As filed with the Securities and Exchange

Commission on May 23, 2024

Registration No. 333-262835

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

POST-EFFECTIVE AMENDMENT NO. 5

TO

FORM F-1

ON

FORM F-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

JEFFS’ BRANDS

LTD

(Exact name of registrant as specified in its charter)

| State of Israel |

|

5900 |

|

Not Applicable |

(State or other jurisdiction of

incorporation or organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification Number) |

Viki Hakmon

Chief Executive Officer

7 Mezada Street, Bnei Brak, Israel 5126112

Tel: +972-3-7713520

(Address, including zip code, and telephone number,

including area code, of registrant’s principal

executive offices) |

|

Puglisi & Associates

850 Library Ave., Suite 204

Newark, Delaware 19711

Tel: (302) 738-6680

(Name, address, including zip code, and telephone number,

including area code, of agent for service) |

Copies to:

Dr.

Shachar Hadar, Adv.

Meitar | Law Offices

16 Abba Hillel Silver Rd.

Ramat Gan 5250608, Israel

Tel: +972-3-610-3100 |

|

Oded Har-Even, Esq.

Angela Gomes, Esq

Sullivan & Worcester LLP

1251 Avenue of the Americas

New York, New York 10020

Tel: (212) 660-3000 |

|

Reut

Alfiah, Adv.

Gal Cohen, Adv.

Sullivan & Worcester Tel-Aviv

(Har-Even & Co.)

28 HaArba’a St. HaArba’a Towers,

North Tower, 35th Floor

Tel-Aviv, Israel 6473925

Tel: +972-74-7580480 |

Approximate date of commencement

of proposed sale to the public: As soon as practicable after the effective date hereof.

If any of the securities being

registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the

following box. ☒

If this form is filed to register

additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective

amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective

amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company

that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to

use the extended transition period for complying with any new or revised financial accounting standards † provided pursuant to

Section 7(a)(2)(B) of the Securities Act. ☐

| † | The term “new or revised financial accounting standard”

refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5,

2012. |

Explanatory Note

This Post-Effective Amendment

No. 5 on Form F-3, or this Post-Effective Amendment, to Registration Statement on Form F-1 (File No. 333-262835), or the Registration

Statement, is being filed pursuant to our undertaking in the Registration Statement to update and supplement information contained in

the Registration Statement as originally declared effective by the Securities and Exchange Commission, or the SEC, on August 25, 2022

and as amended pursuant to the Post-Effective Amendment No. 1 to the Registration Statement declared effective by the SEC on December

6, 2022, Post-Effective Amendment No. 2 to the Registration Statement, as amended by Post-Effective Amendment No. 3 to the

Registration Statement, declared effective by the SEC on September 18, 2023, and Post-Effective Amendment No. 4 to the Registration Statement,

declared effective by the SEC on October 5, 2023. The Registration Statement originally covered a primary offering of (A) 531,068 units,

or Units, at a public offering price of $29.12 per Unit, with each Unit consisting of one of our ordinary shares, no par value per share,

or Ordinary Shares, and one warrant, or Warrant, to purchase one Ordinary Share, at an initial exercise price of $28.28 per Ordinary

Share (and an exercise price of $14.14 following the Exercise Price Adjustment, as defined below), (B) warrants issued to Aegis Capital

Corp., the underwriter in the offering, or Aegis or the Underwriter, to purchase up to 26,554 Ordinary Shares, at an exercise price of

$36.40 per Ordinary Share, or the Underwriter’s Warrants, (C) up to 79,660 additional Ordinary Shares and/or additional Warrants

to purchase up to an aggregate amount of 79,660 Ordinary Shares issuable to the Underwriter solely to cover over-allotments, if any,

pursuant to its over-allotment option, which expired on October 9, 2022, and (D) additional Warrants to purchase up to an aggregate amount

of 403,512 Ordinary Shares issued pursuant to Section 3(e) or 3(h) of the Warrant, or the Additional Warrants. This Post-Effective Amendment

is now being filed to: (i) update certain financial information contained in the Registration Statement; and (ii) cover the sale of Ordinary

Shares issuable from time to time upon exercise of the Warrants, Underwriter’s Warrants and Additional Warrants that remain unexercised

as of the date hereof, and include an updated prospectus related to the offering of Ordinary Shares underlying the Warrants, Underwriter’s

Warrants and Additional Warrants that were registered on the Registration Statement.

On September 7, 2022,

the Company’s volume weighted average stock price was less than the exercise floor of $28.28 for the Warrants. Accordingly, effective

after the closing of trading on November 28, 2022 (the 90th calendar day immediately following the issuance date of the Warrants),

the Warrants were adjusted pursuant to their terms, including, but not limited to, to adjust the exercise price of the Warrants to $14.14,

or the Exercise Price Adjustment. In addition, in connection with the Exercise Price Adjustment, the Company issued Additional Warrants

to purchase up to 403,512 Ordinary Shares to Qualified Buyers (as defined in the Warrant). See “Description of Share Capital —

Warrants” for additional information.

The information included

in this Post-Effective Amendment amends the Registration Statement and the prospectus contained therein. No additional securities are

being registered under this Post-Effective Amendment. All applicable registration fees were paid at the time of the original filing of

the Registration Statement.

On September 5, 2023,

our board of directors approved a 1-for-7 reverse split of our issued and outstanding Ordinary Shares, effective as of November 3, 2023,

pursuant to which holders of our Ordinary Shares received one Ordinary Share for every 7 Ordinary Shares held as of such date. The reverse

stock split did not reduce the number of our authorized share capital. All share data in this prospectus have been adjusted accordingly.

The registrant hereby amends

this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further

amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of

the Securities Act or until the registration statement shall become effective on such date as the Commission, acting pursuant to said

Section 8(a), may determine.

The information in

this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the

Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer

to buy these securities in any state where the offer or sale is not permitted.

| PROSPECTUS |

|

SUBJECT TO COMPLETION

|

|

DATED MAY

23, 2024 |

This prospectus relates

to the issuance of up to 1,021,977 ordinary shares, no par value per share, or Ordinary Shares, of Jeffs’ Brands Ltd, or the Company,

upon the exercise of the following warrants, or the Outstanding Warrants, issued as part of the Company’s initial public offering,

or the IPO: (i) warrants, or the Warrants, to purchase up to 591,912 Ordinary Shares (including Warrants to purchase up to 60,485 Ordinary

Shares issued pursuant to the partial exercise of the over-allotment option granted to Aegis Capital Corp., or the Underwriter, in connection

with the IPO), which are exercisable at an initial exercise price of $28.28 per Ordinary Share (and an exercise price of $14.14 following

the Exercise Price Adjustment, as defined below), were exercisable immediately upon issuance and expire on August 30, 2027; (ii) warrants,

or the Underwriter’s Warrants, issued to the Underwriter to purchase up to 26,554 Ordinary Shares, which are exercisable at an

exercise price of $36.40 per Ordinary Share, became exercisable beginning on February 21, 2023 and will expire on August 25, 2027; and

(iii) additional Warrants, or the Additional Warrants, to purchase up to an aggregate amount of 403,512 Ordinary Shares issued pursuant

to Section 3(e) or 3(h) of the Warrant, effective as of November 28, 2022.

On September 7, 2022,

the Company’s volume weighted average stock price was less than the exercise floor of $28.28 for the Warrants. Accordingly, effective

after the closing of trading on November 28, 2022 (the 90th calendar day immediately following the issuance date of the Warrants),

the Warrants were adjusted pursuant to their terms, including, but not limited to, to reduce the exercise price of the Warrants to $14.14,

or the Exercise Price Adjustment. In addition, in connection with the Exercise Price Adjustment, the Company issued Additional Warrants

to purchase 403,512 Ordinary Shares to Qualified Buyers (as defined in the Warrant. See “Description of Share Capital — Warrants”

for additional information.

We refer to the Ordinary Shares,

the Outstanding Warrants and the Ordinary Shares issued or issuable upon exercise of the Outstanding Warrants, collectively, as the securities.

See “Description of Share Capital” for additional information.

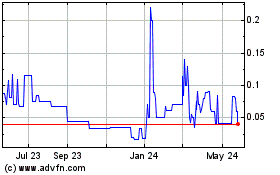

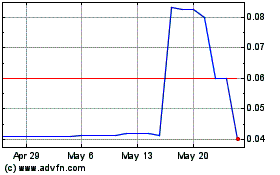

Our Ordinary Shares and

Warrants are listed on the Nasdaq Capital Market, or Nasdaq, under the symbols “JFBR” and “JFBRW,” respectively.

On May 22, 2024, the last reported sale price of our Ordinary Shares and Warrants on Nasdaq was $0.3470 per Ordinary Share and $0.0599

per Warrant, respectively.

On September 5, 2023,

our board of directors approved a 1-for-7 reverse split of our issued and outstanding Ordinary Shares, effective as of November 3, 2023,

pursuant to which holders of our Ordinary Shares received one Ordinary Share for every 7 Ordinary Shares held as of such date. The reverse

stock split did not reduce the number of our authorized share capital. All share data in this prospectus have been adjusted accordingly.

We are an emerging growth company,

as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and are subject to reduced public company reporting

requirements.

Investing in our securities

involves a high degree of risk. See “Risk Factors” beginning on page 5 and “Item 3. — Key Information —

D. Risk Factors” in our Annual Report on Form 20-F for the year ended December 31, 2023, or the 2023 Annual Report, incorporated

by reference in this prospectus for a discussion of the factors you should consider carefully before deciding to purchase these securities.

Neither the Securities and

Exchange Commission, or the SEC, nor any state or other foreign securities commission has approved nor disapproved these securities or

determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is ,

2024

TABLE OF CONTENTS

You should rely only on

the information contained in this prospectus. We have not authorized anyone to provide you with information that is different. If anyone

provides you with different or inconsistent information, you should not rely on it. The information contained in this prospectus is accurate

only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of securities described in this

prospectus. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any

jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus, as well as

information we have previously filed with the Securities and Exchange Commission, or SEC, and incorporated by reference, is accurate as

of the date on the front of those documents only. Our business, financial condition, results of operations and prospects may have changed

since those dates. We offered to sell the securities, and seeking offers to buy the securities, only in jurisdictions where offers and

sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of

delivery of this prospectus or any sale of the securities.

We are incorporated under the

laws of the State of Israel and our registered office and domicile is located in Tel Aviv, Israel. Moreover, the majority of our directors

and senior management are not residents of the United States, and all or a substantial portion of the assets of such persons are

located outside the United States. As a result, it may not be possible for investors to effect service of process within the United States

upon us or upon such persons or to enforce against them judgments obtained in U.S. courts, including judgments in actions predicated

upon the civil liability provisions of the federal securities laws of the United States. We have been informed by our legal counsel

in Israel, Meitar | Law Offices, that it may be difficult to assert U.S. securities law claims in original actions instituted in

Israel. Israeli courts may refuse to hear a claim based on a violation of U.S. securities laws because Israel is not the most appropriate

forum to bring such a claim. See “Enforceability of Civil Liabilities” for additional information.

For investors outside of the

United States: Neither we nor the Underwriter have done anything that would permit this offering or possession or distribution of

this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required

to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

In this prospectus, “we,”

“us,” “our,” the “Company” and “Jeffs’ Brands” refer to Jeffs’ Brands Ltd.

All trademarks or trade names

referred to in this prospectus are the property of their respective owners. Solely for convenience, the trademarks and trade names in

this prospectus are referred to without the ® and ™ symbols, but such references should not be construed as any indicator that

their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend the use or

display of other companies’ trademarks and trade names to imply a relationship with, or endorsement or sponsorship of us by, any

other companies.

Our reporting currency and

functional currency is the U.S. dollar. Unless otherwise expressly stated or the context otherwise requires, references in this

prospectus to “NIS” are to New Israeli Shekels, and references to “dollars” or “$” mean U.S. dollars.

This prospectus includes statistical,

market and industry data and forecasts which we obtained from publicly available information and independent industry publications and

reports that we believe to be reliable sources. These publicly available industry publications and reports generally state that they obtain

their information from sources that they believe to be reliable, but they do not guarantee the accuracy or completeness of the information.

Although we believe that these sources are reliable, we have not independently verified the information contained in such publications.

We report under generally accepted

accounting principles in the United States, or U.S. GAAP, as issued by the Financial Accounting Standards Board, or the FASB.

On February 17, 2022,

our board of directors approved the issuance of bonus shares (equivalent to a stock dividend) on a basis of 664.0547 (prior to adjustments

for subsequent reverse share splits) Ordinary Shares for each Ordinary Share issued and outstanding as of the close of business on February

17, 2022 (provided that any fractional shares be rounded down to the nearest whole number), pursuant to which holders of our Ordinary

Shares received 664.0547 (prior to adjustments for subsequent reverse share splits) Ordinary Shares for every one Ordinary Share held

as of such date.

On May 3, 2022, our board

of directors approved a 0.806-for-1 reverse split of our issued and outstanding Ordinary Shares, effective as of May 3, 2022, pursuant

to which holders of our Ordinary Shares received 0.806 of an Ordinary Share for every one Ordinary Share held as of such date. The reverse

stock split proportionally reduced the number of authorized share capital.

On June 16, 2022, our

board of directors approved a 1-for-1.85 reverse split of our issued and outstanding Ordinary Shares, effective as of June 16, 2022,

pursuant to which holders of our Ordinary Shares received one Ordinary Share for every 1.85 Ordinary Shares held as of such date. The

reverse stock split proportionally reduced the number of authorized share capital.

On September 5, 2023,

our board of directors approved a 1-for-7 reverse split of our issued and outstanding Ordinary Shares, effective as of November 3, 2023,

pursuant to which holders of our Ordinary Shares received one Ordinary Share for every 7 Ordinary Shares held as of such date. The reverse

stock split did not reduce the number of our authorized share capital.

Unless the context expressly

dictates otherwise, all references to share and per share amounts referred to herein give effect to the bonus shares issuance and the

reverse share splits.

PROSPECTUS SUMMARY

This summary highlights

information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing

in our securities. Before you decide to invest in our securities, you should read the entire prospectus carefully, including the “Risk

Factors” section and the financial statements and related notes appearing at the end of this prospectus included in our 2023 Annual

Report, incorporated by reference herein.

Unless otherwise stated, all amounts

reported in this summary are in thousands of U.S. Dollars.

We are an e-commerce

consumer products goods, or CPG, company, operating primarily on the Amazon.com marketplace, or Amazon. We were incorporated in Israel

in March 2021, under the name Jeffs’ Brands Ltd, to provide a variety of professional and business support as well as marketing

support services to Smart Repair Pro that operate online stores for the sale of various consumer products on Amazon, utilizing the Fulfillment

by Amazon, or FBA, model. As of the date of this prospectus, we have five wholly-owned subsidiaries: Smart Repair Pro, Top Rank Ltd.,

or Top Rank, Fort Products Ltd., or Fort, Jeffs’ Brands Holdings Inc., or Jeffs’ Brands Holdings, and Fort Products LLC.

We also own a minority interest in SciSparc Nutraceuticals Inc., or SciSparc U.S., to whom we provide management services.

In addition to executing the

FBA business model, we utilize A.I. and machine learning technologies to analyze sales data and patterns on the Amazon.com marketplace

in order to identify existing stores, niches and products that have the potential for development and growth, and for maximizing sales

of existing proprietary products. We also use our own skills, know-how and profound familiarity with the Amazon.com algorithm and all

the tools that the FBA platform FBA has to offer. In some circumstances we scale the products and improve them.

Recent Development Regarding Nasdaq Compliance

On April 25, 2024, we

received a written notification from the Listing Qualifications Department of the Nasdaq Stock Market LLC notifying us that we were not

in compliance with the minimum bid price requirement for continued listing on the Nasdaq Stock Market LLC, as set forth under Nasdaq

Listing Rule 5550(a)(2), or the Minimum Bid Price Requirement, because the closing bid price of our Ordinary Shares was below $1.00 per

Ordinary Share for the previous 30 consecutive business days. We were granted 180 calendar days, or until October 22, 2024, to regain

compliance with the Minimum Bid Price Requirement. We can regain compliance if, at any time during this 180-day period, the closing bid

price of our Ordinary Shares is at least $1.00 for a minimum of ten consecutive business days, in which case we will be provided with

written confirmation of compliance and this matter will be closed. However, the Nasdaq Stock Market LLC may, in its discretion, require

our Ordinary Shares to maintain a bid price of at least $1.00 for a period in excess of ten consecutive business days, but generally

no more than 20 consecutive business days, before determining that we have demonstrated an ability to maintain long-term compliance.

In the event that we do not regain compliance after the initial 180-day period, we may then be eligible for an additional 180-day compliance

period if we meet the continued listing requirement for market value of publicly held shares and all other initial listing standards

for Nasdaq, with the exception of the minimum bid price requirement. In this case, we will need to provide written notice of our intention

to cure the deficiency during the second compliance period. In May 2023, we previously received a prior notice from Nasdaq notifying

us that we were not in compliance with the Minimum Bid Price Requirement which has since been cured.

We intend to monitor

the closing bid price of our Ordinary Shares and may, if appropriate, consider implementing available options to regain compliance with

the minimum bid price requirement, including initiating a reverse stock split. If we do not regain compliance within the allotted compliance

period(s), including any extensions that may be granted, The Nasdaq Stock Market LLC will provide notice that our Ordinary Shares will

be subject to delisting from the Nasdaq Stock Market LLC. At that time, we may appeal The Nasdaq Stock Market LLC’s determination

to a hearings panel.

Corporate Information

We are an Israeli corporation

based in Tel Aviv, Israel and were incorporated in Israel in 2021 under the name “Jeffs’ Brands Ltd” Our principal executive

offices are located at 7 Mezada Street, Bnei Brak, Israel 5126112. Our telephone number in Israel is +972-3-7713520. Our website address

is www.jeffsbrands.com. The information contained on, or that can be accessed through, our website is not part of this prospectus

or the registration statement of which it forms a part. We have included our website address in this prospectus solely as an inactive

textual reference.

Implications of Being an Emerging Growth Company

We are an “emerging growth

company,” as defined in Section 2(a) of the Securities Act of 1933, as amended, or the Securities Act, as modified

by the JOBS Act. As such, we are eligible to, and intend to, take advantage of certain exemptions from various reporting requirements

applicable to other public companies that are not “emerging growth companies” such as not being required to comply with the

auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act. We could

remain an “emerging growth company” for up to five years, or until the earliest of (a) the last day of the

first fiscal year in which our annual gross revenue exceeds $1.235 billion, (b) the date that we become a “large accelerated

filer” as defined in Rule 12b-2 under the U.S. Securities Exchange Act of 1934, as amended, or the Exchange Act,

which would occur if the market value of our Ordinary Shares that is held by non-affiliates exceeds $700 million as of the last business day

of our most recently completed second fiscal quarter, or (c) the date on which we have issued more than $1 billion in nonconvertible

debt during the preceding three-year period.

Implications of Being a Foreign Private Issuer

We are subject to the

information reporting requirements of the Exchange Act that are applicable to “foreign private issuers,” and under those

requirements we file reports with the SEC. As a foreign private issuer, we are not subject to the same requirements that are imposed

upon U.S. domestic issuers by the SEC. Under the Exchange Act, we are subject to reporting obligations that, in certain

respects, are less detailed and less frequent than those of U.S. domestic reporting companies. For example, we are not required

to issue quarterly reports, proxy statements that comply with the requirements applicable to U.S. domestic reporting companies,

or individual executive compensation information that is as detailed as that required of U.S. domestic reporting companies. We also

have four months after the end of each fiscal year to file our annual report with the SEC and are not required to file current reports

as frequently or promptly as U.S. domestic reporting companies. Our officers, directors and principal shareholders are exempt from

the requirements to report transactions in our equity securities and from the short-swing profit liability provisions contained in Section 16

of the Exchange Act. As a foreign private issuer, we are not subject to the requirements of Regulation FD (Fair Disclosure)

promulgated under the Exchange Act. In addition, as a foreign private issuer, we are permitted to follow certain home country corporate

governance practices instead of those otherwise required under Nasdaq rules for domestic U.S. issuers. See “Risk Factors — Risks

Related to Our Status as a Public Company and Ownership of our Ordinary Shares and Warrants” in our 2023 Annual Report. These exemptions

and leniencies will reduce the frequency and scope of information and protections available to you in comparison to those applicable

to a U.S. domestic reporting company. We intend to take advantage of the exemptions available to us as a foreign private issuer

during and after the period we qualify as an “emerging growth company.”

ABOUT THIS OFFERING

| Issuer |

|

Jeffs’ Brands Ltd |

| Ordinary

Shares currently issued and outstanding(1) |

|

8,555,842 Ordinary

Shares |

| Ordinary

Shares offered by us |

|

Up to 1,021,979 Ordinary

Shares issuable upon the exercise of: (i) Warrants to purchase up to 591,913 Ordinary Shares (including Warrants to purchase up to

60,845 Ordinary Shares issued pursuant to the partial exercise of the over-allotment option granted to the Underwriter in connection

with the IPO), (ii) Underwriter’s Warrants to purchase up to 26,554 Ordinary Shares, and (iii) Additional Warrants, to

purchase up to an aggregate amount of 403,512 Ordinary Shares. |

| Ordinary

Shares to be issued and outstanding assuming exercise of all of the Outstanding Warrants(1) |

|

9,577,821 Ordinary Shares(1) |

| Description

of the Warrants |

|

Each

Warrant had an initial exercise price of $28.28 per Ordinary Share (and an exercise price of $14.14 following the Exercise Price

Adjustment, as described below), was exercisable immediately upon issuance and will expire on August 25, 2022. Subject to certain

exemptions outlined in the Warrant, for a period until the later of: (i) two years from the date of issuance of the Warrant,

or (ii) on the date there are no Qualified Holders, if the Company shall sell, enter into an agreement to sell, or grant any

option to purchase, or sell, enter into an agreement to sell, or grant any right to reprice, or otherwise dispose of or issue (or

announce any offer, sale, grant or any option to purchase or other disposition) any Ordinary Shares or Convertible Security (as defined

in the Warrant), at an effective price per share less than the exercise price of the Warrant then in effect, the exercise price of

the Warrant shall be reduced to equal the effective price per share in such dilutive issuance; provided, however, that in no event

shall the exercise price of the Warrant be reduced to an exercise price lower than 50% of the exercise price of the Warrants on the

issuance date, or the Initial Exercise Price, or $14.14. On the date that is 90 calendar days immediately following the initial

issuance date of the Warrants, or the Issuance Date, the exercise price of the Warrants will adjust to be equal to the greater of

$14.14 per share (which shall equal 50% of the Initial Exercise Price, or $14.14) and 100% of the lowest volume weighted average

price of our Ordinary Shares occurring during the 90 calendar days following the Issuance Date, provided that such value shall

in no event be less than a floor price of 50% of the Initial Exercise Price, or $14.14. Additionally, in the event of any adjustment

under Section 3(e), Section 3(h), or Section 3(i) of the Warrant that results in a reduction of the exercise

price, in aggregate, to 50% of the Initial Exercise Price or an adjustment under Section 3(h) to the exercise price, then

in connection with such adjustment, each holder of at least 17,171 Warrants will receive one Additional Warrant for each Warrant

held by such holder on the date of adjustment. On September 7, 2022, the Company’s volume weighted average stock price

was less than the exercise floor of $28.28 for the Warrants. Accordingly, effective after the closing of trading on November 28,

2022 (the 90th calendar day immediately following the issuance date of the Warrants), the Warrants were adjusted

pursuant to their terms, including, but not limited to, to adjust the exercise price of the Warrants to $14.14 and the Additional

Warrants were issued to each Qualified Holder effective as of November 28, 2022. To better understand the terms of the Warrants,

you should carefully read the “Description of Share Capital — Warrants” section of this prospectus. |

| (1) |

The

number of Ordinary Shares to be outstanding immediately after this offering as shown above assumes that all of the Outstanding Warrants

are exercised, and is based on 8,555,842 Ordinary Shares issued and outstanding as of May 20, 2024. This number excludes: |

| ● | 186,718 Ordinary Shares reserved for

future issuance under our 2022 Incentive Option Plan, or our 2022 Incentive Plan; |

| ● | 8,586 Ordinary Shares issuable upon exercise

of warrants issued to certain investors upon the closing of the IPO with an exercise price

of $28.28 per Ordinary Share; and |

| ● | 2,653 Ordinary Shares issuable upon exercise

of warrants issued to an advisor upon the closing of the IPO with an exercise price of $14.14

per Ordinary Share. |

Unless otherwise indicated,

all information in this prospectus assumes or gives effect to:

| ● | the issuance of 6,630,547 (prior to adjustments for subsequent

reverse share splits) Ordinary Shares on February 17, 2022 in connection with the bonus shares declared by our Board of Directors

on February 17, 2022; |

| ● | a 0.806-for-1 reverse split of the issued

and outstanding Ordinary Shares effected on May 3, 2022; |

| ● | a 1-for-1.85 reverse split of the issued

and outstanding Ordinary Shares effected on June 16, 2022; and |

| |

● |

a 1 for 7 reverse split of the issued and outstanding Ordinary Shares

effected on November 3, 2023. |

| Description

of Additional Warrants |

|

The Additional Warrants have substantially

the same terms as the as-adjusted Warrant; provided, however, that the term of each Additional Warrant is five (5) years from

the issuance date, or November 28, 2027 and such Additional Warrants are not listed on any securities exchange. In addition, as long

as the Additional Warrants are outstanding, each Qualified Holder will receive semi-annual payments equal to approximately 2.3% of

our gross revenues, calculated for the first and second six-month fiscal periods, shared pro rata among such Qualified Holders. The

Additional Warrants may be redeemed by us at any time at a price equal to three times the as-adjusted exercise price, or $42.42.

In connection with the Exercise Price

Adjustment, effective as of November 28, 2022, we issued Additional Warrants to purchase up to 403,512 Ordinary Shares to Qualified

Holders. |

| Description

of the Underwriter’s Warrants |

|

We

issued to the Underwriter Underwriter’s Warrants to purchase up to 26,554 Ordinary Shares. The Underwriter’s Warrants

have an exercise price equal to $36.40, became exercisable beginning on February 21, 2022 and will expire on August 25,

2027. |

| Use

of proceeds |

|

We will receive

up to approximately $13.8 million in net proceeds if all Outstanding Warrants are exercised. |

| |

|

We have used the net proceeds from the

IPO and currently expect to use the net proceeds from the exercise of the Outstanding Warrants for the following purposes:

● approximately

$4.0 million to invest in innovative companies or a strategic partnership, the development of our own new brands, and improvement

of existing brands; and

● the

remainder for working capital and general corporate purposes, including potential acquisitions and collaborations and investments

in warehouse, logistics software and facilities to strengthen our supply chain process.

|

| |

|

The amounts and schedule of our actual expenditures

will depend on multiple factors. As a result, our management will have broad discretion in the application of the net proceeds of the

IPO and the exercise of the Outstanding Warrants. |

| Risk

factors |

|

Investing in our

securities involves a high degree of risk. You should read the “Risk Factors” section starting on page 5 of this prospectus,

and “Item 3. — Key Information — D. Risk Factors” in our 2023 Annual Report, incorporated by reference herein,

and other information included or incorporated by reference in this prospectus for a discussion of factors to consider carefully

before deciding to invest in the Ordinary Shares and Warrants. |

| Nasdaq symbols |

|

The Ordinary Shares and Warrants are listed on Nasdaq under the symbol “JFBR” and “JFBRW”, respectively. We do not intend to apply to list the Underwriter’s Warrants or Additional Warrants on any securities exchange or other nationally recognized trading system. |

RISK FACTORS

An investment in our

securities involves a high degree of risk. You should carefully consider the risks set forth under the caption “Item 3. Key Information

— D. Risk Factors” in our 2023 Annual Report, which are incorporated by reference in this prospectus, or any updates in our

Reports of Foreign Private Issuer on Form 6-K, or Reports on Form 6-K together with all of the other information appearing in this prospectus

or incorporated by reference into this prospectus before making an investment in our securities. Our business, financial condition or

results of operations could be materially and adversely affected if any of these risks occurs and, as a result, the market price of our

securities could decline and you could lose all or part of your investment. This prospectus also contains forward-looking statements

that involve risks and uncertainties. See “Cautionary Statement Regarding Forward-Looking Statements.” Our actual results

could differ materially and adversely from those anticipated in these forward-looking statements as a result of certain factors.

Our management will have immediate and broad

discretion as to the use of the net proceeds from the exercise of the Outstanding Warrants, if any, and may not use them effectively.

We currently intend to use

the net proceeds from the exercise of the Outstanding Warrants for research and development of new technologies and existing products,

marketing and sales efforts in new territories and working capital and general corporate purposes. See “Use of Proceeds.”

However, our management will have broad discretion in the application of any such net proceeds. Our shareholders may not agree with the

manner in which our management chooses to allocate the net proceeds from the exercise of the Outstanding Warrants. The failure by our

management to apply these funds effectively could have a material adverse effect on our business, financial condition and results of operation.

Pending their use, we may invest the net proceeds from the exercise of the Outstanding Warrants in a manner that does not produce income.

The decisions made by our management may not result in positive returns on your investment and you will not have an opportunity to evaluate

the economic, financial or other information upon which our management bases its decisions.

We have been notified

by The Nasdaq Stock Market LLC of our failure to comply with certain continued listing requirements and, if we are unable to regain compliance

with all applicable continued listing requirements and standards of Nasdaq, our Ordinary Shares could be delisted from Nasdaq.

On April 25, 2024, we

received a written notification from the Listing Qualifications Department of the Nasdaq Stock Market LLC notifying us that we were not

in compliance with the Minimum Bid Price Requirement, because the closing bid price of our Ordinary Shares was below $1.00 per Ordinary

Share for the previous 30 consecutive business days. We were granted 180 calendar days, or until October 22, 2024, to regain compliance

with the Minimum Bid Price Requirement. We can regain compliance if, at any time during this 180-day period, the closing bid price of

our Ordinary Shares is at least $1.00 for a minimum of ten consecutive business days, in which case we will be provided with written

confirmation of compliance and this matter will be closed. However, the Nasdaq Stock Market LLC may, in its discretion, require our Ordinary

Shares to maintain a bid price of at least $1.00 for a period in excess of ten consecutive business days, but generally no more than

20 consecutive business days, before determining that we have demonstrated an ability to maintain long-term compliance. In the event

that we do not regain compliance after the initial 180-day period, we may then be eligible for an additional 180-day compliance period

if we meet the continued listing requirement for market value of publicly held shares and all other initial listing standards for Nasdaq,

with the exception of the minimum bid price requirement. In this case, we will need to provide written notice of our intention to cure

the deficiency during the second compliance period. In May 2023, we previously received a prior notice from Nasdaq notifying us that

we were not in compliance with the Minimum Bid Price Requirement which has since been cured.

We intend to monitor the closing

bid price of our Ordinary Shares and may, if appropriate, consider implementing available options to regain compliance with the minimum

bid price requirement, including initiating a reverse stock split. If we do not regain compliance within the allotted compliance period(s),

including any extensions that may be granted, The Nasdaq Stock Market LLC will provide notice that our Ordinary Shares will be subject

to delisting from Nasdaq. At that time, we may appeal The Nasdaq Stock Market LLC’s determination to a hearings panel.

There can be no assurances

that we will be able to regain compliance with the Minimum Bid Price Requirement or if we do later regain compliance with the Minimum

Bid Price Requirement, that we will be able to continue to comply with all applicable Nasdaq listing requirements now or in the future.

If we are unable to maintain compliance with these Nasdaq requirements, our Ordinary Shares will be delisted from Nasdaq.

In the event that our Ordinary

Shares are delisted from Nasdaq, as a result of our failure to comply with the Minimum Bid Price Requirement, or due to our failure to

continue to comply with any other requirement for continued listing on Nasdaq, and are not eligible for listing on another exchange, trading

in our Ordinary Shares could be conducted in the over-the-counter market or on an electronic bulletin board established for unlisted securities

such as the Pink Sheets or the OTC Bulletin Board. In such event, it could become more difficult to dispose of, or obtain accurate price

quotations for, our Ordinary Shares, and it would likely be more difficult to obtain coverage by securities analysts and the news media,

which could cause the price of our Ordinary Shares to decline further. Also, it may be difficult for us to raise additional capital if

we are not listed on a national exchange.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements

made under “Prospectus Summary,” “Risk Factors,” “Use of Proceeds,” “Management’s Discussion

and Analysis of Financial Condition and Results of Operations,” “Business” and elsewhere in this prospectus, including

in our 2023 Annual Report incorporated by reference herein, and other information included or incorporated by reference in this prospectus,

constitute forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may,”

“will,” “should,” “expects,” “plans,” “anticipates,” “believes,”

“estimates,” “predicts,” “potential” “intends” or “continue,” or the negative

of these terms or other comparable terminology.

These forward-looking statements

may include, but are not limited to, statements relating to our objectives, plans and strategies, statements that contain projections

of results of operations or of financial condition, expected capital needs and expenses, statements relating to the research, development,

completion and use of our products, and all statements (other than statements of historical facts) that address activities, events or

developments that we intend, expect, project, believe or anticipate will or may occur in the future.

Forward-looking statements

are not guarantees of future performance and are subject to risks and uncertainties. We have based these forward-looking statements on

assumptions and assessments made by our management in light of their experience and their perception of historical trends, current conditions,

expected future developments and other factors they believe to be appropriate

Important factors that could

cause actual results, developments and business decisions to differ materially from those anticipated in these forward-looking statements

include, among other things:

| |

● |

our ability to raise capital through the issuance of additional securities; |

| |

|

|

| |

● |

our belief that our existing cash and cash equivalents as of December 31, 2023, will be sufficient

to fund our operations through the next twelve months; |

| |

|

| |

● |

our ability to adapt to significant future alterations in Amazon’s policies; |

| |

|

|

| |

● |

our ability to sell our existing products and grow our brands and product offerings, including by acquiring new brands and expanding into new territories; |

| |

|

|

| |

● |

our ability to meet our expectations regarding the revenue growth and the demand for e-commerce; |

| |

|

|

| |

● |

our ability to enter into definitive agreements for our current letters of intent and term sheet; |

| |

|

|

| |

● |

the overall global economic environment; |

| |

|

|

| |

● |

the impact of competition and new e-commerce technologies; |

| |

|

|

| |

● |

general market, political and economic conditions in the countries in which we operate; |

| |

|

|

| |

● |

projected capital expenditures and liquidity; |

| |

● |

our ability to retain key executive members; |

| |

|

|

| |

● |

the impact of possible changes in Amazon’s policies and terms of use; |

| |

|

|

| |

● |

projected capital expenditures and liquidity; |

| |

|

|

| |

● |

our expectations regarding our tax classifications; |

| |

|

|

| |

● |

how long we will qualify as an emerging growth company or a foreign private issuer; |

| |

|

|

| |

● |

interpretations of current laws and the passages of future laws; |

| |

|

|

| |

● |

general market, political and economic conditions

in the countries in which we operate, including those related to recent unrest and actual or potential armed conflict in Israel and

other parts of the Middle East, such as the recent attacks by Iran, Hamas, Hezbollah and other terrorist organizations from

the Gaza Strip and elsewhere in the region and Israel’s war against them; |

| |

|

|

| |

● |

changes in our strategy; |

| |

|

|

| |

● |

litigation; and |

| |

|

|

| |

● |

those factors referred to in “Item 3. Key Information —

D. Risk Factors,” “Item 4. Information on the Company,” and “Item 5. Operating and Financial Review and Prospects,”

of our 2023 Annual Report as well other factors in the 2023 Annual Report. |

These statements are only current

predictions and are subject to known and unknown risks, uncertainties, and other factors that may cause our or our industry’s actual

results, levels of activity, performance or achievements to be materially different from those anticipated by the forward-looking statements.

We discuss many of these risks in this prospectus in greater detail under the heading “Risk Factors” and elsewhere in this

prospectus and the documents incorporated herein by reference. You should not rely upon forward-looking statements as predictions of future

events.

Although we believe that the

expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance,

or achievements. Except as required by law, we are under no duty to update or revise any of the forward-looking statements, whether as

a result of new information, future events or otherwise, after the date of this prospectus.

USE OF PROCEEDS

We will receive up to

approximately $13.8 million in net proceeds if all Outstanding Warrants are exercised for cash.

We have used the net

proceeds from the IPO and we currently expect to use the net proceeds from the exercise of the Outstanding Warrants for the following

purposes:

| |

● |

approximately $4.0 million to invest in innovative

companies or a strategic partnership, the development of our own new brands, and improvement of existing brands; |

| ● | approximately

$2.15 million for the repayment of certain outstanding indebtedness; and |

| ● | the remainder for working capital and general corporate purposes,

including potential acquisitions and collaborations and investments in warehouse, logistics software and facilities to strengthen our

supply chain process. |

Changing circumstances may

cause us to consume capital significantly faster than we currently anticipate. The amounts and timing of our actual expenditures will

depend upon numerous factors, including the progress of our global marketing and sales efforts, the development efforts and the overall

economic environment. Therefore, our management will retain broad discretion over the use of the proceeds from this offering. We may ultimately

use the proceeds for different purposes than what we currently intend. Pending any ultimate use of any portion of the proceeds from this

offering, if the anticipated proceeds will not be sufficient to fund all the proposed purposes, our management will determine the order

of priority for using the proceeds, as well as the amount and sources of other funds needed.

Pending our use of the net

proceeds from the IPO and the exercise of the Outstanding Warrants, we may invest the net proceeds in a variety of capital preservation

investments, including short-term, investment grade, interest bearing instruments and U.S. government securities.

CAPITALIZATION

The following table sets

forth our cash and cash equivalents and capitalization as of December 31, 2023:

| |

● |

on an actual basis; |

| |

|

|

| |

● |

on a pro forma basis to give effect to the issuance of (A) (i)

1,884,461 Ordinary Shares; (ii) pre-funded warrants to purchase up to an 820,000 Ordinary Shares; (iii) Series A Warrants to purchase

up to an aggregate of 3,380,586 Ordinary, or upon the satisfaction of certain conditions, up to an aggregate of 13,373,208 Ordinary Shares

in accordance with the terms therein; and (iv) Series B Warrants to purchase upon the satisfaction of, certain conditions up to an aggregate

of 7,994,068 Ordinary Shares for aggregate net proceeds of $6.3 million, or the January 2024 PIPE; and (B) the issuance of 22,187,276

Ordinary Shares upon the exercise of certain outstanding pre-funded warrants, Series A Warrants and Series B Warrants for aggregate net

proceeds of $8.9 million; and |

| |

|

|

| |

● |

on a pro forma as adjusted basis to give additional effect to the issuance of up to 1,021,979

Ordinary Shares upon the exercise of the Outstanding Warrants, for aggregate net proceeds of $13.8 million |

You should read this

table in conjunction with the section titled “Management’s Discussion and Analysis of Financial Condition and Results of

Operations” and our financial statements and related notes included in our 2023 Annual Report incorporated by reference in this

prospectus.

| |

|

As of December 31, 2023 |

|

| U.S. dollars in thousands |

|

Actual |

|

|

Pro Forma |

|

|

Pro Forma

As Adjusted* |

|

| Cash and cash

equivalents(1) (3) |

|

$ |

535 |

|

|

$ |

15,756 |

|

|

$ |

29,556 |

|

| Other assets |

|

$ |

11,704 |

|

|

$ |

11,704 |

|

|

$ |

11,704 |

|

| Other liabilities |

|

|

2,353 |

|

|

|

2,353 |

|

|

|

2,353 |

|

| Short-term loans |

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Loans from shareholders |

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Warrant liabilities(2) |

|

|

1,375 |

|

|

|

1,375 |

|

|

|

- |

|

| Shareholders’ equity: |

|

|

|

|

|

|

|

|

|

|

|

|

| Share capital and premium(1) (3) |

|

|

16,787 |

|

|

|

32,008 |

|

|

|

47,183 |

|

| Accumulated deficit |

|

|

(8,276 |

) |

|

|

(8,276 |

) |

|

|

(8,276 |

) |

| Total shareholders’ equity |

|

|

8,511 |

|

|

|

23,732 |

|

|

|

38,907 |

|

| Total capitalization** |

|

$ |

12,239 |

|

|

$ |

27,460 |

|

|

$ |

41,260 |

|

| ** | Total capitalization is the sum of long-term

debt, equity and warrant liabilities. |

| (1) |

The

increase in share capital and premium in the pro forma column reflects the receipt of approximately $15.2 million in aggregate net

proceeds from the January 2024 PIPE, which includes $6.3 million in net proceeds received at the closing of the January 2024 PIPE

and an additional $8.9 million in net proceeds received following the closing upon the exercise of the outstanding warrants

issued in the January 2024 PIPE offering. |

| (2) |

The

decrease in warrant liabilities in the pro forma as adjusted columns reflects the reduction in warrant liabilities following the

exercise of the Additional Warrants. The warrant liability includes the value of the semi-annual payments equal to approximately

2.3% of the Company’s gross revenues to the Additional Warrant holders as long as the Additional Warrants are outstanding (i.e.

5 years from the issuance date of the Additional Warrants). See “Description of Share Capital — Warrants” for more

information. |

| (3) |

The

increase in share capital and premium in the pro forma as adjusted column reflects the receipt of approximately $13.8 million in

net proceeds from this offering assuming the exercise of the Outstanding Warrants related to this offering. |

The table above is based on 1,215,512

Ordinary Shares issued and outstanding as of December 31, 2023. This number excludes:

| |

● |

186,718 Ordinary Shares reserved for future issuance

under our 2022 Incentive Plan; |

| |

● |

8,586 Ordinary Shares issuable upon exercise of

warrants issued to certain investors upon the closing of the IPO with an exercise price of $28.28 per Ordinary Share; and |

| |

● |

2,653 Ordinary Shares issuable upon exercise of

warrants issued to an advisor upon the closing of the IPO with an exercise price of $14.14 per Ordinary Share. |

DILUTION

If you invest in our

securities in this offering, your interest will be diluted immediately to the extent of the difference between the price per Ordinary

Share you will pay upon exercise of the Outstanding Warrants and the pro forma as adjusted net tangible book value per Ordinary Share

after exercise of all the Outstanding Warrants.

Our net tangible book

value as of December 31, 2023 was approximately $2,797,000, representing approximately $2.30 per Ordinary Share. Net tangible book value

per Ordinary Share represents the amount of our total tangible assets less our total liabilities, divided by 1,215,512, the total number

of Ordinary Shares issued and outstanding at December 31, 2023.

After giving effect to

(i) the January 2024 PIPE and (ii) the issuance of 8,555,842 Ordinary Shares upon the exercise of certain pre-funded warrants, Series

A Warrants and Series B Warrants following the closing of the January 2024 PIPE, our pro forma net tangible book value as of December

31, 2023 would have been approximately $15,221,000, representing $0.72 per Ordinary Share.

After giving effect to

the issuance of 1,021,979 Ordinary Shares issued upon the exercise of the Outstanding Warrants for cash in this offering, our pro forma

as adjusted net tangible book value as of December 31, 2023 would have been approximately $33,192,531, representing $1.27 per Ordinary

Share. This represents an immediate increase in pro forma net tangible book value of $0.55 per Ordinary Share to existing shareholders

and an immediate dilution in pro forma net tangible book value of $0.05 per Ordinary Share to the Warrant holders.

You should read this

table in conjunction with the section titled “Management’s Discussion and Analysis of Financial Condition and Results of

Operations” and our financial statements and related notes included in our 2023 Annual Report incorporated by reference in this

prospectus.

The following table illustrates

this dilution on a per Ordinary Share basis to investors in this offering:

| Exercise price per Warrant | |

| | | |

$ | 14.14 | |

| Exercise price per Underwriter’s Warrant | |

| | | |

$ | 36.40 | |

| Historical net tangible book value (deficit) per Ordinary share as of

December 31, 2023 | |

$ | 2.30 | | |

| | |

| Decrease in net tangible book value per Ordinary

Share as of December 31, 2023 | |

$ | (1.59 | ) | |

| | |

| Pro forma net tangible book value per Ordinary Share as of December 31,

2023 | |

$ | 0.72 | | |

| | |

| Increase in pro forma net tangible

book value per Ordinary Share attributable to Warrant holders | |

$ | 0.55 | | |

| | |

| Pro forma as adjusted net tangible book value per Ordinary

Share after this offering | |

| | | |

$ | 1.27 | |

| Dilution per Ordinary Share to Warrant holders | |

| | | |

$ | 12.87 | |

The information above

assumes that all of the Outstanding Warrants are exercised and is based on 1,215,512 Ordinary Shares issued and outstanding as of December

31, 2023. This number excludes:

| |

● |

186,718 Ordinary Shares reserved for future issuance under our 2022

Incentive Plan; |

| |

● |

8,586 Ordinary Shares issuable upon exercise of warrants issued to certain

investors upon the closing of the IPO with an exercise price of $28.28 per Ordinary Share; and |

| |

● |

2,653 Ordinary Shares issuable upon exercise of warrants issued to an

advisor upon the closing of the IPO with an exercise price of $14.14 per Ordinary Share. |

The foregoing discussion

and table do not take into account further dilution that could occur upon the exercise of options having a per share exercise or conversion

price less than the per Ordinary Share initial public offering price in this offering.

To the extent that outstanding

options or warrants are exercised, or we issue additional Ordinary Shares under our 2022 Incentive Plan, you may experience further dilution.

In addition, we may choose to raise additional capital due to market conditions or strategic considerations even if we believe that we

have sufficient funds for our current and future operating plans. To the extent that additional capital is raised through the sale of

equity or convertible debt securities, the issuance of those securities could result in further dilution to the holders of our Ordinary

Shares.

DESCRIPTION OF SHARE CAPITAL

The following description of

our share capital and provisions of our amended and restated articles of association, or Articles of Association, are summaries and do

not purport to be complete and is qualified in its entirety by reference to our Articles of Association, Israeli law and any other documents

referenced.

ORDINARY SHARES

As of May 20, 2024, our

authorized share capital consisted of 43,567,567 Ordinary Shares. All of our outstanding Ordinary Shares have been validly issued,

fully paid and non-assessable. Our Ordinary Shares are not redeemable and are not subject to any preemptive right.

Our Ordinary Shares are

listed on the Nasdaq Capital Market, or Nasdaq, under the symbol “JFBR”.

Articles of Association

Purposes and Objects of the Company

Our purpose as stated in our

Articles of Association includes every lawful purpose.

The Powers of the Directors

Our board of directors shall

direct our policy and shall supervise the performance of our Chief Executive Officer and his actions. Our board of directors may exercise

all powers that are not required under the Israeli Companies Law – 1999, or the Companies Law, or under our Articles of Association

to be exercised or taken by our shareholders.

Rights Attached to Shares

Our Ordinary Shares shall confer

upon the holders thereof:

| ● | equal right to attend and to vote at all of our general meetings,

whether regular or special, with each Ordinary Share entitling the holder thereof, which attend the meeting and participate at the voting,

either in person or by a proxy or by a written ballot, to one vote; |

| ● | equal right to participate in distribution of dividends, if

any, whether payable in cash or in bonus shares, in distribution of assets or in any other distribution, on a per share pro rata basis;

and |

| ● | equal right to participate, upon our dissolution, in the distribution

of our assets legally available for distribution, on a per share pro rata basis. |

Transfer of Shares

Our fully paid Ordinary Shares

are issued in registered form and may be freely transferred under our Articles of Association, unless the transfer is restricted or prohibited

by another instrument, applicable law or the rules of the Nasdaq. The ownership or voting of Ordinary Shares by non-residents of Israel

is not restricted in any way by our Articles of Association, or the laws of the State of Israel, except for ownership by nationals of

some countries that are, have been, or will be, in a state of war with Israel.

Election of Directors

Under our Articles of

Association, our board of directors must consist of not less than three but no more than twelve directors. Each of our directors, other

than the external directors, for whom special election requirements apply under the Companies Law, are appointed by a simple majority

vote of holders of Ordinary Shares, participating and voting at an annual general meeting of our shareholders. Our directors are classified,

with respect to the term for which they each severally hold office, into three classes, as nearly equal in number as practicable, and

designated as Class I, Class II and Class III, with one class being elected each year at the annual general meeting of our shareholders,

and serve on our board of directors until the third annual general meeting following such election or re-election or until they are removed

by a vote of 70% of the total voting power of our shareholders at a general meeting of our shareholders or upon the occurrence of certain

events in accordance with the Companies Law and our Articles of Association. The initial Class I directors will hold office until the

first annual general meeting to be held in 2023 and until their successors have been elected and qualified. The initial Class II directors

will hold office until the annual general meeting to be held in 2024 and until their successors have been elected and qualified. The

initial Class III directors will hold office until the annual general meeting to be held in 2025 and until their successors have been

elected and qualified. The board of directors may assign members of the Board already in office to such classes at the time such classification

becomes effective. If the number of directors is changed, any newly created directors or decrease in directors must be apportioned by

the board among the classes to make them equal in number. In addition, our Articles of Association allow our board of directors to appoint

directors to fill vacancies and/or as an addition to the board of directors (subject to the maximum number of directors). A director

so appointed will hold office until the next annual general meeting of our shareholders for the election of the class of directors in

respect of which the vacancy was created, or in the case of a vacancy due to the number of directors being less than the maximum number

of directors, until the next annual general meeting of our shareholders for the election of the class of directors to which such director

was assigned by our board of directors. External directors are elected for an initial term of three years, may be elected for additional

terms of three years each under certain circumstances, and may be removed from office pursuant to the terms of the Companies Law. See

“Item 6.C. Board Practices — External Directors” in our 2023 Annual Report.

Dividend and Liquidation Rights

We may declare a dividend

to be paid to the holders of Ordinary Shares in proportion to their respective shareholdings. Under the Companies Law, dividend distributions

are determined by the board of directors and do not require the approval of the shareholders of a company unless the company’s articles

of association provide otherwise. Our Articles of Association do not require shareholder approval of a dividend distribution and provide

that dividend distributions may be determined by our board of directors.

Pursuant to the Companies

Law, the distribution amount is limited to the greater of retained earnings or earnings generated over the previous two years, according

to the Company’s most recently reviewed or audited financial statements (less the amount of previously distributed dividends, if

not reduced from the earnings), provided that the end of the period to which the financial statements relate is not more than six months

prior to the date of the distribution. If we do not meet such criteria, then we may distribute dividends only with court approval. In

each case, we are only permitted to distribute a dividend if our board of directors and, if applicable, the court determines that there

is no reasonable concern that payment of the dividend will prevent us from satisfying our existing and foreseeable obligations as they

become due.

In the event of the Company’s

liquidation, after satisfaction of liabilities to creditors, its assets will be distributed to the holders of Ordinary Shares in proportion

to their shareholdings. This right, as well as the right to receive dividends, may be affected by the grant of preferential dividend or

distribution rights to the holders of a class of shares with preferential rights which may be authorized in the future.

Exchange control

There are currently no Israeli

currency control restrictions on remittances of dividends on Ordinary Shares, proceeds from the sale of the Ordinary Shares or interest

or other payments to non-residents of Israel, except for shareholders who are subjects of countries that at the time are, or have been,

in a state of war with Israel.

Annual and Special Meetings

Under the Israeli law, we are

required to hold an annual general meeting of our shareholders once every calendar year, at such time and place which shall be determined

by our board of directors, that must be no later than 15 months after the date of the previous annual general meeting. All meetings

other than the annual general meeting of shareholders are referred to as special general meetings. Our board of directors may call special

meetings whenever it sees fit, at such time and place, within or outside of Israel, as it may determine. In addition, the Companies Law

provides that our board of directors is required to convene a special general meeting of our shareholders upon the written request of:

(a) any two of our directors or such number of directors equal to one quarter of the directors then at office; and/or (b) one

or more shareholders holding, in the aggregate, (i) 5% or more of our outstanding issued shares and 1% of our outstanding voting

power or (ii) 5% or more of our outstanding voting power.

Under the Companies Law, one

or more shareholders holding at least 1% of the voting rights at the general meeting of shareholders may request that the board of directors

include a matter in the agenda of a general meeting of shareholders to be convened in the future, provided that it is appropriate to discuss

such a matter at the general meeting. Our Articles of Association contain procedural guidelines and disclosure items with respect to the

submission of shareholder proposals for general meetings. Subject to the provisions of the Companies Law and the regulations promulgated

thereunder, shareholders entitled to participate and vote at general meetings are the shareholders of record on a date to be decided by

the board of directors, which, as a company listed on an exchange outside Israel, may be between four and forty days prior to the

date of the meeting. Resolutions regarding the following matters must be passed at a general meeting of our shareholders:

| ● | amendments to our Articles of Association; |

| ● | the exercise of our board of director’s powers by a

general meeting if our board of directors is unable to exercise its powers and the exercise of any of its powers is required for our

proper management; |

| ● | appointment or termination of our auditors; |

| ● | appointment of directors, including external directors; |

| ● | approval of acts and transactions requiring general meeting

approval pursuant to the provisions of the Companies Law (mainly certain related party transactions and certain compensation matters)

and any other applicable law; |

| ● | increases or reductions of our authorized share capital; and |

| ● | a merger (as such term is defined in the Companies Law). |

Notices

The Companies Law and our Articles

of Association require that a notice of any annual or special shareholders meeting be provided at least 14 or 21 days prior to the

meeting (as applicable), and if the agenda of the meeting includes, among other things, the appointment or removal of directors, the approval

of transactions with office holders or interested or related parties, approval of the company’s chief executive officer to serve

as the chairman of the board of directors or an approval of a merger, notice must be provided at least 35 days prior to the meeting.

Quorum

As permitted under the Companies

Law, the quorum required for our general meetings consists of at least two shareholders present in person, by proxy, written ballot or

voting by means of electronic voting system, who hold or represent between them at least 25% of the total outstanding voting power. If

within half an hour of the time set forth for the general meeting a quorum is not present, the general meeting shall stand adjourned the

same day of the following week, at the same hour and in the same place, or to such other date, time and place as prescribed in the

notice to the shareholders and in such adjourned meeting, if no quorum is present within half an hour of the time arranged, any number

of shareholders participating in the meeting, shall constitute a quorum.

If a special general meeting

was summoned following the request of a shareholder, and within half an hour a legal quorum shall not have been formed, the meeting shall

be cancelled.

Adoption of Resolutions

Our Articles of Association

provide that all resolutions of our shareholders require a simple majority vote, unless otherwise required under the Companies Law or

our Articles of Association. A shareholder may vote in a general meeting in person, by proxy or by a written ballot.

Changing Rights Attached to Shares

Unless otherwise provided by

the terms of the shares and subject to any applicable law, any modification of rights attached to any class of shares must be adopted

by the holders of a majority of the shares of that class present a general meeting of the affected class or by a written consent of all

the shareholders of the affected class.

The enlargement of an existing

class of shares or the issuance of additional shares thereof, shall not be deemed to modify the rights attached to the previously issued

shares of such class or of any other class, unless otherwise provided by the terms of the shares.

Limitations on the Right to Own Securities

in Our Company

There are no limitations on

the right to own our securities in our Articles of Association. In certain circumstances the Warrants have restrictions upon the exercise

of such warrants if such exercise would result in the holders thereof owning more than 4.99% or 9.99% of our Ordinary Shares upon such

exercise, as further described below.

Access to Corporate Records

Under the Companies Law, all

shareholders generally have the right to review minutes of our general meetings, our shareholder register (including with respect to material

shareholders), our Articles of Association, our financial statements, other documents as provided in the Companies Law, and any document

we are required by law to file publicly with the Israeli Registrar of Companies or the Israeli Securities Authority. Any shareholder who

specifies the purpose of its request may request to review any document in our possession that relates to any action or transaction with

a related party which requires shareholder approval under the Companies Law. We may deny a request to review a document if it determines

that the request was not made in good faith, that the document contains a commercial secret or a patent or that the document’s disclosure

may otherwise impair its interests.

Anti-Takeover Provisions

Acquisitions under Israeli Law

Full Tender Offer

A person wishing to acquire

shares of a public Israeli company who would, as a result, hold over 90% of the target company’s voting rights or the target company’s

issued and outstanding share capital (or of a class thereof), is required by the Companies Law to make a tender offer to all of the company’s

shareholders for the purchase of all of the issued and outstanding shares of the company (or the applicable class). If (a) the shareholders

who do not accept the offer hold less than 5% of the issued and outstanding share capital of the company (or the applicable class) and

the shareholders who accept the offer constitute a majority of the offerees that do not have a personal interest in the acceptance of

the tender offer or (b) the shareholders who did not accept the tender offer hold less than 2% of the issued and outstanding share capital

of the company (or of the applicable class), all of the shares that the acquirer offered to purchase will be transferred to the acquirer

by operation of law. A shareholder who had its shares so transferred may petition an Israeli court within six months from the date of

acceptance of the full tender offer, regardless of whether such shareholder agreed to the offer, to determine whether the tender offer

was for less than fair value and whether the fair value should be paid as determined by the court. However, an offeror may provide in

the offer that a shareholder who accepted the offer will not be entitled to petition the court for appraisal rights as described in the

preceding sentence, as long as the offeror and the company disclosed the information required by law in connection with the full tender

offer. If the full tender offer was not accepted in accordance with any of the above alternatives, the acquirer may not acquire shares

of the company that will increase its holdings to more than 90% of the company’s voting rights or the company’s issued and

outstanding share capital (or of the applicable class) from shareholders who accepted the tender offer. Shares purchased in contradiction

to the full tender offer rules under the Companies Law will have no rights and will become dormant shares.

Special Tender Offer

The Companies Law provides