Standard BioTools Announces Exchange of All Outstanding Series B Convertible Preferred Stock for Common Stock

18 March 2024 - 11:12PM

Standard BioTools Inc. (“Standard BioTools” or the “Company”)

(Nasdaq: LAB) today announced that it has exchanged all outstanding

shares of its Series B Convertible Preferred Stock (the “Series B

Preferred”) for shares of common stock pursuant to an agreement

with stockholders affiliated with Viking Global Investors

(“Viking”) and Casdin Capital (“Casdin").

Thomas Carey, Chairman of the Standard BioTools Board of

Directors, said, “We are pleased to reach this agreement with

Viking and Casdin. By streamlining our capital structure, we

believe this transaction will make us more attractive to new

long-term investors and potential M&A partners, as we pursue

our strategy to unlock value for all of our stockholders in this

highly fragmented market. We appreciate Viking and Casdin’s

longstanding support and partnership and are pleased to have them

as common stockholders.”

Michael Egholm, PhD, President and Chief Executive Officer of

Standard BioTools, said, “We are successfully executing on our

strategy to drive profitable growth through a focus on operational

excellence coupled with disciplined M&A to build a more diverse

portfolio of unique products. With our significant momentum and the

progress underway, this transaction is another important step

forward in our commitment to create sustainable, long-term

stockholder value.”

Under the terms of the exchange agreement, Standard BioTools

issued a total of approximately 93 million shares of common stock

in exchange for all of the Series B Preferred at an exchange price

of $2.75 per share. This exchange price resulted in the issuance of

approximately 17.8 million additional shares of common stock, as

compared to the shares of common stock issuable under the Series B

Preferred’s stated $3.40 per share conversion price. The issuance

of the incremental shares of common stock represents less than 5%

dilution on an as-issued basis, and has resulted in the elimination

of all Series B Preferred senior rights, including the elimination

of the approximately $250 million liquidation preference, the put

right in the event of a change in control and Series B Preferred

governance rights. As a result, the Company now has approximately

382.5 million shares of common stock outstanding.

TD Cowen served as financial advisor to the Special Committee of

the Board of Directors and Mintz, Levin, Cohn, Ferris, Glovesky and

Popeo served as legal counsel.

About Standard BioTools Inc.

Standard BioTools Inc. (Nasdaq: LAB), previously known as

Fluidigm Corporation, is driven by a bold purpose – Unleashing

tools to accelerate breakthroughs in human health. Standard

BioTools has an established portfolio of essential, standardized

next-generation technologies that help biomedical researchers

develop medicines faster and better. As a leading solutions

provider, the company provides reliable and repeatable insights in

health and disease using its proprietary mass cytometry and

microfluidics technologies, which help transform scientific

discoveries into better patient outcomes. Standard BioTools works

with leading academic, government, pharmaceutical, biotechnology,

plant and animal research, and clinical laboratories worldwide,

focusing on the most pressing needs in translational and clinical

research, including oncology, immunology, and immunotherapy. Learn

more at www.standardbio.com or connect with us on Twitter®,

Facebook®, LinkedIn, and YouTube™. Standard BioTools, the Standard

BioTools logo, Fluidigm, the Fluidigm logo, “Unleashing tools to

accelerate breakthroughs in human health,” Hyperion, Hyperion XTi,

XTi, and X9 are trademarks and/or registered trademarks of Standard

BioTools Inc. or its affiliates in the United States and/or other

countries. All other trademarks are the sole property of their

respective owners. Standard BioTools products are provided for

Research Use Only. Not for use in diagnostic procedures.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, including, among others, statements regarding the potential

benefits of a streamlined capitalization structure; our ability to

attract new long-term investors and potential M&A partners;

future business performance; expectations, operational and

strategic plans; deployment of capital; and market and growth

opportunities. Forward-looking statements are subject to numerous

risks and uncertainties that could cause actual results to differ

materially from currently anticipated results, including, but not

limited to, the outcome of any legal proceedings related to the

merger with SomaLogic, Inc.; risks that the anticipated benefits of

the merger with SomaLogic, Inc. or other commercial opportunities

may otherwise not be fully realized or may take longer to realize

than expected; risks that we may not realize expected cost savings

from our restructuring, including the anticipated decrease in

operational expenses, at the levels we expect; possible

restructuring and transition-related disruption, including through

the loss of customers, suppliers, and employees and adverse impacts

on our development activities and results of operation;

restructuring activities, including our subleasing plans, customer

and employee relations, management distraction, and reduced

operating performance; risks that internal and external costs

required for ongoing and planned activities may be higher than

expected, which may cause us to use cash more quickly than we

expect or change or curtail some of our plans, or both; risks that

our expectations as to expenses, cash usage, and cash needs may

prove not to be correct for other reasons such as changes in plans

or actual events being different than our assumptions; changes in

our business or external market conditions; challenges inherent in

developing, manufacturing, launching, marketing, and selling new

products; interruptions or delays in the supply of components or

materials for, or manufacturing of, our products; reliance on sales

of capital equipment for a significant proportion of revenues in

each quarter; seasonal variations in customer operations;

unanticipated increases in costs or expenses; continued or

sustained budgetary, inflationary, or recessionary pressures;

uncertainties in contractual relationships; reductions in research

and development spending or changes in budget priorities by

customers; uncertainties relating to our research and development

activities, and distribution plans and capabilities; potential

product performance and quality issues; risks associated with

international operations; intellectual property risks; and

competition. For information regarding other related risks, see the

“Risk Factors” section of our annual report on Form 10-K filed with

the U.S. Securities and Exchange Commission on March 1, 2024, and

in our other filings with the SEC. These forward-looking statements

speak only as of the date hereof. We disclaim any obligation to

update these forward-looking statements except as may be required

by law.

Contacts

InvestorsDavid HolmesGilmartin Group LLC(332)

330-1031ir@standardbio.com

MediaNick Lamplough / Dan Moore / Tali

EpsteinCollected StrategiesLAB-CS@collectedstrategies.com

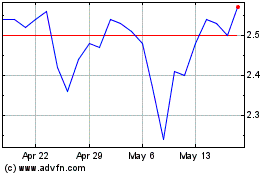

Standard BioTools (NASDAQ:LAB)

Historical Stock Chart

From Feb 2025 to Mar 2025

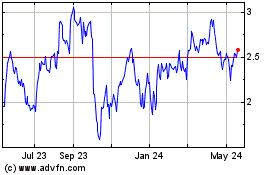

Standard BioTools (NASDAQ:LAB)

Historical Stock Chart

From Mar 2024 to Mar 2025