- Q3 revenue of $40.2M, EPS $0.09

- mini-VSAT Broadband Q3 airtime revenue up 34%

year-over-year

KVH Industries, Inc., (Nasdaq:KVHI) today reported financial

results for the third quarter ended September 30, 2013. The company

reported third quarter revenue of $40.2 million and net income of

$1.4 million or $0.09 per diluted share. During the same period

last year the company reported net income of $1.7 million, or $0.12

per diluted share, on revenues of $38.8 million.

"The third quarter was highlighted with solid growth in our

satellite service business," said Martin Kits van Heyningen, KVH's

chief executive officer. "We are now shipping our new TracPhone

V-IP series terminals with their Integrated CommBox Modem providing

onboard network management, VoIP calling, and Internet café

services as a standard option on every product we ship. We continue

to make good progress developing our new IP-MobileCast content

delivery service, which will offer movies, television, news, and

sports to our customers."

For the nine months ended September 30, 2013, revenue was $123.3

million, up 26% compared to $97.6 million for the nine months ended

September 30, 2012. KVH reported GAAP net income of $4.9 million

for the first nine months of 2013, or $0.32 per diluted share.

Excluding the Headland Media acquisition-related costs, net of

income tax benefit, incurred in the second quarter, the company

recorded non-GAAP net income of $5.6 million or $0.37 per diluted

share. During the same period last year, the company reported GAAP

net income of $0.8 million, or $0.05 per diluted share. A

reconciliation between net income on a GAAP basis and net income on

a non-GAAP basis is provided below.

KVH's mobile communications revenue, which included $3.3 million

of revenue from Headland Media's operations, was $29.0 million in

the third quarter of 2013, a 31% increase year-over-year. Combined,

mini-VSAT Broadband airtime and TracPhone product revenues in the

third quarter amounted to $18.1 million, up 25% compared to the

same period last year while maritime satellite TV sales were up 5%

year-over-year. "Although we saw increases in our global mobile

broadband revenues, continuing poor economic conditions in many

parts of Europe resulted in lower revenues in the European marine

markets with shipping companies continuing to delay equipment

upgrades," continued Mr. Kits van Heyningen.

KVH's guidance and stabilization revenue, which relates to fiber

optic gyro (FOG) solutions, TACNAV military navigation systems, and

related services, was $11.2 million in the third quarter of 2013,

down 33% year-over-year. Revenue from the sale of TACNAV products

of $2.6 million was 59% lower than the same period last year.

TACNAV product revenues under the previously announced Saudi

Arabian National Guard contract ended in the second quarter of

2013. Revenue in the third quarter from this contract was $2.2

million, primarily comprised of lower margin installation services

and project management services. In the third quarter of 2012, we

reported $7.3 million of revenue under this contract, including

$4.5 million of higher margin TACNAV product. During the third

quarter, sales of our FOG products were $5.8 million, down 17%

compared to the same period last year.

Speaking about the company's financial performance, Peter

Rendall, KVH's chief financial officer, said, "We continue to be

pleased with the financial performance of our mobile communications

and commercial FOG businesses and while the year-over-year decline

in revenues in our TACNAV business was significant, it was

expected. The year-over-year decrease in FOG revenues primarily

relate to U.S. government funding cuts that have significantly

slowed orders under the CROWS remote weapon station program. Even

though our year-over-year guidance and stabilization revenues were

down, our mini-VSAT Broadband airtime revenues were up 34% and that

contributed to the 120 basis point increase we saw in our overall

gross profit margin this quarter. The leverage of our mini-VSAT

Broadband airtime infrastructure costs resulted in mini-VSAT

Broadband gross profit margins increasing from 31% in the third

quarter last year to 36% this quarter."

Mr. Rendall added, "We also saw a full quarter's contribution

from the Headland Media business that we acquired in the second

quarter. The integration of that business into the mobile

communications business is now complete. The $2.1 million increase

in operating expenses we recorded this quarter compared to the same

quarter last year was largely the result of incremental Headland

Media operating expenses."

"Planning for the remainder of 2013, we expect our mini-VSAT

Broadband business to continue to show strong year-over-year

growth. Although we continue to see a slowdown in U.S. defense

sales resulting from the implementation of sequestration measures,

our FOG business is expected to continue to benefit from new

commercial applications for the remainder of 2013. Continuing a

trend we have seen throughout 2013, we remain cautious with respect

to expectations for growth in leisure markets, due to ongoing

challenges in global economies. Operating expenses will be

sequentially higher in the fourth quarter as we invest in the

roll-out of the new IP-MobileCast service. With this context, our

full-year revenue guidance is in the range of $161 million to $165

million. We expect to achieve a full-year operating margin in the

range of approximately 4% to 5%. We are projecting that our annual

effective tax rate will be 35% or higher, subject to the effect of

unforeseen discrete items. The net result is that, including the

Headland Media acquisition-related costs, net of income tax benefit

(which equated to $0.05 per share), our GAAP EPS guidance for the

full year is now expected to be in the range of $0.37 to $0.41 per

share."

"For the fourth quarter of 2013, we expect revenue to be in the

range of $38 million to $42 million, reflecting strong

year-over-year growth from our mini-VSAT Broadband business and a

marked decline in sales of TACNAV products. We expect the fourth

quarter EPS to be in the range of $0.05 to $0.09 per share."

Mr. Kits van Heyningen concluded, "We are very pleased with our

overall progress so far this year and, with the acquisition and

integration of Headland Media. Our airtime business continues to

grow and we are on track to deliver exciting new content and

services alongside our global broadband service."

| Recent Operational

Highlights: |

| |

|

| 10/21/2013 |

New DSP-1760 multi-axis fiber optic gyro

offers improved performance and maximum ease of integration |

| |

|

| 10/03/2013 |

KVH wins two prestigious National Marine

Electronics Association "product awards" |

| |

|

| 07/29/2013 |

KVH announces that it has more than

doubled the mini-VSAT Broadband network capacity in the

Asia-Pacific region |

| |

|

| 07/18/2013 |

KVH announces that Crewtoo, which focuses

on seafarers, gains 60,000 members in 12 months |

Please review the corresponding press releases for more details

regarding these developments.

KVH is webcasting its third quarter conference call live at

10:30 a.m. Eastern time today through the company's website.

The conference call can be accessed at investors.kvh.com and

listeners are welcome to submit questions pertaining to the

earnings release and conference call to ir@kvh.com. The audio

archive and an MP3 podcast will also be available on the company

website within three hours of the completion of the call.

About KVH Industries, Inc.

KVH Industries is a leading manufacturer of solutions that

provide global high-speed Internet, television, and voice services

via satellite to mobile users at sea, on land, and in the air.

KVH's Headland Media group is a leading provider of

commercially-licensed news, sports, music, and movies, as well as

the Walport Training video series. KVH is based in

Middletown, RI, with facilities in Illinois, Denmark, Norway, the

U.K., Singapore, the Philippines, Belgium, Holland, Cyprus, and

Japan.

This press release contains forward-looking statements that

involve risks and uncertainties. For example, forward-looking

statements include statements regarding our financial goals for

future periods, and our anticipated revenue growth, competitive

positioning, profitability, and product orders. The actual

results we achieve could differ materially from the statements made

in this press release. Factors that might cause these

differences include, but are not limited to: the impact of extended

economic weakness and increasing fuel prices on the sale and use of

motor vehicles and marine vessels, particularly in Europe;

potential unanticipated technical or legal impediments related to

new service rollout plans and expected strategic relationships; the

need to increase sales of the TracPhone V-IP series products and

related services to improve airtime gross margins; the need for, or

delays in, qualification of products to customer or regulatory

standards; unanticipated declines or changes in customer demand,

due to economic, seasonal, and other factors, particularly with

respect to the TracPhone V-IP series products; potential further

declines in military sales, including to foreign customers, such as

the recent decline in sales of TACNAV to the Saudi Arabian National

Guard; the unpredictability of defense budget priorities as well as

the order timing, purchasing schedules, and priorities for our

defense products, including possible order cancellations; the

uncertain impact of actual and potential budget cuts by government

customers, including the effects of sequestration; potential

reductions in our overall gross margins in the event of a shift in

product mix; unanticipated increases in media costs or loss of

distribution rights; unanticipated challenges in integrating the

operations of Headland Media; and currency fluctuations, export

restrictions, delays in procuring export licenses, and other

international risks. These and other risk factors are

discussed in more detail in our most recent Form 10-Q filed with

the SEC on August 9, 2013. Copies are available through our

Investor Relations department and website,

http://investors.kvh.com. We do not assume any obligation to update

our forward-looking statements to reflect new information and

developments.

KVH Industries, Inc., has used, registered, or applied to

register its trademarks in the USA and other countries around the

world, including the following marks: KVH, KVH logo, Azimuth,

TracVision, TracPhone, Tri-Americas, CommBox, TACNAV, Sailcomp,

mini-VSAT Broadband and the mini-VSAT Broadband logo, E•Core,

Crewtoo, Muzo, and the banded, dome-shaped housing of its satellite

antennas. Other trademarks are the property of their

respective companies.

| |

| |

| |

| KVH INDUSTRIES, INC.

AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS |

| (in thousands, except

per share amounts, unaudited) |

| |

|

|

| |

Three Months

Ended |

Nine Months

Ended |

| |

September

30, |

September

30, |

| |

2013 |

2012 |

2013 |

2012 |

| Sales: |

|

|

|

|

| Product |

$ 20,331 |

$ 24,529 |

$ 71,433 |

$ 62,653 |

| Service |

19,885 |

14,293 |

51,907 |

34,916 |

| Net sales |

40,216 |

38,822 |

123,340 |

97,569 |

| |

|

|

|

|

| Costs and expenses: |

|

|

|

|

| Costs of product sales |

11,780 |

13,297 |

39,999 |

37,026 |

| Costs of service sales |

11,909 |

10,035 |

33,019 |

22,659 |

| Research and development |

3,334 |

2,949 |

9,534 |

9,148 |

| Sales, marketing and support |

6,344 |

6,360 |

20,828 |

17,239 |

| General and administrative |

4,774 |

3,040 |

13,084 |

8,906 |

| Total costs and

expenses |

38,141 |

35,681 |

116,464 |

94,978 |

| |

|

|

|

|

| Income from

operations |

2,075 |

3,141 |

6,876 |

2,591 |

| |

|

|

|

|

| Interest income |

199 |

147 |

572 |

359 |

| Interest expense |

189 |

76 |

450 |

243 |

| Other income, net |

212 |

23 |

290 |

99 |

| |

|

|

|

|

| Income before income tax

expense |

2,297 |

3,235 |

7,288 |

2,806 |

| Income tax expense |

911 |

1,490 |

2,390 |

1,983 |

| Net income |

$

1,386 |

$ 1,745 |

$ 4,898 |

$ 823 |

| |

|

|

|

|

| Net income per common

share: |

|

|

|

|

| Basic |

$ 0.09 |

$ 0.12 |

$ 0.32 |

$ 0.06 |

| Diluted |

$ 0.09 |

$ 0.12 |

$ 0.32 |

$ 0.05 |

| |

|

|

|

|

| Weighted average number of common

shares outstanding: |

|

|

|

|

| Basic |

15,200 |

14,846 |

15,109 |

14,743 |

| Diluted |

15,354 |

15,024 |

15,300 |

14,972 |

| |

| |

| |

| KVH INDUSTRIES, INC.

AND SUBSIDIARIES |

| CONDENSED

CONSOLIDATED BALANCE SHEETS |

| (in thousands,

unaudited) |

| |

|

|

| |

September 30, |

December 31, |

| |

2013 |

2012 |

| ASSETS |

|

|

| |

|

|

| Cash, cash equivalents and marketable

securities |

$ 57,577 |

$ 38,285 |

| Accounts receivable, net |

25,731 |

27,654 |

| Inventories |

18,133 |

16,203 |

| Deferred income taxes |

712 |

1,146 |

| Other current assets |

3,891 |

3,264 |

| Total current

assets |

106,044 |

86,552 |

| |

|

|

| Property and equipment, net |

36,706 |

36,733 |

| Deferred income taxes |

38 |

3,524 |

| Goodwill |

18,086 |

4,712 |

| Intangible assets, net |

15,181 |

1,684 |

| Other non-current assets |

4,972 |

4,363 |

| |

|

|

| Total assets |

$ 181,027 |

$ 137,568 |

| |

|

|

| LIABILITIES AND STOCKHOLDERS'

EQUITY |

|

|

| Accounts payable and accrued

expenses |

$ 21,399 |

$ 19,280 |

| Deferred revenue |

5,468 |

1,892 |

| Current portion of long-term debt |

1,044 |

138 |

| Total current

liabilities |

27,911 |

21,310 |

| |

|

|

| Other long-term liabilities |

1,121 |

140 |

| Long-term debt, excluding current

portion |

6,407 |

3,414 |

| Line of credit |

30,000 |

7,000 |

| Stockholders' equity |

115,588 |

105,704 |

| |

|

|

| Total liabilities and

stockholders' equity |

$ 181,027 |

$ 137,568 |

| |

| |

| |

| KVH INDUSTRIES, INC.

AND SUBSIDIARIES RECONCILIATION OF NET INCOME TO ADJUSTED NET

INCOME Net Income Excluding Transaction Costs and Income Tax

Benefit Related to Business Acquisition (in thousands, except per

share amounts, unaudited) |

| |

|

|

| |

Three Months Ended |

Nine Months Ended |

| |

September 30,

2013 |

September 30,

2013 |

| |

|

|

| Net Income - GAAP |

$ 1,386 |

$ 4,898 |

| |

|

|

| Transaction costs related to business

acquisition of Headland Media |

11 |

876 |

| Tax benefit from transaction costs

related to business acquisition of Headland Media |

|

(152) |

| |

|

|

| Net Income - Non-GAAP |

$ 1,397 |

$ 5,622 |

| |

|

|

| Net income per common share -

Non-GAAP: |

|

|

| Basic |

$ 0.09 |

$ 0.37 |

| Diluted |

$ 0.09 |

$ 0.37 |

Adjusted net income excluding the transaction costs related to

the acquisition of Headland Media on May 11, 2013, for the three

and nine months ended September 30, 2013 is presented in the table

above. This is a non-GAAP financial measure and should not be

considered a replacement for GAAP results. We believe the

adjusted information is useful to investors because it is

reflective of underlying operational trends, as it excludes

significant non-recurring or otherwise unusual transactions as

described above. Our criteria for adjusted net income may

differ from models used by other companies and should not be

considered as an alternative to net income prepared in accordance

with GAAP as an indicator of our operating performance.

CONTACT: KVH Industries, Inc.

Peter Rendall

401-847-3327

prendall@kvh.com

FTI Consulting

Christine Mohrmann

212-850-5600

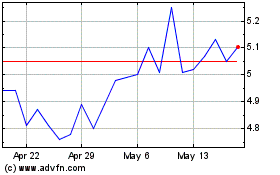

KVH Industries (NASDAQ:KVHI)

Historical Stock Chart

From Jun 2024 to Jul 2024

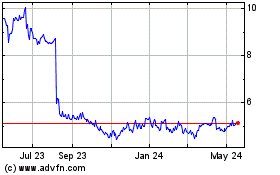

KVH Industries (NASDAQ:KVHI)

Historical Stock Chart

From Jul 2023 to Jul 2024