false

0001158895

0001158895

2025-02-07

2025-02-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(0) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): February 7, 2025

LeMaitre Vascular, Inc.

(Exact Name of Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

| 001-33092 |

04-2825458 |

| (Commission File Number) |

(IRS Employer Identification No.) |

| |

|

| 63 Second Avenue |

|

| Burlington, Massachusetts |

01803 |

| (Address of Principal Executive Offices) |

(Zip Code) |

(781) 221-2266

(Registrant's Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common

|

LMAT

|

The Nasdaq Global Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

(c)

Appointment of Dorian LeBlanc as Chief Financial Officer

On February 7, 2025, LeMaitre Vascular, Inc. (the “Company”) agreed to terms with Dorian LeBlanc to become the Chief Financial Officer and principal financial officer of the Company, effective on March 10, 2025.

Mr. LeBlanc, age 50, joins the Company from LumiraDx Limited (recently acquired by Roche), a next-generation point of care diagnostic company, where he most recently served as Chief Financial Officer since November 2016, and was appointed Vice President, Global Operations in August 2020, and subsequently appointed Chief Operating Officer in November 2023. Prior to joining LumiraDx, Mr. LeBlanc held several positions with Alere Inc. from 2007 to 2015, including Vice President of Finance, Infectious Disease Global Business Unit from 2013 to 2015, and Vice President, Finance and Business Development for Asia Pacific from 2012 to 2015. From 2005 to 2007, Mr. LeBlanc served as Vice President, Finance at Camden National Corporation. From 2003 to 2005, Mr. LeBlanc served as controller for Pierce, a company in the Omnicom group. Mr. LeBlanc received a B.A. in economics from Bowdoin College, and an M.S. in accounting and an M.B.A. from Northeastern University. Mr. LeBlanc is a licensed Certified Public Accountant in the State of Maine.

In connection with Mr. LeBlanc’s appointment as Chief Financial Officer, Mr. LeBlanc and the Company entered into an offer letter (the “LeBlanc Agreement”) which provides for a starting annual base salary of $565,000, a yearly discretionary performance bonus with the target amount of $225,000, an annual equity award of $375,000 with four-year vesting, and a one-time award of restricted stock units valued at $100,000 with four-year vesting. Mr. LeBlanc will also be eligible to participate in the Company’s sponsored benefits provided to other Company employees, subject to the terms and conditions of such policies and programs.

The LeBlanc Agreement further provides that if Mr. LeBlanc’s employment is terminated without cause, he will receive, subject to the satisfaction of certain conditions that include signing a non-disparagement agreement and release, a lump sum severance payment, paid no later than 30 days following termination, in the amount of (a) if termination occurs on or before March 10, 2028, $100,000; or (b) if termination occurs after March 10, 2028, the greater of two weeks of his base salary as of the date of termination for each completed twelve-month period of service prior to termination or $225,000, subject in all cases to applicable withholding and taxes.

The foregoing summary of the LeBlanc Agreement is qualified in its entirety by reference to the full LeBlanc Agreement filed herewith as Exhibit 10.1 and incorporated by reference herein.

There have not been any transactions since the beginning of the Company’s last fiscal year, nor are there any proposed transactions, in which the Company was or is to be a participant involving amounts exceeding $120,000 and in which Mr. LeBlanc had or will have a direct or indirect material interest.

(e) The information set forth in Item 5.02(c) above is incorporated by reference into this Item 5.02(e).

|

Item 9.01.

|

Financial Statement and Exhibits.

|

(d) Exhibits

|

Exhibit Number

|

|

Description

|

|

10.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

LEMAITRE VASCULAR, INC.

|

|

|

Dated: February 13, 2025

|

By:

|

/s/ Joseph P. Pellegrino, Jr.

|

|

|

|

|

Name: Joseph P. Pellegrino, Jr.

|

|

|

|

|

Title: Chief Financial Officer and Secretary

|

|

Exhibit 10.1

January 24, 2025

Dorian LeBlanc 449 W Elm St

Yarmouth, ME 04096

Dear Dorian:

On behalf of LeMaitre Vascular, Inc., I am pleased to offer you the position of Chief Financial Officer, reporting to George LeMaitre, Chairman & Chief Executive Officer, with a start date of Monday, March 10, 2025. This offer of employment is contingent upon the Company’s satisfaction with our background verification, reference checks, and required onboarding processes.

Your salary for this position will be $21,730.77 gross per pay period, which is equivalent to $565,000 per year when annualized over 26 bi-weekly pay periods. You will participate in the company’s annual merit increase process and be eligible for a merit increase (prorated from your start date) effective January 1, 2026. You will be a level 1.5 employee. The company currently has 19 levels of employees, from 0 (CEO) to level 12 (device manufacturers), including six half levels.

In addition to your base salary, you will be eligible for the following:

| |

-

|

An annual target bonus, based upon achievement of goals, of $225,000. Annual bonuses are typically paid at the end of January of the following year; employees must be active as of December 31st of the plan year to be eligible. Your 2025 bonus will be prorated from your start date. Annual bonus plans include the availability of up to 160% of the annual target bonus.

|

| |

-

|

An annual equity award of $375,000 with four-year graded vesting. Equity awards to all employees occur in December each year and are subject to the approval of the Compensation Committee of the Board of Directors. December 2025 is when you should expect your first annual equity grant, 50% stock options, 25% PSUs, and 25% RSUs.

|

| |

-

|

A one-time sign-on equity grant (in RSUs) valued at $100,000 with four-year vesting will be requested from the Compensation Committee of the Board of Directors shortly after you join the company.

|

| |

-

|

Medical and dental insurance coverage effective the first of the month following date of hire.

|

| |

-

|

25 days of vacation accrual per year.

|

| |

-

|

9 paid holidays; also eligible for 2 personal days and 5 sick days per calendar year prorated for 2025.

|

| |

-

|

401(k) plan which offers a company match of 50% on the first 6% after you are enrolled. You will be able to enroll after 30 days of employment. Our 401(k) plan likely will change to 50% on the first 8% with three-year vesting in late 2025.

|

| |

-

|

A three-year hybrid work schedule. Relocation to the Burlington area is the current default.

|

| |

-

|

Our benefits are described in greater detail in the Summary of 2025 Employee Benefits.

|

If you are subject to Termination (defined below), you shall receive a lump sum severance payment, paid no later than thirty (30) days following Termination, in the amount of (a) if Termination occurs on or before March 10, 2028, $100,000; or (b) if Termination occurs after March 10, 2028, the greater of two (2) weeks of your base salary as of the date of Termination for each completed twelve-month period of your service prior to the Termination or $225,000, in any case ((a) or (b)) less applicable withholding and other taxes. Your receipt of such severance payment shall be in full and final satisfaction of your rights and claims under this offer letter and is subject to and conditioned upon (i) your delivery of a signed non-disparagement agreement and release of known and unknown claims related to your employment in a form satisfactory to the Company, (ii) your resignation as an officer of the Company, and (iii) your delivery to the Company of all property of the Company which may be in your possession, custody or control, all of which shall occur within thirty (30) days of Termination otherwise you shall forfeit your right to any and all severance pay. Additionally, if you in any manner breach the Employee Obligations Agreement between you and the Company, then the Company’s duty to pay any severance to you shall terminate and you shall immediately reimburse the Company for any severance payment previously delivered by the Company. The foregoing shall not be the Company’s exclusive remedy for a breach of the Employee Obligations Agreement and shall be in addition to any other damages available at law or in equity.

For purposes hereof:

| |

●

|

“Termination” means a termination of your employment by the Company without Cause (defined below). Notwithstanding anything to the contrary herein, a “Termination” shall not include termination of your employment in connection with a merger, reorganization, sale of the Company’s business, assets or similar transaction, provided that you are immediately rehired on comparable or better terms by the Company’s successor entity. For the avoidance of doubt, a “Termination” shall not include a termination of your employment (a) by the Company for Cause; or (b) by you.

|

| |

●

|

“Cause” means any of (a) your continued failure to perform your duties with the Company for thirty (30) days after a written demand for performance is delivered to you by the Company’s Chief Executive Officer (“CEO”), which specifically identifies the manner in which you have not performed your duties, (b) your engagement in acts of dishonesty or moral turpitude, illegal conduct or gross misconduct, including, without limitation, fraud, misrepresentation, theft, or embezzlement, (c) your violation of Company policy or refusal to follow a lawful directive of the CEO or the Board of Directors, which violation or refusal is not remedied within ten (10) days after receipt of notice thereof from the Company, (d) your breach of this offer letter or the

|

Employee Obligations Agreement, (e) your engagement in conduct that is likely to affect adversely the business and/or reputation of the Company, or (f) your death or disability (defined as your inability to engage in the performance of your duties with the Company for a period of at least one hundred eighty (180) days in any three hundred sixty (360) day period by reason of a physical or mental impairment, with reasonable accommodations).

We look forward to having you join our Company and becoming a member of the LeMaitre team. If you choose to accept this offer, your employment will be at-will and either you or the Company will be free to end your employment at any time, for any reason, and without notice.

Please note, as a condition of your employment you must sign and return the Employee Obligations Agreement before you start work.

To indicate your acceptance of the Company’s offer, please sign and date this letter in the space provided below.

Yours truly,

/s/ Daniel Mumford

Daniel J. Mumford

Sr. Director, Human Resources

| /s/ Dorian LeBlanc |

|

February 7, 2025 |

| |

|

|

| Accepted by – Signature |

|

Date Accepted |

v3.25.0.1

Document And Entity Information

|

Feb. 07, 2025 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

LeMaitre Vascular, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Feb. 07, 2025

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-33092

|

| Entity, Tax Identification Number |

04-2825458

|

| Entity, Address, Address Line One |

63 Second Avenue

|

| Entity, Address, City or Town |

Burlington

|

| Entity, Address, State or Province |

MA

|

| Entity, Address, Postal Zip Code |

01803

|

| City Area Code |

781

|

| Local Phone Number |

221-2266

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

|

| Trading Symbol |

LMAT

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001158895

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

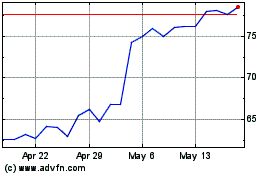

LeMaitre Vascular (NASDAQ:LMAT)

Historical Stock Chart

From Jan 2025 to Feb 2025

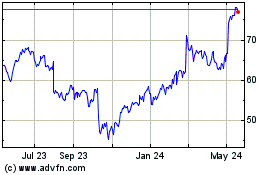

LeMaitre Vascular (NASDAQ:LMAT)

Historical Stock Chart

From Feb 2024 to Feb 2025