Lifecore Biomedical, Inc. (Nasdaq: LFCR) (“Lifecore” or the

“Company”), a fully integrated contract development and

manufacturing organization (“CDMO”), reported results for the

fiscal 2023 fourth quarter and full year ended May 28, 2023.

CEO COMMENTS:

James G. Hall, President and Chief Executive

Officer of Lifecore, commented, "We completed a very busy fourth

quarter finalizing our transition to a stand-alone life sciences

company with the final divestitures of the Curation Foods segment,

strong growth in our development portfolio, and the comprehensive

strategic refinancing and expanded supply agreement with our key

customer Alcon. Our entire organization is now aligned toward a

common goal of expanding Lifecore's position as a leading, fully

integrated CDMO that offers highly differentiated capabilities in

the development, fill and finish of complex sterile injectable

pharmaceutical products in syringes and vials and injectable grade

Hyaluronic Acid ("HA")."

Mr. Hall continued, "We advanced our development

portfolio in the fiscal fourth quarter with the addition of five

projects affiliated with five new customers, which demonstrates the

impact that our expanded commercial strategy and targeted sales

approach is having on our opportunity pipeline. Concurrently, we

are preparing our organization for the significant anticipated

growth embedded in our portfolio, both in terms of capacity and

people. To that end, our multi-use fillers remain on track for

delivery in the coming months which will allow us to double our

theoretical filling capacity to approximately 45 million units and

put Lifecore in a great position to meet market needs and optimize

our production across our manufacturing footprint. We also invested

in our HA fermentation capacity during the fourth quarter and are

in the process of moving from a single-shift fermentation

production staff to a full 24/7 staffing model, which we expect

will increase our sterile HA capacity by up to 50% by June 2024,

allowing us to fulfill the increased HA volume orders associated

with our expanded demand."

"Looking ahead to our fiscal 2024 first quarter,

our commercial momentum has continued, and we will add several new

projects to our development portfolio for the period ended August

27, 2023. We believe this activity will begin to meaningfully

contribute to our financial performance in fiscal 2024 second

quarter and to a greater degree in the second half of the fiscal

year."

LIFECORE FISCAL

FOURTH QUARTER 2023 FINANCIAL

HIGHLIGHTS:

- Consolidated revenues of $31.5

million, an increase of 12.2% year-over-year.

- Consolidated gross profit of $8.4

million, a decrease of $4.3 million, or 33.9% year-over-year

- Consolidated net loss from

continuing operations of $33.8 million, which includes a $23.8

million loss on debt refinancing, $6.8 million of restructuring and

other non-recurring charges such as legal expenses, both net of

tax, as compared to a net loss from continuing operations of $1.0

million in the prior year period, which included $5.2 million of

restructuring and other non-recurring charges, net of tax.

- Consolidated adjusted EBITDA of

$3.7 million, compared to $9.1 million in the prior year

period.

- Lifecore segment adjusted EBITDA of

$6.1 million, compared to $10.7 million in the prior year period,

which reflects the timing of shipments to customers; lower

development revenue associated with a delay in onboarding new

customer projects as well as a higher mix of earlier stage, lower

revenue projects; and inflation associated with legacy commercial

products.

LIFECORE FISCAL YEAR 2023 FINANCIAL

HIGHLIGHTS:

- Consolidated revenues of $103.3

million, a decrease of 7.2% year-over-year.

- Consolidated gross profit of $27.3

million, a decrease of $15.6 million, or 36.4% year-over-year.

- Consolidated net loss from

continuing operations of $69.0 million, which includes $20.0

million of restructuring and other non-recurring charges such as

legal expenses, both net of tax, as compared to a net loss from

continuing operations of $12.0 million in the prior year period,

which included $15.8 million of restructuring and other

non-recurring charges, net of tax.

- Consolidated adjusted EBITDA of

$5.8 million, compared to $22.9 million in the prior year

period.

- Lifecore segment adjusted EBITDA of

$14.7 million, compared to $30.7 million in the prior year

period.

Discontinued Operations

As previously reported, the Company closed on

the sales of certain businesses which are now included in

discontinued operations including the following:

- December 13, 2021, Curation Foods'

fresh packaged salads and vegetables business (the “Eat Smart

Disposition”)

- February 7, 2023, Curation Foods'

avocado products business (the “Yucatan Disposition”)

- April 6, 2023, Curation Foods' O

Olive Oil and Vinegar business (the "O Olive Disposition")

The results of the above dispositions are

reflected as discontinued operations in all periods presented

within the Company’s financial statements reported herein.

CONSOLIDATED FISCAL

FOURTH QUARTER 2023 RESULTS:

Fiscal fourth quarter 2023 results compared to

fiscal fourth quarter 2022 are as follows:

| (Unaudited and in thousands,

except per-share data) |

|

Three Months Ended |

|

Change |

| |

|

May 28, 2023 |

|

May 29, 2022 |

|

Amount |

|

% |

|

Revenues |

|

$ |

31,546 |

|

|

$ |

28,107 |

|

|

$ |

3,439 |

|

|

12 % |

| Gross profit |

|

|

8,391 |

|

|

|

12,690 |

|

|

|

(4,299 |

) |

|

(34)% |

| Net loss from continuing

operations |

|

|

(33,795 |

) |

|

|

(1,010 |

) |

|

|

(32,785 |

) |

|

(3246)% |

| Adjusted net income

(loss)* |

|

|

(26,977 |

) |

|

|

4,203 |

|

|

|

(31,180 |

) |

|

N/M |

| Diluted net loss per

share |

|

|

(1.11 |

) |

|

|

(0.03 |

) |

|

|

(1.08 |

) |

|

(3600)% |

| Adjusted diluted net income

(loss) per share* |

|

|

(0.89 |

) |

|

|

0.15 |

|

|

|

(1.04 |

) |

|

N/M |

| EBITDA* |

|

|

(5,498 |

) |

|

|

(47,087 |

) |

|

|

41,589 |

|

|

88 % |

| Adjusted EBITDA* |

|

|

3,727 |

|

|

|

9,149 |

|

|

|

(5,422 |

) |

|

(59)% |

* See “Non-GAAP Financial Information” at the end of this

release as to how the Company defines these non-GAAP financial

measures and for a reconciliation thereof.

Revenues increased $3.4 million year-over-year,

which was primarily a result of a $3.9 million increase in Lifecore

segment revenues.

Gross profit decreased $4.3 million

year-over-year, which was driven by a $5.0 million decrease in the

Lifecore segment and a $0.7 million increase in the Curation Foods

segment.

Net loss from continuing operations was $33.8

million for fiscal fourth quarter 2023, which includes $6.8 million

of restructuring and non-recurring charges, net of taxes, related

to consolidating and optimizing operations associated with the

Company's strategy to divest its Curation Foods businesses. This

compares to a net loss from continuing operations of $1.0 million

in the prior year period, which includes $5.2 million of

restructuring and non-recurring charges, net of tax, similarly

related to consolidating and optimizing its Curation Foods

businesses.

SEGMENT RESULTS:

Lifecore Segment:

| (Unaudited and in

thousands) |

|

Three Months Ended |

|

Change |

|

Twelve Months Ended |

|

Change |

| |

May 28, 2023 |

|

May 29, 2022 |

|

Amount |

|

% |

|

May 28, 2023 |

|

May 29, 2022 |

|

Amount |

|

% |

| Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CDMO |

|

$ |

24,290 |

|

$ |

22,362 |

|

$ |

1,928 |

|

9 |

% |

|

$ |

76,378 |

|

$ |

86,313 |

|

$ |

(9,935 |

) |

|

(12 |

)% |

|

Fermentation |

|

|

7,256 |

|

|

5,251 |

|

|

2,005 |

|

38 |

% |

|

|

26,891 |

|

|

23,007 |

|

|

3,884 |

|

|

17 |

% |

| Total revenue |

|

$ |

31,546 |

|

$ |

27,613 |

|

$ |

3,933 |

|

14 |

% |

|

$ |

103,269 |

|

$ |

109,320 |

|

$ |

(6,051 |

) |

|

(6 |

)% |

Lifecore is the Company’s CDMO business focused

on product development and manufacturing of sterile injectable

products. Lifecore continues to expand its presence in the robust

CDMO marketplace by utilizing its specialized capabilities to

partner with and provide value-added services to biopharmaceutical

and medical device companies. Lifecore continues to seek to drive

growth with a focus on building its business development pipeline,

maximizing capacity and advancing product commercialization for

innovative new therapies that improve patients’ lives.

In the fiscal fourth quarter 2023, Lifecore

realized total revenues of $31.5 million, representing an increase

of 14.2% as compared to the prior year period, primarily driven by

a 38.2% increase in its HA raw material manufacturing

(fermentation) business and an 8.6% increase in its CDMO business.

The increase in HA raw material manufacturing revenue was primarily

due to the higher demand in the current year. The increase in CDMO

revenues was primarily due to the timing of customer shipments, as

well as a higher mix of earlier phase development projects

onboarded at the earlier lower initial revenue stage.

Lifecore's development pipeline in the fourth

quarter of fiscal 2023 increased by five to 29 active development

programs under contract as of the end of the fiscal 2023 fourth

quarter. These projects are delineated as follows: early phase or

proof of concept (seven projects), Phase 1 and Phase 2 clinical

development (eight projects), and Phase 3 clinical development or

scale-up/commercial validation activity (fourteen projects).

Lifecore currently manufactures 29 commercial products for 14

clients, which is unchanged from fiscal third quarter 2023.

Curation Foods Segment:

| (Unaudited and in

thousands) |

|

Three Months Ended |

|

Change |

|

Twelve Months Ended |

|

Change |

| |

May 28, 2023 |

|

May 29, 2022 |

|

Amount |

|

% |

|

May 28, 2023 |

|

May 29, 2022 |

|

Amount |

|

% |

| Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Technology |

|

|

— |

|

|

494 |

|

|

(494 |

) |

|

(100)% |

|

|

— |

|

|

1,910 |

|

|

(1,910 |

) |

|

(100)% |

| Total revenue |

|

$ |

— |

|

$ |

494 |

|

$ |

(494 |

) |

|

(100)% |

|

$ |

— |

|

$ |

1,910 |

|

$ |

(1,910 |

) |

|

(100)% |

The remaining revenues associated with the

Company’s Curation Foods segment relate to the BreatheWay

technology operations, which have been divested, and are included

in continuing operations within the Company’s financial

statements.

CASH FLOW & BALANCE

SHEETCash used in operations was $34.5 million for the

fiscal year ended May 28, 2023 compared to $23.2 million in

the prior year period. Cash provided by investing activities

decreased $84.1 million compared to the prior year period to $4.2

million used in investing activities in 2023, primarily due to the

timing of Curation Foods' businesses dispositions. Capital

expenditures were $20.8 million for the fiscal year ended

May 28, 2023 which were primarily focused on investing in

Lifecore’s long-term growth initiatives. The results for fiscal

year 2023 and 2022 included herein reflect adjustments to increase

capitalized interest by $2.5 million and $1.8 million,

respectively, which have the effect of increasing capital

expenditures and reducing interest expense by offsetting amounts

for the respective periods. These adjustments remain subject to the

completion of the audit of the Company’s financial statements,

including with respect to any final adjustments to capitalized

interest for those periods. Cash provided by financing activities

was $56.1 million for the fiscal year ended May 28, 2023,

driven primarily by the previously announced sale of common and

convertible preferred stock and proceeds from the debt

refinancing.

The Company had cash and cash equivalents of

$19.1 million as of May 28, 2023. Total term debt, net of

cash, at May 28, 2023, was $147.2 million, consisting of its

line of credit, term debt and debt derivative liability associated

with the new term debt, compared to $137.2 million in the prior

year. With the debt refinancing in the fourth quarter of fiscal

year 2023, debt has been characterized as a long-term liability as

compared to a current liability in the prior year.

As previously announced, on May 22, 2023, the

Company entered into $150 million of new credit arrangements with

Alcon, including a six-year credit agreement and a sale and

leaseback of certain HA fermentation equipment which replaced its

existing term loan. The term facility bears interest at the rate of

10%, which is payable in kind (“PIK”) for the first three years,

and payable 3% in cash interest and 7% PIK interest thereafter

until maturity. Alcon and the Company also entered into an

equipment sale and leaseback transaction related to certain HA

fermentation assets, with a lease term of ten years, subject to

certain repurchase rights.

CONFERENCE CALLThe live webcast

can be accessed via Lifecore's website on the Investor Events &

Presentations page. The webcast will be available for 30 days.

Date: Thursday, August 31,

2023

Time: 7:30 a.m. Central time

(8:30 a.m. Eastern time)

Webcast link:

http://ir.lifecore.com/events-presentations

To participate in the conference call via

telephone, dial toll-free: (877) 407-3982 or (201) 493-6780. Please

call the conference telephone number 5-10 minutes prior to the

start time so the operator can register your name and

organization.

A replay of the call will be available through

Thursday, September 07, 2023 by calling toll-free: (844) 512-2921

or direct (412) 317-6671, and entering code 13740691.

About Lifecore

BiomedicalLifecore Biomedical, Inc. is a fully integrated

contract development and manufacturing organization (CDMO) that

offers highly differentiated capabilities in the development, fill

and finish of complex sterile injectable pharmaceutical products in

syringes and vials. As a leading manufacturer of premium,

injectable grade Hyaluronic Acid, Lifecore brings more than 40

years of expertise as a partner for global and emerging

biopharmaceutical and biotechnology companies across multiple

therapeutic categories to bring their innovations to market. For

more information about the Company, visit Lifecore’s website at

www.lifecore.com.

Non-GAAP Financial

InformationThis press release contains non-GAAP financial

information, including with respects to EBITDA, adjusted EBITDA,

Lifecore segment adjusted EBITDA, Curation Foods segment adjusted

EBITDA, and Other segment adjusted EBITDA. The Company has included

reconciliations of these non-GAAP financial measures to their

respective most directly comparable financial measures calculated

in accordance with GAAP. See the section entitled “Non-GAAP

Financial Information and Reconciliations” in this release for

definitions of EBITDA, adjusted EBITDA, Lifecore segment adjusted

EBITDA, Curation Foods segment adjusted EBITDA, and Other segment

adjusted EBITDA.

The Company has disclosed these non-GAAP

financial measures to supplement its consolidated financial

statements presented in accordance with GAAP. These non-GAAP

financial measures exclude/include certain items that are included

in the Company’s results reported in accordance with GAAP.

Management believes these non-GAAP financial measures provide

useful additional information to investors about trends in the

Company’s operations and are useful for period-over-period

comparisons. These non-GAAP financial measures should not be

considered in isolation or as a substitute for the comparable GAAP

measures. In addition, these non-GAAP financial measures may not be

the same as similar measures provided by other companies due to the

potential differences in methods of calculation and items being

excluded/included. These non-GAAP financial measures should be read

in conjunction with the Company’s consolidated financial statements

presented in accordance with GAAP.

Important Cautions Regarding

Forward-Looking Statements This press release

contains forward-looking statements regarding future events and our

future results that are subject to the safe harbor created under

the Private Securities Litigation Reform Act of 1995 and other safe

harbors under the Securities Act of 1933 and the Securities

Exchange Act of 1934. Words such as “anticipate”, “estimate”,

“expect”, “project”, “plan”, “intend”, “believe”, “may”, “might”,

“will”, “should”, “can have”, “likely” and similar expressions are

used to identify forward-looking statements. All forward-looking

statements involve certain risks and uncertainties that could cause

actual results to differ materially, including such factors among

others, as the outcome of any evaluation of the Company’s strategic

alternatives or any discussions with any potential bidders related

thereto the ability of the Company to continue as a going concern,

the ability of the Company to conduct its strategic review process

in a timely manner or at all, the timing and needs related to

capital expenditures, any future relationship between Alcon and the

Company, if any, the ability of the Company to conduct its

strategic review process in a timely manner or at all, the

Company’s ability to successfully complete the transition of the

Company’s business and operations to focus on Lifecore, the timing

and needs related to capital expenditures, the timing and expenses

associated with operations, the ability to achieve acceptance of

the Company’s new products in the market place, government

regulations affecting our business, the timing of regulatory

approvals, uncertainties related to COVID-19 and the impact of our

responses to it, and the mix between domestic and international

sales. For additional information about factors that could cause

actual results to differ materially from those described in the

forward-looking statements, please refer to our filings with the

Securities and Exchange Commission, including the risk factors

contained in our most recent Quarterly Report on Form 10-Q and

Annual Report on Form 10-K/A. Forward-looking statements represent

management’s current expectations and are inherently uncertain.

Except as required by law, we do not undertake any obligation to

update forward-looking statements made by us to reflect subsequent

events or circumstances.

|

LIFECORE BIOMEDICAL, INC.CONSOLIDATED

CONDENSED BALANCE SHEETS(In thousands, except par

value) |

| |

| |

May 28, 2023 |

|

May 29, 2022 |

| |

(Unaudited) |

|

|

| ASSETS |

|

|

|

| Current Assets: |

|

|

|

|

Cash and cash equivalents |

$ |

19,091 |

|

|

$ |

991 |

|

|

Accounts receivable, less allowance for credit losses |

|

29,708 |

|

|

|

38,836 |

|

|

Inventories |

|

45,384 |

|

|

|

40,711 |

|

|

Prepaid expenses and other current assets |

|

5,078 |

|

|

|

5,158 |

|

|

Current assets, discontinued operations |

|

— |

|

|

|

38,016 |

|

| Total Current Assets |

|

99,261 |

|

|

|

123,712 |

|

| |

|

|

|

| Property and equipment,

net |

|

129,671 |

|

|

|

116,441 |

|

| Operating lease right-of-use

assets |

|

4,922 |

|

|

|

5,646 |

|

| Goodwill |

|

13,881 |

|

|

|

13,881 |

|

| Trademarks/tradenames |

|

4,200 |

|

|

|

4,200 |

|

| Other assets |

|

3,215 |

|

|

|

2,889 |

|

| Other assets, discontinued

operations |

|

— |

|

|

|

12,843 |

|

|

Total Assets |

$ |

255,150 |

|

|

$ |

279,612 |

|

| |

|

|

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

| Current Liabilities: |

|

|

|

|

Accounts payable |

$ |

22,144 |

|

|

$ |

12,952 |

|

|

Accrued compensation |

|

3,921 |

|

|

|

8,941 |

|

|

Other accrued liabilities |

|

6,900 |

|

|

|

6,847 |

|

|

Current portion of lease liabilities |

|

1,270 |

|

|

|

4,368 |

|

|

Deferred revenue |

|

4,055 |

|

|

|

919 |

|

|

Line of credit |

|

— |

|

|

|

40,000 |

|

|

Current portion of long-term debt, net |

|

488 |

|

|

|

98,178 |

|

|

Current liabilities, discontinued operations |

|

— |

|

|

|

4,605 |

|

| Total Current Liabilities |

|

38,778 |

|

|

|

176,810 |

|

| |

|

|

|

| Long-term debt, net |

|

101,273 |

|

|

|

— |

|

| Debt derivative liability |

|

64,500 |

|

|

|

| Long-term lease

liabilities |

|

9,709 |

|

|

|

7,658 |

|

| Deferred taxes, net |

|

373 |

|

|

|

126 |

|

| Other non-current

liabilities |

|

3,114 |

|

|

|

190 |

|

| Non-current liabilities,

discontinued operations |

|

— |

|

|

|

2,063 |

|

| Total Liabilities |

|

217,747 |

|

|

|

186,847 |

|

| |

|

|

|

| Convertible Preferred stock,

$0.001 par value; 2,000 shares authorized; 39 and 0 shares issued

and outstanding at May 28, 2023 and May 29, 2022, respectively |

|

39,245 |

|

|

|

— |

|

| |

|

|

|

| Stockholders’ Equity: |

|

|

|

| Common stock, $0.001 par

value; 50,000 shares authorized; 29,513 and 29,333 shares issued

and outstanding at May 28, 2023 and May 29, 2022, respectively |

|

30 |

|

|

|

30 |

|

| Additional paid-in

capital |

|

174,349 |

|

|

|

167,352 |

|

| Accumulated deficit |

|

(176,221 |

) |

|

|

(74,031 |

) |

| Accumulated other

comprehensive loss |

|

— |

|

|

|

(586 |

) |

| Total Stockholders’

Equity |

|

(1,842 |

) |

|

|

92,765 |

|

| Total Liabilities and

Stockholders’ Equity |

$ |

255,150 |

|

|

$ |

279,612 |

|

|

LIFECORE BIOMEDICAL, INC.CONSOLIDATED

CONDENSED STATEMENTS OF COMPREHENSIVE (LOSS)

INCOME(Unaudited) (In thousands, except per share

amounts) |

| |

| |

Three Months Ended |

|

Twelve Months Ended |

| |

May 28, 2023 |

|

May 29, 2022 |

|

May 28, 2023 |

|

May 29, 2022 |

|

Product sales |

$ |

31,546 |

|

|

$ |

28,107 |

|

|

$ |

103,269 |

|

|

$ |

111,230 |

|

| Cost of product sales |

|

23,155 |

|

|

|

15,417 |

|

|

|

75,977 |

|

|

|

68,301 |

|

| Gross profit |

|

8,391 |

|

|

|

12,690 |

|

|

|

27,292 |

|

|

|

42,929 |

|

| |

|

|

|

|

|

|

|

| Operating costs and

expenses: |

|

|

|

|

|

|

|

|

Research and development |

|

2,116 |

|

|

|

2,023 |

|

|

|

8,240 |

|

|

|

7,712 |

|

|

Selling, general and administrative |

|

11,686 |

|

|

|

9,767 |

|

|

|

43,018 |

|

|

|

35,622 |

|

|

Gain on sale of BreatheWay |

|

— |

|

|

|

— |

|

|

|

(2,108 |

) |

|

|

— |

|

|

Restructuring costs |

|

(385 |

) |

|

|

1,431 |

|

|

|

4,225 |

|

|

|

8,961 |

|

| Total operating costs and

expenses |

|

13,417 |

|

|

|

13,221 |

|

|

|

53,375 |

|

|

|

52,295 |

|

| Operating (loss) income |

|

(5,026 |

) |

|

|

(531 |

) |

|

|

(26,083 |

) |

|

|

(9,366 |

) |

| |

|

|

|

|

|

|

|

| Interest income |

|

15 |

|

|

|

15 |

|

|

|

68 |

|

|

|

81 |

|

| Interest expense |

|

(4,469 |

) |

|

|

(1,675 |

) |

|

|

(18,184 |

) |

|

|

(15,551 |

) |

| Transition services

income |

|

203 |

|

|

|

341 |

|

|

|

273 |

|

|

|

5,814 |

|

| Loss on debt refinancing |

|

(23,774 |

) |

|

|

— |

|

|

|

(23,774 |

) |

|

|

| Other (expense) income,

net |

|

(521 |

) |

|

|

— |

|

|

|

(1,002 |

) |

|

|

641 |

|

| Net (loss) income before

tax |

|

(33,572 |

) |

|

|

(1,850 |

) |

|

|

(68,702 |

) |

|

|

(18,381 |

) |

| Income tax benefit

(expense) |

|

(223 |

) |

|

|

840 |

|

|

|

(301 |

) |

|

|

6,431 |

|

| Net (loss) income from

continuing operations |

$ |

(33,795 |

) |

|

$ |

(1,010 |

) |

|

$ |

(69,003 |

) |

|

$ |

(11,950 |

) |

| |

|

|

|

|

|

|

|

| Discontinued operations: |

|

|

|

|

|

|

|

| Loss from discontinued

operations |

$ |

(2,335 |

) |

|

$ |

(50,539 |

) |

|

$ |

(33,187 |

) |

|

$ |

(100,558 |

) |

| Income tax benefit

(expense) |

|

— |

|

|

|

(208 |

) |

|

|

— |

|

|

|

(365 |

) |

| Loss from discontinued

operations, net of tax |

|

(2,335 |

) |

|

|

(50,747 |

) |

|

|

(33,187 |

) |

|

|

(100,923 |

) |

| Net loss |

$ |

(36,130 |

) |

|

$ |

(51,757 |

) |

|

$ |

(102,190 |

) |

|

$ |

(112,873 |

) |

| |

|

|

|

|

|

|

|

| Basic net loss per share: |

|

|

|

|

|

|

|

| Loss from continuing

operations |

$ |

(1.11 |

) |

|

$ |

(0.03 |

) |

|

$ |

(2.30 |

) |

|

$ |

(0.41 |

) |

| Loss from discontinued

operations |

|

(0.08 |

) |

|

|

(1.72 |

) |

|

|

(1.11 |

) |

|

|

(3.43 |

) |

| Total basic net (loss) income

per share |

$ |

(1.19 |

) |

|

$ |

(1.75 |

) |

|

$ |

(3.41 |

) |

|

$ |

(3.84 |

) |

| |

|

|

|

|

|

|

|

| Diluted net loss per

share |

|

|

|

|

|

|

|

| (Loss) income from continuing

operations |

$ |

(1.11 |

) |

|

$ |

(0.03 |

) |

|

$ |

(2.30 |

) |

|

$ |

(0.41 |

) |

| Loss from discontinued

operations |

|

(0.08 |

) |

|

|

(1.72 |

) |

|

|

(1.11 |

) |

|

|

(3.43 |

) |

| Total diluted net loss per

share |

$ |

(1.19 |

) |

|

$ |

(1.75 |

) |

|

$ |

(3.41 |

) |

|

$ |

(3.84 |

) |

| |

|

|

|

|

|

|

|

| Shares used in diluted per

share computation |

|

30,319 |

|

|

|

29,486 |

|

|

|

29,958 |

|

|

|

29,466 |

|

|

LIFECORE BIOMEDICAL, INC.CONSOLIDATED

STATEMENTS OF CASH FLOWS(Unaudited and in thousands) |

| |

Twelve Months Ended |

| |

May 28, 2023 |

|

May 29, 2022 |

| Cash flows from operating

activities: |

|

|

|

|

Net loss |

$ |

(102,190 |

) |

|

$ |

(112,873 |

) |

| Adjustments to reconcile net

loss to net cash (used in) provided by operating activities: |

|

|

|

| Depreciation, amortization of

intangibles, debt costs and right-of-use assets |

|

13,508 |

|

|

|

17,884 |

|

| Loss on debt refinancing |

|

7,561 |

|

|

|

— |

|

| Stock-based compensation

expense |

|

3,612 |

|

|

|

2,608 |

|

| Deferred taxes |

|

351 |

|

|

|

(6,990 |

) |

| Net loss (gain) on disposal of

property and equipment held and used |

|

30 |

|

|

|

152 |

|

| (Gain) loss on disposal of

property and equipment related to restructuring, net |

|

— |

|

|

|

5,185 |

|

| Loss on sale of Eat Smart |

|

— |

|

|

|

336 |

|

| Gain on sale of

BreatheWay |

|

(2,108 |

) |

|

|

— |

|

| Loss on sale of Yucatan |

|

21,096 |

|

|

|

— |

|

| Loss on sale of O Olive |

|

1,222 |

|

|

|

| Impairment of indefinite-lived

intangible assets and goodwill |

|

300 |

|

|

|

78,146 |

|

| Other, net |

|

86 |

|

|

|

(426 |

) |

| Changes in current assets and

current liabilities: |

|

|

|

| Accounts receivable, net |

|

12,194 |

|

|

|

(6,138 |

) |

| Inventories |

|

(13,823 |

) |

|

|

(5,960 |

) |

| Prepaid expenses and other

current assets |

|

2,749 |

|

|

|

(602 |

) |

| Accounts payable |

|

16,085 |

|

|

|

9,343 |

|

| Accrued compensation |

|

(4,707 |

) |

|

|

(2,546 |

) |

| Other accrued liabilities |

|

6,440 |

|

|

|

(1,346 |

) |

| Deferred revenue |

|

3,136 |

|

|

|

(18 |

) |

| Net cash used in operating

activities |

|

(34,458 |

) |

|

|

(23,245 |

) |

| |

|

|

|

| Cash flows from investing

activities: |

|

|

|

| Purchases of property and

equipment |

|

(20,763 |

) |

|

|

(29,940 |

) |

| Sale of investment in

non-public company |

|

— |

|

|

|

45,100 |

|

| Proceeds from the sale of Eat

Smart, net |

|

|

|

73,500 |

|

| Eat Smart sale net working

capital adjustments |

|

— |

|

|

|

(9,839 |

) |

| Proceeds from sale of

BreatheWay, net |

|

3,135 |

|

|

|

— |

|

| Proceeds from the sale of

Yucatan, net |

|

12,474 |

|

|

|

— |

|

| Proceeds from the Sale of O

Olive |

|

1,001 |

|

|

|

| Proceeds from sales of

property and equipment |

|

— |

|

|

|

1,141 |

|

| Net cash provided by investing

activities |

|

(4,153 |

) |

|

|

79,962 |

|

| |

|

|

|

| Cash flows from financing

activities: |

|

|

|

| Proceeds from sale of common

stock, net of issuance costs |

|

4,822 |

|

|

|

— |

|

| Proceeds from long-term

debt |

|

150,000 |

|

|

|

20,000 |

|

| Payments on long-term

debt |

|

(107,412 |

) |

|

|

(86,411 |

) |

| Payments in connection to debt

extinguishment |

|

— |

|

|

|

— |

|

| Proceeds from lines of

credit |

|

31,450 |

|

|

|

55,111 |

|

| Payments for debt issuance

costs |

|

(5,969 |

) |

|

|

(821 |

) |

| Payments on lines of

credit |

|

(54,640 |

) |

|

|

(44,111 |

) |

| Taxes paid for employee stock

plans |

|

(274 |

) |

|

|

(789 |

) |

| Proceeds from sale of

preferred stock, net of issuance costs |

|

38,082 |

|

|

|

— |

|

| Net cash provided by (used in)

financing activities |

|

56,059 |

|

|

|

(57,021 |

) |

| |

|

|

|

| Net increase (decrease) in

cash and cash equivalents |

|

17,448 |

|

|

|

(304 |

) |

| Cash and cash equivalents,

beginning of period |

|

1,643 |

|

|

|

1,295 |

|

| Cash and cash equivalents, end

of period |

$ |

19,091 |

|

|

$ |

991 |

|

| |

|

|

|

| Supplemental disclosure of

non-cash investing and financing activities: |

|

|

|

| Purchases of property and

equipment on trade vendor credit |

$ |

6,945 |

|

|

$ |

2,260 |

|

| Convertible Preferred Stock

PIK dividend |

$ |

1,163 |

|

|

$ |

— |

|

|

LIFECORE BIOMEDICAL, INC.SEGMENT

RESULTS(Unaudited and in thousands) |

| (Unaudited and in

thousands) |

|

Three Months Ended |

|

Change |

|

Twelve Months Ended |

|

Change |

| |

May 28, 2023 |

|

May 29, 2022 |

|

Amount |

|

% |

|

May 28, 2023 |

|

May 29, 2022 |

|

Amount |

|

% |

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lifecore |

|

$ |

31,546 |

|

|

$ |

27,613 |

|

|

$ |

3,933 |

|

|

14 |

% |

|

$ |

103,269 |

|

|

$ |

109,320 |

|

|

$ |

(6,051 |

) |

|

(6 |

)% |

|

Curation Foods |

|

|

— |

|

|

|

494 |

|

|

|

(494 |

) |

|

(100 |

)% |

|

|

— |

|

|

|

1,910 |

|

|

|

(1,910 |

) |

|

(100 |

)% |

| Total revenues |

|

|

31,546 |

|

|

|

28,107 |

|

|

|

3,439 |

|

|

12 |

% |

|

|

103,269 |

|

|

|

111,230 |

|

|

|

(7,961 |

) |

|

(7 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lifecore |

|

|

8,394 |

|

|

|

13,361 |

|

|

|

(4,967 |

) |

|

(37 |

)% |

|

|

27,242 |

|

|

|

43,746 |

|

|

|

(16,504 |

) |

|

(38 |

)% |

|

Curation Foods |

|

|

(3 |

) |

|

|

(671 |

) |

|

|

668 |

|

|

100 |

% |

|

|

50 |

|

|

|

(817 |

) |

|

|

867 |

|

|

(106 |

)% |

| Total gross profit |

|

|

8,391 |

|

|

|

12,690 |

|

|

|

(4,299 |

) |

|

(34 |

)% |

|

|

27,292 |

|

|

|

42,929 |

|

|

|

(15,637 |

) |

|

(36 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) income from

continuing operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lifecore |

|

|

2,780 |

|

|

|

7,165 |

|

|

|

(4,385 |

) |

|

(61 |

)% |

|

|

5,049 |

|

|

|

18,481 |

|

|

|

(13,432 |

) |

|

(73 |

)% |

|

Curation Foods |

|

|

(649 |

) |

|

|

(3,536 |

) |

|

|

2,887 |

|

|

82 |

% |

|

|

178 |

|

|

|

1,985 |

|

|

|

(1,807 |

) |

|

(91 |

)% |

|

Other |

|

|

(35,926 |

) |

|

|

(4,639 |

) |

|

|

(31,287 |

) |

|

(674 |

)% |

|

|

(72,162 |

) |

|

|

(32,416 |

) |

|

|

(39,746 |

) |

|

(123 |

)% |

| Total net (loss) income from

continuing operations |

|

$ |

(33,795 |

) |

|

$ |

(1,010 |

) |

|

$ |

(32,785 |

) |

|

(3246 |

)% |

|

$ |

(66,935 |

) |

|

$ |

(11,950 |

) |

|

$ |

(54,985 |

) |

|

(460 |

)% |

| Loss from discontinued

operations, net of tax: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Curation Foods |

|

|

(1,641 |

) |

|

|

(50,747 |

) |

|

|

49,106 |

|

|

97 |

% |

|

|

(30,564 |

) |

|

|

(97,882 |

) |

|

|

67,318 |

|

|

69 |

% |

|

Other |

|

|

(694 |

) |

|

|

— |

|

|

|

(694 |

) |

|

N/M |

|

|

|

(2,623 |

) |

|

|

(3,041 |

) |

|

|

418 |

|

|

14 |

% |

| Net loss |

|

$ |

(36,130 |

) |

|

$ |

(51,757 |

) |

|

$ |

15,627 |

|

|

30 |

% |

|

$ |

(100,122 |

) |

|

$ |

(112,873 |

) |

|

$ |

12,751 |

|

|

11 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lifecore |

|

$ |

5,332 |

|

|

$ |

10,621 |

|

|

$ |

(5,289 |

) |

|

(50 |

)% |

|

$ |

13,765 |

|

|

$ |

30,348 |

|

|

$ |

(16,583 |

) |

|

(55 |

)% |

|

Curation Foods |

|

|

(2,108 |

) |

|

|

(54,486 |

) |

|

|

52,378 |

|

|

96 |

% |

|

|

(32,976 |

) |

|

|

(109,338 |

) |

|

|

76,362 |

|

|

70 |

% |

|

Other |

|

|

(8,722 |

) |

|

|

(3,222 |

) |

|

|

(5,500 |

) |

|

(171 |

)% |

|

|

(28,425 |

) |

|

|

(15,708 |

) |

|

|

(12,717 |

) |

|

(81 |

)% |

| Total EBITDA |

|

$ |

(5,498 |

) |

|

$ |

(47,087 |

) |

|

$ |

41,589 |

|

|

88 |

% |

|

$ |

(47,636 |

) |

|

$ |

(94,698 |

) |

|

$ |

47,062 |

|

|

50 |

% |

Non-GAAP Financial Information and

Reconciliations

EBITDA and adjusted EBITDA are non-GAAP

financial measures. We define EBITDA as earnings before interest,

income tax expense (benefit), and depreciation and amortization. We

define adjusted EBITDA as EBITDA before certain restructuring and

other non-recurring charges. See “Non-GAAP Financial Information”

above for further information regarding the Company’s use of

non-GAAP financial measures.

| (Unaudited and in

thousands) |

|

Three Months Ended |

|

Twelve Months Ended |

| |

May 28, 2023 |

|

May 29, 2022 |

|

May 28, 2023 |

|

May 29, 2022 |

|

Net loss |

|

$ |

(36,130 |

) |

|

$ |

(51,757 |

) |

|

$ |

(100,122 |

) |

|

$ |

(112,873 |

) |

|

Interest expense, net of interest income |

|

|

28,228 |

|

|

|

3,466 |

|

|

|

41,890 |

|

|

|

17,276 |

|

|

Income tax (benefit) expense |

|

|

223 |

|

|

|

(840 |

) |

|

|

301 |

|

|

|

(6,431 |

) |

|

Depreciation and amortization |

|

|

2,181 |

|

|

|

2,044 |

|

|

|

10,295 |

|

|

|

7,330 |

|

|

Total EBITDA |

|

$ |

(5,498 |

) |

|

$ |

(47,087 |

) |

|

$ |

(47,636 |

) |

|

$ |

(94,698 |

) |

|

Restructuring and other non-recurring charges |

|

|

6,890 |

|

|

|

5,489 |

|

|

|

20,258 |

|

|

|

16,639 |

|

|

Impairment of indefinite-lived intangible assets |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Loss from discontinued operations, net of tax |

|

|

2,335 |

|

|

|

50,747 |

|

|

|

33,187 |

|

|

|

100,923 |

|

| Total adjusted EBITDA |

|

$ |

3,727 |

|

|

$ |

9,149 |

|

|

$ |

5,809 |

|

|

$ |

22,864 |

|

(1) Includes loss on debt financing of $23.8 million for the

fourth quarter and fiscal year ended 2023.

| (Unaudited and in

thousands) |

|

Lifecore |

|

CurationFoods |

|

Other |

|

Total |

| Three months ended May 28,

2023 |

|

|

|

|

|

|

|

|

|

Net (loss) income |

|

$ |

2,780 |

|

|

$ |

(2,290 |

) |

|

$ |

(36,620 |

) |

|

$ |

(36,130 |

) |

| Interest expense, net of

interest income |

|

|

(15 |

) |

|

|

— |

|

|

|

28,243 |

|

|

|

28,228 |

|

| Income tax (benefit)

expense |

|

|

552 |

|

|

|

29 |

|

|

|

(358 |

) |

|

|

223 |

|

| Depreciation and

amortization |

|

|

2,015 |

|

|

|

153 |

|

|

|

13 |

|

|

|

2,181 |

|

| Total EBITDA |

|

|

5,332 |

|

|

|

(2,108 |

) |

|

|

(8,722 |

) |

|

|

(5,498 |

) |

| Restructuring and other

non-recurring charges (1) |

|

|

751 |

|

|

|

55 |

|

|

|

6,084 |

|

|

|

6,890 |

|

| Impairment of indefinite-lived

intangible assets |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Loss from discontinued

operations, net of tax |

|

|

— |

|

|

|

1,641 |

|

|

|

694 |

|

|

|

2,335 |

|

| Total adjusted EBITDA |

|

$ |

6,083 |

|

|

$ |

(412 |

) |

|

$ |

(1,944 |

) |

|

$ |

3,727 |

|

| |

|

|

|

|

|

|

|

|

| Twelve months ended May 28,

2023 |

|

|

|

|

|

|

|

|

| Net (loss) income |

|

$ |

5,049 |

|

|

$ |

(30,386 |

) |

|

$ |

(74,785 |

) |

|

$ |

(100,122 |

) |

| Interest expense, net of

interest income |

|

|

(62 |

) |

|

|

1 |

|

|

|

41,951 |

|

|

|

41,890 |

|

| Income tax (benefit)

expense |

|

|

1,270 |

|

|

|

(5,334 |

) |

|

|

4,365 |

|

|

|

301 |

|

| Depreciation and

amortization |

|

|

7,508 |

|

|

|

2,743 |

|

|

|

44 |

|

|

|

10,295 |

|

| Total EBITDA |

|

|

13,765 |

|

|

|

(32,976 |

) |

|

|

(28,425 |

) |

|

|

(47,636 |

) |

| Restructuring and other

non-recurring charges |

|

|

936 |

|

|

|

1,775 |

|

|

|

17,547 |

|

|

|

20,258 |

|

| Impairment of indefinite-lived

intangible assets |

|

|

|

|

— |

|

|

|

|

|

— |

|

| Loss from discontinued

operations, net of tax |

|

|

— |

|

|

|

30,564 |

|

|

|

2,623 |

|

|

|

33,187 |

|

| Total adjusted EBITDA |

|

$ |

14,701 |

|

|

$ |

(637 |

) |

|

$ |

(8,255 |

) |

|

$ |

5,809 |

|

| |

|

|

|

|

|

|

|

|

| Three Months Ended May 29,

2022 |

|

|

|

|

|

|

|

|

| Net (loss) income |

|

$ |

7,165 |

|

|

$ |

(54,283 |

) |

|

$ |

(4,639 |

) |

|

$ |

(51,757 |

) |

| Interest expense , net of

interest income |

|

|

(15 |

) |

|

|

— |

|

|

|

3,481 |

|

|

|

3,466 |

|

| Income tax (benefit)

expense |

|

|

1,692 |

|

|

|

(458 |

) |

|

|

(2,074 |

) |

|

|

(840 |

) |

| Depreciation and

amortization |

|

|

1,779 |

|

|

|

255 |

|

|

|

10 |

|

|

|

2,044 |

|

| Total EBITDA |

|

|

10,621 |

|

|

|

(54,486 |

) |

|

|

(3,222 |

) |

|

|

(47,087 |

) |

| Restructuring and other

non-recurring charges |

|

|

116 |

|

|

|

3,424 |

|

|

|

1,949 |

|

|

|

5,489 |

|

| Loss from discontinued

operations, net of tax |

|

|

— |

|

|

|

50,747 |

|

|

|

— |

|

|

|

50,747 |

|

| Total adjusted EBITDA |

|

$ |

10,737 |

|

|

$ |

(315 |

) |

|

$ |

(1,273 |

) |

|

$ |

9,149 |

|

| |

|

|

|

|

|

|

|

|

| Twelve Months Ended May 29,

2022 |

|

|

|

|

|

|

|

|

| Net (loss) income |

|

$ |

18,481 |

|

|

$ |

(95,897 |

) |

|

$ |

(35,457 |

) |

|

$ |

(112,873 |

) |

| Interest expense , net of

interest income |

|

|

(72 |

) |

|

|

299 |

|

|

|

17,049 |

|

|

|

17,276 |

|

| Income tax (benefit)

expense |

|

|

5,266 |

|

|

|

(14,317 |

) |

|

|

2,620 |

|

|

|

(6,431 |

) |

| Depreciation and

amortization |

|

|

6,673 |

|

|

|

577 |

|

|

|

80 |

|

|

|

7,330 |

|

| Total EBITDA |

|

|

30,348 |

|

|

|

(109,338 |

) |

|

|

(15,708 |

) |

|

|

(94,698 |

) |

| Restructuring and other

non-recurring charges |

|

|

387 |

|

|

|

10,364 |

|

|

|

5,888 |

|

|

|

16,639 |

|

| Loss from discontinued

operations, net of tax |

|

|

— |

|

|

|

97,882 |

|

|

|

3,041 |

|

|

|

100,923 |

|

| Total adjusted EBITDA |

|

$ |

30,735 |

|

|

$ |

(1,092 |

) |

|

$ |

(6,779 |

) |

|

$ |

22,864 |

|

(1) During fiscal year 2020, the Company announced a

restructuring plan to drive enhanced profitability, focus the

business on its strategic assets, and redesign the organization to

be the appropriate size to compete and thrive. This included a

reduction-in-force, a reduction in leased office spaces, and the

sale of non-strategic assets. Related to these continued

activities, in the fourth quarter of fiscal year 2023, the Company

incurred (1) $0.7 million of non-recurring charges primarily

related to consolidating and transitioning operations associated

with the Yucatan and O Olive Disposition, (2) $2.9 million of

restructuring and non-recurring charges, primarily related to legal

costs, audit fees and transition costs from corporate headquarters

transition to Lifecore, (3) $2.6 million in restructuring costs

associated with financial advisor and legal fees related to

management of the prior term loan lenders, and (4) $0.7 million in

non-recurring charges primary related to one-time expenses incurred

in the Lifecore production process.

Contact Information:Investor

RelationsJeff Sonnek(646)

277-1263jeff.sonnek@icrinc.com

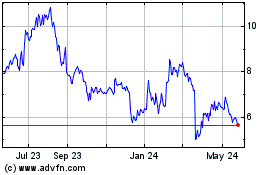

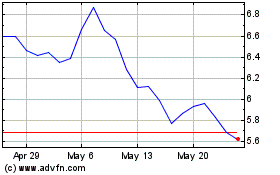

Lifecore Biomedical (NASDAQ:LFCR)

Historical Stock Chart

From Apr 2024 to May 2024

Lifecore Biomedical (NASDAQ:LFCR)

Historical Stock Chart

From May 2023 to May 2024