– Total revenues of $1,044 million in the second quarter (Q2'24)

(+9% Y/Y)

– Jakafi® (ruxolitinib) net product revenues of $706 million in

Q2'24 (+3% Y/Y), total patients increased +7% Y/Y; raising the

bottom end of full year 2024 guidance to a new range of $2,710 -

$2,750 million

– Opzelura® (ruxolitinib) net product revenues of $122 million

in Q2'24 (+52% Y/Y); continued uptake in atopic dermatitis (AD) and

vitiligo in the U.S.; launch momentum and reimbursement expansion

in vitiligo in Europe

– Incyte announces increased R&D focus on innovative high

impact clinical programs; acquisition of Escient Pharmaceuticals

completed

– $2.0 billion share repurchase completed, underscoring

confidence in commercial portfolio and R&D pipeline

Conference Call and Webcast Scheduled Today

at 8:00 a.m. ET

Incyte (Nasdaq:INCY) today reports 2024 second quarter financial

results, and provides a status update on the Company’s clinical

development portfolio.

"In the second quarter of 2024, total revenues grew 9%

year-over-year, surpassing $1.0 billion for the quarter. The

commercial performance during this period was driven by strong

patient demand for Opzelura® (ruxolitinib) and growth across all

indications for Jakafi® (ruxolitinib)," said Hervé Hoppenot, Chief

Executive Officer, Incyte. "In R&D, we completed a strategic

review of our pipeline and have further intensified our focus on

clinical programs that we believe can be transformational for

patients. The $2.0 billion share repurchase completed during the

second quarter, underscores our confidence in our commercial

portfolio, clinical pipeline and Incyte's long-term value."

Transformation of Pipeline

- Incyte announces a strategic review of its pipeline with an

increased focus on high potential impact programs including, but

not limited to:

- IAI/Dermatology: povorcitinib and MRGPRX2 and MRGPRX4,

which were recently acquired from Escient Pharmaceuticals

- MPNs/GVHD: mCALR, JAK2V617Fi, BETi, and ALK2i

- Oncology: CDK2i, KRASG12Di and TGFßR2×PD-1

- The Company will discontinue further development of both oral,

small molecule PD-L1 inhibitors, as well as LAG-3 monoclonal

antibody, TIM-3 monoclonal antibody and LAG-3xPD-1 bispecific.

Recent Company Updates

- Incyte announces positive topline results from two Phase 3

clinical studies evaluating retifanlimab (Zynyz®), a humanized

monoclonal antibody targeting programmed cell death receptor-1

(PD-1), in squamous cell anal carcinoma (SCAC) and non-small cell

lung cancer (NSCLC). The Phase 3 PODIUM-303 study in SCAC met its

primary endpoint of progression free survival and the Phase 3

PODIUM-304 study in NSCLC met its primary endpoint of overall

survival. The safety analysis from both studies demonstrated that

retifanlimab was generally well-tolerated with no new safety

signals observed. Incyte plans to share the Phase 3 data from both

studies in the second half of 2024. POD1UM-303 is a Phase 3,

global, multicenter, randomized, double-blind study evaluating

carboplatin-paclitaxel with retifanlimab or placebo in patients

with inoperable locally recurrent or metastatic SCAC who have not

previously been treated with chemotherapy. POD1UM-304 is a Phase 3,

global, multicenter, randomized, double-blind study evaluating

platinum-based chemotherapy with retifanlimab or placebo in

patients with first-line, metastatic squamous or nonsquamous

NSCLC.

- In June 2024, Incyte repurchased a total of 33,325,849 shares

of its common stock at a price of $60.00 per share, for a total

cost of approximately $2.0 billion, excluding fees and expenses.

These shares represented approximately 14.8 percent of the

Company’s total outstanding shares of common stock as of June 7,

2024.

- In May 2024, Incyte announced it completed the acquisition of

Escient Pharmaceuticals, a clinical-stage drug discovery and

development company advancing novel small molecule therapeutics for

systemic immune and neuro-immune disorders. Under the terms of the

agreement, Incyte acquired Escient and its clinical development

portfolio, including EP262, a first-in-class, potent, highly

selective, once-daily small molecule antagonist of Mas-related G

protein-coupled receptor (MRGPRX2) and EP547, a first-in-class oral

MRGPRX4 antagonist.

- In April 2024, Incyte and China Medical System Holdings Limited

announced the Companies entered into a Collaboration and License

Agreement, through a wholly-owned dermatology medical aesthetic

subsidiary CMS Skinhealth, for the development and

commercialization of povorcitinib, a selective oral JAK1 inhibitor,

in Mainland China, Hong Kong, Macau, Taiwan Region and eleven

Southeast Asian countries.

Jakafi:

Net product revenues for the second quarter 2024 of $706

million (+3% Y/Y):

- Paid demand increased 9% in the second quarter of 2024 versus

the same quarter in the prior year, with growth across all

indications.

- Year over year net product revenue growth was lower than paid

demand growth due to higher channel inventory levels at the end of

the second quarter of 2023 versus the same period of 2024. Channel

inventory at the end of the second quarter of 2024 was within the

normal range.

Opzelura:

Net product revenues for the second quarter 2024 of $122

million (+52% Y/Y):

- Net product revenues growth in the second quarter of 2024 were

driven by patient demand, refills and expansion in payer coverage

in both atopic dermatitis (AD) and vitiligo.

- Net product revenues of $11 million in the second quarter of

2024 in Europe. Incyte achieved full reimbursement in Spain and

Italy at the end of the second quarter 2024 and in France in July

2024.

Additional Pipeline Updates

Myeloproliferative Neoplasms (MPNs) and Graft-Versus-Host

Disease (GVHD) – key highlights

- Combination trials of ruxolitinib twice daily (BID) with

zilurgisertib and BETi are ongoing and continue to enroll. A Phase

3 study for BETi is expected to advance into Phase 3 with an

expected update later this year. Clinical proof-of-concept for

zilurgisertib is anticipated in the second half of 2024.

- The Phase 1 studies evaluating mCALR and JAK2V617Fi are ongoing

and enrolling patients. Initial data for both studies is

anticipated in 2025.

MPN and GVHD Programs

Indication and status

Ruxolitinib XR (QD)

(JAK1/JAK2)

Myelofibrosis, polycythemia vera and

GVHD

Ruxolitinib + zilurgisertib

(JAK1/JAK2 + ALK2i)

Myelofibrosis: Phase 2

Ruxolitinib + INCB57643

(JAK1/JAK2 + BETi)

Myelofibrosis: Phase 2

Axatilimab (anti-CSF-1R)1

Chronic GVHD: Pivotal Phase 2 (third-line

plus therapy) (AGAVE-201); BLA under review in the U.S.

Ruxolitinib + axatilimab1

(JAK1/JAK2 + anti-CSF-1R)

Chronic GVHD: Phase 2 in preparation

Steroids + axatilimab1

(Steroids + anti-CSF-1R)

Chronic GVHD: Phase 3 in preparation

INCA33989

(mCALR)

Myelofibrosis, essential thrombocythemia:

Phase 1

INCB160058

(JAK2V617Fi)

Phase 1

1

Clinical development of axatilimab in GVHD

conducted in collaboration with Syndax Pharmaceuticals.

Other Hematology/Oncology – key highlights

Heme/Oncology Programs

Indication and status

Pemigatinib (Pemazyre®)

(FGFR1/2/3)

Myeloid/lymphoid neoplasms (MLN): approved

in the U.S. and Japan

Cholangiocarcinoma (CCA): Phase 3

(FIGHT-302)

Tafasitamab (Monjuvi®/Minjuvi®)

(CD19)

Relapsed or refractory diffuse large

B-cell lymphoma (DLBCL): Phase 3 (B-MIND)

First-line DLBCL: Phase 3 (frontMIND)

Relapsed or refractory follicular lymphoma

(FL) and relapsed or refractory marginal zone lymphoma (MZL): Phase

3 (inMIND)

Retifanlimab (Zynyz®)1

(PD-1)

Merkel cell carcinoma (MCC): approved in

the U.S. and Europe

Squamous cell anal cancer (SCAC): Phase 3

(POD1UM-303)

Non-small cell lung cancer (NSCLC): Phase

3 (POD1UM-304)

MSI-high endometrial cancer: Phase 2

(POD1UM-101, POD1UM-204)

INCB123667

(CDK2i)

Solid tumors with Amplification/

Overexpression of CCNE1: Phase 1

INCB161734

(KRASG12D)

Advanced metastatic solid tumors with a

KRAS G12D mutation: Phase 1

INCA33890

(TGFßR2×PD-1)2

Advanced or metastatic solid tumors: Phase

1

1

Retifanlimab licensed from

MacroGenics.

2

Development in collaboration with

Merus.

Inflammation and Autoimmunity (IAI) – key highlights

Dermatology

Opzelura

- In March 2024, Incyte presented data at the 2024 AAD Annual

Meeting from its randomized, placebo-controlled, Phase 2 study

evaluating the safety and efficacy of ruxolitinib cream (Opzelura®)

in adults with mild/moderate hidradenitis suppurativa (HS). At Week

16, patients receiving ruxolitinib cream 1.5% twice daily (BID) had

significantly greater decreases from baseline versus placebo in

total abscess and inflammatory nodule (AN) count, the primary

endpoint of the study. The overall safety profile of ruxolitinib

cream was consistent with previous data, and no new safety signals

were observed. A Phase 3 study is expected to initiate in

2025.

- Ruxolitinib cream in other indications: Phase 2 studies in

lichen planus and lichen sclerosus have completed enrollment. Two

Phase 3 trials evaluating ruxolitinib cream in prurigo nodularis

(PN) are ongoing.

Povorcitinib (INCB54707)

- The Phase 2, randomized, double-blind, placebo-controlled, dose

ranging study evaluating the efficacy and safety of povorcitinib in

participants with PN were presented at the 2024 AAD Annual Meeting

with the study meeting its primary and secondary endpoints

following 16 weeks of treatment across all dosing groups,

reinforcing povorcitinib’s potential role in treating PN. A Phase 3

study in PN is expected to initiate in 2024.

- Two Phase 2 trials in asthma and chronic spontaneous urticaria

are enrolling.

IAI and Dermatology Programs

Indication and status

Ruxolitinib cream (Opzelura®)1

(JAK1/JAK2)

Atopic dermatitis: Phase 3 pediatric study

(TRuE-AD3)

Vitiligo: Approved in the U.S. and

Europe

Lichen planus: Phase 2

Lichen sclerosus: Phase 2

Hidradenitis suppurativa: Phase 2; Phase 3

expected to initiate in 2025

Prurigo nodularis: Phase 3 (TRuE-PN1,

TRuE-PN2)

Ruxolitinib cream + UVB

(JAK1/JAK2 + phototherapy)

Vitiligo: Phase 2

Povorcitinib

(JAK1)

Hidradenitis suppurativa: Phase 3

(STOP-HS1, STOP-HS2)

Vitiligo: Phase 3 (STOP-V1, STOP-V2)

Prurigo nodularis: Phase 3 expected to

initiate in 2024

Asthma: Phase 2

Chronic spontaneous urticaria: Phase 2

INCB000262 (EP262)

(MRGPRX2)

Chronic spontaneous urticaria: Phase 2

Chronic inducible urticaria: Phase 1b

Atopic dermatitis: Phase 2a

INCB000547 (EP547)

(MRGPRX4)

Cholestatic pruritus: Phase 2a

INCA034460

(anti-IL-15Rβ)

Vitiligo: Phase 1

1

Novartis’ rights to ruxolitinib outside of

the United States under our Collaboration and License Agreement

with Novartis do not include topical administration.

Other

Other Program

Indication and Phase

Zilurgisertib

(ALK2)

Fibrodysplasia ossificans progressiva:

Pivotal Phase 2

Partnered

Partnered Programs

Indication and Phase

Ruxolitinib (Jakavi®)1

(JAK1/JAK2)

Acute and chronic GVHD: Approved in Europe

and Japan

Baricitinib (Olumiant®)2

(JAK1/JAK2)

AD: Approved in Europe and Japan

Severe alopecia areata (AA): Approved in

the U.S., Europe and Japan

Capmatinib (Tabrecta®)3

(MET)

NSCLC (with MET exon 14 skipping

mutations): Approved in the U.S., Europe and Japan

1

Ruxolitinib (Jakavi®) licensed to Novartis

ex-U.S. for use in hematology and oncology excluding topical

administration.

2

Baricitinib (Olumiant®) licensed to Lilly:

approved as Olumiant in multiple territories globally for certain

patients with moderate-to-severe rheumatoid arthritis; approved as

Olumiant in EU and Japan for certain patients with atopic

dermatitis.

3

Capmatinib (Tabrecta®) licensed to

Novartis.

2024 Second Quarter Financial Results

The financial measures presented in this press release for the

three and six months ended June 30, 2024 and 2023 have been

prepared by the Company in accordance with U.S. Generally Accepted

Accounting Principles (“GAAP”), unless otherwise identified as a

Non-GAAP financial measure. Management believes that Non-GAAP

information is useful for investors, when considered in conjunction

with Incyte’s GAAP disclosures. Management uses such information

internally and externally for establishing budgets, operating goals

and financial planning purposes. These metrics are also used to

manage the Company’s business and monitor performance. The Company

adjusts, where appropriate, for expenses in order to reflect the

Company’s core operations. The Company believes these adjustments

are useful to investors by providing an enhanced understanding of

the financial performance of the Company’s core operations. The

metrics have been adopted to align the Company with disclosures

provided by industry peers.

Non-GAAP information is not prepared under a comprehensive set

of accounting rules and should only be used in conjunction with and

to supplement Incyte’s operating results as reported under GAAP.

Non-GAAP measures may be defined and calculated differently by

other companies in our industry.

As changes in exchange rates are an important factor in

understanding period-to-period comparisons, Management believes the

presentation of certain revenue results on a constant currency

basis in addition to reported results helps improve investors’

ability to understand its operating results and evaluate its

performance in comparison to prior periods. Constant currency

information compares results between periods as if exchange rates

had remained constant period over period. The Company calculates

constant currency by calculating current year results using prior

year foreign currency exchange rates and generally refers to such

amounts calculated on a constant currency basis as excluding the

impact of foreign exchange or being on a constant currency basis.

These results should be considered in addition to, not as a

substitute for, results reported in accordance with GAAP. Results

on a constant currency basis, as the Company presents them, may not

be comparable to similarly titled measures used by other companies

and are not measures of performance presented in accordance with

GAAP.

Financial Highlights

Financial Highlights (unaudited, in

thousands, except per share amounts)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Total GAAP revenues

$

1,043,759

$

954,610

$

1,924,648

$

1,763,283

Total GAAP operating (loss) income

(478,130

)

193,780

(386,232

)

218,550

Total Non-GAAP operating (loss) income

(378,801

)

262,058

(217,618

)

351,787

GAAP net (loss) income

(444,601

)

203,548

(275,053

)

225,251

Non-GAAP net (loss) income

(396,132

)

223,029

(263,413

)

307,606

GAAP basic EPS

$

(2.04

)

$

0.91

$

(1.24

)

$

1.01

Non-GAAP basic EPS

$

(1.82

)

$

1.00

$

(1.19

)

$

1.38

GAAP diluted EPS1

$

(2.04

)

$

0.90

$

(1.24

)

$

1.00

Non-GAAP diluted EPS1

$

(1.82

)

$

0.99

$

(1.19

)

$

1.36

1.All stock options and stock awards were

excluded from the diluted share calculation for the three and six

months ended June 30, 2024 because their effect would have been

anti-dilutive, as we were in a net loss position.

Revenue Details

Revenue Details (unaudited, in

thousands)

Three Months Ended June

30,

% Change (as

reported)

% Change (constant

currency)1

Six Months Ended June

30,

% Change (as

reported)

% Change (constant

currency)1

2024

2023

2024

2023

Net product revenues:

Jakafi

$

705,973

$

682,384

3

%

3%

$

1,277,812

$

1,262,353

1

%

1%

Opzelura

121,695

80,233

52

%

52%

207,419

136,785

52

%

52%

Iclusig

26,862

29,087

(8

%)

(7%)

57,205

56,772

1

%

—%

Pemazyre

20,269

21,572

(6

%)

(6%)

37,945

44,047

(14

%)

(14%)

Minjuvi/ Monjuvi

31,116

13,159

136

%

137%

54,990

19,715

179

%

179%

Zynyz

651

570

14

%

NM

1,118

570

96

%

NM

Total net product revenues

906,566

827,005

10

%

10%

1,636,489

1,520,242

8

%

8%

Royalty revenues:

Jakavi

99,317

90,448

10

%

14%

188,912

167,140

13

%

16%

Olumiant

31,702

32,009

(1

%)

4%

62,291

66,164

(6

%)

(3%)

Tabrecta

5,298

4,799

10

%

NA

10,532

8,976

17

%

NA

Pemazyre

876

349

151

%

NM

1,424

761

87

%

NM

Total royalty revenues

137,193

127,605

8

%

263,159

243,041

8

%

Total net product and royalty revenues

1,043,759

954,610

9

%

1,899,648

1,763,283

8

%

Milestone and contract revenues

—

—

—

%

—%

25,000

—

NM

NM

Total GAAP revenues

$

1,043,759

$

954,610

9

%

$

1,924,648

$

1,763,283

9

%

NM = not meaningful

NA = not available

1.Percentage change in constant currency

is calculated using 2023 foreign exchange rates to recalculate 2024

results.

Product and Royalty Revenues Product revenues and product

and royalty revenues for the quarter ended June 30, 2024 increased

10% and 9%, respectively, over the prior year comparative period,

primarily driven by the following;

- Jakafi net product revenue increased 3% driven by a 9% increase

in paid demand. Year over year net product revenue growth was lower

than paid demand growth due to higher channel inventory levels at

the end of the second quarter of 2023 versus the same period of

2024. Channel inventory at the end of the second quarter of 2024

was within the normal range.

- Opzelura net product revenue increased 52% due to continued

growth in new patient starts and refills.

- Minjuvi/Monjuvi net product revenue increased 136% following

the acquisition of the exclusive global rights to tafasitamab in

February 2024.

- Jakavi royalty revenues increased 10%.

Operating Expenses

Operating Expense Summary (unaudited,

in thousands)

Three Months Ended June

30,

%

Change

Six Months Ended June

30,

%

Change

2024

2023

2024

2023

GAAP cost of product revenues

$

76,634

$

68,326

12

%

$

137,590

$

125,148

10

%

Non-GAAP cost of product revenues1

70,899

62,150

14

%

125,858

112,819

12

%

GAAP research and development

1,138,380

400,750

184

%

1,567,640

807,391

94

%

Non-GAAP research and development2

1,089,089

367,921

196

%

1,477,526

743,541

99

%

GAAP selling, general and

administrative

305,982

283,929

8

%

606,238

599,535

1

%

Non-GAAP selling, general and

administrative3

262,572

263,030

—

%

539,907

557,047

(3

%)

GAAP (gain) loss on change in fair value

of acquisition-related contingent consideration

893

8,374

(89

%)

437

14,570

(97

%)

Non-GAAP (gain) loss on change in fair

value of acquisition-related contingent consideration4

—

—

—

%

—

—

—

%

GAAP (profit) and loss sharing under

collaboration agreements

—

(549

)

—

%

(1,025

)

(1,911

)

(46

%)

1 Non-GAAP cost of product revenues

excludes the amortization of licensed intellectual property for

Iclusig relating to the acquisition of the European business of

ARIAD Pharmaceuticals, Inc. and the cost of stock-based

compensation.

2 Non-GAAP research and development

expenses exclude the cost of stock-based compensation, MorphoSys

transition costs, and Escient acquisition related compensation

expense related to cash settled unvested Escient equity awards and

severance payments.

3 Non-GAAP selling, general and

administrative expenses exclude the cost of stock-based

compensation, MorphoSys transition costs, and Escient acquisition

related compensation expense related to cash settled unvested

Escient equity awards and severance payments.

4 Non-GAAP (gain) loss on change in fair

value of acquisition-related contingent consideration is null.

Cost of product revenues GAAP and Non-GAAP cost of

product revenues for the quarter ended June 30, 2024 increased 12%

and 14%, respectively, compared to the same period in 2023

primarily due to growth in net product revenues.

Research and development expenses GAAP and Non-GAAP

research and development expense for the quarter ended June 30,

2024 increased 184% and 196%, respectively, compared to the same

period in 2023 primarily due to $679.4 million of expense relating

to the IPR&D assets acquired in the Escient acquisition, $12.5

million of Escient acquisition related compensation expense related

to cash settled unvested Escient equity awards and severance

payments, as well as continued investment in our late stage

development assets. Excluding the upfront consideration paid

related to the Escient transaction and other upfront and milestone

payments, research and development expense for the quarter ended

June 30, 2024 increased 13% compared to the same period in 2023 due

to continued investment in our late stage development assets and

timing of certain expenses.

Selling, general and administrative expenses GAAP

selling, general and administrative expenses for the quarter ended

June 30, 2024 increased 8% compared to the same period in 2023

primarily due to $21.5 million of Escient acquisition related

compensation expense related to cash settled unvested Escient

equity awards and severance payments and timing of consumer

marketing activities and of certain other expenses. Excluding the

upfront consideration paid related to the Escient transaction,

selling, general and administrative expenses for the quarter ended

June 30, 2024 were flat compared to the same period in 2023.

Other Financial

Information

Change in fair value of acquisition-related contingent

consideration The change in fair value of contingent

consideration during the quarter ended June 30, 2024, compared to

the same period in 2023, was due primarily to fluctuations in

foreign currency exchange rates impacting future revenue

projections of Iclusig.

Operating income GAAP and Non-GAAP operating income for

the three months ended June 30, 2024 decreased 347% and 245%,

respectively, compared to the same period in 2023, driven primarily

by the aforementioned costs relating to the Escient

acquisition.

Provision for income taxes The income tax expense for the

three months ended June 30, 2024 was $54.8 million on a pre-tax

loss of $389.8 million primarily due to the impact of non-tax

deductible charges of $710.9 million associated with the

acquisition of Escient.

Cash, cash equivalents and marketable securities position

As of June 30, 2024 and December 31, 2023, cash, cash equivalents

and marketable securities totaled $1.4 billion and $3.7 billion,

respectively. The decrease in cash, cash equivalents and marketable

securities during 2024 was driven primarily by the $2.0 billion

share repurchase completed during June 2024, and the total cash

consideration paid to Escient shareholders of $783 million.

Share Repurchase In June 2024, Incyte completed a $2.0

billion share repurchase reflecting our confidence in the future

outlook of our business, the strength of our commercial portfolio

and the clinical development pipeline. In total, approximately 33.3

million shares of common stock were repurchased at $60.00 per share

and represented approximately 14.8% of our common shares

outstanding at the time of the repurchase. As of June 30, 2024,

there were 191.6 million common shares outstanding.

2024 Financial Guidance

Incyte is raising the low end of its full year 2024 Jakafi

revenue guidance as well as updating its full year 2024 research

and development guidance to reflect the ongoing impact of the

acquisition of Escient Pharmaceuticals. The research and

development guidance excludes $691 million of upfront consideration

recorded relating to the acquisition of Escient Pharmaceuticals.

Incyte is maintaining its full year 2024 other hematology/oncology

revenue guidance, as well as its cost of product revenue and

selling, general and administrative guidance. Incyte’s guidance is

summarized below. Guidance does not include revenue from any

potential new product launches or the impact of any potential

future strategic transactions.

Current

Previous

Jakafi net product revenues

$2,710 - $2,750 million

$2,690 - $2,750 million

Other Hematology/Oncology net product

revenues(1)

Unchanged

$325 - $360 million

GAAP Cost of product revenues

Unchanged

7 – 8% of net product revenues

Non-GAAP Cost of product revenues(2)

Unchanged

6 – 7% of net product revenues

GAAP Research and development expenses

$1,755 - $1,800 million

$1,720 - $1,760 million

Non-GAAP Research and development

expenses(3)

$1,615 - $1,655 million

$1,580 - $1,615 million

GAAP Selling, general and administrative

expenses

Unchanged

$1,210 - $1,240 million

Non-GAAP Selling, general and

administrative expenses(3)

Unchanged

$1,115 - $1,140 million

1Pemazyre in the U.S., EU and Japan;

Monjuvi and Zynyz in the U.S.; and Iclusig and Minjuvi in the

EU.

2Adjusted to exclude the amortization of

licensed intellectual property for Iclusig relating to the

acquisition of the European business of ARIAD Pharmaceuticals, Inc.

and the estimated cost of stock-based compensation.

3 Adjusted to exclude the estimated cost

of stock-based compensation.

Conference Call and Webcast Information

Incyte will hold a conference call and webcast this morning at

8:00 a.m. ET. To access the conference call, please dial

877-407-3042 for domestic callers or 201-389-0864 for international

callers. When prompted, provide the conference identification

number, 13747471.

If you are unable to participate, a replay of the conference

call will be available for 90 days. The replay dial-in number for

the United States is 877-660-6853 and the dial-in number for

international callers is 201-612-7415. To access the replay you

will need the conference identification number, 13747471.

The conference call will also be webcast live and can be

accessed at investor.incyte.com.

About Incyte

A global biopharmaceutical company on a mission to Solve On.,

Incyte follows the science to find solutions for patients with

unmet medical needs. Through the discovery, development and

commercialization of proprietary therapeutics, Incyte has

established a portfolio of first-in-class medicines for patients

and a strong pipeline of products in Oncology and Inflammation

& Autoimmunity. Headquartered in Wilmington, Delaware, Incyte

has operations in North America, Europe and Asia.

For additional information on Incyte, please visit Incyte.com or

follow us on social media: LinkedIn, X, Instagram, Facebook,

YouTube.

About Jakafi® (ruxolitinib)

Jakafi® (ruxolitinib) is a JAK1/JAK2 inhibitor approved by the

U.S. FDA for treatment of polycythemia vera (PV) in adults who have

had an inadequate response to or are intolerant of hydroxyurea;

intermediate or high-risk myelofibrosis (MF), including primary MF,

post-polycythemia vera MF and post-essential thrombocythemia MF in

adults; steroid-refractory acute GVHD in adult and pediatric

patients 12 years and older; and chronic GVHD after failure of one

or two lines of systemic therapy in adult and pediatric patients 12

years and older.

Jakafi is a registered trademark of Incyte.

About Opzelura® (ruxolitinib) Cream

Opzelura® (ruxolitinib) cream, a novel cream formulation of

Incyte’s selective JAK1/JAK2 inhibitor ruxolitinib, approved by the

U.S. Food & Drug Administration for the topical treatment of

nonsegmental vitiligo in patients 12 years of age and older, is the

first and only treatment for repigmentation approved for use in the

United States. Opzelura is also approved in the U.S. for the

topical short-term and non-continuous chronic treatment of mild to

moderate atopic dermatitis (AD) in non-immunocompromised patients

12 years of age and older whose disease is not adequately

controlled with topical prescription therapies, or when those

therapies are not advisable. Use of Opzelura in combination with

therapeutic biologics, other JAK inhibitors, or potent

immunosuppressants, such as azathioprine or cyclosporine, is not

recommended.

In Europe, Opzelura (ruxolitinib) cream 15mg/g is approved for

the treatment of non-segmental vitiligo with facial involvement in

adults and adolescents from 12 years of age.

Incyte has worldwide rights for the development and

commercialization of ruxolitinib cream, marketed in the United

States as Opzelura.

Opzelura and the Opzelura logo are registered trademarks of

Incyte.

About Monjuvi® (tafasitamab-cxix)

Monjuvi® (tafasitamab-cxix) is a humanized Fc-modified cytolytic

CD19 targeting monoclonal antibody. In 2010, MorphoSys licensed

exclusive worldwide rights to develop and commercialize tafasitamab

from Xencor, Inc. Tafasitamab incorporates an XmAb® engineered Fc

domain, which mediates B-cell lysis through apoptosis and immune

effector mechanism including Antibody-Dependent Cell-Mediated

Cytotoxicity (ADCC) and Antibody-Dependent Cellular Phagocytosis

(ADCP). MorphoSys and Incyte entered into: (a) in January 2020, a

collaboration and licensing agreement to develop and commercialize

tafasitamab globally; and (b) in February 2024, an agreement

whereby Incyte obtained exclusive rights to develop and

commercialize tafasitamab globally.

In the United States, Monjuvi® (tafasitamab-cxix) received

accelerated approval by the U.S. Food and Drug Administration in

combination with lenalidomide for the treatment of adult patients

with relapsed or refractory diffuse large B-cell lymphoma (DLBCL)

not otherwise specified, including DLBCL arising from low grade

lymphoma, and who are not eligible for autologous stem cell

transplant (ASCT). In Europe, Minjuvi® (tafasitamab) received

conditional Marketing Authorization from the European Medicines

Agency in combination with lenalidomide, followed by Minjuvi

monotherapy, for the treatment of adult patients with relapsed or

refractory DLBCL who are not eligible for ASCT.

XmAb® is a registered trademark of Xencor, Inc.

Monjuvi, Minjuvi, the Minjuvi and Monjuvi logos and the

“triangle” design are (registered) trademarks of Incyte.

About Pemazyre® (pemigatinib)

Pemazyre® (pemigatinib) is a kinase inhibitor indicated in the

United States for the treatment of adults with previously treated,

unresectable locally advanced or metastatic cholangiocarcinoma with

a fibroblast growth factor receptor 2 (FGFR2) fusion or other

rearrangement as detected by an FDA-approved test*. This indication

is approved under accelerated approval based on overall response

rate and duration of response. Continued approval for this

indication may be contingent upon verification and description of

clinical benefit in a confirmatory trial(s).

Pemazyre is also the first targeted treatment approved for use

in the United States for treatment of adults with relapsed or

refractory myeloid/lymphoid neoplasms (MLNs) with FGFR1

rearrangement.

In Japan, Pemazyre is approved for the treatment of patients

with unresectable biliary tract cancer (BTC) with a fibroblast

growth factor receptor 2 (FGFR2) fusion gene, worsening after

cancer chemotherapy.

In Europe, Pemazyre is approved for the treatment of adults with

locally advanced or metastatic cholangiocarcinoma with a fibroblast

growth factor receptor 2 (FGFR2) fusion or rearrangement that have

progressed after at least one prior line of systemic therapy.

Pemazyre is a potent, selective, oral inhibitor of FGFR isoforms

1, 2 and 3 which, in preclinical studies, has demonstrated

selective pharmacologic activity against cancer cells with FGFR

alterations.

Pemazyre is marketed by Incyte in the United States, Europe and

Japan.

Pemazyre and the Pemazyre logo are registered trademarks of

Incyte.

* Pemazyre® (pemigatinib) [Package Insert]. Wilmington, DE:

Incyte; 2020.

About Iclusig® (ponatinib) tablets

Ponatinib (Iclusig®) targets not only native BCR-ABL but also

its isoforms that carry mutations that confer resistance to

treatment, including the T315I mutation, which has been associated

with resistance to other approved TKIs.

In the EU, Iclusig is approved for the treatment of adult

patients with chronic phase, accelerated phase or blast phase

chronic myeloid leukemia (CML) who are resistant to dasatinib or

nilotinib; who are intolerant to dasatinib or nilotinib and for

whom subsequent treatment with imatinib is not clinically

appropriate; or who have the T315I mutation, or the treatment of

adult patients with Philadelphia-chromosome positive acute

lymphoblastic leukemia (Ph+ ALL) who are resistant to dasatinib;

who are intolerant to dasatinib and for whom subsequent treatment

with imatinib is not clinically appropriate; or who have the T315I

mutation.

Click here to view the Iclusig EU Summary of Medicinal

Product Characteristics.

Incyte has an exclusive license from Takeda Pharmaceuticals

International AG to commercialize ponatinib in the European Union

and 29 other countries, including Switzerland, UK, Norway, Turkey,

Israel and Russia. Iclusig is marketed in the U.S. by Millennium

Pharmaceuticals, Inc., a wholly owned subsidiary of Takeda

Pharmaceutical Company Limited.

About Zynyz® (retifanlimab-dlwr)

Zynyz (retifanlimab-dlwr), is an intravenous PD-1 inhibitor

indicated in the U.S. for the treatment of adult patients with

metastatic or recurrent locally advanced Merkel cell carcinoma

(MCC). This indication is approved under accelerated approval based

on tumor response rate and duration of response. Continued approval

for this indication may be contingent upon verification and

description of clinical benefit in confirmatory trials.

Zynyz is marketed by Incyte in the U.S. In 2017, Incyte entered

into an exclusive collaboration and license agreement with

MacroGenics, Inc. for global rights to retifanlimab.

Zynyz and the Zynyz logo are registered trademarks of

Incyte.

Forward-Looking Statements

Except for the historical information set forth herein, the

matters set forth in this press release contain predictions,

estimates and other forward-looking statements, including any

discussion of the following: Incyte’s potential for continued

performance and growth; Incyte’s financial guidance for 2024,

including its expectations regarding sales of Jakafi; expectations

regarding demand for and sales of Opzelura, among other products;

expectations regarding reimbursement for Opzelura in Europe; where

we intend to focus R&D efforts; plans to deliver sustainable

innovation through 2028 and beyond; expectations regarding the

potential and progress of our pipeline, including expectations for

ruxolitinib cream, povorcitinib, INCB000262, INCB000547,

axatilimab, mCALR, JAK2V617Fi, retifanlimab, INCB123667, KRASG12Di

and our TGF-β program; Incyte’s ability to develop new

transformative therapies to treat myeloid disease and cure MPNs;

expectations regarding ongoing clinical trials and clinical trials

to be initiated; expectations regarding data flow/readouts;

expectations regarding regulatory filings, potential regulatory

approvals and potential product launches; and expectations

regarding 2024 newsflow items.

These forward-looking statements are based on Incyte’s current

expectations and subject to risks and uncertainties that may cause

actual results to differ materially, including unanticipated

developments in and risks related to: further research and

development and the possibility that results of clinical trials

will be negative and/or insufficient to meet applicable regulatory

standards or warrant continued development; the ability to enroll

sufficient numbers of subjects in clinical trials and the ability

to enroll subjects in accordance with planned schedules;

determinations made by FDA, EMA, and other regulatory agencies;

Incyte’s dependence on its relationships with and changes in the

plans of its collaboration partners; the efficacy or safety of

Incyte’s products and the products of Incyte’s collaboration

partners; the acceptance of Incyte’s products and the products of

Incyte’s collaboration partners in the marketplace; market

competition; unexpected variations in the supply of and/or demand

for Incyte’s products and the products of Incyte’s collaboration

partners; the effects of announced or unexpected price regulation

or limitations on reimbursement or coverage for Incyte’s products

and the products of Incyte’s collaboration partners; sales,

marketing, manufacturing and distribution requirements, including

Incyte’s and its collaboration partners’ ability to successfully

commercialize and build commercial infrastructure for newly

approved products and any additional products that become approved;

greater than expected expenses, including expenses relating to

litigation or strategic activities; variations in foreign currency

exchange rates; and other risks detailed in Incyte’s reports filed

with the Securities and Exchange Commission, including its annual

report on form 10-K for the year ended December 31, 2023. Incyte

disclaims any intent or obligation to update these forward-looking

statements.

INCYTE CORPORATION

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(unaudited, in thousands,

except per share amounts)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

GAAP

GAAP

Revenues:

Product revenues, net

$

906,566

$

827,005

$

1,636,489

$

1,520,242

Product royalty revenues

137,193

127,605

263,159

243,041

Milestone and contract revenues

—

—

25,000

—

Total revenues

1,043,759

954,610

1,924,648

1,763,283

Costs, expenses and other:

Cost of product revenues (including

definite-lived intangible amortization)

76,634

68,326

137,590

125,148

Research and development

1,138,380

400,750

1,567,640

807,391

Selling, general and administrative

305,982

283,929

606,238

599,535

Loss on change in fair value of

acquisition-related contingent consideration

893

8,374

437

14,570

(Profit) and loss sharing under

collaboration agreements

—

(549

)

(1,025

)

(1,911

)

Total costs, expenses and other

1,521,889

760,830

2,310,880

1,544,733

(Loss) income from operations

(478,130

)

193,780

(386,232

)

218,550

Interest income and other, net

49,769

42,668

94,513

75,541

Interest expense

(657

)

(655

)

(1,087

)

(1,124

)

Realized and unrealized gain on equity

investments

39,241

41,811

139,188

36,493

(Loss) income before provision for income

taxes

(389,777

)

277,604

(153,618

)

329,460

Provision for income taxes

54,824

74,056

121,435

104,209

Net (loss) income

$

(444,601

)

$

203,548

$

(275,053

)

$

225,251

Net (loss) income per share:

Basic

$

(2.04

)

$

0.91

$

(1.24

)

$

1.01

Diluted

$

(2.04

)

$

0.90

$

(1.24

)

$

1.00

Shares used in computing net (loss) income

per share:

Basic

218,175

223,248

221,329

223,104

Diluted

218,175

225,649

221,329

225,541

INCYTE CORPORATION

CONDENSED CONSOLIDATED BALANCE

SHEETS

(unaudited, in

thousands)

June 30, 2024

December 31,

2023

ASSETS

Cash, cash equivalents and marketable

securities

$

1,449,500

$

3,656,043

Accounts receivable

739,050

743,557

Property and equipment, net

762,009

751,513

Finance lease right-of-use assets, net

25,535

25,535

Inventory

355,972

269,937

Prepaid expenses and other assets

231,504

236,782

Short and long term equity investments

99,543

187,716

Other intangible assets, net

113,536

123,545

Goodwill

155,593

155,593

Deferred income tax asset

729,561

631,886

Total assets

$

4,661,803

$

6,782,107

LIABILITIES AND STOCKHOLDERS’

EQUITY

Accounts payable, accrued expenses and

other liabilities

$

1,438,125

$

1,347,669

Finance lease liabilities

32,619

32,601

Acquisition-related contingent

consideration

194,000

212,000

Stockholders’ equity

2,997,059

5,189,837

Total liabilities and stockholders’

equity

$

4,661,803

$

6,782,107

INCYTE CORPORATION

RECONCILIATION OF GAAP NET

(LOSS) INCOME TO SELECTED NON-GAAP ADJUSTED INFORMATION

(unaudited, in thousands,

except per share amounts)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

GAAP Net (Loss) Income

$

(444,601

)

$

203,548

$

(275,053

)

$

225,251

Adjustments1:

Non-cash stock compensation from equity

awards (R&D)2

34,541

32,829

71,333

63,850

Non-cash stock compensation from equity

awards (SG&A)2

21,748

20,899

44,121

42,488

Non-cash stock compensation from equity

awards (COGS)2

351

792

964

1,561

Non-cash interest3

144

139

252

247

Realized and unrealized gain on equity

investments4

(39,241

)

(41,811

)

(139,188

)

(36,493

)

Amortization of acquired product

rights5

5,384

5,384

10,768

10,768

Loss on change in fair value of contingent

consideration6

893

8,374

437

14,570

MorphoSys transition costs7

2,373

—

6,952

—

Escient acquisition related compensation

expense8

34,039

—

34,039

—

Tax effect of Non-GAAP pre-tax

adjustments9

(11,763

)

(7,125

)

(18,038

)

(14,636

)

Non-GAAP Net (Loss) Income9

$

(396,132

)

$

223,029

$

(263,413

)

$

307,606

Non-GAAP net (loss) income per share:

Basic

$

(1.82

)

$

1.00

$

(1.19

)

$

1.38

Diluted10

$

(1.82

)

$

0.99

$

(1.19

)

$

1.36

Shares used in computing Non-GAAP net

(loss) income per share:

Basic

218,175

223,248

221,329

223,104

Diluted10

218,175

225,649

221,329

225,541

1 Included within the Milestone and

contract revenues line item in the Condensed Consolidated

Statements of Operations (in thousands) for the three and six

months ended June 30, 2024 are milestones of $0 and $25,000 earned

from our collaborative partners, as compared to no milestones

earned for the three and six months ended June 30, 2023. Included

within the Research and development expenses line item in the

Condensed Consolidated Statements of Operations (in thousands) for

the three and six months ended June 30, 2024 are upfront

consideration and milestones of $414 and $1,414, respectively,

related to our collaborative partners as compared to upfront

consideration and milestones of $7,000 and $9,700, respectively,

for the three and six months ended June 30, 2023.

2 As included within the Cost of product

revenues (including definite-lived intangible amortization) line

item; the Research and development expenses line item; and the

Selling, general and administrative expenses line item in the

Condensed Consolidated Statements of Operations.

3 As included within the Interest expense

line item in the Condensed Consolidated Statements of

Operations.

4 As included within the Realized and

unrealized gain on equity investments line item in the Condensed

Consolidated Statements of Operations.

5 As included within the Cost of product

revenues (including definite-lived intangible amortization) line

item in the Condensed Consolidated Statements of Operations.

Acquired product rights of licensed intellectual property for

Iclusig is amortized utilizing a straight-line method over the

estimated useful life of 12.5 years.

6 As included within the (Gain) loss on

change in fair value of acquisition-related contingent

consideration line item in the Condensed Consolidated Statements of

Operations.

7 Included within the Research and

development line item in the Condensed Consolidated Statements of

Operations is $2,232 and $6,263 for the three and six months ended

June 30, 2024, respectively, and included within the Selling,

general and administrative expenses line item in the Condensed

Consolidated Statements of Operations is $141 and $689 for the

three and six months ended June 30, 2024, respectively. MorphoSys

transition costs primarily represent employee related costs to

transition research and development and selling, general and

administrative activities to us under the former collaboration

agreement with MorphoSys.

8 Included within the Research and

development line item in the Condensed Consolidated Statements of

Operations is $12,518 for the three and six months ended June 30,

2024, and included within the Selling, general and administrative

expenses line item in the Condensed Consolidated Statements of

Operations is $21,521 for the three and six months ended June 30,

2024. Escient acquisition related compensation expense represents

non-recurring charges associated with (i) cash settled unvested

Escient equity awards in connection with the acquisition, and (ii)

severance payments to former Escient employees.

9 Income tax effects of Non-GAAP pre-tax

adjustments are calculated using an estimated annual effective tax

rate, taking into consideration any permanent items and valuation

allowances against related deferred tax assets. The Non-GAAP net

income for the three months ended March 31, 2024 should have been

$132,719 compared to the $145,269 previously disclosed to correct a

transposition error in the tax effect of Non-GAAP pre-tax

adjustments. For the three months ended March 31, 2024, the tax

effect of Non-GAAP pre-tax adjustments should have been ($6,275)

instead of $6,275.

10.All stock options and stock awards were

excluded from the diluted share calculation for the three and six

months ended June 30, 2024 because their effect would have been

anti-dilutive, as we were in a net loss position.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240730670721/en/

Media media@incyte.com

Investors ir@incyte.com

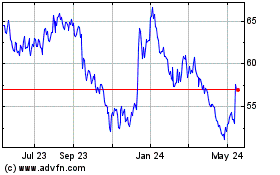

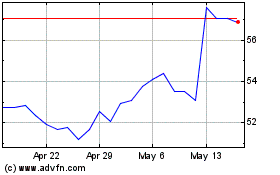

Incyte (NASDAQ:INCY)

Historical Stock Chart

From Jul 2024 to Jul 2024

Incyte (NASDAQ:INCY)

Historical Stock Chart

From Jul 2023 to Jul 2024