Form 8-K - Current report

18 January 2024 - 7:23AM

Edgar (US Regulatory)

false

0001297341

0001297341

2024-01-16

2024-01-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 16, 2024

KENTUCKY FIRST FEDERAL BANCORP

(Exact Name of Registrant as Specified in Its Charter)

| United States |

|

0-51176 |

|

61-1484858 |

| (State or other jurisdiction of |

|

(Commission File Number) |

|

(IRS Employer |

| incorporation or organization) |

|

|

|

Identification No.) |

| 655 Main Street, Hazard, Kentucky |

|

41702 |

| (Address of principal executive offices) |

|

(Zip Code) |

(502) 223-1638

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.01 par value per share |

|

KFFB |

|

The NASDAQ Stock Market LLC |

Item 8.01 Other Information.

On January 16 2024, Kentucky

First Federal Bancorp (the “Company”) announced that the Board of Directors has suspended the payment of the quarterly cash

dividend on the Company’s common stock indefinitely. For more information, reference is made to the Company’s press release

dated January 16, 2024, a copy of which is included as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(a) Not applicable

(b) Not applicable

(c) Not applicable

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

KENTUCKY FIRST FEDERAL BANCORP |

| |

|

|

| Date: January 17, 2024 |

By: |

/s/ Don D. Jennings |

| |

|

Don D. Jennings |

| |

|

President and Chief Executive Officer |

2

Exhibit 99.1

Kentucky First Federal Bancorp

Hazard, Frankfort, Danville and Lancaster, Kentucky

For Immediate Release January 16, 2024

Contact:

Kentucky First Federal Bancorp

Don Jennings, President

(502) 223-1638

KENTUCKY FIRST FEDERAL BANCORP ANNOUNCES

SUSPENSION OF QUARTERLY CASH DIVIDEND

Kentucky First Federal Bancorp

(Nasdaq: KFFB) (the “Company”), the holding company for First Federal Savings and Loan Association of Hazard, Kentucky and

First Federal Savings Bank of Kentucky, Frankfort, Kentucky (collectively the “Banks”), announced today that the Company’s

Board of Directors has voted to suspend the payment of the quarterly cash dividend on the Company’s common stock indefinitely. Emphasizing

that the Banks are both well-capitalized under all applicable regulatory requirements and that asset quality remains good, Don Jennings,

President and Chief Executive Office of the Company stated, “While the suspension of our quarterly dividend is very disappointing,

as previously disclosed, we have experienced historical increases in short-term market interest rates as well as a persistent inversion

of the yield curve that has resulted in compressed net interest margins and much lower earnings at the bank level. As designed, our loans

are repricing in response to the higher rate environment, but due to contractual terms of those loans, increases are restricted as to

time and amount, resulting in a slower pace of increase than that of liabilities. Currently, lower earnings limit the Banks’ ability

to stream sufficient funds to the Company to fund operations and dividends while still maintaining adequate liquidity at the Banks to

fund operations and loan growth. While the Board continues to believe in a strong Company dividend policy, all of these factors, coupled

with regulators’ enhanced scrutiny on liquidity and bank dividend payout ratios to their holding companies relative to bank earnings,

necessitate this change. While, future dividend payments will be dependent upon the Banks’ ability to generate positive retained

earnings and enhanced liquidity, the Board intends to re-evaluate the payment of a quarterly dividend in the future as soon as possible.”

Forward-Looking Statements

This press release may contain

statements that are forward-looking, as that term is defined by the Private Securities Litigation Act of 1995 or the Securities and Exchange

Commission in its rules, regulations and releases. The Company intends that such forward-looking statements be subject to the safe harbors

created thereby. All forward-looking statements are based on current expectations regarding important risk factors including, but not

limited to: general economic conditions; prices for real estate in the Company’s market areas; the interest rate environment and

the impact of the interest rate environment on our business, financial condition and results of operations; our ability to successfully

executive our strategy to increase earnings, increase core deposits, reduce reliance on higher cost funding sources and shift more of

our loan portfolio towards higher-earning loans enhance our liquidity; our ability to pay future dividends and if so at what level; our

ability to receive any required regulatory approval or non-objection for the payment of dividends from the Banks to the Company or from

the Company to shareholders; competitive conditions in the financial services industry; changes in the level of inflation; changes in

the demand for loans, deposits and other financial services that we provide; the possibility that future credit losses may be higher than

currently expected; competitive pressures among financial services companies; the ability to attract, develop and retain qualified employees;

our ability to maintain the security of our data processing and information technology systems; the outcome of pending or threatened litigation,

or of matters before regulatory agencies; changes in law, governmental policies and regulations, rapidly changing technology affecting

financial services, and the Risk Factors described in the Company’s Annual Report on Form 10-K for the year ended June 30, 2023

and in the Company’s Quarterly Report on Form 10-Q for the period ended September 30, 2023. Accordingly, actual results may differ

from those expressed in the forward-looking statements, and the making of such statements should not be regarded as a representation by

the Company or any other person that results expressed therein will be achieved.

About Kentucky First Federal Bancorp

Kentucky First Federal Bancorp

is the parent company of First Federal Savings and Loan Association of Hazard, which operates one banking office in Hazard, Kentucky and

First Federal Savings Bank of Kentucky, which operates three banking offices in Frankfort, Kentucky, two banking offices in Danville,

Kentucky and one banking office in Lancaster, Kentucky. Kentucky First Federal Bancorp shares are traded on the Nasdaq National Market

under the symbol KFFB. At September 30, 2023, the Company had approximately 8,097,695 shares outstanding of which approximately 58.4%

was held by First Federal MHC.

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

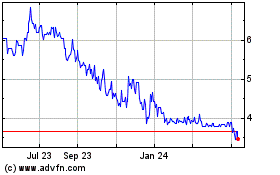

Kentucky First Federal B... (NASDAQ:KFFB)

Historical Stock Chart

From Mar 2025 to Apr 2025

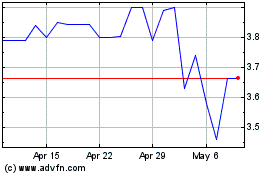

Kentucky First Federal B... (NASDAQ:KFFB)

Historical Stock Chart

From Apr 2024 to Apr 2025