false000165932300-000000000016593232024-05-132024-05-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): May 13, 2024 |

Iterum Therapeutics plc

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Ireland |

001-38503 |

Not applicable |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

Fitzwilliam Court 1st Floor Leeson Close |

|

Dublin 2, , Ireland |

|

Not applicable |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: +353 1 6694820 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Ordinary Shares, par value $0.01 per share |

|

ITRM |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On May 13, 2024, Iterum Therapeutics plc issued a press release announcing its financial results for the first quarter ended March 31, 2024. A copy of the press release is furnished herewith as Exhibit 99.1.

The information in this current report on Form 8-K, including the press release attached as Exhibit 99.1 hereto, is being furnished, but shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained herein and in the accompanying exhibit shall not be incorporated by reference into any filing with the U.S. Securities and Exchange Commission made by Iterum Therapeutics plc, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Iterum Therapeutics plc |

|

|

|

|

Date: |

May 13, 2024 |

By: |

/s/ Corey N. Fishman |

|

|

|

Chief Executive Officer |

EXHIBIT 99.1

FOR IMMEDIATE RELEASE

Iterum Therapeutics Reports First Quarter 2024 Financial Results

--NDA Resubmitted; FDA Action Expected in Early Q4 24—

--Cash Runway into 2025, including through Potential FDA Approval--

--Company to Host Conference Call Today at 8:30 a.m. EDT--

DUBLIN, Ireland and CHICAGO, May 13, 2024 -- Iterum Therapeutics plc (Nasdaq: ITRM), (Iterum) a clinical-stage pharmaceutical company focused on developing next generation oral and IV antibiotics to treat infections caused by multi-drug resistant pathogens in both community and hospital settings, today reported financial results for the first quarter ended March 31, 2024.

“We are pleased to have recently resubmitted our new drug application (NDA) for oral sulopenem just three months after reporting positive topline data from our REASSURE trial in January 2024,” said Corey Fishman, Iterum’s Chief Executive Officer. “We continue to believe that the strong results from this trial, which was conducted under a Special Protocol Assessment (SPA) agreement with the U.S. Food and Drug Administration (FDA), addresses the FDA’s recommendations for additional data to support approval of oral sulopenem for the treatment of adult women with uncomplicated urinary tract infections (uUTIs). The potential approval of oral sulopenem would mark the first oral penem approved in the U.S., and the second antibiotic approved for the treatment of uUTIs over the past 25 years.”

Highlights and Recent Events

•NDA Review Underway: Iterum began enrollment in its pivotal Phase 3 clinical trial, REASSURE (REnewed ASsessment of Sulopenem in uUTI caused by Resistant Enterobacterales), for the treatment of uUTIs in adult women in October 2022 and completed enrollment in October 2023 enrolling 2,222 patients. Iterum reported positive topline data in January 2024 and resubmitted its NDA in April 2024. Provided the FDA is satisfied that the resubmitted NDA addresses all of the deficiencies identified in the Complete Response Letter (CRL) Iterum received from the FDA in July 2021, Iterum expects that the FDA will complete its review and take action six months from the date the FDA received the resubmitted NDA (or early in the fourth quarter of 2024).

•Extended Cash Runway: During the first quarter of 2024, Iterum sold 3.0 million ordinary shares under an at-the-market offering (ATM) agreement, at an average price of $2.51 per share for net proceeds of $7.2 million, which has extended its cash runway into 2025 based on its current operating plan. As of April 30, 2024, Iterum had approximately 16.6 million ordinary shares outstanding.

First Quarter 2024 Financial Results

Cash, cash equivalents and short-term investments were $18.2 million at March 31, 2024. Based on Iterum’s current operating plan, Iterum expects that its current cash, cash equivalents and short-term investments will be sufficient to fund its operations into 2025, including through the expected Prescription Drug User Fee Act (PDUFA) date early in the fourth quarter of 2024.

Research and development (R&D) expenses for the first quarter 2024 were $4.0 million compared to $6.4 million for the same period in 2023. The decrease for the three-month period was primarily due to higher costs incurred in 2023 to support our REASSURE trial, which began enrollment in October 2022 and completed enrollment in October 2023.

General and administrative (G&A) expenses for the first quarter 2024 were $2.2 million compared to $2.1 million for the same period in 2023. The increase for the three-month period was primarily due to an increase in legal fees and an increase in consultants used to support pre-commercial activities.

Net loss for the first quarter 2024 was $7.1 million compared to a net loss of $9.9 million for the same period in 2023. Non-GAAP1 net loss for the first quarter 2024 was $5.8 million compared to a non-GAAP net loss of $7.4 million in 2024.

Conference Call Details

•Iterum will host a conference call today, Monday, May 13, 2024 at 8:30 a.m. Eastern Time. The dial-in information for the call is as follows: United States: 1 833 470 1428; International: 1 404 975 4839; Access code: 818440

About Iterum Therapeutics plc

Iterum Therapeutics plc is a clinical-stage pharmaceutical company dedicated to developing differentiated anti-infectives aimed at combatting the global crisis of multi-drug resistant pathogens to significantly improve the lives of people affected by serious and life-threatening diseases around the world. Iterum is currently advancing its first compound, sulopenem, a novel penem anti-infective compound, in Phase 3 clinical development with an oral formulation.

Sulopenem also has an IV formulation. Sulopenem has demonstrated potent in vitro activity against a wide variety of gram-negative, gram-positive and anaerobic bacteria resistant to other antibiotics. Iterum has received Qualified Infectious Disease Product (QIDP) and Fast Track designations for its oral and IV formulations of sulopenem in seven indications. For more information, please visit http://www.iterumtx.com.

1 Definition and reconciliations of applicable GAAP reported to non-GAAP adjusted information are included at the end of this press release

Non-GAAP Financial Measures

To supplement Iterum’s financial results presented in accordance with U.S. generally accepted accounting principles (“GAAP”), Iterum presents non-GAAP net loss and non-GAAP net loss per share to exclude from reported GAAP net loss and GAAP net loss per share, share-based compensation expense ($0.1 million); the interest expense associated with accrued interest on the Exchangeable Notes, payable in cash, shares or a combination of both upon exchange, redemption or at January 31, 2025 (“the Maturity Date”), whichever is earlier ($0.2 million); the non-cash amortization of the Exchangeable Notes ($0.6 million); and the non-cash adjustments to the fair value of the Royalty-Linked Notes ($0.4 million) for the three months ended March 31, 2024, and intangible asset amortization ($0.4 million); share-based compensation expense ($0.4 million); the interest expense associated with accrued interest on the Exchangeable Notes payable in cash, shares or a combination of both upon exchange, redemption or at the Maturity Date, whichever is earlier ($0.2 million); the non-cash amortization of the Exchangeable Notes ($0.6 million); and the non-cash adjustments to the fair value of derivatives and Royalty-Linked Notes ($0.9 million) for the three months ended March 31, 2023, respectively.

Iterum believes that the presentation of non-GAAP net loss and non-GAAP net loss per share, when viewed with its results under GAAP and the accompanying reconciliation, provides useful supplementary information to, and facilitates additional analysis by, investors, analysts, and Iterum’s management in assessing Iterum’s performance and results from period to period. These non-GAAP financial measures closely align with the way management measures and evaluates Iterum’s performance. These non-GAAP financial measures should be considered in addition to, and not a substitute for, or superior to, net (loss) / income or other financial measures calculated in accordance with GAAP. Non-GAAP net loss and non-GAAP net loss per share are not based on any standardized methodology prescribed by GAAP and represents GAAP net loss, which is the most directly comparable GAAP measure, adjusted to exclude intangible asset amortization; share-based compensation expense; the interest expense associated with accrued interest on the Exchangeable Notes payable in cash, shares or a combination of both upon exchange, redemption or at the Maturity Date, whichever is earlier; the non-cash amortization of the Exchangeable Notes; and the non-cash adjustments to the fair value of derivatives and Royalty-Linked Notes for the three months ended March 31, 2024 and March 31, 2023. Because of the non-standardized definitions of non-GAAP financial measures, non-GAAP net loss and non-GAAP net loss per share used by Iterum in this press release and accompanying tables has limits in its usefulness to investors and may be calculated differently from, and therefore may not be directly comparable to, similarly titled measures used by other companies. A reconciliation of non-GAAP net loss to GAAP net loss and non-GAAP net loss per share to GAAP net loss per share have been provided in the tables included in this press release.

Special Note Regarding Forward Looking Statements

This press release contains forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. These forward-looking statements include, without limitation, statements regarding Iterum’s plans, strategies and prospects for its business, including the development, therapeutic and market potential of sulopenem, Iterum’s ability to address the deficiencies set out in the CRL received in July 2021, the expected timing of review of the resubmitted NDA by the FDA, potential action by the FDA with respect to the

resubmitted NDA, the sufficiency of Iterum’s cash resources to fund its operating expenses into 2025, and Iterum’s strategic process to sell, license, or otherwise dispose of its rights to sulopenem. In some cases, forward-looking statements can be identified by words such as “may,” “believes,” “intends,” “seeks,” “anticipates,” “plans,” “estimates,” “expects,” “should,” “assumes,” “continues,” “could,” “would,” “will,” “future,” “potential” or the negative of these or similar terms and phrases. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause Iterum’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Forward-looking statements include all matters that are not historical facts. Actual future results may be materially different from what is expected due to factors largely outside Iterum’s control, including uncertainties inherent in the design, initiation and conduct of clinical and non-clinical development, changes in regulatory requirements or decisions of regulatory authorities, the timing or likelihood of regulatory filings and approvals, changes in public policy or legislation, commercialization plans and timelines, if oral sulopenem is approved, the actions of third-party clinical research organizations, suppliers and manufacturers, the accuracy of Iterum’s expectations regarding how far into the future Iterum’s cash on hand will fund Iterum’s ongoing operations, the sufficiency of Iterum’s cash resources and the Company’s ability to continue as a going concern, Iterum’s ability to maintain its listing on the Nasdaq Capital Market, risks and uncertainties concerning the outcome, impact, effects and results of Iterum’s pursuit of strategic alternatives, including the terms, timing, structure, value, benefits and costs of any strategic process and Iterum’s ability to complete one whether on attractive terms at all and other factors discussed under the caption “Risk Factors” in its Annual Report on Form 10-Q filed with the SEC on May 13, 2024, and other documents filed with the SEC from time to time. Forward-looking statements represent Iterum’s beliefs and assumptions only as of the date of this press release. Except as required by law, Iterum assumes no obligation to update these forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in the forward-looking statements, even if new information becomes available in the future.

Investor Contact:

Judy Matthews

Chief Financial Officer 312-778-6073

IR@iterumtx.com

|

|

|

|

|

|

|

|

|

ITERUM THERAPEUTICS PLC |

|

Condensed Consolidated Statement of Operations |

|

(In thousands except share and per share data) |

|

(Unaudited) |

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024 |

|

|

2023 |

|

Operating expenses: |

|

|

|

|

|

|

Research and development |

|

|

(3,977 |

) |

|

|

(6,432 |

) |

General and administrative |

|

|

(2,186 |

) |

|

|

(2,098 |

) |

Total operating expenses |

|

|

(6,163 |

) |

|

|

(8,530 |

) |

Operating loss |

|

|

(6,163 |

) |

|

|

(8,530 |

) |

Interest expense, net |

|

|

(487 |

) |

|

|

(399 |

) |

Adjustments to fair value of derivatives |

|

|

(386 |

) |

|

|

(878 |

) |

Other (expense) / income, net |

|

|

(17 |

) |

|

|

41 |

|

Income tax expense |

|

|

(48 |

) |

|

|

(123 |

) |

Net loss |

|

$ |

(7,101 |

) |

|

$ |

(9,889 |

) |

Net loss per share – basic and diluted |

|

$ |

(0.46 |

) |

|

$ |

(0.78 |

) |

Weighted average ordinary shares outstanding – basic and diluted |

|

|

15,432,693 |

|

|

|

12,681,900 |

|

|

|

|

|

|

|

|

Reconciliation of non-GAAP net loss to GAAP net loss |

|

|

|

|

|

|

Net loss - GAAP |

|

$ |

(7,101 |

) |

|

$ |

(9,889 |

) |

Intangible asset amortization |

|

|

— |

|

|

|

429 |

|

Share based compensation |

|

|

138 |

|

|

|

393 |

|

Interest expense - accrued interest and amortization on exchangeable notes |

|

|

750 |

|

|

|

783 |

|

Adjustments to fair value of derivatives |

|

|

386 |

|

|

|

878 |

|

Non-GAAP net loss |

|

$ |

(5,827 |

) |

|

$ |

(7,406 |

) |

Net loss per share - basic and diluted |

|

$ |

(0.46 |

) |

|

$ |

(0.78 |

) |

Non-GAAP net loss per share - basic and diluted |

|

$ |

(0.38 |

) |

|

$ |

(0.58 |

) |

|

|

|

|

|

|

|

ITERUM THERAPEUTICS PLC |

|

Condensed Consolidated Balance Sheet Data |

|

(In thousands) |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

As of |

|

|

As of |

|

|

|

March 31, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

Cash, cash equivalents and short-term investments |

|

$ |

18,214 |

|

|

$ |

23,930 |

|

Other assets |

|

|

1,411 |

|

|

|

2,329 |

|

Total assets |

|

$ |

19,625 |

|

|

$ |

26,259 |

|

Exchangeable notes |

|

$ |

12,203 |

|

|

$ |

11,453 |

|

Royalty-linked notes |

|

|

7,889 |

|

|

|

7,503 |

|

Other liabilities |

|

|

5,683 |

|

|

|

13,706 |

|

Total liabilities |

|

|

25,775 |

|

|

|

32,662 |

|

Total shareholders' deficit |

|

|

(6,150 |

) |

|

|

(6,403 |

) |

Total liabilities and shareholders' deficit |

|

$ |

19,625 |

|

|

$ |

26,259 |

|

v3.24.1.1.u2

Document And Entity Information

|

May 13, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

May 13, 2024

|

| Entity Registrant Name |

Iterum Therapeutics plc

|

| Entity Central Index Key |

0001659323

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-38503

|

| Entity Incorporation, State or Country Code |

L2

|

| Entity Tax Identification Number |

00-0000000

|

| Entity Address, Address Line One |

Fitzwilliam Court

|

| Entity Address, Address Line Two |

1st Floor

|

| Entity Address, Address Line Three |

Leeson Close

|

| Entity Address, City or Town |

Dublin 2

|

| Entity Address, Country |

IE

|

| Entity Address, Postal Zip Code |

Not applicable

|

| City Area Code |

+353

|

| Local Phone Number |

1 6694820

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Ordinary Shares, par value $0.01 per share

|

| Trading Symbol |

ITRM

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

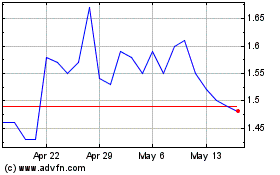

Iterum Therapeutics (NASDAQ:ITRM)

Historical Stock Chart

From Apr 2024 to May 2024

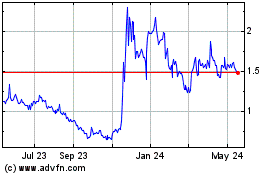

Iterum Therapeutics (NASDAQ:ITRM)

Historical Stock Chart

From May 2023 to May 2024