |

| |

| |

|

Three Months Ended |

|

Six Months Ended |

| |

|

March 31, |

|

March 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Net income attributable to IES Holdings, Inc. |

$ |

52.9 |

|

|

$ |

21.6 |

|

|

$ |

93.9 |

|

|

$ |

48.0 |

|

|

Gain on sale of STR Mechanical |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(13.0 |

) |

|

Provision for income taxes |

|

19.4 |

|

|

|

8.2 |

|

|

|

34.8 |

|

|

|

18.2 |

|

| |

Adjusted net income before taxes |

|

72.3 |

|

|

|

29.7 |

|

|

|

128.7 |

|

|

|

53.2 |

|

|

Adjusted tax expense (1) |

|

(19.4 |

) |

|

|

(5.1 |

) |

|

|

(34.8 |

) |

|

|

(8.7 |

) |

| |

Adjusted net income attributable to IES Holdings, Inc. |

|

52.9 |

|

|

|

24.6 |

|

|

|

93.9 |

|

|

|

44.5 |

|

| |

|

|

|

|

|

|

|

|

| |

Adjustments for computation of earnings per share: |

|

|

|

|

|

|

|

| |

Increase in noncontrolling interest |

|

(5.9 |

) |

|

|

(2.8 |

) |

|

|

(8.7 |

) |

|

|

(5.8 |

) |

| |

Adjusted net income attributable to common stockholders |

$ |

47.0 |

|

|

$ |

21.8 |

|

|

$ |

85.2 |

|

|

$ |

38.7 |

|

| |

|

|

|

|

|

|

|

|

|

Adjusted earnings per share attributable to common

stockholders: |

|

|

|

|

|

|

|

| |

Basic |

$ |

2.32 |

|

|

$ |

1.08 |

|

|

$ |

4.21 |

|

|

$ |

1.92 |

|

| |

Diluted |

$ |

2.29 |

|

|

$ |

1.07 |

|

|

$ |

4.16 |

|

|

$ |

1.90 |

|

| |

|

|

|

|

|

|

|

|

|

Shares used in the computation of earnings per share: |

|

|

|

|

|

|

|

| |

Basic (in thousands) |

|

20,227 |

|

|

|

20,171 |

|

|

|

20,213 |

|

|

|

20,207 |

|

| |

Diluted (in thousands) |

|

20,480 |

|

|

|

20,388 |

|

|

|

20,450 |

|

|

|

20,414 |

|

| |

|

|

|

|

|

|

|

|

|

(1) Adjusted to reflect the utilization of tax net operating loss

carryforwards to offset the cash impact of income tax expense for

the three and six months ended March 31, 2023. As our tax net

operating loss carryforwards were substantially utilized in fiscal

2023, there was no such offset to cash taxes in the three and six

months ended March 31, 2024. |

|

IES HOLDINGS, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE

SHEETS(DOLLARS IN

MILLIONS)(UNAUDITED) |

| |

| |

|

|

|

March 31, |

|

September 30, |

|

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

ASSETS |

|

|

|

| |

CURRENT ASSETS: |

|

|

|

| |

|

Cash and cash equivalents |

$ |

106.0 |

|

|

$ |

75.8 |

|

| |

|

Accounts receivable: |

|

|

|

| |

|

|

Trade, net of allowance |

|

416.7 |

|

|

|

363.8 |

|

| |

|

|

Retainage |

|

87.0 |

|

|

|

76.9 |

|

| |

|

Inventories |

|

104.6 |

|

|

|

95.7 |

|

| |

|

Costs and estimated earnings in excess of billings |

|

48.3 |

|

|

|

48.6 |

|

| |

|

Prepaid expenses and other current assets |

|

34.0 |

|

|

|

10.5 |

|

| |

Total current assets |

|

796.5 |

|

|

|

671.3 |

|

| |

|

Property and equipment, net |

|

67.8 |

|

|

|

63.4 |

|

| |

|

Goodwill |

|

92.4 |

|

|

|

92.4 |

|

| |

|

Intangible assets, net |

|

50.1 |

|

|

|

56.2 |

|

| |

|

Deferred tax assets |

|

21.3 |

|

|

|

20.4 |

|

| |

|

Operating right of use assets |

|

57.6 |

|

|

|

61.8 |

|

| |

|

Other non-current assets |

|

15.4 |

|

|

|

16.1 |

|

|

Total assets |

$ |

1,101.2 |

|

|

$ |

981.6 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

| |

CURRENT LIABILITIES: |

|

|

|

| |

|

Accounts payable and accrued expenses |

$ |

306.4 |

|

|

$ |

296.8 |

|

| |

|

Billings in excess of costs and estimated earnings |

|

127.8 |

|

|

|

103.8 |

|

| |

Total current liabilities |

|

434.2 |

|

|

|

400.6 |

|

| |

Long-term debt |

|

— |

|

|

|

— |

|

| |

Operating long-term lease liabilities |

|

38.2 |

|

|

|

42.1 |

|

| |

Other tax liabilities |

|

22.8 |

|

|

|

22.0 |

|

| |

Other non-current liabilities |

|

11.0 |

|

|

|

17.0 |

|

|

Total liabilities |

|

506.2 |

|

|

|

481.7 |

|

|

Noncontrolling interest |

|

60.1 |

|

|

|

50.0 |

|

| |

STOCKHOLDERS’ EQUITY: |

|

|

|

| |

|

Preferred stock |

|

— |

|

|

|

— |

|

| |

|

Common stock |

|

0.2 |

|

|

|

0.2 |

|

| |

|

Treasury stock, at cost |

|

(50.4 |

) |

|

|

(49.5 |

) |

| |

|

Additional paid-in capital |

|

204.1 |

|

|

|

203.4 |

|

| |

|

Retained earnings |

|

380.9 |

|

|

|

295.8 |

|

|

Total stockholders’ equity |

|

534.8 |

|

|

|

449.9 |

|

|

Total liabilities and stockholders’ equity |

$ |

1,101.2 |

|

|

$ |

981.6 |

|

|

IES HOLDINGS, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS(DOLLARS IN

MILLIONS)(UNAUDITED) |

| |

| |

|

Six Months Ended |

| |

|

|

March 31, |

| |

|

|

2024 |

|

|

|

2023 |

|

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

| |

Net income |

$ |

100.4 |

|

|

$ |

52.9 |

|

| |

Adjustments to reconcile net income to net cash provided by (used

in) operating activities: |

|

|

|

| |

Bad debt expense |

|

0.5 |

|

|

|

0.3 |

|

| |

Deferred financing cost amortization |

|

0.1 |

|

|

|

0.1 |

|

| |

Depreciation and amortization |

|

15.4 |

|

|

|

13.3 |

|

| |

Gain on sale of assets |

|

(1.4 |

) |

|

|

(13.2 |

) |

| |

Non-cash compensation expense |

|

2.9 |

|

|

|

2.0 |

|

| |

Deferred income taxes |

|

1.9 |

|

|

|

7.0 |

|

|

|

Unrealized loss on trading securities |

|

|

1.8 |

|

|

|

— |

|

| |

Changes in operating assets and liabilities: |

|

|

|

| |

Accounts receivable |

|

(53.3 |

) |

|

|

35.7 |

|

| |

Inventories |

|

(9.0 |

) |

|

|

(11.8 |

) |

| |

Costs and estimated earnings in excess of billings |

|

0.3 |

|

|

|

4.1 |

|

| |

Prepaid expenses and other current assets |

|

(35.3 |

) |

|

|

(11.7 |

) |

| |

Other non-current assets |

|

0.3 |

|

|

|

1.7 |

|

| |

Accounts payable and accrued expenses |

|

9.5 |

|

|

|

(30.5 |

) |

| |

Billings in excess of costs and estimated earnings |

|

24.0 |

|

|

|

10.1 |

|

| |

Other non-current liabilities |

|

0.5 |

|

|

|

— |

|

|

Net cash provided by operating activities |

|

58.7 |

|

|

|

60.1 |

|

|

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

| |

Purchases of property and equipment |

|

(13.4 |

) |

|

|

(6.7 |

) |

| |

Proceeds from sale of assets |

|

2.3 |

|

|

|

19.1 |

|

| |

Cash paid in conjunction with equity investments |

|

(0.4 |

) |

|

|

(0.2 |

) |

|

Net cash provided by (used in) investing activities |

|

(11.4 |

) |

|

|

12.3 |

|

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

| |

Borrowings of debt |

|

1,346.4 |

|

|

|

1,163.0 |

|

| |

Repayments of debt |

|

(1,346.4 |

) |

|

|

(1,230.5 |

) |

| |

Cash paid for finance leases |

|

(2.0 |

) |

|

|

(1.6 |

) |

| |

Settlement of contingent consideration liability |

|

(4.1 |

) |

|

|

— |

|

| |

Distribution to noncontrolling interest |

|

(7.9 |

) |

|

|

(5.3 |

) |

| |

Purchase of treasury stock |

|

(3.2 |

) |

|

|

(7.6 |

) |

|

Net cash used in financing activities |

|

(17.1 |

) |

|

|

(82.1 |

) |

|

NET DECREASE IN CASH AND CASH EQUIVALENTS |

|

30.2 |

|

|

|

(9.7 |

) |

|

CASH and CASH EQUIVALENTS, beginning of period |

|

75.8 |

|

|

|

24.8 |

|

|

CASH and CASH EQUIVALENTS, end of period |

$ |

106.0 |

|

|

$ |

15.1 |

|

|

IES HOLDINGS, INC. AND

SUBSIDIARIESOPERATING SEGMENT STATEMENT OF

OPERATIONS(DOLLARS IN

MILLIONS)(UNAUDITED) |

| |

| |

|

Three Months Ended |

|

Six Months Ended |

| |

|

March 31, |

|

March 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Revenues |

|

|

|

|

|

|

|

| |

Communications |

$ |

193.6 |

|

|

$ |

141.1 |

|

|

$ |

364.3 |

|

|

$ |

288.4 |

|

| |

Residential |

|

339.3 |

|

|

|

306.1 |

|

|

|

655.2 |

|

|

|

624.2 |

|

| |

Infrastructure Solutions |

|

75.8 |

|

|

|

52.6 |

|

|

|

138.7 |

|

|

|

101.9 |

|

| |

Commercial & Industrial |

|

97.0 |

|

|

|

69.0 |

|

|

|

182.0 |

|

|

|

129.3 |

|

|

Total revenue |

$ |

705.8 |

|

|

$ |

568.9 |

|

|

$ |

1,340.2 |

|

|

$ |

1,143.8 |

|

| |

|

|

|

|

|

|

|

|

|

Operating income (loss) |

|

|

|

|

|

|

|

| |

Communications |

$ |

21.9 |

|

|

$ |

11.8 |

|

|

$ |

43.3 |

|

|

$ |

21.2 |

|

| |

Residential |

|

34.7 |

|

|

|

16.8 |

|

|

|

58.8 |

|

|

|

37.3 |

|

| |

Infrastructure Solution |

|

16.1 |

|

|

|

8.2 |

|

|

|

27.0 |

|

|

|

12.9 |

|

| |

Commercial & Industrial (1) |

|

11.7 |

|

|

|

0.4 |

|

|

|

18.7 |

|

|

|

11.4 |

|

| |

Corporate |

|

(6.7 |

) |

|

|

(5.6 |

) |

|

|

(12.1 |

) |

|

|

(10.5 |

) |

|

Total operating income |

$ |

77.7 |

|

|

$ |

31.6 |

|

|

$ |

135.7 |

|

|

$ |

72.3 |

|

(1) Commercial & Industrial's operating income

for the six months ended March 31, 2023 includes a pretax gain of

$13.0 million related to the sale of STR Mechanical.

|

IES HOLDINGS, INC. AND

SUBSIDIARIESNON-GAAP RECONCILIATION OF ADJUSTED

EBITDA(DOLLARS IN

MILLIONS)(UNAUDITED) |

| |

| |

Three Months Ended |

|

Six Months Ended |

| |

March 31, |

|

March 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Net income attributable to IES Holdings, Inc. |

$ |

52.9 |

|

|

$ |

21.6 |

|

|

$ |

93.9 |

|

|

$ |

48.0 |

|

|

Provision for income taxes |

|

19.4 |

|

|

|

8.2 |

|

|

|

34.8 |

|

|

|

18.2 |

|

|

Interest & other (income) expense, net |

|

1.5 |

|

|

|

(0.7 |

) |

|

|

0.5 |

|

|

|

1.2 |

|

|

Depreciation and amortization |

|

7.8 |

|

|

|

6.9 |

|

|

|

15.4 |

|

|

|

13.3 |

|

|

EBITDA |

$ |

81.6 |

|

|

$ |

35.9 |

|

|

$ |

144.6 |

|

|

$ |

80.6 |

|

|

Gain on sale of STR Mechanical |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(13.0 |

) |

|

Non-cash equity compensation expense |

|

1.5 |

|

|

|

1.1 |

|

|

|

2.9 |

|

|

|

2.0 |

|

|

Adjusted EBITDA |

$ |

83.1 |

|

|

$ |

36.9 |

|

|

$ |

147.5 |

|

|

$ |

69.6 |

|

|

IES HOLDINGS, INC. AND

SUBSIDIARIESSUPPLEMENTAL REMAINING PERFORMANCE

OBLIGATIONS AND NON-GAAP RECONCILIATION OF BACKLOG

DATA(DOLLARS IN

MILLIONS)(UNAUDITED) |

| |

| |

|

March 31, |

|

September 30, |

|

March 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2023 |

|

|

Remaining performance obligations |

|

$ |

1,065 |

|

|

$ |

1,143 |

|

|

$ |

1,012 |

|

|

Agreements without an enforceable obligation (1) |

|

|

298 |

|

|

|

415 |

|

|

|

377 |

|

|

Backlog |

|

$ |

1,363 |

|

|

$ |

1,558 |

|

|

$ |

1,389 |

|

| |

|

|

|

|

|

|

|

(1) Our backlog contains signed agreements and letters of intent

which we do not have a legal right to enforce prior to work

starting. These arrangements are excluded from remaining

performance obligations until work begins. |

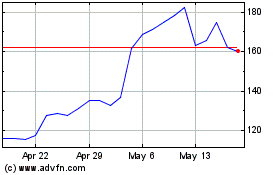

IES (NASDAQ:IESC)

Historical Stock Chart

From Apr 2024 to May 2024

IES (NASDAQ:IESC)

Historical Stock Chart

From May 2023 to May 2024