000156751412-312024Q2false22388300480xbrli:sharesiso4217:USDiso4217:USDxbrli:sharesitci:segmentxbrli:pure00015675142024-01-012024-06-3000015675142024-08-0500015675142024-06-3000015675142023-12-310001567514us-gaap:ProductMember2024-04-012024-06-300001567514us-gaap:ProductMember2023-04-012023-06-300001567514us-gaap:ProductMember2024-01-012024-06-300001567514us-gaap:ProductMember2023-01-012023-06-300001567514us-gaap:GrantMember2024-04-012024-06-300001567514us-gaap:GrantMember2023-04-012023-06-300001567514us-gaap:GrantMember2024-01-012024-06-300001567514us-gaap:GrantMember2023-01-012023-06-3000015675142024-04-012024-06-3000015675142023-04-012023-06-3000015675142023-01-012023-06-300001567514us-gaap:CommonStockMember2022-12-310001567514us-gaap:AdditionalPaidInCapitalMember2022-12-310001567514us-gaap:RetainedEarningsMember2022-12-310001567514us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-3100015675142022-12-310001567514us-gaap:CommonStockMember2023-01-012023-03-310001567514us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-3100015675142023-01-012023-03-310001567514us-gaap:RetainedEarningsMember2023-01-012023-03-310001567514us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001567514us-gaap:CommonStockMember2023-03-310001567514us-gaap:AdditionalPaidInCapitalMember2023-03-310001567514us-gaap:RetainedEarningsMember2023-03-310001567514us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-3100015675142023-03-310001567514us-gaap:CommonStockMember2023-04-012023-06-300001567514us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001567514us-gaap:RetainedEarningsMember2023-04-012023-06-300001567514us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001567514us-gaap:CommonStockMember2023-06-300001567514us-gaap:AdditionalPaidInCapitalMember2023-06-300001567514us-gaap:RetainedEarningsMember2023-06-300001567514us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-3000015675142023-06-300001567514us-gaap:CommonStockMember2023-12-310001567514us-gaap:AdditionalPaidInCapitalMember2023-12-310001567514us-gaap:RetainedEarningsMember2023-12-310001567514us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001567514us-gaap:CommonStockMember2024-01-012024-03-310001567514us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-3100015675142024-01-012024-03-310001567514us-gaap:RetainedEarningsMember2024-01-012024-03-310001567514us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001567514us-gaap:CommonStockMember2024-03-310001567514us-gaap:AdditionalPaidInCapitalMember2024-03-310001567514us-gaap:RetainedEarningsMember2024-03-310001567514us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-3100015675142024-03-310001567514us-gaap:CommonStockMember2024-04-012024-06-300001567514us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300001567514us-gaap:RetainedEarningsMember2024-04-012024-06-300001567514us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-300001567514us-gaap:CommonStockMember2024-06-300001567514us-gaap:AdditionalPaidInCapitalMember2024-06-300001567514us-gaap:RetainedEarningsMember2024-06-300001567514us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-3000015675142024-04-012024-04-3000015675142024-04-300001567514us-gaap:SalesRevenueNetMemberitci:ThreeMajorWholesalersMemberus-gaap:CustomerConcentrationRiskMember2024-01-012024-06-300001567514itci:CustomerOneMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2024-01-012024-06-300001567514itci:CustomerTwoMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2024-01-012024-06-300001567514us-gaap:SalesRevenueNetMemberitci:CustomerThreeMemberus-gaap:CustomerConcentrationRiskMember2024-01-012024-06-300001567514itci:CustomerOneMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-06-300001567514itci:CustomerTwoMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-06-300001567514us-gaap:SalesRevenueNetMemberitci:CustomerThreeMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-06-300001567514us-gaap:USGovernmentAgenciesDebtSecuritiesMember2024-06-300001567514itci:FDICCertificatesOfDepositMember2024-06-300001567514us-gaap:CertificatesOfDepositMember2024-06-300001567514us-gaap:CommercialPaperMember2024-06-300001567514us-gaap:CorporateDebtSecuritiesMember2024-06-300001567514us-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-12-310001567514itci:FDICCertificatesOfDepositMember2023-12-310001567514us-gaap:CertificatesOfDepositMember2023-12-310001567514us-gaap:CommercialPaperMember2023-12-310001567514us-gaap:CorporateDebtSecuritiesMember2023-12-310001567514us-gaap:DebtSecuritiesMember2024-06-300001567514us-gaap:DebtSecuritiesMember2023-12-310001567514us-gaap:FairValueInputsLevel3Member2023-12-310001567514us-gaap:FairValueInputsLevel3Member2024-06-300001567514us-gaap:CashAndCashEquivalentsMember2024-06-300001567514us-gaap:CashAndCashEquivalentsMember2023-12-310001567514us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2024-06-300001567514us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2024-06-300001567514us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMember2024-06-300001567514us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMember2024-06-300001567514us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2024-06-300001567514us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2024-06-300001567514us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2024-06-300001567514us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Member2024-06-300001567514us-gaap:FairValueMeasurementsRecurringMemberitci:FDICCertificatesOfDepositMember2024-06-300001567514us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberitci:FDICCertificatesOfDepositMember2024-06-300001567514us-gaap:FairValueMeasurementsRecurringMemberitci:FDICCertificatesOfDepositMemberus-gaap:FairValueInputsLevel2Member2024-06-300001567514us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberitci:FDICCertificatesOfDepositMember2024-06-300001567514us-gaap:CertificatesOfDepositMemberus-gaap:FairValueMeasurementsRecurringMember2024-06-300001567514us-gaap:FairValueInputsLevel1Memberus-gaap:CertificatesOfDepositMemberus-gaap:FairValueMeasurementsRecurringMember2024-06-300001567514us-gaap:CertificatesOfDepositMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2024-06-300001567514us-gaap:CertificatesOfDepositMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2024-06-300001567514us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMember2024-06-300001567514us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMember2024-06-300001567514us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CommercialPaperMember2024-06-300001567514us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CommercialPaperMember2024-06-300001567514us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2024-06-300001567514us-gaap:FairValueInputsLevel1Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2024-06-300001567514us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2024-06-300001567514us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2024-06-300001567514us-gaap:FairValueMeasurementsRecurringMember2024-06-300001567514us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-06-300001567514us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2024-06-300001567514us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2024-06-300001567514us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2023-12-310001567514us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2023-12-310001567514us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMember2023-12-310001567514us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMember2023-12-310001567514us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-12-310001567514us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-12-310001567514us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2023-12-310001567514us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Member2023-12-310001567514us-gaap:FairValueMeasurementsRecurringMemberitci:FDICCertificatesOfDepositMember2023-12-310001567514us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberitci:FDICCertificatesOfDepositMember2023-12-310001567514us-gaap:FairValueMeasurementsRecurringMemberitci:FDICCertificatesOfDepositMemberus-gaap:FairValueInputsLevel2Member2023-12-310001567514us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberitci:FDICCertificatesOfDepositMember2023-12-310001567514us-gaap:CertificatesOfDepositMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001567514us-gaap:FairValueInputsLevel1Memberus-gaap:CertificatesOfDepositMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001567514us-gaap:CertificatesOfDepositMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-12-310001567514us-gaap:CertificatesOfDepositMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-12-310001567514us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMember2023-12-310001567514us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMember2023-12-310001567514us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CommercialPaperMember2023-12-310001567514us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CommercialPaperMember2023-12-310001567514us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2023-12-310001567514us-gaap:FairValueInputsLevel1Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001567514us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-12-310001567514us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-12-310001567514us-gaap:FairValueMeasurementsRecurringMember2023-12-310001567514us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001567514us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-12-310001567514us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-12-310001567514stpr:NY2018-09-300001567514stpr:NJ2024-05-310001567514us-gaap:VehiclesMember2024-06-300001567514itci:BristolMyersSquibbCompanyMemberus-gaap:ProductMember2005-05-312024-06-300001567514itci:BristolMyersSquibbCompanyMemberus-gaap:ProductMember2024-06-300001567514itci:BristolMyersSquibbCompanyMemberus-gaap:ProductMember2005-05-310001567514itci:BristolMyersSquibbCompanyMembersrt:MinimumMemberus-gaap:ProductMember2005-05-312005-05-310001567514itci:BristolMyersSquibbCompanyMembersrt:MaximumMemberus-gaap:ProductMember2005-05-312005-05-310001567514itci:BristolMyersSquibbCompanyMemberus-gaap:ProductMember2024-01-012024-06-300001567514us-gaap:PurchaseCommitmentMember2024-06-300001567514us-gaap:PurchaseCommitmentMember2023-12-310001567514itci:InventoriableCostsMember2024-04-012024-06-300001567514itci:InventoriableCostsMember2023-04-012023-06-300001567514itci:InventoriableCostsMember2024-01-012024-06-300001567514itci:InventoriableCostsMember2023-01-012023-06-300001567514us-gaap:SellingGeneralAndAdministrativeExpensesMember2024-04-012024-06-300001567514us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-04-012023-06-300001567514us-gaap:SellingGeneralAndAdministrativeExpensesMember2024-01-012024-06-300001567514us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-01-012023-06-300001567514us-gaap:ResearchAndDevelopmentExpenseMember2024-04-012024-06-300001567514us-gaap:ResearchAndDevelopmentExpenseMember2023-04-012023-06-300001567514us-gaap:ResearchAndDevelopmentExpenseMember2024-01-012024-06-300001567514us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-06-3000015675142023-01-012023-12-310001567514us-gaap:RestrictedStockUnitsRSUMember2023-12-310001567514us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001567514us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-06-300001567514us-gaap:RestrictedStockUnitsRSUMember2024-06-300001567514itci:TimeBasedRestrictedStockUnitsRSUMember2024-06-300001567514us-gaap:EmployeeStockOptionMember2024-04-012024-06-300001567514us-gaap:EmployeeStockOptionMember2023-04-012023-06-300001567514us-gaap:RestrictedStockUnitsRSUMember2024-04-012024-06-300001567514us-gaap:RestrictedStockUnitsRSUMember2023-04-012023-06-300001567514itci:MichaelIHalsteadMember2024-01-012024-06-300001567514itci:SharonMatesPh.DTradingArrangementMay22PlanMemberitci:SharonMatesPh.DMember2024-04-012024-06-300001567514itci:SharonMatesPh.DTradingArrangementMay22PlanMemberitci:SharonMatesPh.DMember2024-06-300001567514itci:SharonMatesPh.DTradingArrangementMay28PlanMemberitci:SharonMatesPh.DMember2024-04-012024-06-300001567514itci:SharonMatesPh.DTradingArrangementMay28PlanMemberitci:SharonMatesPh.DMember2024-06-300001567514itci:SureshDurgamM.DMember2024-04-012024-06-300001567514itci:SureshDurgamM.DMember2024-06-300001567514itci:MarkNeumannMember2024-04-012024-06-300001567514itci:MarkNeumannMember2024-06-300001567514itci:SharonMatesPh.DMember2024-04-012024-06-300001567514itci:Dr.MatesMember2024-04-012024-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________

FORM 10-Q

_______________________

(Mark One)

| | | | | |

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2024

or

| | | | | |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from_________to_________

Commission File Number: 001-36274

_______________________

INTRA-CELLULAR THERAPIES, INC.

(Exact name of registrant as specified in its charter)

_______________________

| | | | | | | | |

| Delaware | | 36-4742850 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

430 East 29th Street New York, New York | | 10016 |

| (Address of principal executive offices) | | (Zip Code) |

(646) 440-9333

(Registrant’s telephone number, including area code)

_______________________

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

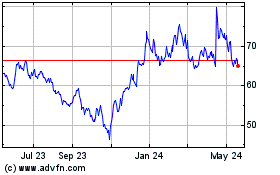

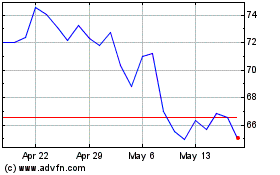

| Common Stock | | ITCI | | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | | Accelerated filer | o |

| | | | | |

| Non-accelerated filer | o | | Smaller reporting company | o |

| | | | | |

| | | | Emerging growth company | o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of August 5, 2024, the registrant had 105,666,925 shares of common stock outstanding.

Intra-Cellular Therapies, Inc.

Index to Form 10-Q

In this Quarterly Report on Form 10-Q, the terms “we,” “us,” “our,” and the “Company” mean Intra-Cellular Therapies, Inc. and our subsidiary. “ITI” refers to our wholly-owned subsidiary ITI, Inc.

PART I: FINANCIAL INFORMATION

Item 1. FINANCIAL STATEMENTS

Intra-Cellular Therapies, Inc. and Subsidiary

Condensed Consolidated Balance Sheets (in thousands except share and per share amounts)

| | | | | | | | | | | |

| June 30, 2024 | | December 31, 2023 |

| (unaudited) | | |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 693,306 | | | $ | 147,767 | |

| Investment securities, available-for-sale | 329,601 | | | 350,174 | |

| Restricted cash | 1,750 | | | 1,750 | |

| Accounts receivable, net | 145,714 | | | 114,018 | |

| Inventory | 20,082 | | | 11,647 | |

| Prepaid expenses and other current assets | 73,798 | | | 42,443 | |

| Total current assets | 1,264,251 | | | 667,799 | |

| Property and equipment, net | 1,445 | | | 1,654 | |

| Right of use assets, net | 14,507 | | | 12,928 | |

| Inventory, non-current | 32,562 | | | 38,621 | |

| Other assets | 7,739 | | | 7,293 | |

| Total assets | $ | 1,320,504 | | | $ | 728,295 | |

| Liabilities and stockholders’ equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 17,548 | | | $ | 11,452 | |

| Accrued and other current liabilities | 39,713 | | | 27,944 | |

| Accrued customer programs | 77,971 | | | 53,173 | |

| Accrued employee benefits | 22,372 | | | 27,364 | |

| Operating lease liabilities | 4,171 | | | 3,612 | |

| Total current liabilities | 161,775 | | | 123,545 | |

| Operating lease liabilities, non-current | 14,117 | | | 13,326 | |

| Total liabilities | 175,892 | | | 136,871 | |

| Stockholders’ equity: | | | |

Common stock, $0.0001 par value: 175,000,000 shares authorized at June 30, 2024 and December 31, 2023, respectively; 105,624,902 and 96,379,811 shares issued and outstanding at June 30, 2024 and December 31, 2023, respectively | 11 | | | 10 | |

| Additional paid-in capital | 2,793,896 | | | 2,208,470 | |

| Accumulated deficit | (1,648,627) | | | (1,617,160) | |

Accumulated comprehensive (loss) income | (668) | | | 104 | |

| Total stockholders’ equity | 1,144,612 | | | 591,424 | |

| Total liabilities and stockholders’ equity | $ | 1,320,504 | | | $ | 728,295 | |

See accompanying notes to these condensed consolidated financial statements.

Intra-Cellular Therapies, Inc. and Subsidiary

Condensed Consolidated Statements of Operations (in thousands except share and per share amounts) (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, | | |

| 2024 | | 2023 | | 2024 | | 2023 | | | | |

| Revenues | | | | | | | | | | | |

| Product sales, net | $ | 161,276 | | | $ | 110,128 | | | $ | 306,119 | | | $ | 204,859 | | | | | |

| Grant revenue | 112 | | | 664 | | | 135 | | | 1,239 | | | | | |

| Total revenues, net | 161,388 | | | 110,792 | | | 306,254 | | | 206,098 | | | | | |

| Operating expenses: | | | | | | | | | | | |

| Cost of product sales | 11,354 | | | 7,163 | | | 21,254 | | | 13,914 | | | | | |

| Selling, general and administrative | 121,574 | | | 101,014 | | | 234,659 | | | 199,937 | | | | | |

| Research and development | 56,183 | | | 49,794 | | | 99,016 | | | 87,818 | | | | | |

| Total operating expenses | 189,111 | | | 157,971 | | | 354,929 | | | 301,669 | | | | | |

| Loss from operations | (27,723) | | | (47,179) | | | (48,675) | | | (95,571) | | | | | |

| Interest income | 11,560 | | | 4,530 | | | 17,624 | | | 8,879 | | | | | |

| Loss before provision for income taxes | (16,163) | | | (42,649) | | | (31,051) | | | (86,692) | | | | | |

| Income tax expense | (57) | | | (135) | | | (416) | | | (145) | | | | | |

| Net loss | $ | (16,220) | | | $ | (42,784) | | | $ | (31,467) | | | $ | (86,837) | | | | | |

| Net loss per common share: | | | | | | | | | | | |

| Basic & Diluted | $ | (0.16) | | | $ | (0.45) | | | $ | (0.31) | | | $ | (0.91) | | | | | |

| Weighted average number of common shares: | | | | | | | | | | | |

| Basic & Diluted | 103,723,007 | | 95,948,063 | | 100,299,141 | | 95,543,626 | | | | |

| | | | | | | | | | | |

See accompanying notes to these condensed consolidated financial statements.

Intra-Cellular Therapies, Inc. and Subsidiary

Condensed Consolidated Statements of Comprehensive Loss (in thousands) (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, | | |

| 2024 | | 2023 | | 2024 | | 2023 | | | | |

| Net loss | $ | (16,220) | | | $ | (42,784) | | | $ | (31,467) | | | $ | (86,837) | | | | | |

| Other comprehensive (loss) gain: | | | | | | | | | | | |

| Unrealized (loss) gain on investment securities | (238) | | | 430 | | | (772) | | | 1,922 | | | | | |

| Comprehensive loss | $ | (16,458) | | | $ | (42,354) | | | $ | (32,239) | | | $ | (84,915) | | | | | |

See accompanying notes to these condensed consolidated financial statements.

Intra-Cellular Therapies, Inc. and Subsidiary

Condensed Consolidated Statements of Stockholders’ Equity (in thousands except share and per share amounts) (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional

Paid-in

Capital | | Accumulated

Deficit | | Accumulated

Comprehensive

(Loss) Income | | Total

Stockholders’

Equity |

| Shares | | Amount | | | | |

| Balance at December 31, 2022 | 94,829,794 | | $ | 9 | | | $ | 2,137,737 | | | $ | (1,477,486) | | | $ | (4,190) | | | $ | 656,070 | |

| Exercise of stock options and issuances of restricted stock | 849,827 | | 1 | | | 3,639 | | | — | | | — | | | 3,640 | |

| Stock issued for services | 408 | | — | | | 22 | | | — | | | — | | | 22 | |

| Share-based compensation | — | | — | | | 10,439 | | | — | | | — | | | 10,439 | |

| Net loss | — | | — | | | — | | | (44,053) | | | — | | | (44,053) | |

| Other comprehensive gain | — | | — | | | — | | | — | | | 1,492 | | | 1,492 | |

| Balance at March 31, 2023 | 95,680,029 | | $ | 10 | | | $ | 2,151,837 | | | $ | (1,521,539) | | | $ | (2,698) | | | $ | 627,610 | |

| Exercise of stock options and issuances of restricted stock | 402,994 | | — | | | 8,585 | | | — | | | — | | | 8,585 | |

| Stock issued for services | 364 | | — | | | 23 | | | — | | | — | | | 23 | |

| Share-based compensation | — | | — | | | 13,226 | | | — | | | — | | | 13,226 | |

| Net loss | — | | — | | | — | | | (42,784) | | | — | | | (42,784) | |

| Other comprehensive loss | — | | — | | | — | | | — | | | 430 | | | 430 | |

| Balance at June 30, 2023 | 96,083,387 | | $ | 10 | | | $ | 2,173,671 | | | $ | (1,564,323) | | | $ | (2,268) | | | $ | 607,090 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional Paid-in Capital | | Accumulated Deficit | | Accumulated Comprehensive (Loss) Income | | Total Stockholders’ Equity |

| Shares | | Amount | | | | |

| Balance at December 31, 2023 | 96,379,811 | | $ | 10 | | | $ | 2,208,470 | | | $ | (1,617,160) | | | $ | 104 | | | $ | 591,424 | |

| Exercise of stock options and issuances of restricted stock | 1,097,668 | | — | | | 9,989 | | | — | | | — | | | 9,989 | |

| Stock issued for services | 339 | | — | | | 23 | | | — | | | — | | | 23 | |

| Share-based compensation | — | | — | | | 13,843 | | | — | | | — | | | 13,843 | |

| Net loss | — | | — | | | — | | | (15,247) | | | — | | | (15,247) | |

| Other comprehensive loss | — | | — | | | — | | | — | | | (534) | | | (534) | |

| Balance at March 31, 2024 | 97,477,818 | | $ | 10 | | | $ | 2,232,325 | | | $ | (1,632,407) | | | $ | (430) | | | $ | 599,498 | |

| Common shares issued | 7,876,713 | | 1 | | | 543,085 | | | — | | | — | | | 543,086 | |

| Exercise of stock options and issuances of restricted stock | 270,026 | | — | | | 2,093 | | | — | | | — | | | 2,093 | |

| Stock issued for services | 345 | | — | | | 23 | | | — | | | — | | | 23 | |

| Share-based compensation | — | | — | | | 16,370 | | | — | | | — | | | 16,370 | |

| Net loss | — | | — | | | — | | | (16,220) | | | — | | | (16,220) | |

| Other comprehensive loss | — | | — | | | — | | | — | | | (238) | | | (238) | |

| Balance at June 30, 2024 | 105,624,902 | | $ | 11 | | | $ | 2,793,896 | | | $ | (1,648,627) | | | $ | (668) | | | $ | 1,144,612 | |

See accompanying notes to these condensed consolidated financial statements.

Intra-Cellular Therapies, Inc. and Subsidiary

Condensed Consolidated Statements of Cash Flows (in thousands) (Unaudited)

| | | | | | | | | | | |

| Six Months Ended June 30, |

| 2024 | | 2023 |

| Cash flows used in operating activities | | | |

| Net loss | $ | (31,467) | | | $ | (86,837) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| Depreciation | 261 | | | 257 | |

| Share-based compensation | 30,213 | | | 23,665 | |

| Stock issued for services | 46 | | | 45 | |

| Amortization of premiums and accretion of discounts on investment securities, net | (4,196) | | | (3,670) | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable, net | (31,696) | | | (20,775) | |

| Inventory | (2,376) | | | (17,975) | |

| Prepaid expenses and other assets | (31,801) | | | (417) | |

| Accounts payable | 6,096 | | | (2,662) | |

| Accrued and other current liabilities | 11,769 | | | 7,799 | |

| Accrued customer programs | 24,798 | | | 6,089 | |

| Accrued employee benefits | (4,992) | | | (1,373) | |

| Operating lease liabilities, net | (229) | | | (1,014) | |

| Net cash used in operating activities | (33,574) | | | (96,868) | |

Cash flows provided by investing activities | | | |

| Purchases of investments | (169,570) | | | (174,411) | |

| Maturities of investments | 193,568 | | | 252,697 | |

| Purchases of property and equipment | (53) | | | — | |

Net cash provided by investing activities | 23,945 | | | 78,286 | |

| Cash flows provided by financing activities | | | |

| Proceeds from exercise of stock options | 12,082 | | | 12,225 | |

Proceeds from sale of common stock, net | 543,086 | | | — | |

| Net cash provided by financing activities | 555,168 | | | 12,225 | |

Net increase (decrease) in cash, cash equivalents, and restricted cash | 545,539 | | | (6,357) | |

| Cash, cash equivalents, and restricted cash at beginning of period | 149,517 | | | 150,365 | |

| Cash, cash equivalents, and restricted cash at end of period | $ | 695,056 | | | $ | 144,008 | |

Non-cash investing and financing activities | | | |

| Right of use assets under operating leases | $ | 2,548 | | | $ | — | |

Supplemental cash flow information | | | |

Cash paid for taxes | $ | 1,364 | | | $ | 6 | |

The following table provides a reconciliation of cash, cash equivalents and restricted cash reported within the condensed consolidated balance sheets that sum to the total of the same such amounts shown in the condensed consolidated statements of cash flows:

| | | | | | | | | | | |

| June 30, |

| 2024 | | 2023 |

| Cash and cash equivalents | $ | 693,306 | | | $ | 142,258 | |

| Restricted cash | 1,750 | | | 1,750 | |

| Total cash, cash equivalents and restricted cash | $ | 695,056 | | | $ | 144,008 | |

See accompanying notes to these condensed consolidated financial statements.

Intra-Cellular Therapies, Inc.

Notes to Condensed Consolidated Financial Statements (Unaudited)

June 30, 2024

1. Organization

Intra-Cellular Therapies, Inc. (the “Company”), through its wholly-owned operating subsidiary, ITI, Inc. (“ITI”), is a biopharmaceutical company focused on the discovery, clinical development and commercialization of innovative, small molecule drugs that address underserved medical needs primarily in psychiatric and neurological disorders. In December 2019, CAPLYTA® (lumateperone) was approved by the U.S. Food and Drug Administration (“FDA”) for the treatment of schizophrenia in adults (42 mg/day) and the Company initiated the commercial launch of CAPLYTA in March 2020. In December 2021, CAPLYTA was approved by the FDA for the treatment of bipolar depression in adults (42 mg/day) and the Company initiated the commercial launch of CAPLYTA for the treatment of bipolar depression. Additionally, in April 2022, the FDA approved two additional dosage strengths of CAPLYTA, 10.5 mg and 21 mg capsules, to provide dosage recommendations for patients concomitantly taking strong or moderate CYP3A4 inhibitors, and 21 mg capsules for patients with moderate or severe hepatic impairment (Child-Pugh class B or C). The commercial launch of these special population doses occurred in August 2022. As used in these Notes to Condensed Consolidated Financial Statements, “CAPLYTA” refers to lumateperone approved by the FDA for the treatment of schizophrenia in adults and for the treatment of bipolar depression in adults, and “lumateperone” refers to, where applicable, CAPLYTA as well as lumateperone for the treatment of indications beyond schizophrenia and bipolar depression.

In April 2024, the Company completed a public offering of common stock in which the Company sold 7,876,713 shares of common stock at a public offering price of $73.00 per share for aggregate gross proceeds of $575.0 million. After deducting underwriting discounts, commissions and offering expenses, the net proceeds to the Company were approximately $543.1 million.

2. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying condensed consolidated financial statements of Intra-Cellular Therapies, Inc. and its wholly owned subsidiary have been prepared in conformity with accounting principles generally accepted in the United States of America (“GAAP”). Any reference in these notes to applicable guidance is meant to refer to the authoritative United States GAAP set forth in the Accounting Standards Codification (“ASC”) and Accounting Standards Update (“ASU”) of the Financial Accounting Standards Board (“FASB”). All intercompany accounts and transactions have been eliminated in consolidation. The Company currently operates in one operating segment. Operating segments are defined as components of an enterprise about which separate discrete information is available for the chief operating decision maker, or decision making group, in deciding how to allocate resources and assessing performance. The Company views its operations and manages its business in one segment, which is discovering, developing and commercializing drugs primarily in psychiatric and neurological disorders.

Recent Accounting Pronouncements

In November 2023, the FASB issued ASU 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures, requiring public entities to disclose information about their reportable segments’ significant expenses and other segment items on an interim and annual basis. Public entities with a single reportable segment are also required to apply the disclosure requirements. The standard is effective for annual reporting periods beginning after December 15, 2023, and for interim reporting periods beginning January 1, 2025, with early adoption permitted. The Company is currently evaluating the potential impact that this new standard will have on its consolidated financial statements and related disclosures.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Although actual results could differ from those estimates, management does not believe that such differences would be material.

Significant Accounting Policies

The accounting policies used by the Company in its presentation of interim financial results are consistent with those presented in Note 2 to the consolidated financial statements included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023.

Concentration of Credit Risk

Financial instruments which potentially subject the Company to concentrations of credit risk consist of accounts receivable, net from customers and cash, cash equivalents and investments held at financial institutions. For the six-month period ended June 30, 2024, 97% of product sales were generated from three major industry wholesalers.

Three individual customers accounted for approximately 35%, 26%, and 36% as well as 37%, 30%, and 29% of product sales for the six-month periods ended June 30, 2024 and 2023, respectively. As of June 30, 2024, the Company continues to believe that such customers are of high credit quality.

Cash equivalents are held with major financial institutions in the United States. Certificates of deposit, cash and cash equivalents held with banks may exceed the amount of insurance provided on such deposits. Generally, these deposits may be redeemed upon demand and, therefore, bear minimal risk.

3. Investment Securities

Investment securities consisted of the following (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| June 30, 2024 |

| Amortized

Cost | | Unrealized

Gains | | Unrealized

(Losses) | | Estimated

Fair

Value |

| U.S. Government Agency Securities | $ | 91,148 | | | $ | 5 | | | $ | (142) | | | $ | 91,011 | |

| FDIC Certificates of Deposit | 1,470 | | | — | | | (1) | | | 1,469 | |

| Certificates of Deposit | 60,000 | | | — | | | — | | | 60,000 | |

| Commercial Paper | 33,669 | | | — | | | (19) | | | 33,650 | |

| Corporate Notes/Bonds | 163,982 | | | 6 | | | (517) | | | 163,471 | |

| $ | 350,269 | | | $ | 11 | | | $ | (679) | | | $ | 349,601 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| December 31, 2023 |

| Amortized

Cost | | Unrealized

Gains | | Unrealized

(Losses) | | Estimated

Fair

Value |

| U.S. Government Agency Securities | $ | 150,651 | | | $ | 148 | | | $ | (204) | | | $ | 150,595 | |

| FDIC Certificates of Deposit | 4,410 | | | 2 | | | (12) | | | 4,400 | |

| Certificates of Deposit | 60,000 | | | — | | | — | | | 60,000 | |

| Commercial Paper | 78,610 | | | 59 | | | (27) | | | 78,642 | |

| Corporate Notes/Bonds | 118,899 | | | 281 | | | (143) | | | 119,037 | |

| $ | 412,570 | | | $ | 490 | | | $ | (386) | | | $ | 412,674 | |

The Company has classified all of its investment securities as available-for-sale, including those with maturities beyond one year, as current assets on the condensed consolidated balance sheets based on the highly liquid nature of the investment securities and because these investment securities are considered available for use in current operations. As of June 30, 2024 and December 31, 2023, the Company held $110.7 million and $77.8 million, respectively, of available-for-sale investment securities with contractual maturity dates more than one year and less than two years, with the remainder of the available-for-sale investment securities having contractual maturity dates less than one year. Accrued interest receivable from investment securities as of June 30, 2024 and December 31, 2023 was $2.7 million and $2.3 million, respectively, and are included within prepaid expenses and other current assets.

The aggregate related fair value of investments with unrealized losses as of June 30, 2024 was $274.7 million, which consisted of $81.0 million of U.S. government agency securities, $1.5 million of certificates of deposit, $33.7 million of commercial paper, and $158.5 million of corporate notes/bonds. $16.2 million of the aggregate fair value of investments with unrealized losses as of June 30, 2024 has been held in a continuous unrealized loss position for over 12 months, with the remaining $258.5 million held in a continuous unrealized loss position for less than 12 months. As of December 31, 2023, the aggregate related fair value of investments with unrealized losses was $165.2 million. $70.1 million of the aggregate fair value of investments with unrealized losses as of December 31, 2023 had been held in a continuous unrealized loss position for more than 12 months, with the remaining $95.1 million held in a continuous unrealized loss position for less than 12 months.

The Company reviewed all of the investments which were in a loss position at the respective balance sheet dates, as well as the remainder of the portfolio. The Company has analyzed the unrealized losses and determined that market conditions were the primary factor driving these changes. After analyzing the securities in an unrealized loss position, the portion of these losses that relate to changes in credit quality is insignificant. The Company does not intend to sell these securities, nor is it more likely than not that the Company will be required to sell them prior to the end of their contractual terms. Furthermore, the Company does not believe that these securities expose the Company to undue market risk or counterparty credit risk.

4. Fair Value Measurements

The Company applies the fair value method under ASC Topic 820, Fair Value Measurements and Disclosures. The ASC Topic 820 hierarchy ranks the quality and reliability of inputs, or assumptions, used in the determination of fair value and requires assets and liabilities carried at fair value to be classified and disclosed in one of the following categories based on the lowest level input used that is significant to a particular fair value measurement:

•Level 1—Fair value is determined by using unadjusted quoted prices that are available in active markets for identical assets and liabilities.

•Level 2—Fair value is determined by using inputs other than Level 1 quoted prices that are directly or indirectly observable. Inputs can include quoted prices for similar assets and liabilities in active markets or quoted prices for identical assets and liabilities in inactive markets. Related inputs can also include those used in valuation or other pricing models, such as interest rates and yield curves that can be corroborated by observable market data.

•Level 3—Fair value is determined by inputs that are unobservable and not corroborated by market data. Use of these inputs involves significant and subjective judgments to be made by a reporting entity—e.g., determining an appropriate adjustment to a discount factor for illiquidity associated with a given security.

The Company had no assets or liabilities that were measured using prices with significant unobservable inputs (Level 3 assets and liabilities) as of June 30, 2024 and December 31, 2023. The carrying value of cash held in money market funds of $81.9 million as of June 30, 2024 and $10.7 million as of December 31, 2023 is included in cash and cash equivalents on the condensed consolidated balance sheets and approximates market value based on quoted market prices or Level 1 inputs. The carrying value of cash held in certificates of deposit of $20.0 million as of June 30, 2024 is included in cash and cash equivalents. The carrying value of cash held in U.S. government agency securities of $2.5 million and certificates of deposit of $60.0 million as of December 31, 2023 is included in cash and cash equivalents.

The fair value measurements of the Company’s cash equivalents and available-for-sale investment securities are identified in the following tables (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| | | Fair Value Measurements at

Reporting Date Using |

| June 30,

2024 | | Quoted Prices

in Active

Markets for

Identical

Assets

(Level 1) | | Significant

Other

Observable

Inputs

(Level 2) | | Significant

Unobservable

Inputs

(Level 3) |

| Money Market Funds | $ | 81,940 | | | $ | 81,940 | | | $ | — | | | $ | — | |

| U.S. Government Agency Securities | 91,011 | | | — | | | 91,011 | | | — | |

| FDIC Certificates of Deposit | 1,469 | | | — | | | 1,469 | | | — | |

| Certificates of Deposit | 60,000 | | | — | | | 60,000 | | | — | |

| Commercial Paper | 33,650 | | | — | | | 33,650 | | | — | |

| Corporate Notes/Bonds | 163,471 | | | — | | | 163,471 | | | — | |

| $ | 431,541 | | | $ | 81,940 | | | $ | 349,601 | | | $ | — | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | Fair Value Measurements at

Reporting Date Using |

| December 31,

2023 | | Quoted Prices

in Active

Markets for

Identical

Assets

(Level 1) | | Significant

Other

Observable

Inputs

(Level 2) | | Significant

Unobservable

Inputs

(Level 3) |

| Money Market Funds | $ | 10,698 | | | $ | 10,698 | | | $ | — | | | $ | — | |

| U.S. Government Agency Securities | 150,595 | | | — | | | 150,595 | | | — | |

| FDIC Certificates of Deposit | 4,400 | | | — | | | 4,400 | | | — | |

| Certificates of Deposit | 60,000 | | | — | | | 60,000 | | | — | |

| Commercial Paper | 78,642 | | | — | | | 78,642 | | | — | |

| Corporate Notes/Bonds | 119,037 | | | — | | | 119,037 | | | — | |

| $ | 423,372 | | | $ | 10,698 | | | $ | 412,674 | | | $ | — | |

5. Inventory

Inventory consists of the following (in thousands):

| | | | | | | | | | | |

| June 30,

2024 | | December 31,

2023 |

| Raw materials | $ | 32,562 | | | $ | 38,621 | |

| Work in process | 12,151 | | | 4,277 | |

| Finished goods | 7,931 | | | 7,370 | |

| Total | 52,644 | | | 50,268 | |

| Less: Current portion | (20,082) | | | (11,647) | |

| Total inventory, non-current | $ | 32,562 | | | $ | 38,621 | |

As of June 30, 2024 and December 31, 2023, the Company has recorded $8.0 million and $7.7 million, respectively, in inventory on the condensed consolidated balance sheets which is subject to supplemental regulatory procedures but the Company believes it is probable that such inventory has future economic benefit.

6. Prepaid and Other Assets

Prepaid expenses and other assets consist of the following (in thousands):

| | | | | | | | | | | |

| June 30,

2024 | | December 31,

2023 |

| Prepaid operating expenses | $ | 27,990 | | | $ | 19,465 | |

| Production campaign deposits | 24,202 | | | 15,127 | |

| Clinical trial advances | 24,778 | | | 11,630 | |

| Prefunded customer programs | 4,567 | | | 3,514 | |

| Total | 81,537 | | | 49,736 | |

| Less: Current portion | (73,798) | | | (42,443) | |

| Total other assets | $ | 7,739 | | | $ | 7,293 | |

7. Right of Use Assets and Lease Liabilities

In 2014, the Company entered into a long-term lease with a related party, which, as amended, provided for a lease of useable laboratory and office space located in New York, New York. A member of the Company’s board of directors is the Executive Chairman of the parent company to the landlord under this lease. Concurrent with this lease, the Company entered into a license agreement to occupy certain vivarium-related space in the same facility for the same term and rent escalation provisions as the lease. This license has the primary characteristics of a lease and is characterized as a lease in accordance with ASC Topic 842, Leases, for accounting purposes. In September 2018, the Company further amended the lease to obtain an additional office space beginning October 1, 2018 and to extend the term of the lease for previously acquired space. The lease, as amended, has a term of 14.3 years ending in May 2029. In May 2024, the Company entered into a long-term lease of office space in Bedminster, New Jersey. The lease has a term of 5.7 years ending in February 2030.

The Company has also entered into an agreement (the “Vehicle Lease”) with a company (the “Lessor”) to acquire motor vehicles for certain employees. The Vehicle Lease provides for individual vehicle leases, which at each lease commencement was determined to qualify for operating lease treatment. The contractual period of each lease is 12 months, followed by month-to-month renewal periods. The Company estimates the lease term for each vehicle to be 12 months. Leases which the Company determined to have a lease term of 12 months or less will be treated as short-term in accordance with the accounting policy election and are not recognized on the balance sheet. Each lease permits either party to terminate the lease at any time via written notice to the other party. The Company neither acquires ownership of, nor has the option to purchase the vehicles at any time. The Company is required to maintain an irrevocable $1.75 million letter of credit that the Lessor may draw upon in the event the Company defaults on the Vehicle Lease, which has been recorded as restricted cash on the condensed consolidated balance sheets.

The following table presents the weighted average remaining lease term, and the weighted average discount rates related to leases as of June 30, 2024 and December 31, 2023:

| | | | | | | | | | | |

| June 30, 2024 | | December 31, 2023 |

| Other information | | | |

| Weighted average remaining lease term | 4.9 years | | 5.3 years |

| Weighted average discount rate | 8.83 | % | | 9.07 | % |

The following table presents the lease cost for the six-month periods ended June 30, 2024 and 2023 (in thousands):

| | | | | | | | | | | |

| Six Months Ended June 30, |

| 2024 | | 2023 |

| Lease cost | | | |

| Operating lease cost | $ | 1,974 | | $ | 2,003 |

| Variable lease cost | 844 | | 724 |

| Short-term lease cost | 1,216 | | 599 |

| $ | 4,034 | | $ | 3,326 |

Maturity analysis under the lease agreements is as follows (in thousands):

| | | | | |

| Six months ending December 31, 2024 | $ | 2,165 | |

| Year ending December 31, 2025 | 4,436 | |

| Year ending December 31, 2026 | 4,513 | |

| Year ending December 31, 2027 | 4,573 | |

| Year ending December 31, 2028 | 4,707 | |

| Thereafter | 2,351 | |

| Total | 22,745 | |

| Less: Present value discount | (4,457) | |

| Total operating lease liability | 18,288 | |

| Less: Current portion | (4,171) | |

| Operating lease liabilities, non-current | $ | 14,117 | |

8. Commitments and Contingencies

License and Royalty Commitments

On May 31, 2005, the Company entered into a worldwide, exclusive License Agreement with Bristol-Myers Squibb Company (“BMS”), pursuant to which the Company holds a license to certain patents and know-how of BMS relating to lumateperone and other specified compounds. The agreement was amended on November 3, 2010. The licensed rights are exclusive, except BMS retains rights in specified compounds in the fields of obesity, diabetes, metabolic syndrome and cardiovascular disease. However, BMS has no right to use, develop or commercialize lumateperone and other specified compounds in any field of use. The Company has the right to grant sublicenses of the rights conveyed by BMS. The Company is obliged under the agreement to use commercially reasonable efforts to develop and commercialize the licensed technology. The Company is also prohibited from engaging in the clinical development or commercialization of specified competitive compounds.

Under the agreement, the Company has made payments of $10.8 million to BMS related to milestones achieved to date for lumateperone. Possible milestone payments remaining total $5.0 million. Under the agreement, the Company may be obliged to make other milestone payments to BMS for each licensed product of up to an aggregate of approximately $14.75 million. The Company is also obliged to make tiered single digit percentage royalty payments ranging between 5 – 9% on sales of licensed products. The Company is obliged to pay to BMS a percentage of non-royalty payments made in consideration of any sublicense.

The agreement extends, and royalties are payable, on a country-by-country and product-by-product basis, through the later of 10 years after first commercial sale of a licensed product in such country, expiration of the last licensed patent covering a licensed product, its method of manufacture or use, or the expiration of other government grants providing market exclusivity, subject to certain rights of the parties to terminate the agreement on the occurrence of certain events. On termination of the agreement, the Company may be obliged to convey to BMS rights in developments relating to a licensed compound or licensed product, including regulatory filings, research results and other intellectual property rights.

Purchase Commitments

The Company enters into certain long-term commitments for goods and services that are outstanding for periods greater than one year. The manufacturing service agreements commit the Company to certain minimum annual purchase commitments for which the Company anticipates making payments within the years 2025 through 2029. As of June 30, 2024, the Company has committed to purchasing production campaigns for various raw materials including active pharmaceutical ingredients (“API”) and its intermediates from each of its supply vendors. The current campaigns are expected to be received into inventory through 2027. Over the course of the vendors’ manufacturing period, the Company will remit payments to each vendor based on the payment plan set forth in their respective agreements. The Company has paid deposits of $24.2 million and $15.1 million as of June 30, 2024 and December 31, 2023, respectively, related to these campaigns. Of the $24.2 million balance as of June 30, 2024, $16.6 million is recorded within prepaid expenses and other current assets as the campaigns are expected to be received within one year of the balance sheet date and $7.6 million is recorded within other assets on the condensed consolidated balance sheet as the campaigns are expected to be received after June 30, 2025. Of the $15.1 million balance as of December 31, 2023, $7.9 million is recorded within prepaid expenses and other current assets and $7.2 million is recorded within other assets on the condensed consolidated balance sheet.

9. Share-Based Compensation

Total share-based compensation expense related to all of the Company's share-based awards, including stock options and restricted stock units (“RSUs”), granted to employees and directors recognized during the six-month periods ended June 30, 2024 and 2023, was comprised of the following (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Inventoriable costs | | $ | 491 | | | $ | 420 | | | $ | 908 | | | $ | 762 | |

| Selling, general and administrative | | 10,808 | | | 8,725 | | | 20,025 | | | 15,705 | |

| Research and development | | 5,071 | | | 4,081 | | | 9,280 | | | 7,198 | |

| Total share-based compensation expense | | $ | 16,370 | | | $ | 13,226 | | | $ | 30,213 | | | $ | 23,665 | |

Information regarding the stock options activity, including with respect to grants to employees and directors under the Amended and Restated 2018 Equity Incentive Plan (the Amended 2018 Plan) and 2019 Inducement Award Plan (the 2019 Inducement Plan) as of June 30, 2024, and changes during the six-month period then ended, are summarized as follows:

| | | | | | | | | | | | | | | | | |

| Number of

Shares | | Weighted-

Average

Exercise

Price | | Weighted-

Average

Contractual

Life |

| Outstanding at December 31, 2023 | 4,239,982 | | $ | 28.22 | | | 5.2 years |

| Options granted 2024 | 17,288 | | | | |

| Options exercised 2024 | (574,301) | | | | |

| Options canceled or expired 2024 | (9,347) | | | | |

| Outstanding at June 30, 2024 | 3,673,622 | | $ | 29.38 | | | 5.1 years |

| Vested and expected to vest at June 30, 2024 | 3,673,622 | | $ | 29.38 | | | |

| Exercisable at June 30, 2024 | 3,320,956 | | $ | 26.94 | | | 4.7 years |

The fair value of the time-based RSUs is based on the closing price of the Company’s common stock on the date of grant. Information regarding the time-based RSU activity, including with respect to grants to employees under the Amended 2018 Plan and 2019 Inducement Plan, and changes during the six-month period ended June 30, 2024 is summarized as follows:

| | | | | | | | | | | | | | | | | |

| Number of

Shares | | Weighted-Average

Grant Date

Fair Value Per Share | | Weighted-

Average

Contractual

Life |

| Outstanding at December 31, 2023 | 1,645,130 | | $ | 48.92 | | | 1.0 year |

| Time-based RSUs granted in 2024 | 1,033,819 | | | | |

| Time-based RSUs vested in 2024 | (719,864) | | | | |

| Time-based RSUs cancelled in 2024 | (29,622) | | | | |

| Outstanding at June 30, 2024 | 1,929,463 | | $ | 59.99 | | | 1.4 years |

As of June 30, 2024, there were $99.6 million of unrecognized compensation costs estimated related to unvested time-based RSUs.

10. Loss Per Share

The following share-based awards were excluded in the calculation of diluted net loss per common share because their effect could be anti-dilutive as applied to the loss from operations for the three and six-month periods ended June 30, 2024 and 2023:

| | | | | | | | | | | |

| Three and Six Months Ended June 30, |

| 2024 | | 2023 |

| | | |

| Stock options | 3,673,622 | | 4,515,188 |

| RSUs | 2,153,965 | | 1,841,855 |

Item 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

You should read the following in conjunction with our unaudited condensed consolidated financial statements and the related notes thereto that appear elsewhere in this Quarterly Report on Form 10-Q and the audited consolidated financial statements and notes thereto and under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K filed on February 22, 2024. In addition to historical information, the following discussion and analysis includes forward-looking information that involves risks, uncertainties and assumptions. Our actual results and the timing of events could differ materially from those anticipated by these forward-looking statements as a result of many factors, including those discussed under “Risk Factors” in our Annual Report on Form 10-K filed on February 22, 2024, as updated from time to time in our subsequent periodic and current reports filed with the SEC.

Overview

We are a biopharmaceutical company focused on the discovery, clinical development and commercialization of innovative, small molecule drugs that address underserved medical needs primarily in psychiatric and neurological disorders. In December 2019, CAPLYTA® (lumateperone) was approved by the U.S. Food and Drug Administration (FDA), for the treatment of schizophrenia in adults (42 mg/day) and we initiated the commercial launch of CAPLYTA in March 2020. In December 2021, CAPLYTA was approved by the FDA for the treatment of bipolar depression in adults (42 mg/day). We initiated the commercial launch of CAPLYTA for the treatment of bipolar depression in December 2021. Additionally, in April 2022, the FDA approved two additional dosage strengths of CAPLYTA, 10.5 mg and 21 mg capsules, to provide dosage recommendations for patients concomitantly taking strong or moderate CYP3A4 inhibitors, and 21 mg capsules for patients with moderate or severe hepatic impairment (Child-Pugh class B or C). We initiated the commercial launch of these special population doses in August 2022. As used in this report, “CAPLYTA” refers to lumateperone approved by the FDA for the treatment of schizophrenia in adults and for the treatment of bipolar depression in adults, and “lumateperone” refers to, where applicable, CAPLYTA as well as lumateperone for the treatment of indications beyond schizophrenia and bipolar depression.

Lumateperone is in Phase 3 clinical development as a novel treatment for major depressive disorder, or MDD.

In April 2024, we announced positive topline results from our Phase 3 clinical trial, Study 501, evaluating lumateperone 42 mg as an adjunctive therapy to antidepressants for the treatment of MDD. Lumateperone 42 mg given once daily as adjunctive therapy to antidepressants met the primary endpoint in Study 501 by demonstrating a statistically significant and clinically meaningful reduction in the Montgomery Asberg Depression Rating Scale (MADRS) total score compared to placebo at Week 6. In the modified intent-to-treat (mITT) study population, the least squares (LS) mean reduction from baseline for lumateperone 42 mg was 14.7 points, versus 9.8 points for placebo (LS mean difference = -4.9 points; p<0.0001; ES= 0.61). Lumateperone 42 mg also met the key secondary endpoint in the study by demonstrating a statistically significant and clinically meaningful reduction in the Clinical Global Impression Scale for Severity of Illness (CGI-S) score compared to placebo at Week 6 (p<0.0001; ES= 0.67). Statistically significant efficacy was seen at the earliest time point tested (Week 1) and maintained throughout the study in both the primary and the key secondary endpoints. In this study, lumateperone 42 mg robustly improved depressive symptoms as reported by patients as measured by the Quick Inventory of Depressive Symptomatology Self Report (QIDS-SR-16) (p<0.0001). Lumateperone was generally safe and well-tolerated in this study. The most commonly reported adverse events that were observed at a rate greater than or equal to 5% and greater than twice the rate of placebo in the total population were dry mouth (10.8%), fatigue (9.5%) and tremor (5.0%). Adverse events were mostly mild to moderate and resolved within a short period of time. These adverse events were similar to those seen in prior studies of lumateperone as a treatment for bipolar depression and schizophrenia.

In June 2024, we announced positive topline results from our Phase 3 clinical trial, Study 502, evaluating lumateperone 42 mg as an adjunctive therapy to antidepressants for the treatment of MDD. Lumateperone 42 mg given once daily as adjunctive therapy to antidepressants met the primary endpoint in Study 502 by demonstrating a statistically significant and clinically meaningful reduction in the MADRS total score compared to placebo at Week 6. In the mITT study population, the LS mean reduction from baseline for lumateperone 42 mg was 14.7 points, versus 10.2 points for placebo (LS mean difference = -4.5 points; p<0.0001; ES= 0.56). Numerical improvement versus placebo on the MADRS total score was seen as early as Week 1 and statistically significant efficacy was seen at Week 2 and maintained throughout the study. Lumateperone 42 mg also met the key secondary endpoint in the study by demonstrating a statistically significant and clinically meaningful reduction in the CGI-S score compared to placebo at Week 6 (p<0.0001; ES=0.51). Statistically significant separation on the CGI-S versus placebo was observed starting at Week 3 and maintained throughout the study. In this study, lumateperone 42 mg robustly improved depressive symptoms as reported by patients as measured by the QIDS-SR-16 (p<0.0001). Lumateperone was generally safe and well-tolerated in this study. The most commonly reported adverse events that were observed at a rate greater than or equal to 5% and greater than twice the rate of placebo in the total population were dizziness, somnolence, dry mouth, nausea, diarrhea and fatigue. Adverse events were mostly mild to moderate and resolved within the course of the study. These adverse events were similar to those seen in prior studies of lumateperone as a treatment for MDD, bipolar depression and schizophrenia.

We are currently conducting an additional global Phase 3 clinical trial, Study 505, evaluating lumateperone 42 mg as an adjunctive therapy to antidepressants for the treatment of MDD. We are also conducting an open label roll-over study, Study 503, to assess long-term safety in this patient population. We expect to submit an sNDA with the FDA for approval of lumateperone as an adjunctive therapy to antidepressants for the treatment of MDD in the second half of 2024.

In the first quarter of 2020, as part of our lumateperone bipolar depression clinical program, we initiated our third monotherapy Phase 3 study, Study 403, evaluating lumateperone as monotherapy in the treatment of major depressive episodes associated with bipolar I or bipolar II disorder. Following the positive results in our adjunctive study that was part of our bipolar depression clinical program, Study 402, we amended Study 403 to evaluate major depressive episodes with mixed features in bipolar disorder in patients with bipolar I or bipolar II disorder and mixed features in patients with MDD. In March 2023, we announced positive topline results from Study 403 as lumateperone 42 mg given once daily met the primary endpoint in the study by demonstrating a statistically significant and clinically meaningful reduction in the MADRS total score compared to placebo at Week 6 in the combined patient population of MDD with mixed features and bipolar depression with mixed features (5.7 point reduction vs. placebo; p<0.0001; Cohen’s d effect size (ES) of 0.64). Robust results were also seen in the individual patient population of MDD with mixed features (5.9 point reduction vs. placebo; p<0.0001; ES= 0.67), and in the individual patient population of bipolar depression with mixed features (5.7 point reduction vs. placebo; p<0.0001; ES= 0.64). Additionally, lumateperone 42 mg met the key secondary endpoint in the study by demonstrating a statistically significant and clinically meaningful reduction in the clinician’s assessment of improvement in the overall severity on the CGI-S score compared to placebo at Week 6 in the combined patient population of MDD with mixed features and bipolar depression with mixed features (p<0.0001; ES= 0.59) and in the individual patient population of MDD with mixed features (p=0.0003; ES= 0.57), as well as the individual patient population of bipolar depression with mixed features (p<0.0001; ES=0.61).

We also have an ongoing study, Study 304, evaluating lumateperone for the prevention of relapse in patients with schizophrenia. The study is being conducted in five phases consisting of a screening phase; a 6-week, open-label run-in phase during which all patients will receive 42 mg of lumateperone per day; a 12-week, open-label stabilization phase during which all patients will receive 42 mg of lumateperone per day; a double-blind treatment phase, 26 weeks in duration, during which patients receive either 42 mg of lumateperone per day or placebo (1:1 ratio); and a 2-week safety follow-up phase. This study is being conducted in accordance with our post approval marketing commitment to the FDA in connection with the approval of CAPLYTA for the treatment of schizophrenia as is typical for antipsychotics. We expect to complete Study 304 and report topline results in the second half of 2024.

Within the lumateperone portfolio, we have conducted or are in the process of conducting studies with pediatric patients in schizophrenia, bipolar disorder and irritability associated with autism spectrum disorder. Our lumateperone pediatric program includes a double-blind, placebo-controlled study in bipolar depression and two double-blind, placebo-controlled studies in irritability associated with autism spectrum disorder. Additionally, the program includes an open-label safety study in schizophrenia and bipolar disorder. Patient enrollment is ongoing in the open-label safety study as well as in the double-blind, placebo-controlled study in bipolar depression. We expect to begin enrollment in the two double-blind, placebo-controlled studies in irritability associated with autism spectrum disorder in the second half of 2024. Also, in the second quarter of 2024, we initiated two multicenter, randomized, double-blind, placebo-controlled, Phase 3 studies evaluating lumateperone in adults in the acute treatment of manic or mixed episodes associated with bipolar I disorder (bipolar mania). In addition, we are developing a long-acting injectable, or LAI, formulation to provide more treatment options to patients suffering from mental illness. We have conducted a Phase 1 single ascending dose study with an LAI formulation. This study evaluated the pharmacokinetics, safety and tolerability of a lumateperone LAI in patients with stable symptoms of schizophrenia and was generally safe and well-tolerated. We are evaluating several additional formulations of a lumateperone LAI with treatment durations of one month and longer. We have completed all non-clinical studies to support the initiation of a Phase 1 study with additional formulations of our LAI. We expect to commence clinical conduct in this study in the second half of 2024. Given the encouraging efficacy and favorable safety profile to date with oral lumateperone, we believe that an LAI option, in particular, may lend itself to being an important formulation choice for certain patients.

We are developing ITI-1284-ODT-SL for the treatment of generalized anxiety disorder, psychosis in Alzheimer's disease and agitation in patients with Alzheimer's disease. ITI-1284-ODT-SL is a deuterated form of lumateperone, a new molecular entity formulated as an oral disintegrating tablet for sublingual administration. ITI-1284-ODT-SL is formulated as an oral solid dosage form that dissolves almost instantly when placed under the tongue, allowing for ease of use in the elderly and may be particularly beneficial for patients who have difficulty swallowing conventional tablets. Phase 1 single and multiple ascending dose studies in healthy volunteers and healthy elderly volunteers (> than 65 years of age) evaluated the safety, tolerability and pharmacokinetics of ITI-1284-ODT-SL. In these studies, there were no reported serious adverse events in either age group. In the elderly cohort, reported adverse events were infrequent with the most common adverse event being transient dry mouth (mild). Based on these results, we have initiated Phase 2 programs evaluating ITI-1284-ODT-SL for the treatment of generalized anxiety disorder, psychosis in Alzheimer's disease and agitation in patients with Alzheimer’s disease. The FDA has informed us that they do not believe the deuterated and undeuterated forms of lumateperone are identical. As a result, the non-clinical data from lumateperone may not be broadly applied to ITI-1284-ODT-SL, and we conducted additional toxicology studies. These studies have been completed and we have commenced patient enrollment in our Phase 2 study evaluating ITI-1284-ODT-SL as adjunctive therapy to anti-anxiety medications in patients with generalized anxiety disorder. We expect to initiate patient enrollment in Phase 2 study evaluating ITI-1284-ODT-SL as monotherapy in patients with generalized anxiety disorder in the second half of 2024. We have also initiated patient enrollment in a Phase 2 clinical study evaluating ITI-1284-ODT-SL as monotherapy in patients with psychosis associated with Alzheimer’s disease. We anticipate commencing patient enrollment in our Phase 2 program in agitation associated with Alzheimer’s disease in the second half of 2024. We are continuing with Phase 1 studies with ITI-1284-ODT-SL, including drug-drug interaction studies.

We have another major program that has yielded a portfolio of compounds that selectively inhibit the enzyme phosphodiesterase type 1, or PDE1. PDE1 enzymes are highly active in multiple disease states, and our PDE1 inhibitors are designed to reestablish normal function in these disease states. Abnormal PDE1 activity is associated with cellular proliferation and activation of inflammatory cells. Our PDE1 inhibitors ameliorate both of these effects in animal models. We intend to pursue the development of our phosphodiesterase, or PDE, program, for the treatment of aberrant immune system activation in several central nervous system, or CNS, and non-CNS conditions with a focus on diseases where excessive PDE1 activity has been demonstrated and increased inflammation is an important contributor to disease pathogenesis. Our potential disease targets include immune system regulation, neurodegenerative diseases, cancers and other non-CNS disorders. Lenrispodun (ITI-214) is our lead compound in this program. Following the favorable safety and tolerability results in our Phase 1 program, we initiated our development program for lenrispodun for Parkinson’s disease and conducted a Phase 1/2 clinical trial of lenrispodun in patients with Parkinson’s disease to evaluate safety and tolerability in this patient population, as well as motor and non-motor exploratory endpoints. In this study, lenrispodun was generally well-tolerated with a favorable safety profile and clinical signs consistent with improvements in motor symptoms and dyskinesias. Our Phase 2 clinical trial of lenrispodun evaluating improvements in motor symptoms, changes in cognition, and inflammatory biomarkers in patients with Parkinson’s disease is ongoing. We expect to report topline results from this study in 2025. We also have an active Investigational New Drug application, or IND, to evaluate our newest candidate within the PDE1 inhibitor program, ITI-1020, as a novel cancer immunotherapy. Our Phase 1 program with ITI-1020 in healthy volunteers is ongoing.

We also have a development program with our ITI-333 compound as a potential treatment for substance use disorders, pain and psychiatric comorbidities including depression and anxiety. There is a pressing need to develop new drugs to treat opioid addiction and safe, effective, non-addictive treatments to manage pain. ITI-333 is a novel compound that uniquely combines activity as an antagonist at serotonin 5-HT2A receptors and a partial agonist at µ-opioid receptors. These combined actions support the potential utility of ITI-333 in the treatment of opioid use disorder and associated comorbidities (e.g., depression, anxiety, sleep disorders) without opioid-like safety and tolerability concerns. We have conducted a Phase 1 single ascending dose study evaluating the safety, tolerability and pharmacokinetics of ITI-333 in healthy volunteers. In this study, ITI-333 achieved plasma exposures at or above those required for efficacy and was generally safe and well-tolerated. We have commenced a neuroimaging study to investigate brain occupancy for receptors that play a role in substance use disorder and also have applicability for pain. The results of this study will support the dose selection for future studies. We also have an ongoing multiple ascending dose study with ITI-333 in healthy volunteers.

We also have the ITI-1500 program focused on the development of novel non-hallucinogenic psychedelics, which we refer to as neuroplastogens. Compounds in this series interact with serotonergic (5-HT2a) receptors in a unique way, potentially allowing the development of this new drug class in mood, anxiety and other neuropsychiatric disorders without the liabilities of known psychedelics including the hallucinogenic potential and risk for cardiac valvular pathologies. Our lead compound in this program, ITI-1549, is currently being evaluated in IND enabling studies and is expected to enter human testing in 2025.

Results of Operations

The following discussion summarizes the key factors our management believes are necessary for an understanding of our financial statements.

Revenues

Revenues are comprised primarily of net product sales of our commercial product, CAPLYTA, in the United States. Our net product sales of CAPLYTA represent sales primarily to wholesalers and specialty distributors and reflect certain adjustments deducted from product sales, gross to arrive at product sales, net.

Expenses

Our operating expenses are comprised of (i) costs of product sales; (ii) selling expenses; (iii) general and administrative expenses; and (iv) research and development expenses.

Costs of product sales are comprised of:

•royalty payments on product sales;

•direct costs of formulating, manufacturing and packaging drug product; and

•overhead costs consisting of labor, share-based compensation, shipping, external inventory manufacturing and other miscellaneous operating costs.

Selling expenses are incurred in three major categories:

•salaries, share-based compensation and related benefit costs of a dedicated sales force and commercial organization;

•marketing and promotion expenses; and

•sales operation costs.

General and administrative expenses are incurred in three major categories:

•salaries, share-based compensation and related benefit costs;

•patent, legal and professional costs; and

•office, facilities and infrastructure overhead.

Research and development costs are comprised of:

•fees paid to external parties that provide us with contract services, such as pre-clinical testing, manufacturing and related testing, clinical trial activities and license milestone payments; and

•internal recurring costs, such as costs relating to labor and fringe benefits, share-based compensation, materials, supplies, facilities and maintenance.

The process of researching, developing and commercializing drugs for human use is lengthy, unpredictable and subject to many risks. The costs associated with the commercialization of CAPLYTA are substantial and will be incurred prior to our generating sufficient revenue to offset these costs. Costs for the clinical development of lumateperone-related projects, including for the treatment of MDD, consume and, together with our required post-marketing studies and other anticipated clinical development programs, will continue to consume a large portion of our current, as well as projected, resources. We intend to pursue other disease indications that lumateperone may address, but there are significant costs associated with pursuing FDA approval for those indications, which would include the cost of additional clinical trials.

A portion of product sold through June 30, 2024 consisted of active pharmaceutical ingredient (API) and drug product that was previously charged to research and development expenses prior to FDA approval of CAPLYTA. Because the Company’s policy does not allow for the capitalization of the cost of drug product that was incurred prior to FDA approval, the cost of drug product sold is lower than it would have been and has a positive impact on our cost of product sales for the three and six-month periods ended June 30, 2024 and 2023. We expect to continue to have this favorable impact on cost of product sales and related product gross margins until the cost of our sales of CAPLYTA include drug product that is manufactured entirely after the FDA approval. We expect that this will be the case for the near term and, as a result, our cost of product sales is less than we anticipate it will be in future periods. In addition, as our net product sales increase and, we exceed certain sales thresholds, the applicable royalty rate for payments we make under our License Agreement with Bristol Myers Squibb (BMS) increases, which results in an increase to cost of product sales.