Prospectus Supplement

(To Prospectus dated August 9, 2023) |

Filed pursuant to Rule

424(b)(5)

Registration No. 333-272324 |

Up

to US$1,000,000

Common Shares

Snow

Lake Resources Ltd.

We

have entered into an ATM Sales Agreement, or the Sales Agreement, with ThinkEquity LLC, or ThinkEquity or the Sales Agent, relating

to our common shares, no par value, offered by this prospectus supplement and the accompanying base prospectus. In accordance

with the terms of the Sales Agreement, we may offer and sell our common shares having an aggregate offering price of up to US$1,000,000

from time to time through the Sales Agent, acting as sales agent or principal.

Our

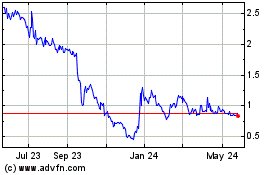

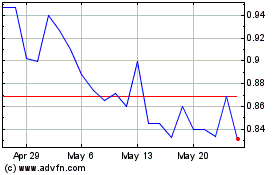

common shares are listed on the Nasdaq Capital Market under the symbol “LITM.” The last reported sale price of our

common shares on the Nasdaq Capital Market on August 21, 2024 was US$0.45 per share.

Upon

our delivery of a placement notice and subject to the terms and conditions of the Sales Agreement, the Sales Agent may sell our

common shares by methods deemed to be an “at the market offering” as defined in Rule 415(a)(4) promulgated under the

U.S. Securities Act of 1933, as amended, or the Securities Act. The Sales Agent will use its commercially reasonable efforts consistent

with its normal trading and sales practices and applicable state and federal laws, rules and regulations and the rules of the

Nasdaq Capital Market. There is no arrangement for funds to be received in any escrow, trust or similar arrangement.

We

will pay the Sales Agent a total commission for its services in acting as agent in the sale of common shares equal to 3.0% of

the gross sales price per share of all shares sold through the Sales Agent as agent under the Sales Agreement. See “Plan

of Distribution” for information relating to certain expenses of the Sales Agent to be reimbursed by us.

In

connection with the sale of the common shares on our behalf, the Sales Agent will be deemed to be an “underwriter”

within the meaning of the Securities Act and the compensation of the Sales Agent will be deemed to be underwriting commissions

or discounts. We have also agreed to provide indemnification and contribution to the Sales Agent with respect to certain liabilities,

including liabilities under the Securities Act and the U.S. Securities Exchange Act of 1934, as amended, or the Exchange Act.

As of the date of this prospectus supplement,

the aggregate market value of our outstanding common shares held by non-affiliates, or our public float, was approximately US$20,488,884

based on a total of 27,790,561 common shares outstanding, of which 21,122,561 shares were held by non-affiliates, at a price of

US$0.97 per share, the closing sales price of our common shares on July 23, 2024, which is the highest closing price of our common

shares on the Nasdaq Capital Market within the prior 60 days. Pursuant to General Instruction I.B.5. of Form F-3, in no event

will we sell our securities in a public primary offering in reliance on General Instruction I.B.5. of Form F-3 with a value

exceeding one-third of our public float in any 12-calendar-month period so long as our public float remains below US$75,000,000.

During the 12 calendar months prior to and including the date of this prospectus supplement, we have offered and sold a total

of US$5,697,724 of securities pursuant to General Instruction I.B.5. of Form F-3. As a result, we may sell up to US$1,131,904

of our common shares hereunder.

We

are an “emerging growth company” and a “foreign private issuer” as defined under U.S. federal securities

laws, and, as such, have elected to comply with certain reduced public company reporting requirements for this prospectus supplement

and the accompanying base prospectus, and the documents incorporated by reference herein and therein, and may elect to comply

with reduced public company reporting requirements in future filings. See “Prospectus Supplement Summary—Implications

of Being an Emerging Growth Company” and “Prospectus Supplement Summary—Implications of Being a Foreign

Private Issuer” for more information.

Investing

in our common shares involves a high degree of risk. You should carefully review the risks and uncertainties described under the

heading “Risk Factors” in this prospectus supplement beginning on page S-18, and under similar headings in

the accompanying base prospectus and the documents incorporated by reference into this prospectus supplement and the accompanying

base prospectus.

Neither

the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities

or determined if this prospectus supplement or the accompanying base prospectus is truthful or complete. Any representation to

the contrary is a criminal offense.

ThinkEquity

The

date of this prospectus supplement is August 22, 2024

TABLE

OF CONTENTS

PROSPECTUS

SUPPLEMENT

PROSPECTUS

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

prospectus supplement and the accompanying base prospectus are part of a “shelf” registration statement on Form F-3

(File No. 333-272324) that we filed with the U.S. Securities and Exchange Commission, or the SEC, and was declared effective by

the SEC on August 9, 2023. This prospectus supplement and the accompanying base prospectus relate to an “at the market”

offering of our common shares. Before buying any of the common shares offered hereby, we urge you to read carefully this prospectus

supplement, the accompanying base prospectus, and the documents incorporated by reference into this prospectus supplement and

the accompanying base prospectus. You should also read and consider the information in the documents to which we have referred

you in the sections of this prospectus supplement entitled “Where You Can Find More Information” and “Incorporation

of Certain Information by Reference.” These documents contain important information that you carefully should consider

when making your investment decision.

This

document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering of

our common shares and also adds to and updates information contained in the accompanying base prospectus and the documents incorporated

by reference into this prospectus supplement and the accompanying base prospectus. The second part, the accompanying base prospectus,

provides more general information, some of which may not apply to this offering. Generally, when we refer to this prospectus,

we are referring to both parts of this document combined. The information included or incorporated by reference in this prospectus

supplement also adds to, updates, and changes information contained or incorporated by reference in the accompanying base prospectus.

If information included or incorporated by reference in this prospectus supplement is inconsistent with the accompanying base

prospectus or the information incorporated by reference therein, then this prospectus supplement or the information incorporated

by reference in this prospectus supplement will apply and will supersede the information in the accompanying base prospectus and

the documents incorporated by reference therein.

You

should rely only on the information contained in, or incorporated by reference into, this prospectus supplement and the accompanying

base prospectus. We have not, and the Sales Agent has not, authorized anyone to provide you with different or additional information,

or to make any representations other than those contained in, or incorporated by reference into, this prospectus supplement and

the accompanying base prospectus. We and the Sales Agent take no responsibility for, and can provide no assurance as to the reliability

of, any other information that others may give you. We are not making offers to sell or solicitations to buy our common shares

in any jurisdiction in which an offer or solicitation is not authorized or in which the person making that offer or solicitation

is not qualified to do so or to anyone to whom it is unlawful to make an offer or solicitation.

You

should assume that the information in this prospectus supplement and the accompanying base prospectus is accurate only as of the

date on the front of the respective document and that any information that we have incorporated by reference is accurate only

as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus supplement or

the accompanying base prospectus or the time of any sale of our common shares. Our business, financial condition, results of operations

and prospects may have changed since those dates.

This

prospectus supplement and the accompanying base prospectus contain summaries of certain provisions contained in some of the documents

described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in

their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will

be incorporated herein by reference as exhibits to the registration statement of which this prospectus supplement is a part, and

you may obtain copies of those documents as described below under the section entitled “Where You Can Find More Information.”

We

further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any

document that is incorporated by reference herein were made solely for the benefit of the parties to such agreement, including,

in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation,

warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made.

Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state

of our affairs.

This prospectus supplement, the accompanying

base prospectus, and the documents incorporated by reference in this prospectus supplement and the accompanying base prospectus,

contain references to trademarks, trade names and service marks. Solely for convenience, trademarks, trade names and service marks

referred to in this prospectus supplement, the accompanying base prospectus, and the documents incorporated by reference in this

prospectus supplement and the accompanying base prospectus may appear without the ® or TM symbols, but

such references are not intended to indicate, in any way, that the applicable licensor will not assert, to the fullest extent under

applicable law, its rights to such trademarks and trade names. We do not intend our use or display of other entities’ trade

names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other entities.

In

this prospectus, unless the context otherwise requires, “we,” “us,” “our,” “our company,”

“Snow Lake” and similar references refer to Snow Lake Resources Ltd. (d/b/a Snow Lake Energy) and, where appropriate,

its consolidated subsidiaries.

PROSPECTUS

SUPPLEMENT SUMMARY

This

summary highlights selected information contained in or incorporated by reference in this prospectus supplement and does not contain

all of the information that is important to you in making an investment decision. This summary is qualified in its entirety by

the more detailed information included elsewhere in this prospectus supplement, the accompanying base prospectus, and the documents

incorporated by reference in this prospectus supplement and the accompanying base prospectus. Before making your investment decision

with respect to our securities, you should carefully read this entire prospectus supplement and the accompanying base prospectus,

including our consolidated financial statements and related notes, and other information incorporated by reference from our other

filings with the SEC.

Our

Company

Our

Corporate Strategy

Our

corporate strategy is to assemble and develop a portfolio of clean energy mineral projects designed to support the clean energy

transition and electric vehicle, or EV, transition. Our overall focus is on uranium and lithium minerals projects. Geopolitical

events continue to shape both the uranium and lithium markets, with the uranium market showing considerable strength, and the

lithium market continuing to show weakness. Given the current state of the uranium and lithium markets, our primary focus over

the next year will be to advance the exploration of our two uranium projects, while taking a slower, more careful approach to

exploring our two lithium projects.

Overview

We

are a Canadian clean energy exploration company with a global portfolio of clean energy mineral projects comprised of two uranium

projects and two hard rock lithium projects. Our uranium projects consist of (i) the Black Lake Uranium Project, located

in the Athabasca basin, Saskatchewan, Canada, and (ii) the Engo Valley Uranium Project, in Namibia. Our lithium projects consist

of (i) the Shatford Lake Lithium Project, adjacent to the Tanco tantalum, cesium and lithium mine in Southern Manitoba, Canada,

and (ii) the Thompson Brothers project and the Grass River project, or collectively, the Snow Lake Lithium™ Project, in

the Snow Lake region of Northern Manitoba, Canada.

At

present, we believe our uranium projects provide the best current opportunity to create shareholder value, and we intend to focus

the majority of our exploration efforts and expenditures on our two uranium projects in the near term.

Uranium

Market

Overview

Currently,

the primary significant commercial use for U3O8 is as a fuel for nuclear power plants for the generation

of electricity. Global demand for electricity is estimated to grow by approximately 50% by 2040, with calls to triple global nuclear

capacity by 2050.

Nuclear

energy underpins the three major global trends of electrification, decarbonization, and energy security. Nuclear power plays

a critical role in energy transition, as it is widely stated that there is no path to net zero carbon without nuclear power. At

the 2023 United Nations Climate Change Conference or Conference of the Parties of the UNFCCC (more commonly known as COP 28),

a total of 22 countries agreed to target tripling nuclear capacity by 2050 as countries focus on energy security and affordability.

Nuclear energy provides clean, non-CO2 emissions, and low-cost energy, with greater generating capacity per footprint

than other fuel sources. Nuclear power programs continue to expand, with 440 operating reactors in 31 countries, and with 60 reactors

under construction in 18 countries.

Geopolitical

Events

Geopolitical

events continue to shape the global uranium market, including the ongoing Russian invasion of Ukraine, political instability in

Niger, and the United States passing a series of laws banning the importation of Russian uranium and facilitating American nuclear

energy leadership. These events continue to influence and drive the global energy mix and policy, with renewed focus on nuclear

power as a means of ensuring energy security.

In

the past couple of months, the United States has passed two significant pieces of legislation designed to advance clean energy,

enhance energy security and independence, and revive an aging nuclear energy industry at home and bolster cutting-edge technologies

abroad.

In

May 2024, President Biden signed into law the “Prohibiting Russian Uranium Imports Act,” which bans the import of

enriched uranium produced in Russia or by Russian entities, and is designed to enhance the United States’ energy security by reducing

its dependence on Russia for nuclear fuels. It also unlocks funding to support domestic uranium production. Russia is currently

the largest foreign supplier of enriched uranium to the United States, according to U.S. Energy Department data.

In

July 2024, President Biden signed into law, the “Accelerating Deployment of Versatile, Advanced Nuclear for Clean Energy

Act,” or the ADVANCE Act, which is designed to reestablish the United States as the global leader in nuclear energy in the

21st century. The ADVANCE Act is aimed at strengthening the United States’ energy security, as well as expanding nuclear

power as a clean, reliable power source designed to remain a major part of the United States future energy mix.

Supply

of Uranium

Geopolitical

events continue to disrupt the global uranium supply chain. A combination of low prices over the past decade, underinvestment

in uranium projects and nuclear power, mine closures, challenges in re-starting idled uranium mines, and the COVID-19 pandemic,

have all contributed to a reduction in the global supply of uranium. More recently, uranium producers, developers, and physical

uranium holding companies have continued to buy physical uranium, putting further strain on the uranium supply chain.

Demand

for Uranium

Demand

for uranium is being driven by the increasing focus on nuclear power as a component part of net zero, a policy shift to include

nuclear power as clean energy, and the number of nuclear reactors in operation and under construction.

As

noted above, with 440 operating reactors in 31 countries, and with 60 reactors under construction in 18 countries, total uncovered

uranium requirements are estimated to be more than 500 million pounds through 2030. The World Nuclear Association’s Nuclear Fuel

Report (2023) predicts a 28% increase in uranium demand from 2023 through 2030, with a 51% increase in uranium demand for the

period from 2031 through 2040, providing plenty of scope for growth in nuclear capacity in a world focused on carbon emissions.

Demand for uranium is forecast to outstrip uranium supply over the next decade.

Prices

As

a result of the demand-and-supply dynamics, prices of uranium have recovered from their lows over the past decade and briefly

exceeded US$100 per pound U3O8 in January 2024, with current prices hovering around US$85 per pound

U3O8.

We

are of the view that the combination of supply and demand factors, against the backdrop of the search for solutions to decarbonization

and managing global geopolitical risks, is positive for uranium exploration over the next decade.

Our

Uranium Projects

The

Engo Valley Uranium Project

In

February 2024, our company, OG Acquisition 2 Corp., a private British Columbia company, or OG, Engo Valley Pty Ltd, a private

Australian company, or Engo Valley, and Namibia Minerals and Investment Holdings (Proprietary) Limited, a private Namibian company,

or NMIH, entered into a binding letter of intent, as amended by agreements dated March 15, 2024 and June 30, 2024, pursuant to

which we agreed to acquire up to 100% of Engo Valley, which holds an 85% interest in NMIH, which in turn, is the sole registered

and beneficial owner of 100% of the right, title and interest in Exclusive Prospecting License 5887, or EPL-5887. EPL 5887 hosts

the Engo Valley Uranium Project. EPL-5887 covers an area of 69,530 hectares, is valid until February 12, 2026, and covers base

and rare metals, industrial minerals, non-nuclear fuel mineral, nuclear fuel minerals, precious metals and precious stones.

The

Engo Valley Uranium Project is located in the Skeleton Coast, in the Opuwo District of the Kunene Region, along the coast of northwest

Namibia, approximately 600 kilometers (or approximately 373 miles) north of Swakopmund, Namibia. It is accessible from the south

via 190 kilometers (or approximately 118 miles) of desert track roads from Mowe Bay, via the Sarusas mine. To the east, there

are unconfirmed track roads that connect the project area to the settlement of Orupembe.

In

July 2024, we entered into a share purchase agreement with the shareholders of Engo Valley, or the Engo Valley Shareholders, Engo

Valley, OG, and NMIH, to acquire Engo Valley in two stages, as follows:

| |

(i) |

We acquired an

initial 80% undivided interest in Engo Valley, which represents a 68% undivided interest in NMIH, or the First Stage Interest,

by (a) paying to OG, upon the execution of the binding letter of intent, a cash amount of US$250,000, (b) incurring exploration

expenditures of a minimum of US$200,000 on the Engo Valley Uranium Project on or prior to July 31, 2024, and (c) issuing to

Engo Valley and its designees, on August 7, 2024 (being the closing date of the First Stage Interest), an aggregate of 2,024,496

of our common shares, or the First Stage Shares, being the common shares calculated by dividing US$2.0 million by the 5-day

volume weighted average price of our common shares as of a specified date (which was US$0.9879). In accordance with the terms

of the share purchase agreement, 50% of the First Stage Shares issued to Engo Valley and its designees have vested. The remaining

50% of the First Stage Shares have been placed in escrow, and will vest and be released from escrow upon the completion of

an SK-1300 compliant mineral resource estimate on the Engo Valley Uranium Project; provided, that such unvested First Stage

Shares will be cancelled if the SK-1300 compliant mineral resource estimate is not completed on or before June 30, 2025. |

| |

(ii) |

We will acquire

an additional 20% undivided interest in Engo Valley, which represents a 17% undivided interest in NMIH, or the Second Stage

Interest, upon our incurring additional exploration expenditures of a minimum of US$800,000 on the Engo Valley Uranium Project

on or before June 30, 2025; provided, that any expenditures we incurred in excess of the US200,000 minimum exploration expenditures

in connection with our acquisition of the First Stage Interest will be credited against the expenditure commitment for the

Second Stage Interest. |

After

our acquiring of the Second Stage Interest, we will be obligated to make the following payments to Engo Valley, in the form of

our common shares, upon the achievement of the following milestones:

| (i) | Milestone

Payment No. 1: In the event an SK-1300 compliant technical report determines there

is a uranium mineral resource on the Engo Valley Uranium Project of a minimum of 10 million

pounds with a minimum average grade of 250 parts per million, or ppm, U3O8,

we will issue to Engo Valley or as it directs, an aggregate of 1,030,927 of our common

shares, being the common shares calculated by dividing US$1,000,000 by the closing price

of our common shares on February 20, 2024, as reported by the Nasdaq Capital Market (which

was USD$0.97); and |

| (ii) | Milestone

Payment No. 2: In the event an SK-1300 compliant technical report determines there

is a uranium mineral resource on the Engo Valley Uranium Project of a minimum of 25 million

pounds with a minimum average grade of 250 ppm U3O8, we will issue

to Engo Valley or as it directs, an aggregate of 1,030,927 of our common shares, being

the common shares calculated by dividing US$1,000,000 by the closing price of our common

shares on February 20, 2024, as reported by the Nasdaq Capital Market (which was USD$0.97). |

We

have designed a multi-phase exploration program for 2024 for the Engo Valley Uranium Project, which includes:

| ● | analysis

of all airborne survey data previously flown by the Namibian Government over the project

area, together with all other historical exploration reports and data on the project

area on file with the Namibian Ministry of Mines and Energy (now complete); |

| ● | topographical

survey of the project site (now complete); |

| ● | locating

all historic drill collars from Gencor’s 1970 drilling campaign (now complete); |

| ● | radon

cup survey of all historical targets, as well as a number of new targets, in order to

verify the historical airborne survey data and to confirm both historic and new drill

targets (now complete); |

| ● | an

initial 1,000-meter reverse circulation drill program to twin the historical drill holes,

and to begin an in-fill grid pattern between the historical drill holes (pending); and |

| ● | downhole

radiometrics on each of the new drill holes (pending). |

Exploration

field crews began mobilizing to site in May 2024 in order to undertake the field portion of Phase 1 of the program. Results

from the radon cup survey, the initial phase of drilling, and the downhole gamma logging, will inform a second round of drilling.

The two phases of drilling are designed to both test the validity of the various exploration targets and to produce an initial

SK-1300 compliant mineral resource estimate.

We cannot assure you that all of the

conditions necessary to acquire the Second Stage Interest will be satisfied.

We

do not consider the Engo Valley Uranium Project material at this time.

The

foregoing description of the material terms of our acquisition of an indirect interest in NMIH is qualified in its entirety by

reference to the share purchase agreement dated July 31, 2024, which is incorporated by reference as an exhibit to the registration

statement of which this prospectus supplement forms a part.

The

Black Lake Uranium Project

The

Black Lake Uranium Project is located in the Athabasca Basin, Saskatchewan, Canada, 55 kilometers (or approximately 34 miles)

to the northeast of the town of Stoney Rapids, Saskatchewan, Canada. It consists of 20 mining claims covering 18,908 hectares

and is divided into four projects, namely, Higginson Lake, Charlebois Lake, Fisher Hayes and Spreckley Lake.

Doctors

Investment Group Ltd., a private British Columbia company, or Doctors Investment, is the sole registered and beneficial owner

of 100% of the right, title and interest in the mineral claims comprising the Black Lake Uranium Project.

Global

Uranium Acquisition Corp (Pty) Ltd, a private Australian company, or Global Uranium, is party to a mineral property option agreement

with Doctors Investment, dated March 24, 2024, pursuant to which Global Uranium can earn a 100% interest in the Black Lake Uranium

Project, as explained further below.

In

May 2024, we entered into a share purchase agreement with the shareholders of Global Uranium, or the Global Uranium Shareholders,

and Global Uranium, to acquire Global Uranium, for the following consideration:

| ● | Payment

by us to Global Uranium of an amount of C$50,000, in cash, upon the execution of the

letter of intent relating to the acquisition, which amount has been paid; |

| ● | Our

issuance to the Global Uranium Shareholders of an aggregate of 1,000,000 of our fully

paid and non-assessable common shares, or the Initial Snow Lake Shares, upon execution

of the share purchase agreement, which shares have been issued; and |

| ● | Our

issuance to the Global Uranium Shareholders of an aggregate of 1,000,000 of our fully

paid and non-assessable common shares, in the event an SK-1300 compliant technical report

determines that there is a uranium mineral resource on the Black Lake Uranium Project

of a minimum of 10 million pounds U3O8 with a minimum average grade

of 500 ppm U3O8 per tonne. |

Our

acquisition of Global Uranium was completed on June 21, 2024.

Pursuant

to Global Uranium’s mineral property option agreement with Doctors Investment, Global Uranium can earn a 100% interest in

the Black Lake Uranium Project, upon the satisfaction of the following conditions:

| (i) | Cash

Payments: Payment by Global Uranium to Doctors Investment of the following amounts in

cash: |

| (a) | C$50,000

within two days of signing the mineral property option agreement, which amount has been

paid; |

| (b) | C$150,000

within 30 days of the signing of the mineral property option agreement, which amount

has been paid; |

| (c) | C$250,000

on or before the first anniversary of the signing of the mineral property option agreement; |

| (d) | C$350,000

on or before the second anniversary of the signing of the mineral property option agreement; |

| (e) | C$400,000

on or before the third anniversary of the signing of the mineral property option agreement;

and |

| (f) | C$600,000

on or before the fourth anniversary of the signing of the mineral property option agreement;

and |

| (ii) | Exploration

Expenditures. Global Uranium incurring the following exploration expenditures on the

Black Lake Uranium Project: |

| (a) | C$500,000

in exploration expenditures on or before the first anniversary of the signing of the

mineral property option agreement; |

| (b) | C$500,000

in exploration expenditures on or before the second anniversary of the signing of the

mineral property option agreement; and |

| (c) | C$1,000,000

in exploration expenditures on or before the third anniversary of the signing of the

mineral property option agreement. |

Global Uranium has the right under the option agreement to accelerate both cash payments and/or the exploration expenditures prescribed

under the option agreement.

Following

the exercise of the option, Global Uranium will grant a 1% net smelter royalty to Doctors Investment upon commencement of commercial

production, which net smelter royalty may be purchased by Global Uranium at any time at a cost of C$1,500,000.

We

have designed a multi-phase exploration program for 2024 for the Black Lake Uranium Project, which includes:

| |

● |

compiling, digitizing

and reviewing all historical exploration plans, maps, geological reports, survey reports, assessment reports, all previous

geologic, radiometric, and scintillometer surveys, assay results from prior diamond drilling programs on the Higginson Lake,

Charlebois Lake and Spreckley Lake project areas from prior companies’ exploration programs in the 1950’s and

1970’s (now complete); |

| ● | an

airborne survey over the entire Black Lake Uranium Project area (scheduling); |

| ● | upon

receipt of permits, a program of prospecting and mapping and ground geophysics, focusing

on areas of known mineralization, in order to assist in locating high-value drill targets

(pending); and |

| ● | upon

receipt of permits, a program of diamond drilling, which is intended to be a program

of up to 2,000 meters of diamond drilling, spread over approximately 10 holes of approximately

200 meters each, dependent upon appropriate drill target identification from prior phases

of the program. Based upon successful drilling, the objective of the 2024 work program

would be to produce an initial SK-1300 compliant mineral resource estimate (pending). |

We

cannot assure you that all of the conditions necessary for Global Uranium to earn a 100% interest in the Black Lake Uranium Project

will be satisfied.

We

do not consider the Black Lake Uranium Project material at this time.

The

foregoing descriptions of the material terms of our acquisition of Global Uranium, and Global Uranium’s mineral property

option agreement with Doctors Investment, are qualified in their entirety by reference to their respective agreements, each of

which is incorporated by reference as an exhibit to the registration statement of which this prospectus supplement forms a part.

Our

Lithium Projects

Our

lithium projects consist of the projects described below. Until recently, our Snow Lake Project constituted our sole material

project. The lithium market currently remains depressed. Lithium prices continue to remain low after a stratospheric rise in 2022,

followed by a precipitous 80% drop during 2023. Demand for lithium continues to be weak, and a number of major global lithium

producers continue to curtail production until the lithium market and lithium prices recover. Given the current state of the lithium

markets, as mentioned above, our primary focus over the next year will be to advance the exploration of our two uranium projects

described above, while taking a slower, more careful approach to exploring our two lithium projects described below. At present,

we do not consider our lithium projects to be material to our company.

The

Shatford Lake Lithium Project

In

January 2024, we signed an option agreement with ACME Lithium Inc., or ACME, pursuant to which ACME granted us the option to earn

up to a 90% undivided interest in the mineral claims held by ACME at its Manitoba lithium pegmatite project areas, located in

southeastern Manitoba, Canada, or the Shatford lake Lithium Project.

We

may exercise the option by paying a total cash amount of C$800,000 and incurring a total of C$1.8 million in exploration and development

expenditures, in each case over a two-year period.

Once

we have earned a 90% undivided interest in the Shatford lake Lithium Project, and completed a positive feasibility study, a joint

venture between us and ACME will be formed for further development, the detailed market standard terms and conditions of which

will be agreed at the time of formation of the joint venture.

Upon

formation of the joint venture: (i) we will hold a 90% interest, and ACME will hold 10% interest in the joint venture, (ii) our

interest will be a 90% participating interest in the joint venture, but will fund 100% of all expenditures until the completion

of a positive feasibility study, and (iii) ACME will retain a 10% free carried interest, without the need to contribute to expenditures

until the completion of a positive feasibility study on the Shatford lake Lithium Project.

The

Shatford Lake Lithium Project is comprised of 37 mineral claims located over three project areas, being Shatford Lake, Birse Lake,

and Cat-Euclid Lake, totaling approximately 17,000 acres. The project is located in the Bird River Greenstone Belt in southeastern

Manitoba, Canada. The region hosts hundreds of individual pegmatite bodies, many of which are classified as complex rare-element

Lithium-Cesium-Tantalum, or LCT, pegmatites. Thirty-one of the mineral claims are contiguous to the south of Sinomine Corporation’s

Tanco Mine, an LCT producer since 1969.

We

have, together with Critical Discoveries, a private geological services consulting company, designed a multi-phase exploration

program for 2024 for the Shatford Lake Lithium Project, which includes:

| ● | compiling

and analyzing all past exploration data generated by ACME, including all geophysical

and geochemical data, as well as past drilling results, in order to identify targets

for field work (now complete); |

| ● | initial

prospecting and mapping, focusing on the northwest corner of the Shatford Lake Lithium

Project and then expanding to cover the balance of the project. Initial prospecting activities

to date have included the discovery of numerous pegmatites under heavy overburden. Samples

have been taken and submitted to an assay lab for analysis (in progress); |

| ● | depending

on assay results and receipts of permits, a program of up to 2,000 meters of diamond

drilling, spread over approximately 10 holes of approximately 200 meters each, and further

dependent upon appropriate drill target identification from the previous phases of the

program (pending); and |

| ● | compilation

and evaluation of all field data, assay results, and drill results from the 2024 exploration

program (pending). |

We

do not consider the Shatford lake Lithium Project material at this time.

The

foregoing description of the material terms of our option agreement relating to the Shatford lake Lithium Project is qualified

in its entirety by reference to the option agreement, dated January 29, 2024, between us and ACME, which is incorporated by reference

as an exhibit to the registration statement of which this prospectus supplement forms a part.

The

Snow Lake Lithium™ Project

The

Snow Lake Lithium™ Project is a 100%-owned exploration stage project located in the Snow Lake region of Northern

Manitoba, Canada, comprising 122 mineral claims covering 24,515 hectares (approximately 60,577 acres). The Snow Lake Lithium™

Project consists of two deposits, the Thompson Brothers deposit and the Grass River deposit, which together have a measured, indicated

and inferred resource estimate of approximately 8.2 million tonnes grading approximately 1% Li2O. To date, a total of 26,000 meters

of drilling has been completed, of which approximately 20,000 meters are included in the current mineral resource estimate, with

approximately 6,000 meters of drilling not included.

In

July 2023, we completed an S-K 1300 Technical Report Summary of Initial Assessment, or the PEA, which considered a mine plan consisting

of underground mining on both deposits, with an initial open pit on the Grass River deposit. Metallurgical testwork has

demonstrated that conventional lithium process technologies of dense media separation and floatation will provide robust recoveries.

The PEA contemplated that tailings would ultimately be backfilled underground, with no permanent tailing facility above ground.

The PEA also looked at the possibility of direct shipping ore, or DSO, as an early cash flow generating opportunity to use revenue

from DSO sales to offset initial capital costs to construct the mine and processing facility. We believe, but cannot assure you,

that options exist to sell the DSO to a variety of parties. The PEA is preliminary in nature

and is intended to provide an initial, high-level review of the Snow Lake Lithium™ Project’s economic potential and design

options. The projected economic results include numerous assumptions and are based on measured, indicated and inferred mineral

resource estimates for the Snow Lake Lithium™ Project, as specified in the PEA. Inferred resources are considered

to be too speculative geologically to have economic considerations applied to them that would enable them to be categorized as

mineral reserves, and there is no certainty that the pea will be realized. Unlike mineral reserves, mineral resource estimates

do not have demonstrated economic viability.

Due

to a number of factors, including the current state of the lithium market and warmer than normal winter weather conditions in

Northern Manitoba during early 2024, we did not undertake a planned winter drilling campaign. During 2024, we will complete our

second year of environmental baseline data collection. Additional exploration, including additional infill drilling, and drilling

of the open extensions of both the Thompson Brothers and Grass River deposits, will not take place during 2024 due the factors

described above.

We

are of the view that the Snow Lake Lithium™ Project does not have the scale, size, grade or project economics to make it

an attractive exploration project at the present time given the current lithium pricing environment. As such, our management has

determined that the Snow Lake Lithium™ Project is no longer a material asset to the Company. While we do not intend to abandon

the Snow Lake LithiumTM Project, further exploration activities have been limited until such time as the lithium market

recovers, lithium prices recover, investor interest in the lithium sector returns, and capital once again becomes available to

fund exploration and development of lithium projects.

Our

Competitive Strengths

We

believe that the following competitive strengths will contribute to our success and differentiate us from our competitors:

| ● | We

have a unique portfolio of clean energy mineral projects including uranium and lithium

projects. |

| ● | Our

operations are located in the mining friendly jurisdictions of Canada and Namibia. |

| ● | Our

uranium operations are located in Canada, the world’s second largest uranium producer,

and Namibia, the world’s third largest uranium producer. |

| ● | Our

uranium projects are considered to be top tier exploration projects with historical,

non-modern mining code compliant uranium resources, that would benefit from modern exploration

techniques and technology for uranium exploration. |

| ● | Our

leadership team consists of experienced mining executives, with a track record of exploration,

development and operations, as well as corporate financing and mergers and acquisitions. |

Our

Growth Strategies

We

have a corporate strategy to assemble and develop a portfolio of clean energy mineral projects designed to support the clean energy

transition and the EV transition. We continue to review North American opportunities in the clean energy space, in an effort to

identify additional sources of clean energy that have the potential to be commercialized, that would contribute to net zero, and

that would complement our current portfolio of uranium and lithium projects.

We

have developed a strategic plan for exploration and development of our projects that includes the following milestones:

| ● | Undertake

exploration activities on our uranium projects. We intend to conduct exploration activities on our Engo Valley Uranium

Project and Black Lake Uranium Project to confirm the existence of historical uranium mineralization and to produce an S-K 1300

compliant mineral resource estimate. |

| ● | Undertake

preliminary exploration activities on our Shatford Lake Lithium Project. We intend to conduct initial exploration activities

on our Shatford Lake Lithium Project to identify and confirm the potential existence of tantalum, cesium and lithium mineralization. |

| ● | Acquisitions

of additional clean energy projects. In addition to our existing projects, our

growth strategy includes the acquisition of other clean energy projects, including in

areas of clean energy beyond uranium. |

Recent

Developments

Shareholder

Approval of Certain Matters

Continuance

On

May 8, 2024, we held our annual general and special meeting of our shareholders, or the 2024 Annual Meeting, at which our shareholders

passed a special resolution authorizing and approving our continuance from the Province of Manitoba into the Province of Ontario,

or the Continuance, under the Business Corporations Act (Ontario), or the OBCA, and to effect, at such time as our board deems

appropriate, but in any event no later than three years after the 2024 Annual Meeting, such Continuance in accordance with the

Corporations Act (Manitoba), or the MCA, and the OBCA, subject to our board of directors’ authority to decide not to proceed

with the Continuance.

If

the Continuance is effected, we will become a corporation under the laws of the Province of Ontario as if we had been incorporated

under the OBCA. While the Continuance, if effected, will not, by itself, result in any change of our business or our assets or

liabilities, or in the persons who constitute our board of directors or management, it will affect certain rights of our shareholders

as they currently exist under the MCA. Consequently, you should consult your legal advisors regarding the implications of our

effecting the Continuance, prior to purchasing our common shares in this offering.

A

comparative summary of certain differences between the MCA and the OBCA is set forth in our management information circular for

the 2024 Annual Meeting, dated March 28, 2024, attached as Exhibit 99.1 to our Form 6-K furnished to the SEC on April 11, 2024,

and incorporated herein by reference. Such summary is not a comprehensive review of the two statutes, and is qualified in its

entirety by the full text both statutes and the regulations thereunder.

Share

Consolidation

At

the 2024 Annual Meeting, our shareholders also passed a special resolution authorizing and approving the consolidation of our

issued and outstanding common shares at such a consolidation ratio to be determined by our board of directors, at its sole discretion,

and to effect, at such time as our board of directors deems appropriate, but in any event no later than three years after the

2024 Annual Meeting, a share consolidation of all of our issued and outstanding common shares on the basis of such determined

consolidation ratio, subject to our board of directors’ authority to decide not to proceed with the consolidation.

Name

Change

At

the 2024 Annual Meeting, our shareholders also passed a special resolution to authorize our board of directors to amend our articles

to change our current name to a name to be decided by our board of directors, in its sole discretion, and to effect such name

change, at such time as our board of directors deems appropriate, but in any event no later than three years after the 2024 Annual

Meeting, subject to our board of directors’ authority to decide not to proceed with the name change.

Appointment

of Interim Chief Financial Officer

Our

prior chief financial officer, Keith Li, resigned from his position effective June 30, 2024. In connection therewith, Kyle Nazareth

was appointed as our Interim Chief Financial Officer, effective July 1, 2024.

Termination

of Option Agreement Relating to the Muskrat Dam Project

In

February 2024, we entered into an option agreement with 10183923 Manitoba Ltd., a private Manitoba company, or ManCo, to acquire

up to a 90% undivided interest in a group of mineral claims in the Muskrat Dam Lake area of Western Ontario, near Kenora and the

border with Manitoba, or the Muskrat Dam Project. The option agreement was amended and terminated on June 28, 2024. As consideration

for the option, we paid C$50,000 in cash to ManCo, and issued an aggregate of 500,000 shares and 2,000,000 warrants to ManCo,

and as consideration for the amendment and termination on June 28, 2024, we issued an aggregate of 3,500,000 shares to ManCo’s

assignees and the 2,000,000 warrants previously issued to ManCo were cancelled.

Our

Risks and Challenges

Our

business is subject to numerous risks and uncertainties that you should be aware of before making an investment decision, including

those highlighted in the section entitled “Risk Factors” in this prospectus supplement and under similar headings

in the documents incorporated by reference herein. These risks include, but are not limited to, the following:

| ● | We

have no history of mineral production, a limited operating history, and have not yet

generated any revenues. |

| ● | Our

financial statements have been prepared on a going concern basis and our financial status

creates a doubt whether we will continue as a going concern. |

| ● | All

of our business activities are in the exploration stage and there can be no assurance

that our exploration efforts will result in commercial development of mineral deposits. |

| ● | We

may not achieve exploration success on our uranium and lithium projects. |

| ● | Fluctuations

in the price of uranium and alternate sources of energy could have an adverse effect

on our uranium projects. |

| ● | Fluctuations

in the price of lithium, and a slow-down in the uptake of EVs, could have an adverse effect on our lithium projects. |

| ● | If

we do not obtain additional financing, our business may be at risk or execution of our

business plan may be delayed. |

| ● | Mineral

exploration and development are subject to extraordinary operating risks. We currently

do not insure against these risks. In the event of a cave-in or similar occurrence, our

liability may exceed our resources, which could have an adverse impact on us. |

| ● | Our

business operations are exposed to a high degree of risk associated with the mining industry. |

| ● | We

may not be able to obtain or renew licenses or permits that are necessary to our operations. |

| ● | We

are subject to numerous regulations. Failure to comply with federal, provincial and/or

local laws and regulations, as well as environmental regulations, could adversely affect

our business.

|

| ● | Our

mining operations are dependent on the adequate and timely supply of water, electricity

or other power supply, chemicals and other critical supplies.

|

| ● | There

can be no guarantee that our projects are free from any title defects.

|

| ● | A

major shareholder, Nova Minerals Limited, owns a significant interest in our outstanding

common shares. As a result, it will have the ability to influence all matters submitted

to our shareholders for approval.

|

| ● | Our

directors and officers are engaged in other business activities and accordingly may not

devote sufficient time to our business affairs, which may affect our ability to conduct

operations and generate revenue.

|

| ● | In

the event that key personnel leave our company, we would be harmed since we are heavily

dependent upon them for all aspects of our activities.

|

| ● | Volatility

in uranium and lithium prices and uranium and lithium demand may make it commercially

unfeasible for us to develop our uranium and lithium projects in the foreseeable future,

if ever.

|

| ● | The

future market demand for uranium is and will be heavily dependent on the energy transition,

government policies to support the energy transition, and geopolitical events. Any and

all of these events may adversely affect uranium prices and the commercial feasibility

of our uranium projects. |

| ● | The

future market demand for lithium is and will be heavily dependent on the growth and development

and continuing market acceptance and growth in market share of EVs with the overall North

American and worldwide auto industry. Any reduction in the rate of growth of the EV industry

may adversely affect lithium prices and the commercial feasibility of our lithium projects.

|

| ● | Our

mineral resource projects located in Manitoba and Saskatchewan may face indigenous land

claims. |

| ● | We

have obtained an S-K 1300 compliant mineral resource report on our Snow Lake Lithium™

Project, which represented only estimates and no assurance can be given that any anticipated

tonnages and grades will be achieved, or that the indicated level of recovery will be

realized. Further drilling will be required to determine whether the Snow Lake Lithium™

Project contains proven or probable mineral reserves and there can be no assurance that

we will be successful in our efforts to prove our resource.

|

| ● | Our

mineral resources or reserves may be significantly lower than expected. |

| ● | The

market price of our common shares has been, and is likely to continue to be volatile.

|

| ● | There

is no guarantee that an active trading market for our common shares will be sustained. |

| ● | There

can be no assurance that our common shares will continue to be listed on Nasdaq. |

The

risks described above should be read together with the text of the full risk factors set forth in, or incorporated by reference

into, the section entitled “Risk Factors” in this prospectus supplement, and the other information set forth

in, or incorporated by reference into, this prospectus supplement, including our consolidated financial statements and the related

notes. The risks summarized above or described in this prospectus supplement and the documents incorporated by reference herein

are not the only risks that we face. Additional risks and uncertainties not presently known to us, or that we currently deem to

be immaterial may also materially adversely affect our business, financial condition, results of operations and future prospects.

Corporate

Information

We

were incorporated in the Province of Manitoba, Canada under the MCA on May 25, 2018. We have five wholly owned subsidiaries, Snow

Lake Exploration Ltd., Snow Lake (Crowduck) Ltd., Global Uranium Acquisition Corp Pty Ltd., Snow Lake Investments (US) Ltd., and

Snow Lake Exploration (US) Ltd. We also hold a majority interest in Engo Valley Pty Ltd.

Snow

Lake Exploration Ltd. is an operating company formed to conduct the exploration and development of mineral resources. Snow Lake

(Crowduck) Ltd. is an asset holding company that holds all of the ownership interests in 133 mineral claims on the Snow Lake Lithium™

Project. Global Uranium Acquisition Corp Pty Ltd is an asset holding company that holds the option to acquire all of the ownership

interests in the 20 mineral claims on the Black Lake Uranium Project. Engo Valley Pty Ltd is an asset holding company that holds

an 85% interest in Namibia Minerals and Investment Holdings (Proprietary) Limited, the Namibian private company that holds EPL-5887.

EPL-5887 hosts the Engo Valley Uranium Project. Snow Lake Exploration (US) Ltd. is an asset holding company that holds our majority

interest in Engo Valley Pty Ltd., and Snow Lake Investments (US) Ltd. does not currently have any operations or assets.

The

mailing address for our principal executive office is 360 Main Street, 30th Floor, Winnipeg, Manitoba, Canada R3C 4G1,

and our telephone number is (204) 815-5806. Our company email address is info@snowlakelithium.com.

Our

agent for service of process in the United States is Cogency Global Inc., located at 122 East 42nd Street, 18th Floor,

New York, New York 10168.

Our

website address is www.snowlakeenergy.com. The information contained in or accessible from our website is not a part of this prospectus,

nor is such information incorporated by reference herein, and should not be relied upon in determining whether to make an investment

in our common shares. We have included our website address in this prospectus solely as an inactive textual reference.

Implications

of Being an Emerging Growth Company

We

are an “emerging growth company” as defined in the Securities Act, as modified by the Jumpstart Our Business Startups

Act of 2012, or the JOBS Act. As such, we are eligible to take, have taken, and intend to take, advantage of certain exemptions

from various reporting requirements applicable to other public companies that are not emerging growth companies for as long as

we continue to be an emerging growth company, including the exemption from the auditor attestation requirements with respect to

internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act of 2002.

In

addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition

period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words,

an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply

to private companies. We have elected to take advantage of the benefits of this extended transition period. Our financial statements

may therefore not be comparable to those of companies that comply with such new or revised accounting standards.

We

will remain an emerging growth company until the earliest of (i) the last day of the fiscal year during which we have total annual

gross revenues of at least US$1.235 billion; (ii) the last day of our fiscal year following the fifth anniversary of the completion

of our initial public offering; (iii) the date on which we have, during the preceding three year period, issued more than US$1.0

billion in non-convertible debt; or (iv) the date on which we are deemed to be a “large accelerated filer” under the

Exchange Act, which could occur if the market value of our common shares that are held by non-affiliates is US$700 million or

more as of the last business day of our most recently completed second fiscal quarter.

Implications

of Being a Foreign Private Issuer

We

are subject to the information reporting requirements of the Exchange Act that are applicable to “foreign private issuers,”

and under those requirements we file certain reports with the SEC. As a foreign private issuer, we are not subject to the same

requirements that are imposed upon U.S. domestic issuers by the SEC. Under the Exchange Act, we are subject to reporting obligations

that, in certain respects, are less detailed and less frequent than those of U.S. domestic reporting companies. For example, we

have four months after the end of each fiscal year to file our annual reports with the SEC and we are not required to file current

reports as frequently or promptly as U.S. domestic reporting companies. We also present our financial statements pursuant to International

Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or the IASB, instead of pursuant

to U.S. generally accepted accounting principles. IFRS differs in certain significant respects

from U.S. generally accepted accounting principles. Furthermore, our officers, directors and principal shareholders are

exempt from the requirements to report transactions in our equity securities and from the short-swing profit liability provisions

contained in Section 16 of the Exchange Act. As a foreign private issuer, we are also not subject to the requirements of Regulation

FD (Fair Disclosure) promulgated under the Exchange Act. In addition, as a foreign private issuer, we are permitted, and intend

to follow certain home country corporate governance practices instead of those otherwise required under the listing rules of Nasdaq

for domestic U.S. issuers. These exemptions and leniencies will reduce the frequency and scope of information and protections

available to you in comparison to those applicable to U.S. domestic reporting companies.

THE

OFFERING

Common

shares offered by us pursuant to this prospectus supplement

|

Common

shares having an aggregate offering price of up to US$1,000,000. |

Common

shares to be outstanding immediately after this offering |

Up

to 30,012,784 shares (as more fully described in the notes following this table), assuming

sales of 2,222,223 common shares in this offering at an offering price of US$0.45 per

share, which was the last reported sale price of our common shares on The Nasdaq Capital

Market on August 21, 2024. The actual number of shares issued will vary depending on

the sales price under this offering.

|

| Manner

of Offering |

“At

the market offering” as defined in Rule 415(a)(4) under the Securities Act, including sales made directly on or through

the Nasdaq Capital Market, or any other existing trading market for our common shares in the United States or to or through

a market maker, through the Sales Agent. See “Plan of Distribution” on page S-30 of this prospectus

supplement. |

| Use

of proceeds |

We

intend to use the net proceeds of this offering for working capital and general corporate purposes. See “Use of Proceeds.” |

| Risk

factors |

Investing

in our common shares involves a high degree of risk and purchasers of our common shares may lose part or all of their investment.

You should read this prospectus supplement and the accompanying base prospectus, and the documents incorporated by reference

herein and therein carefully, including the sections entitled “Risk Factors” and our consolidated financial

statements and related notes, before investing in our common shares. |

| Nasdaq

Capital Market Symbol |

“LITM” |

The number of common shares to be outstanding

immediately after this offering is based on 27,790,561 common shares outstanding as of the date of this prospectus supplement,

which includes 20,381,065 common shares outstanding as of December 31, 2023 and 7,409,496 common shares issued subsequent to December

31, 2023, and excludes:

| |

● |

807,771

common shares issuable upon the exercise of options outstanding as of the date of this prospectus supplement under the Snow

Lake Resources Ltd. Amended and Restated Stock Option Plan, or our Stock Option Plan, at a weighted average exercise price

of C$4.12 (approximately US$3.03(1)) per share; |

| |

● |

1,295,000

common shares issuable upon the exercise of warrants outstanding as of the date of this

prospectus supplement, with a weighted average exercise price of C$5.10 (approximately

US$3.75(1)) per share;

|

| |

● |

440,000

common shares issuable upon the vesting of restricted share units outstanding as of the date of this prospectus supplement;

|

| |

● |

Up

to 1,000,000 common shares issuable upon the achievement of various milestones; and |

| |

● |

1,598,961

common shares available for issuance under our Stock Option Plan. |

(1)

Based on a daily average exchange rate of C$1.00 = US$0.7357 on August 21, 2024, as reported by the Bank of Canada. See “Financial

Information and Currency Presentation” for additional details.

Except

as otherwise noted, all information in this prospectus supplement assumes no exercise of the warrants and options or vesting of

the restricted share units described above.

RISK

FACTORS

Investing

in our common shares involves a high degree of risk and uncertainties. Before you make a decision to invest in our common shares,

you should carefully consider the risks and uncertainties described below, in the section titled “Risk Factors” in

our most recent Annual Report on Form 20-F, and in other documents that we subsequently file with the SEC that update, supersede

or supplement such information, which are incorporated by reference into this prospectus supplement and accompanying base prospectus.

If any of these risks actually occur, our business, financial condition and results of operations could be materially and adversely

affected and we may not be able to achieve our goals, the value of our common shares could decline and you could lose some or

all of your investment. The risks described in these documents are not the only ones we face. Additional risks and uncertainties

not presently known to us or that we currently deem immaterial may also impair our business operations. Past financial performance

may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results or trends

in future periods. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow

could be materially adversely affected. This could cause the trading price of our common shares to decline, resulting in a loss

of all or part of your investment. Please also carefully read the section titled “Cautionary Statement Regarding Forward-Looking

Statements.”

Additional

Risks Related to this Offering and Ownership of Our Common Shares

The

actual number of common shares we will issue under the Sales Agreement, at any one time or in total, is uncertain.

Subject

to certain limitations in the Sales Agreement and compliance with applicable law, we have the discretion to deliver instructions

to the Sales Agent to sell our common shares at any time throughout the term of the Sales Agreement. The number of common shares

that are sold through the Sales Agent after our instruction will fluctuate based on a number of factors, including the market

price of our common shares during the sales period, the limits we set in any instruction to the Sales Agent under the Sales Agreement

to sell common shares, and the demand for our common shares during the sales period. Because the price per share of each common

share sold will fluctuate during this offering, it is not currently possible to predict the number of common shares that will

be sold or the gross proceeds to be raised in connection with those sales, if any.

The

common shares offered hereby will be sold in “at the market offerings,” and investors who buy shares at different

times will likely pay different prices.

Investors

who purchase shares in this offering at different times will likely pay different prices and, as such, may experience different

levels of dilution and different outcomes in their investment results. We will have discretion, subject to market demand, to vary

the timing, prices, and numbers of common shares, if any, to be sold in this offering. Investors may experience a decline in the

value of the shares they purchase in this offering as a result of sales made at prices lower than the prices they paid.

You

may experience future dilution as a result of future equity offerings.

In

order to raise additional capital, we may in the future offer additional common shares or other securities convertible into or

exchangeable for our common shares. We may not be able to sell shares or other securities in any other offering at a price per

share that is equal to or greater than the price per share paid by investors in this offering, and investors purchasing shares

or other securities in the future could have rights superior to existing shareholders. The price per share at which we sell additional

common shares or other securities convertible into or exchangeable for our common shares in future transactions may be higher

or lower than the price per share in this offering.

We

will have broad discretion in how we use the net proceeds from this offering and may not use such proceeds effectively, which

could affect our results of operations and cause our share price to decline.

We

will have considerable discretion in the application of the net proceeds from this offering, and you will not have the opportunity

as part of your investment decision to assess whether the net proceeds are being used appropriately. Due to the number and variability

of factors that will determine our use of the net proceeds from this offering, their ultimate use may vary substantially from

their currently intended use. As a result, investors will be relying upon management’s judgment with only limited information

about our specific intentions for the use of the net proceeds of this offering. We may use the net proceeds for purposes that

do not yield a significant return or any return at all for our shareholders. In addition, pending their use, we may invest the

net proceeds from this offering in a manner that does not produce income or that loses value. See “Use of Proceeds”

on page S-25 of this prospectus supplement for a description of our proposed use of proceeds from this offering.

We

may not be able to maintain a listing of our common shares on Nasdaq.

Although

our common shares are listed on Nasdaq, we must meet certain financial and liquidity criteria to maintain such listing. If we

violate Nasdaq’s listing requirements, or if we fail to meet any of Nasdaq’s listing standards, our common shares

may be delisted.

On

December 7, 2023, we received a written notification from Nasdaq that we were not in compliance with Nasdaq Listing Rule 5550(a)(2),

as the minimum bid price of our common shares had been below US$1.00 per share for 30 consecutive business days. In accordance

with Nasdaq rules, we had a period of 180 calendar days (or until June 4, 2024) to regain compliance with the minimum bid price

requirement. On January 11, 2024, we received written notification from the Nasdaq that we had regained compliance with Nasdaq

Listing Rule 5550(a)(2), as the minimum bid price of our common shares had been above US$1.00 per share for 10 consecutive business

days.

Subsequently,

on May 24, 2024, we received another written notification from Nasdaq that we were not in compliance with Nasdaq Listing Rule

5550(a)(2), as the minimum bid price of our common shares had been below US$1.00 per share for 30 consecutive business days. In

accordance with Nasdaq rules, we have a period of 180 calendar days (or until November 20, 2024) to regain compliance with the

minimum bid price requirement. To regain compliance, the closing bid price of our common shares must meet or exceed US$1.00 for

at least ten consecutive business days during this 180-calendar day period. In the event we do not regain compliance by November

20, 2024, we may be eligible for an additional 180 calendar day grace period if we meet the continued listing requirement for

market value of publicly held shares (US$1.0 million) and all other Nasdaq initial listing standards, with the exception of the

bid price and we provide written notice to Nasdaq of our intention to cure the deficiency during the second compliance period,

by effecting a reverse stock split, if necessary. If it appears to Nasdaq that we will not be able to cure the deficiency, or

if we are not otherwise eligible for additional time to regain compliance, our common shares will be subject to delisting by Nasdaq.

We may still appeal Nasdaq’s determination to delist our common shares, and during any appeal process, our common shares would

continue to trade on Nasdaq. We cannot assure you that we will regain compliance with the minimum bid price requirement by November

20, 2024 or qualify for an additional 180 calendar day grace period in the event we are unable to satisfy the minimum bid price

requirement by November 20, 2024. In the event of a Nasdaq determination to delist our common shares, we cannot assure you that

our appeal, if any, against such determination, will be successful.

Should

we regain compliance, we cannot assure you that we will not, in the future, fail to comply with Nasdaq’s requirements to

maintain the listing of our common shares on Nasdaq, or that we will be able to regain compliance in the event of any such non-compliance.

In addition, our board of directors may determine that the cost of maintaining our listing on a national securities exchange outweighs

the benefits of such listing.

A

delisting of our common shares from Nasdaq may materially impair our shareholders’ ability to buy and sell our common shares

and could have an adverse effect on the market price of, and the efficiency of the trading market for, our common shares. The

delisting of our common shares could significantly impair our ability to raise capital and the value of your investment.

Because

we have no current plans to pay cash dividends on our common shares, you may not receive any return on investment unless you sell

your common shares for a price greater than that which you paid for it.

We

have never declared or paid cash dividends on our common shares. We currently intend to retain all available funds and any future

earnings for use in the operation of our business and do not anticipate paying any cash dividends on our common shares in the

near future. We may also enter into credit agreements or other borrowing arrangements in the future that may restrict our ability

to declare or pay cash dividends on our common shares. Any future determination to declare dividends will be made at the discretion

of our board of directors and will depend on our financial condition, operating results, capital requirements, general business

conditions, and other factors that our board of directors may deem relevant. Further, under the terms of the MCA, we are prohibited

from declaring or paying a dividend if our board has reasonable grounds for believing that we are, or would after the payment

be, unable to pay our liabilities as they become due, or the realizable value of our assets would thereby be less than the aggregate

of our liabilities and stated capital. We may not pay any dividends on our common shares in the foreseeable future. As a result,

capital appreciation, if any, of our common shares will be your sole source of gain for the foreseeable future.

Additional

Risks Related to Our Business and Industry

We

may not achieve exploration success on our mineral resource projects.

Exploration

for mineral resources is highly speculative, and few properties that are explored are ultimately developed into producing mines.

Our mineral resource projects are subject to all of the risks and uncertainties inherent in mineral resource exploration and development

activities, including, without limitation: commodity price fluctuations, general economic, market and business conditions; regulatory

processes and actions; failure to obtain necessary permits and approvals; technical challenges; new legislation; ability to raise

further capital to fund; competitive and general economic factors and conditions; uncertainties resulting from potential delays

or changes in plans; occurrence of unexpected events; and, management’s capacity to execute and implement its future plans.

There can be no assurance that we will be successful in overcoming these risks, and we may not achieve exploration success on

any of our mineral resource projects.

Further,

even if commercial quantities of ore are discovered with respect to any of our mineral resource projects, we cannot assure you

that it will be developed and brought into commercial production, whether as expected or at all. The commercial viability of a

mineral deposit once discovered is dependent upon a number of factors, most of which are beyond our control and may result in

us not receiving adequate return on investment capital. Our ability to achieve exploration success with any of our mineral resource

projects, or ones we may acquire in the future, is also dependent upon the services of appropriately experienced personnel and/or

third-party contractors who can provide such expertise. There can be no assurance that we will have available to us the necessary

expertise when and if we bring any of our mineral resource projects into production.

Fluctuations

in the price of uranium and alternate sources of energy could have an adverse effect on our uranium projects and our securities.

The

price of our common shares will be sensitive to fluctuations in the price of uranium. Historically, fluctuations in the price

of uranium have been, and are expected to continue to be, affected by numerous factors which are beyond our control. Such factors

include, without limitation, demand for nuclear power, political and economic conditions in uranium producing and consuming countries,

public and political response to a nuclear accident, improvements in nuclear reactor efficiencies, reprocessing of used reactor

fuel and the re-enrichment of depleted uranium tails, sales of excess inventories by governments and industry participants, and

production levels and production costs in key uranium producing countries.

In

addition, nuclear energy competes with other sources of energy like oil, natural gas, coal and hydroelectricity. These sources

are somewhat interchangeable with nuclear energy, particularly over the longer term. If lower prices of oil, natural gas, coal

and hydroelectricity are sustained over time, it may result in lower demand for uranium concentrates and uranium conversion services,

which, among other things, could lead to lower uranium prices. Growth of the uranium and nuclear power industry will also depend

on continuing and growing public support for nuclear technology to generate electricity. Unique political, technological and environmental

factors affect the nuclear industry, exposing it to the risk of public opinion, which could have a negative effect on the demand

for nuclear power and increase the regulation of the nuclear power industry. An accident at a nuclear reactor anywhere in the