Standard BioTools Inc. (“Standard BioTools” or the “Company”)

(Nasdaq: LAB) today announced financial results for the fourth

quarter and fiscal year ended December 31, 2023.

Standard BioTools Stand-Alone 2023

Fourth Quarter and Full Year Selected Financial

Results2

|

|

Quarter Ended |

|

Year Ended |

|

(Unaudited, in millions, except percentages) |

December 31, 2023 |

|

December 31, 2023 |

|

Revenue |

$ |

28.2 |

|

|

$ |

106.3 |

|

| GAAP gross

margin |

|

47.4 |

% |

|

|

47.4 |

% |

| Non-GAAP gross

margin |

|

59.6 |

% |

|

|

60.1 |

% |

| Operating

expenses |

$ |

34.7 |

|

|

$ |

127.1 |

|

| Non-GAAP operating

expenses |

$ |

24.3 |

|

|

$ |

98.6 |

|

| Operating

loss |

$ |

(21.4 |

) |

|

$ |

(76.6 |

) |

| Net loss |

$ |

(19.8 |

) |

|

$ |

(74.7 |

) |

| Non-GAAP adjusted

EBITDA |

$ |

(7.5 |

) |

|

$ |

(34.7 |

) |

| Cash, cash

equivalents, restricted cash and short-term investments |

|

|

|

|

$ |

115.7 |

|

| Combined pro forma

cash, cash equivalents, restricted cash and short-term

investments3 |

|

|

|

|

$ |

565.3 |

|

| |

|

|

|

|

|

|

|

"In our first full year of operational

execution, the Standard BioTools team hit our major target of

standardizing the core business units and instilling SBS business

systems throughout the organization. We also did so in one of the

more challenging economic environments I’ve seen in life sciences

over the last 20 years,” said Michael Egholm, PhD, President and

Chief Executive Officer of Standard BioTools. "We have now

assembled a team of seasoned operators, executing with a

laser-focus on operational discipline, behind a clear strategy to

bring together unique technologies under one roof. We believe this

team is well positioned to achieve scale and profitability. The

team has confirmed its capabilities through the ongoing reduction

of expenses and cash consumption, while at the same time returning

a declining business back to growth.”

Standard BioTools Financial Highlights

Compared to 2022

- Total revenue

increased 9% in fiscal year 2023 and 4% in the fourth quarter;

- Instrument sales

grew 46% in fiscal year 2023 and 44% in the fourth quarter;

- Non-GAAP gross

margin expanded 900 basis points to 60.1% in fiscal year 2023 and

630 basis points to 59.6% in the fourth quarter;

- Non-GAAP operating

expenses declined $20 million, or 17%, in fiscal year 2023 and $1

million, or 5% in the fourth quarter;

- Non-GAAP adjusted

EBITDA loss improved $34 million in fiscal year 2023 and over $3

million in the fourth quarter; and

- Operating cash use

declined $47 million, or 53%, in fiscal 2023 and $6 million, or

32%, in the fourth quarter.

On a combined pro forma basis, after giving

effect to the merger with SomaLogic, Inc. (“SomaLogic”), total

revenue for the year ended December 31, 2023 was approximately $192

million, and cash, cash equivalents, restricted cash and short-term

investments at December 31, 2023 were approximately $565

million.

Egholm added, “With the recent closing of the

merger with SomaLogic, we have moved into the next phase of the

growth strategy. I am delighted to report that the merger

integration process is well underway. We are building significant

momentum and are excited to capitalize on technological and

commercial potential while accelerating the collective path to

profitability. We are also continuing to identify new partners with

emerging technologies and businesses where together we can scale

their operations, diversify our collective revenue, and empower our

customers to do amazing research. We believe the best is yet to

come for Standard BioTools and SomaLogic – we are better

together.”

A reconciliation of non-GAAP gross margin,

non-GAAP operating expenses, and non-GAAP adjusted EBITDA is

provided in the financial schedules that are part of this press

release. An explanation of these non-GAAP financial measures is

also included below under the heading “Use of Non-GAAP Financial

Information.”

Outlook for 2024

For fiscal year 2024, the combined Company

expects revenue in the range of $200 million to $205 million.

Conference Call Information

Standard BioTools will host a conference call

and webcast today at 1:30 p.m. PT, 4:30 p.m. ET, to discuss fourth

quarter and full year 2023 financial results and operational

progress as well as to provide additional color on its strategic

actions.

The Company today is providing an Investor

Relations presentation with additional information on its business

and operations, including an appendix with Supplemental Financial

Information which is available, concurrent with this news release,

on the Investor Relations page of the Company's website at Events

& Presentations.

Live audio of the webcast will be available

online along with an archived version of the webcast under the

Events & Presentations page of the Company’s website.

To participate in the conference call by phone,

may do so using one of the following dial-in numbers below:

- US domestic callers: 1-888-346-3970

- Outside US callers: 1-412-902-4297

Use of Non-GAAP Financial

Information

Standard BioTools has presented certain

financial information in accordance with U.S. GAAP and also on a

non-GAAP basis. The non-GAAP financial measures included in this

press release are non-GAAP gross margin, non-GAAP operating

expenses, and adjusted EBITDA. Management uses these non-GAAP

financial measures, in addition to GAAP financial measures, as a

measure of operating performance because the non-GAAP financial

measures do not include the impact of items that management does

not consider indicative of the Company’s core operating

performance. Management believes that non-GAAP financial measures,

taken in conjunction with GAAP financial measures, provide useful

information for both management and investors by excluding certain

non-cash and other expenses that are not indicative of the

Company’s core operating results. Management uses non-GAAP measures

to compare the Company’s performance relative to forecasts and

strategic plans and to benchmark the company’s performance

externally against competitors. Non-GAAP information is not

prepared under a comprehensive set of accounting rules and should

only be used to supplement an understanding of the company’s

operating results as reported under U.S. GAAP. Standard BioTools

encourages investors to carefully consider its results under GAAP,

as well as its supplemental non-GAAP information and the

reconciliations between these presentations, to more fully

understand its business. Reconciliations between GAAP and non-GAAP

operating results are presented in the accompanying tables of this

release.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995, including, among others, statements regarding

future financial and business performance; expectations,

operational and strategic plans; deployment of capital; market and

growth opportunity and potential; the potential to realize the

expected benefits following the merger of the Company and

SomaLogic; and the Company’s revenue outlook for the full year

2024. Forward-looking statements are subject to numerous risks and

uncertainties that could cause actual results to differ materially

from currently anticipated results, including, but not limited to,

the outcome of any legal proceedings related to the merger; risks

that the anticipated benefits of the merger or other commercial

opportunities may otherwise not be fully realized or may take

longer to realize than expected; risks that the Company may not

realize expected cost savings from our restructuring, including the

anticipated decrease in operational expenses, at the levels it

expects; possible restructuring and transition-related disruption,

including through the loss of customers, suppliers, and employees

and adverse impacts on the Company’s development activities and

results of operation; restructuring activities, including the

Company’s subleasing plans, customer and employee relations,

management distraction, and reduced operating performance; risks

that internal and external costs required for ongoing and planned

activities may be higher than expected, which may cause the Company

to use cash more quickly than it expects or change or curtail some

of the Company’s plans, or both; risks that the Company’s

expectations as to expenses, cash usage, and cash needs may prove

not to be correct for other reasons such as changes in plans or

actual events being different than our assumptions; changes in the

Company’s business or external market conditions; challenges

inherent in developing, manufacturing, launching, marketing, and

selling new products; interruptions or delays in the supply of

components or materials for, or manufacturing of, the

Company’s products; reliance on sales of capital equipment for a

significant proportion of revenues in each quarter; seasonal

variations in customer operations; unanticipated increases in costs

or expenses; continued or sustained budgetary, inflationary, or

recessionary pressures; uncertainties in contractual relationships;

reductions in research and development spending or changes in

budget priorities by customers; uncertainties relating to the

Company’s research and development activities, and distribution

plans and capabilities; potential product performance and quality

issues; risks associated with international operations;

intellectual property risks; and competition. For information

regarding other related risks, see the “Risk Factors” section of

the Company’s annual report on Form 10-K filed with

the SEC today, and in the Company’s other filings

with the SEC. These forward-looking statements speak only as

of the date hereof. The Company disclaims any obligation to

update these forward-looking statements except as may be required

by law.

About Standard BioTools

Inc.

Standard BioTools Inc. (Nasdaq: LAB), previously

known as Fluidigm Corporation, is driven by a bold purpose –

Unleashing tools to accelerate breakthroughs in human health.

Standard BioTools has an established portfolio of essential,

standardized next-generation technologies that help biomedical

researchers develop medicines faster and better. As a leading

solutions provider, the company provides reliable and repeatable

insights in health and disease using its proprietary mass cytometry

and microfluidics technologies, which help transform scientific

discoveries into better patient outcomes. Standard BioTools works

with leading academic, government, pharmaceutical, biotechnology,

plant and animal research, and clinical laboratories worldwide,

focusing on the most pressing needs in translational and clinical

research, including oncology, immunology, and immunotherapy. Learn

more at www.standardbio.com or connect with us on Twitter®,

Facebook®, LinkedIn, and YouTube™. Standard BioTools, the Standard

BioTools logo, Fluidigm, the Fluidigm logo, “Unleashing tools to

accelerate breakthroughs in human health,” Hyperion, Hyperion XTi,

XTi, and X9 are trademarks and/or registered trademarks of Standard

BioTools Inc. or its affiliates in the United States and/or other

countries. All other trademarks are the sole property of their

respective owners. Standard BioTools products are provided for

Research Use Only. Not for use in diagnostic

procedures.

Available Information

Standard BioTools uses its website

(standardbio.com), investor site (investors.standardbio.com),

corporate Twitter account (@Standard_BioT), Facebook page

(facebook.com/StandardBioT), and LinkedIn page

(linkedin.com/company/standard-biotools) as channels of

distribution of information about its products, its planned

financial and other announcements, its attendance at upcoming

investor and industry conferences, and other matters. Such

information may be deemed material information, and Standard

BioTools may use these channels to comply with its disclosure

obligations under Regulation FD. Therefore, investors should

monitor Standard BioTools’ website and its social media accounts in

addition to following its press releases, SEC filings, public

conference calls, and webcasts.

Investor Contacts

David HolmesGilmartin Group LLC(332) 330-1031

ir@standardbio.com

__________________1 Reflects (i) pro forma

combined revenue of the Company and SomaLogic, including

SomaLogic’s unaudited 2023 revenue of $86.1 million and (ii) pro

forma combined cash, cash equivalents, restricted cash and

short-term investments as of December 31, 2023, including

SomaLogic’s unaudited cash, cash equivalents and short-term

investments of $449.8 million as of December 31, 2023, in each case

after giving effect to the merger with SomaLogic, which closed on

January 5, 2024. 2 Unless otherwise noted financial results include

only the Standard BioTools legacy business in 2023, and exclude the

results of SomaLogic, which became part of Standard BioTools on

January 5, 2024 and will be included in the Company’s consolidated

financial statements beginning with the quarter ended March 31,

2024.3 Reflects pro forma combined cash, cash equivalents,

restricted cash and short-term investments as of December 31, 2023,

including SomaLogic’s unaudited cash, cash equivalents and

short-term investments of $449.8 million as of December 31, 2023,

after giving effect to the merger with SomaLogic, which closed on

January 5, 2024.

| |

| STANDARD

BIOTOOLS INC.CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(In thousands, except per share

amounts) |

| |

|

|

|

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

|

(Unaudited) |

|

|

|

|

|

Revenue: |

|

|

|

|

|

|

|

|

|

Product revenue |

|

$ |

21,384 |

|

|

$ |

20,919 |

|

|

$ |

79,198 |

|

|

$ |

72,454 |

|

|

Service and other revenue |

|

|

6,804 |

|

|

|

6,102 |

|

|

|

27,142 |

|

|

|

25,494 |

|

|

Total revenue |

|

|

28,188 |

|

|

|

27,021 |

|

|

|

106,340 |

|

|

|

97,948 |

|

|

Cost of revenue: |

|

|

|

|

|

|

|

|

|

Cost of product revenue |

|

|

11,666 |

|

|

|

13,387 |

|

|

|

44,942 |

|

|

|

52,555 |

|

|

Cost of service and other revenue |

|

|

3,165 |

|

|

|

2,467 |

|

|

|

10,948 |

|

|

|

8,342 |

|

|

Total cost of revenue |

|

|

14,831 |

|

|

|

15,854 |

|

|

|

55,890 |

|

|

|

60,897 |

|

|

Gross profit |

|

|

13,357 |

|

|

|

11,167 |

|

|

|

50,450 |

|

|

|

37,051 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

Research and development |

|

|

6,909 |

|

|

|

7,425 |

|

|

|

25,948 |

|

|

|

37,382 |

|

|

Selling, general and administrative |

|

|

21,354 |

|

|

|

20,224 |

|

|

|

87,541 |

|

|

|

102,285 |

|

|

Restructuring and related charges |

|

|

1,661 |

|

|

|

4,630 |

|

|

|

7,076 |

|

|

|

9,732 |

|

|

Transaction-related expenses |

|

|

4,819 |

|

|

|

— |

|

|

|

6,485 |

|

|

|

3,857 |

|

|

Total operating expenses |

|

|

34,743 |

|

|

|

32,279 |

|

|

|

127,050 |

|

|

|

153,256 |

|

|

Loss from operations |

|

|

(21,386 |

) |

|

|

(21,112 |

) |

|

|

(76,600 |

) |

|

|

(116,205 |

) |

|

Interest expense |

|

|

(1,098 |

) |

|

|

(1,190 |

) |

|

|

(4,567 |

) |

|

|

(4,331 |

) |

|

Loss on forward sale of Series B Preferred Stock |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(60,081 |

) |

|

Loss on Bridge Loans |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(13,719 |

) |

|

Other income (expense), net |

|

|

2,546 |

|

|

|

1,527 |

|

|

|

6,963 |

|

|

|

1,408 |

|

|

Loss before income taxes |

|

|

(19,938 |

) |

|

|

(20,775 |

) |

|

|

(74,204 |

) |

|

|

(192,928 |

) |

|

Income tax benefit (expense) |

|

|

162 |

|

|

|

(70 |

) |

|

|

(452 |

) |

|

|

2,830 |

|

|

Net loss |

|

$ |

(19,776 |

) |

|

$ |

(20,845 |

) |

|

$ |

(74,656 |

) |

|

$ |

(190,098 |

) |

|

Net loss per share, basic and diluted |

|

$ |

(0.25 |

) |

|

$ |

(0.26 |

) |

|

$ |

(0.94 |

) |

|

$ |

(2.43 |

) |

|

Shares used in computing net loss per share, basic and diluted |

|

|

79,729 |

|

|

|

79,434 |

|

|

|

79,160 |

|

|

|

78,305 |

|

| |

| STANDARD

BIOTOOLS INC.CONDENSED CONSOLIDATED BALANCE

SHEETS(In thousands) |

| |

|

|

|

December 31, 2023 |

|

December 31, 2022 |

|

ASSETS |

|

|

|

|

|

Current assets: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

51,704 |

|

|

$ |

81,309 |

|

|

Short-term investments |

|

|

63,191 |

|

|

|

84,475 |

|

|

Accounts receivable, net |

|

|

19,660 |

|

|

|

17,280 |

|

|

Inventories, net |

|

|

20,533 |

|

|

|

21,473 |

|

|

Prepaid expenses and other current assets |

|

|

3,127 |

|

|

|

4,278 |

|

|

Total current assets |

|

|

158,215 |

|

|

|

208,815 |

|

|

Property and equipment, net |

|

|

24,187 |

|

|

|

25,652 |

|

|

Operating lease right-of-use asset, net |

|

|

30,663 |

|

|

|

33,883 |

|

|

Other non-current assets |

|

|

2,285 |

|

|

|

3,109 |

|

|

Developed technology, net |

|

|

1,400 |

|

|

|

12,600 |

|

|

Goodwill |

|

|

106,317 |

|

|

|

106,251 |

|

|

Total assets |

|

$ |

323,067 |

|

|

$ |

390,310 |

|

|

|

|

|

|

|

|

LIABILITIES, MEZZANINE EQUITY AND STOCKHOLDERS’

DEFICIT |

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

Accounts payable |

|

$ |

9,236 |

|

|

$ |

7,914 |

|

|

Accrued compensation and related benefits |

|

|

11,867 |

|

|

|

9,153 |

|

|

Operating lease liabilities, current |

|

|

4,323 |

|

|

|

3,682 |

|

|

Deferred revenue, current |

|

|

11,607 |

|

|

|

10,792 |

|

|

Deferred grant income, current |

|

|

3,612 |

|

|

|

3,644 |

|

|

Other accrued liabilities |

|

|

9,152 |

|

|

|

6,175 |

|

|

Term loan, current |

|

|

5,000 |

|

|

|

2,083 |

|

|

Convertible notes, current |

|

|

54,530 |

|

|

|

— |

|

|

Total current liabilities |

|

|

109,327 |

|

|

|

43,443 |

|

|

Convertible notes, non-current |

|

|

569 |

|

|

|

54,615 |

|

|

Term loan, non-current |

|

|

3,414 |

|

|

|

8,194 |

|

|

Deferred tax liability |

|

|

841 |

|

|

|

1,055 |

|

|

Operating lease liabilities, non-current |

|

|

30,374 |

|

|

|

34,081 |

|

|

Deferred revenue, non-current |

|

|

3,520 |

|

|

|

3,816 |

|

|

Deferred grant income, non-current |

|

|

10,755 |

|

|

|

14,359 |

|

|

Other non-current liabilities |

|

|

1,065 |

|

|

|

961 |

|

|

Total liabilities |

|

|

159,865 |

|

|

|

160,524 |

|

|

Mezzanine equity: |

|

|

|

|

|

Redeemable preferred stock |

|

|

311,253 |

|

|

|

311,253 |

|

|

Total stockholders’ deficit |

|

|

(148,051 |

) |

|

|

(81,467 |

) |

|

Total liabilities, mezzanine equity and stockholders’ deficit |

|

$ |

323,067 |

|

|

$ |

390,310 |

|

| |

|

STANDARD BIOTOOLS INC.CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS(In

thousands) |

| |

|

|

|

Twelve Months Ended December 31, |

|

|

|

2023 |

|

2022 |

|

Operating activities |

|

|

|

|

|

Net loss |

|

$ |

(74,656 |

) |

|

$ |

(190,098 |

) |

|

Loss on forward sale of Series B Preferred Stock |

|

|

— |

|

|

|

60,081 |

|

|

Loss on bridge loans |

|

|

— |

|

|

|

13,719 |

|

|

Stock-based compensation expense |

|

|

13,123 |

|

|

|

14,880 |

|

|

Amortization of developed technology |

|

|

11,200 |

|

|

|

11,528 |

|

|

Depreciation and amortization |

|

|

3,980 |

|

|

|

3,499 |

|

|

Provision for excess and obsolete inventory |

|

|

1,496 |

|

|

|

7,874 |

|

|

Impairment of InstruNor developed technology intangible |

|

|

— |

|

|

|

3,526 |

|

|

Amortization of debt discounts, premiums and issuance costs |

|

|

770 |

|

|

|

830 |

|

|

Other non-cash items |

|

|

(987 |

) |

|

|

273 |

|

|

Changes in assets and liabilities, net |

|

|

1,787 |

|

|

|

(15,482 |

) |

|

Net cash used in operating activities |

|

|

(43,287 |

) |

|

|

(89,370 |

) |

|

|

|

|

|

|

|

Investing activities |

|

|

|

|

|

Purchases of short-term investments |

|

|

(94,896 |

) |

|

|

(137,302 |

) |

|

Proceeds from sales and maturities of investments |

|

|

117,964 |

|

|

|

53,000 |

|

|

Purchases of property and equipment |

|

|

(2,831 |

) |

|

|

(3,825 |

) |

|

Net cash provided by (used in) investing activities |

|

|

20,237 |

|

|

|

(88,127 |

) |

|

|

|

|

|

|

|

Financing activities |

|

|

|

|

|

Proceeds from bridge loans |

|

|

— |

|

|

|

25,000 |

|

|

Proceeds from issuance of Series B Preferred Stock |

|

|

— |

|

|

|

225,000 |

|

|

Repayment of term loan and advances under revolving credit

facility |

|

|

(2,083 |

) |

|

|

(6,838 |

) |

|

Payment of debt and equity issuance costs |

|

|

— |

|

|

|

(12,547 |

) |

|

Repurchase of common stock |

|

|

(5,414 |

) |

|

|

(563 |

) |

|

Proceeds from ESPP stock issuance |

|

|

827 |

|

|

|

917 |

|

|

Payments for taxes related to net share settlement of equity awards

and other |

|

|

(139 |

) |

|

|

(211 |

) |

|

Net cash provided by (used in) financing activities |

|

|

(6,809 |

) |

|

|

230,758 |

|

|

Effect of foreign exchange rate fluctuations on cash and cash

equivalents |

|

|

34 |

|

|

|

(404 |

) |

|

Net increase (decrease) in cash, cash equivalents and restricted

cash |

|

|

(29,825 |

) |

|

|

52,857 |

|

|

Cash, cash equivalents and restricted cash at beginning of

period |

|

|

82,324 |

|

|

|

29,467 |

|

|

Cash, cash equivalents and restricted cash at end of period |

|

$ |

52,499 |

|

|

$ |

82,324 |

|

|

|

|

|

|

|

|

Cash, cash equivalents, and restricted cash consists of: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

51,704 |

|

|

$ |

81,309 |

|

|

Restricted cash |

|

|

795 |

|

|

|

1,015 |

|

|

Total cash, cash equivalents and restricted cash |

|

$ |

52,499 |

|

|

$ |

82,324 |

|

| |

|

STANDARD BIOTOOLS INC.RECONCILIATION OF

GAAP TO NON-GAAP FINANCIAL INFORMATION(In

thousands)(Unaudited)ITEMIZED

RECONCILIATION OF GAAP TO NON-GAAP GROSS PROFIT AND MARGIN

PERCENTAGE |

| |

|

|

|

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

GAAP gross profit |

|

$ |

13,357 |

|

|

$ |

11,167 |

|

|

$ |

50,450 |

|

|

$ |

37,051 |

|

|

Amortization of developed technology |

|

|

2,800 |

|

|

|

2,800 |

|

|

|

11,200 |

|

|

|

11,208 |

|

|

Depreciation and amortization |

|

|

482 |

|

|

|

297 |

|

|

|

1,473 |

|

|

|

1,245 |

|

|

Stock-based compensation expense |

|

|

163 |

|

|

|

133 |

|

|

|

811 |

|

|

|

592 |

|

|

Non-GAAP gross profit |

|

$ |

16,802 |

|

|

$ |

14,397 |

|

|

$ |

63,934 |

|

|

$ |

50,096 |

|

|

|

|

|

|

|

|

|

|

|

|

GAAP gross margin percentage |

|

|

47.4 |

% |

|

|

41.3 |

% |

|

|

47.4 |

% |

|

|

37.8 |

% |

|

Amortization of developed technology |

|

|

9.9 |

% |

|

|

10.4 |

% |

|

|

10.5 |

% |

|

|

11.4 |

% |

|

Depreciation and amortization |

|

|

1.7 |

% |

|

|

1.1 |

% |

|

|

1.4 |

% |

|

|

1.3 |

% |

|

Stock-based compensation expense |

|

|

0.6 |

% |

|

|

0.5 |

% |

|

|

0.8 |

% |

|

|

0.6 |

% |

|

Non-GAAP gross margin percentage |

|

|

59.6 |

% |

|

|

53.3 |

% |

|

|

60.1 |

% |

|

|

51.1 |

% |

| |

|

STANDARD BIOTOOLS INC.RECONCILIATION OF

GAAP TO NON-GAAP FINANCIAL INFORMATION(In

thousands)(Unaudited)ITEMIZED

RECONCILIATION OF GAAP TO NON-GAAP OPERATING EXPENSES |

| |

|

|

|

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

GAAP operating expenses |

|

$ |

34,743 |

|

|

$ |

32,279 |

|

|

$ |

127,050 |

|

|

$ |

153,256 |

|

|

Restructuring and related charges |

|

|

(1,661 |

) |

|

|

(4,630 |

) |

|

|

(7,076 |

) |

|

|

(9,732 |

) |

|

Transaction-related expenses |

|

|

(4,819 |

) |

|

|

— |

|

|

|

(6,485 |

) |

|

|

(3,857 |

) |

|

Stock-based compensation expense |

|

|

(3,312 |

) |

|

|

(1,548 |

) |

|

|

(12,312 |

) |

|

|

(14,288 |

) |

|

Depreciation and amortization |

|

|

(624 |

) |

|

|

(523 |

) |

|

|

(2,507 |

) |

|

|

(2,575 |

) |

|

Impairment of intangible assets |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(3,526 |

) |

|

Loss on disposal of property and equipment |

|

|

— |

|

|

|

(100 |

) |

|

|

(73 |

) |

|

|

(312 |

) |

|

Non-GAAP operating expenses |

|

$ |

24,327 |

|

|

$ |

25,478 |

|

|

$ |

98,597 |

|

|

$ |

118,966 |

|

|

|

|

|

|

|

|

|

|

|

|

GAAP R&D operating expenses |

|

$ |

6,909 |

|

|

$ |

7,425 |

|

|

$ |

25,948 |

|

|

$ |

37,382 |

|

|

Stock-based compensation expense |

|

|

(430 |

) |

|

|

(467 |

) |

|

|

(1,671 |

) |

|

|

(2,481 |

) |

|

Depreciation and amortization |

|

|

(125 |

) |

|

|

(150 |

) |

|

|

(526 |

) |

|

|

(954 |

) |

|

Impairment of intangible assets |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(3,526 |

) |

|

Non-GAAP R&D operating expenses |

|

$ |

6,354 |

|

|

$ |

6,808 |

|

|

$ |

23,751 |

|

|

$ |

30,421 |

|

|

|

|

|

|

|

|

|

|

|

|

GAAP SG&A operating expenses |

|

$ |

21,354 |

|

|

$ |

20,224 |

|

|

$ |

87,541 |

|

|

$ |

102,285 |

|

|

Stock-based compensation expense |

|

|

(2,882 |

) |

|

|

(1,081 |

) |

|

|

(10,641 |

) |

|

|

(11,807 |

) |

|

Depreciation and amortization |

|

|

(499 |

) |

|

|

(373 |

) |

|

|

(1,981 |

) |

|

|

(1,621 |

) |

|

Loss on disposal of property and equipment |

|

|

— |

|

|

|

(100 |

) |

|

|

(73 |

) |

|

|

(312 |

) |

|

Non-GAAP SG&A operating expenses |

|

$ |

17,973 |

|

|

$ |

18,670 |

|

|

$ |

74,846 |

|

|

$ |

88,545 |

|

| |

|

STANDARD BIOTOOLS INC.RECONCILIATION

OF GAAP TO NON-GAAP FINANCIAL INFORMATION(In

thousands)(Unaudited)ITEMIZED

RECONCILIATION OF GAAP NET LOSS TO NON-GAAP ADJUSTED

EBITDA |

| |

|

|

|

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

GAAP net loss |

|

$ |

(19,776 |

) |

|

$ |

(20,845 |

) |

|

$ |

(74,656 |

) |

|

$ |

(190,098 |

) |

|

Income tax expense (benefit) |

|

|

(162 |

) |

|

|

70 |

|

|

|

452 |

|

|

|

(2,830 |

) |

|

Interest expense |

|

|

1,098 |

|

|

|

1,190 |

|

|

|

4,567 |

|

|

|

4,331 |

|

|

Amortization of developed technology |

|

|

2,800 |

|

|

|

2,800 |

|

|

|

11,200 |

|

|

|

11,528 |

|

|

Depreciation and amortization |

|

|

1,106 |

|

|

|

819 |

|

|

|

3,980 |

|

|

|

3,499 |

|

|

Restructuring and related charges |

|

|

1,661 |

|

|

|

4,630 |

|

|

|

7,076 |

|

|

|

9,732 |

|

|

Transaction-related expenses |

|

|

4,819 |

|

|

|

— |

|

|

|

6,485 |

|

|

|

3,857 |

|

|

Stock-based compensation expense |

|

|

3,475 |

|

|

|

1,681 |

|

|

|

13,123 |

|

|

|

14,880 |

|

|

Impairment of intangible assets |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3,526 |

|

|

Loss on forward sale of Series B Preferred Stock |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

60,081 |

|

|

Loss on bridge loans |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

13,719 |

|

|

Other non-operating expense (income) |

|

|

(2,546 |

) |

|

|

(1,527 |

) |

|

|

(6,963 |

) |

|

|

(1,408 |

) |

|

Loss on disposal of property and equipment |

|

|

— |

|

|

|

100 |

|

|

|

73 |

|

|

|

312 |

|

|

Non-GAAP adjusted EBITDA |

|

$ |

(7,525 |

) |

|

$ |

(11,082 |

) |

|

$ |

(34,663 |

) |

|

$ |

(68,871 |

) |

| CALCULATION

OF OPERATING CASH USE |

| |

|

|

|

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Net cash used in operating activities (1) |

|

$ |

(14,061 |

) |

|

$ |

(19,181 |

) |

|

$ |

(43,287 |

) |

|

$ |

(89,370 |

) |

|

Purchases of property and equipment |

|

|

(78 |

) |

|

|

(755 |

) |

|

|

(2,831 |

) |

|

|

(3,825 |

) |

|

Cash paid for interest |

|

|

1,648 |

|

|

|

1,646 |

|

|

|

3,819 |

|

|

|

3,493 |

|

|

Operating cash use |

|

$ |

(12,491 |

) |

|

$ |

(18,290 |

) |

|

$ |

(42,299 |

) |

|

$ |

(89,702 |

) |

|

|

|

(1) Derived from the Condensed Consolidated Statements of Cash

Flows. |

| |

|

|

|

|

|

|

|

|

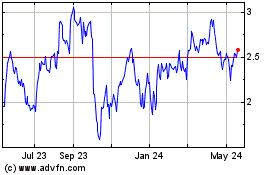

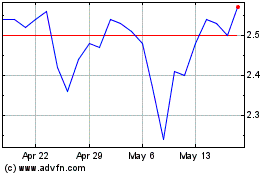

Standard BioTools (NASDAQ:LAB)

Historical Stock Chart

From Feb 2025 to Mar 2025

Standard BioTools (NASDAQ:LAB)

Historical Stock Chart

From Mar 2024 to Mar 2025