Kura Sushi USA, Inc. (“Kura Sushi” or the “Company”) (NASDAQ:

KRUS), a technology-enabled Japanese restaurant concept, today

announced financial results for the fiscal third quarter ended May

31, 2023.

Fiscal Third Quarter 2023

Highlights

- Total sales were

$49.2 million, compared to $38.0 million in the third quarter of

2022;

- Comparable restaurant sales

increased 10.3% for the third quarter of 2023 as compared to the

third quarter of 2022;

- Operating income was $1.3 million,

compared to operating income of $0.5 million in the third quarter

of 2022;

- Net income was $1.7 million, or

$0.16 per diluted share, compared to net income of $0.5 million, or

$0.05 per diluted share, in the third quarter of 2022;

- Restaurant-level operating profit*

was $11.6 million, or 23.5% of sales;

- Adjusted EBITDA* was $5.1 million;

and

- One new restaurant opened during

the fiscal third quarter of 2023.

* Restaurant-level operating profit and Adjusted

EBITDA are non-GAAP measures and are defined below under “Key

Financial Definitions.” Please see the reconciliation of non-GAAP

measures accompanying this release. See also “Non-GAAP Financial

Measures” below.

Hajime Uba, President and Chief Executive Officer of Kura Sushi,

stated, “I’m pleased to announce another excellent quarter for Kura

Sushi, both in terms of restaurant-level performance and corporate

initiatives. Year-over-year revenue has grown by approximately 30%,

driven by our aggressive unit growth and industry-leading

comparable sales trends. Our G&A leveraging efforts continue to

bear fruit, with an improvement of 130 basis points over the prior

year, as well. I’m exceptionally proud to see Kura Sushi continue

to mature as a company as it expands its footprint and takes

strides towards greater profitability.”

Follow-on Offering of Common

Stock

During the third quarter of 2023, the Company

completed an underwritten public offering of 1,265,000 shares of

its Class A common stock at a public offering price of $54.00 per

share, including the exercise in full of the underwriters’ option

to purchase 165,000 additional shares of Class A common stock. The

Company received aggregate net proceeds from the offering, net of

underwriters’ discounts and commissions and offering expenses of

approximately $64.3 million.

Review of Fiscal Third Quarter 2023

Financial Results

Total sales were $49.2 million compared to $38.0

million in the third quarter of 2022. Comparable restaurant sales

increased 10.3% for the third quarter of 2023 as compared to the

third quarter of 2022.

Food and beverage costs as a percentage of sales

were 30.0% compared to 29.7% in the third quarter of 2022. The

increase is primarily due to food cost inflation, partially offset

by increases in menu prices.

Labor and related costs as a percentage of sales

decreased to 29.2% from 31.0% in the third quarter of 2022. The

decrease in cost as a percentage of sales was primarily due to

increases in menu prices and technological initiatives, partially

offset by increases in wage rates.

Occupancy and related expenses were $3.6 million

compared to $2.7 million in the third quarter of 2022. The increase

is primarily due to nine new restaurants opening since the third

quarter of 2022.

Other costs as a percentage of sales increased

to 12.5% compared to 11.5% in the third quarter of 2022. The

increase was primarily driven by advertising, repair and

maintenance and travel costs.

General and administrative expenses were $7.0

million compared to $5.9 million in the third quarter of 2022. This

increase was primarily due to compensation-related costs,

professional fees and travel costs. As a percentage of sales,

general and administrative expenses decreased to 14.2% from 15.5%

in the third quarter of 2022, primarily due to higher sales

leverage.

Operating income was $1.3 million compared to

operating income of $0.5 million in the third quarter of 2022.

Income tax expense was $41 thousand compared to

income tax benefit of $2 thousand in the third quarter of 2022.

Net income was $1.7 million, or $0.16 per

diluted share, compared to net income of $0.5 million, or $0.05 per

diluted share, in the third quarter of 2022.

Restaurant-level operating profit* was $11.6

million, or 23.5% of sales, compared to $8.5 million, or 22.5% of

sales, in the third quarter of 2022.

Adjusted EBITDA* was $5.1 million compared to

$3.2 million in the third quarter of 2022.

Restaurant Development

During the fiscal third quarter of 2023, the

Company opened one new restaurant in Buford, Georgia.

Subsequent to May 31, 2023, the Company opened

one new restaurant in Framingham, Massachusetts.

Fiscal Year 2023 Outlook

For the full fiscal year of 2023, the Company

reiterates and updates the following annual guidance:

- Total sales

between $187 million and $189 million;

- General and administrative expenses

as a percentage of sales to be between 15.0% and 15.5%; and

- 9 to 11 new restaurants, with

average net capital expenditures per unit of approximately $2.5

million.

The Company’s guidance assumes no material

changes in consumer behavior or broader macroeconomic trends.

Conference Call

A conference call and webcast to discuss Kura

Sushi’s financial results is scheduled for 5:00 p.m. ET today.

Hosting the conference call and webcast will be Hajime “Jimmy” Uba,

President and Chief Executive Officer, Jeff Uttz, Chief Financial

Officer, and Benjamin Porten, SVP Investor Relations & System

Development.

Interested parties may listen to the conference

call via telephone by dialing 201-689-8471. A telephone replay will

be available shortly after the call has concluded and can be

accessed by dialing 412-317-6671; the passcode is 13739075. The

webcast will be available at www.kurasushi.com under the investor

relations section and will be archived on the site shortly after

the call has concluded.

About Kura Sushi USA, Inc.

Kura Sushi USA, Inc. is a technology-enabled

Japanese restaurant concept with 47 locations across 14 states and

Washington DC. The Company offers guests a distinctive dining

experience built on authentic Japanese cuisine and an engaging

revolving sushi service model. Kura Sushi USA, Inc. was established

in 2008 as a subsidiary of Kura Sushi, Inc., a Japan-based

revolving sushi chain with over 500 restaurants and 40 years of

brand history. For more information, please visit

www.kurasushi.com.

Key Financial Definitions

EBITDA, a non-GAAP measure, is

defined as net income (loss) before interest, income taxes and

depreciation and amortization expenses.

Adjusted EBITDA, a non-GAAP

measure, is defined as EBITDA plus stock-based compensation

expense, non-cash lease expense and asset disposals, closure costs

and restaurant impairments, that the Company believes are not

indicative of its core operating results. Adjusted EBITDA margin is

defined as adjusted EBITDA divided by sales.

Restaurant-level Operating Profit

(Loss), a non-GAAP measure, is defined as operating income

(loss) plus depreciation and amortization expenses; stock-based

compensation expense; pre-opening costs and general and

administrative expenses which are considered normal, recurring,

cash operating expenses and are essential to supporting the

development and operations of restaurants; non-cash lease expense;

and asset disposals, closure costs and restaurant impairments; less

corporate-level stock-based compensation expense recognized within

general and administrative expenses. Restaurant-level operating

profit (loss) margin is defined as restaurant-level operating

profit (loss) divided by sales.

Comparable Restaurant Sales

Performance refers to the change in year-over-year sales

for the comparable restaurant base. The Company includes

restaurants in the comparable restaurant base that have been in

operation for at least 18 months prior to the start of the

accounting period presented due to new restaurants experiencing a

period of higher sales upon opening, including those temporarily

closed for renovations during the year. For restaurants that were

temporarily closed for renovations during the year, the Company

makes fractional adjustments to sales such that sales are

annualized in the associated period. Performance in comparable

restaurant sales represents the percent change in sales from the

same period in the prior year for the comparable restaurant

base.

Non-GAAP Financial Measures

To supplement the condensed financial statements

presented in accordance with U.S. generally accepted accounting

principles (“GAAP”), the Company presents certain financial

measures, such as adjusted net income (loss), EBITDA, adjusted

EBITDA, adjusted EBITDA margin, restaurant-level operating profit

(loss) and restaurant-level operating profit (loss) margin

(“non-GAAP measures”) that are not recognized under GAAP. These

non-GAAP measures are intended as supplemental measures of its

performance that are neither required by, nor presented in

accordance with, GAAP. The Company is presenting these non-GAAP

measures because the Company believes that they provide useful

information to management and investors regarding certain financial

and business trends relating to its financial condition and

operating results. These measures also may not provide a complete

understanding of the operating results of the Company as a whole

and such measures should be reviewed in conjunction with its GAAP

financial results. Additionally, the Company presents

restaurant-level operating profit (loss) because it excludes the

impact of general and administrative expenses which are not

incurred at the restaurant-level. The Company also uses

restaurant-level operating profit (loss) to measure operating

performance and returns from opening new restaurants.

The Company believes that the use of these

non-GAAP financial measures provides an additional tool for

investors to use in evaluating ongoing operating results and trends

and in comparing the Company’s financial measures with those of

comparable companies, which may present similar non-GAAP financial

measures to investors. However, you should be aware that

restaurant-level operating profit (loss) and restaurant-level

operating profit (loss) margin are financial measures which are not

indicative of overall results for the Company, and restaurant-level

operating profit (loss) and restaurant-level operating profit

(loss) margin do not accrue directly to the benefit of stockholders

because of corporate-level and certain other expenses excluded from

such measures. In addition, you should be aware when evaluating

these non-GAAP financial measures that in the future the Company

may incur expenses similar to those excluded when calculating these

measures. The Company’s presentation of these measures should not

be construed as an inference that its future results will be

unaffected by unusual or non-recurring items. The Company’s

computation of these non-GAAP financial measures may not be

comparable to other similarly titled measures computed by other

companies, because all companies may not calculate these non-GAAP

financial measures in the same fashion. Because of these

limitations, these non-GAAP financial measures should not be

considered in isolation or as a substitute for performance measures

calculated in accordance with GAAP. The Company compensates for

these limitations by relying primarily on its GAAP results and

using these non-GAAP financial measures on a supplemental

basis.

Forward-Looking Statements

Except for historical information contained

herein, the statements in this press release or otherwise made by

the Company’s management in connection with the subject matter of

this press release are forward-looking statements (as such term is

defined in the Private Securities Litigation Reform Act of 1995)

and involve risks and uncertainties and are subject to change based

on various important factors. This press release includes

forward-looking statements that are based on management’s current

estimates or expectations of future events or future results. These

statements are not historical in nature and can generally be

identified by such words as “target,” “may,” “might,” “will,”

“objective,” “intend,” “should,” “could,” “can,” “would,” “expect,”

“believe,” “design,” “estimate,” “continue,” “predict,”

“potential,” “plan,” “anticipate” or the negative of these terms,

and similar expressions. Management’s expectations and assumptions

regarding future results are subject to risks, uncertainties and

other factors that could cause actual results to differ materially

from the anticipated results or other expectations expressed in the

forward-looking statements included in this press release. These

risks and uncertainties include but are not limited to: the impact

of a potential resurgence of the COVID-19 pandemic or an outbreak

of other highly contagious viruses; the Company’s ability to

successfully maintain increases in our comparable restaurant sales;

the Company’s ability to successfully execute our growth strategy

and open new restaurants that are profitable; the Company’s ability

to expand in existing and new markets; the Company’s projected

growth in the number of its restaurants; macroeconomic conditions

and other economic factors, including rising interest rates, the

possibility of a recession and instability in financial markets;

the Company’s ability to compete with many other restaurants; the

Company’s reliance on vendors, suppliers and distributors,

including its majority stakeholder Kura Sushi, Inc.; changes in

food and supply costs, including the impact of inflation and

tariffs; concerns regarding food safety and foodborne illness;

changes in consumer preferences and the level of acceptance of the

Company’s restaurant concept in new markets; minimum wage increases

and mandated employee benefits that could cause a significant

increase in labor costs, as well as the impact of labor

availability; the failure of the Company’s automated equipment or

information technology systems or the breach of its network

security; the loss of key members of the Company’s management team;

the impact of governmental laws and regulations; volatility in the

price of the Company’s common stock; and other risks and

uncertainties as described in the Company’s filings with the

Securities and Exchange Commission (“SEC”). These and other factors

that could cause results to differ materially from those described

in the forward-looking statements contained in this press release

can be found in the Company’s other filings with the SEC. Undue

reliance should not be placed on forward-looking statements, which

are only current as of the date they are made. The Company assumes

no obligation to update or revise its forward-looking statements,

except as may be required by applicable law.

Investor Relations Contact:Jeff Priester or

Steven Boediarto(657) 333-4010investor@kurausa.com

|

Kura Sushi USA, Inc. |

|

|

Condensed Statements of Operations and Comprehensive Income

(Loss) |

|

|

(in thousands, except per share amounts;

unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended May 31, |

|

|

Nine months ended May 31, |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Sales |

|

$ |

49,238 |

|

|

$ |

37,969 |

|

|

$ |

132,500 |

|

|

$ |

99,091 |

|

| Restaurant operating costs: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Food and beverage costs |

|

|

14,770 |

|

|

|

11,282 |

|

|

|

40,440 |

|

|

|

29,615 |

|

|

Labor and related costs |

|

|

14,362 |

|

|

|

11,788 |

|

|

|

40,751 |

|

|

|

31,840 |

|

|

Occupancy and related expenses |

|

|

3,554 |

|

|

|

2,693 |

|

|

|

9,504 |

|

|

|

7,195 |

|

|

Depreciation and amortization expenses |

|

|

1,975 |

|

|

|

1,376 |

|

|

|

5,309 |

|

|

|

3,814 |

|

|

Other costs |

|

|

6,165 |

|

|

|

4,372 |

|

|

|

17,352 |

|

|

|

12,326 |

|

|

Total restaurant operating costs |

|

|

40,826 |

|

|

|

31,511 |

|

|

|

113,356 |

|

|

|

84,790 |

|

| General and administrative

expenses |

|

|

7,012 |

|

|

|

5,900 |

|

|

|

20,776 |

|

|

|

16,714 |

|

| Depreciation and amortization

expenses |

|

|

92 |

|

|

|

85 |

|

|

|

265 |

|

|

|

256 |

|

|

Total operating expenses |

|

|

47,930 |

|

|

|

37,496 |

|

|

|

134,397 |

|

|

|

101,760 |

|

| Operating income (loss) |

|

|

1,308 |

|

|

|

473 |

|

|

|

(1,897 |

) |

|

|

(2,669 |

) |

| Other expense (income): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

23 |

|

|

|

23 |

|

|

|

53 |

|

|

|

70 |

|

|

Interest income |

|

|

(436 |

) |

|

|

(25 |

) |

|

|

(593 |

) |

|

|

(75 |

) |

| Income (loss) before income

taxes |

|

|

1,721 |

|

|

|

475 |

|

|

|

(1,357 |

) |

|

|

(2,664 |

) |

| Income tax expense (benefit) |

|

|

41 |

|

|

|

(2 |

) |

|

|

66 |

|

|

|

13 |

|

| Net income (loss) |

|

$ |

1,680 |

|

|

$ |

477 |

|

|

$ |

(1,423 |

) |

|

$ |

(2,677 |

) |

| Net income (loss) per Class A and

Class B shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.16 |

|

|

$ |

0.05 |

|

|

$ |

(0.14 |

) |

|

$ |

(0.28 |

) |

|

Diluted |

|

$ |

0.16 |

|

|

$ |

0.05 |

|

|

$ |

(0.14 |

) |

|

$ |

(0.28 |

) |

| Weighted average Class A and

Class B shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

10,485 |

|

|

|

9,722 |

|

|

|

10,028 |

|

|

|

9,714 |

|

|

Diluted |

|

|

10,807 |

|

|

|

10,069 |

|

|

|

10,028 |

|

|

|

9,714 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive income

(loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized loss on short-term investments |

|

$ |

(7 |

) |

|

|

— |

|

|

$ |

(7 |

) |

|

|

— |

|

| Comprehensive income (loss) |

|

$ |

1,673 |

|

|

$ |

477 |

|

|

$ |

(1,430 |

) |

|

$ |

(2,677 |

) |

|

Kura Sushi USA, Inc. |

|

|

Selected Balance Sheet Data and Selected Operating

Data |

|

|

(in thousands, except restaurants and percentages;

unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

May 31, 2023 |

|

|

August 31, 2022 |

|

| Selected Balance Sheet

Data: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

70,474 |

|

|

$ |

35,782 |

|

| Total assets |

|

$ |

286,248 |

|

|

$ |

201,356 |

|

| Total liabilities |

|

$ |

126,508 |

|

|

$ |

108,062 |

|

| Total stockholders’ equity |

|

$ |

159,740 |

|

|

$ |

93,294 |

|

|

|

|

Three months ended May 31, |

|

|

Nine months ended May 31, |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Selected Operating

Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Restaurants at the end of period |

|

|

46 |

|

|

|

37 |

|

|

|

46 |

|

|

|

37 |

|

| Comparable restaurant sales

performance |

|

|

10.3 |

% |

|

|

65.3 |

% |

|

|

11.0 |

% |

|

|

118.7 |

% |

| EBITDA |

|

$ |

3,375 |

|

|

$ |

1,934 |

|

|

$ |

3,677 |

|

|

$ |

1,401 |

|

| Adjusted EBITDA |

|

$ |

5,118 |

|

|

$ |

3,183 |

|

|

$ |

8,065 |

|

|

$ |

4,361 |

|

|

Adjusted EBITDA margin |

|

|

10.4 |

% |

|

|

8.4 |

% |

|

|

6.1 |

% |

|

|

4.4 |

% |

| Operating income (loss) |

|

$ |

1,308 |

|

|

$ |

473 |

|

|

$ |

(1,897 |

) |

|

$ |

(2,669 |

) |

|

Operating income (loss) margin |

|

|

2.7 |

% |

|

|

1.2 |

% |

|

|

(1.4 |

)% |

|

|

(2.7 |

)% |

| Restaurant-level operating

profit |

|

$ |

11,576 |

|

|

$ |

8,543 |

|

|

$ |

27,664 |

|

|

$ |

19,919 |

|

|

Restaurant-level operating profit margin |

|

|

23.5 |

% |

|

|

22.5 |

% |

|

|

20.9 |

% |

|

|

20.1 |

% |

|

Kura Sushi USA, Inc. |

|

|

Reconciliation of Net Income (Loss) to EBITDA and Adjusted

EBITDA |

|

|

(in thousands; unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended May 31, |

|

|

Nine months ended May 31, |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Net income (loss) |

|

$ |

1,680 |

|

|

$ |

477 |

|

|

$ |

(1,423 |

) |

|

$ |

(2,677 |

) |

|

Interest income, net |

|

|

(413 |

) |

|

|

(2 |

) |

|

|

(540 |

) |

|

|

(5 |

) |

|

Income tax expense (benefit) |

|

|

41 |

|

|

|

(2 |

) |

|

|

66 |

|

|

|

13 |

|

|

Depreciation and amortization expenses |

|

|

2,067 |

|

|

|

1,461 |

|

|

|

5,574 |

|

|

|

4,070 |

|

| EBITDA |

|

|

3,375 |

|

|

|

1,934 |

|

|

|

3,677 |

|

|

|

1,401 |

|

|

Stock-based compensation expense(1) |

|

|

975 |

|

|

|

732 |

|

|

|

2,570 |

|

|

|

1,771 |

|

|

Non-cash lease expense(2) |

|

|

768 |

|

|

|

517 |

|

|

|

1,818 |

|

|

|

1,189 |

|

| Adjusted EBITDA |

|

$ |

5,118 |

|

|

$ |

3,183 |

|

|

$ |

8,065 |

|

|

$ |

4,361 |

|

|

Kura Sushi USA, Inc. |

|

|

Reconciliation of Operating Income (Loss) to

Restaurant-level Operating Profit |

|

|

(in thousands; unaudited) |

|

|

|

|

|

|

|

Three months ended May 31, |

|

|

Nine months ended May 31, |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Operating income (loss) |

|

$ |

1,308 |

|

|

$ |

473 |

|

|

$ |

(1,897 |

) |

|

$ |

(2,669 |

) |

|

Depreciation and amortization expenses |

|

|

2,067 |

|

|

|

1,461 |

|

|

|

5,574 |

|

|

|

4,070 |

|

|

Stock-based compensation expense(1) |

|

|

975 |

|

|

|

732 |

|

|

|

2,570 |

|

|

|

1,771 |

|

|

Pre-opening costs(3) |

|

|

258 |

|

|

|

104 |

|

|

|

1,011 |

|

|

|

420 |

|

|

Non-cash lease expense(2) |

|

|

768 |

|

|

|

517 |

|

|

|

1,818 |

|

|

|

1,189 |

|

|

General and administrative expenses |

|

|

7,012 |

|

|

|

5,900 |

|

|

|

20,776 |

|

|

|

16,714 |

|

|

Corporate-level stock-based compensation included in general and

administrative expenses |

|

|

(812 |

) |

|

|

(644 |

) |

|

|

(2,188 |

) |

|

|

(1,576 |

) |

| Restaurant-level operating

profit |

|

$ |

11,576 |

|

|

$ |

8,543 |

|

|

$ |

27,664 |

|

|

$ |

19,919 |

|

(1) Stock-based compensation

expense includes non-cash stock-based compensation, which is

comprised of restaurant-level stock-based compensation included in

other costs and corporate-level stock-based compensation included

in general and administrative expenses in the statements of

operations and comprehensive income (loss).

(2) Non-cash lease expense

includes lease expense from the date of possession of restaurants

that did not require cash outlay in the respective periods.

(3) Pre-opening costs consist

of labor costs and travel expenses for new employees and trainers

during the training period, recruitment fees, legal fees,

cash-based lease expenses incurred between the date of possession

and opening day of restaurants, and other related pre-opening

costs.

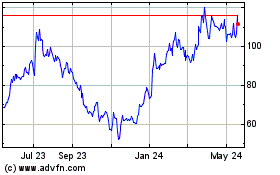

Kura Sushi USA (NASDAQ:KRUS)

Historical Stock Chart

From Jan 2025 to Feb 2025

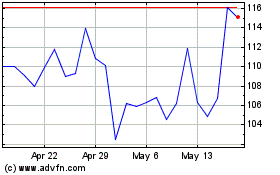

Kura Sushi USA (NASDAQ:KRUS)

Historical Stock Chart

From Feb 2024 to Feb 2025