false

0000828146

0000828146

2024-08-08

2024-08-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event

Reported): August 8, 2024

INTERLINK ELECTRONICS, INC.

(Exact Name of Registrant as Specified in Charter)

| Nevada |

001-37659 |

77-0056625 |

| (State or Other Jurisdiction |

(Commission |

(IRS Employer |

| of Incorporation) |

File Number) |

Identification No.) |

| |

15707 Rockfield Boulevard, Suite 105 |

|

| |

Irvine, California |

92618 |

| |

(Address of Principal Executive Offices) |

(Zip Code) |

(805) 484-8855

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock, $0.001 par value |

|

LINK |

|

The NASDAQ Stock Market LLC |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c)) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02. | Results of Operations and Financial Condition. |

On August 8, 2024, Interlink Electronics, Inc.

announced its financial results for the quarter ended June 30, 2024. A copy of the press release is being furnished as Exhibit 99.1

to this Current Report on Form 8-K.

The information in this Item 2.02 of Current Report

on Form 8-K and Exhibit 99.1 attached hereto is intended to be furnished and shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of

that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except

as expressly set forth by specific reference in such filing.

| Item 9.01 | Financial Statements and Exhibits. |

The following exhibits are filed as part

of this Current Report on Form 8-K:

| Exhibit | |

| Number | Description |

| 104 | Cover Page Interactive Data File for this Current Report on Form 8-K (formatted as Inline XBRL and contained in Exhibit 101) |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: August 9, 2024 |

INTERLINK ELECTRONICS, INC. |

| |

|

|

| |

By: |

/s/ Ryan J. Hoffman |

| |

|

Ryan J. Hoffman |

| |

|

Chief Financial Officer |

Exhibit 99.1

Interlink Electronics Reports Second Quarter

2024 Results

IRVINE,

Calif., Aug. 8, 2024 /PRNewswire/ – Interlink Electronics, Inc. (Nasdaq: LINK), a world-leading provider of sensors

and printed electronic solutions that support a wide range of applications including Human-Machine Interface devices and Internet-of-Things

solutions, today announced its financial results for the three- and six-month periods ended June 30, 2024.

Revenue for the quarter was approximately $2.9 million, down 28%

from the prior year period due to lower shipments of our traditional force-sensor products and gas-sensor products, offset in part by

higher sales of our membrane keypads, graphic overlays, printed electronics and industrial label products at our Calman Technology Limited

subsidiary, acquired in March 2023. The change in our sales and product mix impacted our gross margin, which was 45.0% for the current

quarter compared to 50.9% in the prior-year quarter.

The following table sets forth the consolidated financial highlights.

Consolidated Financial Highlights

(Amounts in thousands except per share data and percentages)

| |

Three Months

Ended June 30, | | |

Six Months

Ended June 30, | |

| Consolidated Financial Results | |

2024 | | |

2023 | | |

$ ∆ | | |

% ∆ | | |

2024 | | |

2023 | | |

$ ∆ | | |

% ∆ | |

| Revenue | |

$ | 2,898 | | |

$ | 4,049 | | |

$ | (1,151 | ) | |

| (28.4 | )% | |

$ | 6,022 | | |

$ | 7,327 | | |

$ | (1,305 | ) | |

| (17.8 | )% |

| Gross profit | |

$ | 1,305 | | |

$ | 2,061 | | |

$ | (756 | ) | |

| (36.7 | )% | |

$ | 2,558 | | |

$ | 3,648 | | |

$ | (1,090 | ) | |

| (29.9 | )% |

| Gross margin | |

| 45.0 | % | |

| 50.9 | % | |

| | | |

| | | |

| 42.5 | % | |

| 49.8 | % | |

| | | |

| | |

| Income (loss) from operations | |

$ | (313 | ) | |

$ | 406 | | |

$ | (719 | ) | |

| | | |

$ | (1,064 | ) | |

$ | 233 | | |

$ | (1,297 | ) | |

| | |

| Net income (loss) | |

$ | (307 | ) | |

$ | 381 | | |

$ | (688 | ) | |

| | | |

$ | (1,048 | ) | |

$ | 190 | | |

$ | (1,238 | ) | |

| | |

| Net income (loss) applicable

to common stockholders | |

$ | (407 | ) | |

$ | 281 | | |

$ | (688 | ) | |

| | | |

$ | (1,248 | ) | |

$ | (10 | ) | |

$ | (1,238 | ) | |

| | |

| Earnings (loss) per common share

– diluted | |

$ | (0.04 | ) | |

$ | 0.03 | | |

$ | (0.07 | ) | |

| | | |

$ | (0.13 | ) | |

$ | 0.00 | | |

$ | (0.13 | ) | |

| | |

| Adjusted EBITDA | |

$ | (80 | ) | |

$ | 579 | | |

$ | (659 | ) | |

| | | |

$ | (588 | ) | |

$ | 452 | | |

$ | (1,040 | ) | |

| | |

| · | Revenue for the second quarter of 2024 decreased 28% to $2.9 million from $4.0 million for the same quarter last year, and decreased

18% to $6.0 million for the first half of 2024 compared to $7.3 million for the first half of 2023, due primarily to lower shipments of

our traditional force-sensor products and gas-sensor products, offset in part by the inclusion of sales of our printed electronics products

at our Calman Technology subsidiary (acquired in March 2023). Our revenues for a particular period are impacted by fluctuations in

the timing of receipt and fulfilment of customer orders, which varies based on their demand for their own order-flow and production cycles.

Our robust pipeline of prospective customers and orders includes several large force-sensor and gas-sensor opportunities, and we continue

to expand our product offerings, particularly for air quality solutions and instruments in our gas sensors business, all of which provide

the potential for organic revenue growth for 2025. |

| · | Gross profit margin for the second quarter was 45.0%, down from 50.9% in the prior-year, and for the first half was 42.5%, down from

49.8% last year, due primarily to the decline in revenue and changes in the mix of products sold. Gross profit margin for the second quarter

of 2024 was up 490 basis points sequentially from the first quarter of 2024 due to production efficiencies and favorable changes in the

mix of our products sold. |

| · | Net income/loss for the quarter was a loss of $307,000, compared with net income of $381,000 for the same quarter last year. Net income/loss

for the first half of 2024 was a loss of $1,048,000, compared with income of $190,000 for the same period last year. The increases in

net loss were due primarily to lower gross profit on lower revenue, together with increased intangible asset amortization expense from

the recent acquisitions of Calman Technology, SPEC Sensors, and KWJ Engineering, offset in part by reduced compensation cost on reduced

headcount and lower professional services expenses. We have recently implemented various cost reduction initiatives that we expect will

result in annual cost savings in excess of $500,000, including work-force right-sizing, changes in certain suppliers and selected inventories

and supplies, and deferring certain non-critical operating activities and initiatives. |

| · | Adjusted EBITDA for the three- and six-month periods ended June 30, 2024 were ($80,000) and ($588,000), respectively, as compared

to Adjusted EBITDA of $579,000 and $452,000 for the three- and six-month periods ended June 30, 2023, respectively. |

| · | In order to position us for future growth, we are expanding our operations and footprint, including: |

| o | Recent launch of our strategic executive office in Bellevue, WA |

| o | Recent launch of our new Silicon Valley R&D center in Fremont, CA, expected to be completed in the fourth quarter of 2024 |

| o | Plans to open a European sales office led by a seasoned Business Development Manager by year-end |

| · | We ended the quarter with $4.0 million of cash and cash equivalents. |

“In spite of a slowdown in demand from several existing customers,

we continue to execute our long-term strategic growth plans,” said Steven N. Bronson, Chairman, President, and CEO of Interlink

Electronics. “We are placing a great emphasis on product development and sales resources to drive future organic growth.”

About Interlink Electronics, Inc.

Interlink

Electronics is a world-leading provider of sensors and printed electronic solutions that support a wide range of applications,

including Human-Machine Interface (“HMI”) devices and Internet-of-Things (“IoT”) solutions, utilizing our expertise

in materials science, manufacturing, firmware and software to produce in-house system solutions for custom specifications. We have a proven

track record of supplying mission-critical technological solutions in diverse markets including medical devices, automotive, gas detection

and environmental quality monitoring, oil and gas and general industrial, and consumer electronics, providing standard and custom-designed

sensors that provide the flexibility and functionality needed for today's sophisticated applications.

The Company’s products and solutions currently focus on three

main fields:

| · | For nearly 40 years, the Company has led the printed electronics industry in commercializing its patented Force Sensing Resistor®

technology, which offers pressure and position sensing and rugged capabilities in a very wide range of temperatures. Our piezoelectric

film sensors offer strain, bend and vibration sensing and can be used on curved surfaces, while our advanced matrix sensor solutions offer

multiple touch capabilities. We supply some of the world's top electronics manufacturers with intuitive sensor and interface technologies

for use in advanced applications such as medical robotics and vehicle collision detection. |

| · | Our Gas and Environmental Sensors division has over 25 years of experience in cutting-edge design and manufacture of electrochemical

gas-sensing technology for industry, community, health and home. We provide advanced sensor solutions, precision sensing instruments,

and custom engineering services for detecting gases such as carbon monoxide, ozone, hydrogen, NOx gases and ammonia, for transdermal alcohol

detection and for air quality monitoring. Our innovative printed sensor design enables high-sensitivity, low-power and cost-effective

solutions for broad adoption in the rapidly growing IoT market. |

| · | Our Calman Technology subsidiary brings over 25 years of experience in the design and manufacture of membrane keypads, graphic overlays,

printed electronics and industrial label products. We offer IP-rated digital and hybrid printed devices featuring integrated backlighting

and shielding and printed electronics with advanced materials ink printing. Calman has customers in fields such as medical devices and

defense technologies and gives the Company a base in Europe. |

We serve our international customer base from our corporate headquarters

in Irvine, California; our Global Product Development and Materials Science Center and distribution and logistics center in Camarillo,

California; our advanced printed-electronics manufacturing facilities in Shenzhen, China, and Irvine, Scotland; and our proprietary gas

sensor production and product development facility in Silicon Valley, California.

For more information, please visit www.InterlinkElectronics.com.

Forward Looking Statements

This release contains “forward-looking statements” within

the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be generally

identified by phrases such as “thinks,” “anticipates,” “believes,” “estimates,” “expects,”

“intends,” “plans,” and similar words. Forward-looking statements in this press release include statements about

our projected sales and revenues, cost-cutting initiatives and European expansion plans. Forward-looking statements are not guarantees

of future performance and are inherently subject to uncertainties and other factors which could cause actual results to differ materially

from the forward-looking statement. These statements are based upon, among other things, assumptions made by, and information currently

available to, management, including management’s own knowledge and assessment of the company’s industry, R&D initiatives,

competition and capital requirements. Other factors and uncertainties that could affect the company’s forward-looking statements

include, among other things, the following: our success in predicting new markets and the acceptance of our new products; efficient management

of our infrastructure; the pace of technological developments and industry standards evolution and their effect on our target product

and market choices; the effect of outsourcing technology development; changes in the ordering patterns of our customers; a decrease in

the quality and/or reliability of our products; protection of our proprietary intellectual property; competition by alternative sophisticated

as well as generic products; continued availability of raw materials for our products at competitive prices; disruptions in our manufacturing

facilities; risks of international sales and operations including fluctuations in exchange rates; compliance with regulatory requirements

applicable to our manufacturing operations; and customer concentrations. Additional factors that could cause actual results to differ

materially from those anticipated by our forward-looking statements are under the captions “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” in our most recent Annual Report (Form 10-K) or Quarterly

Report (Form 10-Q) filed with the Securities and Exchange Commission. Forward-looking statements are made as of the date of this

release, and we expressly disclaim any obligation to publicly update or revise any forward-looking statements, whether as a result of

new information, future events or otherwise.

Non-GAAP Financial Measure

To supplement our condensed consolidated financial statements, which

are prepared and presented in accordance with United States generally accepted accounting principles (“GAAP”), we use the

following non-GAAP financial measure: Adjusted EBITDA. The presentation of this financial information is not intended to be considered

in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP.

We define Adjusted EBITDA for a particular period as net income (loss)

before interest, taxes, depreciation and amortization, and as further adjusted for stock-based compensation expense.

We use this non-GAAP financial measure for financial and operational

decision-making and as a means to evaluate period-to-period comparisons. We believe that this non-GAAP financial measure provides meaningful

supplemental information regarding our performance by excluding certain items that may not be indicative of our core business operating

results, such as amortization expense related to our recent acquisitions. We believe that both management and investors benefit from referring

to this non-GAAP financial measure in assessing our performance and when planning, forecasting, and analyzing future periods. This non-GAAP

financial measure also facilitates management’s internal comparisons to our historical performance and liquidity as well as comparisons

to our competitors’ operating results. We believe this non-GAAP financial measure is useful to investors both because (1) is

allows for greater transparency with respect to key metrics used by management in its financial and operational decision-making and (2) it

is used by our investors to help them analyze the health of our business.

There are a number of limitations related to the use of non-GAAP financial

measures. We compensate for these limitations by providing specific information regarding the GAAP amounts excluded from these non-GAAP

financial measures and evaluating these non-GAAP financial measures together with their relevant financial measures in accordance with

GAAP.

Contact:

Interlink Electronics, Inc.

IR@iefsr.com

Steven N. Bronson, CEO

805-623-4184

INTERLINK ELECTRONICS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited)

| | |

June 30, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| | |

(in thousands) | |

| ASSETS | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 3,960 | | |

$ | 4,304 | |

| Accounts receivable, net | |

| 1,477 | | |

| 2,167 | |

| Inventories | |

| 2,555 | | |

| 2,476 | |

| Prepaid expenses and other current assets | |

| 303 | | |

| 381 | |

| Total current assets | |

| 8,295 | | |

| 9,328 | |

| Property, plant and equipment, net | |

| 254 | | |

| 313 | |

| Intangible assets, net | |

| 2,251 | | |

| 2,654 | |

| Goodwill | |

| 2,438 | | |

| 2,461 | |

| Right-of-use assets | |

| 814 | | |

| 143 | |

| Deferred tax assets | |

| 86 | | |

| 83 | |

| Other assets | |

| 103 | | |

| 80 | |

| Total assets | |

$ | 14,241 | | |

$ | 15,062 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 360 | | |

$ | 464 | |

| Accrued liabilities | |

| 429 | | |

| 492 | |

| Lease liabilities, current | |

| 259 | | |

| 126 | |

| Accrued income taxes | |

| 392 | | |

| 293 | |

| Total current liabilities | |

| 1,440 | | |

| 1,375 | |

| | |

| | | |

| | |

| Long-term liabilities | |

| | | |

| | |

| Lease liabilities, long term | |

| 592 | | |

| 33 | |

| Deferred tax liabilities | |

| 540 | | |

| 626 | |

| Total long-term liabilities | |

| 1,132 | | |

| 659 | |

| Total liabilities | |

| 2,572 | | |

| 2,034 | |

| | |

| | | |

| | |

| Stockholders’ equity | |

| | | |

| | |

| Preferred stock | |

| 2 | | |

| 2 | |

| Common stock | |

| 10 | | |

| 10 | |

| Additional paid-in-capital | |

| 62,284 | | |

| 62,279 | |

| Accumulated other comprehensive income | |

| 84 | | |

| 200 | |

| Accumulated deficit | |

| (50,711 | ) | |

| (49,463 | ) |

| Total stockholders’ equity | |

| 11,669 | | |

| 13,028 | |

| Total liabilities and stockholders’ equity | |

$ | 14,241 | | |

$ | 15,062 | |

INTERLINK ELECTRONICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

| | |

Three Months Ended June 30, | | |

Six Months Ended June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| | |

(in thousands, except per share data) | |

| Revenue, net | |

$ | 2,898 | | |

$ | 4,049 | | |

$ | 6,022 | | |

$ | 7,327 | |

| Cost of revenue | |

| 1,593 | | |

| 1,988 | | |

| 3,464 | | |

| 3,679 | |

| Gross profit | |

| 1,305 | | |

| 2,061 | | |

| 2,558 | | |

| 3,648 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Engineering, research and development | |

| 510 | | |

| 650 | | |

| 1,086 | | |

| 1,177 | |

| Selling, general and administrative | |

| 1,108 | | |

| 1,005 | | |

| 2,536 | | |

| 2,238 | |

| Total operating expenses | |

| 1,618 | | |

| 1,655 | | |

| 3,622 | | |

| 3,415 | |

| Income (loss) from operations | |

| (313 | ) | |

| 406 | | |

| (1,064 | ) | |

| 233 | |

| Other income (expense), net | |

| 16 | | |

| 64 | | |

| 48 | | |

| 128 | |

| Income (loss) before income taxes | |

| (297 | ) | |

| 470 | | |

| (1,016 | ) | |

| 361 | |

| Income tax expense | |

| 10 | | |

| 89 | | |

| 32 | | |

| 171 | |

| Net income (loss) | |

$ | (307 | ) | |

$ | 381 | | |

$ | (1,048 | ) | |

$ | 190 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) applicable to common stockholders | |

$ | (407 | ) | |

$ | 281 | | |

$ | (1,248 | ) | |

$ | (10 | ) |

| Earnings (loss) per common share – basic and diluted | |

$ | (0.04 | ) | |

$ | 0.03 | | |

$ | (0.13 | ) | |

$ | 0.00 | |

| Weighted average common shares outstanding – basic and diluted | |

| 9,860 | | |

| 9,900 | | |

| 9,860 | | |

| 9,915 | |

INTERLINK ELECTRONICS, INC.

RECONCILIATION OF CONSOLIDATED NET INCOME (LOSS)

TO CONSOLIDATED ADJUSTED EBITDA

(unaudited)

| | |

Three Months Ended June 30, | | |

Six Month Ended June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| | |

(in thousands) | |

| Net income (loss) | |

$ | (307 | ) | |

$ | 381 | | |

$ | (1,048 | ) | |

$ | 190 | |

| Adjustments to arrive at earnings before interest, taxes, depreciation, and amortization (EBITDA): | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| (14 | ) | |

| (31 | ) | |

| (32 | ) | |

| (98 | ) |

| Income tax expense | |

| 10 | | |

| 89 | | |

| 32 | | |

| 171 | |

| Depreciation expense | |

| 37 | | |

| 46 | | |

| 77 | | |

| 83 | |

| Amortization expense | |

| 189 | | |

| 94 | | |

| 378 | | |

| 106 | |

| EBITDA | |

| (85 | ) | |

| 579 | | |

| (593 | ) | |

| 452 | |

| Adjustments to arrive at Adjusted EBITDA: | |

| | | |

| | | |

| | | |

| | |

| Stock-based compensation expense | |

| 5 | | |

| — | | |

| 5 | | |

| — | |

| Adjusted EBITDA | |

$ | (80 | ) | |

$ | 579 | | |

$ | (588 | ) | |

$ | 452 | |

v3.24.2.u1

Cover

|

Aug. 08, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 08, 2024

|

| Entity File Number |

001-37659

|

| Entity Registrant Name |

INTERLINK ELECTRONICS, INC.

|

| Entity Central Index Key |

0000828146

|

| Entity Tax Identification Number |

77-0056625

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

15707 Rockfield Boulevard

|

| Entity Address, Address Line Two |

Suite 105

|

| Entity Address, City or Town |

Irvine

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92618

|

| City Area Code |

805

|

| Local Phone Number |

484-8855

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value

|

| Trading Symbol |

LINK

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

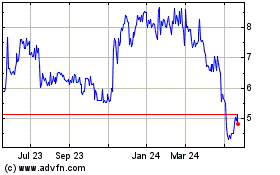

Interlink Electronics (NASDAQ:LINK)

Historical Stock Chart

From Dec 2024 to Jan 2025

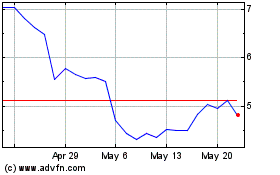

Interlink Electronics (NASDAQ:LINK)

Historical Stock Chart

From Jan 2024 to Jan 2025