As filed with the Securities and Exchange Commission on May 29, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

____________________________

FORM S-8

REGISTRATION STATEMENT UNDER THE

SECURITIES ACT OF 1933

____________________________

The Joint Corp.

(Exact name of registrant as specified in its charter)

____________________________

|

Delaware

(State or other jurisdiction of

incorporation or organization) |

90-0544160

(I.R.S. Employer

Identification No.) |

| |

|

|

16767 N. Perimeter Drive, Suite 110

Scottsdale, Arizona

(Address of Principal Executive Offices) |

85260

(Zip Code) |

The Joint Corp. 2024 Incentive Stock Plan

(Full title of the plan)

Peter D. Holt

President and Chief Executive Officer

16767 N. Perimeter Drive, Suite 110

Scottsdale, Arizona 85260

(480) 245-5960

(Name and address of agent for service and telephone number, including area

code, of agent for service)

Copies to:

Frank M. Placenti, Esq.

Katherine A. Beck, Esq.

Greenberg Traurig, LLP

2375 E. Camelback Road, Suite 800

Phoenix, AZ 85016

(602) 445-8000

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer,

a non-accelerated filer, a smaller reporting company or an emerging growth company.

| Large accelerated filer |

☐ |

Accelerated filer |

☑ |

| |

|

|

|

| Non-accelerated filer |

☐ |

Smaller reporting company |

☑ |

| |

|

|

|

| |

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 7(a)(2)(B) of the Securities Act. ☐

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

| Item 1. |

Plan Information. |

The documents containing the information specified

in this Item 1 will be sent or given to participants as specified by Rule 428(b)(1) under the Securities Act of 1933, as amended (the

“Securities Act”). In accordance with the rules and regulations of the Securities and Exchange Commission (the “Commission”)

and the instructions to Form S-8, such documents are not being filed with the Commission either as part of this Registration Statement

or as prospectuses or prospectus supplements pursuant to Rule 424 under the Securities Act.

| Item 2. |

Registrant Information and Employee Plan Annual Information. |

The documents containing the information specified

in this Item 2 will be sent or given to participants as specified by Rule 428(b)(1) under the Securities Act. In accordance with the rules

and regulations of the Commission and the instructions to Form S-8, such documents are not being filed with the Commission either as part

of this Registration Statement or as prospectuses or prospectus supplements pursuant to Rule 424 under the Securities Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

| Item 3. |

Incorporation of Documents by Reference. |

The Joint Corp. (the “Registrant”) hereby

incorporates by reference into this Registration Statement the following documents previously filed by the Registrant with the Commission:

| (a) | Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the Commission on March

8, 2024; |

| (b) | Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, filed with the Commission on May 3,

2024; |

| | (c) | Current Report on Form 8-K filed with the Commission on May 24, 2024; |

| (d) | Definitive Proxy Statement on Schedule 14A, filed with the Commission on April 19, 2024, and Definitive

Additional Materials on Schedule 14A filed with the Commission on May 13, 2024; and |

| (e) | The description of the Registrant’s common stock contained in Exhibit 4.1 to the Registrant’s

Annual Report on Form 10-K for the fiscal year ended December 31, 2019, filed with the Commission on March 6, 2020, including any amendments

or reports filed for the purpose of updating such description. |

In addition, all reports and other documents subsequently

filed by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), (excluding any portion of those documents that has been “furnished” to the Commission but not “filed”

for purposes of the Exchange Act) after the date of this Registration Statement, but prior to the filing of a post-effective amendment

which indicates that all securities offered hereby have been sold or which deregisters all securities then remaining unsold, shall be

deemed to be incorporated by reference herein and to be a part hereof from the date of filing of such documents.

Any statement contained in a document incorporated

or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement

to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated

by reference herein modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified

or superseded, to constitute a part of this Registration Statement.

| Item 4. |

Description of Securities. |

Not applicable.

| Item 5. |

Interests of Named Experts and Counsel. |

Not applicable.

| Item 6. |

Indemnification of Directors and Officers. |

The Registrant is incorporated under the laws of the

state of Delaware. Reference is made to Section 102(b)(7) of the Delaware General Corporation Law (“DGCL”), which enables

a corporation in its original certificate of incorporation or an amendment thereto to eliminate or limit the personal liability of a director

for violations of the director’s fiduciary duty, except (1) for any breach of the director’s duty of loyalty to the corporation

or its stockholders, (2) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of

law, (3) pursuant to Section 174 of the DGCL, which provides for liability of directors for unlawful payments of dividends of

unlawful stock purchase or redemptions or (4) for any transaction from which a director derived an improper personal benefit.

Reference is also made to Section 145 of the DGCL,

which provides that a corporation may indemnify any person, including an officer or director, who is, or is threatened to be made, party

to any threatened, pending or completed legal action, suit or proceeding, whether civil, criminal, administrative or investigative, other

than an action by or in the right of such corporation, by reason of the fact that such person was an officer, director, employee or agent

of such corporation or is or was serving at the request of such corporation as a director, officer, employee or agent of another corporation

or enterprise. The indemnity may include expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually

and reasonably incurred by such person in connection with such action, suit or proceeding, provided such officer, director, employee or

agent acted in good faith and in a manner he reasonably believed to be in, or not opposed to, the corporation’s best interest and,

for criminal proceedings, had no reasonable cause to believe that his conduct was unlawful. A Delaware corporation may indemnify any officer

or director in an action by or in the right of the corporation under the same conditions, except that no indemnification is permitted

without judicial approval if the officer or director is adjudged to be liable to the corporation. Where an officer or director is successful

on the merits or otherwise in the defense of any action referred to above, the corporation must indemnify him against the expenses that

such officer or director actually and reasonably incurred.

The Registrant’s amended and restated certificate

of incorporation (as amended, its “Certificate of Incorporation”) eliminates the personal liability of its directors to the

fullest extent permitted by law. If a director were to breach his or her fiduciary duty of care, neither the Registrant nor its stockholders

could recover monetary damages from the director, and the only course of action available to the stockholders would be equitable remedies,

such as an action to enjoin or rescind the transaction or event involving the breach of the fiduciary duty of care. To the extent that

claims against directors are thereby limited to equitable remedies, this provision of Registrant’s Certificate of Incorporation

may reduce the likelihood of derivative litigation against its directors for the breach of their fiduciary duty of care. In addition,

equitable remedies may not be effective in many situations. If a stockholder’s only remedy is to enjoin the completion of the action

in question by the board of directors, this remedy would be ineffective if the stockholder does not become aware of the transaction or

event until after it has been completed. In this situation, the stockholder would not have an effective remedy against the directors.

The Registrant’s Certificate of Incorporation

and fourth amended and restated bylaws (as amended, its “Bylaws”) provide that the Registrant will indemnify its directors

and officers to the fullest extent permitted by law. The Registrant’s bylaws also require the Registrant to advance the litigation

expenses of a director or officer upon receipt of his or her written undertaking to repay all amounts advanced if it is ultimately determined

that he or she is not entitled to indemnification.

In addition, the Registrant’s Bylaws permit the

Registrant to secure insurance on behalf of any officer or director for any liability arising out of his or her actions, and Registrant

has acquired directors’ and officers’ liability insurance. By reason of this insurance, the Registrant’s directors and

officers are insured against actual liabilities, including liabilities under the federal securities laws, for acts or omissions related

to the conduct of their duties.

The Registrant has entered into agreements to indemnify

its directors and executive officers, in addition to the indemnification provided for in its Certificate of Incorporation and Bylaws.

These agreements, among other things, provide for indemnification of the Registrant’s directors and officers for expenses, judgments,

fines, penalties and settlement amounts incurred by any such person in any action or proceeding arising out of such person’s services

as a director or officer or at the Registrant’s request.

| Item 7. |

Exemption from Registration Claimed. |

Not applicable.

The following exhibits are incorporated by reference herein.

EXHIBIT INDEX

| A. | The undersigned Registrant hereby undertakes: |

(1) To file, during any period in which offers or sales

are being made, a post-effective amendment to this Registration Statement:

(i) To include any prospectus required by

Section 10(a)(3) of the Securities Act;

(ii) To reflect in the prospectus any facts

or events arising after the effective date of this Registration Statement (or the most recent post-effective amendment thereof) which,

individually or in the aggregate, represent a fundamental change in the information set forth in this Registration Statement. Notwithstanding

the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed

that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the

form of prospectus filed with the Commission pursuant to Rule 424(b) (§ 230.424(b) of this chapter) if, in the aggregate, the changes

in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration

Fee” table in the effective registration statement; and

(iii) To include any material information

with respect to the plan of distribution not previously disclosed in this Registration Statement or any material change to such information

in this Registration Statement;

provided, however, that paragraphs

(a)(1)(i) and (a)(1)(ii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is

contained in periodic reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the

Exchange Act that are incorporated by reference in this Registration Statement.

(2) That, for the purpose of

determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement

relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona

fide offering thereof; and

(3) To remove from registration

by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

| B. | The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the

Securities Act, each filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and,

where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is

incorporated by reference in the Registration Statement shall be deemed to be a new registration statement relating to the securities

offered herein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering

thereof. |

| C. | Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors,

officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised

that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore,

unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses

incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding)

is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless

in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the

question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final

adjudication of such issue. |

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant

certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this

Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, on May 29, 2024.

| |

|

THE JOINT CORP. |

| |

|

|

| |

By: |

/s/ Peter D. Holt |

| |

|

Peter D. Holt |

| |

|

President and Chief Executive Officer |

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears

below hereby constitutes and appoints Peter D. Holt and Jake Singleton, or each of them, as his or her attorney-in-fact, each with full

power of substitution and resubstitution, to sign for us, in our names and in the capacities indicated below, this Registration Statement

on Form S-8 and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange

Commission, and any and all amendments to said Registration Statement (including post-effective amendments), granting unto said attorneys,

and either of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done in connection

therewith, as fully to all intents and purposes as he might or could do in person, and hereby ratifying and confirming all that said attorneys,

or either of them, or their substitute or substitutes, may lawfully do or cause to be done by virtue of this Power of Attorney. This Power

of Attorney may be executed in counterparts and all capacities to sign any and all amendments.

Pursuant to the requirements of the Securities Act

of 1933, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

|

Signature |

|

Title |

|

Date |

| |

|

|

|

|

|

/s/ Peter Holt |

|

President, Chief Executive Officer and Director

(Principal Executive Officer) |

|

May 29, 2024 |

| Peter Holt |

|

|

|

| |

|

|

|

|

|

/s/ Jake Singleton |

|

Chief Financial Officer

(Principal Financial and Accounting Officer) |

|

May 29, 2024 |

| Jake Singleton |

|

|

|

| |

|

|

|

|

|

/s/ Matthew E. Rubel |

|

Lead Director |

|

May 29, 2024 |

| Matthew E. Rubel |

|

|

|

| |

|

|

|

|

|

/s/ Ronald V. DaVella |

|

Director |

|

May 29, 2024 |

| Ronald V. DaVella |

|

|

|

| |

|

|

|

|

|

/s/ Jefferson Graham |

|

Director |

|

May 29, 2024 |

| Jefferson Graham |

|

|

|

| |

|

|

|

|

|

/s/ Suzanne M. Decker |

|

Director |

|

May 29, 2024 |

| Suzanne M. Decker |

|

|

|

| |

|

|

|

|

|

/s/ Abe Hong |

|

Director |

|

May 29, 2024 |

| Abe Hong |

|

|

|

|

|

|

Director |

|

May 29, 2024 |

| Glenn J. Krevlin |

|

|

|

Exhibit 5.1

May 29, 2024

The Joint Corp.

16767 N. Perimeter Drive, Suite 110

Scottsdale, Arizona 85260

| Re: | Registration Statement on Form S-8

The Joint Corp. |

Ladies and Gentlemen:

As legal counsel to The Joint Corp., a Delaware corporation

(the “Company”), we have assisted in the preparation of the Company’s Registration Statement on Form S-8 (the

“Registration Statement”), to be filed with the Securities and Exchange Commission on or about May 29, 2024, in connection

with the registration under the Securities Act of 1933, as amended, of 2,000,000 shares of the Company’s common stock, par value

$0.001 per share (“Common Stock”), issuable under the Company’s 2024 Incentive Stock Plan (the “2024

Plan”). The shares of Common Stock issuable pursuant to the Plan are collectively referred to as the “Shares.” The

facts, as we understand them, are set forth in the Registration Statement.

With respect to the opinion set forth below, we have

examined originals, certified copies, or copies otherwise identified to our satisfaction as being true copies, only of the following:

A. The Amended

and Restated Certificate of Incorporation of the Company;

B. The Fourth

Amended and Restated Bylaws of the Company;

C. Records

of corporate proceedings of the Company related to the Plan;

D. The Plan;

E. The Registration

Statement; and

F. Such other

documents, corporate records, certificates of public officials, and other instruments as we have deemed necessary or advisable for the

purpose of rendering this opinion.

Subject to the assumptions that (i) the documents and

signatures examined by us are genuine and authentic, and (ii) the persons executing the documents examined by us have the legal capacity

to execute such documents, and subject to the further limitations and qualifications set forth below, based solely upon our review of

items A through F above, it is our opinion that the Shares will be validly issued, fully paid, and nonassessable when issued and sold

in accordance with the terms of the Plan.

We express no opinion as to the applicability or effect

of any laws, orders, or judgments of any state or other jurisdiction other than federal securities laws and the substantive laws of the

state of Delaware, including judicial interpretations of such laws. Further, our opinion is based solely upon existing laws, rules, and

regulations, and we undertake no obligation to advise you of any changes that may be brought to our attention after the date hereof.

Greenberg Traurig, LLP | Attorneys at Law

2375 East Camelback Road | Suite 800 | Phoenix, Arizona

85016 | T +1 602.445.8000| F +1 602.445.8100

www.gtlaw.com

The Joint Corp.

May 29, 2024

Page 2

We hereby expressly consent to any reference to our firm in the Registration

Statement, inclusion of this Opinion as an exhibit to the Registration Statement, and to the filing of this Opinion with any other appropriate

governmental agency.

Very truly yours,

/s/ Greenberg Traurig, LLP

Greenberg Traurig, LLP | Attorneys at Law

www.gtlaw.com

Exhibit 10.1

The Joint Corp. 2024 Incentive Stock Plan

Article 1

Purpose

The purpose of this plan is to recognize and reward

participants for their efforts on the Company’s behalf, to motivate participants by appropriate incentives to contribute to the

Company’s attainment of its performance objectives, and to align participants’ interests with those of the Company’s

other stockholders through compensation based on the performance of the Company’s common stock.

Article 2

Definitions

Annual Restricted Share Grant is defined in Article

7.

Award means an Option, SAR Award, Restricted

Stock Award or RSU Award under the Plan.

Award Agreement means a written or electronic

agreement between the Company and a Participant incorporating the terms of an Award to the Participant.

Board means the Company’s Board of Directors.

Change of Control is defined in Article 8.

The terms “continuing Director,” “appointed Director” and “elected Director” are also defined in Article

8.

Code means the Internal Revenue Code of 1986,

as amended.

Committee is defined in Section 3.1. Unless

the Board designates a different committee, the Compensation Committee of the Board shall serve as the Committee (as long as all of the

members of the Compensation Committee qualify under Section 3.1).

common stock means the Company’s common

stock, par value $.001 per share.

Company means The Joint Corp., a Delaware corporation.

Consultant means any individual who provides

bona fide consulting or advisory services to the Company or a Subsidiary.

Director means a director of the Company.

Eligible Person means, in respect of all types

of Awards except ISOs, any Employee, Director or Consultant and, in respect of ISOs, any Employee.

Employee means a full-time or part-time employee

of the Company or a Subsidiary.

Exchange Act means the Securities Exchange Act

of 1934, as amended.

Expiration Date means the last day on which an

Option or SAR may be exercised.

Fair Market Value means, for a given day, the

value of a share of common stock determined as follows:

i.

If the common stock is listed on The NASDAQ Stock Market, its Fair Market Value will be the last reported sales price of a share

of common stock as quoted on such exchange on the day in question (or on the most recent trading day if the day in question is not a trading

day);

ii.

For purposes of any Awards granted on the Registration Date, the Fair Market Value will be the initial price to the public as set

forth in the final prospectus included within the registration statement in Form S-1 filed with the Securities and Exchange Commission

for the initial public offering of the Company’s common stock; or

iii.

In the absence of an established market for the common stock, the Fair Market Value will be determined in good faith by the Administrator.

Grant Date means, in respect of an Award, the

date that the Committee grants the Award or any later date that the Committee specifies as the effective date of the Award.

ISO means an incentive stock option described

in §422 of the Code.

NSO means a nonstatutory stock option (i.e.,

any stock option other than an ISO).

Option means an award pursuant to Article

5 of an option to purchase shares of common stock. In the case of an award pursuant to Article 5, the Committee shall designate

at the time of grant whether an Option is an ISO or a NSO.

Outside Director means a Director who is not

an Employee.

Participant means an Eligible Person who holds

an Award under the Plan.

Performance Goals means one or more of the following

objective performance goals for the Company, a division or a Subsidiary, measured over a 12-month or longer period and specified either

in absolute terms or in percentage terms relative to a target, base period, index or peer group:

| • | | earnings before interest, taxes, depreciation and amortization |

| • | | return on invested capital |

| • | | return on stockholders’ equity |

| • | | total return to stockholders |

Plan means this plan, as it may be amended. The

name of this Plan is the “The Joint Corp. 2024 Incentive Stock Plan.”

Registration Date means the effective date of

the first registration statement that is filed by the Company and declared effective pursuant to Section 12(g) of the Exchange Act, with

respect to the Company’s shares.

Restricted Shares means shares of common stock

subject to a risk of forfeiture or other restrictions that will lapse if and when specified service requirements, Performance Goals or

other conditions are satisfied.

Restricted Stock Award means an award of Restricted

Shares pursuant to Article 6.

Restricted Stock Unit means a contractual right

to receive one share of common stock in the future if and when specified service requirements, Performance Goals or other conditions are

satisfied.

RSU Award means an award of Restricted Stock

Units pursuant to Article 6.

SAR, or stock appreciation right, means a contractual

right to receive a payment representing the excess of the Fair Market Value of a share of common stock on the date that the right is exercised

over the exercise price per share of the right.

SAR Award means an award of a Stand-Alone SAR

or Tandem SAR pursuant to Article 5.

Section 16 Officer means an “officer”

as defined by Rule 16a-1 promulgated under the Exchange Act.

share means a share of the Company’s common

stock.

Stand-Alone SAR means an SAR that is not related

to an Option.

Subsidiary means a “subsidiary corporation”

as defined in §424(f) of the Code.

Tandem SAR means an SAR that is related to an

Option.

Termination means, in respect of an Employee,

his or her termination of service to the Company or a Subsidiary. An employee’s (i) transferring employment from the Company to

a Subsidiary or from a Subsidiary to the Company or to another Subsidiary or (ii) leaving service as an Employee but continuing service

as a Consultant or Director shall not be considered a termination of service. Termination means, in respect of a Director, his or her

termination of service on the Board of the Company. A Director’s leaving the Board but continuing in service to the Company as an

Employee or Consultant shall not be considered a termination of service. Termination means, in respect of a Consultant, his or her termination

of service as a Consultant.

Termination Date means the date on which an Employee,

Director or Consultant, as the case may be, incurs a Termination.

Article 3

Administration

3.1 Committee

The Board shall designate a committee of the Board (the

“Committee”) to administer the Plan except in respect of Directors, for whom the full Board shall administer the Plan. The

Committee shall consist of two or more Directors both or all of whom shall be (i) “non-employee directors” as defined in Rule

16b-3 under the Exchange Act, and (ii) “independent directors” under the applicable listing standards of The NASDAQ Global

Market.

3.1 Authority

Subject to the terms of the Plan, the Committee shall

have the authority to select the Eligible Persons to whom Awards are to be granted and to determine the time, type, number of shares,

vesting, restrictions, limitations and other terms and conditions of each Award. The Committee may, in a limited manner and from time

to time, delegate authority to the Chief Executive Officer or to the Chair of the Committee to grant Awards to employees, including officers

who are not deemed Section 16 Officers (defined below), of The Joint that are newly hired employees, newly promoted individuals and recipients

of recognition equity awards other than awards granted in connection with annual incentive programs. Any such delegation must be made

within the guidelines established by the Committee and may be subject to review by the Committee (or the Board of Directors), at the discretion

of the Committee (or the Board of Directors).

Awards under the Plan need not be uniform in respect

of different Eligible Persons, whether or not similarly situated. The Committee may consider such factors as it deems relevant in selecting

Eligible Persons for Awards and in determining their Awards.

The Committee may condition the vesting of any Award

on the attainment of one or more Performance Goals. Performance Goals may differ from Participant to Participant and from Award to Award.

The Committee shall specify the applicable Performance Goal or Goals in the underlying Award Agreement. The Committee’s evaluation

of a Performance Goal’s attainment may be adjusted to exclude any extraordinary events and transactions as described in Accounting

Principles Board Opinion No. 30, but in all other respects, the measurement of Performance Goals shall be determined in accordance with

the Company’s financial statements and U.S. generally accepted accounting principles.

The Committee may interpret the Plan, adopt, revise

and rescind policies and procedures to administer the Plan, and make all factual and other determinations required for Plan’s administration.

The Committee’s determinations, interpretations

and other actions shall be final and binding. No member of the Committee shall be liable for any action of the Committee in good faith.

3.3 Procedures

The members of the Committee shall elect a chairman,

and the Committee shall meet as necessary at the call of the chairman or any two members of the Committee. A majority of the members of

the Committee shall constitute a quorum, and all actions of the Committee at a meeting at which a quorum is present shall be taken by

majority vote.

A member of the Committee may participate in any meeting

of the Committee by a conference telephone call or other means that enable all persons participating in the meeting to hear one another,

and participation in this manner shall constitute his or her presence in person at the meeting. The Committee also may act by the unanimous

written consent of its members.

Article 4

Plan Operation

4.1 Effective

Date

This Plan shall become effective if and when approved

by the Company’s stockholders, such date, the “Effective Date”).

4.2 Term

This Plan shall terminate at the earliest of (a) such

time as no shares remain available for issuance under the Plan, (b) termination of the Plan by the Board, or (c) the tenth (10th)

anniversary of the Effective Date. No Award may be granted under the Plan after its expiration. Awards outstanding upon expiration of

the Plan shall remain in effect until they have been exercised or terminated or have expired and shall remain subject to the terms of

the Plan.

4.3 Maximum

Number of Shares

The maximum total number of shares of common stock for

which Awards may be granted under this Plan is 2,000,000 shares. This maximum shall be subject to the capitalization adjustments under

Section 4.5.

The shares for which Options, Restricted Stock Awards,

RSU Awards, and SARs are granted shall count against this limit on a 1-for-1 basis.

The shares for which Awards may be granted shall be

shares currently authorized but unissued or shares that the Company currently holds or subsequently acquires as treasury shares, including

shares purchased in the open market or in private transactions.

4.4 Shares

Available for Awards

The determination of the number of shares of common

stock available for Awards under the Plan shall take into account the following:

(a) If

an Option lapses or expires unexercised, the number of shares in respect of which the Option lapsed or expired shall be added back to

the available number of shares for which Awards may be granted.

(b) If

a Restricted Stock Award or RSU Award lapses or is forfeited, the number of shares in respect of which the Award lapsed or was forfeited

shall be added back to the available number of shares for which Awards may be granted.

(c) If

a SAR Award or RSU Award is settled in cash, the number of shares in respect of which the Award was settled in cash shall not be added

back to the available number of shares for which Awards may be granted.

(d) If

the exercise price of an Option is paid by delivery of shares of common stock pursuant to Section 5.8, the number of shares issued

upon exercise of the Option, without netting the shares delivered in payment of the exercise price, shall be taken into account in determining

the available number of shares for which Awards may be granted.

(e) Notwithstanding

anything in this Section 4.4 to the contrary but subject to the capitalization adjustments under Section 4.5 hereof, the maximum

aggregate number of shares of common stock that may be delivered under the Plan as a result of the exercise of an ISO shall be 2,000,000

shares.

(f) Notwithstanding

anything herein to the contrary, the maximum number of shares subject to Awards granted during a single fiscal year to any Outside Director,

together with any cash fees paid to such Outside Director during the fiscal year shall not exceed a total value of $500,000 (calculating

the value of any Awards based on the grant date fair value for financial reporting purposes).

4.5 Capitalization

Adjustments

In the event of a change in the number of outstanding

shares of common stock by reason of a stock dividend, stock split, recapitalization, reorganization or the like, the Committee may, and

in the case of a reverse stock split, the Committee shall, equitably adjust the following in order to prevent a dilution or enlargement

of the benefits or potential benefits intended to be provided under the Plan: (i) the number of shares for which Awards may be granted

under the Plan, (ii) the maximum number of shares for which Awards may be granted to any Eligible Person in a calendar year, (iii) the

aggregate number of shares in respect of each outstanding Award and (iv) the exercise price of each outstanding Option and SAR. The Committee

may also make any other equitable adjustments that the Committee considers appropriate. Except in the case of a reverse stock split, adjustments

shall be made in the Committee’s discretion, and its decisions shall be final and binding.

Article 5

Stock Options and SARs

5.1 Grant

The Committee may grant an Option or SAR to any Eligible

Person. Subject to the terms of this Plan, the Committee shall determine the restrictions, limitations and other terms and conditions

of each Option and SAR Award.

The Committee shall designate each Option as either

an ISO or NSO, and shall designate each SAR Award as either a Stand-Alone SAR or a Tandem SAR. A Tandem SAR may not be granted later than

the time that its related Option is granted.

5.2 Exercise

Price

The Committee shall determine the exercise price of

each Option and SAR. The exercise price per share may not be less than the Fair Market Value on the Grant Date of the Option or SAR.

Except for capitalization adjustments under Section

4.5 or as approved by the Company’s stockholders, the exercise price per share of any outstanding Option or SAR may not be reduced,

and the Option or SAR may not be surrendered to the Company for cash or as consideration for the grant of a new Option or SAR with a lower

exercise price per share.

5.3 Vesting

and Term

The Committee shall determine the time or times at which

each Option and Stand-Alone SAR becomes vested. Vesting may be based on continuous service or on the attainment of Performance Goals or

other conditions specified in the Award Agreement. A Tandem SAR shall vest if and to the extent that its related Option vests, and shall

expire or be canceled when its related Option expires or is canceled. No Option or SAR may have an Expiration Date more than 10 years

from its Grant Date. The Committee, in its discretion, at any time may accelerate the vesting of an Option or SAR or extend its Expiration

Date (subject to the foregoing maximum 10-year term).

5.4 Termination

of Employment or Service as a Director

Unless otherwise specified in the underlying Award Agreement,

in the case of an Option or SAR held by an Employee or Director who incurs a Termination:

(a) if

and to the extent that the Option or SAR is unvested as of the Employee’s or Director’s Termination Date, the Option or SAR

shall lapse on the Termination Date unless the Termination is incurred by reason of his or her death, in which case the Option or SAR

shall become fully vested as of the Employee’s or Director’s Termination Date; and

(b) subject

to subsection (c) in the case of an Option granted to a Director, if and to the extent that the Option or SAR is (or becomes) vested as

of the Employee’s or Director’s Termination Date, the Option or SAR shall expire (i) on the earlier of 90 days after the Termination

Date or the Expiration Date of the Option or SAR, or (ii) if the Termination is incurred by reason of his or her death, on the earlier

of the first anniversary of the Employee’s or Director’s death or the Expiration Date of the Option or SAR.

(c) in

the case of an Option granted to a Director, if and to the extent that the Option is (or becomes) vested as of the Director’s Termination

Date, the Option shall expire on its Expiration Date.

5.5 Transferability

No Option or SAR may be transferred, assigned or pledged,

whether by operation of law or otherwise, except (i) as provided in the underlying Award Agreement or as the Committee otherwise permits,

or (ii) as provided by will or the applicable laws of intestacy or (iii) if:

(a) the

transferee is a revocable trust that the employee established for estate planning reasons (in respect of which the employee is treated

as the owner for federal income tax purposes); or

(b) the

transferee is (i) the spouse of the employee or a child, step-child, grandchild, parent, sibling or child of a sibling of the employee

(each an “eligible transferee”), (ii) a custodian for an eligible transferee under any Uniform Transfers to Minors

Act or Uniform Gifts to Minors Act or (iii) a trust for the primary benefit of one or more eligible transferees.

Transfers described in the preceding clause (b) shall

be subject to any restrictions and requirements that the Committee considers appropriate (for example, the transferee’s written

agreement to be bound by the terms of the Plan and the underlying Award Agreement).

No Option or SAR shall be subject to execution, attachment

or similar process.

5.6 Additional

ISO Rules

To the extent that the aggregate fair market value (determined

in respect of each ISO on the basis of the Fair Market Value of a share of common stock on the ISO’s Grant Date) of the underlying

shares of all ISOs that become exercisable by an individual for the first time in any calendar year exceeds $100,000, the Options shall

be treated as NSOs. This limitation shall be applied by taking ISOs into account in the order in which they were granted.

In the case of an ISO granted to an Employee who at

the time of grant owns stock possessing more than 10% of the total combined voting power of all classes of stock of the Company (or any

Subsidiary), the exercise price per share may not be less than 110% of the Fair Market Value on the Grant Date and the ISO may not have

an Expiration Date more than five years from the Grant Date.

The Award Agreement underlying an Option that the Committee

designates as an ISO may contain any additional terms, beyond those of this Plan, that the Committee considers necessary or desirable

to include to assure that the Option complies with the requirements of §422 of the Code.

5.7 Manner

of Exercise

A vested Option or SAR may be exercised in full or only

partially (but in the case of a partial exercise, only in respect of a whole number of shares) by (i) written notice to the Committee

or its designee stating the number of shares in respect of which the Option or SAR is being exercised and, in the case of an Option, (ii)

full payment of the exercise price of those shares.

5.8 Payment

of Exercise Price

Payment of the exercise price of an Option shall be

made by check or, if permitted by the Committee (either in the underlying Award Agreement or at the time of exercise), by: (i) delivery

of shares of common stock having a Fair Market Value on the date of exercise equal to the exercise price; (ii) directing the Company to

withhold, from the shares otherwise issuable upon exercise of the Option, shares having a Fair Market Value on the date of exercise equal

to the exercise price; (iii) by an open-market broker-assisted sale pursuant to which the Company is promptly delivered the portion of

the sales proceeds necessary to pay the exercise price; (iv) any combination of these methods of payment; or (v) any other method of payment

that the Committee authorizes.

5.9 Tandem

SARs

A Tandem SAR shall entitle the Participant to elect

to exercise either the SAR or the related Option as to all or any portion of the shares subject to the SAR and Option. The exercise of

a Tandem SAR shall cause the immediate and automatic cancellation of its related Option with respect to the same number of shares, and

the exercise, expiration or cancellation of the related Option (other than by reason of the exercise of the Tandem SAR) shall cause the

automatic and immediate cancellation of the Tandem SAR with respect to the same number of shares.

5.10 Settlement

of SARs

Settlement of a SAR may be made, in the Committee’s

discretion, in shares of common stock or in cash, or in a combination of the two, subject to applicable tax withholding requirements.

Any cash payment in settlement of a SAR shall be made on the basis of the Fair Market Value of a share of common stock on the date that

the SAR is exercised.

Article 6

Restricted Stock

and Restricted Stock Units

6.1 Grant

The Committee may issue Restricted Shares or grant Restricted

Stock Units to any Eligible Person. Subject to the terms of this Plan, the Committee shall determine the restrictions, limitations and

other terms and conditions of each Restricted Stock Award and RSU Award.

6.2 Vesting

The Committee shall determine the time or times at which

each Restricted Stock Award or RSU Award becomes vested. Vesting may be based on continuous service or on the attainment of specified

Performance Goals or other conditions specified in the Award Agreement.

Each Restricted Stock Award and RSU Award held by an

Employee or a Director shall become fully vested as of his or her Termination Date if the Termination is incurred by reason of his or

her death.

6.3 Transferability

Prior to the vesting of a Restricted Stock Award, the

Restricted Shares subject to the Award may not be transferred, assigned or pledged (except as provided in the Award Agreement or as the

Committee permits) and shall not be subject to execution, attachment or similar process. After vesting, the shares may still remain subject

to restrictions on transfer under applicable securities laws and any restrictions imposed by the Award Agreement. If the Restricted Shares

are issued in certificated form, the Committee may require each certificate representing Restricted Shares to bear a legend making appropriate

reference to the restrictions on the shares, and may also require that the certificate, together with a stock power duly endorsed in blank

by the Participant, remain in the Company’s physical custody or in escrow with a third party until all restrictions have lapsed.

6.4 Rights

as Stockholder

Subject to the terms of the Plan and as provided in

the underlying Award Agreement, a Participant may have some or all of the rights of a stockholder in respect of unvested Restricted Shares

subject to a Restricted Stock Award, including the right to vote the shares and to receive dividends and other distributions in respect

of the shares. A Participant shall have all of the rights of a stockholder when Restricted Shares become vested. The Committee may provide

in the Award Agreement for the payment of dividends and distributions; provided, however any such dividends or other distributions paid

on unvested Restricted Shares will be held by the Company and transferred to the Participant, without interest, as and when the Restricted

Shares become vested (or within a reasonable time thereafter). Dividends or other distributions paid on unvested Restricted Shares that

are forfeited shall also be forfeited.

A Participant shall not have any rights as a stockholder

in respect of the shares of common stock subject to a RSU Award until those shares have been issued and delivered to the Participant pursuant

to the terms of the Award.

6.5 Settlement

of RSU Award

Settlement of a RSU Award may be made, in the Committee’s

discretion, in shares of common stock or in cash, or in a combination of the two, subject to applicable tax withholding requirements.

Any cash payment in settlement of a RSU Award shall be made on the basis of the Fair Market Value of a share of common stock on the date

that the shares subject to the Award become issuable to the Participant.

6.6 Deferrals

The Committee may (but shall not be required to) permit

a Participant to elect to defer the delivery of shares upon the vesting or settlement of a Restricted Stock Award or RSU Award. Any such

election shall be for a deferral period and in a manner and on terms that the Committee approves and that comply with the requirements

of §409A of the Code.

Article 7

Automatic Restricted Stock Award Grants

to Outside Directors

7.1 Grant

All grants of Restricted Shares to Outside Directors

pursuant to this Article will be automatic and nondiscretionary, except as otherwise provided herein, made in accordance with the provisions

in this Article, and otherwise subject to the terms and conditions of the Plan.

7.2 Annual

Grant

Each Outside Director automatically will be granted

a number of Restricted Shares (the “Annual Restricted Share Grant”) equal to $50,000 divided by the closing price of

share of the Company’s stock on the date of his or her election or re-election as a Director.

7.3 Terms

The Restricted Shares subject to the Annual Restricted

Share Grant will vest in full on the earlier of (a) first anniversary of its Grant Date (or on the Director’s death if the Director

incurs a Termination by reason of his or her death prior to the first anniversary of the Grant Date) and (b) the next annual meeting of

the Company’s stockholders after the Annual Restricted Share Grant, subject to the Outside Directors continuous service through

the applicable vesting date.

Article 8

Change of Control; Dissolution or Liquidation

The following shall apply to Awards to the extent not

otherwise provided in the applicable Award Agreement or individual severance or employment agreement to which a Participant is a party

(and except as is necessary to satisfy the requirements for exemption under Section 409A or the requirements of §409A of the Code

to the extent applicable):

8.1 Treatment

of Outstanding Awards in Event of a Change of Control that is Not a Corporate Transaction

(a)

In the event of a Change of Control that is not also a Corporate Transaction, all of a Participant’s outstanding Awards shall

become fully vested and exercisable, and all vesting conditions on the shares underlying Restricted Stock Awards of a Participant shall

lapse, upon the occurrence of both:

| (1) | A Change of Control; and |

| (2) | (x) Termination by the Company of such Participant for a reason other than Cause during the Window Period;

or (y) a Termination by the Participant for Good Reason during the Window Period (the date upon which both (1) and either (2)(x)

or 2(y) have occurred shall be referred to as the “Double Trigger Date”). |

(b)

Notwithstanding subsection (a) above, any Award (or portion of an Award) that is conditioned on the attainment of one or more Performance

Goals shall vest, if at all, on the basis, of actual satisfaction of the Performance Goals as of a date reasonably proximal to the Double

Trigger Date (based on pro-rated performance metrics through such date), as determined by the Committee, in its sole discretion. If an

Award contains multiple performance periods, any accelerated vesting provided for hereunder shall apply only to that portion of an outstanding

Award applicable to the incomplete performance period within which the Double Trigger Date has occurred. Any performance-based Award (or

portion of such Award) that does not vest in accordance with the foregoing, including when the Committee, in its sole discretion, determines

that actual performance is not reasonably determinable, shall be forfeited. In the case of any adjustment in an Award hereunder, the shares

subject to the Award will be rounded down to the nearest whole share.

8.2 Treatment

of Outstanding Awards in Event of a Change of Control that is a Corporate Transaction

(a) In

the Event of a Change of Control that is also a Corporate Transaction, and contingent upon the consummation of the Corporate Transaction,

the Committee may, in its sole discretion at or after grant of an Award and without the consent of any Participant, provide for (i) the

assumption of outstanding Awards by the acquiror or successor entity (or its parent), (ii) the substitution of new awards of comparable

value covering shares of an acquiror or successor entity (or its parent), with appropriate adjustments as to the number and kind of shares

and purchase price, (iii) the continuation of the Awards by the Company (if the Company is the surviving corporation), or (iv) the cancellation

of the Awards in accordance with subsection (b) below. Outstanding Awards do not have to be uniformly treated for all Participants.

(b) If

and to the extent that there is no assumption, substitution or continuation of Awards, then all outstanding Awards shall become fully

vested and exercisable, and all vesting conditions on shares underlying Restricted Stock Awards shall lapse. Notwithstanding the forgoing,

if and to the extent that there is no assumption, substitution or continuation of an Award (or portion of an Award) that is conditioned

on the attainment of one or more Performance Goals, then such Award shall vest, if at all, in accordance with Section 8.1(b).

(c) With

respect to any outstanding vested and nonforfeitable Awards that are not assumed, substituted or continued, and effective only immediately

before (and conditioned upon) the consummation of the Corporate Transaction:

(i)

The Committee shall take either (or both) of the following actions:

| (1) | allow Participants to exercise any Awards of Options and SARs within a reasonable period prior to the

consummation of the Corporate Transaction and cancel any outstanding Options or SARs that remain unexercised upon consummation of the

Corporate Transaction; or |

| (2) | cancel any or all of such outstanding Awards in exchange for a payment with respect to each vested share

subject to such canceled Award in (a) cash, (b) stock of the Company or of a corporation or other business entity that is a party to the

Corporate Transaction, or (c) other property which, in any such case, shall be in an amount having a fair market value equal to the fair

market value of the consideration to be paid per share of common stock in the Corporate Transaction, reduced (but not below zero) by the

exercise or purchase price per share, if any, under such Award. |

(ii)

In the event that an Award has an exercise or purchase price per share equal to or greater than the fair market value of the consideration

to be paid per share of stock in the Corporate Transaction, then such Award shall be canceled without the payment of any consideration

and shall cease to be outstanding.

(d) Prior

to any payment contemplated under this section, and pursuant to any purchase or merger agreement or other applicable transaction agreement,

the Committee may require each Participant to (i) represent and warrant as to the unencumbered title to the Participant’s Awards;

(ii) bear such Participant’s pro rata share of any post-closing indemnity obligations and be subject to the same post-closing purchase

price adjustments, escrow terms, offset rights, holdback terms, and similar conditions as the other holders of common stock, subject to

any limitations or reductions as may be necessary to comply with §409A of the Code; and (iii) deliver customary transfer documentation

as reasonably determined by the Committee.

(e) If

and to the extent that Awards are continued, assumed or replaced under subsection (a) above and a Participant holding such an Award experiences

a Termination by the Company for a reason other than Cause during the Window Period or there is a Termination by Participant for Good

Reason during the Window Period, then all of such Participant’s outstanding Awards shall become fully vested and exercisable, and

all vesting conditions on the shares underlying Restricted Stock Awards of such Participant shall lapse. Notwithstanding this subsection

(e), any Award (or portion of an Award) that is conditioned on the attainment of one or more Performance Goals shall vest, if at all,

in accordance with Section 8.1(b).

8.3 Treatment

of Outstanding Awards in Event of a Dissolution or Liquidation of the Company

In the event of a proposed dissolution or liquidation

of the Company (other than in connection with a Corporate Transaction), the Committee will notify Participants as soon as practicable

prior to such dissolution or liquidation and provide them with the opportunity to exercise any outstanding Awards to the extent vested

as of the date immediately prior to such dissolution or liquidation. Awards (or the portions thereof) that are vested but remain unexercised

thereafter or that are unvested or subject to forfeiture conditions shall be canceled and cease to be outstanding. Notwithstanding the

foregoing, the Committee may, in its sole discretion, cause some or all outstanding Awards to become fully vested, exercisable and/or

no longer subject to forfeiture. In the event that an Award has an exercise or purchase price per share equal to or greater than the fair

market value of a share of the Company’s stock (as determined by the Committee in its sole discretion), then such Award shall be

canceled without notice to or payment of any consideration to the Participant and shall cease to be outstanding. The exercise, cancellation

or acceleration of vesting of an Award hereunder shall be effective only immediately before the proposed dissolution or liquidation and

conditioned upon its consummation.

8.4 Definitions

A “Change of Control” means an event

or the last of a series of related events by which:

(a) any

Person (as that term is used in sections 13(d) and 14(d) of the Exchange Act, together with all of that person’s “affiliates”

and “associates” as those terms are defined in Rule 12b-2 under the Exchange Act) directly or indirectly acquires or otherwise

becomes entitled to vote stock having more than 50% of the voting power in elections for Directors; or

(b) during

any 24-month period, a majority of the members of the Board ceases to consist of Qualifying Directors. A Director shall be considered

a “Qualifying Director” if he or she falls into any one of the following five categories:

(1) a

Director at the beginning of the period (“continuing Directors”); or

(2) a

Director elected to office after the start of the period by the Board with the approval of two-thirds of the incumbent continuing Directors

(an “appointed Director”); or

(3) a

Director elected to office after the start of the period by the Company’s stockholders following nomination for election by the

Board with the approval of two-thirds of the incumbent continuing and appointed Directors (an “elected Director”);

or

(4) a

Director elected to office after the start of the period by the Board with the approval of two-thirds of the incumbent continuing, appointed

and elected Directors; or

(5) a

Director elected to office after the start of the period by the Company’s stockholders following nomination for election by the

Board with the approval of two-thirds of the incumbent continuing, appointed and elected Directors; or

(c) A

Corporate Transaction is consummated, unless, immediately following such Corporate Transaction, holders of the Company’s voting

securities immediately prior to such Corporate Transaction beneficially own, directly or indirectly, more than 50% of the voting power

of the outstanding securities of the surviving or acquiring entity resulting from such Corporate Transaction (including beneficial ownership

through the ultimate parent of such entity) in substantially the same proportions as their ownership immediately prior to such Corporate

Transaction.

“Cause” means any one or more of

the following: (i) the commission of any crime involving dishonesty, breach of trust or physical harm to any person, (ii) willfully engaging

in conduct that is in bad faith or injurious to the Company or its business (including, for example, fraud or embezzlement), (iii) gross

misconduct, whether personal or professional, which could cause harm to the business or reputation of the Company, (iv) failure to comply

with the significant provisions of the Company’s policies as specified in the Employee Handbook or Code of Ethics, or as otherwise

adopted by the board of directors then in effect, (v) willful and material failure to perform or observe, or gross negligence in the performance

of, the Participant’s job, including the failure to follow the reasonable written directions of the person to whom the Participant

reports, or (vi) any breach of covenants of confidentiality, non-competition, non-solicitation or other covenants the Participant has

agreed to with the Company.

“Corporate Transaction” means (i)

a sale or other disposition of all or substantially all of the consolidated assets of the Company and its Subsidiaries, or (ii) a merger,

consolidation, share exchange or similar transaction involving the Company, regardless of whether the Company is the surviving entity.

“Good Reason” means one or more of

the following: (i) a material reduction during the Window Period of the Participant’s compensation where the Company has not implemented

an across-the-board reduction in compensation, or in the case of Outside Directors, an across-the-board reduction in compensation of the

Board; (ii) other than with respect to Outside Directors, the relocation during the Window Period (without the Participant’s prior

written consent) of the Participant’s primary work site to a location greater than seventy five (75) miles from the Participant’s

work site; or (iii) a material reduction during the Window Period of the Participant’s duties (without the Participant’s prior

written consent) from those in effect prior to the Window Period; provided, however, that to invoke a Termination for Good Reason, (A)

the Participant must provide written notice to the Company within thirty (30) days of the event believed to constitute Good Reason, which

notice must be within the Window Period, (B) the Company must fail to cure such event within thirty (30) days of the receipt of such written

notice, and (C) the Participant must terminate employment within thirty (30) days following the expiration of the Company’s cure

period described above, which may be during or after the Window Period.

“Termination” shall mean, for purposes

of this Article 8 only, (i) in respect of an Employee, termination of employment (but transferring employment from the Company

to a Subsidiary or from a Subsidiary to the Company or to another Subsidiary shall not be considered a Termination); (ii) in respect of

a Consultant, his or her termination of service as a Consultant; and (iii) in respect of an Outside Director, termination of service on

the Board, or if the Company is not the surviving entity in a Corporate Transaction, on the board of directors of the surviving entity,

which in either case, shall include the Outside Director’s failure to be nominated or to be elected to serve as a director. “Company”

as used in this definition shall be deemed to include a successor to or acquiror of the Company.

“Window Period” means a period beginning

thirty (30) calendar days prior to the date the Change of Control is effected and ending on the one-year anniversary of the date the Change

if Control is effected.

Article 9

Miscellaneous Provisions

9.1 Award

Agreement

Each Award under the Plan shall be evidenced by an Award

Agreement which shall be subject to and incorporate the terms of the Plan.

9.2 Tax

Withholding

The Company may withhold an amount sufficient to satisfy

its withholding tax obligations, if any, in connection with any Award under the Plan, and the Company may defer making any payment or

delivery of shares pursuant to the Award unless and until the Participant indemnifies the Company to its satisfaction in respect of its

withholding obligation.

9.3 Clawback

Policy

The Committee may, to the fullest extent permitted by

applicable law, (a) cause the cancellation or forfeiture of any Award, (b) require reimbursement of any Award or related cash payment

by a Participant or beneficiary, and (c) effect any other right of recoupment of equity or other compensation provided under this Plan

or otherwise in accordance with any Company policies that currently exist or that may from time to time be adopted in the future by the

Company to comply with Section 954 of the Dodd-Frank Wall Street Reform and Consumer Protection Act and/or applicable stock exchange requirements

(each, a “Clawback Policy”). By accepting an Award, a Participant is also agreeing to be bound by any Clawback Policy

(including any Clawback Policy amendment as necessary to comply with applicable laws or stock exchange requirements).

9.4 Minimum

Vesting Conditions

Except for certain limited situations (e.g., death and

certain circumstances as a result of a Change in Control), all Awards granted under this Plan shall be subject to a minimum vesting period

of one (1) year (the “Minimum Vesting Condition”); provided, that such Minimum Vesting Condition will not be required

on Awards covering, in the aggregate, a number of shares not to exceed 5% of the maximum Share pool limit set forth in Section 4(3) hereof

(subject to adjustment as provided in Section 4.5 hereof).

9.5 Amendment

and Termination

The Board may amend, suspend or terminate the Plan at

any time. The Company’s stockholders shall be required to approve any amendment that would (i) materially increase the number of

shares of common stock for which Awards may be granted, (ii) increase the number of shares of common stock for which ISOs may be granted

(other than an amendment authorized under Section 4.5), (iii) permit any action that would be treated as a repricing of Awards

under applicable stock exchange rules or (iv) otherwise require stockholder approval under any applicable laws, regulations or stock exchange

rules. If the Plan is terminated, the Plan shall remain in effect for Awards outstanding as of its termination. No amendment, suspension

or termination of the Plan shall adversely affect the rights of the holder of any outstanding Award without his or her consent.

9.6 Foreign

Jurisdictions

The Committee may adopt, amend and terminate a supplement

to the Plan to permit Employees in another country to receive Awards under the supplement (on terms not inconsistent with the terms of

Awards under the Plan) in compliance with that country’s securities, tax and other laws.

9.7 No

Right To Employment

Nothing in this Plan or in any Award Agreement shall

give any person the right to continue in the employ of the Company or any Subsidiary or limit the right of the Company or Subsidiary to

terminate his or her employment.

9.8 Notices

Notices required or permitted under this Plan shall

be considered to have been duly given if sent by certified or registered mail addressed to the Committee at the Company’s principal

office or to any other person at his or her address as it appears on the Company’s payroll or other records.

9.9 Severability

If any provision of this Plan is held illegal or invalid

for any reason, the illegality or invalidity shall not affect the remaining provisions, and the Plan shall be construed and administered

as if the illegal or invalid provision had not been included.

9.10 Governing

Law

This Plan and all Award Agreements shall be governed

in accordance with the laws of the State of Delaware.

13

Exhibit 23.1

|

Tel: 602-956-3400

Fax: 602-956-3402

www.bdo.com |

2555 E. Camelback Road,

Suite 750

Phoenix, AZ 85016 |

Consent of Independent Registered Public Accounting

Firm

We hereby consent to the incorporation by reference in this Registration

Statement on Form S-8 of our report dated March 7, 2024, relating to the consolidated financial statements and the effectiveness of internal

control over financial reporting, of The Joint Corp. (the Company) appearing in the Company’s Annual Report on Form 10-K for the

year ended December 31, 2023.

We also consent to the reference to us under the caption

“Experts” in the Prospectus.

BDO USA, P.C.

Phoenix, Arizona

May 29, 2024

BDO USA, P.C., a Virginia

professional corporation, is the U.S. member of BDO International Limited, a UK company limited by guarantee, and forms part of the international

BDO network of independent member firms.

BDO is the brand name for

the BDO network and for each of the BDO Member Firms.

Exhibit 107

Calculation of Filing Fee Table

S-8

(Form Type)

The Joint Corp.

(Exact Name of Registrant as Specified in its Charter)

Table 1 – Newly Registered Securities

| Security Type |

Security Class Title |

Fee Calculation Rule |

Amount Registered (1) |

Proposed Maximum

Offering Price Per

Unit (2) |

Maximum

Aggregate Offering

Price (2) |

Fee Rate |

Amount of Registration Fee |

| Equity |

Common Stock, par value $0.001 per share |

Other (2) |

2,000,000 (3) |

$15.8950 |

$31,790,000.00 |

0.00014760 |

$4,692.20 |

| Total Offering Amounts |

|

|

|

$4,692.20 |

| Total Fee Offsets |

|

|

|

— |

| Net Fee Due |

|

|

|

$4,692.20 |

| (1) | Pursuant to Rule 416(a) promulgated under the Securities Act of 1933, as amended (the “Securities

Act”), this Registration Statement shall also cover any additional shares of The Joint Corp. (the “Registrant”) common

stock, par value $0.001 per share, that may become issuable under The Joint Corp. 2024 Incentive Stock Plan (the “Plan”) by

reason of any stock dividend, stock split, recapitalization, or any other similar transaction that results in an increase in the number

of the outstanding shares of common stock of the Registrant. |

| (2) | Pursuant to Rule 457(c) and 457(h)(1) under the Securities Act, the proposed maximum offering price per

share and the proposed maximum aggregate offering price for the shares have been calculated solely for the purpose of computing the registration

fee on the basis of the average high and low prices of the Registrant’s common stock as reported by the Nasdaq Stock Market LLC

on May 28, 2024. |

| (3) | Represents shares of common stock authorized for issuance under the Plan. |

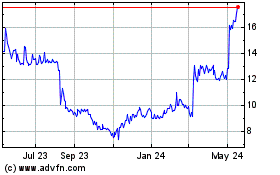

Joint (NASDAQ:JYNT)

Historical Stock Chart

From May 2024 to Jun 2024

Joint (NASDAQ:JYNT)

Historical Stock Chart

From Jun 2023 to Jun 2024