Amended Statement of Changes in Beneficial Ownership (4/a)

11 August 2021 - 9:34AM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Andersen Paw |

2. Issuer Name and Ticker or Trading Symbol

Metromile, Inc.

[

MILE

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

Chief Technology Officer |

|

(Last)

(First)

(Middle)

C/O METROMILE, INC., 425 MARKET STREET, SUITE 700 |

3. Date of Earliest Transaction

(MM/DD/YYYY)

2/9/2021 |

|

(Street)

SAN FRANCISCO, CA 94105

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

2/11/2021 |

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common Stock | 2/9/2021 | | A(1) | | 143328 (2) | A | $0.00 | 143328 | D | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Stock Option (right to buy) | $2.96 | 2/9/2021 | | A (1) | | 192518 | | (3) | 6/18/2029 | Common Stock | 192518 | $0.00 | 192518 | D | |

| Stock Option (right to buy) | $3.02 | 2/9/2021 | | A (1) | | 133280 | | (4) | 7/27/2030 | Common Stock | 133280 | $0.00 | 133280 | D | |

| Explanation of Responses: |

| (1) | Received pursuant to the Agreement and Plan of Merger and Reorganization, dated as of November 24, 2020, as amended January 12, 2021 and further amended February 8, 2021, by and among INSU Acquisition Corp. II (n/k/a Metromile, Inc.) (the "Issuer"), INSU II Merger Sub Corp. and MetroMile, Inc. (n/k/a Metromile Operating Company) ("Legacy Metromile") (the "Merger Agreement") pursuant to which, through a series of mergers Legacy Metromile became a direct, wholly-owned subsidiary of the Issuer. Pursuant to the Merger Agreement former securityholders of Legacy Metromile will receive additional shares of the Issuer's common stock (the "Additional Shares") if the closing sale price of the Issuer's common stock exceeds $15.00 per share for 20 out of any 30 consecutive trading days during the first two years following the closing of the merger. |

| (2) | Includes 128,076 shares subject to restricted stock units ("RSU") and 15,252 shares to be received as Additional Shares. Each RSU represents a contingent right to receive one share of the Issuer's common stock upon settlement. |

| (3) | 1/4 of share shares subject to the option vested on March 13, 2020, and 1/48 of the shares vest monthly thereafter. |

| (4) | 1/48 of the shares subject to the option vested on on August 15, 2020, and 1/48 of the shares vest monthly thereafter. |

Remarks:

This amendment is being filed to correct the share amounts received in the Business Combination resulting from a post-closing correction to the final exchange ratio. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Andersen Paw

C/O METROMILE, INC.

425 MARKET STREET, SUITE 700

SAN FRANCISCO, CA 94105 |

|

| Chief Technology Officer |

|

Signatures

|

| /s/ Kris Tsao Kachia, Attorney-in-Fact | | 8/10/2021 |

| **Signature of Reporting Person | Date |

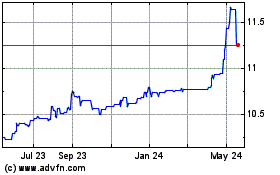

Insight Acquisition (NASDAQ:INAQ)

Historical Stock Chart

From Dec 2024 to Jan 2025

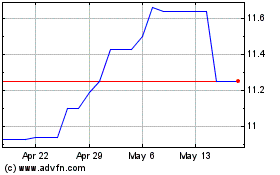

Insight Acquisition (NASDAQ:INAQ)

Historical Stock Chart

From Jan 2024 to Jan 2025