IES Holdings, Inc. (or “IES” or the “Company”) (NASDAQ: IESC) today

announced that it has amended and restated its existing Credit and

Security Agreement, increasing the commitment amount of the

revolving credit facility to $300 million from $150 million and

extending the maturity date to January 21, 2030 while expanding the

size of the lending group. In addition, the amended credit

agreement transitions the Company to a cash flow-based facility,

enabling increased borrowing capacity compared to the previous

asset-based structure, where availability was limited by eligible

collateral. Wells Fargo Bank, National Association acted as

Administrative Agent, Wells Fargo Securities, LLC acted as Left

Lead Arranger and Joint Bookrunner, and Fifth Third Bank, National

Association acted as Joint Lead Arranger and Joint Bookrunner.

Jeff Gendell, IES’s Chairman and Chief Executive

Officer, said, “We appreciate the confidence that Wells Fargo,

Fifth Third and our new banking partners have shown in IES through

this larger and more flexible credit facility. This facility

strengthens our ability to execute on our capital allocation

strategy by providing us the liquidity and flexibility to pursue

our strategic priorities, including organic growth, acquisitions,

share repurchases and other investment opportunities.”

About IES Holdings, Inc.

IES designs and installs integrated electrical

and technology systems and provides infrastructure products and

services to a variety of end markets, including data centers,

residential housing, and commercial and industrial facilities. Our

more than 9,000 employees serve clients in the United States. For

more information about IES, please visit www.ies-co.com.

Company Contact:

Tracy McLauchlinChief Financial OfficerIES Holdings, Inc.(713)

860-1500

Investor Relations Contact:

Robert Winters or Stephen PoeAlpha IR

Group312-445-2870IESC@alpha-ir.com

Certain statements in this release may be deemed

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934, all of which are based upon various estimates

and assumptions that the Company believes to be reasonable as of

the date hereof. In some cases, you can identify forward-looking

statements by terminology such as “may,” “will,” “could,” “should,”

“expect,” “plan,” “project,” “intend,” “anticipate,” “believe,”

“seek,” “estimate,” “predict,” “potential,” “pursue,” “target,”

“continue,” the negative of such terms or other comparable

terminology. These statements involve risks and uncertainties that

could cause the Company’s actual future outcomes to differ

materially from those set forth in such statements. Such risks and

uncertainties include, but are not limited to, a general reduction

in the demand for our products or services; changes in general

economic conditions, including supply chain constraints, high rates

of inflation, changes in consumer sentiment, elevated interest

rates, and market disruptions resulting from a number of factors,

including geo-political events; competition in the industries in

which we operate, which could result in the loss of one or more

customers or lead to lower margins on new projects; our ability to

successfully manage and execute projects, the cost and availability

of qualified labor and the ability to maintain positive labor

relations, and our ability to pass along increases in the cost of

commodities used in our business; supply chain disruptions due to

our suppliers' access to materials and labor, their ability to ship

products timely, or credit or liquidity problems they may face;

inaccurate estimates used when entering into fixed-price contracts,

the possibility of errors when estimating revenue and progress to

date on percentage-of-completion contracts, and complications

associated with the incorporation of new accounting, control and

operating procedures; our ability to enter into, and the terms of,

future contracts; the existence of a small number of customers from

whom we derive a meaningful portion of our revenues; reliance on

third parties, including subcontractors and suppliers, to complete

our projects; the inability to carry out plans and strategies as

expected, including the inability to identify and complete

acquisitions that meet our investment criteria, or the subsequent

underperformance of those acquisitions; challenges integrating new

businesses into the Company or new types of work, products or

processes into our segments; backlog that may not be realized or

may not result in profits; failure to adequately recover on

contract change orders or claims against customers; closures or

sales of our facilities resulting in significant future charges or

a significant disruption of our operations; the impact of future

epidemics or pandemics on our business; an increased cost of surety

bonds affecting margins on work and the potential for our surety

providers to refuse bonding or require additional collateral at

their discretion; the impact of seasonality, adverse weather

conditions, and climate change; fluctuations in operating activity

due to factors such as cyclicality, downturns in levels of

construction or the housing market, and differing regional economic

conditions; difficulties in managing our billings and collections;

accidents resulting from the physical hazards associated with our

work and the potential for accidents; the possibility that our

current insurance coverage may not be adequate or that we may not

be able to obtain policies at acceptable rates; the effect of

litigation, claims and contingencies, including warranty losses,

damages or other latent defect claims in excess of our existing

reserves and accruals; costs and liabilities under existing or

potential future laws and regulations, including those laws and

regulations related to the environment and climate change, as well

as the inability to transfer, renew and obtain electrical and other

professional licenses; interruptions to our information systems and

cyber security or data breaches; expenditures to conduct

environmental remediation activities required by certain

environmental laws and regulations; loss of key personnel,

ineffective transition of new management, or general labor

constraints; credit and capital market conditions, including

changes in interest rates that affect the cost of construction

financing and mortgages, and the inability of some of our customers

to obtain sufficient financing at acceptable rates, which could

lead to project delays or cancellations; limitations on our ability

to access capital markets and generate cash from operations to fund

our capital needs; the impact on our effective tax rate or cash

paid for taxes from changes in tax positions we have taken or

changes in tax laws; difficulty in fulfilling the covenant terms of

our revolving credit facility, including liquidity, and other

financial requirements, which could result in a default and

acceleration of any indebtedness under such revolving credit

facility; reliance on certain estimates and assumptions that may

differ from actual results in the preparation of our financial

statements; uncertainties inherent in the use of

percentage-of-completion accounting, which could result in the

reduction or elimination of previously recorded revenues and

profits; the recognition of potential goodwill, long-lived assets

and other investment impairments; the existence of a controlling

shareholder, who has the ability to take action not aligned with

other shareholders or to dispose of all or a significant portion of

the shares of our common stock it holds, which may trigger certain

change of control provisions in a number of our material

agreements; the relatively low trading volume of our common stock,

which could increase the volatility of our stock price and could

make it more difficult for shareholders to sell a substantial

number of shares for the same price at which shareholders could

sell a smaller number of shares; the possibility that we issue

additional shares of common stock, preferred stock or convertible

securities that will dilute the percentage ownership interest of

existing stockholders and may dilute the value per share of our

common stock; the potential for substantial sales of our common

stock, which could adversely affect our stock price; the impact of

increasing scrutiny and changing expectations from investors and

customers, or new or changing regulations, with respect to

environmental, social and governance practices; the cost or effort

required for our shareholders to bring certain claims or actions

against us, as a result of our designation of the Court of Chancery

of the State of Delaware as the sole and exclusive forum for

certain types of actions and proceedings; and the possibility that

our internal controls over financial reporting and our disclosure

controls and procedures may not prevent all possible errors that

could occur, as well as other risk factors discussed in the

Company’s annual report on Form 10-K for the year ended September

30, 2024 and in the Company’s other reports on file with the SEC.

You should understand that such risk factors could cause future

outcomes to differ materially from those experienced previously or

those expressed in such forward-looking statements. The Company

undertakes no obligation to publicly update or revise any

information or any forward-looking statements to reflect events or

circumstances that may arise after the date of this release.

Forward-looking statements are provided in this press release

pursuant to the safe harbor established under the Private

Securities Litigation Reform Act of 1995 and should be evaluated in

the context of the estimates, assumptions, uncertainties, and risks

described herein.

General information about IES Holdings, Inc. can be found at

http://www.ies-co.com under "Investor Relations." The Company's

annual report on Form 10-K, quarterly reports on Form 10-Q and

current reports on Form 8-K, as well as any amendments to those

reports, are available free of charge through the Company's website

as soon as reasonably practicable after they are filed with, or

furnished to, the SEC.

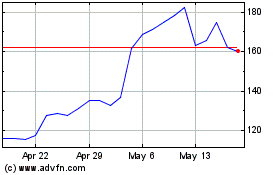

IES (NASDAQ:IESC)

Historical Stock Chart

From Jan 2025 to Feb 2025

IES (NASDAQ:IESC)

Historical Stock Chart

From Feb 2024 to Feb 2025