Disc Medicine Announces Pricing of $225.5 Million Upsized Public Offering of Common Stock and Pre-Funded Warrants

23 January 2025 - 1:35PM

Disc Medicine, Inc. (NASDAQ: IRON) (Disc), a clinical-stage

biopharmaceutical company focused on the discovery, development,

and commercialization of novel treatments for patients suffering

from serious hematologic diseases, today announced the pricing of

its upsized underwritten offering of shares of its common stock

and, in lieu of common stock to certain investors that so choose,

pre-funded warrants to purchase shares of its common stock. Disc is

selling 3,918,182 shares of common stock and pre-funded warrants to

purchase 181,818 shares of common stock in the offering. The shares

of common stock are being sold at an offering price of $55.00 per

share, and the pre-funded warrants are being sold at an offering

price of $54.9999 per pre-funded warrant, which represents the per

share offering price for the common stock less the $0.0001 per

share exercise price for each such pre-funded warrant. The

aggregate gross proceeds to Disc from this offering are expected to

be approximately $225.5 million, before deducting underwriting

discounts and commissions and other offering expenses, excluding

the exercise of any pre-funded warrants. In addition, Disc has

granted the underwriters a 30-day option to purchase up to an

additional $33.825 million of shares of its common stock at the

public offering price, less underwriting discounts and commissions.

All of the securities being sold in the offering are being offered

by Disc. The offering is expected to close on January 24, 2025,

subject to the satisfaction of customary closing conditions.

Disc intends to use the net proceeds from the

offering to fund research and clinical development of its current

or additional product candidates, to support the potential

commercialization of bitopertin for erythropoietic protoporphyria

(EPP) and X-linked protoporphyria (XLP), as well as for working

capital and other general corporate purposes.

Jefferies, Leerink Partners, Stifel and Cantor

are acting as joint book-running managers for the offering. BMO

Capital Markets, LifeSci Capital, Wedbush PacGrow and H.C.

Wainwright & Co. are acting as co-managers for the

offering.

The securities described above are being offered

by Disc pursuant to an automatic shelf registration statement on

Form S-3 (No. 333-281359) that was previously filed with the

Securities and Exchange Commission (SEC) on August 8, 2024. This

offering is being made only by means of a prospectus and prospectus

supplement that form a part of the registration statement. A final

prospectus supplement and accompanying prospectus related to the

offering will be filed with the SEC and will be available on the

SEC’s website at www.sec.gov. Copies of the final prospectus

supplement and the accompanying prospectus relating to this

offering may also be obtained, when available, by contacting:

Jefferies LLC, Attention: Equity Syndicate Prospectus Department,

520 Madison Avenue, 2nd Floor, New York, NY 10022, by telephone at

(877) 821-7388, or by email at prospectus_department@jefferies.com;

Leerink Partners LLC, Attention: Syndicate Department, 53 State

Street, 40th Floor, Boston, MA 02109, (800) 808-7525 ext. 6105 or

by email at syndicate@leerink.com; Stifel, Nicolaus & Company,

Incorporated, Attention: Syndicate, One Montgomery Street, Suite

3700, San Francisco, California 94104, by telephone at (415)

364-2720 or by email at syndprospectus@stifel.com; or Cantor

Fitzgerald & Co., Attention: Capital Markets, 110 East 59th

Street, 6th Floor, New York, New York, 10022, or by email at

prospectus@cantor.com.

This press release does not constitute an offer

to sell or a solicitation of an offer to buy these securities, nor

shall there be any sale of these securities in any state or

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of that state or jurisdiction.

About Disc Medicine

Disc Medicine (NASDAQ: IRON) is a clinical-stage

biopharmaceutical company committed to discovering, developing, and

commercializing novel treatments for patients who suffer from

serious hematologic diseases. We are building a portfolio of

innovative, potentially first-in-class therapeutic candidates that

aim to address a wide spectrum of hematologic diseases by targeting

fundamental biological pathways of red blood cell biology,

specifically heme biosynthesis and iron homeostasis.

Cautionary Statement Regarding

Forward-Looking Statements

This press release contains “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995, as amended, including, without limitation,

express or implied statements related to Disc’s expectations

regarding the timing and closing of the offering, and the

anticipated use of proceeds from the offering. The words “may,”

“will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,”

“intend,” “believe,” “estimate,” “predict,” “project,” “potential,”

“continue,” “seek,” “target” and similar expressions are intended

to identify forward-looking statements, although not all

forward-looking statements contain these identifying words. Any

forward-looking statements in this press release are based on

management’s current expectations and beliefs and are subject to a

number of risks, uncertainties and important factors that may cause

actual events or results to differ materially from those expressed

or implied by any forward-looking statements contained in this

press release. These risks and uncertainties include fluctuations

in Disc’s stock price, changes in market conditions, the

satisfaction of customary closing conditions related to the

underwritten offering, and other risks identified in our SEC

filings, including our Quarterly Report on Form 10-Q for the

quarter ended September 30, 2024, and in the prospectus supplement

related to the offering we will file with the SEC. We caution you

not to place undue reliance on any forward-looking statements,

which speak only as of the date they are made. We disclaim any

obligation to publicly update or revise any such statements to

reflect any change in expectations or in events, conditions or

circumstances on which any such statements may be based, or that

may affect the likelihood that actual results will differ from

those set forth in the forward-looking statements.

Media ContactPeg RusconiDeerfield Group

peg.rusconi@deerfieldgroup.com

Investor Relations ContactChristina

TartagliaPrecision AQ christina.tartaglia@precisionaq.com

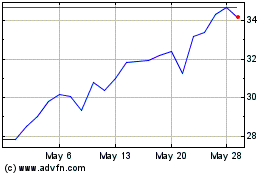

Disc Medicine (NASDAQ:IRON)

Historical Stock Chart

From Dec 2024 to Jan 2025

Disc Medicine (NASDAQ:IRON)

Historical Stock Chart

From Jan 2024 to Jan 2025