IES Holdings, Inc. (or “IES” or the “Company”) (NASDAQ: IESC) today

announced financial results for the quarter and fiscal year ended

September 30, 2024.

Fourth Quarter

2024 Highlights

-

Revenue of $776 million for the fourth quarter of fiscal 2024, an

increase of 20% compared with $649 million for the same quarter of

fiscal 2023

- Operating income of

$75.0 million for the fourth quarter of fiscal 2024, an increase of

41% compared with $53.2 million for the same quarter of fiscal

2023

- Net income

attributable to IES of $63.1 million for the fourth quarter of

fiscal 2024, an increase of 67% compared with $37.8 million for the

same quarter of fiscal 2023, and diluted earnings per share

attributable to common stockholders of $3.06 for the fourth quarter

of fiscal 2024, compared with $1.66 for the same quarter of fiscal

2023

- Adjusted net income

attributable to IES (a non-GAAP financial measure, as defined

below) of $57.6 million for the fourth quarter of fiscal 2024,

an increase of 46% compared with $39.5 million for the same

quarter of fiscal 2023, and diluted adjusted earnings per share

attributable to common stockholders of $2.79 for the fourth quarter

of fiscal 2024, compared with $1.74 for the same quarter of fiscal

2023

- Remaining

performance obligations, a GAAP measure of future revenue to be

recognized from current contracts with customers, of approximately

$1.2 billion as of September 30, 2024

- Backlog (a non-GAAP financial measure,

as defined below) of approximately $1.8 billion as of

September 30, 2024

Fiscal Year

2024 Highlights

-

Revenue of $2.9 billion for fiscal 2024, an increase of 21%

compared with $2.4 billion for fiscal 2023

- Operating income of

$300.9 million for fiscal 2024, an increase of 88% compared with

$159.8 million for fiscal 2023

- Net income

attributable to IES of $219.1 million for fiscal 2024, an increase

of 102% compared with $108.3 million for fiscal 2023, and diluted

earnings per share attributable to common stockholders of $9.89 for

fiscal 2024, compared with $4.54 for fiscal 2023

- Adjusted net income

attributable to IES of $213.6 million for fiscal 2024, an increase

of 91% compared with $111.9 million for fiscal 2023, and diluted

adjusted earnings per share attributable to common stockholders of

$9.62 for fiscal 2024 compared with $4.71 for fiscal 2023

Overview of Results

“In fiscal 2024 we continued to build on the

progress we made in 2023, with all four of our operating segments

growing revenue while expanding operating margins," said Jeff

Gendell, Chairman and Chief Executive Officer. "Year-over-year

consolidated revenue increased 21%, as we continued to see strong

demand across our key end markets and continued our Residential

plumbing and HVAC expansion into new markets. Operating income

increased substantially compared with the prior year, both for the

fourth quarter and the full fiscal year, reflecting our revenue

growth, strong project execution, improved capacity utilization and

favorable impacts of materials purchases. I want to thank the

entire IES team for their dedication and hard work in delivering

these results.

"Looking forward to fiscal 2025, we expect our

Communications, Infrastructure Solutions and Commercial &

Industrial operating segments to benefit from continued strong

demand, particularly in our data center end markets. In addition,

we see opportunities to provide all of our operating segments with

additional capital to drive further organic growth. Within our

Residential segment, we remain cautious about near-term

single-family housing demand due to housing affordability

challenges and the potential that some buyers may delay home

purchases in anticipation of lower mortgage rates over the next

year. Nevertheless, we expect to continue to grow our Residential

business through further expansion of our plumbing and HVAC

services, and we remain optimistic about long-term demand in the

housing market.”

Our Communications segment’s revenue was

$776.5 million in fiscal 2024, an increase of 29% compared

with fiscal 2023, with increased demand from data center customers

driving the growth. We also continue to see strong demand from

high-tech manufacturing and e-commerce customers. The segment's

operating income increased to $86.9 million for fiscal 2024,

compared with $51.5 million for fiscal 2023, as we benefited

from improved project execution and the impact of improved market

conditions.

Our Residential segment’s revenue was

$1.4 billion in fiscal 2024, an increase of 9% compared with

fiscal 2023, reflecting expansion of our plumbing and HVAC trades,

as well as continued strong demand, particularly in the Florida

single-family housing market, and successful execution of our

multi-family backlog. The Residential segment’s operating income

was $137.3 million for fiscal 2024, an increase of 66%

compared with fiscal 2023. During fiscal 2024, our operating

margins benefited from favorable purchases of certain materials,

improved project execution in our multi-family business, improved

procurement processes and more disciplined project selection. While

we did experience some disruption to our Florida operations as a

result of hurricane Milton in mid-October, we expect only a minor

impact on the Residential segment's Florida revenues in the first

quarter of fiscal 2025.

Our Infrastructure Solutions segment’s revenue was

$351.1 million in fiscal 2024, an increase of 62% compared

with fiscal 2023, primarily driven by continued strong demand in

our custom power solutions business, including generator

enclosures, primarily for the data center end market. Operating

income for fiscal 2024 was $67.5 million, compared with

$29.2 million for fiscal 2023. The year-over-year profit

improvement was driven by higher volumes, improved pricing and

operating efficiencies at our facilities as well as the impact of

investments we have made over the last several years to increase

capacity. Greiner Industries, which we acquired on April 1, 2024,

contributed $34.0 million of revenue and $2.5 million of operating

income for fiscal 2024.

Our Commercial & Industrial segment’s revenue

was $368.0 million in fiscal 2024, compared with

$279.6 million in fiscal 2023. Segment operating income for

fiscal 2024 was $41.4 million, compared with

$19.3 million for fiscal 2023. The increase in revenue and

improved results from fiscal 2023 to 2024 were primarily driven by

strong performance on a large data center project. Results for

fiscal 2023 included a $13.0 million pretax gain from the sale of

our former STR Mechanical business in the first quarter of fiscal

2023. The large data center project mentioned above was

substantially complete as of the end of fiscal 2024. Therefore, we

expect to see a reduction in segment revenue for the first quarter

of fiscal 2025, and that revenue will begin to increase going into

the second quarter, as work ramps up on new projects in

backlog.

Matt Simmes, President and Chief Operating Officer,

commented, “During fiscal 2024, we realized the benefits of

investments we have made over the past few years to build more

robust and scalable platforms for growth. These initiatives include

expanded capacity for our Infrastructure Solutions business, a more

coordinated procurement function across all of our businesses, and

better controls and processes around project selection. We are

pleased to see that these efforts have generated higher margins

across the business. As we enter fiscal 2025, we will continue to

invest in the scalability of the business, and expect to increase

our expenditures on information technology solutions that will

provide better visibility and data for decision making, including

through the ongoing implementation of our new ERP system. We also

expect to make additional investments in human capital management,

as recruiting and retention of a skilled workforce is essential to

continued growth to meet the needs of our customers.”

“We generated operating cash flow of

$234.4 million in fiscal 2024, reflecting improved

profitability and working capital efficiency,” added Tracy

McLauchlin, Chief Financial Officer. “As a result, even after

making significant investments during fiscal 2024, we ended the

year with no debt and a cash balance of $100.8 million,

compared with no debt and a cash balance of $75.8 million at

September 30, 2023. During fiscal 2024, our strong cash flow

generation enabled us to acquire Greiner Industries, invest in

expansion capital expenditures, purchase the 20% retained interest

in Bayonet Plumbing, Heating and Air Conditioning, invest $33

million in marketable securities and repurchase $39 million of our

stock on the open market, while still growing our cash balance. In

fiscal 2025, we expect to continue deploying our capital for

acquisitions, organic expansion of our operations and select

investment opportunities.”

Stock Buyback Plan

On July 31, 2024, the Company’s Board of Directors

authorized and announced a stock repurchase program for purchasing

up to $200 million of our common stock from time to time, which

replaced the Company's previous program. For the year ended

September 30, 2024, the Company repurchased 289,284 shares at an

average price of $136.34 under its previous and current programs

combined. The Company had $198.1 million remaining under its stock

repurchase authorization at September 30, 2024.

Non-GAAP Financial Measures and Other

Adjustments

This press release includes adjusted net income

attributable to IES, adjusted diluted earnings per share

attributable to common stockholders, and backlog, and, in the

non-GAAP reconciliation tables included herein, adjusted net income

attributable to common stockholders, adjusted EBITDA and adjusted

net income before taxes, each of which is a financial measure not

calculated in accordance with generally accepted accounting

principles in the U.S. (“GAAP”). Management believes that these

measures provide useful information to our investors by, in the

case of adjusted net income attributable to common stockholders,

adjusted earnings per share attributable to common stockholders,

adjusted EBITDA and adjusted net income before taxes,

distinguishing certain nonrecurring events such as litigation

settlements, significant expenses associated with leadership

changes, or gains or losses from the sale of a business, or noncash

events, such as impairment charges or our valuation allowances

release and write-down of our deferred tax assets, or, in the case

of backlog, providing a common measurement used in IES's industry,

as described further below, and that these measures, when

reconciled to the most directly comparable GAAP measures, help our

investors to better identify underlying trends in the operations of

our business and facilitate easier comparisons of our financial

performance with prior and future periods and to our peers.

Non-GAAP financial measures should not be considered in isolation

from, or as a substitute for, financial information calculated in

accordance with GAAP. Investors are encouraged to review the

reconciliation of these non-GAAP measures to their most directly

comparable GAAP financial measures, which has been provided in the

financial tables included in this press release.

Remaining performance obligations represent the

unrecognized revenue value of our contract commitments. While

backlog is not a defined term under GAAP, it is a common

measurement used in IES’s industry and IES believes this non-GAAP

measure enables it to more effectively forecast its future results

and better identify future operating trends that may not otherwise

be apparent. IES’s remaining performance obligations are a

component of IES’s backlog calculation, which also includes signed

agreements and letters of intent which we do not have a legal right

to enforce prior to work starting. These arrangements are excluded

from remaining performance obligations until work begins. IES’s

methodology for determining backlog may not be comparable to the

methodologies used by other companies.

For further details on the Company’s financial

results, please refer to the Company’s annual report on Form 10-K

for the fiscal year ended September 30, 2024, to be filed with the

Securities and Exchange Commission ("SEC") by November 22,

2024, and any amendments thereto.

About IES Holdings, Inc.

IES designs and installs integrated electrical and

technology systems and provides infrastructure products and

services to a variety of end markets, including data centers,

residential housing, and commercial and industrial facilities. Our

more than 9,000 employees serve clients in the United States. For

more information about IES, please visit www.ies-co.com.

Company Contact:

Tracy McLauchlinChief Financial OfficerIES

Holdings, Inc.(713) 860-1500

Investor Relations Contact:

Robert Winters or Stephen PoeAlpha IR

Group312-445-2870IESC@alpha-ir.com

Certain statements in this release may be deemed

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934, all of which are based upon various estimates

and assumptions that the Company believes to be reasonable as of

the date hereof. In some cases, you can identify forward-looking

statements by terminology such as “may,” “will,” “could,” “should,”

“expect,” “plan,” “project,” “intend,” “anticipate,” “believe,”

“seek,” “estimate,” “predict,” “potential,” “pursue,” “target,”

“continue,” the negative of such terms or other comparable

terminology. These statements involve risks and uncertainties that

could cause the Company’s actual future outcomes to differ

materially from those set forth in such statements. Such risks and

uncertainties include, but are not limited to, a general reduction

in the demand for our products or services; changes in general

economic conditions, including supply chain constraints, high rates

of inflation, changes in consumer sentiment, elevated interest

rates, and market disruptions resulting from a number of factors,

including geo-political events; competition in the industries in

which we operate, which could result in the loss of one or more

customers or lead to lower margins on new projects; our ability to

successfully manage and execute projects, the cost and availability

of qualified labor and the ability to maintain positive labor

relations, and our ability to pass along increases in the cost of

commodities used in our business; supply chain disruptions due to

our suppliers' access to materials and labor, their ability to ship

products timely, or credit or liquidity problems they may face;

inaccurate estimates used when entering into fixed-price contracts,

the possibility of errors when estimating revenue and progress to

date on percentage-of-completion contracts, and complications

associated with the incorporation of new accounting, control and

operating procedures; our ability to enter into, and the terms of,

future contracts; the existence of a small number of customers from

whom we derive a meaningful portion of our revenues; reliance on

third parties, including subcontractors and suppliers, to complete

our projects; the inability to carry out plans and strategies as

expected, including the inability to identify and complete

acquisitions that meet our investment criteria, or the subsequent

underperformance of those acquisitions; challenges integrating new

businesses into the Company or new types of work, products or

processes into our segments; backlog that may not be realized or

may not result in profits; failure to adequately recover on

contract change orders or claims against customers; closures or

sales of our facilities resulting in significant future charges or

a significant disruption of our operations; the impact of future

epidemics or pandemics on our business; an increased cost of surety

bonds affecting margins on work and the potential for our surety

providers to refuse bonding or require additional collateral at

their discretion; the impact of seasonality, adverse weather

conditions, and climate change; fluctuations in operating activity

due to factors such as cyclicality, downturns in levels of

construction or the housing market, and differing regional economic

conditions; difficulties in managing our billings and collections;

accidents resulting from the physical hazards associated with our

work and the potential for accidents; the possibility that our

current insurance coverage may not be adequate or that we may not

be able to obtain policies at acceptable rates; the effect of

litigation, claims and contingencies, including warranty losses,

damages or other latent defect claims in excess of our existing

reserves and accruals; costs and liabilities under existing or

potential future laws and regulations, including those laws and

regulations related to the environment and climate change, as well

as the inability to transfer, renew and obtain electrical and other

professional licenses; interruptions to our information systems and

cyber security or data breaches; expenditures to conduct

environmental remediation activities required by certain

environmental laws and regulations; loss of key personnel,

ineffective transition of new management, or general labor

constraints; credit and capital market conditions, including

changes in interest rates that affect the cost of construction

financing and mortgages, and the inability of some of our customers

to obtain sufficient financing at acceptable rates, which could

lead to project delays or cancellations; limitations on our ability

to access capital markets and generate cash from operations to fund

our capital needs; the impact on our effective tax rate or cash

paid for taxes from changes in tax positions we have taken or

changes in tax laws; difficulty in fulfilling the covenant terms of

our revolving credit facility, including liquidity, and other

financial requirements, which could result in a default and

acceleration of any indebtedness under such revolving credit

facility; reliance on certain estimates and assumptions that may

differ from actual results in the preparation of our financial

statements; uncertainties inherent in the use of

percentage-of-completion accounting, which could result in the

reduction or elimination of previously recorded revenues and

profits; the recognition of potential goodwill, long-lived assets

and other investment impairments; the existence of a controlling

shareholder, who has the ability to take action not aligned with

other shareholders or to dispose of all or a significant portion of

the shares of our common stock it holds, which may trigger certain

change of control provisions in a number of our material

agreements; the relatively low trading volume of our common stock,

which could increase the volatility of our stock price and could

make it more difficult for shareholders to sell a substantial

number of shares for the same price at which shareholders could

sell a smaller number of shares; the possibility that we issue

additional shares of common stock, preferred stock or convertible

securities that will dilute the percentage ownership interest of

existing stockholders and may dilute the value per share of our

common stock; the potential for substantial sales of our common

stock, which could adversely affect our stock price; the impact of

increasing scrutiny and changing expectations from investors and

customers, or new or changing regulations, with respect to

environmental, social and governance practices; the cost or effort

required for our shareholders to bring certain claims or actions

against us, as a result of our designation of the Court of Chancery

of the State of Delaware as the sole and exclusive forum for

certain types of actions and proceedings; and the possibility that

our internal controls over financial reporting and our disclosure

controls and procedures may not prevent all possible errors that

could occur, as well as other risk factors discussed in this

document, in the Company’s annual report on Form 10-K for the year

ended September 30, 2024 and in the Company’s other reports on file

with the SEC. You should understand that such risk factors could

cause future outcomes to differ materially from those experienced

previously or those expressed in such forward-looking statements.

The Company undertakes no obligation to publicly update or revise

any information or any forward-looking statements to reflect events

or circumstances that may arise after the date of this release.

Forward-looking statements are provided in this

press release pursuant to the safe harbor established under the

Private Securities Litigation Reform Act of 1995 and should be

evaluated in the context of the estimates, assumptions,

uncertainties, and risks described herein.

General information about IES Holdings, Inc. can

be found at http://www.ies-co.com under "Investor Relations." The

Company's annual report on Form 10-K, quarterly reports on Form

10-Q and current reports on Form 8-K, as well as any amendments to

those reports, are available free of charge through the Company's

website as soon as reasonably practicable after they are filed

with, or furnished to, the SEC.

| |

|

|

IES HOLDINGS, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENT OF

OPERATIONS(DOLLARS IN MILLIONS, EXCEPT PER SHARE

DATA)(UNAUDITED) |

| |

|

| |

|

Three Months Ended |

|

Year Ended |

| |

|

September 30, |

|

September 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Revenues |

$ |

775.8 |

|

|

$ |

649.0 |

|

|

$ |

2,884.4 |

|

|

$ |

2,377.2 |

|

|

Cost of services |

|

589.4 |

|

|

|

508.5 |

|

|

|

2,187.8 |

|

|

|

1,932.7 |

|

| |

Gross profit |

|

186.4 |

|

|

|

140.5 |

|

|

|

696.6 |

|

|

|

444.5 |

|

|

Selling, general and administrative expenses |

|

110.9 |

|

|

|

87.2 |

|

|

|

396.7 |

|

|

|

298.6 |

|

|

Contingent consideration |

|

0.6 |

|

|

|

0.1 |

|

|

|

0.7 |

|

|

|

0.3 |

|

|

(Gain) loss on sale of assets |

|

(0.1 |

) |

|

|

0.1 |

|

|

|

(1.7 |

) |

|

|

(14.1 |

) |

| |

Operating income |

|

75.0 |

|

|

|

53.2 |

|

|

|

300.9 |

|

|

|

159.8 |

|

|

Interest expense |

|

0.1 |

|

|

|

0.4 |

|

|

|

1.3 |

|

|

|

3.0 |

|

|

Other income |

|

(5.4 |

) |

|

|

(0.6 |

) |

|

|

(5.1 |

) |

|

|

(1.8 |

) |

| |

Income from operations before income taxes |

|

80.3 |

|

|

|

53.4 |

|

|

|

304.7 |

|

|

|

158.6 |

|

|

Provision for income taxes |

|

14.8 |

|

|

|

12.4 |

|

|

|

72.2 |

|

|

|

38.8 |

|

| |

Net income |

|

65.5 |

|

|

|

41.0 |

|

|

|

232.5 |

|

|

|

119.8 |

|

|

Net income attributable to noncontrolling interest |

|

(2.4 |

) |

|

|

(3.2 |

) |

|

|

(13.4 |

) |

|

|

(11.5 |

) |

| |

Net income attributable to IES Holdings, Inc. |

$ |

63.1 |

|

|

$ |

37.8 |

|

|

$ |

219.1 |

|

|

$ |

108.3 |

|

| |

|

|

|

|

|

|

|

|

|

Computation of earnings per share: |

|

|

|

|

|

|

|

|

Net income attributable to IES Holdings, Inc. |

$ |

63.1 |

|

|

$ |

37.8 |

|

|

$ |

219.1 |

|

|

$ |

108.3 |

|

|

Increase in noncontrolling interest |

|

(1.0 |

) |

|

|

(4.0 |

) |

|

|

(17.1 |

) |

|

|

(15.7 |

) |

|

Net income attributable to common stockholders of IES Holdings,

Inc. |

$ |

62.1 |

|

|

$ |

33.8 |

|

|

$ |

202.0 |

|

|

$ |

92.6 |

|

| |

|

|

|

|

|

|

|

|

|

Earnings per share attributable to common stockholders: |

|

|

|

|

|

|

|

| |

Basic |

$ |

3.10 |

|

|

$ |

1.68 |

|

|

$ |

10.02 |

|

|

$ |

4.58 |

|

| |

Diluted |

$ |

3.06 |

|

|

$ |

1.66 |

|

|

$ |

9.89 |

|

|

$ |

4.54 |

|

| |

|

|

|

|

|

|

|

|

|

Shares used in the computation of earnings per share: |

|

|

|

|

|

|

|

| |

Basic (in thousands) |

|

19,991 |

|

|

|

20,192 |

|

|

|

20,160 |

|

|

|

20,197 |

|

| |

Diluted (in thousands) |

|

20,257 |

|

|

|

20,426 |

|

|

|

20,415 |

|

|

|

20,413 |

|

| |

|

IES HOLDINGS, INC. AND

SUBSIDIARIESNON-GAAP RECONCILIATION OF ADJUSTED

NET INCOME ATTRIBUTABLETO IES HOLDINGS, INC. AND

ADJUSTED EARNINGS PER SHAREATTRIBUTABLE TO COMMON

STOCKHOLDERS(DOLLARS IN MILLIONS, EXCEPT PER SHARE

DATA)(UNAUDITED) |

| |

| |

|

Three Months Ended |

|

Year Ended |

| |

|

September 30, |

|

September 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Net income attributable to IES Holdings, Inc. |

$ |

63.1 |

|

|

$ |

37.8 |

|

|

$ |

219.1 |

|

|

$ |

108.3 |

|

|

Gain on sale of STR Mechanical |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(13.0 |

) |

|

Gain on sale of real estate |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1.0 |

) |

|

Severance expense |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3.6 |

|

|

Provision for income taxes |

|

14.8 |

|

|

|

12.4 |

|

|

|

72.2 |

|

|

|

38.8 |

|

| |

Adjusted income from operations before income taxes |

|

77.9 |

|

|

|

50.1 |

|

|

|

291.3 |

|

|

|

136.6 |

|

|

Adjusted tax expense (1) |

|

(20.3 |

) |

|

|

(10.6 |

) |

|

|

(77.7 |

) |

|

|

(24.7 |

) |

| |

Adjusted net income attributable to IES Holdings, Inc. |

|

57.6 |

|

|

|

39.5 |

|

|

|

213.6 |

|

|

|

111.9 |

|

| |

|

|

|

|

|

|

|

|

| |

Adjustments for computation of earnings per share: |

|

|

|

|

|

|

|

| |

Increase in noncontrolling interest |

|

(1.0 |

) |

|

|

(4.0 |

) |

|

|

(17.1 |

) |

|

|

(15.7 |

) |

| |

Adjusted net income attributable to common stockholders |

$ |

56.6 |

|

|

$ |

35.5 |

|

|

$ |

196.5 |

|

|

$ |

96.2 |

|

| |

|

|

|

|

|

|

|

|

|

Adjusted earnings per share attributable to common

stockholders: |

|

|

|

|

|

|

|

| |

Basic |

$ |

2.83 |

|

|

$ |

1.76 |

|

|

$ |

9.75 |

|

|

$ |

4.76 |

|

| |

Diluted |

$ |

2.79 |

|

|

$ |

1.74 |

|

|

$ |

9.62 |

|

|

$ |

4.71 |

|

| |

|

|

|

|

|

|

|

|

|

Shares used in the computation of earnings per share: |

|

|

|

|

|

|

|

| |

Basic (in thousands) |

|

19,991 |

|

|

|

20,192 |

|

|

|

20,160 |

|

|

|

20,197 |

|

| |

Diluted (in thousands) |

|

20,257 |

|

|

|

20,426 |

|

|

|

20,415 |

|

|

|

20,413 |

|

| |

|

|

|

|

|

|

|

|

|

(1) The year ended September 30, 2024 was adjusted to remove

non-cash tax benefits from the release of reserves for certain

uncertain tax positions upon the lapse of the applicable statutes

of limitations in fiscal 2024. The year ended September 30, 2023

was adjusted to reflect the utilization of tax net operating loss

carryforwards to offset the cash impact of income tax expense. As

our tax net operating loss carryforwards were substantially

utilized in fiscal 2023, there was no such offset to cash taxes in

the year ended September 30, 2024. |

| |

|

IES HOLDINGS, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE

SHEETS(DOLLARS IN

MILLIONS)(UNAUDITED) |

| |

| |

|

|

|

September 30, |

|

September 30, |

|

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

ASSETS |

|

|

|

| |

CURRENT ASSETS: |

|

|

|

| |

|

Cash and cash equivalents |

$ |

100.8 |

|

|

$ |

75.8 |

|

| |

|

Marketable securities |

|

35.0 |

|

|

|

— |

|

| |

|

Accounts receivable: |

|

|

|

| |

|

|

Trade, net of allowance |

|

469.8 |

|

|

|

363.8 |

|

| |

|

|

Retainage |

|

89.8 |

|

|

|

76.9 |

|

| |

|

Inventories |

|

101.7 |

|

|

|

95.7 |

|

| |

|

Costs and estimated earnings in excess of billings |

|

60.2 |

|

|

|

48.6 |

|

| |

|

Prepaid expenses and other current assets |

|

14.4 |

|

|

|

10.5 |

|

| |

Total current assets |

|

871.7 |

|

|

|

671.3 |

|

| |

|

Property and equipment, net |

|

134.2 |

|

|

|

63.4 |

|

| |

|

Goodwill |

|

93.9 |

|

|

|

92.4 |

|

| |

|

Intangible assets, net |

|

45.9 |

|

|

|

56.2 |

|

| |

|

Deferred tax assets |

|

22.4 |

|

|

|

20.4 |

|

| |

|

Operating right of use assets |

|

62.0 |

|

|

|

61.8 |

|

| |

|

Other non-current assets |

|

13.9 |

|

|

|

16.1 |

|

|

Total assets |

$ |

1,244.0 |

|

|

$ |

981.6 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

| |

CURRENT LIABILITIES: |

|

|

|

| |

|

Accounts payable and accrued expenses |

$ |

363.6 |

|

|

$ |

296.8 |

|

| |

|

Billings in excess of costs and estimated earnings |

|

159.0 |

|

|

|

103.8 |

|

| |

Total current liabilities |

|

522.6 |

|

|

|

400.6 |

|

| |

Long-term debt |

|

— |

|

|

|

— |

|

| |

Operating long-term lease liabilities |

|

40.4 |

|

|

|

42.1 |

|

| |

Other tax liabilities |

|

16.7 |

|

|

|

22.0 |

|

| |

Other non-current liabilities |

|

12.2 |

|

|

|

17.0 |

|

|

Total liabilities |

|

591.9 |

|

|

|

481.7 |

|

|

Noncontrolling interest |

|

41.0 |

|

|

|

50.0 |

|

| |

STOCKHOLDERS’ EQUITY: |

|

|

|

| |

|

Preferred stock |

|

— |

|

|

|

— |

|

| |

|

Common stock |

|

0.2 |

|

|

|

0.2 |

|

| |

|

Treasury stock, at cost |

|

(90.3 |

) |

|

|

(49.5 |

) |

| |

|

Additional paid-in capital |

|

203.4 |

|

|

|

203.4 |

|

| |

|

Retained earnings |

|

497.8 |

|

|

|

295.8 |

|

|

Total stockholders’ equity |

|

611.1 |

|

|

|

449.9 |

|

|

Total liabilities and stockholders’ equity |

$ |

1,244.0 |

|

|

$ |

981.6 |

|

| |

|

IES HOLDINGS, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS(DOLLARS IN

MILLIONS)(UNAUDITED) |

| |

| |

|

Year Ended |

| |

|

|

September 30, |

| |

|

|

2024 |

|

|

|

2023 |

|

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

| |

Net income |

$ |

232.5 |

|

|

$ |

119.8 |

|

| |

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

| |

Bad debt expense |

|

1.5 |

|

|

|

(0.1 |

) |

| |

Deferred financing cost amortization |

|

0.3 |

|

|

|

0.3 |

|

| |

Depreciation and amortization |

|

37.1 |

|

|

|

29.4 |

|

| |

Gain on sale of assets |

|

(1.7 |

) |

|

|

(14.1 |

) |

| |

Non-cash compensation expense |

|

5.5 |

|

|

|

4.4 |

|

| |

Deferred income tax expense (benefit) and other non-cash tax

adjustments, net |

|

(1.1 |

) |

|

|

5.2 |

|

|

|

Unrealized loss on trading securities |

|

|

(1.8 |

) |

|

|

— |

|

| |

Changes in operating assets and liabilities: |

|

|

|

| |

Marketable securities |

|

(33.2 |

) |

|

|

— |

|

| |

Accounts receivable |

|

(93.5 |

) |

|

|

2.9 |

|

| |

Inventories |

|

(3.5 |

) |

|

|

(1.1 |

) |

| |

Costs and estimated earnings in excess of billings |

|

(4.0 |

) |

|

|

3.5 |

|

| |

Prepaid expenses and other current assets |

|

(16.7 |

) |

|

|

(7.3 |

) |

| |

Other non-current assets |

|

0.2 |

|

|

|

2.1 |

|

| |

Accounts payable and accrued expenses |

|

57.9 |

|

|

|

(10.0 |

) |

| |

Billings in excess of costs and estimated earnings |

|

54.5 |

|

|

|

19.1 |

|

| |

Other non-current liabilities |

|

0.4 |

|

|

|

0.2 |

|

|

Net cash provided by operating activities |

|

234.4 |

|

|

|

153.9 |

|

|

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

| |

Purchases of property and equipment |

|

(45.2 |

) |

|

|

(17.7 |

) |

| |

Proceeds from sale of assets |

|

3.7 |

|

|

|

20.6 |

|

| |

Cash paid in conjunction with equity investments |

|

(0.4 |

) |

|

|

(0.2 |

) |

| |

Cash paid in conjunction with business combinations, net of cash

acquired |

|

(67.0 |

) |

|

|

— |

|

|

Net cash provided by (used in) investing activities |

|

(108.9 |

) |

|

|

2.8 |

|

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

| |

Borrowings of debt |

|

2,896.3 |

|

|

|

2,381.6 |

|

| |

Repayments of debt |

|

(2,896.3 |

) |

|

|

(2,464.2 |

) |

| |

Cash paid for finance leases |

|

(4.3 |

) |

|

|

(3.3 |

) |

| |

Purchase of noncontrolling interest |

|

(32.0 |

) |

|

|

— |

|

| |

Settlement of contingent consideration liability |

|

(4.0 |

) |

|

|

— |

|

| |

Distribution to noncontrolling interest |

|

(16.2 |

) |

|

|

(11.5 |

) |

| |

Purchase of treasury stock |

|

(44.0 |

) |

|

|

(8.3 |

) |

|

Net cash used in financing activities |

|

(100.5 |

) |

|

|

(105.8 |

) |

|

NET INCREASE IN CASH AND CASH EQUIVALENTS |

|

25.0 |

|

|

|

50.9 |

|

|

CASH and CASH EQUIVALENTS, beginning of period |

|

75.8 |

|

|

|

24.8 |

|

|

CASH and CASH EQUIVALENTS, end of period |

$ |

100.8 |

|

|

$ |

75.8 |

|

| |

|

IES HOLDINGS, INC. AND

SUBSIDIARIESOPERATING SEGMENT STATEMENT OF

OPERATIONS(DOLLARS IN

MILLIONS)(UNAUDITED) |

| |

| |

|

Three Months Ended |

|

Year Ended |

| |

|

September 30, |

|

September 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Revenues |

|

|

|

|

|

|

|

| |

Communications |

$ |

219.9 |

|

|

$ |

170.8 |

|

|

$ |

776.5 |

|

|

$ |

600.8 |

|

| |

Residential |

|

356.1 |

|

|

|

337.3 |

|

|

|

1,388.8 |

|

|

|

1,279.5 |

|

| |

Infrastructure Solutions |

|

110.4 |

|

|

|

58.4 |

|

|

|

351.1 |

|

|

|

217.3 |

|

| |

Commercial &

Industrial |

|

89.4 |

|

|

|

82.5 |

|

|

|

368.0 |

|

|

|

279.6 |

|

|

Total revenue |

$ |

775.8 |

|

|

$ |

649.0 |

|

|

$ |

2,884.4 |

|

|

$ |

2,377.2 |

|

| |

|

|

|

|

|

|

|

|

|

Operating income (loss) |

|

|

|

|

|

|

|

| |

Communications |

$ |

22.6 |

|

|

$ |

16.8 |

|

|

$ |

86.9 |

|

|

$ |

51.5 |

|

| |

Residential (1) |

|

34.8 |

|

|

|

30.2 |

|

|

|

137.3 |

|

|

|

82.9 |

|

| |

Infrastructure Solutions

(2) |

|

20.7 |

|

|

|

8.1 |

|

|

|

67.5 |

|

|

|

29.2 |

|

| |

Commercial & Industrial

(3) |

|

9.7 |

|

|

|

5.3 |

|

|

|

41.4 |

|

|

|

19.3 |

|

| |

Corporate |

|

(12.8 |

) |

|

|

(7.2 |

) |

|

|

(32.2 |

) |

|

|

(23.1 |

) |

|

Total operating income |

$ |

75.0 |

|

|

$ |

53.2 |

|

|

$ |

300.9 |

|

|

$ |

159.8 |

|

|

|

|

(1) Residential's operating income for the year ended September 30,

2023 includes pretax severance expense of $3.6 million. |

|

(2) Infrastructure Solutions' operating income for the year ended

September 30, 2023 includes a pretax gain of $1.0 million related

to the sale of real estate. |

|

(3) Commercial & Industrial's operating income for the year

ended September 30, 2023 includes a pretax gain of $13.0 million

related to the sale of STR Mechanical. |

| |

|

IES HOLDINGS, INC. AND

SUBSIDIARIESNON-GAAP RECONCILIATION OF ADJUSTED

EBITDA(DOLLARS IN

MILLIONS)(UNAUDITED) |

| |

| |

Three Months Ended |

|

Year Ended |

| |

|

September 30, |

|

September 30, |

| |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Net income attributable to IES Holdings, Inc. |

$ |

63.1 |

|

|

$ |

37.8 |

|

|

$ |

219.1 |

|

|

$ |

108.3 |

|

|

Provision for income taxes |

|

14.8 |

|

|

|

12.4 |

|

|

|

72.2 |

|

|

|

38.8 |

|

|

Interest & other (income) expense, net |

|

(5.3 |

) |

|

|

(0.2 |

) |

|

|

(3.8 |

) |

|

|

1.2 |

|

|

Depreciation and amortization |

|

11.1 |

|

|

|

9.3 |

|

|

|

37.1 |

|

|

|

29.4 |

|

|

EBITDA |

$ |

83.7 |

|

|

$ |

59.3 |

|

|

$ |

324.6 |

|

|

$ |

177.7 |

|

|

Gain on sale of STR Mechanical |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(13.0 |

) |

|

Gain on sale of real estate |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1.0 |

) |

|

Non-cash equity compensation expense |

|

1.2 |

|

|

|

1.1 |

|

|

|

5.5 |

|

|

|

4.3 |

|

|

Severance expense |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3.6 |

|

|

Adjusted EBITDA |

$ |

84.9 |

|

|

$ |

60.4 |

|

|

$ |

330.1 |

|

|

$ |

171.6 |

|

| |

|

IES HOLDINGS, INC. AND

SUBSIDIARIESSUPPLEMENTAL REMAINING PERFORMANCE

OBLIGATIONS AND NON-GAAP RECONCILIATION OF BACKLOG

DATA(DOLLARS IN

MILLIONS)(UNAUDITED) |

| |

| |

|

September 30, |

|

June 30, |

|

September 30, |

|

|

|

|

2024 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Remaining performance obligations |

|

$ |

1,176 |

|

|

$ |

1,177 |

|

|

$ |

1,143 |

|

|

Agreements without an enforceable obligation (1) |

|

|

610 |

|

|

|

520 |

|

|

|

415 |

|

|

Backlog |

|

$ |

1,786 |

|

|

$ |

1,697 |

|

|

$ |

1,558 |

|

| |

|

|

|

|

|

|

|

(1) Our backlog contains signed agreements and letters of intent

which we do not have a legal right to enforce prior to work

starting. These arrangements are excluded from remaining

performance obligations until work begins. |

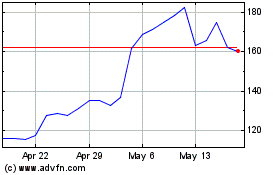

IES (NASDAQ:IESC)

Historical Stock Chart

From Jan 2025 to Feb 2025

IES (NASDAQ:IESC)

Historical Stock Chart

From Feb 2024 to Feb 2025