International General Insurance Holdings Ltd. (“IGI” or the

“Company”) (NASDAQ: IGIC) today reported financial results for the

fourth quarter and full year 2024.

Highlights for the fourth quarter and full year 2024

include:

(in millions of U.S. Dollars, except

percentages and per share information)

Quarter Ended

December 31,

Year Ended

December 31,

2024

2023

2024

2023

Gross written premiums

$174.6

$164.9

$700.1

$688.7

Net premiums earned

$120.6

$114.9

$483.1

$447.2

Underwriting income (1)

$48.8

$43.5

$187.5

$183.1

Net investment income

$13.6

$14.5

$53.9

$50.2

Net income

$30.0

$33.0

$135.2

$118.2

Combined ratio (1)

77.8%

81.8%

79.9%

76.7%

Earnings per share (diluted)

(2)

$0.65

$0.72

$2.98

$2.55

Return on average equity (3)

18.4%

26.1%

22.6%

24.8%

Core operating income (3)

$40.9

$30.0

$144.8

$133.8

Core operating earnings per share

(diluted) (3)

$0.89

$0.65

$3.19

$2.88

Core operating return on average

equity (3)

25.0%

23.7%

24.2%

28.1%

(1)

See “Supplementary Financial Information”

below.

(2)

See “Note to the Consolidated Financial

Statements (Unaudited)” below.

(3)

See the section titled “Non-GAAP Financial

Measures” below.

IGI Group President & CEO Mr. Waleed Jabsheh said, “We

posted strong fourth quarter financial results to round out another

excellent year in 2024. For the full year, we delivered a combined

ratio of 79.9%, and produced record net income and operating

income, leading to a return on average equity of 22.6% and a core

operating return on average equity of 24.2%. Most importantly, we

grew our book value per share by almost 20%.”

“We have a long history of generating value for our shareholders

across market cycles by actively and effectively managing our

capital focusing first on underwriting discipline, intelligent risk

selection and shifting to those lines and markets with the best

risk-adjusted returns and, secondly, by returning excess capital to

shareholders. In 2024, we returned close to $50 million to

shareholders in common share dividends and share repurchases.”

Results for the Periods ended December 31, 2024 and

2023

Net income for the quarter ended December 31, 2024 was $30.0

million compared to $33.0 million for the quarter ended December

31, 2023. Net income for the full year 2024 increased 14.4% to

$135.2 million compared to $118.2 million for the full year 2023.

The fourth quarter and full year for 2024 and 2023 were positively

impacted by underwriting income generated across all segments and

net investment income earned.

Return on average equity (annualized) was 18.4% for the fourth

quarter of 2024, compared to 26.1% for the fourth quarter of 2023

and 22.6% for the full year 2024, compared to 24.8% for the full

year 2023.

Core operating income, a non-GAAP measure, was $40.9 million for

the fourth quarter of 2024, compared to $30.0 million for the same

period in 2023. The core operating return on average equity

(annualized) was 25.0% for the fourth quarter of 2024 compared to

23.7% for the fourth quarter of 2023. Core operating income was

$144.8 million for the year ended December 31, 2024, compared to

$133.8 million for the same period in 2023. The core operating

return on average equity was 24.2% for the full year 2024, compared

to 28.1% for the full year 2023.

Underwriting income increased to $48.8 million for the fourth

quarter of 2024 compared to $43.5 million for the fourth quarter of

2023, primarily due to an increase in net premiums earned.

Underwriting income increased to $187.5 million for the full year

2024 compared to $183.1 million for the full year 2023, with an

increase in net premiums earned partially offset by a higher level

of net loss and loss adjustment expenses.

Gross written premiums increased by 5.9% to $174.6 million in

the quarter ended December 31, 2024, compared to $164.9 million for

the comparable period in 2023. The increase was primarily in the

Reinsurance Segment. Gross written premiums were $700.1 million for

the full year 2024 compared to $688.7 million for the full year

2023. The increase was driven by growth in the Reinsurance and

Short-tail segments, partially offset by a decrease in the

Long-tail Segment.

The loss ratio was 43.0% for the quarter ended December 31,

2024, compared to 47.6% for the same period in 2023. The loss ratio

for the full year 2024 was 44.7% compared to 42.3% for the full

year 2023.

The net policy acquisition expense ratio was 16.6% for the

fourth quarter of 2024 compared to 14.5% for the same quarter of

2023, and 16.5% for the full year 2024, compared to 16.8% for the

full year 2023.

The general & administrative expense ratio was 18.2% for the

fourth quarter of 2024, compared to 19.7% for the same quarter of

2023, and 18.7% for the full year 2024, compared to 17.6% for the

full year 2023. General and administrative expenses for the fourth

quarter of 2024 were $22.0 million compared to $22.6 million for

the same quarter of 2023 and increased to $90.4 million for the

full year 2024 from $78.9 million for the full year 2023. This

increase was largely driven by higher human resources costs in line

with the Company’s growth.

The combined ratio was 77.8% for the fourth quarter of 2024,

compared to 81.8% for the fourth quarter of 2023, and 79.9% for the

full year 2024, compared to 76.7% for the full year 2023.

Segment Results

The Specialty Short-tail Segment, which represented 59%

of the Company’s gross written premiums for the year ended December

31, 2024, generated gross written premiums of $106.2 million for

the fourth quarter of 2024, compared to $105.2 million for the

fourth quarter of 2023. Net premiums earned were $62.4 million for

the fourth quarter of 2024, compared to $62.5 million for the same

quarter of 2023. Underwriting income was $21.0 million for the

fourth quarter of 2024, compared to $27.2 million for the same

quarter of 2023, with the decrease primarily driven by a higher

level of net loss and loss adjustment expenses during the fourth

quarter of 2024, compared to the same period in 2023.

Gross written premiums for the full year 2024 were $412.3

million, an increase of 2.9% compared to $400.7 million for the

full year 2023. Net premiums earned for the full year 2024 were

$256.0 million, an increase of 8.4% compared to $236.2 million for

the full year 2023. Underwriting income was $112.2 million for the

full year 2024, an increase of 4.8% compared to $107.1 million for

the full year 2023, primarily due to a higher level of net premiums

earned, partially offset by a higher level of net loss and loss

adjustment expenses for the full year 2024 compared to 2023.

The Specialty Long-tail Segment, which represented

29% of the Company’s gross written premiums for the year ended

December 31, 2024, recorded gross written premiums of $63.6 million

for the fourth quarter of 2024, compared to $64.6 million for the

fourth quarter of 2023. Net premiums earned for the quarter ended

December 31, 2024 were $35.8 million, a decrease of 4.8% compared

to $37.6 million for the same quarter of 2023. This segment

recorded an underwriting income of $14.3 million in the fourth

quarter of 2024, compared to $7.0 million in the fourth quarter of

2023, largely due to a lower level of net loss and loss adjustment

expenses for the fourth quarter of 2024 compared to the same period

in 2023.

Gross written premiums for the full year 2024 were $204.4

million, a decrease of 9.9% compared to $226.9 million for the full

year 2023. Net premiums earned for the year ended December 31, 2024

were $146.3 million, a decrease of 7.3% compared to $157.8 million

for the full year 2023, primarily as a result of the lower level of

gross written premiums. Underwriting income was $39.5 million for

the full year 2024, a decrease of 31.2% compared to $57.4 million

for the full year 2023, primarily due to a lower level of net

premiums earned and a higher level of net loss and loss adjustment

expenses for the full year 2024 compared to 2023.

The Reinsurance Segment, which represented 12% of the

Company’s gross written premiums for the year ended December 31,

2024, recorded gross written premiums of $4.8 million compared to

negative $4.9 million for the fourth quarter of 2023 which was

impacted by prior period premium adjustments. Net premiums earned

for the quarter ended December 31, 2024 were $22.4 million, an

increase of $7.6 million compared to $14.8 million for the same

quarter in 2023. Underwriting income increased to $13.5 million for

the fourth quarter of 2024, compared to $9.3 million for the fourth

quarter of 2023, primarily the result of the higher level of net

premiums earned, partially offset by a higher level of net loss and

loss adjustment expenses, and net policy acquisition expenses,

during the fourth quarter of 2024.

Gross written premiums for the full year 2024 were $83.4

million, an increase of 36.5% compared to $61.1 million for the

full year 2023. Net premiums earned for the full year 2024 were

$80.8 million, an increase of 51.9% compared to $53.2 million for

the full year 2023, primarily as a result of the higher level of

gross written premiums. Underwriting income increased to $35.8

million for the full year 2024, compared to $18.6 million for the

full year 2023, primarily due to a higher level of net premiums

earned partially offset by a higher level of net loss and loss

adjustment expenses and net policy acquisition expenses for the

full year 2024 compared to 2023.

Investment Results

Investment income increased by 19.8% to $13.9 million in the

fourth quarter of 2024, compared to the fourth quarter of 2023,

driven by higher yields on a larger fixed income portfolio. The

annualized investment yield on average total investments and cash

and cash equivalents was 4.4% for the fourth quarter of 2024, up

from 4.3% in the corresponding period of 2023. Net investment

income was $13.6 million for the fourth quarter of 2024, compared

to $14.5 million for the fourth quarter of 2023.

Investment income increased 28.5% to $51.9 million for the full

year 2024 as compared to $40.4 million for the full year 2023 for

the same reasons described above. This represented an investment

yield of 4.3% for the full year 2024, compared to a 3.9% investment

yield for the full year 2023. Net investment income increased to

$53.9 million for the full year 2024, compared to $50.2 million for

the full year 2023.

Net Foreign Exchange (Loss) Gain

The net foreign exchange loss for the fourth quarter of 2024 was

$12.9 million, compared to a gain of $8.5 million for the fourth

quarter of 2023, both of which primarily represent currency

revaluation movements. The fourth quarter of 2024 experienced a

negative currency movement in the Company’s major transactional

currencies (mainly the UK Pound Sterling and the Euro) against the

U.S. Dollar, compared to positive currency movement for the fourth

quarter of 2023.

The net foreign exchange loss for the full year of 2024 was $8.1

million, compared to a gain of $5.1 million for the full year of

2023.

Change in Fair Value of Derivative Financial

Liabilities

The change in fair value of derivative financial liabilities for

the fourth quarter of 2024 was $nil compared to $6.7 million for

the same quarter of 2023 and was $4.9 million for the full year

2024 compared to $27.3 million for the full year 2023. These

changes were driven by the final tranche of earnout shares that

vested during the third quarter of 2024.

Income tax

For the fourth quarter and full year of 2024, an income tax

credit of $4.3 million and $2.8 million, respectively was recorded

compared to an income tax expense of $1.6 million and $7.8 million

for the fourth quarter and full year of 2023, respectively. This

change from an expense to a credit was largely driven by deferred

tax assets recognized in 2024 with respect to two subsidiaries.

Total Shareholders’ Equity

Total shareholders’ equity at December 31, 2024 was $654.8

million, compared to $540.5 million at December 31, 2023. The

movement in total shareholders’ equity during the quarter and year

ended December 31, 2024 is illustrated below:

(in millions of U.S. Dollars)

Quarter Ended December

31, 2024

Year Ended December 31,

2024

Total Shareholders’ equity at beginning

of period

$651.6

$540.5

Net income

$30.0

$135.2

Unrealized (losses) gains on

available-for-sale investments

($21.8

)

$2.0

Change in foreign currency translation

reserve

($0.1

)

-

Purchase of treasury shares (a)

($4.9

)

($23.2

)

Issuance of common shares under

share-based compensation plan

$1.2

$4.6

Vesting of earnout shares

-

$22.2

Cash dividends declared

($1.2

)

($26.5

)

Total shareholders’ equity at December

31, 2024

$654.8

$654.8

Book value per share was $14.85 at

December 31, 2024, reflecting growth of 19.8% over book value per

share of $12.40 at December 31, 2023.

(a)

In the fourth quarter of 2024, the Company

repurchased approximately 220,354 common shares at an average price

per share of $22.37. During the full year of 2024, the Company

repurchased 1,476,621 common shares at an average price per share

of $15.68. At December 31, 2024, the Company had approximately 2.3

million common shares remaining under its existing 7.5 million

common share repurchase authorization.

International General Insurance Holdings Ltd.

Consolidated Statements of Income (Unaudited)

Quarter Ended December

31,

Year Ended December

31,

(in millions of U.S. Dollars except per

share data)

2024

2023

2024

2023

Gross written premiums

$174.6

$164.9

$700.1

$688.7

Ceded written premiums

($56.0

)

($49.3

)

($210.6

)

($191.5

)

Net written premiums

$118.6

$115.6

$489.5

$497.2

Net change in unearned premiums

$2.0

($0.7

)

($6.4

)

($50.0

)

Net premiums earned

$120.6

$114.9

$483.1

$447.2

Investment income

$13.9

$11.6

$51.9

$40.4

Net realized gain on investments

$0.4

$2.0

$0.6

$6.7

Net unrealized (loss) gain on

investments

($0.8

)

$0.6

$1.4

$2.7

Change in allowance for expected credit

losses on investments

$0.1

$0.3

-

$0.4

Net investment income

$13.6

$14.5

$53.9

$50.2

Other revenues

$1.0

$0.1

$2.0

$1.9

Total revenues

$135.2

$129.5

$539.0

$499.3

Expenses

Net loss and loss adjustment expenses

($51.8

)

($54.7

)

($216.1

)

($189.1

)

Net policy acquisition expenses

($20.0

)

($16.7

)

($79.5

)

($75.0

)

General and administrative expenses

($22.0

)

($22.6

)

($90.4

)

($78.9

)

Change in allowance for expected credit

losses on receivables

$0.3

($2.0

)

($1.5

)

($2.5

)

Change in fair value of derivative

financial liabilities (1)

-

($6.7

)

($4.9

)

($27.3

)

Other expenses

($3.1

)

($0.7

)

($6.1

)

($5.6

)

Net Foreign exchange (loss) gain

($12.9

)

$8.5

($8.1

)

$5.1

Total expenses

($109.5

)

($94.9

)

($406.6

)

($373.3

)

Income before income taxes

$25.7

$34.6

$132.4

$126.0

Income tax credit (expense)

$4.3

($1.6

)

$2.8

($7.8

)

Net income for the period

$30.0

$33.0

$135.2

$118.2

Diluted earnings per share attributable

to equity holders (2)

$0.65

$0.72

$2.98

$2.55

(1)

The change in fair value of derivative

financial liabilities has been reclassified from Total revenues for

the prior year to conform to the current presentation.

(2)

See “Note to the Consolidated Financial

Statements (Unaudited)”.

International General Insurance Holdings Ltd.

Consolidated Balance Sheets (Unaudited)

(in millions of U.S. Dollars)

As at December 31,

2024

As at December 31,

2023

ASSETS

Investments

Fixed maturity securities

available-for-sale, at fair value

$1,002.1

$765.6

Fixed maturity securities held to

maturity

$2.0

$2.0

Equity securities, at fair value

$29.0

$26.2

Other investments, at fair value

$12.3

$11.1

Short-term investments

$89.5

$42.2

Term deposits

$0.7

$105.1

Equity-method investments measured at fair

value

$1.9

$3.5

Total investments

$1,137.5

$955.7

Cash and cash equivalents

$155.2

$177.0

Accrued investment income

$15.3

$11.5

Premiums receivable

$256.0

$245.2

Reinsurance recoverables

$225.7

$223.1

Ceded unearned premiums

$113.3

$98.0

Deferred policy acquisition costs, net of

ceding commissions

$67.1

$65.3

Deferred tax assets, net

$7.0

$4.1

Other assets

$60.5

$58.0

TOTAL ASSETS

$2,037.6

$1,837.9

LIABILITIES

Reserve for unpaid loss and loss

adjustment expenses

$794.2

$712.1

Unearned premiums

$465.3

$443.5

Insurance and reinsurance payables

$90.1

$89.7

Other liabilities

$33.2

$34.8

Derivative financial liability

-

$17.3

TOTAL LIABILITIES

$1,382.8

$1,297.4

SHAREHOLDERS’ EQUITY

Common shares at par value

$0.5

$0.4

Additional paid-in capital

$144.9

$137.6

Treasury shares

($3.7

)

-

Accumulated other comprehensive loss, net

of taxes

($18.6

)

($20.6

)

Retained earnings

$531.7

$423.1

TOTAL SHAREHOLDERS’ EQUITY

$654.8

$540.5

TOTAL LIABILITIES AND SHAREHOLDERS’

EQUITY

$2,037.6

$1,837.9

International General Insurance Holdings Ltd.

Supplementary Financial Information – Combined Ratio

(Unaudited)

Quarter Ended

December 31,

Year Ended

December 31,

2024

2023

2024

2023

Loss ratio (a)

43.0%

47.6%

44.7%

42.3%

Net policy acquisition expense ratio

(b)

16.6%

14.5%

16.5%

16.8%

General and administrative expense ratio

(c)

18.2%

19.7%

18.7%

17.6%

Expense ratio (d)

34.8%

34.2%

35.2%

34.4%

Combined ratio (e)

77.8%

81.8%

79.9%

76.7%

(a)

Represents net loss and loss adjustment

expenses as a percentage of net premiums earned.

(b)

Represents net policy acquisition expenses

as a percentage of net premiums earned.

(c)

Represents general and administrative

expenses as a percentage of net premiums earned.

(d)

Represents the sum of the net policy

acquisition expense ratio and the general and administrative

expense ratio.

(e)

Represents the sum of the loss ratio and

the expense ratio.

International General Insurance Holdings Ltd.

Supplementary Financial Information – Book Value per Share

(Unaudited)

(in millions of U.S. Dollars, except share

and per share data)

As at December 31,

2024

As at December 31,

2023

Common shares outstanding (in

millions)*

45.1

46.1

Minus: Unvested shares (in millions)**

1.0

2.5

Number of vested common outstanding

shares (in millions) (a)

44.1

43.6

Total shareholders’ equity (b)

$654.8

$540.5

Book value per share (b)/(a)

$14.85

$12.40

* Common shares issued and outstanding as at December 31, 2024

are as follows:

No. of shares as at

December 31, 2024

Vested common shares as of December 31,

2023

43,584,549

Treasury shares balance as of December 31,

2023

3,800

Vested restricted share awards

397,293

Vested earnout shares

1,612,500

Cancelled treasury shares

(1,326,410)

Treasury shares balance as of December 31,

2024

(154,011)

Total vested common shares as of

December 31, 2024

44,117,721

Unvested restricted share awards as of

December 31, 2024

991,215

Total common shares outstanding as of

December 31, 2024

45,108,936

** 3,012,500 Earnout Shares were

originally subject to vesting at stock prices ranging from $11.50

to $15.25, and were entitled to dividends and voting rights, but

were non-transferable by their holders until they vested. As of

December 31, 2024, the vesting conditions attached to Earnout

Shares have been met for all tranches totaling 3,012,500 shares,

and these shares are now included in the weighted average number of

common shares outstanding for the calculation of diluted earnings

per share. Restricted Share Awards were issued pursuant to the

Company’s 2020 Omnibus Incentive Plan and beneficiaries are

entitled to dividends and voting rights. However, the Restricted

Share Awards are non-transferable by their holders until they vest

per the respective Restricted Share Award Agreements. At December

31, 2024, the vesting conditions attached to the unvested

Restricted Share Awards to employees have not been met.

International General Insurance Holdings Ltd.

Supplementary Financial Information - Segment Results

(Unaudited) Segment information for IGI’s consolidated

operations is as follows:

For the quarter ended December 31,

2024

(in millions of U.S. Dollars)

Specialty Long-tail

Specialty Short-tail

Reinsurance

Total

Underwriting revenues

Gross written premiums

$63.6

$106.2

$4.8

$174.6

Ceded written premiums

($27.9)

($28.1)

-

($56.0)

Net written premiums

$35.7

$78.1

$4.8

$118.6

Net change in unearned premiums

$0.1

($15.7)

$17.6

$2.0

Net premiums earned

$35.8

$62.4

$22.4

$120.6

Net loss and loss adjustment expenses

($14.5)

($31.4)

($5.9)

($51.8)

Net policy acquisition expenses

($7.0)

($10.0)

($3.0)

($20.0)

Underwriting income

$14.3

$21.0

$13.5

$48.8

For the quarter ended December 31,

2023

(in millions of U.S. Dollars)

Specialty Long-tail

Specialty Short-tail

Reinsurance

Total

Underwriting revenues

Gross written premiums

$64.6

$105.2

($4.9)

$164.9

Ceded written premiums

($28.0)

($21.3)

-

($49.3)

Net written premiums

$36.6

$83.9

($4.9)

$115.6

Net change in unearned premiums

$1.0

($21.4)

$19.7

($0.7)

Net premiums earned

$37.6

$62.5

$14.8

$114.9

Net loss and loss adjustment expenses

($24.1)

($26.7)

($3.9)

($54.7)

Net policy acquisition expenses

($6.5)

($8.6)

($1.6)

($16.7)

Underwriting income

$7.0

$27.2

$9.3

$43.5

International General Insurance Holdings Ltd.

Supplementary Financial Information - Segment Results

(Unaudited)

For the Year ended December 31,

2024

(in millions of U.S. Dollars)

Specialty Long-tail

Specialty Short-tail

Reinsurance

Total

Underwriting revenues

Gross written premiums

$204.4

$412.3

$83.4

$700.1

Ceded written premiums

($68.2)

($140.9)

($1.5)

($210.6)

Net written premiums

$136.2

$271.4

$81.9

$489.5

Net change in unearned premiums

$10.1

($15.4)

($1.1)

($6.4)

Net premiums earned

$146.3

$256.0

$80.8

$483.1

Net loss and loss adjustment expenses

($78.7)

($103.3)

($34.1)

($216.1)

Net policy acquisition expenses

($28.1)

($40.5)

($10.9)

($79.5)

Underwriting income

$39.5

$112.2

$35.8

$187.5

For the Year ended December 31,

2023

(in millions of U.S. Dollars)

Specialty Long-tail

Specialty Short-tail

Reinsurance

Total

Underwriting revenues

Gross written premiums

$226.9

$400.7

$61.1

$688.7

Ceded written premiums

($73.9)

($117.6)

-

($191.5)

Net written premiums

$153.0

$283.1

$61.1

$497.2

Net change in unearned premiums

$4.8

($46.9)

($7.9)

($50.0)

Net premiums earned

$157.8

$236.2

$53.2

$447.2

Net loss and loss adjustment expenses

($69.2)

($93.1)

($26.8)

($189.1)

Net policy acquisition expenses

($31.2)

($36.0)

($7.8)

($75.0)

Underwriting income

$57.4

$107.1

$18.6

$183.1

International General Insurance Holdings Ltd.

Supplementary Financial Information – Investment Yield

(Unaudited)

The following table shows the investment yield calculation:

Quarter Ended

December 31,

Year Ended

December 31,

(in millions of U.S. Dollars, except

percentages)

2024

2023

2024

2023

Investment income

$13.9

$11.6

$51.9

$40.4

Average total investments and cash and

cash equivalents(i)

$1,287.9

$1,076.3

$1,215.2

$1,029.1

Investment Yield (annualized)

4.4%

4.3%

4.3%

3.9%

(i)

This represents the average of the month

end fair value balances of total investments and cash and cash

equivalents in each reporting period.

International General Insurance Holdings Ltd. Note to

the Consolidated Financial Statements (Unaudited)

(1) Represents net income for the period available to common

shareholders divided by the weighted average number of vested

common shares – diluted calculated as follows:

Quarter Ended

December 31,

Year Ended

December 31,

(in millions of U.S. Dollars, except share

and per share information)

2024

2023

2024

2023

Net income for the period

$30.0

$33.0

$135.2

$118.2

Minus: Net income attributable to the

earnout shares

-

$2.0

$1.4

$7.4

Minus: Dividends attributable to

restricted share awards

-

-

$0.6

-

Net income available to common

shareholders (a)

$30.0

$31.0

$133.2

$110.8

Weighted average number of shares –

diluted (in millions of shares) (b)*

46.2

43.1

44.7

43.5

Diluted earnings per share attributable

to equity holders (a/b)

$0.65

$0.72

$2.98

$2.55

* The weighted average number of common

shares refers to the number of common shares calculated after

adjusting for the changes in issued and outstanding common shares

over a reporting period.

International General Insurance Holdings Ltd. Non-GAAP

Financial Measures

In presenting IGI’s financial results, management has included

and discussed certain non-GAAP financial measures. We believe that

these non-GAAP measures, which may be defined and calculated

differently by other companies, help to explain and enhance the

understanding of our results of operations. However, these measures

should not be viewed as a substitute for those determined in

accordance with U.S. GAAP.

Reconciliation of Combined Ratio to Accident Year Combined

Ratio Prior to CAT Losses

The table below illustrates the reconciliation of the combined

ratio on a financial and accident year basis.

Quarter Ended

December 31,

Year Ended

December 31,

(In millions of U.S. Dollars, except

percentages)

2024

2023

2024

2023

Net premiums earned (a)

$120.6

$114.9

$483.1

$447.2

Net loss and loss adjustment expenses

(b)

($51.8)

($54.7)

($216.1)

($189.1)

Net policy acquisition expenses (c)

($20.0)

($16.7)

($79.5)

($75.0)

General and administrative expenses

(d)

($22.0)

($22.6)

($90.4)

($78.9)

Prior years unfavorable (favorable)

development (e)

($2.8)

$3.3

($37.2)

($39.3)

Current accident year catastrophe (“CAT”)

losses (f)*

$7.2

$9.5

$44.6

$38.3

Combined ratio ((b+c+d)/a)**

77.8%

81.8%

79.9%

76.7%

Minus: Prior years unfavorable (favorable)

development (e/a)

(2.3%)

2.9%

(7.7%)

(8.8%)

Accident year combined ratio

80.1%

78.9%

87.6%

85.5%

Minus: CAT losses on an accident year

basis (f/a)

6.0%

8.3%

9.2%

8.6%

Accident year combined ratio prior to

CAT losses

74.1%

70.6%

78.4%

76.9%

*The CAT losses for the quarter ended

December 31, 2024 are primarily attributable to $6.7 million of

combined reserves recorded for Hurricane Helene in the southeastern

United States (in the Short-tail and Reinsurance Segments) and

flooding in the United Arab Emirates, Oman and the United Kingdom

(in the Short-tail and Reinsurance Segments).

The CAT losses for the quarter ended

December 31, 2023 are primarily attributable to $6.9 million of

combined losses recorded for the earthquake in Turkey (in the

Reinsurance Segment), flash floods in India, Hurricane Otis in

Mexico and the Hawaii Wildfires (all in the Short-tail

Segment).

The CAT losses for the year ended December

31, 2024 are primarily attributable to $18.0 million of reserves

recorded for the earthquake in Taiwan (in the Short-tail and

Reinsurance segments) and flooding in the United Arab Emirates,

Oman, Southern Germany and Morocco (in all segments), Hurricane

Helene in the southeastern United States (in the Short-tail and

Reinsurance Segments) and a general CAT reserve of $13.9

million.

The CAT losses for the year ended December

31, 2023 are primarily attributable to $21.0 million of combined

losses recorded for the earthquake in Turkey (in the Reinsurance

Segment), flooding in New Zealand from Cyclone Gabrielle, flash

floods in India, Hurricane Otis in Mexico, adverse weather

conditions in Oman and the Hawaii Wildfires (all in the Short-tail

Segment), and a general CAT reserve of $9.0 million.

** See “Supplementary Financial

Information - Combined Ratio (Unaudited)”

International General Insurance Holdings Ltd. Non-GAAP

Financial Measures

The table below illustrates the split of loss ratio between

current accident year, current year CAT losses, which are included

in ‘Net loss and loss adjustment expenses’, and prior years’ loss

development as follows:

Quarter Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

(in millions of U.S. Dollars, except

percentages)

Net loss and loss adjustment

expenses

% of net premiums earned

Net loss and loss adjustment

expenses

% of net premiums earned

Net loss and loss adjustment

expenses

% of net premiums earned

Net loss and loss adjustment

expenses

% of net premiums earned

Current year net incurred claims and loss

ratio

$51.8

43.0%

$54.7

47.6%

$216.1

44.7%

$189.1

42.3%

Minus: Current accident year CAT

losses

$7.2

6.0%

$9.5

8.3%

$44.6

9.2%

$38.3

8.6%

Minus: Effect of prior years’

development

($2.8)

(2.3%)

$3.3

2.9%

($37.2)

(7.7%)

($39.3)

(8.8%)

Current Accident year (Prior to CAT

losses)

$47.4

39.3%

$41.9

36.4%

$208.7

43.2%

$190.1

42.5%

Core Operating Income

Core operating income measures the performance of our operations

without the influence of after-tax gains or losses on investments

and foreign currencies and other items as noted in the table below.

We exclude these items from our calculation of core operating

income because the amounts of these gains and losses are heavily

influenced by, and fluctuate in part according to, economic and

other factors external to the Company and/or transactions or events

that are typically not a recurring part of, and are largely

independent of, our core underwriting activities and including them

distorts the analysis of trends in our operations. We believe the

reporting of core operating income enhances an understanding of our

results by highlighting the underlying profitability of our core

insurance operations. Our underwriting profitability is impacted by

earned premiums, the adequacy of pricing, and the frequency and

severity of losses. Over time, such profitability is also

influenced by underwriting discipline, which seeks to manage the

Company’s exposure to loss through favorable risk selection and

diversification, IGI’s management of claims, use of reinsurance and

the ability to manage the expense ratio, which the Company

accomplishes through the management of acquisition costs and other

underwriting expenses.

In addition to presenting net income for the period determined

in accordance with U.S. GAAP, we believe that showing “core

operating income” provides investors with a valuable measure of

profitability and enables investors, rating agencies and other

users of our financial information to analyze the Company’s results

in a similar manner to the way in which Management analyzes the

Company’s underlying business performance.

International General Insurance Holdings Ltd. Non-GAAP

Financial Measures

Core operating income is calculated by the addition or

subtraction of certain line items reported in the “Consolidated

Statements of Income” from net income for the period and tax

effecting each line item (resulting in each item being a non-GAAP

measure), as illustrated in the table below:

Quarter Ended

December 31,

Year Ended

December 31,

(in millions of U.S. Dollars, except for

percentages and per share data)

2024

2023

2024

2023

Net income for the period

$30.0

$33.0

$135.2

$118.2

Reconciling items between net income for

the period and core operating income:

Net realized gain on investments

($0.4)

($2.0)

($0.6)

($6.7)

Net unrealized loss (gain) on

investments

$0.8

($0.6)

($1.4)

($2.7)

Tax impact of net unrealized loss (gain)

on investments(i)

($0.1)

$0.1

-

$0.1

Change in allowance for expected credit

losses on investments

($0.1)

($0.3)

-

($0.4)

Tax impact of change in allowance for

expected credit losses on investments(i)

$0.1

$0.1

-

-

Change in fair value of derivative

financial liabilities

-

$6.7

$4.9

$27.3

Expense related to conversion of warrants

into cash(ii)

-

($0.1)

-

$1.9

Net foreign exchange loss (gain)

$12.9

($8.5)

$8.1

($5.1)

Tax impact of net foreign exchange loss

(gain)(i)

($2.3)

$1.6

($1.4)

$1.2

Core operating income

$40.9

$30.0

$144.8

$133.8

Average shareholders’ equity (iii)

$653.2

$505.3

$597.6

$475.7

Core operating return on average equity

(annualized) (iv) and (vi)

25.0%

23.7%

24.2%

28.1%

Diluted core operating earnings per share

(v)

$0.89

$0.65

$3.19

$2.88

Return on average equity (annualized)

(vi)

18.4%

26.1%

22.6%

24.8%

i.

The tax impact was calculated by applying

the prevailing corporate tax rate of each subsidiary to the gross

value of the relevant reconciling items as recognized separately by

the subsidiaries on a standalone basis.

ii.

This expense is included in the ‘Other

expenses’ line item in the condensed consolidated statements of

income.

iii.

Represents the total shareholders’ equity

at the end of the reporting period plus the total shareholders’

equity as of the beginning of the reporting period, divided by

2.

iv.

Represents annualized core operating

income for the period divided by average shareholders’ equity.

v.

Represents core operating income

attributable to vested equity holders divided by the weighted

average number of vested common shares – diluted as follows:

Quarter Ended

December 31,

Year Ended

December 31,

(in millions of U.S. Dollars, except per

share information)

2024

2023

2024

2023

Core operating income for the period

$40.9

$30.0

$144.8

$133.8

Minus: Core operating income attributable

to earnout shares

-

$1.8

$1.5

$8.5

Minus: Dividends attributable to

restricted share awards

-

-

$0.6

-

Core operating income available to

common shareholders (a)

$40.9

$28.2

$142.7

$125.3

Weighted average number of shares –

diluted (in millions of shares) (b)

46.2

43.1

44.7

43.5

Diluted core operating earnings per

share (a/b)

$0.89

$0.65

$3.19

$2.88

vi.

Return on average equity (annualized) and

core operating return on average equity (annualized), both non-GAAP

financial measures, represent the returns generated on common

shareholders’ equity during the period.

The Company has posted a Fourth Quarter 2024 investor

presentation deck on its website at www.iginsure.com in the

Investors section under the Presentations & Webcasts tab.

About IGI:

IGI is an international specialty risks commercial insurer and

reinsurer underwriting a diverse portfolio of specialty lines.

Established in 2001, IGI has a worldwide portfolio of energy,

property, general aviation, construction & engineering, ports

& terminals, marine cargo, marine trades, contingency,

political violence, financial institutions, general third-party

liability (casualty), legal expenses, professional indemnity,

D&O, marine liability and reinsurance treaty business.

Registered in Bermuda, with operations in Bermuda, London, Malta,

Dubai, Amman, Oslo, Kuala Lumpur and Casablanca, IGI aims to

deliver outstanding levels of service to clients and brokers. IGI

is rated “A” (Excellent)/Stable by AM Best and “A-”(Strong)/Stable

by S&P Global Ratings. For more information about IGI, please

visit www.iginsure.com.

Forward-Looking Statements:

This press release contains “forward-looking statements” within

the meaning of the “safe harbour” provisions of the Private

Securities Litigation Reform Act of 1995. The expectations,

estimates, and projections of the business of IGI may differ from

its actual results and, consequently, you should not rely on

forward-looking statements as predictions of future events. Words

such as “expect,” “estimate,” “project,” “budget,” “forecast,”

“anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,”

“believe,” “predict,” “potential,” “continue,” “commitment,”

“able,” “success” and similar expressions are intended to identify

such forward-looking statements. Forward-looking statements

contained in this press release may include, but are not limited

to, our expectations regarding the performance of our business, our

financial results, our liquidity and capital resources, the outcome

of our strategic initiatives, our expectations regarding other

market conditions, and our growth prospects. These forward-looking

statements involve significant risks and uncertainties that could

cause the actual results to differ materially from the expected

results. Most of these factors are outside of the control of IGI

and are difficult to predict. Factors that may cause such

differences include, but are not limited to: (1) changes in demand

for IGI’s services together with the possibility that IGI may be

adversely affected by other economic, business, and/or competitive

factors globally and in the regions in which it operates; (2)

competition, the ability of IGI to grow and manage growth

profitably, and IGI’s ability to retain its key employees; (3)

changes in applicable laws or regulations; (4) risks related to

fluctuations in global currencies including the UK Pound Sterling,

the Euro, and the U.S. Dollar; (5) the outcome of any legal

proceedings that may be instituted against the Company; (6) the

effects of the war between Russia and Ukraine; (7) the effects of

the hostilities between Israel, Hamas, Hezbollah, and Iran; (8) the

inability to maintain the listing of the Company’s common shares on

Nasdaq; and (9) other risks and uncertainties indicated in IGI’s

filings with the SEC. The foregoing list of factors is not

exclusive. In addition, forward-looking statements are inherently

based on various estimates and assumptions that are subject to the

judgment of those preparing them and are also subject to

significant economic, competitive, industry and other uncertainties

and contingencies, all of which are difficult or impossible to

predict and many of which are beyond the control of IGI. There can

be no assurance that IGI’s financial condition or results of

operations will be consistent with those set forth in such

forward-looking statements. You should not place undue reliance

upon any forward-looking statements, which speak only as of the

date made. IGI does not undertake or accept any obligation or

undertaking to release publicly any updates or revisions to any

forward-looking statements to reflect any change in its

expectations or any change in events, conditions, or circumstances

on which any such statement is based except to the extent that is

required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250225822479/en/

IGI Contacts: Investors: Robin Sidders, Head of Investor

Relations M: + 44 (0) 7384 514785 Email:

robin.sidders@iginsure.com

Media: Aaida Abu Jaber, AVP PR & Marketing T:

+96265662082 Ext. 407 M: +962770415540 Email:

aaida.abujaber@iginsure.com

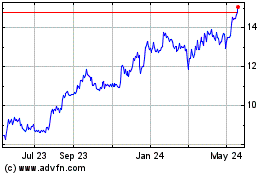

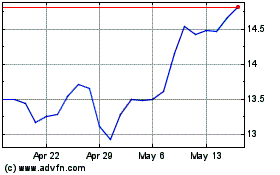

International General In... (NASDAQ:IGIC)

Historical Stock Chart

From Feb 2025 to Mar 2025

International General In... (NASDAQ:IGIC)

Historical Stock Chart

From Mar 2024 to Mar 2025