UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 2, 2022 (February 1, 2022)

METROMILE, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-39484

|

|

84-4916134

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

425 Market Street #700

San Francisco, CA

|

|

94105

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(888) 242-5204

(Registrant’s telephone number,

including area code)

N/A

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2.

below):

|

|

☒

|

Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b)

of the Act:

|

Title of each class

|

|

Trading symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.0001 par value per share

|

|

MILE

|

|

The Nasdaq Capital Market

|

|

Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 per share

|

|

MILEW

|

|

The Nasdaq Capital Market

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b–2

of the Securities Exchange Act of 1934 (§240.12b–2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

ITEM 5.07. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

A special meeting of stockholders (the “Special

Meeting”) of Metromile, Inc. (“Metromile”) was held on February 1, 2022 to vote on the proposals identified in the definitive

proxy statement filed by Metromile with the U.S. Securities and Exchange Commission (the “SEC”) on December 29, 2021 (as supplemented

by the Current Report on Form 8-K filed by Metromile with the SEC on January 21, 2021) in connection with the transactions contemplated

by the Agreement and Plan of Merger (the “Merger Agreement”), dated as of November 8, 2021, by and among Metromile, Lemonade,

Inc. (“Lemonade”), Citrus Merger Sub A, Inc., a wholly owned subsidiary of Lemonade (“Acquisition Sub I”), and

Citrus Merger Sub B, LLC, a wholly owned subsidiary of Lemonade (“Acquisition Sub II”) that provides for the acquisition of

Metromile by Lemonade. Upon the terms and subject to the conditions set forth in the Merger Agreement, (i) Acquisition Sub I will merge

with and into Metromile, with Metromile continuing as the surviving entity (the “Initial Surviving Corporation”) (the “First

Merger”) and (ii) the Initial Surviving Corporation will then merge with and into Acquisition Sub II, with Acquisition Sub II continuing

as the surviving entity and as a wholly owned subsidiary of Lemonade (the “Second Merger” and, together with the first merger,

the “Mergers”).

At the Special Meeting, the following proposals

were considered:

|

1.

|

A proposal to adopt the Merger Agreement (the “Merger Proposal”); and

|

|

2.

|

A proposal to approve the adjournment of the Special Meeting to another time and place to solicit additional proxies, if necessary or appropriate, if there are insufficient votes to approve the Merger Proposal (the “Adjournment Proposal”).

|

At the Special Meeting, the Merger Proposal was

approved by the requisite vote of Metromile’s stockholders. Sufficient votes were received to approve the Adjournment Proposal,

but such an adjournment was not necessary in light of the approval of the Merger Proposal. The final voting results for each proposal

are described below.

1. Merger Proposal

|

Votes For

|

|

Votes Against

|

|

Abstentions

|

|

|

86,013,619

|

|

3,446,873

|

|

40,276

|

|

2. Adjournment Proposal

|

Votes For

|

|

Votes Against

|

|

Abstentions

|

|

|

82,451,909

|

|

6,898,786

|

|

150,073

|

|

ITEM 7.01. REGULATION FD DISCLOSURE.

On February 1, 2022, Metromile issued a press

release announcing that the Merger Agreement had been adopted by Metromile’s stockholders at the Special Meeting, a copy of which

is filed herewith as Exhibit 99.1 and is incorporated herein by reference.

The information in this Item 7.01, including Exhibit

99.1, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference

in any filing made by Metromile under the Securities Act of 1933, as amended, or Exchange Act, except as shall be expressly set forth

by specific reference in such a filing.

Cautionary Notice Regarding Forward Looking Statements

The information in this Current Report on

Form 8-K includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the United

States Private Securities Litigation Reform Act of 1995, as amended. Forward-looking statements may be identified by the use of words

such as “estimates,” “projected,” “expects,” “anticipates,” “forecasts,” “plans,”

“intends,” “believes,” “seeks,” “may,” “will,” “should,” “future,”

“propose” and variations of these words or similar expressions or the negative versions of such terms or other similar expressions

that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include,

but are not limited to, statements with respect to a possible acquisition involving Metromile, and Lemonade and/or the combined group’s

estimated or anticipated future business, performance and results of operations and financial condition, including estimates, forecasts,

targets and plans for Lemonade and, following the acquisition, if completed, the combined entity. Any statements that refer to projections,

forecasts, or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements.

These forward-looking statements are subject

to known and unknown risks, uncertainties, and assumptions about us that may cause our actual results, levels of activity, performance,

or achievements to be materially different from any future results, levels of activities, performance, or achievements expressed or implied

by such forward-looking statements. Such risks and uncertainties include, but are not limited to, the possibility that a possible acquisition

will not be pursued, failure to obtain necessary regulatory approvals or to satisfy any of the other conditions to the possible acquisition,

adverse effects on the market price of Metromile’s or Lemonade’s shares of common stock and on Metromile’s and Lemonade’s

operating results because of a failure to complete the possible acquisition, failure to realize the expected benefits of the possible

acquisition, failure to promptly and effectively integrate Metromile’s businesses, negative effects relating to the announcement

of the possible acquisition or any further announcements relating to the possible acquisition or the consummation of the possible acquisition

on the market price of Metromile’s or Lemonade’s shares of common stock, significant transaction costs and/or unknown or inestimable

liabilities, potential litigation associated with the possible acquisition, general economic and business conditions that affect the combined

companies following the consummation of the possible acquisition, changes in global, political, economic, business, competitive, market

and regulatory forces, future exchange and interest rates, changes in tax laws, regulations, rates and policies, future business acquisitions

or disposals and competitive developments. These forward-looking statements are based on numerous assumptions and assessments made in

light of Metromile’s or, as the case may be, Lemonade’s experience and perception of historical trends, current conditions,

business strategies, operating environment, future developments and other factors it believes appropriate. By their nature, forward-looking

statements involve known and unknown risks and uncertainties because they relate to events and depend on circumstances that will occur

in the future. The factors described in the context of such forward-looking statements in this communication could cause Lemonade’s

plans with respect to Metromile, Metromile’s or Lemonade’s actual results, performance or achievements, industry results and

developments to differ materially from those expressed in or implied by such forward-looking statements. Although it is believed that

the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove

to have been correct and persons reading this communication are therefore cautioned not to place undue reliance on these forward-looking

statements which speak only as at the date of this communication. Additional information about economic, competitive, governmental, technological

and other factors that may affect Metromile is set forth under the captions “Risk Factors” in Metromile’s Form 10-K

filed with the SEC on March 31, 2021, Form 10-Q filed with the SEC on August 10, 2021, and in its other filings with the SEC.

Any forward-looking statements in this communication

are based upon information available to Metromile and/or its board of directors, as the case may be, as of the date of this communication

and, while believed to be true when made, may ultimately prove to be incorrect. Subject to any obligations under applicable law, neither

Metromile nor any member of its board of directors undertakes any obligation to update any forward-looking statement as a result of subsequent

events or developments, except as required by law to update any forward-looking statement whether as a result of new information, future

developments or otherwise, or to conform any forward-looking statement to actual results, future events, or to changes in expectations.

All subsequent written and oral forward-looking statements attributable to Metromile or its board of directors or any person acting on

behalf of any of them are expressly qualified in their entirety by this paragraph.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

Dated: February 2, 2022

|

METROMILE, INC.

|

|

|

By:

|

/s/ Dan Preston

|

|

|

Name:

|

Dan Preston

|

|

|

Title:

|

Chief Executive Officer

|

3

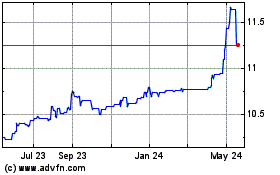

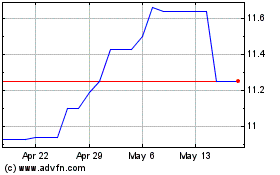

Insight Acquisition (NASDAQ:INAQ)

Historical Stock Chart

From Nov 2024 to Dec 2024

Insight Acquisition (NASDAQ:INAQ)

Historical Stock Chart

From Dec 2023 to Dec 2024