Company Delivers 6% Sales Growth and Strong

Profitability; Raises FY 2025 Outlook

SIX Swiss Exchange Ad hoc announcement pursuant to Art. 53 LR

— Logitech International (SIX: LOGN) (Nasdaq: LOGI) today

announced financial results for the second quarter of Fiscal Year

2025.

- Sales were $1.12 billion, up 6 percent in US dollars and 6

percent in constant currency compared to Q2 of the prior year.

- GAAP gross margin was 43.6 percent, up 210 basis points

compared to Q2 of the prior year. Non-GAAP gross margin was 44.1

percent, up 210 basis points compared to Q2 of the prior year.

- GAAP operating income was $161 million, up 3 percent compared

to Q2 of the prior year. Non-GAAP operating income was $193

million, up 5 percent compared to Q2 of the prior year.

- GAAP earnings per share (EPS) was $0.95, up 10 percent compared

to Q2 of the prior year. Non-GAAP EPS was $1.20, up 10 percent

compared to Q2 of the prior year.

- Cash flow from operations was $166 million. The quarter-ending

cash balance was approximately $1.4 billion.

- The Company returned $340 million of cash to shareholders

through its annual dividend payment and share repurchases.

“This quarter we delivered continued robust, profitable growth

driven by improving demand,” said Hanneke Faber, Logitech chief

executive officer. “Growth was broad-based, across regions,

categories, and both our consumer and business customers. We

launched a terrific set of innovations in the quarter and we are

ready for the holidays.”

“Once again, our teams executed with discipline this quarter,”

said Matteo Anversa, Logitech chief financial officer. “We

delivered year-over-year expansion of non-GAAP gross margin thanks

to the continued strength of our operations. Our strong results and

overall business momentum give us the confidence to raise our

annual outlook. I’m impressed by the team, our excellent

operational rigor and the many opportunities for future

growth.”

Outlook

Logitech raised its full-year outlook for Fiscal Year 2025:

Previous FY25 outlook

New FY25 outlook

Sales

$4.34 - $4.43 billion

$4.39 - $4.47 billion

Sales growth (in US dollars, year over

year)

1% - 3%

2% - 4%

Non-GAAP operating income

$700 - $730 million

$720 - $750 million

Non-GAAP op. inc. growth (year over

year)

0% - 4%

3% - 7%

Financial Results Videoconference and Webcast

Logitech will hold a financial results videoconference to

discuss the results for Q2 Fiscal Year 2025 on Tuesday, October 22,

2024 at 5:30 a.m. Pacific Daylight Time and 2:30 p.m. Central

European Summer Time. A livestream of the event will be available

on the Logitech corporate website at https://ir.logitech.com. This

press release and the Q2 Fiscal Year 2025 Shareholder Letter are

also available there.

Use of Non-GAAP Financial Information and Constant

Currency

To facilitate comparisons to Logitech’s historical results,

Logitech has included non-GAAP adjusted measures in this press

release, which exclude share-based compensation expense,

amortization of intangible assets, acquisition-related costs,

restructuring charges (credits), net, loss (gain) on investments,

non-GAAP income tax adjustment, and other items detailed under

“Supplemental Financial Information” after the tables below and

posted to our website at https://ir.logitech.com. Logitech also

presents percentage sales growth in constant currency (“cc”), a

non-GAAP measure, to show performance unaffected by fluctuations in

currency exchange rates. Percentage sales growth in constant

currency is calculated by translating prior period sales in each

local currency at the current period’s average exchange rate for

that currency and comparing that to current period sales. Logitech

believes this information, used together with the GAAP financial

information, will help investors to evaluate its current period

performance, outlook and trends in its business. With respect to

the Company’s outlook for non-GAAP operating income, most of these

excluded amounts pertain to events that have not yet occurred and

are not currently possible to estimate with a reasonable degree of

accuracy. Therefore, no reconciliation to the GAAP amounts has been

provided for the Fiscal Year 2025 non-GAAP operating income

outlook.

Public Dissemination of Certain Information

Recordings of Logitech’s earnings videoconferences and certain

events Logitech participates in or hosts, with members of the

investment community are posted on the company’s investor relations

website at https://ir.logitech.com. Additionally, Logitech provides

notifications of news or announcements regarding its operations and

financial performance, including its filings with the Securities

and Exchange Commission (SEC), investor events, and press and

earnings releases as part of its investor relations website.

Logitech intends to use its investor relations website as means of

disclosing material nonpublic information and for complying with

its disclosure obligations under Regulation FD. Logitech’s

corporate governance information also is available on its investor

relations website.

About Logitech

Logitech designs software-enabled hardware solutions that help

businesses thrive and bring people together when working, creating,

gaming and streaming. As the point of connection between people and

the digital world, our mission is to extend human potential in work

and play, in a way that is good for people and the planet. Founded

in 1981, Logitech International is a Swiss public company listed on

the SIX Swiss Exchange (LOGN) and on the Nasdaq Global Select

Market (LOGI). Find Logitech and its other brands, including

Logitech G, at www.logitech.com or company blog.

This press release contains forward-looking statements within

the meaning of U.S. federal securities laws, including, without

limitation, statements regarding: our preliminary financial results

for the three and six months ended September 30, 2024, Fiscal Year

2025 outlook for sales and non-GAAP operating income, opportunities

for growth, and related assumptions. The forward-looking statements

in this press release are subject to risks and uncertainties that

could cause Logitech’s actual results and events to differ

materially from those anticipated in these forward-looking

statements, including, without limitation: macroeconomic and

geopolitical conditions and other factors and their impact, for

example inflation, interest rate and foreign currency fluctuations,

changes in fiscal policies, geopolitical conflicts, low economic

growth in certain regions, and uncertainty in consumer and

enterprise demand; our expectations regarding our expense

discipline efforts, including the timing thereof; changes in

secular trends that impact our business; if our product offerings,

marketing activities and investment prioritization decisions do not

result in the sales, profitability or profitability growth we

expect, or when we expect it; if we fail to innovate and develop

new products in a timely and cost-effective manner for our new and

existing product categories; issues relating to development and use

of artificial intelligence; if we do not successfully execute on

our growth opportunities or our growth opportunities are more

limited than we expect; the effect of demand variability, supply

shortages and other supply chain challenges; the effect of

logistics challenges, including disruptions in logistics; the

effect of pricing, product, marketing and other initiatives by our

competitors, and our reaction to them, on our sales, gross margins

and profitability; if we are not able to maintain and enhance our

brands; if our products and marketing strategies fail to separate

our products from competitors’ products; if we do not efficiently

manage our spending; our expectations regarding our restructuring

efforts, including the timing thereof; if there is a deterioration

of business and economic conditions in one or more of our sales

regions or product categories, or significant fluctuations in

exchange rates; changes in trade regulations, policies and

agreements and the imposition of tariffs that affect our products

or operations and our ability to mitigate; if we do not

successfully execute on strategic acquisitions and investments;

risks associated with acquisitions; and the effect of changes to

our effective income tax rates. A detailed discussion of these and

other risks and uncertainties that could cause actual results and

events to differ materially from such forward-looking statements is

included in Logitech’s periodic filings with the Securities and

Exchange Commission (“SEC”), including our Annual Report on Form

10-K for the fiscal year ended March 31, 2024, our Quarterly Report

on Form 10-Q for the quarter ended June 30, 2024, and other reports

filed with the SEC, available at www.sec.gov, under the caption

Risk Factors and elsewhere. Logitech does not undertake any

obligation to update any forward-looking statements to reflect new

information or events or circumstances occurring after the date of

this press release.

Note that unless noted otherwise, comparisons are year over

year.

Logitech and other Logitech marks are trademarks or registered

trademarks of Logitech Europe S.A. and/or its affiliates in the

U.S. and other countries. All other trademarks are the property of

their respective owners. For more information about Logitech and

its products, visit the company’s website at www.logitech.com.

LOGITECH INTERNATIONAL S.A.

PRELIMINARY RESULTS*

(In thousands, except per share

amounts) - unaudited

Three months ended

September 30,

Six months ended

September 30,

GAAP CONDENSED CONSOLIDATED STATEMENTS

OF OPERATIONS

2024

2023

2024

2023

Net sales

$

1,116,034

$

1,057,008

$

2,204,251

$

2,031,507

Cost of goods sold

627,491

615,403

1,247,008

1,211,115

Amortization of intangible assets

2,452

2,983

4,894

6,128

Gross profit

486,091

438,622

952,349

814,264

Operating expenses:

Marketing and selling

201,863

176,356

398,768

355,541

Research and development

76,205

68,559

151,512

139,118

General and administrative

44,173

35,538

81,631

76,835

Amortization of intangible assets and

acquisition-related costs

2,725

3,318

5,428

6,003

Restructuring charges (credits), net

229

(1,788

)

615

1,723

Total operating expenses

325,195

281,983

637,954

579,220

Operating income

160,896

156,639

314,395

235,044

Interest income

14,637

11,856

30,427

21,682

Other income (expense), net

533

(1,044

)

(1,365

)

(14,016

)

Income before income taxes

176,066

167,451

343,457

242,710

Provision for income taxes

30,583

30,334

56,141

42,866

Net income

$

145,483

$

137,117

$

287,316

$

199,844

Net income per share:

Basic

$

0.95

$

0.87

$

1.88

$

1.26

Diluted

$

0.95

$

0.86

$

1.86

$

1.25

Weighted average shares used to compute

net income per share:

Basic

152,460

157,911

152,875

158,385

Diluted

153,672

158,934

154,320

159,545

LOGITECH INTERNATIONAL S.A.

PRELIMINARY RESULTS*

(In thousands, except per share

amounts) - unaudited

September 30,

March 31,

CONDENSED CONSOLIDATED BALANCE

SHEETS

2024

2024

Current assets:

Cash and cash equivalents

$

1,363,276

$

1,520,842

Accounts receivable, net

629,278

541,715

Inventories

520,493

422,513

Other current assets

146,511

146,270

Total current assets

2,659,558

2,631,340

Non-current assets:

Property, plant and equipment, net

112,357

116,589

Goodwill

463,712

461,978

Other intangible assets, net

34,810

44,603

Other assets

374,056

350,194

Total assets

$

3,644,493

$

3,604,704

Current liabilities:

Accounts payable

$

555,490

$

448,627

Accrued and other current liabilities

646,831

637,262

Total current liabilities

1,202,321

1,085,889

Non-current liabilities:

Income taxes payable

125,779

112,572

Other non-current liabilities

204,499

172,590

Total liabilities

1,532,599

1,371,051

Shareholders’ equity:

Registered shares, CHF 0.25 par value:

30,148

30,148

Issued shares — 173,106 at September 30,

2024 and March 31, 2024

Additional shares that may be issued out

of conditional capital — 50,000 at September 30, 2024 and March 31,

2024

Additional shares that may be issued out

of the capital band — 17,311 at September 30, 2024 and March 31,

2024

Additional paid-in capital

72,268

63,524

Shares in treasury, at cost — 21,270 at

September 30, 2024 and 19,243 at March 31, 2024

(1,518,149

)

(1,351,336

)

Retained earnings

3,626,999

3,602,519

Accumulated other comprehensive loss

(99,372

)

(111,202

)

Total shareholders’ equity

2,111,894

2,233,653

Total liabilities and shareholders’

equity

$

3,644,493

$

3,604,704

LOGITECH INTERNATIONAL S.A.

PRELIMINARY RESULTS*

(In thousands) - unaudited

Three months ended

September 30,

Six months ended

September 30,

CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS

2024

2023

2024

2023

Cash flows from operating

activities:

Net income

$

145,483

$

137,117

$

287,316

$

199,844

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation

14,597

16,637

29,103

34,135

Amortization of intangible assets

5,092

5,682

10,171

11,509

Loss (gain) on investments

413

(214

)

1,599

11,609

Share-based compensation expense

26,469

22,068

49,874

43,579

Deferred income taxes

4,827

8,146

16,489

11,108

Other

81

76

57

100

Changes in assets and liabilities, net of

acquisitions:

Accounts receivable, net

(27,616

)

(100,752

)

(81,568

)

(35,362

)

Inventories

(54,812

)

35,929

(93,907

)

146,369

Other assets

(2,666

)

(22,343

)

2,241

11,999

Accounts payable

(652

)

106,442

108,376

88,022

Accrued and other liabilities

54,786

14,476

12,280

(59,853

)

Net cash provided by operating

activities

166,002

223,264

342,031

463,059

Cash flows from investing

activities:

Purchases of property, plant and

equipment

(14,527

)

(18,493

)

(29,113

)

(34,731

)

Acquisitions, net of cash acquired

—

(12,878

)

—

(14,138

)

Purchases of deferred compensation

investments

(2,905

)

(1,479

)

(3,600

)

(2,548

)

Proceeds from sales of deferred

compensation investments

1,561

1,551

2,299

2,622

Other investing activities

(96

)

(322

)

(912

)

(356

)

Net cash used in investing

activities

(15,967

)

(31,621

)

(31,326

)

(49,151

)

Cash flows from financing

activities:

Payment of cash dividends

(207,853

)

(182,305

)

(207,853

)

(182,305

)

Payment of contingent consideration for

business acquisition

(1,245

)

(5,002

)

(1,245

)

(5,002

)

Purchases of registered shares

(132,286

)

(93,865

)

(263,185

)

(188,941

)

Proceeds from exercises of stock options

and purchase rights

15,617

13,206

20,235

15,319

Tax withholdings related to net share

settlements of restricted stock units

(2,390

)

(2,028

)

(21,243

)

(26,224

)

Other financing activities

(1,663

)

(1,116

)

(1,663

)

(1,116

)

Net cash used in financing

activities

(329,820

)

(271,110

)

(474,954

)

(388,269

)

Effect of exchange rate changes on cash

and cash equivalents

8,681

(7,715

)

6,683

(10,758

)

Net increase (decrease) in cash and

cash equivalents

(171,104

)

(87,182

)

(157,566

)

14,881

Cash and cash equivalents, beginning of

the period

1,534,380

1,251,086

1,520,842

1,149,023

Cash and cash equivalents, end of the

period

$

1,363,276

$

1,163,904

$

1,363,276

$

1,163,904

LOGITECH INTERNATIONAL S.A.

PRELIMINARY RESULTS*

(In thousands) - unaudited

SUPPLEMENTAL FINANCIAL

INFORMATION

Three months ended September

30,

Six months ended September

30,

NET SALES

2024

2023

Change

2024

2023

Change

Net sales by product category:

Gaming (1)

$

300,470

$

282,104

7

%

$

609,945

$

548,533

11

%

Keyboards & Combos

209,936

194,914

8

425,269

375,769

13

Pointing Devices

195,936

191,676

2

385,882

366,130

5

Video Collaboration

159,660

152,389

5

306,702

291,735

5

Webcams

80,249

88,222

(9

)

153,153

163,422

(6

)

Tablet Accessories

85,614

63,677

34

164,153

134,013

22

Headsets

46,916

44,411

6

91,152

81,261

12

Other (2)

37,253

39,615

(6

)

67,995

70,644

(4

)

Total Net Sales

$

1,116,034

$

1,057,008

6

%

$

2,204,251

$

2,031,507

9

%

(1)

Gaming includes streaming services revenue

generated by Streamlabs.

(2)

Other primarily consists of mobile

speakers and PC speakers.

LOGITECH INTERNATIONAL S.A.

PRELIMINARY RESULTS*

(In thousands, except per share

amounts) - unaudited

SUPPLEMENTAL FINANCIAL

INFORMATION

Three months ended

September 30,

Six months ended

September 30,

GAAP TO NON-GAAP RECONCILIATION

(A)

2024

2023

2024

2023

Gross profit - GAAP

$

486,091

$

438,622

$

952,349

$

814,264

Share-based compensation expense

3,902

2,462

6,500

3,877

Amortization of intangible assets

2,452

2,983

4,894

6,128

Gross profit - Non-GAAP

$

492,445

$

444,067

$

963,743

$

824,269

Gross margin - GAAP

43.6

%

41.5

%

43.2

%

40.1

%

Gross margin - Non-GAAP

44.1

%

42.0

%

43.7

%

40.6

%

Operating expenses - GAAP

$

325,195

$

281,983

$

637,954

$

579,220

Less: Share-based compensation expense

22,567

19,606

43,374

39,702

Less: Amortization of intangible assets

and acquisition-related costs

2,725

3,318

5,428

6,003

Less: Restructuring charges (credits),

net

229

(1,788

)

615

1,723

Operating expenses - Non-GAAP

$

299,674

$

260,847

$

588,537

$

531,792

% of net sales - GAAP

29.1

%

26.7

%

28.9

%

28.5

%

% of net sales - Non-GAAP

26.9

%

24.7

%

26.7

%

26.2

%

Operating income - GAAP

$

160,896

$

156,639

$

314,395

$

235,044

Share-based compensation expense

26,469

22,068

49,874

43,579

Amortization of intangible assets and

acquisition-related costs

5,177

6,301

10,322

12,131

Restructuring charges (credits), net

229

(1,788

)

615

1,723

Operating income - Non-GAAP

$

192,771

$

183,220

$

375,206

$

292,477

% of net sales - GAAP

14.4

%

14.8

%

14.3

%

11.6

%

% of net sales - Non-GAAP

17.3

%

17.3

%

17.0

%

14.4

%

Net income - GAAP

$

145,483

$

137,117

$

287,316

$

199,844

Share-based compensation expense

26,469

22,068

49,874

43,579

Amortization of intangible assets and

acquisition-related costs

5,177

6,301

10,322

12,131

Restructuring charges (credits), net

229

(1,788

)

615

1,723

Loss (gain) on investments

413

(214

)

1,599

11,609

Non-GAAP income tax adjustment

6,315

9,933

8,985

7,930

Net income - Non-GAAP

$

184,086

$

173,417

$

358,711

$

276,816

Net income per share:

Diluted - GAAP

$

0.95

$

0.86

$

1.86

$

1.25

Diluted - Non-GAAP

$

1.20

$

1.09

$

2.32

$

1.74

Shares used to compute net income per

share:

Diluted - GAAP and Non-GAAP

153,672

158,934

154,320

159,545

LOGITECH INTERNATIONAL S.A.

PRELIMINARY RESULTS*

(In thousands) - unaudited

SUPPLEMENTAL FINANCIAL

INFORMATION

Three months ended

September 30,

Six months ended

September 30,

SHARE-BASED COMPENSATION

EXPENSE

2024

2023

2024

2023

Share-based Compensation

Expense

Cost of goods sold

$

3,902

$

2,462

$

6,500

$

3,877

Marketing and selling

10,469

9,262

22,320

19,745

Research and development

5,067

4,694

10,806

9,147

General and administrative

7,031

5,650

10,248

10,810

Total share-based compensation

expense

26,469

22,068

49,874

43,579

Income tax benefit

(4,776

)

(2,548

)

(12,378

)

(7,866

)

Total share-based compensation expense,

net of income tax benefit

$

21,693

$

19,520

$

37,496

$

35,713

*Note: These preliminary results for the three and six months

ended September 30, 2024 are subject to adjustments, including

subsequent events that may occur through the date of filing our

Quarterly Report on Form 10-Q.

(A) Non-GAAP Financial Measures

To supplement our condensed consolidated financial results

prepared in accordance with GAAP, we use a number of financial

measures, both GAAP and non-GAAP, in analyzing and assessing our

overall business performance, for making operating decisions and

for forecasting and planning future periods. We consider the use of

non-GAAP financial measures helpful in assessing our current

financial performance, ongoing operations and prospects for the

future as well as understanding financial and business trends

relating to our financial condition and results of operations.

While we use non-GAAP financial measures as a tool to enhance

our understanding of certain aspects of our financial performance

and to provide incremental insight into the underlying factors and

trends affecting both our performance and our cash-generating

potential, we do not consider these measures to be a substitute

for, or superior to, the information provided by GAAP financial

measures. Consistent with this approach, we believe that disclosing

non-GAAP financial measures to the readers of our financial

statements provides useful supplemental data that, while not a

substitute for GAAP financial measures, can offer insight in the

review of our financial and operational performance and enables

investors to more fully understand trends in our current and future

performance. In assessing our business during the quarter ended

September 30, 2024 and prior periods presented, we excluded items

in the following general categories, each of which are described

below:

Share-based compensation expense. We believe that

providing non-GAAP measures excluding share-based compensation

expense, in addition to the GAAP measures, allows for a more

transparent comparison of our financial results from period to

period. We prepare and maintain our budgets and forecasts for

future periods on a basis consistent with this non-GAAP financial

measure. Further, companies use a variety of types of equity awards

as well as a variety of methodologies, assumptions and estimates to

determine share-based compensation expense. We believe that

excluding share-based compensation expense enhances our ability and

the ability of investors to understand the impact of non-cash

share-based compensation on our operating results and to compare

our results against the results of other companies.

Amortization of intangible assets. We incur intangible

asset amortization expense, primarily in connection with our

acquisitions of various businesses and technologies. The

amortization of purchased intangibles varies depending on the level

of acquisition activity. We exclude these various charges in

budgeting, planning and forecasting future periods and we believe

that providing the non-GAAP measures excluding these various

non-cash charges, as well as the GAAP measures, provides additional

insight when comparing our gross profit, operating expenses, and

financial results from period to period.

Acquisition-related costs. We incurred expenses and

credits in connection with our acquisitions which we generally

would not have otherwise incurred in the periods presented as a

part of our continuing operations. Acquisition-related costs

include certain incremental expenses incurred to effect a business

combination. We believe that providing the non-GAAP measures

excluding these costs, as well as the GAAP measures, assists our

investors because such costs are not reflective of our ongoing

operating results.

Restructuring charges (credits), net. These charges

(credits) are associated with restructuring plans, and will vary

based on the initiatives in place during any given period.

Restructuring charges may include costs related to employee

terminations, facility closures and early cancellation of certain

contracts as well as other costs resulting from our restructuring

initiatives. We believe that providing the non-GAAP measures

excluding these items, as well as the GAAP measures, assists our

investors because such charges (credits) are not reflective of our

ongoing operating results.

Loss (gain) on investments. We recognize losses (gains)

related to our investments in various companies, which vary

depending on the operational and financial performance of the

companies in which we invest. These amounts include our losses

(earnings) on equity method investments, investment impairments and

losses (gains) resulting from sales or other events related to our

investments. We believe that providing the non-GAAP measures

excluding these items, as well as the GAAP measures, assists our

investors because such losses (gains) are not reflective of our

ongoing operations.

Non-GAAP income tax adjustment. Non-GAAP income tax

adjustment primarily measures the income tax effect of non-GAAP

adjustments excluded above as well as the income tax impact of

non-recurring deferred taxes, tax settlements, and other

non-routine tax events, the determination of which is based upon

the nature of the underlying items.

Each of the non-GAAP financial measures described above, and

used in this press release, should not be considered in isolation

from, or as a substitute for, a measure of financial performance

prepared in accordance with GAAP. Further, investors are cautioned

that there are inherent limitations associated with the use of each

of these non-GAAP financial measures as an analytical tool. In

particular, these non-GAAP financial measures are not based on a

comprehensive set of accounting rules or principles and many of the

adjustments to the GAAP financial measures reflect the exclusion of

items that are recurring and may be reflected in the Company’s

financial results for the foreseeable future. We compensate for

these limitations by providing specific information in the

reconciliation included in this press release regarding the GAAP

amounts excluded from the non-GAAP financial measures. In addition,

as noted above, we evaluate the non-GAAP financial measures

together with the most directly comparable GAAP financial

information.

Additional Supplemental Financial Information –

Constant Currency

In addition, Logitech presents percentage sales growth in

constant currency to show performance unaffected by fluctuations in

currency exchange rates. Percentage sales growth in constant

currency is calculated by translating prior period sales in each

local currency at the current period’s average exchange rate for

that currency and comparing that to current period sales.

(LOGIIR)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241021877163/en/

Editorial Contacts: Kate Beerkens, Director of Investor

Relations – ir@logitech.com Nicole Kenyon, Head of Global Corporate

and Internal Communications – nkenyon@logitech.com (USA) Ben

Starkie, Corporate Communications – +41 (0) 79-292-3499,

bstarkie1@logitech.com (Europe/Asia)

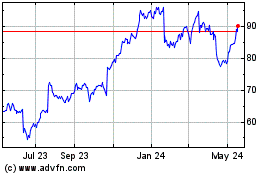

Logitech (NASDAQ:LOGI)

Historical Stock Chart

From Nov 2024 to Dec 2024

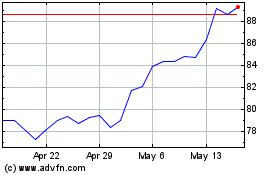

Logitech (NASDAQ:LOGI)

Historical Stock Chart

From Dec 2023 to Dec 2024