IMPERIAL PETROLEUM INC. (NASDAQ: IMPP, the “Company”), a

ship-owning company providing petroleum products, crude oil and dry

bulk seaborne transportation services, announced today its

unaudited financial and operating results for the third quarter and

nine months ended September 30, 2024.

OPERATIONAL AND FINANCIAL

HIGHLIGHTS

- Fleet operational utilization of

65.6% in Q3 24’ versus 70.5% in Q3 23’.

- Increased idle time in Q3 24’

compared to the same period of last year mainly due to seasonal

factors, the drydocking of a product tanker and the minor incident

of one of our product tankers which, remained off hire for the

whole of Q3 24’.

- Spot activity in Q3 24’ in the

order of 65.7%, reduced compared to previous quarter, due to a rise

in tanker time charter activity.

- Revenues of $33.0 million in Q3 24’

compared to $29.4 million in Q3 23’ equivalent to a 12.2%

increase.

- Net income of $10.1 million in Q3

24’ compared to $12.1 million in Q3 23’.

- Adjusted net income of $10.9

million in Q3 24’ versus $4.5 million in Q3 23’ up by $6.4 million

or 142.2%.

- Cash and cash equivalents including

time deposits slightly below $200 million as of September 30, 2024

versus $126 million as of September 30, 2023- equivalent to a 58.7%

rise.

- For the 9M 24’ period our total net

income was $46.2 million while our operating cash flows amounted to

$68.0 million.

Third Quarter 2024 Results:

-

Revenues for the three months ended September 30, 2024 amounted to

$33.0 million, an increase of $3.6 million, or 12.2%, compared to

revenues of $29.4 million for the three months ended September 30,

2023, primarily due to an increase in voyage days by 19.5% (145

days) attributed mainly to the increase of our average number of

vessels by 1.27 vessels along with improved revenue stemming from

product tankers as three product tankers underwent drydocking in Q3

23’.

-

Voyage expenses and vessels’ operating expenses for the three

months ended September 30, 2024 were $13.0 million and $7.2

million, respectively, compared to $12.6 million and $6.1 million,

respectively, for the three months ended September 30, 2023. The

$0.4 million increase in voyage expenses is mainly attributed to

the increase in bunkers consumption due to increase in spot days by

11.3% and to expenses incurred in connection with the EU Emission

Allowances (EUAs) in order to meet our obligation arising from the

CO2 emissions as a result of the new EU regulations entered into

force starting from January 1, 2024. The increase was partially

offset by the decrease in port expenses due to change in trade

routes and therefore, decreased transit through the Suez Canal. The

$1.1 million increase in vessels’ operating expenses was primarily

due to the increased size of our fleet by an average of 1.27

vessels.

-

Drydocking costs for the three months ended September 30, 2024 and

2023 were $0.9 million and $2.8 million, respectively. This

decrease is due to the fact that during the three months ended

September 30, 2024, one of our product tankers underwent drydocking

while in the same period of last year three of our product tankers

underwent drydocking.

-

General and administrative costs for the three months ended

September 30, 2024 and 2023 were $1.2 million and $1.3 million,

respectively.

-

Depreciation for the three months ended September 30, 2024 and 2023

was $4.3 million and $3.5 million, respectively. The change is

attributable to the increase in the average number of our

vessels.

-

Management fees for the three months ended September 30, 2024 and

2023 were $0.4 million.

- Net gain on sale of vessel for the

three months ended September 30, 2024 and 2023 were nil and $8.2

million, respectively. In the three months ended September 30,

2023, the net gain on sale of vessel was related to the sale of the

Aframax tanker Afrapearl II (ex. Stealth Berana) to C3is Inc., a

related party.

-

Interest income for the three months ended September 30, 2024 was

$2.3 million as compared to $1.7 million for the three months ended

September 30, 2023. The $0.6 million increase is mainly attributed

to a higher amount of funds placed under time deposits.

-

Foreign exchange (loss)/gain for the three months ended September

30, 2024 was $1.7 million gain as compared to $0.8 million loss for

the three months ended September 30, 2023. The $2.5 million

increase in gain is mainly attributed to fluctuations in exchange

rates in key currencies mainly from funds placed under time

deposits on foreign currency.

- As a result of the above, for the

three months ended September 30, 2024, the Company reported net

income of $10.1 million, compared to net income of $12.1 million

for the three months ended September 30, 2023. Dividends paid on

Series A Preferred Shares amounted to $0.4 million for the three

months ended September 30, 2024. The weighted average number of

shares of common stock outstanding, basic, for the three months

ended September 30, 2024 was 31.4 million. Earnings per share,

basic and diluted, for the three months ended September 30, 2024

amounted to $0.29 and $0.27, respectively, compared to earnings per

share, basic and diluted, of $0.56 and $0.43, respectively, for the

three months ended September 30, 2023.

- Adjusted net income1 was $10.9

million corresponding to an Adjusted EPS1, basic of $0.32 for the

three months ended September 30, 2024 compared to an Adjusted net

income of $4.5 million corresponding to an Adjusted EPS, basic, of

$0.19 for the same period of last year.

- EBITDA1 for the three months ended

September 30, 2024 amounted to $12.2 million, while Adjusted

EBITDA1 for the three months ended September 30, 2024 amounted to

$13.0 million.

-

An average of 10.4 vessels were owned by the Company during the

three months ended September 30, 2024 compared to 9.1 vessels for

the same period of 2023.

Nine months 2024 Results:

-

Revenues for the nine months ended September 30, 2024 amounted to

$121.3 million, a decrease of $32.5 million, or 21.1%, compared to

revenues of $153.8 million for the nine months ended September 30,

2023, primarily due to a year to date decline of daily spot market

rates of suezmax tankers by approximately 18% and the seasonal

weakening of tanker market rates following the end of the first

half of 2024.

-

Voyage expenses and vessels’ operating expenses for the nine months

ended September 30, 2024 were $43.6 million and $19.7 million,

respectively, compared to $48.7 million and $20.0 million,

respectively, for the nine months ended September 30, 2023. The

$5.1 million decrease in voyage expenses is mainly attributed to

the decreased port expenses by approximately $3.9 million due to

decreased transit through the Suez Canal and decreased voyage

commissions by approximately $1.1 million due to the lower

revenues. The $0.3 million decrease in vessels’ operating expenses

was primarily due to the slight decrease in the average number of

vessels.

-

Drydocking costs for the nine months ended September 30, 2024 and

2023 were $1.5 million and $4.1 million, respectively. This

decrease is due to the fact that during the nine months ended

September 30, 2024 two tanker vessels underwent drydocking while in

the same period of last year three of our product tankers and one

of our drybulk carriers underwent drydocking.

-

General and administrative costs for the nine months ended

September 30, 2024 and 2023 were $3.9 million and $3.8 million,

respectively.

-

Depreciation for the nine months ended September 30, 2024 was $12.5

million, a $0.4 million increase from $12.1 million for the same

period of last year, due to the higher carrying amount of our newly

acquired vessels.

-

Management fees for the nine months ended September 30, 2024 and

2023 were $1.2 million.

-

Other operating income for the nine months ended September 30, 2024

was $1.9 million and related to the collection of an insurance

claim in connection with repairs undertaken in prior years.

- Net loss on sale of vessel/ Net

gain on sale of vessel - related party for the nine months ended

September 30, 2024 was $1.6 million and related to the sale of the

Aframax tanker Gstaad Grace II to a third party whereas net gain on

sale of vessel for the nine months ended September 30, 2023 was

$8.2 million and related to the sale of the Aframax tanker

Afrapearl II (ex. Stealth Berana) to C3is Inc., a related

party.

-

Impairment loss for the nine months period ended September 30, 2024

and 2023 stood at nil and $9.0 million, and related to the spin-off

of two drybulk carriers to C3is Inc. The decline of drybulk

vessels’ fair values, at the time of the spin off, compared to one

year before when these vessels were acquired resulted in the

incurrence of impairment loss.

- Interest and finance costs for the

nine months ended September 30, 2024 and 2023 were $0.1 million and

$1.8 million, respectively. The $0.1 million of costs for the nine

months ended September 30, 2024 relate mainly to the accrued

interest expense – related party, in connection with the $14.0

million, part of the acquisition price of our bulk carrier,

Neptulus, which is payable by May 2025. The $1.8 million of costs

for the nine months ended September 30, 2023 related mainly to $1.3

million of interest charges incurred up to the full repayment of

all outstanding loans concluded in April 2023 along with the full

amortization of $0.5 million of loan related charges following the

repayment of the Company’s outstanding debt.

-

Interest income for the nine months ended September 30, 2024 and

2023 was $6.0 million and $3.8 million, respectively. The increase

is mainly attributed to the interest earned from the time deposits

held by the Company as well as the $1.6 million interest income –

related party for the nine months ended September 30, 2024 in

connection with the $38.7 million of the sale price of the Aframax

tanker Afrapearl II (ex. Stealth Berana) which was received in July

2024. For the nine months ended September 30, 2023, the accrued

interest income – related party amounted to $0.6 million.

-

As a result of the above, the Company reported net income for the

nine months ended September 30, 2024 of $46.2 million, compared to

a net income of $64.7 million for the nine months ended September

30, 2023. The weighted average number of shares outstanding, basic,

for the nine months ended September 30, 2024 was 29.0 million.

Earnings per share, basic and diluted, for the nine months ended

September 30, 2024 amounted to $1.47 and $1.32, respectively,

compared to earnings per share, basic and diluted, of $3.59 and

$3.05 for the nine months ended September 30, 2023.

- Adjusted Net Income was $50.6

million corresponding to an Adjusted EPS, basic of $1.61 for the

nine months ended September 30, 2024 compared to adjusted net

income of $67.2 million, or $3.74 Adjusted EPS, basic, for the same

period of last year.

- EBITDA for the nine months ended

September 30, 2024 amounted to $52.9 million while Adjusted EBITDA

for the nine months ended September 30, 2024 amounted to $57.2

million.

-

An average of 10.2 vessels were owned by the Company during the

nine months ended September 30, 2024 compared to 10.3 vessels for

the same period of 2023.

-

As of September 30, 2024, cash and cash equivalents including time

deposits amounted to $199.2 million and total debt amounted to

nil.

1 EBITDA, Adjusted EBITDA, Adjusted Net Income

and Adjusted EPS are non-GAAP measures. Refer to the reconciliation

of these measures to the most directly comparable financial measure

in accordance with GAAP set forth later in this release.

Reconciliations of Adjusted Net Income, EBITDA and Adjusted EBITDA

to Net Income are set forth below.

Fleet Employment Table

As of December 2, 2024, the profile and

deployment of our fleet is the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

YearBuilt |

|

CountryBuilt |

|

Vessel Size(dwt) |

|

VesselType |

|

EmploymentStatus |

|

Expiration ofCharter(1) |

|

|

Tankers(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Magic Wand |

|

2008 |

|

Korea |

|

47,000 |

|

MR product tanker |

|

Spot |

|

|

|

Clean Thrasher |

|

2008 |

|

Korea |

|

47,000 |

|

MR product tanker |

|

Time Charter |

|

January 2025 |

|

Clean Sanctuary (ex. Falcon Maryam) |

|

2009 |

|

Korea |

|

46,000 |

|

MR product tanker |

|

Spot |

|

|

|

Clean Nirvana |

|

2008 |

|

Korea |

|

50,000 |

|

MR product tanker |

|

Spot |

|

|

|

Clean Justice |

|

2011 |

|

Japan |

|

46,000 |

|

MR product tanker |

|

Time Charter |

|

August 2027 |

|

Aquadisiac |

|

2008 |

|

Korea |

|

51,000 |

|

MR product tanker |

|

Spot |

|

|

|

Suez Enchanted |

|

2007 |

|

Korea |

|

160,000 |

|

Suezmax tanker |

|

Spot |

|

|

|

Suez Protopia |

|

2008 |

|

Korea |

|

160,000 |

|

Suezmax tanker |

|

Spot |

|

|

|

Drybulk Carriers(3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Eco Wildfire |

|

2013 |

|

Japan |

|

33,000 |

|

Handysize drybulk |

|

Time Charter |

|

December 2024 |

|

Glorieuse |

|

2012 |

|

Japan |

|

38,000 |

|

Handysize drybulk |

|

Time Charter |

|

December 2024 |

|

Neptulus |

|

2012 |

|

Japan |

|

33,000 |

|

Handysize drybulk |

|

Time Charter |

|

December 2024 |

|

Fleet Total |

|

|

|

|

|

711,000 dwt |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Earliest date charters could expire.(2) We have contracted

to acquire a product tanker, with approximately 40,000 dwt

capacity, which is expected to be delivered to us in the first

quarter of 2025.(3) We have contracted to acquire seven Japanese

built drybulk carriers, aggregating approximately 443,000 dwt,

which are expected to be delivered to us between January 2025 and

May 2025.

CEO, Harry Vafias,

commented:

“In spite of an unexciting and seasonally weak

quarter, Imperial Petroleum was yet again profitable. Our adjusted

net income this quarter was up 141% compared to Q3 23 and our cash

increased by 58.7% compared to the end of the same quarter last

year. Since the beginning of the year we have generated a net

profit of close to $46 million with a fleet of about 10 vessels.

Apart from our ongoing profitability, our financial strength is

shown by our cash of about $200 million in conjunction with zero

leverage. Market was volatile and weak during Q3 24’and it still

remains an unknown how future geopolitical tensions will affect the

tanker and broader shipping market overall.”

Conference Call details:

On December 2, 2024 at 10:00 am ET, the

company’s management will host a conference call to discuss the

results and the company’s operations and outlook.

Online Registration:

Conference call participants should pre-register

using the below link to receive the dial-in numbers and a personal

PIN, which are required to access the conference call.

https://register.vevent.com/register/BI58bf738ae0ac4adfb87e3222819503a9

Slides and audio webcast:

There will also be a live and then archived

webcast of the conference call, through the IMPERIAL PETROLEUM INC.

website (www.ImperialPetro.com). Participants to the live webcast

should register on the website approximately 10 minutes prior to

the start of the webcast.

About IMPERIAL PETROLEUM

INC.

IMPERIAL PETROLEUM INC. is a ship-owning company

providing petroleum products, crude oil and drybulk seaborne

transportation services. The Company owns a total of eleven vessels

on the water - six M.R. product tankers, two suezmax tankers and

three handysize drybulk carriers - with a total capacity of 711,000

deadweight tons (dwt), and has contracted to acquire an additional

40,000 dwt M.R. product tanker and an additional seven drybulk

carriers of 443,000 dwt aggregate capacity. Following these

deliveries the Company’s fleet will count a total of 19 vessels.

IMPERIAL PETROLEUM INC.’s shares of common stock and 8.75% Series A

Cumulative Redeemable Perpetual Preferred Stock are listed on the

Nasdaq Capital Market and trade under the symbols “IMPP” and

“IMPPP,” respectively.

Forward-Looking Statements

Matters discussed in this release may constitute

forward-looking statements. Forward-looking statements reflect our

current views with respect to future events and financial

performance and may include statements concerning plans,

objectives, goals, strategies, future events or performance, and

underlying assumptions and other statements, which are other than

statements of historical facts. The forward-looking statements in

this release are based upon various assumptions, many of which are

based, in turn, upon further assumptions, including without

limitation, management’s examination of historical operating

trends, data contained in our records and other data available from

third parties. Although IMPERIAL PETROLEUM INC. believes that these

assumptions were reasonable when made, because these assumptions

are inherently subject to significant uncertainties and

contingencies which are difficult or impossible to predict and are

beyond our control, IMPERIAL PETROLEUM INC. cannot assure you that

it will achieve or accomplish these expectations, beliefs or

projections. Important factors that, in our view, could cause

actual results to differ materially from those discussed in the

forward-looking statements include the strength of world economies

and currencies, general market conditions, including changes in

charter hire rates and vessel values, charter counterparty

performance, changes in demand that may affect attitudes of time

charterers to scheduled and unscheduled drydockings, shipyard

performance, changes in IMPERIAL PETROLEUM INC’s operating

expenses, including bunker prices, drydocking and insurance costs,

ability to obtain financing and comply with covenants in our

financing arrangements, actions taken by regulatory authorities,

potential liability from pending or future litigation, domestic and

international political conditions, the conflict in Ukraine and

related sanctions, the conflict in Israel and Gaza, potential

disruption of shipping routes due to ongoing attacks by Houthis in

the Red Sea and Gulf of Aden or accidents and political

events or acts by terrorists.

Risks and uncertainties are further described in

reports filed by IMPERIAL PETROLEUM INC. with the U.S. Securities

and Exchange Commission.

Fleet List and Fleet

Deployment

For information on our fleet and further

information:Visit our website at www.ImperialPetro.com

Company Contact:

Fenia SakellarisIMPERIAL PETROLEUM INC.E-mail:

info@ImperialPetro.com

Fleet Data:

The following key indicators highlight the

Company’s operating performance during the periods ended September

30, 2023 and September 30, 2024.

|

FLEET DATA |

Q3 2023 |

Q3 2024 |

9M 2023 |

9M 2024 |

| Average number of vessels (1) |

9.14 |

10.41 |

10.34 |

10.18 |

| Period end

number of owned vessels in fleet |

9 |

11 |

9 |

11 |

| Total

calendar days for fleet (2) |

841 |

958 |

2,822 |

2,789 |

| Total voyage

days for fleet (3) |

745 |

890 |

2,692 |

2,690 |

| Fleet

utilization (4) |

88.6% |

92.9% |

95.4% |

96.5% |

| Total

charter days for fleet (5) |

180 |

261 |

898 |

646 |

| Total spot

market days for fleet (6) |

565 |

629 |

1,794 |

2,044 |

| Fleet

operational utilization (7) |

70.5% |

65.6% |

77.0% |

75.5% |

| |

|

|

|

|

1) Average number of vessels is the number of

owned vessels that constituted our fleet for the relevant period,

as measured by the sum of the number of days each vessel was a part

of our fleet during the period divided by the number of calendar

days in that period.2) Total calendar days for fleet are the total

days the vessels we operated were in our possession for the

relevant period including off-hire days associated with major

repairs, drydockings or special or intermediate surveys.3) Total

voyage days for fleet reflect the total days the vessels we

operated were in our possession for the relevant period net of

off-hire days associated with major repairs, drydockings or special

or intermediate surveys.4) Fleet utilization is the percentage of

time that our vessels were available for revenue generating voyage

days, and is determined by dividing voyage days by fleet calendar

days for the relevant period.5) Total charter days for fleet are

the number of voyage days the vessels operated on time or bareboat

charters for the relevant period.6) Total spot market charter days

for fleet are the number of voyage days the vessels operated on

spot market charters for the relevant period.7) Fleet operational

utilization is the percentage of time that our vessels generated

revenue, and is determined by dividing voyage days excluding

commercially idle days by fleet calendar days for the relevant

period.

Reconciliation of Adjusted Net Income,

EBITDA, adjusted EBITDA and adjusted

EPS:

Adjusted net income represents net income before

impairment loss, net (gain)/loss on sale of vessel and share based

compensation. EBITDA represents net income before interest and

finance costs, interest income and depreciation. Adjusted EBITDA

represents net income before interest and finance costs, interest

income, depreciation, impairment loss, net (gain)/loss on sale of

vessel and share based compensation.

Adjusted EPS represents Adjusted net income

attributable to common shareholders divided by the weighted average

number of shares. EBITDA, adjusted EBITDA, adjusted net income and

adjusted EPS are not recognized measurements under U.S. GAAP. Our

calculation of EBITDA, adjusted EBITDA, adjusted net income and

adjusted EPS may not be comparable to that reported by other

companies in the shipping or other industries. In evaluating

Adjusted EBITDA, Adjusted net income and Adjusted EPS, you should

be aware that in the future we may incur expenses that are the same

as or similar to some of the adjustments in this presentation.

EBITDA, adjusted EBITDA, adjusted net income and

adjusted EPS are included herein because they are a basis, upon

which we and our investors assess our financial performance. They

allow us to present our performance from period to period on a

comparable basis and provide investors with a means of better

evaluating and understanding our operating performance.

|

(Expressed in United States Dollars,

except number of shares) |

Third Quarter Ended September 30th, |

Nine months Period Ended September 30th, |

|

|

2023 |

2024 |

2023 |

2024 |

| Net Income - Adjusted

Net Income |

|

|

|

|

| Net

income |

12,119,472 |

10,061,069 |

64,670,059 |

46,240,111 |

| Less/Plus net (gain)/loss on

sale of vessel |

(8,182,777) |

-- |

(8,182,777) |

1,589,702 |

| Plus impairment loss |

-- |

-- |

8,996,023 |

-- |

| Plus share based

compensation |

591,259 |

836,648 |

1,682,448 |

2,732,020 |

| Adjusted Net

Income |

4,527,954 |

10,897,717 |

67,165,753 |

50,561,833 |

|

|

|

|

|

|

| Net income –

EBITDA |

|

|

|

|

| Net

income |

12,119,472 |

10,061,069 |

64,670,059 |

46,240,111 |

| Plus interest and finance

costs |

-- |

113,471 |

1,810,769 |

121,698 |

| Less interest income |

(1,697,999) |

(2,262,938) |

(3,829,145) |

(6,036,542) |

| Plus depreciation |

3,453,982 |

4,290,384 |

12,144,043 |

12,525,453 |

| EBITDA |

13,875,455 |

12,201,986 |

74,795,726 |

52,850,720 |

|

|

|

|

|

|

| Net income - Adjusted

EBITDA |

|

|

|

|

| Net income |

12,119,472 |

10,061,069 |

64,670,059 |

46,240,111 |

| Less/Plus net (gain)/loss on

sale of vessel |

(8,182,777) |

-- |

(8,182,777) |

1,589,702 |

| Plus impairment loss |

-- |

-- |

8,996,023 |

-- |

| Plus share based

compensation |

591,259 |

836,648 |

1,682,448 |

2,732,020 |

| Plus interest and finance

costs |

-- |

113,471 |

1,810,769 |

121,698 |

| Less interest income |

(1,697,999) |

(2,262,938) |

(3,829,145) |

(6,036,542) |

| Plus depreciation |

3,453,982 |

4,290,384 |

12,144,043 |

12,525,453 |

| Adjusted

EBITDA |

6,283,937 |

13,038,634 |

77,291,420 |

57,172,442 |

|

|

|

|

|

|

| EPS |

|

|

|

|

|

Numerator |

|

|

|

|

| Net income |

12,119,472 |

10,061,069 |

64,670,059 |

46,240,111 |

| Less: Cumulative dividends on

preferred shares |

(612,538) |

(435,245) |

(1,668,029) |

(1,305,737) |

| Less: Undistributed earnings

allocated to non-vested shares |

(462,091) |

(437,903) |

(2,159,357) |

(2,353,108) |

| Net income attributable to

common shareholders, basic |

11,044,843 |

9,187,921 |

60,842,673 |

42,581,266 |

|

Denominator |

|

|

|

|

| Weighted average number of

shares |

19,754,613 |

31,383,953 |

16,928,482 |

28,995,256 |

| EPS -

Basic |

0.56 |

0.29 |

3.59 |

1.47 |

| |

|

|

|

|

| Adjusted

EPS |

|

|

|

|

|

Numerator |

|

|

|

|

| Adjusted net income |

4,527,954 |

10,897,717 |

67,165,753 |

50,561,833 |

| Less: Cumulative dividends on

preferred shares |

(612,538) |

(435,245) |

(1,668,029) |

(1,305,737) |

| Less: Undistributed earnings

allocated to non-vested shares |

(157,234) |

(475,965) |

(2,244,895) |

(2,579,426) |

| Adjusted net income

attributable to common shareholders, basic |

3,758,182 |

9,986,507 |

63,252,829 |

46,676,670 |

|

|

|

|

|

|

|

Denominator |

|

|

|

|

| Weighted average number of

shares |

19,754,613 |

31,383,953 |

16,928,482 |

28,995,256 |

| Adjusted EPS,

Basic |

0.19 |

0.32 |

3.74 |

1.61 |

| |

|

|

|

|

|

Imperial Petroleum Inc.Unaudited

Consolidated Statements of Income(Expressed in

United States Dollars, except for number of

shares) |

|

|

|

Quarters Ended September 30, |

|

Nine month Periods Ended September 30, |

|

|

|

2023 |

|

2024 |

|

2023 |

|

2024 |

|

|

|

|

|

|

|

|

Revenues |

|

|

|

|

|

|

|

| |

Revenues |

29,378,684 |

|

33,023,153 |

|

153,844,006 |

|

121,268,315 |

|

|

|

|

|

|

|

|

|

|

|

Expenses |

|

|

|

|

|

|

|

| |

Voyage expenses |

12,206,039 |

|

12,558,037 |

|

46,806,284 |

|

42,046,339 |

|

|

Voyage expenses - related

party |

358,645 |

|

415,715 |

|

1,905,444 |

|

1,518,099 |

| |

Vessels' operating

expenses |

5,993,408 |

|

7,142,040 |

|

19,754,593 |

|

19,482,856 |

|

|

Vessels' operating expenses -

related party |

74,750 |

|

79,000 |

|

229,083 |

|

238,500 |

| |

Drydocking costs |

2,778,264 |

|

870,486 |

|

4,096,574 |

|

1,495,943 |

|

|

Management fees – related

party |

370,480 |

|

421,520 |

|

1,242,120 |

|

1,227,160 |

| |

General and administrative

expenses |

1,294,943 |

|

1,215,921 |

|

3,761,348 |

|

3,899,293 |

|

|

Depreciation |

3,453,982 |

|

4,290,384 |

|

12,144,043 |

|

12,525,453 |

|

|

Other operating income |

-- |

|

-- |

|

-- |

|

(1,900,000) |

| |

Impairment loss |

-- |

|

-- |

|

8,996,023 |

|

-- |

| |

Net loss on sale of

vessel |

-- |

|

-- |

|

-- |

|

1,589,702 |

| |

Net gain on sale of vessel –

related party |

(8,182,777) |

|

-- |

|

(8,182,777) |

|

-- |

|

Total expenses |

18,347,734 |

|

26,993,103 |

|

90,752,735 |

|

82,123,345 |

| |

|

|

|

|

|

|

|

|

|

Income from operations |

11,030,950 |

|

6,030,050 |

|

63,091,271 |

|

39,144,970 |

|

|

|

|

|

|

|

|

|

|

| Other

(expenses)/income |

|

|

|

|

|

|

|

| |

Interest and finance

costs |

-- |

|

(4,534) |

|

(1,810,769) |

|

(12,761) |

| |

Interest expense – related

party |

-- |

|

(108,937) |

|

-- |

|

(108,937) |

|

|

Interest income |

1,078,279 |

|

2,142,734 |

|

3,209,425 |

|

4,399,902 |

|

|

Interest income – related

party |

619,720 |

|

120,204 |

|

619,720 |

|

1,636,640 |

| |

Dividend income from related

party |

191,667 |

|

191,666 |

|

212,500 |

|

570,833 |

|

|

Foreign exchange

(loss)/gain |

(801,144) |

|

1,689,886 |

|

(652,088) |

|

609,464 |

|

Other income, net |

1,088,522 |

|

4,031,019 |

|

1,578,788 |

|

7,095,141 |

|

|

|

|

|

|

|

|

|

|

|

Net Income |

12,119,472 |

|

10,061,069 |

|

64,670,059 |

|

46,240,111 |

|

|

|

|

|

|

|

|

|

|

| Earnings

per share |

|

|

|

|

|

|

|

| - Basic |

0.56 |

|

0.29 |

|

3.59 |

|

1.47 |

| - Diluted |

0.43 |

|

0.27 |

|

3.05 |

|

1.32 |

|

|

|

|

|

|

|

|

|

|

| Weighted

average number of shares |

|

|

|

|

|

|

|

| -Basic |

19,754,613 |

|

31,383,953 |

|

16,928,482 |

|

28,995,256 |

| -Diluted |

26,506,177 |

|

34,263,264 |

|

20,181,126 |

|

32,435,279 |

|

|

|

|

|

|

|

|

|

|

|

Imperial Petroleum Inc.Unaudited

Consolidated Balance Sheets(Expressed in United

States Dollars) |

|

|

|

|

|

|

December 31, |

|

September 30, |

|

|

|

|

|

|

2023 |

|

2024 |

|

|

|

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

| Current

assets |

|

|

|

|

|

| |

Cash and cash

equivalents |

|

91,927,512 |

|

167,148,589 |

|

|

Time deposits |

|

|

32,099,810 |

|

32,021,300 |

|

|

Receivables from

related parties |

|

37,906,821 |

|

-- |

| |

Trade and other

receivables |

|

13,498,813 |

|

12,488,735 |

|

|

Other current

assets |

|

|

302,773 |

|

96,026 |

| |

Inventories |

|

|

7,291,123 |

|

6,693,024 |

|

|

Advances and

prepayments |

|

161,937 |

|

289,162 |

|

Total current assets |

|

|

183,188,789 |

|

218,736,836 |

|

|

|

|

|

|

|

|

|

| Non

current assets |

|

|

|

|

|

| |

Operating lease

right-of-use asset |

|

-- |

|

96,317 |

|

|

Vessels, net |

|

|

180,847,252 |

|

212,696,467 |

| |

Investment in

related party |

|

12,798,500 |

|

12,798,500 |

|

Total non current assets |

|

|

193,645,752 |

|

225,591,284 |

|

Total assets |

|

|

|

376,834,541 |

|

444,328,120 |

|

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders' Equity |

|

|

|

|

| Current

liabilities |

|

|

|

|

|

| |

Trade accounts

payable |

|

8,277,118 |

|

5,619,766 |

|

|

Payable to related

parties |

|

2,324,334 |

|

17,940,113 |

| |

Accrued

liabilities |

|

|

3,008,500 |

|

3,630,476 |

|

|

Operating lease

liability, current portion |

|

-- |

|

72,704 |

| |

Deferred

income |

|

|

919,116 |

|

974,079 |

|

Total current liabilities |

|

|

14,529,068 |

|

28,237,138 |

|

|

|

|

|

|

|

|

|

| Non

current liabilities |

|

|

|

|

|

| |

Operating lease

liability, non-current portion |

|

|

-- |

|

23,613 |

|

Total non current liabilities |

|

-- |

|

23,613 |

|

Total liabilities |

|

|

14,529,068 |

|

28,260,751 |

|

|

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' equity |

|

|

|

|

|

| |

Common stock |

|

|

332,573 |

|

379,786 |

| |

Preferred Stock,

Series A |

|

7,959 |

|

7,959 |

|

|

Preferred Stock,

Series B |

|

160 |

|

160 |

|

|

Treasury

stock |

|

(5,885,727) |

|

(8,390,225) |

| |

Additional paid-in

capital |

|

270,242,635 |

|

281,527,442 |

|

|

Retained

earnings |

|

|

97,607,873 |

|

142,542,247 |

|

Total stockholders' equity |

|

|

362,305,473 |

|

416,067,369 |

|

Total liabilities and stockholders' equity |

|

376,834,541 |

|

444,328,120 |

|

|

|

|

|

|

|

Imperial Petroleum Inc.Unaudited

Consolidated Statements of Cash Flows(Expressed in

United States Dollars |

|

|

|

Nine month Periods Ended September 30, |

|

|

|

2023 |

|

2024 |

|

|

|

|

| Cash flows

from operating activities |

|

|

|

| |

Net income for the

period |

64,670,059 |

|

46,240,111 |

|

|

|

|

|

|

|

Adjustments to reconcile net income to net

cash |

|

|

|

| provided

by operating activities: |

|

|

|

| |

Depreciation |

12,144,043 |

|

12,525,453 |

|

|

Amortization of

deferred finance charges |

474,039 |

|

-- |

| |

Non - cash lease

expense |

46,859 |

|

53,681 |

|

|

Share based

compensation |

1,682,448 |

|

2,732,020 |

| |

Impairment

loss |

8,996,023 |

|

-- |

| |

Net (gain)/loss on

sale of vessel |

(8,182,777) |

|

1,589,702 |

| |

Unrealized foreign

exchange loss on time deposits |

-- |

|

580,990 |

|

|

Dividend income

from related party |

(212,500) |

|

-- |

|

|

|

|

|

|

| Changes in

operating assets and liabilities: |

|

|

|

| |

(Increase)/decrease in |

|

|

|

| |

Trade and other

receivables |

(5,804,281) |

|

1,010,078 |

|

|

Other current

assets |

41,636 |

|

206,747 |

| |

Inventories |

(2,689,405) |

|

598,099 |

|

|

Changes in

operating lease liabilities |

(46,859) |

|

(53,681) |

| |

Advances and

prepayments |

(343,434) |

|

(127,225) |

| |

Due from related

parties |

(1,505,223) |

|

2,206,821 |

|

|

Increase/(decrease) in |

|

|

|

| |

Trade accounts

payable |

1,191,399 |

|

(1,876,732) |

|

|

Due to related

parties |

2,865,875 |

|

2,253,296 |

| |

Accrued

liabilities |

1,230,122 |

|

621,976 |

|

|

Deferred

income |

(827,135) |

|

54,963 |

|

Net cash provided by operating activities |

73,730,889 |

|

68,616,299 |

|

|

|

|

|

|

| Cash flows

from investing activities |

|

|

|

| |

Proceeds from sale

of vessel, net |

3,865,890 |

|

41,153,578 |

| |

Acquisition and

improvement of vessels |

(27,684,795) |

|

(74,593,568) |

|

|

Increase in bank

time deposits |

(138,646,650) |

|

(120,331,710) |

| |

Maturity of bank

time deposits |

129,905,200 |

|

119,829,230 |

| |

Proceeds from

seller financing |

-- |

|

35,700,000 |

|

Net cash (used in)/provided by investing

activities |

(32,560,355) |

|

1,757,530 |

|

|

|

|

|

|

| Cash flows

from financing activities |

|

|

|

| |

Proceeds from

equity offerings |

27,950,586 |

|

-- |

| |

Proceeds from

warrants exercise |

-- |

|

8,600,000 |

| |

Stock issuance

costs |

(303,933) |

|

-- |

| |

Stock

repurchase |

(220,571) |

|

(2,504,498) |

|

|

Dividends paid on

preferred shares |

(1,515,789) |

|

(1,248,254) |

| |

Loan

repayments |

(70,438,500) |

|

-- |

|

|

Cash retained by

C3is Inc. at spin-off |

(5,000,000) |

|

-- |

|

Net cash (used in)/provided by financing

activities |

(49,528,207) |

|

4,847,248 |

|

|

|

|

|

|

| Net

(decrease)/increase in cash and cash equivalents |

(8,357,673) |

|

75,221,077 |

| Cash and cash

equivalents at beginning of period |

57,506,919 |

|

91,927,512 |

|

Cash and cash equivalents at end of period |

49,149,246 |

|

167,148,589 |

| Cash

breakdown |

|

|

|

|

|

Cash

and cash equivalents |

49,149,246 |

|

167,148,589 |

|

Total cash and cash equivalents shown in the statements of

cash flows |

49,149,246 |

|

167,148,589 |

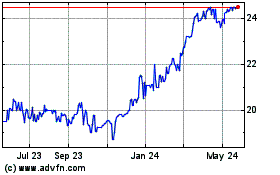

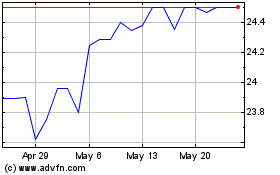

Imperial Petroleum (NASDAQ:IMPPP)

Historical Stock Chart

From Feb 2025 to Mar 2025

Imperial Petroleum (NASDAQ:IMPPP)

Historical Stock Chart

From Mar 2024 to Mar 2025