false

0001850119

0001850119

2024-08-08

2024-08-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 8, 2024

Century Therapeutics, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-40498 |

|

84-2040295 |

(State or other jurisdiction of

incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

|

25

North 38th Street, 11th Floor

Philadelphia, Pennsylvania |

|

19104 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (267) 817-5790

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

Trading Symbol |

|

Name

of Exchange on Which Registered |

| Common Stock, par value $0.0001 per share |

|

IPSC |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

|

Item 2.02 |

Results of Operations and Financial Condition |

On August

8, 2024, Century Therapeutics, Inc. (the “Company”) issued a press release announcing its financial results for the

quarter ended June 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated

herein by reference.

The information contained in this Item 2.02 (including Exhibit 99.1)

is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), or otherwise subject to the liabilities of that section and shall not be deemed to be incorporated

by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act,

except as shall be expressly set forth by specific reference in such filing.

| Item 7.01 |

Regulation FD Disclosure |

On August 8, 2024, the

Company updated information reflected in a slide presentation, which is attached as Exhibit 99.2 to this Current Report on Form 8-K

and is incorporated herein by reference. Representatives of the Company will use the updated presentation in various meetings with investors

from time to time.

The information contained

in this Item 7.01 (including Exhibit 99.2) is being furnished and shall not be deemed “filed” for purposes of Section 18

of the Exchange Act, or otherwise subject to the liabilities of that section and shall not be deemed incorporated by reference in any

filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

|

Item 9.01 |

Financial Statements and Exhibits |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

CENTURY THERAPEUTICS, INC. |

| |

|

|

| |

By: |

/s/ Brent Pfeiffenberger, Pharm.D. |

| |

Name: |

Brent Pfeiffenberger, Pharm.D. |

| |

Title: |

President and Chief Executive Officer |

Date: August 8, 2024

Exhibit 99.1

Century Therapeutics Reports Second Quarter

2024 Financial Results and Provides Business Updates

– Initiation of Phase 1 CALiPSO-1

Trial of CNTY-101 in Systemic Lupus Erythematosus, marking strategic expansion into autoimmune disease; protocol amended to include additional

cohort of Lupus Nephritis patients –

– Presented interim results

from Phase 1 ELiPSE-1 trial of CNTY-101 demonstrating encouraging preliminary efficacy and tolerability data in heavily pretreated relapsed/refractory

(R/R) CD19-positive B-cell lymphomas at ASCO –

– Completed dose escalation

for ELiPSE-1 and advancing into dose expansion in 2H 2024 –

– Ended second quarter 2024

with cash, cash equivalents, and investments of $269.6 million; Cash runway expected into 2026 –

PHILADELPHIA,

August 8, 2024 -- Century Therapeutics, Inc. (NASDAQ: IPSC), an innovative biotechnology

company developing induced pluripotent stem cell (iPSC)-derived cell therapies in immuno-oncology and autoimmune disease, today

reported financial results and business highlights for the second quarter ended June 30, 2024.

“Our strategic autoimmune expansion, as highlighted by the recent

initiation of the CALiPSO-1 trial in Systemic Lupus Erythematosus and addition of a Lupus Nephritis-specific cohort, positions Century

as a potential leader in allogeneic cell therapies for autoimmune diseases. 2024 remains a time of focused execution as we work to advance

our next-generation allogeneic iPSC-derived cell therapy platform and pipeline, equipped with our proprietary Allo-Evasion™ technology,

capturing a diversified opportunity to address a broad range of indications with high unmet need. I am proud of the significant progress

we have achieved in such a short period of time, particularly underscored by the evolution of our platform and capabilities, which we

anticipate will enable our iPSC candidates to have a more controlled, durable, and tolerable profile,” said Brent Pfeiffenberger,

Pharm.D., Chief Executive Officer of Century Therapeutics. “We remain focused on progressing CNTY-101 in both of our clinical-stage

programs, including advancement into dose expansion in the ELiPSE-1 trial in patients with r/r B-cell lymphomas and acceleration of patient

enrollment following the recent initiation of the CALiPSO-1 trial. We’ve made strides in our initial execution of autoimmune expansion

as evidenced by our CALiPSO-1 trial updates, while simultaneously pursuing additional regulatory filings for CNTY-101 in other autoimmune

disease indications in the second half of the year. We look forward to continued execution and the opportunity to deliver on our next

set of potential catalysts, including the expectation of initial clinical data from CALiPSO-1 by year-end.”

Research & Development Highlights

| · | Consistent

with Century’s autoimmune disease expansion efforts announced in April 2024, the Company

recently initiated the Phase 1 CALiPSO-1 trial of CNTY-101 (NCT06255028) in Systemic Lupus

Erythematosus (SLE). The first clinical trial site has been activated, with additional sites

continuing to open across the United States. The Company expects initial clinical data from

CALiPSO-1 by year-end 2024. Furthermore, Century recently amended the protocol to include

a new indication-specific cohort of Lupus Nephritis (LN) patients. CALiPSO-1 is an open-label

multi-center clinical trial to evaluate the safety, tolerability, pharmacokinetics, and clinical

response of CNTY-101 in patients with moderate to severe SLE and LN who have failed at least

two standard immunosuppressive therapies. The inclusion of LN patients highlights Century’s

execution in pursuing additional regulatory filings as a way of accelerating and broadening

its research and development initiatives in autoimmune diseases. The Company intends to submit

additional regulatory filings for CNTY-101 in autoimmune disease indications with limited

current treatment options and high unmet need in the second half of 2024. |

| · | In

May 2024, Century presented two posters at the American Society of Gene and Cell Therapy

(ASGCT) Annual Meeting showcasing the potential ability of its lead program, CNTY-101, a

CD19 targeting allogeneic iNK cell therapy with 6 precision gene edits powered by Century’s

Allo-Evasion™ technology, to treat B-Cell driven autoimmune diseases including SLE,

and new preclinical data demonstrating the potential utility of using a novel synthetic ligand

targeting CD300a as a universal strategy for preventing natural killer (NK) cell mediated

rejection in allogeneic cell therapies. The Company believes that these capabilities demonstrate

the potential protection of allogeneic cell therapies with the possibility for improved outcomes,

while delivering a broadly beneficial treatment option across a range of indications. |

| · | In

June 2024, the Company presented encouraging interim efficacy and safety data from the ongoing

Phase 1 ELiPSE-1, multicenter, open-label clinical trial of CNTY-101 (NCT05336409) in heavily

pre-treated patients with R/R CD19-positive B-cell lymphomas at the American Society of Clinical

Oncology (ASCO) Annual Meeting. Evaluable preliminary safety (n=12) and efficacy (n=10) as

of the data cutoff date of March 27, 2024, from the ongoing dose escalation portion of the

trial, demonstrated a manageable tolerability profile with no observed dose limiting toxicities

(DLT) or graft-versus-host disease (GvHD). After rapidly trafficking out of circulation,

pharmacokinetics (PK), evaluated by a novel cell-free DNA method, showed that CNTY-101 persistence

outside the bloodstream trended with increases in dose. Data also showed additional responses

across escalating doses and different types of B-cell malignancies in heavily pretreated

patients with predominantly aggressive or high-risk histologies. |

| · | The

Company recently completed dose escalation of schedule A (single dose per cycle) and schedule

B (3 doses per cycle) in the ELiPSE-1 trial and is currently enrolling patients in the dose

confirmation portion. Progression into dose expansion is expected in the second half of 2024. |

Corporate Highlights

| · | In

April 2024, the Company completed a private placement of common stock with gross proceeds

of $60 million with new and existing investors. Also in April 2024, the Company closed the

acquisition of Clade Therapeutics, bringing enhancement of its Allo-Evasion™ platform

and adding three preclinical stage αβ iT programs spanning across cancer and autoimmune

diseases to its pipeline. |

Second Quarter 2024 Financial Results

| · | Cash

Position: Cash, cash equivalents, and marketable securities were $269.6 million

as of June 30, 2024, as compared to $261.8 million as of December 31, 2023. Net cash used

in operations was $57.6 million for the six months ended June 30, 2024, compared to net cash

used in operations of $48.5 million for the six months ended June 30, 2023. |

| · | Collaboration

Revenue: Collaboration revenue generated through the Company’s collaboration,

option, and license agreement with Bristol-Myers Squibb was $0.8 million for the three months

ended June 30, 2024, compared to $0.1 million for the same period in 2023. |

| · | Research

and Development (R&D) expenses: R&D expenses were $27.2 million for the three

months ended June 30, 2024, compared to $22.7 million for the same period in 2023. The increase

in R&D expenses was primarily due to increased manufacturing activity for CNTY-101 and

the acquisition of Clade Therapeutics. |

| · | General

and Administrative (G&A) expenses: G&A expenses were $8.3 million for the three

months ended June 30, 2024, compared to $8.2 million for the same period in 2023. |

| · | Net

loss: Net loss was $31.2 million for the three months ended June 30, 2024, compared

to $33.3 million for the three months ended June 30, 2023. |

Financial Guidance

| · | The

Company expects full year generally accepted accounting principles (GAAP) operating expenses

to be between $150 million and $160 million. |

| · | The

Company estimates its cash, cash equivalents, and investments will support operations into

2026. |

About Century Therapeutics

Century

Therapeutics (NASDAQ: IPSC) is harnessing the power of adult stem cells to develop curative cell therapy products for cancer and autoimmune

diseases that we believe will allow us to overcome the limitations of first-generation cell therapies. Our genetically engineered, iPSC-derived

cell product candidates are designed to specifically target hematologic and solid tumor cancers, with a broadening application to autoimmune

diseases. We are leveraging our expertise in cellular reprogramming, genetic engineering, and manufacturing to develop therapies with

the potential to overcome many of the challenges inherent to cell therapy and provide a significant advantage over existing cell therapy

technologies. We believe our commitment to developing off-the-shelf cell therapies will expand patient access and provide an unparalleled

opportunity to advance the course of cancer and autoimmune disease care. For more information on Century Therapeutics please visit www.centurytx.com.

Century Therapeutics Forward-Looking Statement

This

press release contains forward-looking statements within the meaning of, and made pursuant to the safe harbor provisions of, The Private

Securities Litigation Reform Act of 1995. All statements contained in this press release, other than statements of historical facts or

statements that relate to present facts or current conditions, including but not limited to, statements regarding our clinical development

plans and timelines and the initial safety and efficacy profiles of CNTY-101 are forward-looking statements. These statements involve

known and unknown risks, uncertainties and other important factors that may cause our actual results, performance, or achievements to

be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

In some cases, you can identify forward-looking statements by terms such as “may,” “might,” “will,”

“should,” “expect,” “plan,” “aim,” “seek,” “anticipate,” “could,”

“intend,” “target,” “project,” “contemplate,” “believe,” “estimate,”

“predict,” “forecast,” “potential” or “continue” or the negative of these terms or other

similar expressions. The forward-looking statements in this press release are only predictions. We have based these forward-looking statements

largely on our current expectations and projections about future events and financial trends that we believe may affect our business,

financial condition, and results of operations. These forward-looking statements speak only as of the date of this press release and

are subject to a number of risks, uncertainties and assumptions, some of which cannot be predicted or quantified and some of which are

beyond our control, including, among others: our ability to successfully advance our current and future product candidates through development

activities, preclinical studies, and clinical trials; our dependence on the success of our lead product candidate, CNTY-101; the ability

of CNTY-101 to be administered as part of a multi-dose strategy and to enable responses without lymphodepletion; uncertainties inherent

in the results of preliminary data, pre-clinical studies and earlier-stage clinical trials, which may not be predictive of final results

or the results of later-stage clinical trials; the timing of and our ability to successfully enroll the Phase 1 SLE and

LN trial; the timing of and our ability to enter dose expansion of the Phase 1 R/R CD19-positive B-cell lymphomas trial;

our ability to obtain FDA clearance of our future IND submissions and commence and complete clinical trials on expected timelines, or

at all; our reliance on the maintenance of certain key collaborative relationships for the manufacturing and development of our product

candidates; the timing, scope and likelihood of regulatory filings and approvals, including final regulatory approval of our product

candidates; the impact of geopolitical issues, banking instability and inflation on our business and operations, supply chain and labor

force; the performance of third parties in connection with the development of our product candidates, including third parties conducting

our clinical trials as well as third-party suppliers and manufacturers; our ability to successfully commercialize our product candidates

and develop sales and marketing capabilities, if our product candidates are approved; our ability to recruit and maintain key members

of management and our ability to maintain and successfully enforce adequate intellectual property protection. These and other risks and

uncertainties are described more fully in the “Risk Factors” section of our most recent filings with the Securities and Exchange

Commission and available at www.sec.gov. You should not rely on these forward-looking statements as predictions of future events. The

events and circumstances reflected in our forward-looking statements may not be achieved or occur, and actual results could differ materially

from those projected in the forward-looking statements. Moreover, we operate in a dynamic industry and economy. New risk factors and

uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties that

we may face. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained

herein, whether as a result of any new information, future events, changed circumstances or otherwise.

For More Information:

Investor Relations &

Media Contacts

Century Therapeutics

Katja Buhrer

SVP, Head of Corporate Affairs

and Strategy

katja.buhrer@centurytx.com

917-969-3438

Argot Partners

Julie Seidel/Noor Pahlavi

century@argotpartners.com

212-600-1902

Century Therapeutics,

Inc.

Condensed Balance Sheets

(unaudited, in thousands)

| | |

June 30, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| Assets | |

| | | |

| | |

| Current Assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 41,457 | | |

$ | 47,324 | |

| Short-term investments | |

| 154,945 | | |

| 125,414 | |

| Prepaid expenses and other current assets | |

| 7,076 | | |

| 4,256 | |

| Total current assets | |

| 203,478 | | |

| 176,994 | |

| Property and equipment, net | |

| 69,405 | | |

| 71,705 | |

| Operating lease right-of-use assets, net | |

| 28,570 | | |

| 20,376 | |

| Long-term investments | |

| 73,226 | | |

| 89,096 | |

| Goodwill | |

| 5,091 | | |

| - | |

| Intangible assets | |

| 33,300 | | |

| - | |

| Other long-term assets | |

| 3,376 | | |

| 2,520 | |

| Total assets | |

$ | 416,446 | | |

$ | 360,691 | |

| | |

| | | |

| | |

| Liabilities, convertible preferred stock, and stockholders' equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 3,358 | | |

$ | 2,741 | |

| Accrued expenses and other liabilities | |

| 11,445 | | |

| 10,733 | |

| Long-term debt, current | |

| - | | |

| - | |

| Deferred revenue, current | |

| 4,360 | | |

| 4,372 | |

| Total current liabilities | |

| 19,163 | | |

| 17,846 | |

| Operating lease liability, noncurrent | |

| 52,713 | | |

| 46,658 | |

| Other long-term liabilities | |

| 3,386 | | |

| 56 | |

| Deferred revenue | |

| 109,768 | | |

| 111,381 | |

| Contingent consideration liability | |

| 9,312 | | |

| - | |

| Total liabilities | |

| 194,342 | | |

| 175,941 | |

| Stockholders' equity | |

| | | |

| | |

| Common stock | |

| 8 | | |

| 6 | |

| Additional paid-in capital | |

| 937,445 | | |

| 840,407 | |

| Accumulated deficit | |

| (715,040 | ) | |

| (655,771 | ) |

| Accumulated other comprehensive loss | |

| (309 | ) | |

| 108 | |

| Total stockholders' equity | |

| 222,104 | | |

| 184,750 | |

| Total liabilities and stockholders' equity | |

$ | 416,446 | | |

$ | 360,691 | |

Century Therapeutics, Inc.

Condensed consolidated statements of operations

(unaudited, in thousands, except share and per share amounts)

| | |

Three Months Ended | | |

Three Months Ended | | |

Six Months Ended | | |

Six Months Ended | |

| | |

June 30, 2024 | | |

June 30, 2023 | | |

June 30, 2024 | | |

June 30, 2023 | |

| Collaboration Revenue | |

$ | 771 | | |

$ | 99 | | |

$ | 1,625 | | |

$ | 1,819 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating Expenses | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 27,220 | | |

| 22,727 | | |

| 50,641 | | |

| 47,626 | |

| General and administrative | |

| 8,306 | | |

| 8,229 | | |

| 17,052 | | |

| 17,131 | |

| Impairment on long-lived assets | |

| - | | |

| 4,220 | | |

| - | | |

| 4,220 | |

| Total operating expenses | |

| 35,526 | | |

| 35,176 | | |

| 67,693 | | |

| 68,977 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (34,755 | ) | |

| (35,077 | ) | |

| (66,068 | ) | |

| (67,158 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| - | | |

| (136 | ) | |

| - | | |

| (540 | ) |

| Interest income | |

| 3,582 | | |

| 3,058 | | |

| 6,820 | | |

| 5,681 | |

| Other income, net | |

| (12 | ) | |

| (186 | ) | |

| 1 | | |

| (380 | ) |

| Loss before provision for income taxes | |

| (31,185 | ) | |

| (32,341 | ) | |

| (59,247 | ) | |

| (62,397 | ) |

| Provision for income taxes | |

| (22 | ) | |

| (950 | ) | |

| (22 | ) | |

| (2,158 | ) |

| Net Loss | |

$ | (31,207 | ) | |

$ | (33,291 | ) | |

$ | (59,269 | ) | |

$ | (64,555 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Unrealized (loss) gain on investments | |

| (102 | ) | |

| 59 | | |

| (453 | ) | |

| 1,255 | |

| Foreign currency translation adjustment gain (loss) | |

| 35 | | |

| 9 | | |

| 36 | | |

| - | |

| Comprehensive loss | |

$ | (31,274 | ) | |

$ | (33,223 | ) | |

$ | (59,686 | ) | |

$ | (63,300 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per common share - Basic and Diluted | |

| (0.38 | ) | |

| (0.56 | ) | |

| 0.82 | | |

| (1.10 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average common shares outstanding | |

| 82,092,167 | | |

| 59,251,363 | | |

| 72,194,402 | | |

| 58,904,726 | |

Exhibit 99.2

Corporate Overview August 2024

2 Forward - looking statements This presentation contains forward - looking statements within the meaning of, and made pursuant to the safe harbor provisions of, The Private Securities Litigation Reform Act of 1995. All statements contained in this presentation, other than statements of historical facts or statements that relate to present facts or current conditions, including but not limited to, statements regarding our clinical development plans and timelines and the initial safety and efficacy profiles of CNTY - 101 are forward - looking statements. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance, or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward - looking statements. In some cases, you can identify forward - looking statements by terms such as “may,” “might,” “will,” “should,” “expect,” “plan,” “aim,” “seek,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “forecast,” “potential” or “continue” or the negative of these terms or other similar expressions. The forward - looking statements in this presentation are only predictions. We have based these forward - looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition, and results of operations. These forward - looking statements speak only as of the date of this presentation and are subject to a number of risks, uncertainties and assumptions, some of which cannot be predicted or quantified and some of which are beyond our control, including, among others: our ability to successfully advance our current and future product candidates through development activities, preclinical studies, and clinical trials; our dependence on the success of our lead product candidate, CNTY - 101; the ability of CNTY - 101 to be administered as part of a multi - dose strategy and to enable responses without lymphodepletion; uncertainties inherent in the results of preliminary data, pre - clinical studies and earlier - stage clinical trials, which may not be predictive of final results or the results of later - stage clinical trials; the timing of and our ability to successfully enroll the Phase 1 SLE and LN trial; the timing of and our ability to enter dose expansion of the Phase 1 R/R CD19 - positive B - cell lymphomas trial ; our ability to obtain FDA clearance of our future IND submissions and commence and complete clinical trials on expected timelines, or at all; our reliance on the maintenance of certain key collaborative relationships for the manufacturing and development of our product candidates; the timing, scope and likelihood of regulatory filings and approvals, including final regulatory approval of our product candidates; the impact of geopolitical issues, banking instability and inflation on our business and operations, supply chain and labor force; the performance of third parties in connection with the development of our product candidates, including third parties conducting our clinical trials as well as third - party suppliers and manufacturers; our ability to successfully commercialize our product candidates and develop sales and marketing capabilities, if our product candidates are approved; our ability to recruit and maintain key members of management and our ability to maintain and successfully enforce adequate intellectual property protection. These and other risks and uncertainties are described more fully in the “Risk Factors” section of our most recent filings with the Securities and Exchange Commission and available at www.sec.gov. You should not rely on these forward - looking statements as predictions of future events. The events and circumstances reflected in our forward - looking statements may not be achieved or occur, and actual results could differ materially from those projected in the forward - looking statements. Moreover, we operate in a dynamic industry and economy. New risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties that we may face. Except as required by applicable law, we do not plan to publicly update or revise any forward - looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise.

3 Century Therapeutics: Building an industry - leading, next - generation allogeneic iPSC - derived cell therapy platform LIMITLESS POTENTIAL… PRECISION DESIGN… ENDURING IMPACT… Foundational investments in iPSC technology, genetic editing, protein engineering, and manufacturing Progressing differentiated clinical programs based on Allo - Evasion TM technology in oncology and autoimmune diseases Well - capitalized into 2026 to enable delivery on key milestones and clinical data

Overview of Foundational Platform Technologies

5 Century’s singular focus: To deliver best - in - class iPSC - derived cell therapies Century platform enables the incorporation of critical features we b elieve can only be realized via iPSC - derived cell therapies Infinite replicative capacity at the iPSC stage enables potentially unlimited genomic editing via CRISPR HDR Single cell cloning of engineered iPSC allows selection of a fully characterized clone for a master cell bank, ensuring safety and functional reproducibility of the final drug product Production from a master cell bank – derived from a single donor – enables larger batch sizes and lower cost of goods than donor - derived or autologous Platform capable of fully leveraging multiple advances in synthetic biology into a single product Differentiation conditions developed for generating multiple immune effector cells , including NK cells, CD4+ T cells (Th and Treg), CD8+ T cells, monocytes / macrop hages Cell expansion during multiple stages of differentiation yields large cell harvests, decreasing risk of cell exhaustion, reducing COGs and providing robust drug inventory that is potentially infinitely replenishable

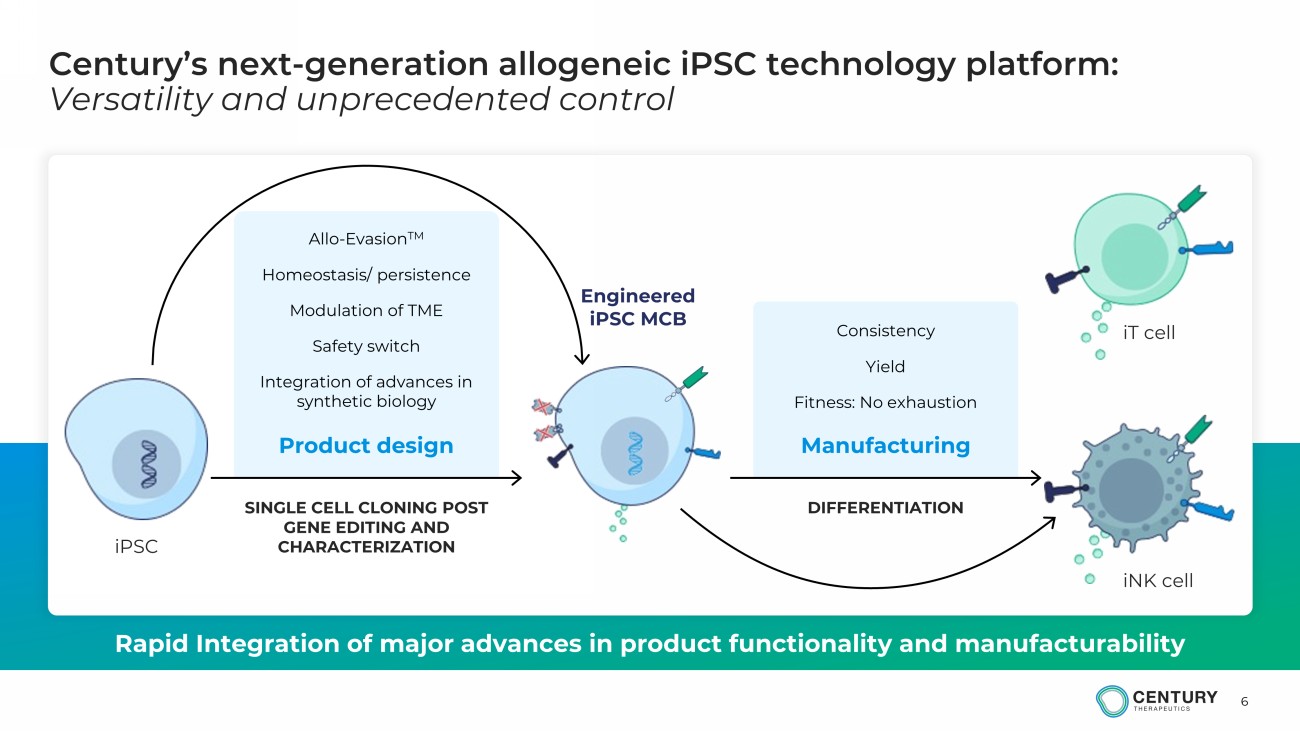

6 Century’s next - generation allogeneic iPSC technology platform: Versatility and unprecedented control Rapid Integration of major advances in product functionality and manufacturability iPSC iT cell iNK cell SINGLE CELL CLONING POST GENE EDITING AND CHARACTERIZATION DIFFERENTIATION Consistency Yield Fitness: No exhaustion Allo - Evasion TM Homeostasis/ persistence Modulation of TME Safety switch Integration of advances in synthetic biology Product design Manufacturing Engineered iPSC MCB

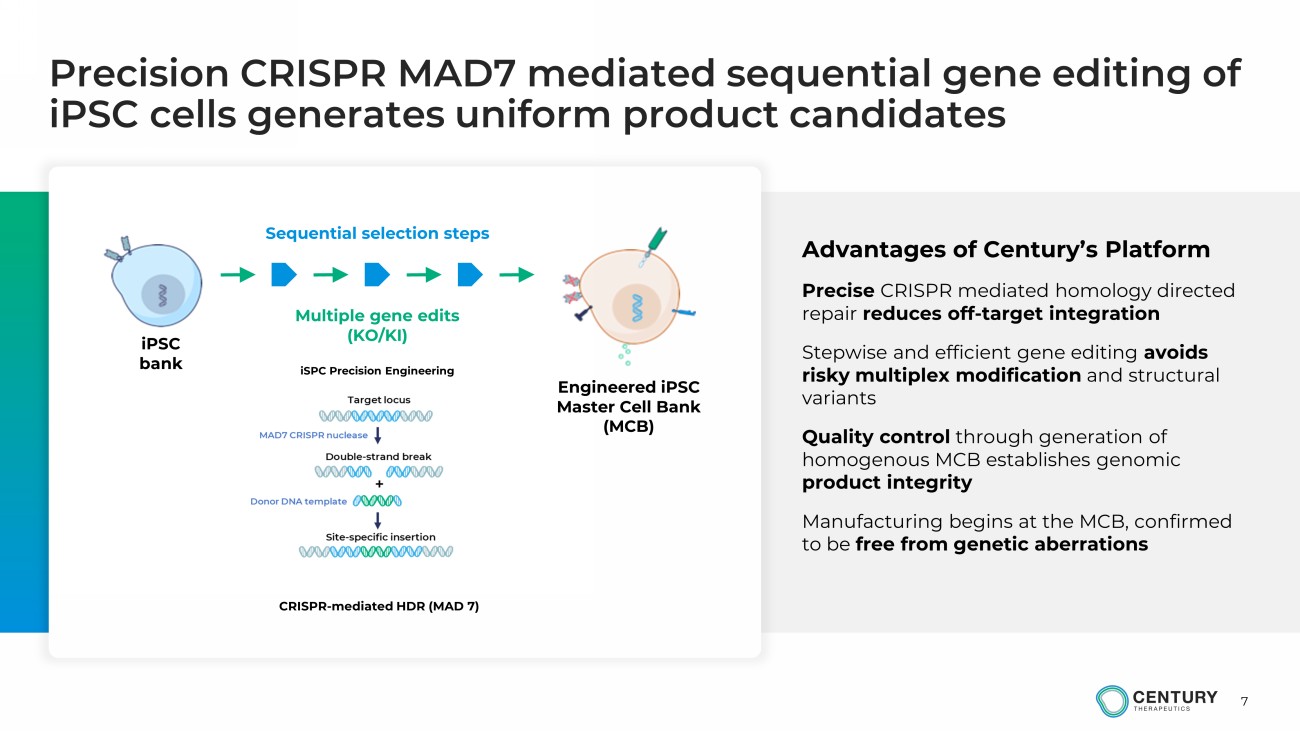

7 Precision CRISPR MAD7 mediated sequential gene editing of iPSC cells generates uniform product candidates Multiple gene edits (KO/KI) iPSC bank Engineered iPSC Master Cell Bank (MCB) Sequential selection steps iSPC Precision Engineering CRISPR - mediated HDR (MAD 7) Advantages of Century’s Platform Precise CRISPR mediated homology directed repair reduces off - target integration Stepwise and efficient gene editing avoids risky multiplex modification and structural variants Quality control through generation of homogenous MCB establishes genomic product integrity Manufacturing begins at the MCB, confirmed to be free from genetic aberrations

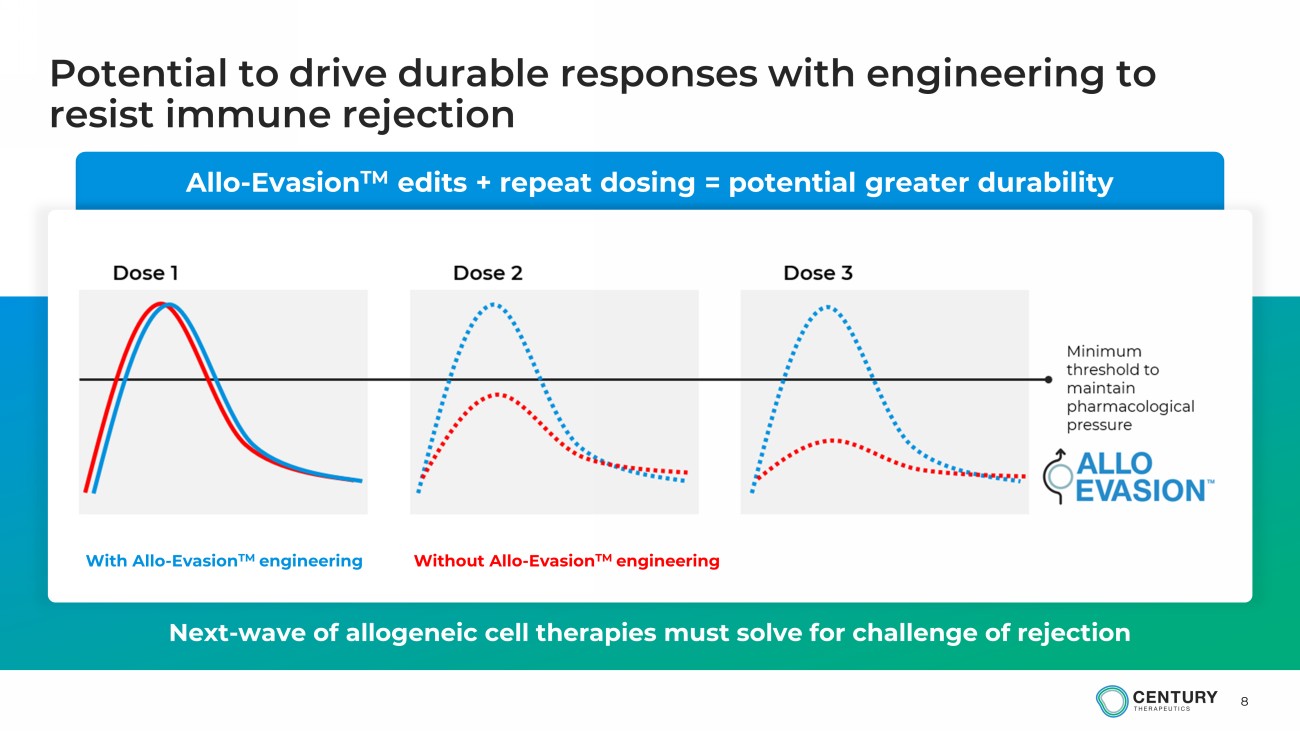

8 Allo - Evasion TM edits + repeat dosing = potential greater durability Potential to drive durable responses with engineering to resist immune rejection Next - wave of allogeneic cell therapies must solve for challenge of rejection With Allo - Evasion TM engineering Without Allo - Evasion TM engineering

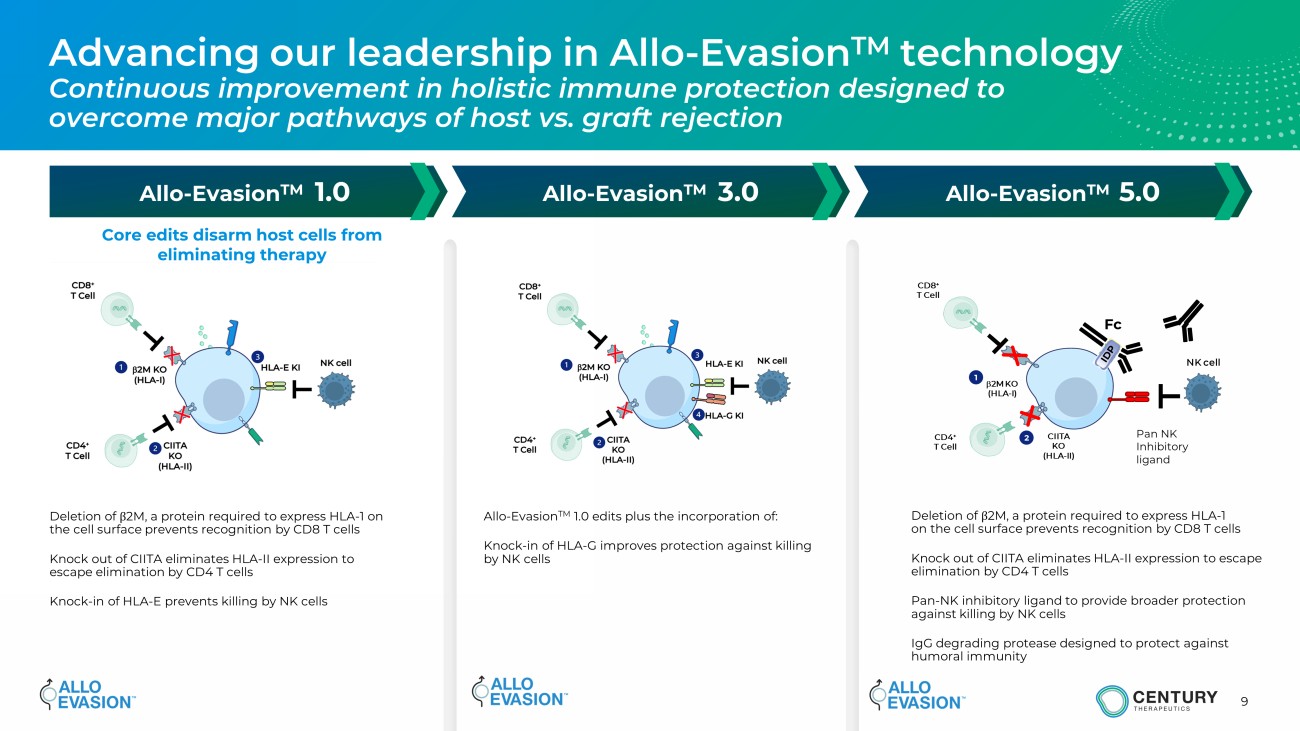

9 Advancing our leadership in Allo - Evasion TM technology Continuous improvement in holistic immune protection designed to overcome major pathways of host vs. graft rejection Allo - Evasion TM 1.0 Allo - Evasion TM 3.0 Allo - Evasion TM 5.0 b 2M KO (HLA - I) CIITA KO (HLA - II) CD8 + T Cell CD4 + T Cell Pan NK Inhibitory ligand Fc NK cell 1 2 Core edits disarm host cells from eliminating therapy Deletion of β 2M, a protein required to express HLA - 1 on the cell surface prevents recognition by CD8 T cells Knock out of CIITA eliminates HLA - II expression to escape elimination by CD4 T cells Knock - in of HLA - E prevents killing by NK cells Allo - Evasion TM 1.0 edits plus the incorporation of: Knock - in of HLA - G improves protection against killing by NK cells Deletion of β 2M, a protein required to express HLA - 1 on the cell surface prevents recognition by CD8 T cells Knock out of CIITA eliminates HLA - II expression to escape elimination by CD4 T cells Pan - NK inhibitory ligand to provide broader protection against killing by NK cells IgG degrading protease designed to protect against humoral immunity

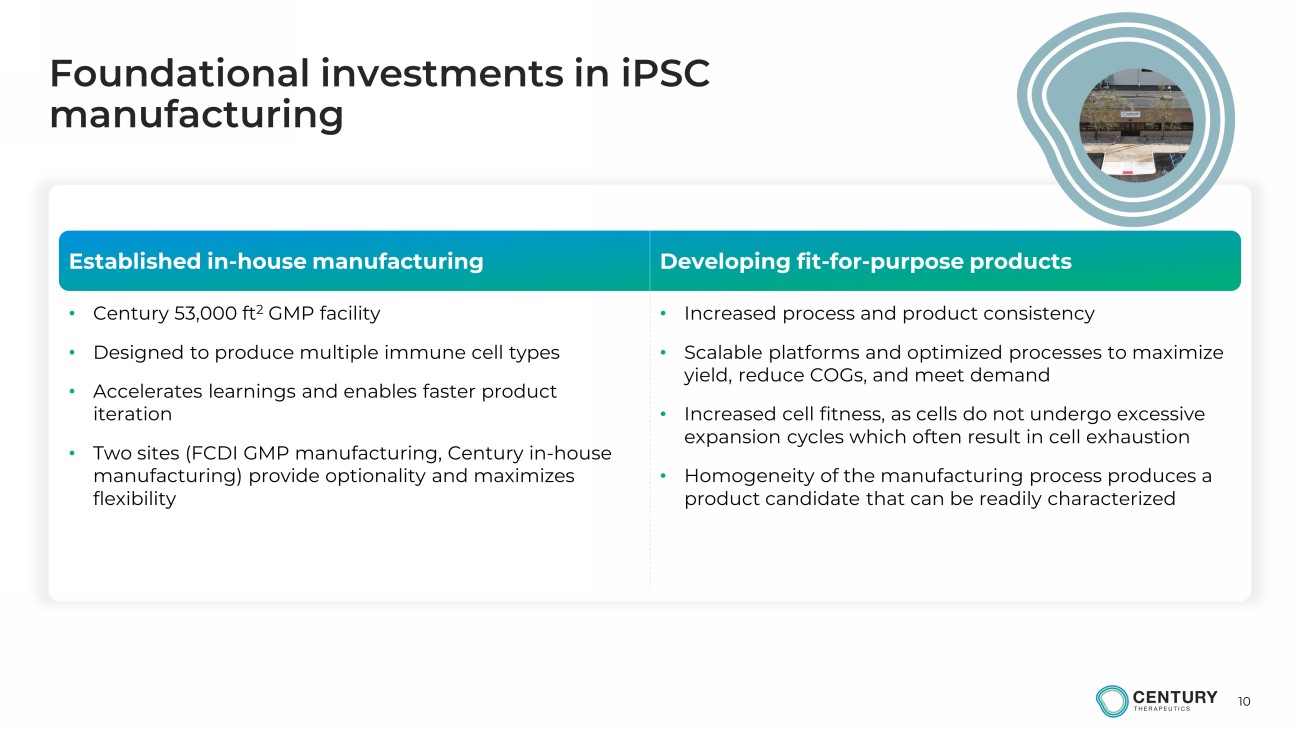

10 Foundational investments in iPSC manufacturing Established in - house manufacturing Developing fit - for - purpose products • Century 53,000 ft 2 GMP facility • Designed to produce multiple immune cell types • Accelerates learnings and enables faster product iteration • Two sites (FCDI GMP manufacturing, Century in - house manufacturing) provide optionality and maximizes flexibility • Increased process and product consistency • Scalable platforms and optimized processes to maximize yield, reduce COGs, and meet demand • Increased cell fitness, as cells do not undergo excessive expansion cycles which often result in cell exhaustion • Homogeneity of the manufacturing process produces a product candidate that can be readily characterized

Pipeline

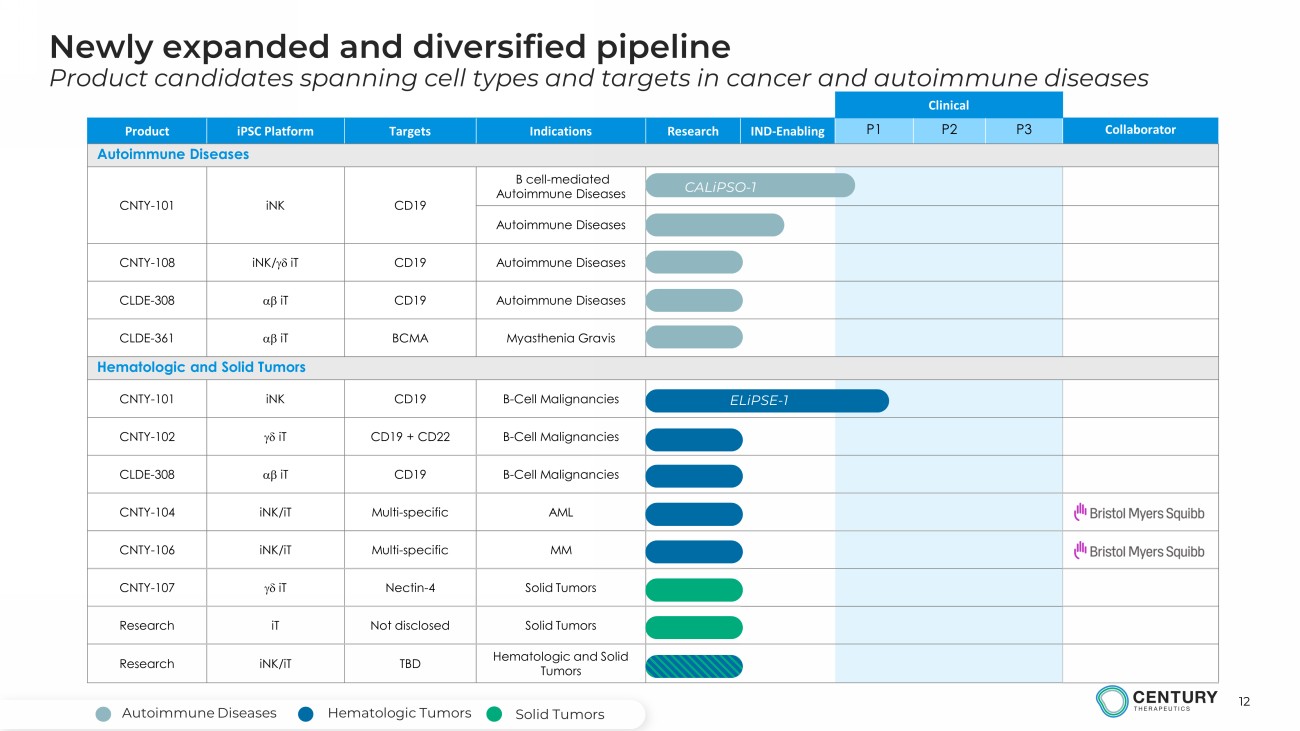

12 Newly expanded and diversified pipeline Product candidates spanning cell types and targets in cancer and autoimmune diseases Clinical Product iPSC Platform Targets Indications Research IND - Enabling P1 P2 P3 Collaborator Autoimmune Diseases CNTY - 101 iNK CD19 B cell - mediated Autoimmune Diseases Autoimmune Diseases CNTY - 108 iNK / gd iT CD19 Autoimmune Diseases CLDE - 308 ab iT CD19 Autoimmune Diseases CLDE - 361 ab iT BCMA Myasthenia Gravis Hematologic and Solid Tumors CNTY - 101 iNK CD19 B - Cell Malignancies CNTY - 102 gd iT CD19 + CD22 B - Cell Malignancies CLDE - 308 ab iT CD19 B - Cell Malignancies CNTY - 104 iNK/iT Multi - specific AML CNTY - 106 iNK/iT Multi - specific MM CNTY - 107 gd iT Nectin - 4 Solid Tumors Research iT Not disclosed Solid Tumors Research iNK/iT TBD Hematologic and Solid Tumors ELiPSE - 1 CALiPSO - 1 Hematologic Tumors Autoimmune Diseases Solid Tumors

CNTY - 101 Clinical Programs

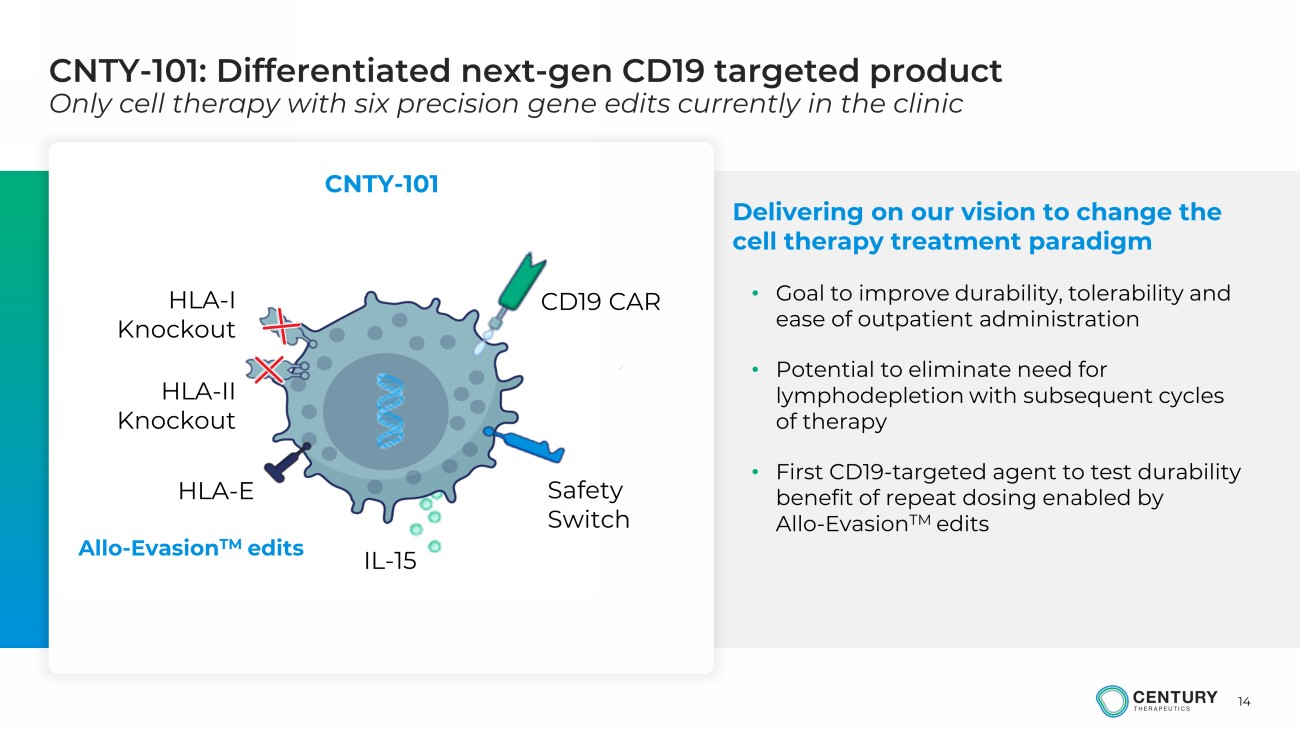

14 CNTY - 101: Differentiated next - gen CD19 targeted product Only cell therapy with six precision gene edits currently in the clinic Delivering on our vision to change the cell therapy treatment paradigm • Goal to improve durability, tolerability and ease of outpatient administration • Potential to eliminate need for lymphodepletion with subsequent cycles of therapy • First CD19 - targeted agent to test durability benefit of repeat dosing enabled by Allo - Evasion TM edits CNTY - 101 Allo - Evasion TM edits HLA - I Knockout IL - 15 HLA - II Knockout CD19 CAR HLA - E Safety Switch

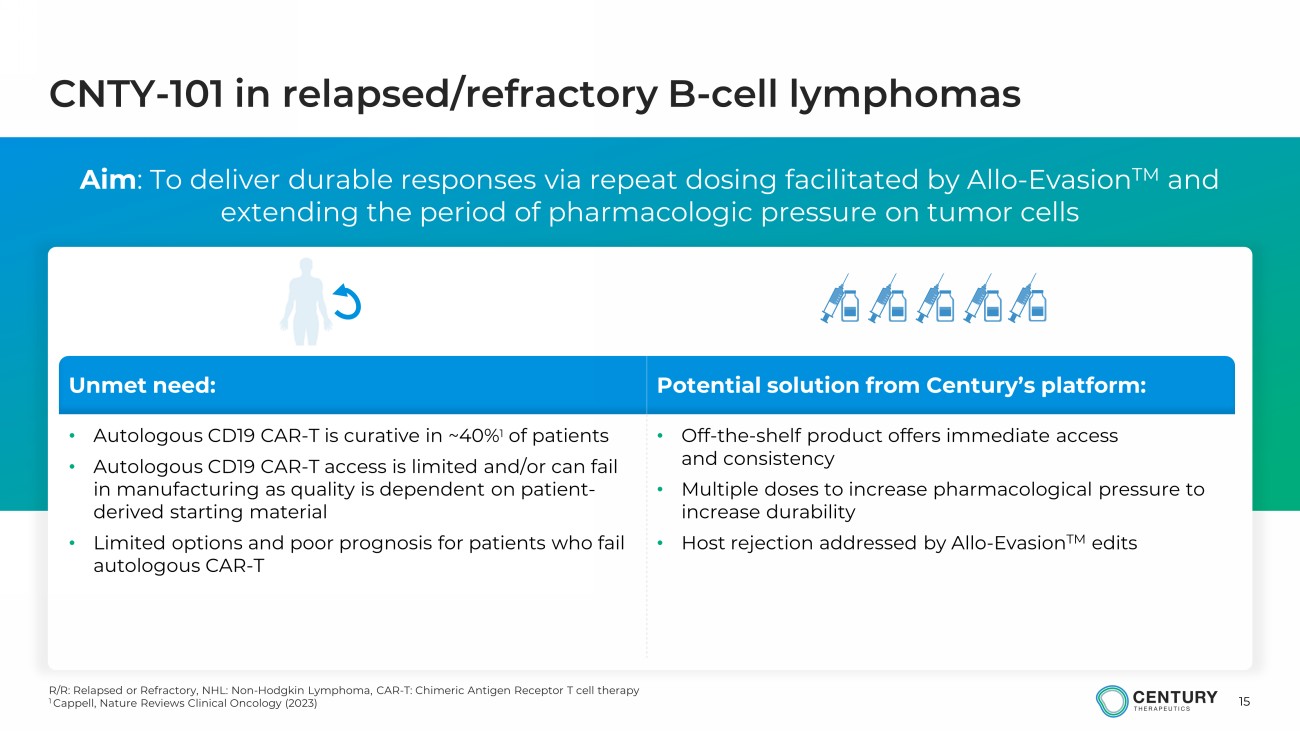

15 CNTY - 101 in relapsed/refractory B - cell lymphomas Aim : To deliver durable responses via repeat dosing facilitated by Allo - Evasion TM and extending the period of pharmacologic pressure on tumor cells R/R: Relapsed or Refractory, NHL: Non - Hodgkin Lymphoma, CAR - T: Chimeric Antigen Receptor T cell therapy 1 Cappell , Nature Reviews Clinical Oncology (2023) Unmet need: Potential solution from Century’s platform: • Autologous CD19 CAR - T is curative in ~40 % 1 of patients • Autologous CD19 CAR - T access is limited and/or can fail in manufacturing as quality is dependent on patient - derived starting material • Limited options and poor prognosis for patients who fail autologous CAR - T • Off - the - shelf product offers immediate access and consistency • Multiple doses to increase pharmacological pressure to increase durability • Host rejection addressed by Allo - Evasion TM edits

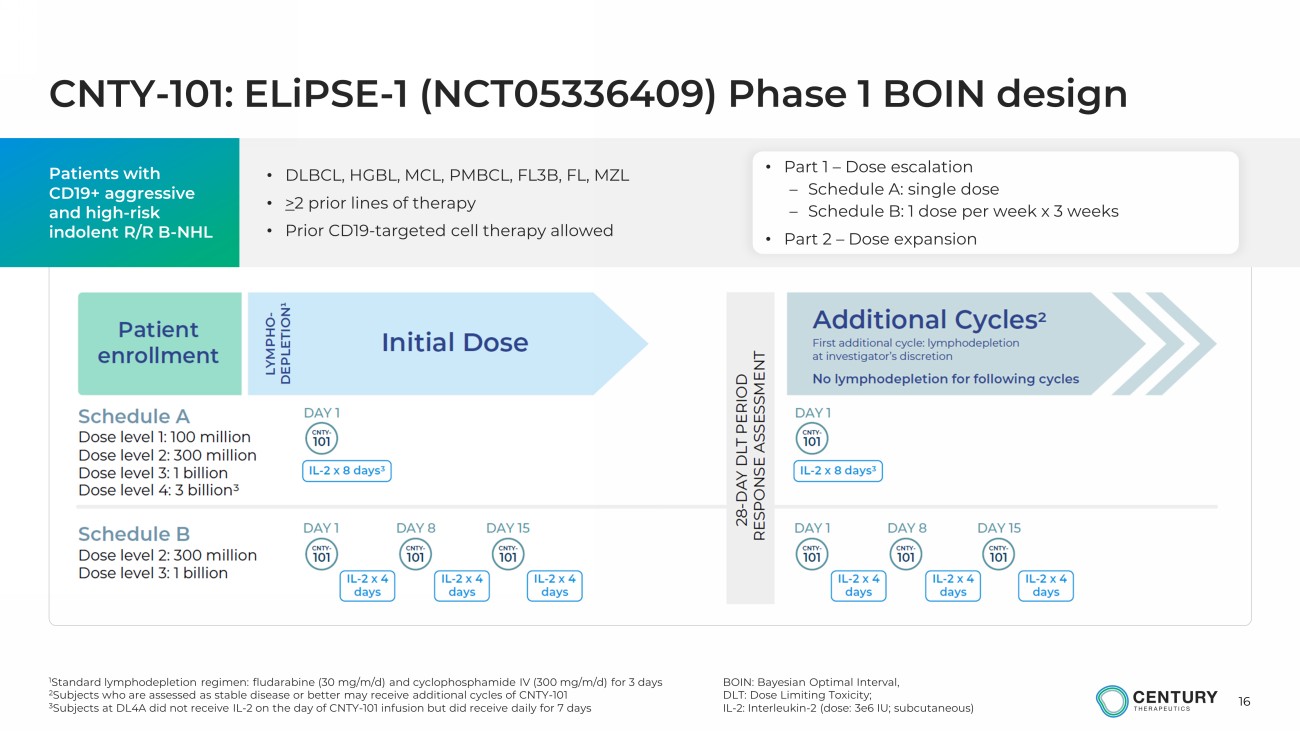

16 CNTY - 101: ELiPSE - 1 (NCT05336409) Phase 1 BOIN design Patients with CD19+ aggressive and high - risk indolent R/R B - NHL • Part 1 – Dose escalation – Schedule A: single dose – Schedule B: 1 dose per week x 3 weeks • Part 2 – Dose expansion BOIN: Bayesian Optimal Interval, DLT: Dose Limiting Toxicity; IL - 2: Interleukin - 2 (dose: 3e6 IU; subcutaneous) • DLBCL, HGBL, MCL, PMBCL, FL3B, FL, MZL • > 2 prior lines of therapy • Prior CD19 - targeted cell therapy allowed 1 Standard lymphodepletion regimen: fludarabine (30 mg/m/d) and cyclophosphamide IV (300 mg/m/d) for 3 days 2 Subjects who are assessed as stable disease or better may receive additional cycles of CNTY - 101 3 Subjects at DL4A did not receive IL - 2 on the day of CNTY - 101 infusion but did receive daily for 7 days

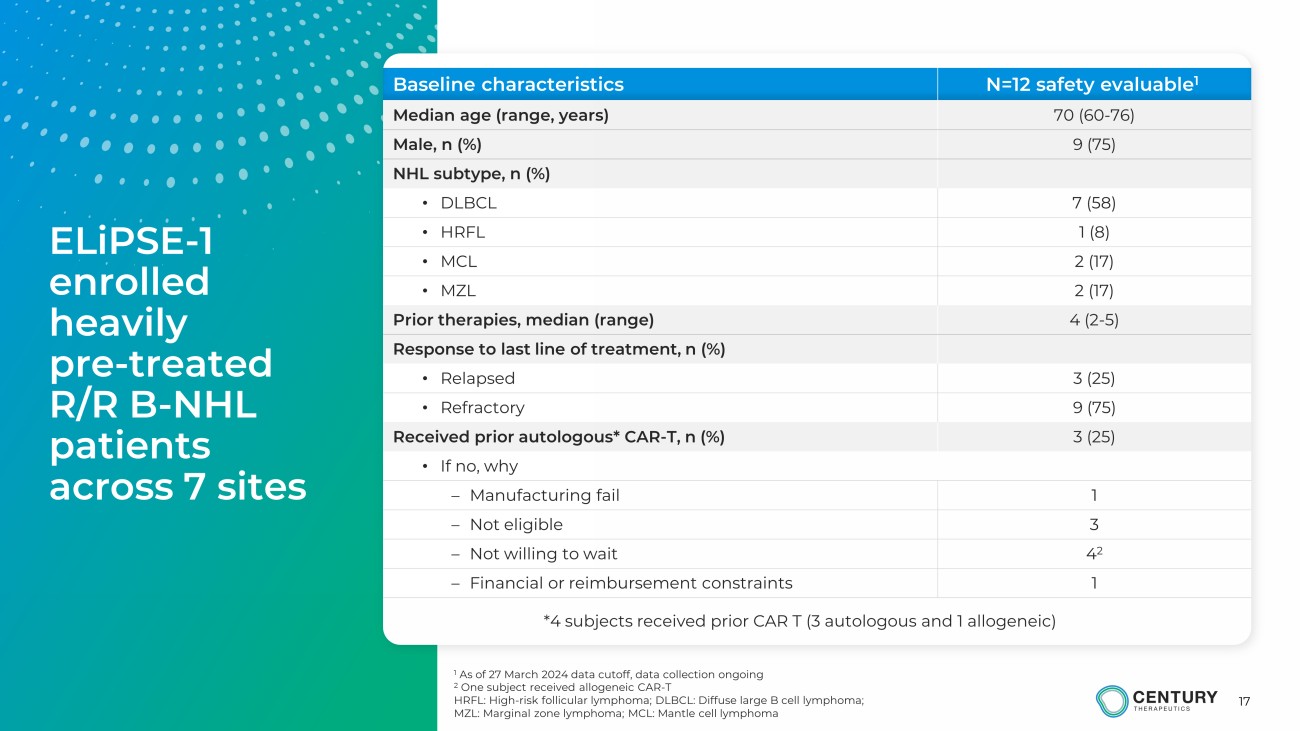

17 1 As of 27 March 2024 data cutoff, data collection ongoing 2 One subject received allogeneic CAR - T HRFL: High - risk follicular lymphoma; DLBCL: Diffuse large B cell lymphoma ; MZL: Marginal zone lymphoma; MCL: Mantle cell lymphoma Baseline characteristics N=12 safety evaluable 1 Median age (range, years) 70 (60 - 76) Male, n (%) 9 (75) NHL subtype, n (%) • DLBCL 7 (58) • HRFL 1 (8) • MCL 2 (17) • MZL 2 (17) Prior therapies, median (range) 4 (2 - 5) Response to last line of treatment, n (%) • Relapsed 3 (25) • Refractory 9 (75) Received prior autologous* CAR - T, n (%) 3 (25) • If no, why – Manufacturing fail 1 – Not eligible 3 – Not willing to wait 4 2 – Financial or reimbursement constraints 1 * 4 subjects received prior CAR T (3 autologous and 1 allogeneic) ELiPSE - 1 enrolled heavily pre - treated R/R B - NHL patients across 7 sites

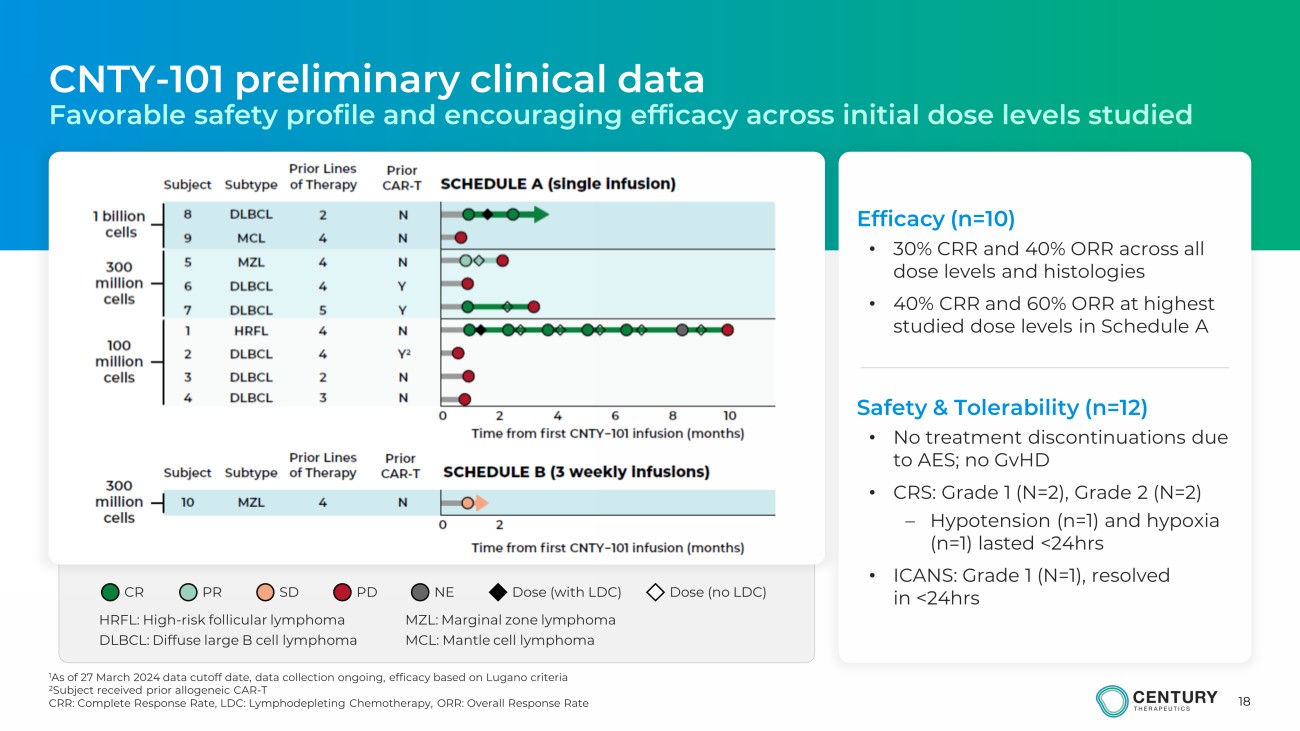

18 Efficacy (n=10) • 30% CRR and 40% ORR across all dose levels and histologies • 40% CRR and 60% ORR at highest studied dose levels in Schedule A Safety & Tolerability (n=12) • No treatment discontinuations due to AES ; no GvHD • CRS: Grade 1 (N=2), Grade 2 (N=2) – Hypotension (n=1) and hypoxia (n=1) lasted <24hrs • ICANS: Grade 1 (N=1), resolved in <24hrs CNTY - 101 preliminary clinical data Favorable safety profile and encouraging efficacy across initial dose levels studied NE CR PR SD PD NE Dose (with LDC) Dose (no LDC) DLBCL: Diffuse large B cell lymphoma HRFL: High - risk follicular lymphoma MZL: Marginal zone lymphoma MCL: Mantle cell lymphoma 1 As of 27 March 2024 data cutoff date, data collection ongoing, efficacy based on Lugano criteria 2 Subject received prior allogeneic CAR - T CRR: Complete Response Rate, LDC: Lymphodepleting Chemotherapy, ORR: Overall Response Rate

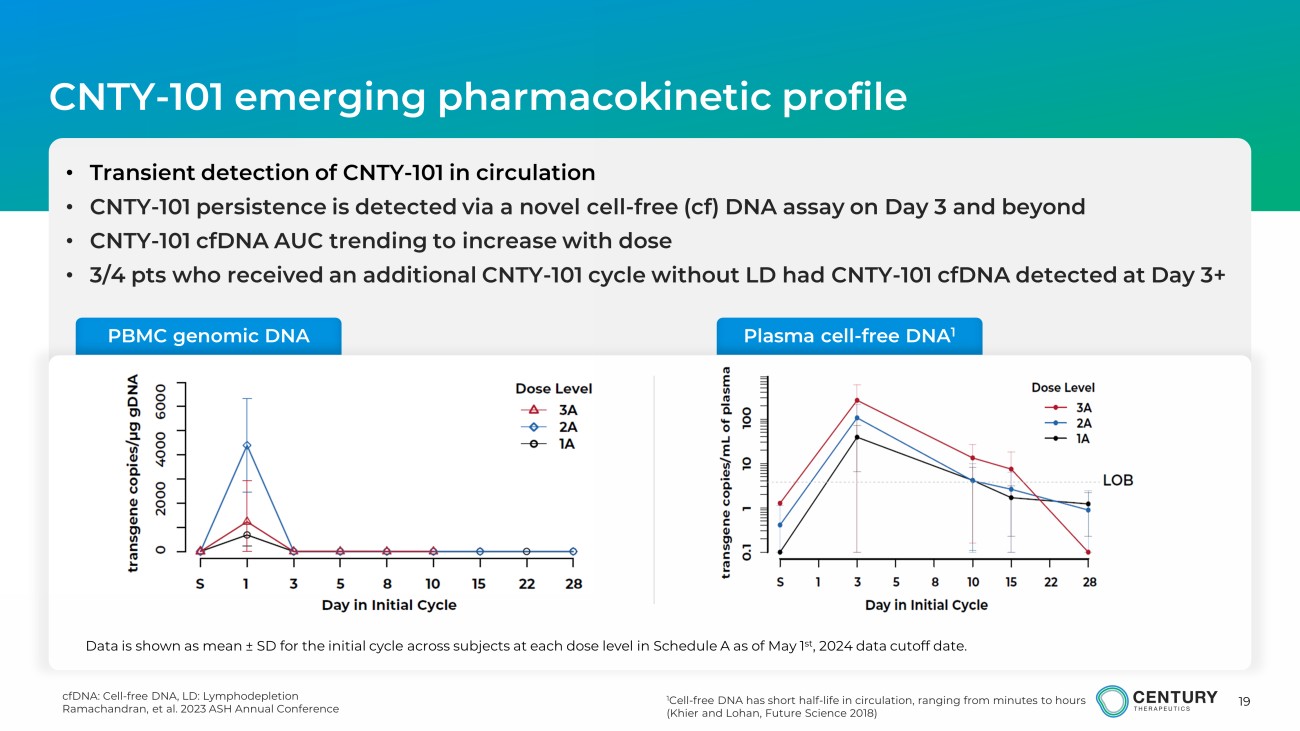

19 cfDNA: Cell - free DNA, LD: Lymphodepletion Ramachandran, et al. 2023 ASH Annual Conference CNTY - 101 emerging pharmacokinetic profile 1 Cell - free DNA has short half - life in circulation, ranging from minutes to hours ( Khier and Lohan, Future Science 2018) • Transient detection of CNTY - 101 in circulation • CNTY - 101 persistence is detected via a novel cell - free ( cf ) DNA assay on Day 3 and beyond • CNTY - 101 cfDNA AUC trending to increase with dose • 3 / 4 pts who received an additional CNTY - 101 cycle without LD had CNTY - 101 cfDNA detected at Day 3+ PBMC genomic DNA Plasma cell - free DNA 1 Data is shown as mean ± SD for the initial cycle across subjects at each dose level in Schedule A as of May 1 st , 2024 data cutoff date.

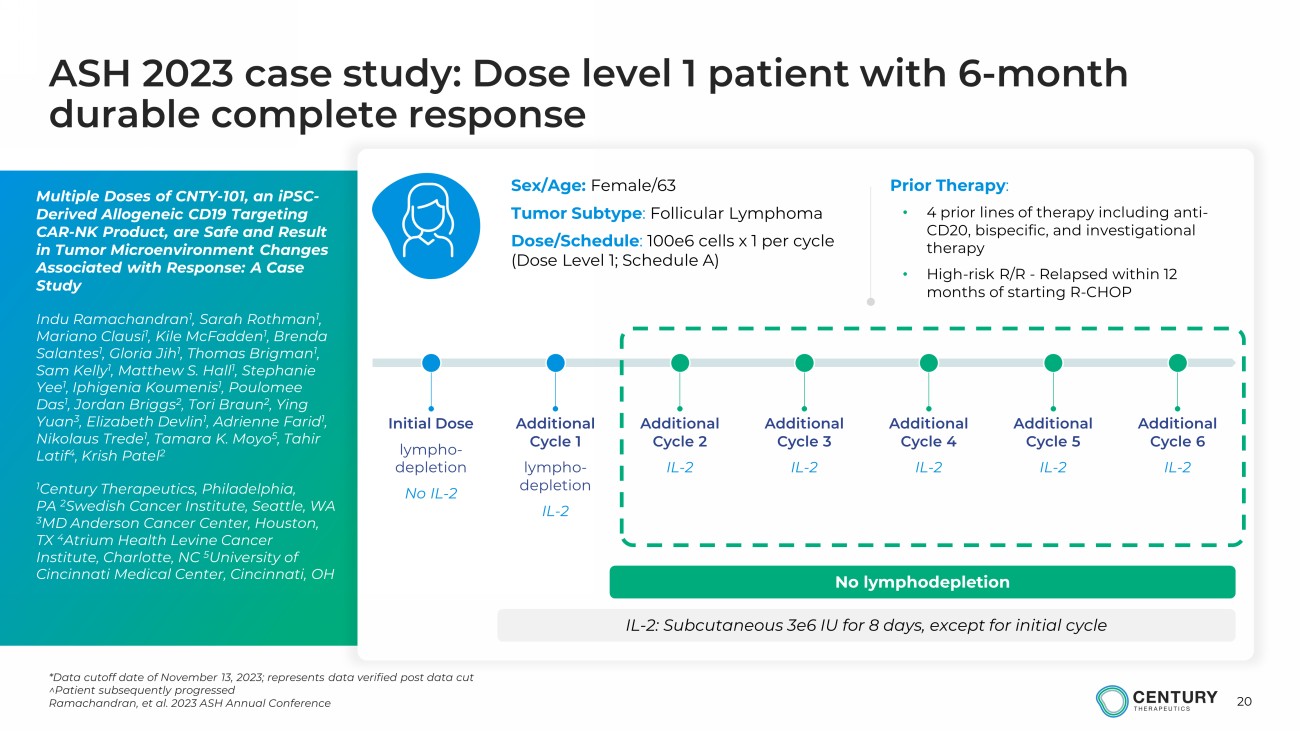

20 ASH 2023 case study: Dose level 1 patient with 6 - month durable complete response *Data cutoff date of November 13, 2023; represents data verified post data cut ^Patient subsequently progressed Ramachandran, et al. 2023 ASH Annual Conference Multiple Doses of CNTY - 101, an iPSC - Derived Allogeneic CD19 Targeting CAR - NK Product, are Safe and Result in Tumor Microenvironment Changes Associated with Response: A Case Study Indu Ramachandran 1 , Sarah Rothman 1 , Mariano Clausi 1 , Kile McFadden 1 , Brenda Salantes 1 , Gloria Jih 1 , Thomas Brigman 1 , Sam Kelly 1 , Matthew S. Hall 1 , Stephanie Yee 1 , Iphigenia Koumenis 1 , Poulomee Das 1 , Jordan Briggs 2 , Tori Braun 2 , Ying Yuan 3 , Elizabeth Devlin 1 , Adrienne Farid 1 , Nikolaus Trede 1 , Tamara K. Moyo 5 , Tahir Latif 4 , Krish Patel 2 1 Century Therapeutics, Philadelphia, PA 2 Swedish Cancer Institute, Seattle, WA 3 MD Anderson Cancer Center, Houston, TX 4 Atrium Health Levine Cancer Institute, Charlotte, NC 5 University of Cincinnati Medical Center, Cincinnati, OH Sex/Age: Female/63 Tumor Subtype : Follicular Lymphoma Dose/Schedule : 100e6 cells x 1 per cycle (Dose Level 1; Schedule A) Prior Therapy : • 4 prior lines of therapy including anti - CD20, bispecific, and investigational therapy • High - risk R/R - Relapsed within 12 months of starting R - CHOP Initial Dose lympho - depletion No IL - 2 Additional Cycle 1 lympho - depletion IL - 2 Additional Cycle 2 IL - 2 Additional Cycle 3 IL - 2 Additional Cycle 4 IL - 2 Additional Cycle 5 IL - 2 Additional Cycle 6 IL - 2 IL - 2: Subcutaneous 3e6 IU for 8 days, except for initial cycle No lymphodepletion

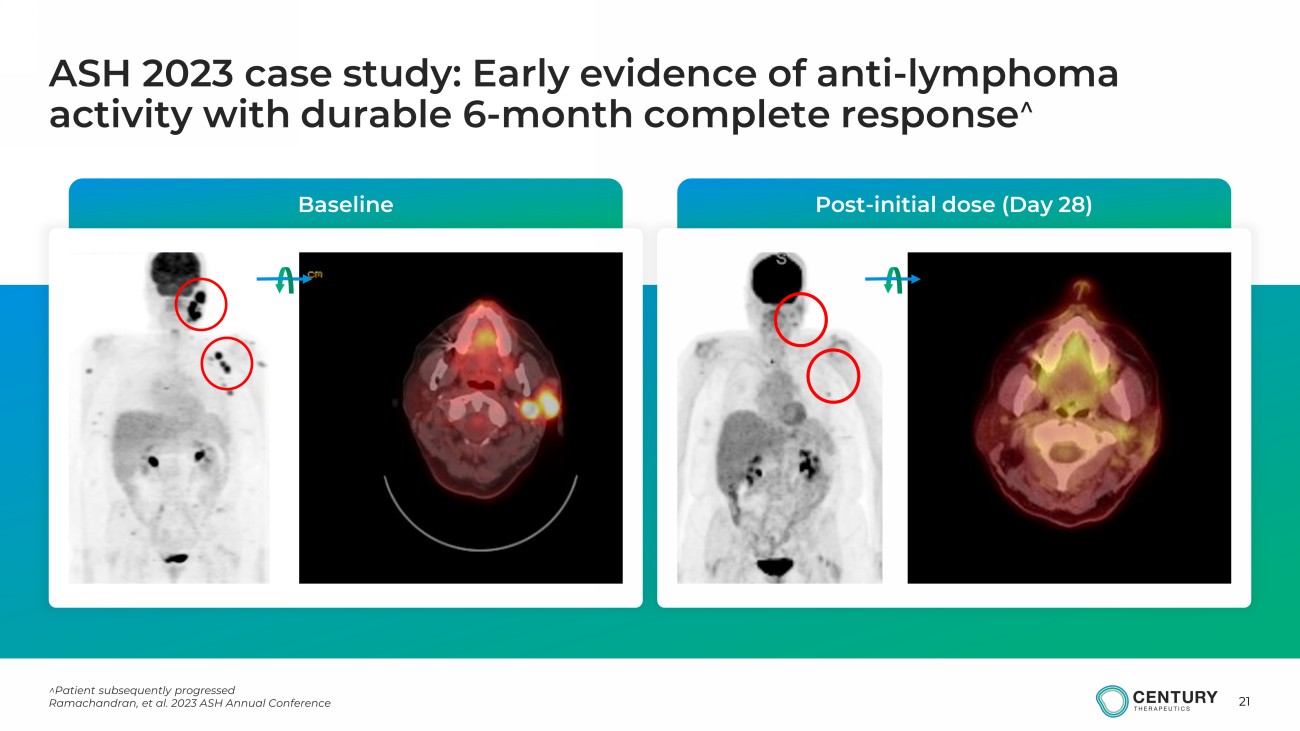

21 ^Patient subsequently progressed Ramachandran, et al. 2023 ASH Annual Conference ASH 2023 case study: Early evidence of anti - lymphoma activity with durable 6 - month complete response ^ Baseline Post - initial dose (Day 28)

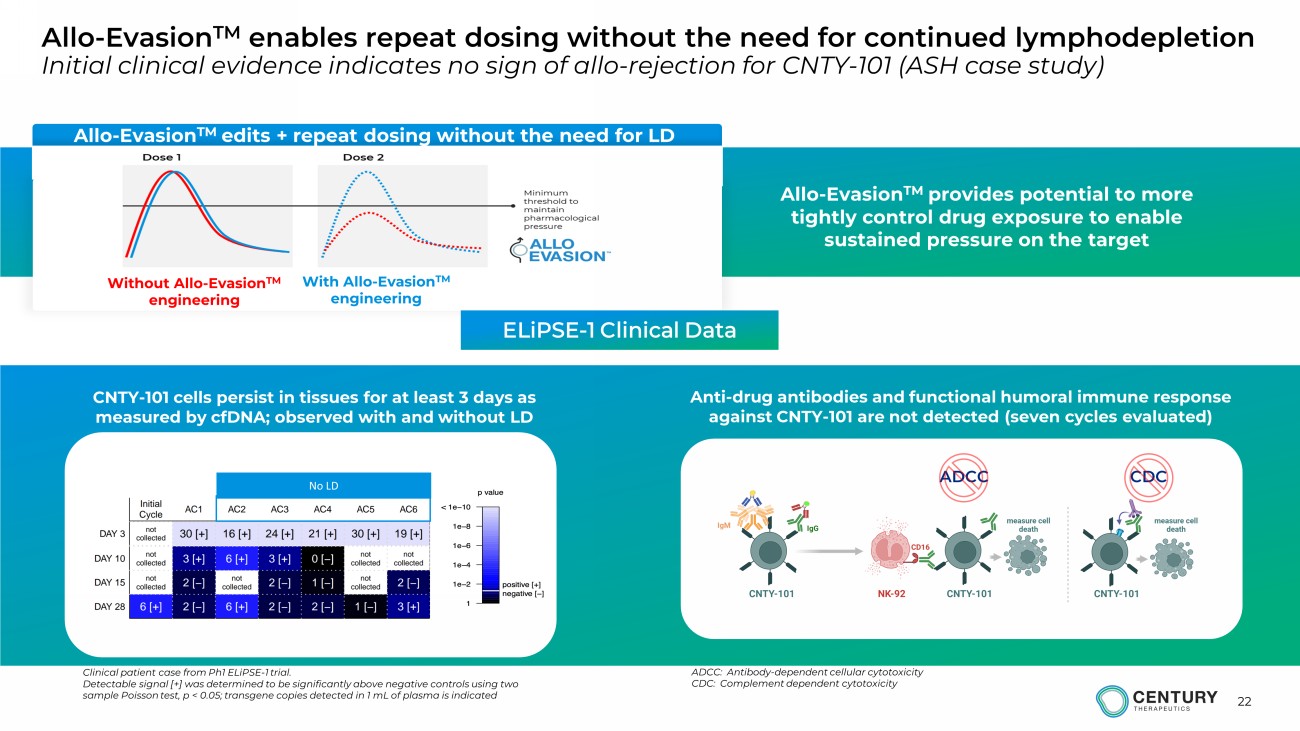

22 Allo - Evasion TM edits + repeat dosing without the need for LD With Allo - Evasion TM engineering Without Allo - Evasion TM engineering Allo - Evasion TM enables repeat dosing without the need for continued lymphodepletion Initial clinical evidence indicates no sign of allo - rejection for CNTY - 101 (ASH case study) Allo - Evasion TM provides potential to more tightly control drug exposure to enable sustained pressure on the target CNTY - 101 cells persist in tissues for at least 3 days as measured by cfDNA; observed with and without LD Clinical patient case from Ph1 ELiPSE - 1 trial. Detectable signal [+] was determined to be significantly above negative controls using two sample Poisson test, p < 0.05; transgene copies detected in 1 mL of plasma is indicated Anti - drug antibodies and functional humoral immune response against CNTY - 101 are not detected (seven cycles evaluated) ADCC CDC ELiPSE - 1 Clinical Data No LD ADCC: Antibody - dependent cellular cytotoxicity CDC: Complement dependent cytotoxicity

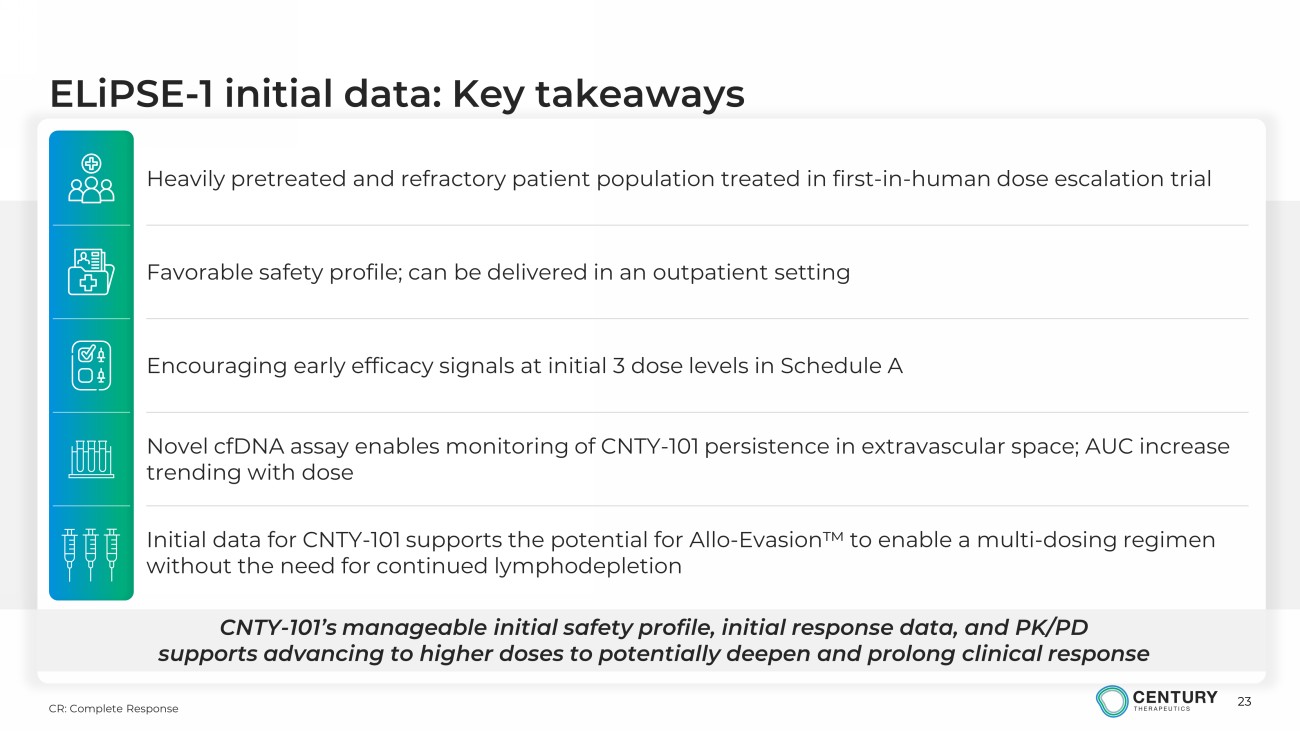

23 ELiPSE - 1 initial data: Key takeaways Heavily pretreated and refractory patient population treated in first - in - human dose escalation trial Favorable safety profile; can be delivered in an outpatient setting Encouraging early efficacy signals at initial 3 dose levels in Schedule A Novel cfDNA assay enables monitoring of CNTY - 101 persistence in extravascular space; AUC increase trending with dose Initial data for CNTY - 101 supports the potential for Allo - Evasion ۲ to enable a multi - dosing regimen without the need for continued lymphodepletion CR: Complete Response CNTY - 101’s manageable initial safety profile, initial response data, and PK/PD supports advancing to higher doses to potentially deepen and prolong clinical response

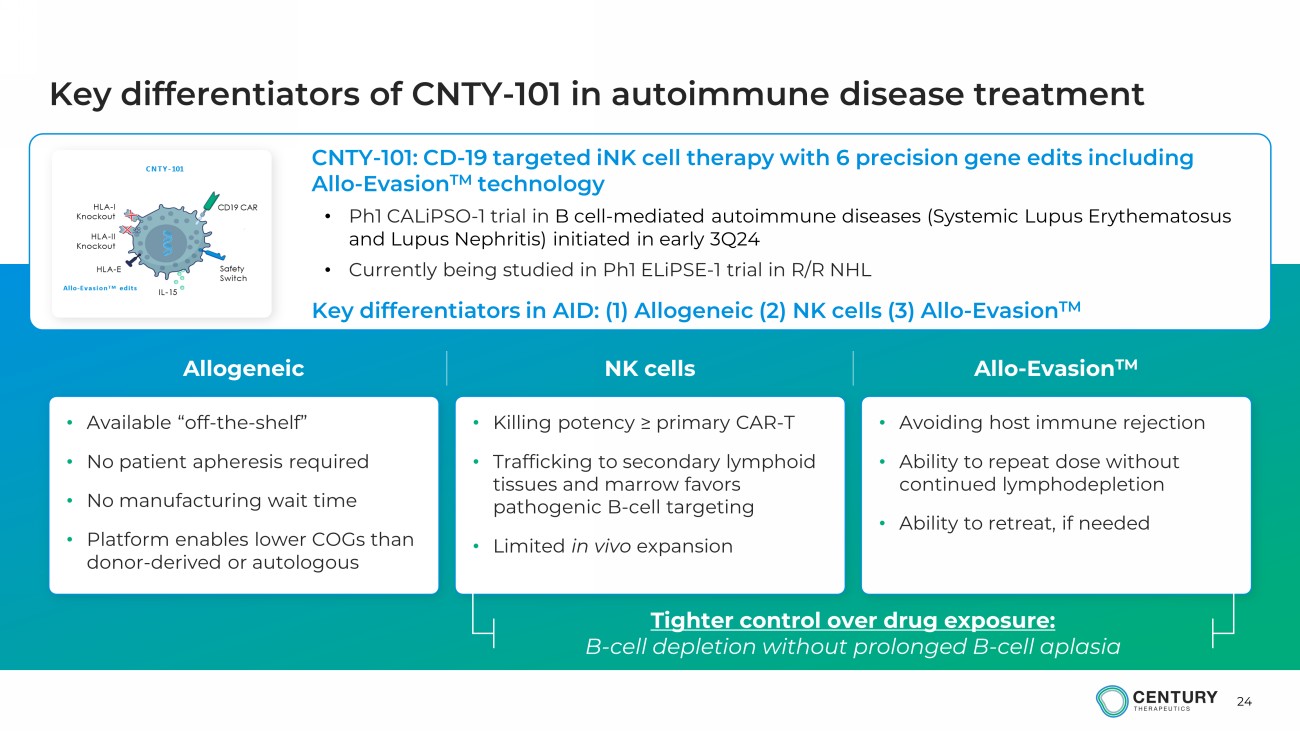

24 Key differentiators of CNTY - 101 in autoimmune disease treatment CNTY - 101: CD - 19 targeted iNK cell therapy with 6 precision gene edits including Allo - Evasion TM technology • Ph1 CALiPSO - 1 trial in B cell - mediated autoimmune diseases (Systemic Lupus Erythematosus and Lupus Nephritis) initiated in early 3Q24 • Currently being studied in Ph1 ELiPSE - 1 trial in R/R NHL Key differentiators in AID: (1) Allogeneic (2) NK cells (3) Allo - Evasion TM NK cells Allogeneic Allo - Evasion TM • Killing potency ≥ primary CAR - T • Trafficking to secondary lymphoid tissues and marrow favors pathogenic B - cell targeting • Limited in vivo expansion • Available “off - the - shelf” • No patient apheresis required • No manufacturing wait time • Platform enables lower COGs than donor - derived or autologous • Avoiding host immune rejection • Ability to repeat dose without continued lymphodepletion • Ability to retreat, if needed Tighter control over drug exposure: B - cell depletion without prolonged B - cell aplasia

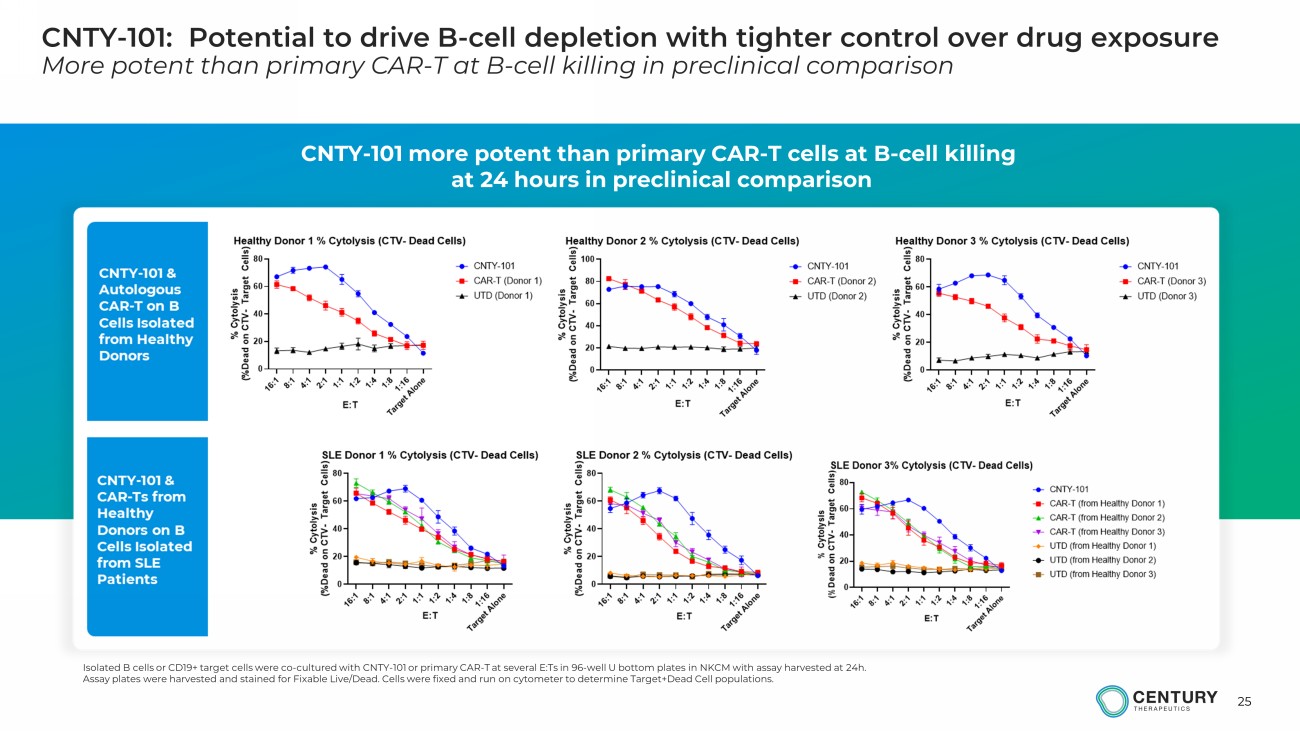

25 CNTY - 101: Potential to drive B - cell depletion with tighter control over drug exposure More potent than primary CAR - T at B - cell killing in preclinical comparison CNTY - 101 more potent than primary CAR - T cells at B - cell killing at 24 hours in preclinical comparison Isolated B cells or CD19+ target cells were co - cultured with CNTY - 101 or primary CAR - T at several E:Ts in 96 - well U bottom plate s in NKCM with assay harvested at 24h. Assay plates were harvested and stained for Fixable Live/Dead. Cells were fixed and run on cytometer to determine Target+Dead Cell populations.

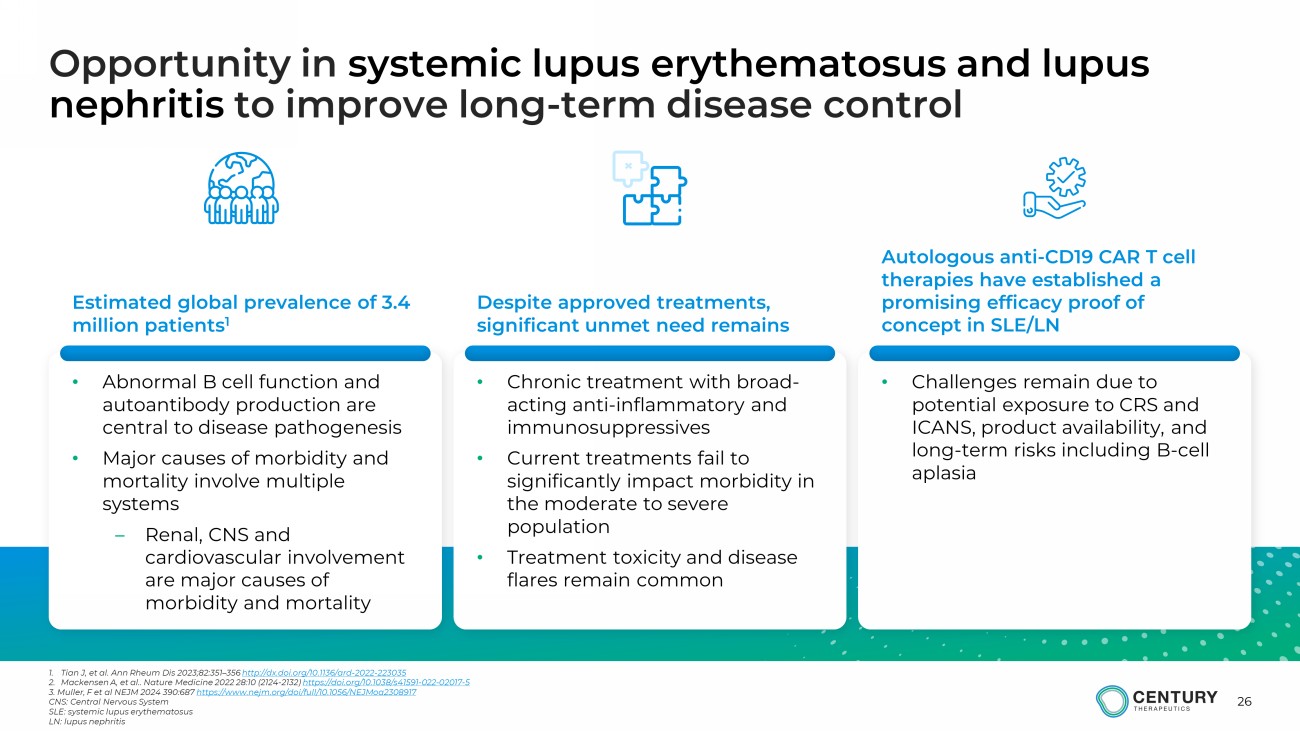

26 Opportunity in systemic lupus erythematosus and lupus nephritis to improve long - term disease control 1. Tian J, et al. Ann Rheum Dis 2023;82:351 – 356 http://dx.doi.org/10.1136/ard - 2022 - 223035 2. Mackensen A, et al.. Nature Medicine 2022 28:10 (2124 - 2132) https://doi.org/10.1038/s41591 - 022 - 02017 - 5 3. Muller, F et al NEJM 2024 390:687 https://www.nejm.org/doi/full/10.1056/NEJMoa2308917 CNS: Central Nervous System SLE: systemic lupus erythematosus LN: lupus nephritis • Abnormal B cell function and autoantibody production are central to disease pathogenesis • Major causes of morbidity and mortality involve multiple systems – Renal, CNS and cardiovascular involvement are major causes of morbidity and mortality • Chronic treatment with broad - acting anti - inflammatory and immunosuppressives • Current treatments fail to significantly impact morbidity in the moderate to severe population • Treatment toxicity and disease flares remain common • Challenges remain due to potential exposure to CRS and ICANS, product availability, and long - term risks including B - cell aplasia Estimated global prevalence of 3.4 million patients 1 Despite approved treatments, significant unmet need remains Autologous anti - CD19 CAR T cell therapies have established a promising efficacy proof of concept in SLE/LN

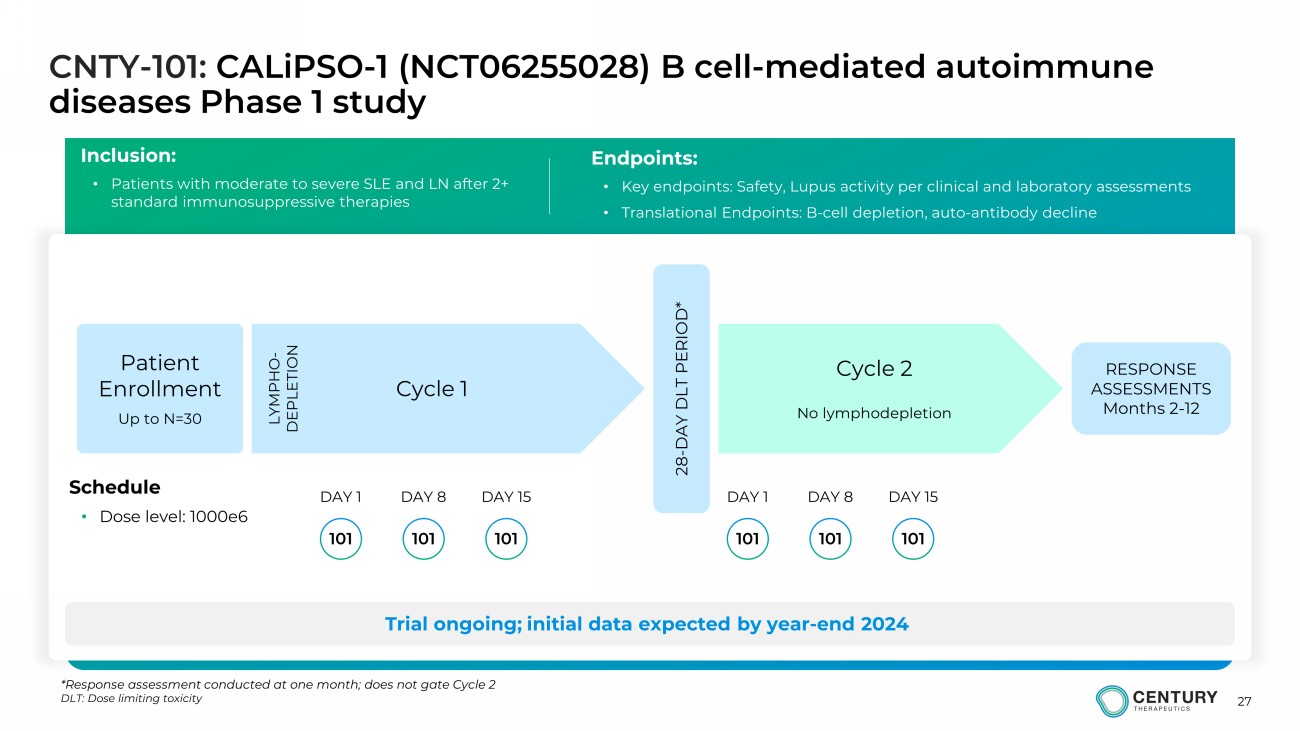

27 CNTY - 101: CALiPSO - 1 (NCT06255028) B cell - mediated autoimmune diseases Phase 1 study Inclusion: • Patients with moderate to severe SLE and LN after 2+ standard immunosuppressive therapies Endpoints: • Key endpoints: Safety, Lupus activity per clinical and laboratory assessments • Translational Endpoints: B - cell depletion, auto - antibody decline Trial ongoing; initial data expected by year - end 2024 Cycle 1 Cycle 2 No lymphodepletion Schedule • Dose level: 1000e6 LYMPHO - DEPLETION 28 - DAY DLT PERIOD* Patient Enrollment Up to N=30 101 DAY 1 DAY 8 101 101 DAY 15 101 DAY 1 DAY 8 101 101 DAY 15 RESPONSE ASSESSMENTS Months 2 - 12 *Response assessment conducted at one month; does not gate Cycle 2 DLT: Dose limiting toxicity

Discovery Programs

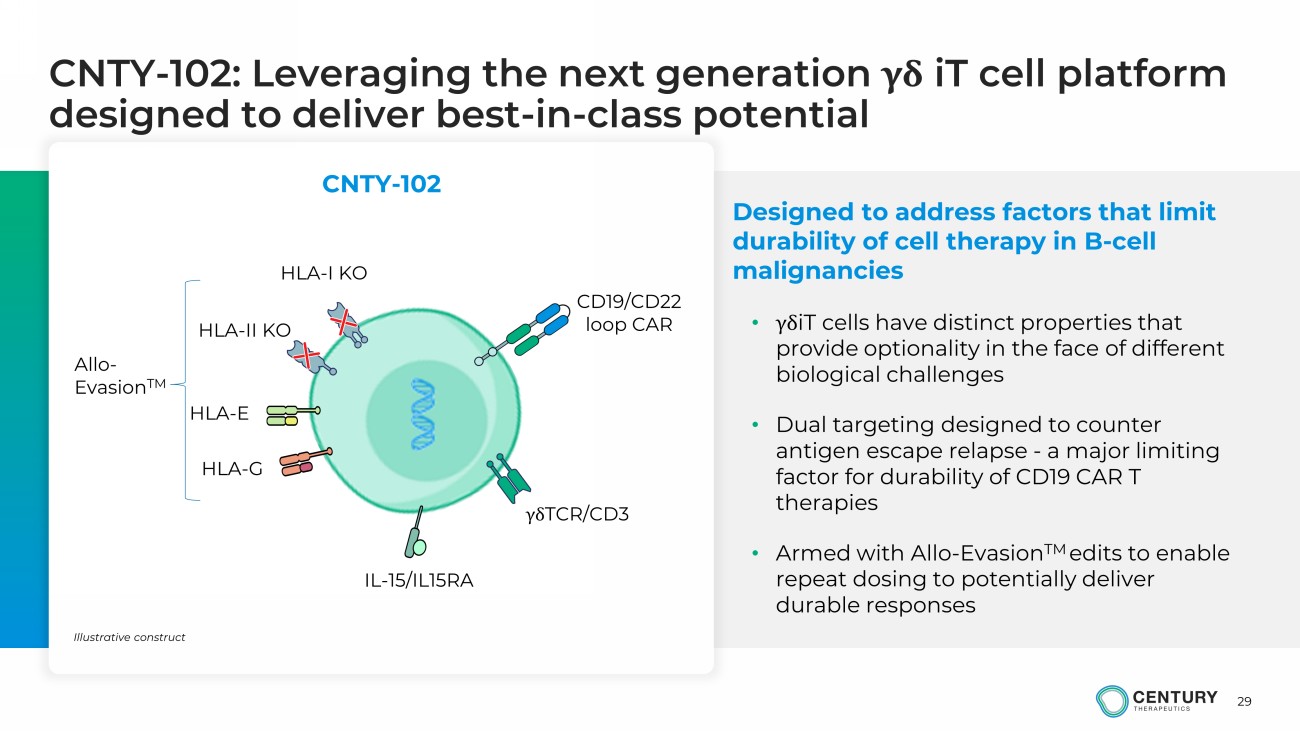

29 CNTY - 102: Leveraging the next generation γδ iT cell platform designed to deliver best - in - class potential Designed to address factors that limit durability of cell therapy in B - cell malignancies • γδ iT cells have distinct properties that provide optionality in the face of different biological challenges • Dual targeting designed to counter antigen escape relapse - a major limiting factor for durability of CD19 CAR T therapies • Armed with Allo - Evasion TM edits to enable repeat dosing to potentially deliver durable responses CNTY - 102 HLA - II KO γδ TCR/CD3 IL - 15/IL15RA HLA - E HLA - G HLA - I KO CD19/CD22 loop CAR Allo - Evasion TM Illustrative construct

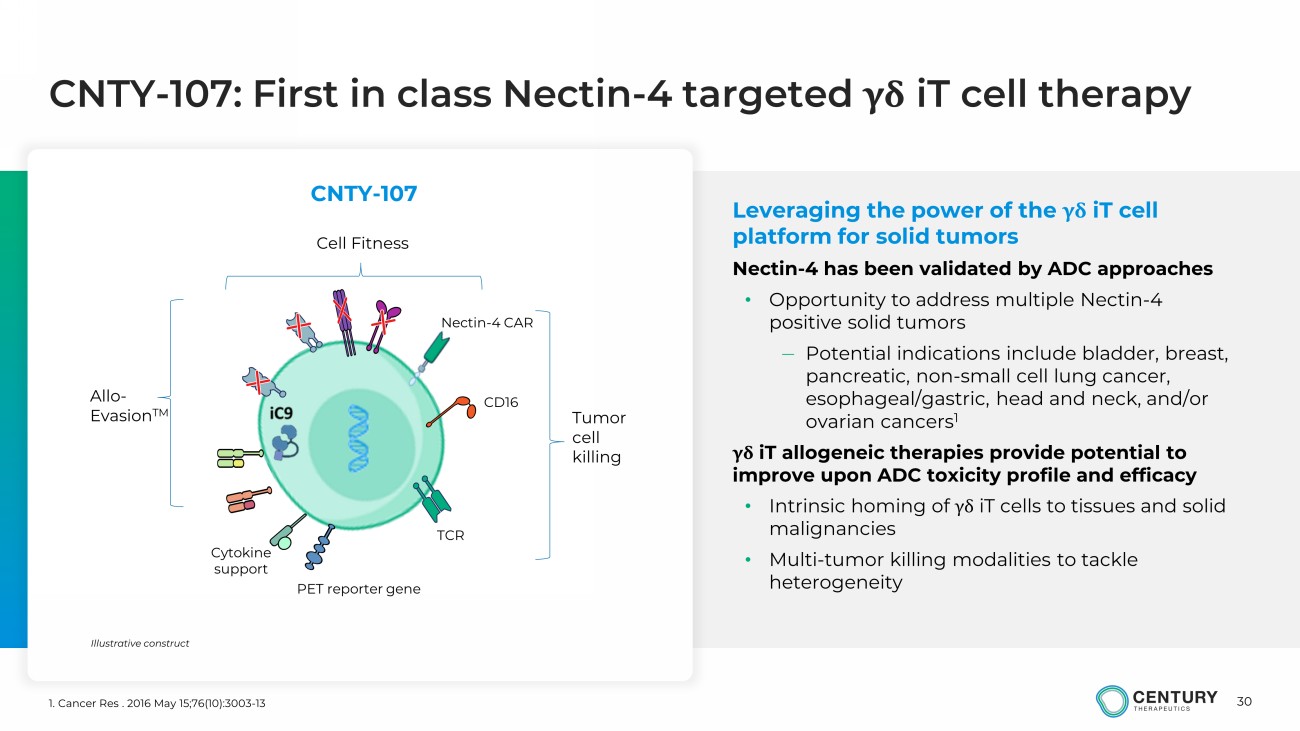

30 CNTY - 107: First in class Nectin - 4 targeted γδ iT cell therapy Leveraging the power of the γδ iT cell platform for solid tumors Nectin - 4 has been validated by ADC approaches • Opportunity to address multiple Nectin - 4 positive solid tumors — Potential indications include bladder, breast, pancreatic, non - small cell lung cancer, esophageal/gastric, head and neck, and/or ovarian cancers 1 γδ iT allogeneic therapies provide potential to improve upon ADC toxicity profile and efficacy • Intrinsic homing of γδ iT cells to tissues and solid malignancies • Multi - tumor killing modalities to tackle heterogeneity 1. Cancer Res . 2016 May 15;76(10):3003 - 13 Tumor cell killing Allo - Evasion TM Cell Fitness Illustrative construct Nectin - 4 CAR CD16 PET reporter gene TCR Cytokine support CNTY - 107

Corporate Position & Upcoming Milestones

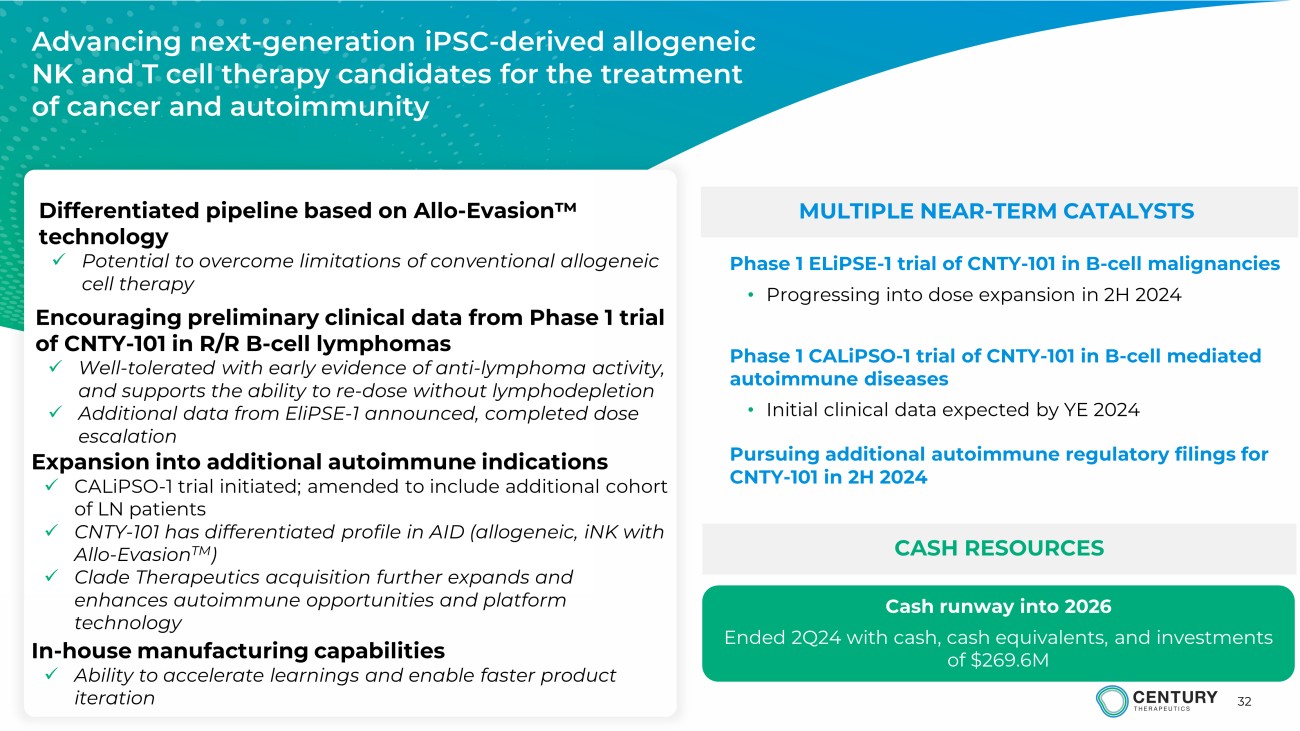

32 MULTIPLE NEAR - TERM CATALYSTS CASH RESOURCES Advancing next - generation iPSC - derived allogeneic NK and T cell therapy candidates for the treatment of cancer and autoimmunity Phase 1 ELiPSE - 1 trial of CNTY - 101 in B - cell malignancies • Progressing into dose expansion in 2H 2024 Phase 1 CALiPSO - 1 trial of CNTY - 101 in B - cell mediated autoimmune diseases • Initial clinical data expected by YE 2024 Cash runway into 2026 Ended 2Q24 with cash, cash equivalents, and investments of $ 269.6 M Differentiated pipeline based on Allo - Evasion ۲ technology x Potential to overcome limitations of conventional allogeneic cell therapy Encouraging preliminary clinical data from Phase 1 trial of CNTY - 101 in R/R B - cell lymphomas x Well - tolerated with early evidence of anti - lymphoma activity, and supports the ability to re - dose without lymphodepletion x Additional data from EliPSE - 1 announced, completed dose escalation Expansion into additional autoimmune indications x CALiPSO - 1 trial initiated; amended to include additional cohort of LN patients x CNTY - 101 has differentiated profile in AID (allogeneic, iNK with Allo - Evasion TM ) x Clade Therapeutics acquisition further expands and enhances autoimmune opportunities and platform technology In - house manufacturing capabilities x Ability to accelerate learnings and enable faster product iteration Pursuing additional autoimmune regulatory filings for CNTY - 101 in 2H 2024

33 Century Therapeutics: Building an industry - leading, next - generation allogeneic iPSC - derived cell therapy platform LIMITLESS POTENTIAL… PRECISION DESIGN… ENDURING IMPACT… Foundational investments in iPSC technology, genetic editing, protein engineering, and manufacturing Progressing differentiated clinical programs based on Allo - Evasion TM technology in oncology and autoimmune diseases Well - capitalized into 2026 to enable delivery on key milestones and clinical data

v3.24.2.u1

Cover

|

Aug. 08, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 08, 2024

|

| Entity File Number |

001-40498

|

| Entity Registrant Name |

Century Therapeutics, Inc.

|

| Entity Central Index Key |

0001850119

|

| Entity Tax Identification Number |

84-2040295

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

25

North 38th Street

|

| Entity Address, Address Line Two |

11th Floor

|

| Entity Address, City or Town |

Philadelphia

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

19104

|

| City Area Code |

267

|

| Local Phone Number |

817-5790

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

IPSC

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Century Therapeutics (NASDAQ:IPSC)

Historical Stock Chart

From Dec 2024 to Dec 2024

Century Therapeutics (NASDAQ:IPSC)

Historical Stock Chart

From Dec 2023 to Dec 2024