KVH Industries, Inc., (Nasdaq: KVHI) reported financial results for

the quarter ended September 30, 2018 today. The company will hold a

conference call to discuss these results at 10:30 a.m. ET today,

which can be accessed at investors.kvh.com. Following the call, a

replay of the webcast will be available through the company’s

website.

Third Quarter 2018 Highlights

- Shipments of VSAT units increased more than 125% compared to

the third quarter of 2017.

- AgilePlans subscription service, our Connectivity as a Service

Program for the commercial maritime sector, amounted to 64% of

total commercial maritime VSAT shipments, and 54% of the total VSAT

shipments for the quarter. Installations for the quarter increased

27% compared to the second quarter of 2018.

- Fiber optic gyro (FOG) product sales grew 53% compared to the

third quarter of 2017, the seventh consecutive quarter of

double-digit growth.

- Our mini-VSAT Broadband installed base of subscribers increased

9% compared to the third quarter of 2017.

- Total revenue increased in the third quarter of 2018 to $43.5

million from $40.4 million in the third quarter of 2017, driven

primarily by an increase in FOG product sales and an increase in

mini-VSAT Broadband airtime revenue. Revenue increased even though

revenue is not recognized immediately on AgilePlans shipments as

revenues under the AgilePlans program are recognized over

time.

- Net loss in the third quarter of 2018 was $1.2 million, or

$0.07 per share, compared to a net loss of $2.4 million, or $0.15

per share in the third quarter of 2017.

- Non-GAAP net income in the third quarter of 2018 was $0.7

million, or $0.04 per share, compared to $0.4 million, or $0.02 per

share in the third quarter of 2017.

- Non-GAAP adjusted EBITDA in the third quarter of 2018 was $3.2

million, compared to $1.8 million in the third quarter of

2017.

- On October 30, 2018, we amended and restated our existing

credit agreement. As part of the new, three-year agreement, we

repaid approximately $17.0 million of outstanding borrowings,

increased the amounts available under our revolving facility to

$20.0 million, and changed certain covenant requirements to be less

restrictive. At the closing of the transaction, we borrowed $5.0

million under the revolver.

Commenting on the quarter, Martin Kits van

Heyningen, KVH’s chief executive officer, said, “Our third quarter

results reflect a continuation of the strong momentum that drove

the first half of our year. Our VSAT shipments were a third quarter

record for us, growing more than 125% compared to the third quarter

of 2017. Our VSAT shipments through the first nine months of the

year have already surpassed our shipments for all of 2017 by more

than 40%. Our AgilePlans Connectivity as a Service Program was a

significant driver of this growth, but traditional shipments of our

VSAT products increased almost 45% as well. Our airtime subscribers

again grew by 9%. Our pace of AgilePlans installations increased

27% compared to the second quarter of 2018. In our inertial

navigation segment, our FOG revenue increased by over 50% in the

most recent quarter, our seventh consecutive quarter of double

digits growth. The development of our photonic chip-based FOG

continues on track, and we continue to expect to provide test units

to customers by the end of this year.”

The company operates in two segments, mobile

connectivity and inertial navigation. Net sales for the mobile

connectivity segment increased $0.7 million, or 2%, compared to the

third quarter of 2017 due to a $1.1 million increase in our

mini-VSAT Broadband airtime revenue and a $0.5 million increase in

marine mobile connectivity product sales, partially offset by a

$0.9 million decrease in content and training revenue. Net sales

for our inertial navigation segment increased $2.4 million, or 31%,

compared to the third quarter of 2017, due to a $2.7 million

increase in FOG sales and a $0.5 million increase in contracted

engineering service sales, partially offset by a $0.9 million

decrease in TACNAV sales.

Financial Highlights (in millions, except per

share data)

|

|

|

Three Months

EndedSeptember 30, |

|

Nine Months

EndedSeptember 30, |

|

|

|

2018 |

|

2017 |

|

2018 |

|

2017 |

|

GAAP Results |

|

|

|

|

|

|

|

|

|

Revenue |

|

$ |

43.5 |

|

|

$ |

40.4 |

|

|

$ |

127.0 |

|

|

$ |

121.1 |

|

|

Net loss |

|

$ |

(1.2 |

) |

|

$ |

(2.4 |

) |

|

$ |

(6.4 |

) |

|

$ |

(9.3 |

) |

|

Net loss per share |

|

$ |

(0.07 |

) |

|

$ |

(0.15 |

) |

|

$ |

(0.38 |

) |

|

$ |

(0.57 |

) |

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Results |

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

0.7 |

|

|

$ |

0.4 |

|

|

$ |

0.3 |

|

|

$ |

(0.2 |

) |

|

Net income (loss) per share |

|

$ |

0.04 |

|

|

$ |

0.02 |

|

|

$ |

0.02 |

|

|

$ |

(0.01 |

) |

|

Adjusted EBITDA |

|

$ |

3.2 |

|

|

$ |

1.8 |

|

|

$ |

7.0 |

|

|

$ |

3.4 |

|

For more information regarding our non-GAAP financial measures,

see the tables at the end of this release.

Third Quarter Financial Summary

Revenue was $43.5 million for the third quarter of 2018, an

increase of 8%, compared to the third quarter of 2017.

Product revenues for the third quarter of $16.3

million were 16% higher than the prior year quarter, due to an

increase in inertial navigation product sales of $1.8 million and a

$0.4 million increase in mobile connectivity product sales. Mobile

connectivity product sales increased primarily due to a $0.5

million increase in marine product sales, partially offset by a

$0.1 million decrease in land mobile product sales. The increase in

marine product sales was due to a $0.2 million increase in

mini-VSAT Broadband product sales and a $0.3 million increase in

marine accessories and LTE product sales. The adoption of ASC 606

negatively impacted marine product sales by $0.4 million. Inertial

navigation product sales increased primarily due to a $2.7 million

increase in FOG product sales, partially offset by a $0.9 million

decrease in TACNAV product sales.

Service revenues for the third quarter were

$27.2 million, an increase of 3% compared to the third quarter of

2017, due to a $0.6 million increase in inertial navigation service

sales and a $0.3 million increase in mobile connectivity service

sales. Airtime service revenues, which include mini-VSAT Broadband

airtime revenues, increased 6% in the third quarter of 2018

compared to the third quarter of 2017 due to a 9% increase in

subscribers. Content and training revenues, which include our

entertainment, eLearning, and safety content, decreased by 12% in

the third quarter of 2018 compared to the third quarter of 2017.

Our engineering service revenues in the third quarter of 2018

increased by $0.5 million compared to the third quarter of 2017 as

a result of a substantial contract which began in the first quarter

of 2018 and was extended through the third quarter.

Our operating expenses remained flat compared to

the third quarter of 2017 at $19.3 million. The key drivers were a

$0.4 million increase in funded engineering expenses, which reduced

research and development expense, and a $0.3 million decrease in

marketing expenses, partially offset by a $0.4 million increase in

salaries, benefits, and taxes, and a $0.3 million increase in bad

debt expense.

Nine Months Ended September 30 Financial

Summary

Revenue was $127.0 million for the nine months

ended September 30, 2018, an increase of 5% compared to the nine

months ended September 30, 2017. Product revenues for the nine

months ended September 30, 2018 were $46.5 million, which was 7%

higher than the nine months ended September 30, 2017 due to a $5.5

million increase in inertial navigation product sales, which was

partially offset by a $2.3 million decrease in mobile connectivity

product sales. Inertial navigation product sales increased

primarily due to a $5.6 million increase in FOG product sales,

partially offset by a $0.1 million decrease in TACNAV product

sales. Mobile connectivity product sales decreased primarily due to

a $1.5 million decrease in marine product sales due partly to the

impact of the AgilePlans subscription service, the adoption of ASC

606, and a $0.8 million decrease in sales of our land mobile

connectivity products.

Service revenues for the nine months ended

September 30, 2018 were $80.5 million, an increase of 3% compared

to the nine months ended September 30, 2017 due to a $1.5 million

increase in inertial navigation service sales and a $1.2 million

increase in mobile connectivity service sales. Airtime service

revenues, which include mini-VSAT Broadband airtime revenues,

increased 5%. Content and training revenues, which include our

entertainment, eLearning, and safety content, in the nine months

ended September 30, 2018 decreased by 6% compared to the nine

months ended September 30, 2017. Our engineering service revenues

in the nine months ended September 30, 2018 increased 48% compared

to the nine months ended September 30, 2017 as a result of a

substantial contract which began in the first quarter of 2018 and

was extended through the third quarter.

Our operating expenses decreased $0.8 million

year-over-year to $58.8 million in the nine months ended September

30, 2018 compared to $59.6 million in the nine months ended

September 30, 2017. The key drivers were a $1.0 million increase in

funded engineering expenses, a $0.5 million decrease in marketing

expenses, and a $0.4 million decrease in outside consulting fees.

These decreases were partially offset by a $0.8 million increase in

warranty expense and $0.2 million increase in bad debt expense.

Fourth Quarter 2018 and Full Year 2018

Outlook

Our guidance for the fourth quarter and full

year of 2018 is below. We expect that our full-year 2018 VSAT

shipments will almost double compared to 2017, largely as a result

of the popularity of our AgilePlans program among our commercial

customers. We have reduced our full year guidance for revenues and

earnings, partly as a result of the continued success of our

AgilePlans program which, to some extent, negatively impacts the

amount of revenues we are able to record in a particular period.

The reduction in our full year revenue and earnings forecast also

reflects lower than expected TACNAV orders, attributable somewhat

to the recent political tensions in certain international markets,

and higher operating expenses associated with the launch of our new

TracPhone V3-HTS antenna along with our continuing investment in

long-term initiatives such as our new photonic chip-based FOG.

|

(in millions, except per share data) |

|

Fourth Quarter |

|

Full Year |

|

|

|

From |

|

To |

|

From |

|

To |

|

Revenue |

|

$ |

44.0 |

|

|

$ |

48.0 |

|

|

$ |

171.0 |

|

|

$ |

175.0 |

|

|

GAAP EPS |

|

$ |

(0.10 |

) |

|

$ |

(0.01 |

) |

|

$ |

(0.48 |

) |

|

$ |

(0.38 |

) |

|

Non-GAAP EPS |

|

$ |

0.02 |

|

|

$ |

0.09 |

|

|

$ |

0.04 |

|

|

$ |

0.11 |

|

|

Non-GAAP adjusted EBITDA |

|

$ |

3.0 |

|

|

$ |

5.0 |

|

|

$ |

10.0 |

|

|

$ |

12.0 |

|

ASC 606 requires that certain revenues that had

been recognized in prior periods be reversed as of January 1, 2018

and be recognized over time as performance obligations are met,

and, likewise, that certain currently generated revenues that would

have been recognized under previous accounting guidance instead be

deferred and recognized over time as performance obligations are

met. We expect the net impact of this change in accounting

guidance, which is reflected in the above tables, will be as

follows:

|

(in millions, except per share data) |

|

Fourth Quarter |

|

Full Year |

|

Revenue |

|

$ |

(1.0 |

) |

|

$ |

(2.0 |

) |

|

GAAP EPS |

|

$ |

(0.02 |

) |

|

$ |

(0.03 |

) |

|

Non-GAAP EPS |

|

$ |

(0.01 |

) |

|

$ |

(0.02 |

) |

|

Non-GAAP adjusted EBITDA |

|

$ |

(0.2 |

) |

|

$ |

(0.3 |

) |

Other Recent Announcements

- Singtel, Asia's leading communications technology group,

announced a partnership to provide shipping companies a seamless

broadband service with KVH's mini-VSAT Broadband satellite

connectivity to help accelerate the digital transformation of the

maritime industry across the Asia-Pacific region.

- National Marine Electronics Association (NMEA) recognized KVH

Marine Satellite Systems with 2018 Product Excellence Awards.

- KVH pledged support to Maritime UK's Women in Maritime

campaign, which aims to promote fairness, equality, and inclusion

within the maritime sector.

- KVH Videotel introduced a new training package free to mariners

worldwide, "Seafarers’ Mental Health and Wellbeing".

Please review the corresponding press releases for more details

regarding these developments.

Conference Call Details

KVH Industries will host a conference call today

at 10:30 a.m. ET through the company’s website. The conference call

can be accessed at investors.kvh.com and listeners are welcome to

submit questions pertaining to the earnings release and conference

call to ir@kvh.com. The audio archive will be available on the

company website within three hours of the completion of the

call.

Non-GAAP Financial Measures

This release provides non-GAAP financial

information, which may include constant-currency revenue, non-GAAP

net income (loss), non-GAAP diluted EPS, and non-GAAP adjusted

EBITDA, as a supplement to our condensed consolidated financial

statements, which are prepared in accordance with generally

accepted accounting principles (“GAAP”). Management uses these

non-GAAP financial measures internally in analyzing financial

results to assess operational performance. Constant-currency

revenue is calculated on the basis of local currency results, using

foreign currency exchange rates applicable to the earlier

comparative period, and management believes that presenting

information on a constant-currency basis helps management and

investors to isolate the impact of changes in those rates from

other factors. The presentation of this financial information is

not intended to be considered in isolation or as a substitute for

the financial information prepared in accordance with GAAP. The

non-GAAP financial measures used in this press release adjust for

specified items that can be highly variable or difficult to

predict. Management generally uses these non-GAAP financial

measures to facilitate financial and operational decision-making,

including evaluation of our historical operating results,

comparison to competitors’ operating results, and determination of

management incentive compensation. These non-GAAP financial

measures reflect an additional way of viewing aspects of our

operations that, when viewed with GAAP results and the

reconciliations to corresponding GAAP financial measures, may

provide a more complete understanding of factors and trends

affecting our business.

Some limitations of non-GAAP net income (loss),

non-GAAP diluted EPS, and non-GAAP adjusted EBITDA include the

following:

- Non-GAAP net income (loss) and diluted EPS exclude amortization

of intangibles, stock-based compensation, employee termination and

other non-recurring costs, foreign exchange transaction gains and

losses, the tax effect of the foregoing and the change in valuation

allowance.

- Non-GAAP adjusted EBITDA represents net income (loss) before

interest income, interest expense, income taxes, depreciation,

amortization, stock-based compensation, employee termination and

other non-recurring costs, and foreign exchange transaction gains

and losses.

These non-GAAP financial measures exclude the

effect of foreign exchange transaction losses, which represents a

change from calculations presented in prior earnings releases. We

decided to exclude foreign exchange transaction losses because we

do not believe such gains or losses are indicative of operating

performance. Other companies, including companies in KVH’s

industry, may calculate these non-GAAP financial measures

differently or not at all, which will reduce their usefulness as a

comparative measure.

Future Non-GAAP Adjustments

Future GAAP diluted EPS may be affected by

changes in ongoing assumptions and judgments, and may also be

affected by non-recurring, unusual or unanticipated charges,

expenses or gains, which are excluded in the calculation of our

non-GAAP diluted EPS guidance as described in this press

release.

Because non-GAAP financial measures exclude the

effect of items that will increase or decrease our reported results

of operations, management strongly encourages investors to review

our consolidated financial statements and publicly filed reports in

their entirety. Reconciliations of the non-GAAP financial measures

to the most directly comparable GAAP financial measures are

included in the tables accompanying this release.

About KVH Industries, Inc.

KVH Industries, Inc. (Nasdaq: KVHI), is a global

leader in mobile connectivity and inertial navigation systems,

innovating to enable a mobile world. The market leader in maritime

VSAT, KVH designs, manufactures, and provides connectivity and

content services globally. KVH is also a premier manufacturer of

high-performance sensors and integrated inertial systems for

defense and commercial applications. Founded in 1982, the company

is based in Middletown, RI, with research, development, and

manufacturing operations in Middletown, RI, and Tinley Park, IL,

and more than a dozen offices around the globe.

This press release contains forward-looking

statements that involve risks and uncertainties. For example,

forward-looking statements include statements regarding our

financial goals for future periods, the success of our new

initiatives, our investment plans, our development goals, our

anticipated revenue and earnings, the anticipated impact of ASC

606, and the impact of our future initiatives on revenue,

competitive positioning, profitability, and product orders. Actual

results could differ materially from the forward-looking statements

made in this press release. Factors that might cause these

differences include, but are not limited to: the uncertain duration

of the initial adverse impact on our overall revenues of our new

AgilePlans, under which we recognize no revenue for product sales,

either at the time of shipment or over the contract term; increased

costs arising from the new HTS network; the impact of recent

changes in revenue recognition and lease accounting standards,

including potential changes in the interpretation of those

standards; the uncertain impact of tax reform and federal budget

deficits; the uncertain impact of changes in trade policy,

including potential tariffs and trade wars with other countries;

unanticipated obstacles in our photonic chip and other product

development efforts; delays in the receipt of anticipated orders

for our products and services, including significant orders for

TACNAV products, or the potential failure of such orders to occur

at all; continued adverse impacts of currency fluctuations,

particularly the British Pound; risks associated with the impact of

Brexit on sales and operations in the U.K. and Europe and on the

overall global economy; our ability to successfully implement our

new initiatives without unanticipated additional expenses;

potential reduced sales to companies in or dependent upon the

turbulent oil and gas industry; continued substantial fluctuations

in military sales, including to foreign customers; the

unpredictability of defense budget priorities as well as the order

timing, purchasing schedules, and priorities for defense products,

including possible order cancellations; the uncertain impact of

potential budget cuts by government customers; the impact of

extended economic weakness on the sale and use of marine vessels

and recreational vehicles; the potential inability to increase or

maintain our market share in the market for airtime services; the

need to increase sales of the TracPhone V-IP and V-HTS series

products and related services to maintain and improve airtime gross

margins; the need for, or delays in, qualification of products to

customer or regulatory standards; potential declines or changes in

customer demand, due to economic, weather-related, seasonal, and

other factors, particularly with respect to the TracPhone V-IP and

V-HTS series, including with respect to new pricing models;

increased price and service competition in the mobile connectivity

market; potential increased expenses associated with investments in

new technology; exposure for potential intellectual property

infringement; potential additional litigation expenses;

fluctuations in interest rates; potential changes in tax and

accounting requirements or assessments, including management’s

assessment of the probability and effect of future events; stock

price volatility; and export restrictions, delays in procuring

export licenses, and other international risks. These and other

factors are discussed in more detail in our Quarterly Report on

Form 10-Q filed with the Securities and Exchange Commission on

August 2, 2018. Copies are available through our Investor Relations

department and website, http://investors.kvh.com. We do not assume

any obligation to update our forward-looking statements to reflect

new information and developments.

KVH Industries, Inc. has used, registered, or applied to

register its trademarks in the USA and other countries around the

world, including but not limited to the following marks: KVH,

TracVision, TracPhone, CommBox, TACNAV, IP-MobileCast, Videotel,

mini-VSAT Broadband, NEWSlink, KVH OneCare, and AgilePlans by KVH.

Other trademarks are the property of their respective

companies.

| |

| KVH INDUSTRIES, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(in thousands, except per share amounts,

unaudited) |

| |

|

|

|

Three Months

EndedSeptember 30, |

|

Nine Months

EndedSeptember 30, |

|

|

|

2018 |

|

2017 |

|

2018 |

|

2017 |

|

Sales: |

|

|

|

|

|

|

|

|

|

Product |

|

$ |

16,367 |

|

|

$ |

14,169 |

|

|

$ |

46,521 |

|

|

$ |

43,355 |

|

|

Service |

|

27,150 |

|

|

26,281 |

|

|

80,489 |

|

|

77,755 |

|

|

Net sales |

|

43,517 |

|

|

40,450 |

|

|

127,010 |

|

|

121,110 |

|

|

Costs and expenses: |

|

|

|

|

|

|

|

|

| Costs of

product sales |

|

9,767 |

|

|

9,578 |

|

|

28,784 |

|

|

29,412 |

|

| Costs of

service sales |

|

15,376 |

|

|

13,374 |

|

|

44,690 |

|

|

39,736 |

|

| Research

and development |

|

3,789 |

|

|

3,990 |

|

|

11,288 |

|

|

11,698 |

|

| Sales,

marketing and support |

|

8,421 |

|

|

8,234 |

|

|

25,856 |

|

|

25,098 |

|

| General

and administrative |

|

7,084 |

|

|

7,075 |

|

|

21,679 |

|

|

22,805 |

|

| Total costs and expenses |

|

44,437 |

|

|

42,251 |

|

|

132,297 |

|

|

128,749 |

|

| Loss from operations |

|

(920 |

) |

|

(1,801 |

) |

|

(5,287 |

) |

|

(7,639 |

) |

| Interest

income |

|

161 |

|

|

166 |

|

|

464 |

|

|

491 |

|

| Interest

expense |

|

453 |

|

|

379 |

|

|

1,290 |

|

|

1,081 |

|

| Other

income (expense), net |

|

199 |

|

|

(141 |

) |

|

371 |

|

|

(321 |

) |

| Loss before income tax expense |

|

(1,013 |

) |

|

(2,155 |

) |

|

(5,742 |

) |

|

(8,550 |

) |

|

Income tax expense |

|

161 |

|

|

283 |

|

|

668 |

|

|

799 |

|

| Net loss |

|

$ |

(1,174 |

) |

|

$ |

(2,438 |

) |

|

$ |

(6,410 |

) |

|

$ |

(9,349 |

) |

|

Net loss per common share: |

|

|

|

|

|

|

|

|

| Basic and

Diluted |

|

$ |

(0.07 |

) |

|

$ |

(0.15 |

) |

|

$ |

(0.38 |

) |

|

$ |

(0.57 |

) |

|

Weighted average number of common shares

outstanding: |

|

|

|

|

|

|

|

|

| Basic and

Diluted |

|

17,188 |

|

|

16,469 |

|

|

17,025 |

|

|

16,393 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| KVH INDUSTRIES, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE

SHEETS(in thousands, unaudited) |

| |

|

|

|

|

|

|

|

September 30,2018 |

|

December 31,2017 |

|

ASSETS |

|

|

|

|

| Cash,

cash equivalents and marketable securities |

|

$ |

33,236 |

|

|

$ |

42,915 |

|

| Accounts

receivable, net |

|

28,971 |

|

|

28,316 |

|

|

Inventories |

|

24,676 |

|

|

22,732 |

|

| Other

current assets and contract assets |

|

7,201 |

|

|

3,816 |

|

| Total current assets |

|

94,084 |

|

|

97,779 |

|

| Property

and equipment, net |

|

52,375 |

|

|

43,521 |

|

|

Goodwill |

|

32,848 |

|

|

33,872 |

|

|

Intangible assets, net |

|

11,637 |

|

|

15,120 |

|

| Other

non-current assets and contract assets |

|

13,327 |

|

|

5,927 |

|

|

Non-current deferred income taxes |

|

201 |

|

|

20 |

|

| Total assets |

|

$ |

204,472 |

|

|

$ |

196,239 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

| Accounts

payable and accrued expenses |

|

$ |

35,651 |

|

|

$ |

33,948 |

|

| Contract

liabilities |

|

10,770 |

|

|

— |

|

| Deferred

revenue |

|

— |

|

|

6,919 |

|

| Current

portion of long-term debt |

|

22,691 |

|

|

2,482 |

|

| Total current liabilities |

|

69,112 |

|

|

43,349 |

|

| Other

long-term liabilities |

|

2,060 |

|

|

19 |

|

| Long-term

contract liabilities |

|

8,771 |

|

|

— |

|

|

Non-current deferred tax liability |

|

2,547 |

|

|

2,634 |

|

| Long-term

debt, excluding current portion |

|

20,252 |

|

|

44,572 |

|

|

Stockholders’ equity |

|

101,730 |

|

|

105,665 |

|

| Total liabilities and stockholders’

equity |

|

$ |

204,472 |

|

|

$ |

196,239 |

|

| |

|

|

|

|

|

|

|

|

| |

| KVH INDUSTRIES, INC. AND

SUBSIDIARIESRECONCILIATION OF GAAP NET LOSS TO

NON-GAAP NET INCOME (LOSS)(in thousands, except

per share amounts, unaudited) |

| |

|

|

|

Three Months EndedSeptember

30, |

|

Nine Months

EndedSeptember 30, |

|

|

|

2018 |

|

2017 |

|

2018 |

|

2017 |

|

Net loss - GAAP |

|

$ |

(1,174 |

) |

|

$ |

(2,438 |

) |

|

$ |

(6,410 |

) |

|

$ |

(9,349 |

) |

| Amortization of intangibles |

|

958 |

|

|

1,096 |

|

|

3,101 |

|

|

3,266 |

|

| Stock-based compensation expense |

|

860 |

|

|

809 |

|

|

2,452 |

|

|

2,621 |

|

| Employee termination and other non-recurring

costs |

|

— |

|

|

— |

|

|

195 |

|

|

— |

|

| Foreign exchange transaction (gain) loss (a) |

|

(141 |

) |

|

192 |

|

|

(258 |

) |

|

482 |

|

| Tax effect on the foregoing |

|

(333 |

) |

|

(527 |

) |

|

(1,088 |

) |

|

(1,630 |

) |

| Change in valuation allowance (b) |

|

514 |

|

|

1,278 |

|

|

2,273 |

|

|

4,401 |

|

|

Net income (loss) - Non-GAAP |

|

$ |

684 |

|

|

$ |

410 |

|

|

$ |

265 |

|

|

$ |

(209 |

) |

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per common share -

Non-GAAP: |

|

|

|

|

|

|

|

|

| Basic and Diluted |

|

$ |

0.04 |

|

|

$ |

0.02 |

|

|

$ |

0.02 |

|

|

$ |

(0.01 |

) |

| |

|

|

|

|

|

|

|

|

|

Weighted average number of common shares

outstanding: |

|

|

|

|

|

|

|

|

| Basic |

|

17,188 |

|

|

16,469 |

|

|

17,025 |

|

|

16,393 |

|

| Diluted |

|

17,429 |

|

|

16,649 |

|

|

17,282 |

|

|

16,393 |

|

(a) We

changed our definition of non-GAAP net income (loss) and non-GAAP

net income (loss) per common share to exclude the impacts of

realized and unrealized foreign exchange transaction gains and

losses since such gains and losses are not indicative of operating

performance in any particular period. If we had presented non-GAAP

net income (loss) and non-GAAP net income (loss) per common share

consistent with our prior practice, the non-GAAP net income and

non-GAAP net income per common share for the three months ended

September 30, 2018 would have been $0.2 million and $0.01 per

common share, respectively, greater than the amounts reported in

the table, the non-GAAP net income for the three months ended

September 30, 2017 would have been $0.1 million less than the

amounts reported in the table, and there would have been in the

non-GAAP net earnings per common share for the three months ended

September 30, 2017. The non-GAAP net income and non-GAAP net income

per common share for the nine months ended September 30, 2018 would

have been $0.3 million and $0.01 per common share, respectively,

greater than the amounts reported in the table. The non-GAAP net

loss and non-GAAP net loss per common share for the nine months

ended September 30, 2017 would have been $0.4 million and $0.03 per

common share, respectively, greater than the amounts reported in

the table.

(b) Represents an

increase in deferred tax asset valuation allowance on additional

United States net operating losses.

| |

| KVH INDUSTRIES, INC. AND

SUBSIDIARIESRECONCILIATION OF GAAP NET LOSS TO

NON-GAAPEBITDA AND NON-GAAP ADJUSTED

EBITDA(in thousands, unaudited) |

| |

|

|

|

Three Months EndedSeptember

30, |

|

Nine Months

EndedSeptember 30, |

|

|

|

2018 |

|

2017 |

|

2018 |

|

2017 |

|

GAAP net loss |

|

$ |

(1,174 |

) |

|

$ |

(2,438 |

) |

|

$ |

(6,410 |

) |

|

$ |

(9,349 |

) |

| Income tax expense |

|

161 |

|

|

283 |

|

|

668 |

|

|

799 |

|

| Interest expense, net |

|

292 |

|

|

213 |

|

|

826 |

|

|

590 |

|

| Depreciation and amortization |

|

3,193 |

|

|

2,745 |

|

|

9,481 |

|

|

8,222 |

|

|

Non-GAAP EBITDA |

|

2,472 |

|

|

803 |

|

|

4,565 |

|

|

262 |

|

| Stock-based compensation expense |

|

860 |

|

|

809 |

|

|

2,452 |

|

|

2,621 |

|

| Employee termination and other non-recurring

costs |

|

— |

|

|

— |

|

|

195 |

|

|

— |

|

| Foreign exchange transaction (gain) loss (a) |

|

(141 |

) |

|

192 |

|

|

(258 |

) |

|

482 |

|

|

Non-GAAP adjusted EBITDA |

|

$ |

3,191 |

|

|

$ |

1,804 |

|

|

$ |

6,954 |

|

|

$ |

3,365 |

|

(a) We changed our

definition of non-GAAP adjusted EBITDA to exclude the impacts of

realized and unrealized foreign exchange transaction gains and

losses since such gains and losses are not indicative of operating

performance in any particular period. If we had presented non-GAAP

adjusted EBITDA consistent with our prior practice, non-GAAP

adjusted EBITDA would have been $0.2 million greater and $0.2

million lower, respectively, than the amounts presented in the

table for the three months ended September 30, 2018 and 2017,

respectively. If we had presented non-GAAP adjusted EBITDA

consistent with our prior practice, non-GAAP adjusted EBITDA would

have been $0.3 million greater and $0.5 million lower,

respectively, than the amounts presented in the table for the nine

months ended September 30, 2018 and 2017, respectively.

| |

| KVH INDUSTRIES, INC. AND

SUBSIDIARIESREVENUE AND OPERATING INCOME (LOSS) BY

SEGMENT(in millions except for percentages,

unaudited) |

| |

|

Segment Net Sales |

|

Three Months

EndedSeptember 30, |

|

Nine Months

EndedSeptember 30, |

|

|

|

2018 |

|

2017 |

|

2018 |

|

2017 |

|

Mobile connectivity sales |

|

|

|

|

|

|

|

|

|

Product |

|

$ |

7.6 |

|

|

$ |

7.2 |

|

|

$ |

23.6 |

|

|

$ |

25.9 |

|

|

Service |

|

25.9 |

|

|

25.6 |

|

|

76.4 |

|

|

75.2 |

|

| Net sales |

|

$ |

33.5 |

|

|

$ |

32.8 |

|

|

$ |

100.0 |

|

|

$ |

101.1 |

|

|

|

|

|

|

|

|

|

|

|

|

Inertial navigation sales |

|

|

|

|

|

|

|

|

|

Product |

|

$ |

8.7 |

|

|

$ |

6.9 |

|

|

$ |

22.9 |

|

|

$ |

17.4 |

|

|

Service |

|

1.3 |

|

|

0.7 |

|

|

4.1 |

|

|

2.6 |

|

| Net sales |

|

$ |

10.0 |

|

|

$ |

7.6 |

|

|

$ |

27.0 |

|

|

$ |

20.0 |

|

|

Operating Income (Loss) |

|

Three Months

EndedSeptember 30, |

|

Nine Months

EndedSeptember 30, |

|

|

|

2018 |

|

2017 |

|

2018 |

|

2017 |

|

Mobile connectivity |

|

$ |

1.5 |

|

|

$ |

2.0 |

|

|

$ |

3.7 |

|

|

$ |

5.3 |

|

|

Inertial navigation |

|

1.9 |

|

|

0.4 |

|

|

3.8 |

|

|

0.7 |

|

|

|

|

3.4 |

|

|

2.4 |

|

|

7.5 |

|

|

6.0 |

|

|

Unallocated |

|

(4.3 |

) |

|

(4.2 |

) |

|

(12.8 |

) |

|

(13.6 |

) |

| Loss from operations |

|

$ |

(0.9 |

) |

|

$ |

(1.8 |

) |

|

$ |

(5.3 |

) |

|

$ |

(7.6 |

) |

|

|

|

Three Months

EndedSeptember 30, |

|

Nine Months

EndedSeptember 30, |

|

|

|

2018 |

|

2017 |

|

2018 |

|

2017 |

|

Mobile Connectivity Revenue Components |

|

(percentage of net

sales) |

| Product sales |

|

17 |

% |

|

18 |

% |

|

19 |

% |

|

21 |

% |

| mini-VSAT Broadband airtime |

|

41 |

% |

|

42 |

% |

|

41 |

% |

|

41 |

% |

| Content and training |

|

16 |

% |

|

20 |

% |

|

18 |

% |

|

20 |

% |

|

Inertial Navigation Revenue Components |

|

|

|

|

|

|

|

|

| FOG-based products |

|

18 |

% |

|

13 |

% |

|

16 |

% |

|

12 |

% |

| Tactical navigation products |

|

3 |

% |

|

4 |

% |

|

2 |

% |

|

3 |

% |

| |

| KVH INDUSTRIES, INC. AND

SUBSIDIARIESNON-GAAP EPS

GUIDANCE(unaudited) |

| |

|

|

|

|

|

|

|

Fourth

QuarterFiscal 2018 (Projected) |

|

Full

YearFiscal 2018 (Projected) |

|

Net loss per common share |

|

$(0.10) - $(0.01) |

|

$(0.48) - $(0.38) |

|

|

|

|

|

|

|

Estimated amortization of intangibles (a) |

|

$0.06 |

|

$0.24 |

|

Estimated stock-based compensation expense |

|

$0.05 |

|

$0.20 |

|

Estimated tax effect |

|

$(0.02) |

|

$(0.09) |

| Change in valuation allowance (b) |

|

$0.03 - $ 0.01 |

|

$0.17 - $0.14 |

|

|

|

|

|

|

|

Non-GAAP net income per common share (c) |

|

$0.02 - $0.09 |

|

$0.04 - $0.11 |

- Includes amortization of intangible assets resulting from

acquisitions.

- Represents incremental forecasted valuation allowance that we

expect to record against additional deferred tax assets generated

in 2018.

- Assumes no significant change in realized and unrealized

foreign exchange transactions gains and losses.

| |

| KVH INDUSTRIES, INC. AND

SUBSIDIARIESNON-GAAP ADJUSTED EBITDA

GUIDANCE(in millions, unaudited) |

| |

|

|

|

Fourth Quarter

Fiscal 2018 (Projected) |

|

Full

YearFiscal 2018 (Projected) |

|

GAAP net loss |

|

($2.0) - $0.0 |

|

($8.4) - ($6.4) |

|

|

|

|

|

|

|

Estimated income tax provision |

|

$0.2 |

|

$0.8 |

|

Estimated interest expense, net |

|

$0.2 |

|

$1.1 |

|

Estimated depreciation and amortization (a) |

|

$3.7 |

|

$13.1 |

|

Estimated stock-based compensation expense |

|

$0.9 |

|

$3.4 |

|

|

|

|

|

|

|

Non-GAAP adjusted EBITDA(b) |

|

$3.0 - $5.0 |

|

$10.0 - $12.0 |

- Reflects amortization of intangible assets resulting from

acquisitions and depreciation of fixed assets.

- Assumes no significant change in realized and unrealized

foreign exchange transaction gains and losses.

|

|

|

|

|

|

|

Contact: |

|

KVH

Industries, Inc.Donald W. Reilly401-608-8977dreilly@kvh.com |

|

FTI

ConsultingChristine Mohrmann212-850-5600 |

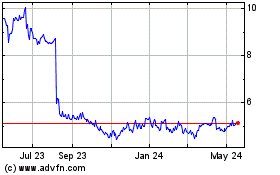

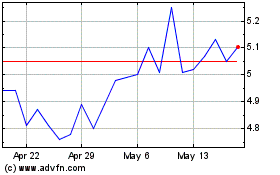

KVH Industries (NASDAQ:KVHI)

Historical Stock Chart

From Jun 2024 to Jul 2024

KVH Industries (NASDAQ:KVHI)

Historical Stock Chart

From Jul 2023 to Jul 2024