Kentucky First Federal Bancorp (Nasdaq: KFFB), the holding company

(the “Company”) for First Federal Savings and Loan Association of

Hazard and First Federal Savings Bank of Kentucky, Frankfort,

Kentucky, announced net earnings of $334,000 or $0.04 diluted

earnings per share for the three months ended March 31, 2022,

compared to net earnings of $473,000 or $0.06 diluted earnings per

share for the three months ended March 31, 2021, a decrease of

$139,000 or 29.4%. Net earnings were $1.4 million or $0.17 diluted

earnings per share for the nine months ended March 31, 2022,

compared to net earnings of $1.1 million or $0.14 diluted earnings

per share for the nine months ended March 31, 2021, an increase of

$256,000 or 22.7%.

The decrease in net earnings for the quarter

ended March 31, 2022 was primarily attributable to lower net

interest income and lower non-interest income, which were partially

offset by decreased non-interest expense and negative provision for

losses on loans. The increase in net earnings for the nine months

ended March 31, 2022, was primarily attributed to lower

non-interest expense and lower provision for losses on loans, which

were partially offset by decreased net interest income.

Net interest income decreased $310,000 or 12.7%

and totaled $2.1 million for the quarter ended March 31, 2022,

primarily because interest income decreased more than interest

expense decreased. Interest income decreased $379,000 or 12.9% and

totaled $2.6 million for the recently-ended quarterly period due

primarily to a decreased average balance of interest-earning assets

period to period as well as a lower average interest rate earned on

those assets. Interest expense decreased $69,000 or 14.0% and

totaled $423,000 for the three months just ended primarily due to

lower average interest rates paid on funding sources. Non-interest

income decreased $88,000 or 48.4% to $94,000 for the recently ended

quarter due primarily to decreased net gains on sales of loans. The

decrease in net gains on sales of loans was primarily due to a

reduction in volume of loans sold during the comparable period. The

Company sells most of its long-term, fixed-rate mortgage loans to

the Federal Home Loan Bank of Cincinnati, while retaining the

servicing rights on the loans. With recent increases in market

interest rates, the Company is experiencing lower demand for

long-term, fixed-rate mortgages that can be sold.

Non-interest expense decreased $148,000 or 7.3%

to $1.9 million for the quarter ended March 31, 2022, due primarily

to a decrease in employee compensation and benefits. The Company’s

required contribution to its defined benefit (“DB”) pension plan

for the current fiscal year has decreased. The Company’s DB plan

administrator estimates contributions for the fiscal year ending

June 30, 2022, to be approximately $376,000, compared to $955,000

in contributions for the fiscal year ended June 30, 2021. The

Company recorded a $106,000 negative provision for loan losses for

the three-month period ended March 31, 2022, compared to no

provision recorded for the prior year quarter. The negative

provision was due in part to continued strong repayment performance

of the Company’s loan portfolio. In calculating the allowance for

loan and lease losses, management considers historical losses which

have been reduced considerably due to a strong real estate market.

Further, the volume in the overall portfolio has declined over the

most recent three quarters, particularly in certain areas for which

management weight heavier in its loss analysis, such as

multi-family loans.

The increase in net earnings on a nine-month

basis was primarily attributable to lower non-interest expense, and

decreased provision for loan losses, which were partially offset by

decreased net interest income, increased provision for income tax,

and decreased non-interest income.

Non-interest expense decreased $385,000 or 6.3%

to $5.7 million for the nine months ended March 31, 2022, due

primarily to a decrease in the Company’s required contribution to

its DB pension plan, referenced above. The Company recorded a

$106,000 negative provision for loan losses for the nine-month

period just ended, compared to a provision of $192,000 recorded for

the prior year period.

Net interest income decreased $335,000 or 4.6%

and totaled $7.0 million for the nine months ended March 31, 2022,

as interest income decreased more than interest expense decreased.

Interest income decreased $655,000 or 7.3% and totaled $8.3 million

for the nine months just ended primarily due to a decrease in the

average rate earned on the assets, although the average volume of

assets also decreased period to period. Interest expense decreased

$320,000 or 19.3% and totaled $1.3 million for the nine months just

ended, primarily due to a decrease in the average rate paid on

funding sources. Income tax expense increased $81,000 or 27.6% to

$374,000 for the nine months just ended, primarily due to the Banks

now being subject to Kentucky corporate income tax. Non-interest

income decreased $11,000 or 2.5% and totaled $422,000 for the

recently-ended nine month period, primarily due to decreased net

gains on sales of loans.

At March 31, 2022, assets totaled $333.9

million, a decrease of $4.2 million or 1.2%, compared to $338.1

million at June 30, 2021. The decrease in assets was attributed

primarily to a $28.5 million or 9.6% decrease in loans, net, which

totaled $269.4 million at March 31, 2022, while cash and cash

equivalents increased $24.4 million or 112.8% to $46.1 million. The

decrease in loans is primarily due to the combined effect of: the

fact that certain borrowers sold their real estate holdings to

realize the benefit of increased market values; certain

borrowers sold properties due to age or health issues; and

management’s determination not to match terms of certain loans

offered by other financial institutions that management did not

believe to be prudent. Deposits increased $11.8 million or 5.2% to

$238.6 million at March 31, 2022 compared to June 30, 2021 while

advances decreased $16.1 million or 28.3% to $40.8 million at the

end of the period.

At March 31, 2022, the Company reported its book

value per share as $6.41. The change in shareholders’ equity was

primarily associated with net profits for the period, less

dividends paid on common stock and common stock repurchased for

treasury purposes.

This press release may contain statements that

are forward-looking, as that term is defined by the Private

Securities Litigation Act of 1995 or the Securities and Exchange

Commission in its rules, regulations and releases. The Company

intends that such forward-looking statements be subject to the safe

harbors created thereby. All forward-looking statements are based

on current expectations regarding important risk factors including,

but not limited to, real estate values, the impact of interest

rates on financing, changes in general economic conditions,

legislative and regulatory changes that adversely affect the

business of the Company, changes in the securities markets and the

Risk Factors described in Item 1A of the Company’s Annual Report on

Form 10-K for the year ended June 30, 2021. Accordingly, actual

results may differ from those expressed in the forward-looking

statements, and the making of such statements should not be

regarded as a representation by the Company or any other person

that results expressed therein will be achieved.

Kentucky First Federal Bancorp is the parent

company of First Federal Savings and Loan Association of Hazard,

which operates one banking office in Hazard, Kentucky and First

Federal Savings Bank of Kentucky, which operates three banking

offices in Frankfort, Kentucky, two banking offices in Danville,

Kentucky and one banking office in Lancaster, Kentucky. Kentucky

First Federal Bancorp shares are traded on the Nasdaq National

Market under the symbol KFFB. At March 31, 2022, the Company had

approximately 8,218,215 shares outstanding of which approximately

57.5% was held by First Federal MHC.

|

SUMMARY OF FINANCIAL HIGHLIGHTS |

|

|

Condensed Consolidated Balance Sheets |

|

|

|

|

|

|

|

|

| (In

thousands, except share data) |

|

|

March

31, |

|

|

|

June

30, |

|

| |

|

|

2022 |

|

|

|

2021 |

|

|

ASSETS |

|

|

(Unaudited) |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

46,061 |

|

|

$ |

21,648 |

|

| |

|

|

|

|

|

|

|

|

| Time

deposits in other financial institutions |

|

|

-- |

|

|

|

247 |

|

|

Investment Securities |

|

|

387 |

|

|

|

495 |

|

|

Loans available-for sale |

|

|

1,342 |

|

|

|

1,307 |

|

|

Loans, net |

|

|

269,396 |

|

|

|

297,902 |

|

| |

|

|

|

|

|

|

|

|

|

Real estate acquired through foreclosure |

|

|

61 |

|

|

|

82 |

|

|

Goodwill |

|

|

947 |

|

|

|

947 |

|

|

Other Assets |

|

|

15,704 |

|

|

|

15,435 |

|

|

Total Assets |

|

$ |

333,898 |

|

|

$ |

338,063 |

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

Deposits |

|

$ |

238,642 |

|

|

$ |

226,843 |

|

|

FHLB Advances |

|

|

40,782 |

|

|

|

56,873 |

|

|

Other Liabilities |

|

|

1,828 |

|

|

|

2,051 |

|

|

Total liabilities |

|

|

281,252 |

|

|

|

285,767 |

|

|

Shareholders' Equity |

|

|

52,646 |

|

|

|

52,296 |

|

|

Total liabilities and shareholders' equity |

|

$ |

333,898 |

|

|

$ |

338,063 |

|

| Book value

per share |

|

$ |

6.41 |

|

|

$ |

6.36 |

|

| Tangible

book value per share |

|

$ |

6.29 |

|

|

$ |

6.25 |

|

| Outstanding

shares |

|

|

8,218,215 |

|

|

|

8,222,046 |

|

| |

|

|

|

|

|

|

|

|

| Condensed

Consolidated Statements of Income |

|

|

|

|

|

| (In thousands, except share

data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Nine months ended March 31, |

|

|

|

Three months ended March 31, |

|

| |

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

2021 |

| |

|

(Unaudited) |

|

|

|

(Unaudited) |

|

Interest Income |

|

$ |

8,316 |

|

|

$ |

8,971 |

|

|

$ |

2,561 |

|

|

$ |

2,940 |

|

| Interest Expense |

|

|

1,340 |

|

|

|

1,660 |

|

|

|

423 |

|

|

|

492 |

|

| Net Interest Income |

|

|

6,976 |

|

|

|

7,311 |

|

|

|

2,138 |

|

|

|

2,448 |

|

| Provision for Losses on

Loans |

|

|

(106 |

) |

|

|

192 |

|

|

|

(106 |

) |

|

|

-- |

|

| Non-interest Income |

|

|

422 |

|

|

|

433 |

|

|

|

94 |

|

|

|

182 |

|

| Non-interest Expense |

|

|

5,746 |

|

|

|

6,131 |

|

|

|

1,871 |

|

|

|

2,019 |

|

| Income Before Income

Taxes |

|

|

1,758 |

|

|

|

1,421 |

|

|

|

467 |

|

|

|

611 |

|

| Income Taxes |

|

|

374 |

|

|

|

293 |

|

|

|

133 |

|

|

|

138 |

|

| Net Income |

|

$ |

1,384 |

|

|

$ |

1,128 |

|

|

$ |

334 |

|

|

$ |

473 |

|

| Earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and Diluted |

|

$ |

0.17 |

|

|

$ |

0.14 |

|

|

$ |

0.04 |

|

|

$ |

0.06 |

|

| Weighted average outstanding

shares: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and Diluted |

|

|

8,216,989 |

|

|

|

8,217,654 |

|

|

|

8,215,825 |

|

|

|

8,211,789 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contact: |

|

Don Jennings, President, or Clay Hulette, Vice President (502)

223-1638 216 West Main Street P.O. Box 535 Frankfort, KY 40602 |

|

|

|

|

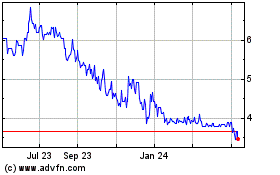

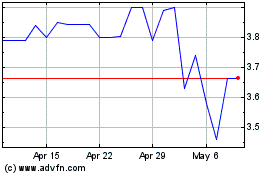

Kentucky First Federal B... (NASDAQ:KFFB)

Historical Stock Chart

From Feb 2025 to Mar 2025

Kentucky First Federal B... (NASDAQ:KFFB)

Historical Stock Chart

From Mar 2024 to Mar 2025