LM Funding America, Inc. estimates that the 135.7 Bitcoin holdings on August 31, 2024, were valued at approximately $8.7 million in their monthly updates

25 September 2024 - 11:00PM

LM Funding America, Inc. (NASDAQ: LMFA) (“LM Funding” or

the “Company”), a cryptocurrency mining and

technology-based specialty finance company, today provided a

preliminary, unaudited Bitcoin mining and operational update for

the month ended August 31, 2024.

|

Metrics * |

Three Months 1st Qtr. 2024 |

One Month April 30,

2024 |

One Month May 31,

2024 |

One Month June 30,

2024 |

One Month July 31, 2024 |

One Month August 31, 2024 |

Eight Months Ended August 31, 2024 |

|

Bitcoin Beginning Balance |

95.1 |

|

163.4 |

|

155.1 |

|

163.1 |

|

160.5 |

|

132.5 |

|

95.1 |

|

|

Bitcoin Mined, net |

86.4 |

|

24.7 |

|

14.0 |

|

5.4 |

|

4.6 |

|

7.2 |

|

142.3 |

|

|

Bitcoin Sold |

(18.0 |

) |

(33.0 |

) |

(6.0 |

) |

(8.0 |

) |

(32.5 |

) |

(4.0 |

) |

(101.5 |

) |

|

Service Fee |

(0.1 |

) |

- |

|

- |

|

- |

|

(0.1 |

) |

- |

|

(0.2 |

) |

| Bitcoin Holdings at Month

End |

163.4 |

|

155.1 |

|

163.1 |

|

160.5 |

|

132.5 |

|

135.7 |

|

135.7 |

|

|

|

|

|

|

|

|

|

|

| Approximate Miners Deployed at

Month End |

5,940 |

|

5,880 |

|

5,510 |

|

1,878 |

|

3,800 |

|

3,700 |

|

|

| Approximate Miners In-Transit at

Month End |

|

|

370 |

|

4,002 |

|

2,080 |

|

2,200 |

|

|

| Approximate Potential Hash Rate

at Month End (PH/s) |

614 |

|

639 |

|

639 |

|

639 |

|

639 |

|

639 |

|

|

*Unaudited

The Company estimates that the value of its

135.7 Bitcoin holdings on August 31, 2024, was approximately $8.7

million, based on an estimated September 24, 2024, BTC price of

$64,250.

Bruce Rodgers, Chairman and CEO of LM Funding, commented, "We

continue to make significant progress on our key initiatives,

including the expansion of our new 15 MW hosting facility near

Oklahoma City, where we relocated approximately 3,000 Antminer S19j

Pro machines. Hosting these machines at cost for the next six

months will enable us to significantly reduce our operating

expenses.”

“We are also investing the proceeds from our recent private

placement, alongside the $5 million secured non-convertible loan

facility, into high-return projects. These strategic investments

are expected to be accretive, while accelerating our growth and

driving meaningful returns on capital for our shareholders,”

concluded Rodgers.

About LM Funding AmericaLM Funding America,

Inc. (Nasdaq: LMFA), together with its subsidiaries, is a

cryptocurrency mining business that commenced Bitcoin mining

operations in September 2022. The Company also operates a

technology-based specialty finance company that provides funding to

nonprofit community associations (Associations) primarily located

in the state of Florida, as well as in the states of Washington,

Colorado, and Illinois, by funding a certain portion of the

Associations' rights to delinquent accounts that are selected by

the Associations arising from unpaid Association assessments.

Forward-Looking StatementsThis

press release may contain forward-looking statements made pursuant

to the Private Securities Litigation Reform Act of 1995. Words such

as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,”

and “project” and other similar words and expressions are intended

to signify forward-looking statements. Forward-looking statements

are not guaranties of future results and conditions but rather are

subject to various risks and uncertainties. Some of these risks and

uncertainties are identified in the Company's most recent Annual

Report on Form 10-K and its other filings with the SEC, which are

available at www.sec.gov. These risks and uncertainties include,

without limitation, uncertainty created by the risks of entering

into and operating in the cryptocurrency mining business,

uncertainty in the cryptocurrency mining business in general,

problems with hosting vendors in the mining business, the capacity

of our Bitcoin mining machines and our related ability to purchase

power at reasonable prices, the ability to finance and grow our

cryptocurrency mining operations, our ability to acquire new

accounts in our specialty finance business at appropriate prices,

the potential need for additional capital in the future, changes in

governmental regulations that affect our ability to collected

sufficient amounts on defaulted consumer receivables, changes in

the credit or capital markets, changes in interest rates, and

negative press regarding the debt collection industry. The

occurrence of any of these risks and uncertainties could have a

material adverse effect on our business, financial condition, and

results of operations.

Contact:Crescendo Communications, LLCTel: (212)

671-1021Email: LMFA@crescendo-ir.com

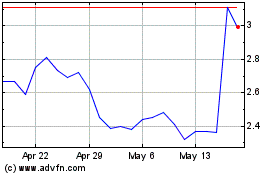

LM Funding America (NASDAQ:LMFA)

Historical Stock Chart

From Dec 2024 to Jan 2025

LM Funding America (NASDAQ:LMFA)

Historical Stock Chart

From Jan 2024 to Jan 2025