Katapult Announces 1-for-25 Reverse Stock Split of Common Stock

12 July 2023 - 6:45AM

Katapult Holdings, Inc. (“Katapult”) (NASDAQ: KPLT), an

e-commerce-focused financial technology company, today announced

that its Board of Directors has approved a 1-for 25 reverse stock

split (the “Reverse Stock Split”) of Katapult’s common stock, par

value $0.0001 per share (the “Common Stock”). The Reverse Stock

Split was approved by Katapult’s stockholders at the Annual Meeting

of Stockholders held virtually on June 6, 2023. The Reverse Stock

Split will become effective at 5:01 p.m. Eastern Time on July 27,

2023, and the Common Stock will open for trading on The Nasdaq

Stock Market (“Nasdaq”) on a reverse split-adjusted basis on July

28, 2023 under the existing trading symbol “KPLT.”

The new CUSIP number for the Common Stock following the Reverse

Stock Split will be 485859 201. Katapult’s publicly traded warrants

will continue to be traded on the Nasdaq under the symbol “KPLTW”

and the CUSIP number for the warrants will remain unchanged.

At the effective time of the Reverse Stock Split, every 25

shares of Common Stock either issued and outstanding or held as

treasury stock will be automatically reclassified into one new

share of Common Stock. The par value per share of the Common Stock

will remain unchanged at $0.0001.

As a result of the Reverse Stock Split, proportionate

adjustments will be made to the number of shares of Common Stock

underlying Katapult’s outstanding equity awards and the number of

shares issuable under Katapult’s equity incentive plans and certain

existing agreements, as well as the exercise, grant and acquisition

prices of such equity awards, as applicable.

In addition, proportionate adjustments will be made to

Katapult’s outstanding warrants, resulting in: (i) each publicly

traded warrant issued under the Warrant Agreement, dated October

31, 2019, becoming exercisable for 1/25th of a share of Common

Stock at an exercise price of $287.50 per whole share; and (ii) the

warrant under the Warrant to Purchase Stock, dated March 6, 2023,

issued by Katapult to Midtown Madison Management LLC, becoming

exercisable for up to 160,000 shares of Common Stock at an exercise

price of $0.25 per share.

No fractional shares will be issued in connection with the

Reverse Stock Split. Stockholders who would otherwise be entitled

to receive fractional shares as a result of the Reverse Stock Split

will be entitled to receive one full share of post-Reverse Stock

Split Common Stock, in lieu of receiving such fractional

shares.

Continental Stock Transfer & Trust Company is acting as

transfer and exchange agent for the Reverse Stock Split. Registered

stockholders who hold shares of Common Stock are not required to

take any action to receive post-Reverse Stock Split shares of

Common Stock. If a stockholder is entitled to post-Reverse Stock

Split shares of Common Stock, a transaction statement will

automatically be sent to the stockholder’s address of record

indicating the number of shares (including fractional shares) of

Common Stock held following the Reverse Stock Split. Stockholders

owning shares via a broker, bank, trust or other nominee will have

their positions automatically adjusted to reflect the Reverse Stock

Split, subject to such broker's particular processes, and will not

be required to take any action in connection with the Reverse Stock

Split.

Additional information about the Reverse Stock Split can be

found in Katapult’s definitive proxy statement filed with the

Securities and Exchange Commission (the “SEC”) on April 25, 2023,

which is available free of charge at the SEC’s

website, www.sec.gov, and on Katapult’s website

at ir.katapultholdings.com.

About Katapult

Katapult is a technology driven lease-to-own platform that

integrates with omni-channel retailers and e-commerce platforms to

power the purchasing of everyday durable goods for underserved U.S.

non-prime consumers. Through our point-of-sale (POS) integrations

and innovative, mobile app featuring Katapult Pay™, consumers who

may be unable to access traditional financing can shop a growing

network of merchant partners. Our process is simple, fast, and

transparent. We believe that seeing the good in people is good for

business, humanizing the way underserved consumers get the things

they need with payment solutions based on fairness and dignity.

Forward-Looking Statements

The information in this press release includes “forward-looking

statements” within the meaning of the safe harbor provisions of the

United States Private Securities Litigation Reform Act of 1995.

Forward-looking statements generally are accompanied by words such

as “anticipate,” “assume” “believe,” “continue,” “could,” “design,”

“estimate,” “expect,” “intend,” “may,” “plan,” “potentially,”

“predict,” “seek,” “should,” “will,” “would,” or the negative of

these terms or other similar expressions that predict or indicate

future events or trends or that are not statements of historical

matters. Such statements may include, but are not limited to,

statements about the Reverse Stock Split and the timing thereof, as

well as the trading of the Common Stock. These statements are based

on current expectations on the date of this press release and

involve a number of risks and uncertainties that may cause actual

results to differ significantly. Further information on factors

that could cause Katapult’s actual results to differ materially

from the results anticipated by Katapult’s forward-looking

statements is included in the reports Katapult has filed with the

U.S. Securities and Exchange Commission. Katapult does not assume

any obligation to update or revise any such forward-looking

statements, whether as the result of new developments or otherwise.

Readers are cautioned not to put undue reliance on forward-looking

statements.

Contact

ir@katapult.com

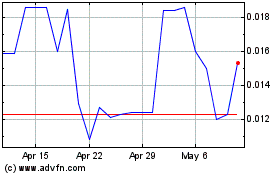

Katapult (NASDAQ:KPLTW)

Historical Stock Chart

From Oct 2024 to Nov 2024

Katapult (NASDAQ:KPLTW)

Historical Stock Chart

From Nov 2023 to Nov 2024