0001705338FALSE00017053382023-08-112023-08-110001705338us-gaap:CommonStockMember2023-08-112023-08-110001705338lov:AmericanDepositaryShareADSMember2023-08-112023-08-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): August 14, 2023

Spark Networks SE

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Germany | | 001-38252 | | N/A |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

Kohlfurter Straße 41/43

Berlin Germany 10999

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (+49) 30 868000

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol | | Name of each exchange on which registered |

| American Depository Shares each representing one-tenth of an ordinary share | | LOV | | The Nasdaq Stock Market, LLC |

Ordinary shares, €1.00 nominal value per share* | | | | |

* Not for trading purposes, but only in connection with the registration of American Depository Shares pursuant to the requirements of the Securities and Exchange Commission.

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

EXPLANATORY NOTE

This Current Report on Form 8-K/A (this “Amendment”) is being furnished by Spark Networks SE (the “Company”) to correct the second quarter of 2023 Adjusted EBITDA previously provided by the Company in its second quarter earnings release issued on August 14, 2023 (the “Original Earnings Release”). Subsequent to the issuance of the Original Earnings Release, it was determined that certain line items in the reconciliation of Adjusted EBITDA guidance figures were misstated resulting in the overstatement of second quarter of 2023 Adjusted EBITDA guidance figures in the Original Earnings Release. The Adjusted EBITDA guidance figures and related reconciliation table have been corrected in the earnings release furnished herewith as Exhibit 99.1. This Amendment is filed solely to correct this error, and no other changes have been made to the Original Earnings Release. The information contained in this Amendment and the corrected earnings release amend and supersede the Original Earnings Release.

Item 2.02 Results of Operations and Financial Condition

On August 14, 2023, the Company reported its second quarter of 2023 financial results. A copy of the corrected press release is furnished herewith as Exhibit 99.1 and incorporated herein by reference. The updated press release is also available on the Investor Relations section of the Company’s website, www.spark.net.

The information provided in this Item 2.02, including Exhibit 99.1, is intended to be “furnished” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | |

Exhibit No. | Description |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| Spark Networks SE |

| | |

| Dated: August 23, 2023 | By: | /s/ Frederic Beckley |

| | Frederic Beckley |

| | General Counsel & Chief Administrative Officer |

EXHIBIT 99.1

Spark Networks Reports Second Quarter 2023 Results

BERLIN, August 14, 2023 -- Spark Networks SE (NASDAQ: LOV) (the “Company”), a leading social dating platform for meaningful relationships, today reported financial results for its second quarter ended June 30, 2023.

Colleen Birdnow Brown, Interim CEO of Spark Networks, said: “As we have previously reported, Spark has embarked on a transformational plan intended to drive the Company forward with revenue growth as well as improved margins, Adjusted EBITDA and cash flow. Teaming with a leading performance marketing agency, our first step in that plan was to completely reevaluate the ways in which we spend our marketing dollars. As a result, we reduced our user acquisition spend during the quarter by 43% as compared to the second quarter of 2022. In addition, we also reduced our operating expenses during the quarter by 16% year over year, primarily by reducing headcount and renegotiating vendor spend. With these cost reductions, we increased Adjusted EBITDA by $7.2 million compared to the second quarter of 2022. We note, however, that while we made immediate gains in Adjusted EBITDA, we also saw a negative impact on subscription rates, which were down 21% compared to the second quarter of 2022. We attribute this primarily to our reduced marketing spend. Moving forward, we expect to identify more profitable ways to increase our marketing spend in order to improve subscription rates and drive future revenue, and we are already seeing promising results from our new outsourced performance marketing initiative.

“As part of the next phase of the transformation plan, we look to partner with a major managed service provider and outsource a significant portion of our technology and operations. Through this plan, we believe we can materially improve our product and technology stack while at the same time delivering long-term cost savings, revenue growth and improved operating margins. We expect to complete our outsourcing by the first quarter of 2024, resulting in a dramatically reduced employee headcount. In addition, we expect to continue to implement the initiatives in our plan over the next 18 months.”

Second Quarter 2023 Financial Results

•Revenue was $41.2 million, compared to $48.0 million in the second quarter of 2022.

•Net loss was $26.9 million, compared to $8.8 million in the second quarter of 2022.

•Adjusted EBITDA(3) was $5.5 million, or a 13.2% Adjusted EBITDA margin, compared to $(1.7) million, or a (3.6)% Adjusted EBITDA margin, in the second quarter of 2022.

Please see the table captioned “Reconciliation of Net loss to Adjusted EBITDA” included at the end of this release for a reconciliation of Adjusted EBITDA, which is a non-U.S. GAAP measure, and Adjusted EBITDA margin, which is a non-U.S. GAAP ratio, to U.S. GAAP.

Investor Conference Call

Spark Networks management will host a conference call and live webcast for analysts and investors today at 5:00 p.m. Eastern Time (2:00 p.m. Pacific Time) to discuss the Company's financial results.

To access the live call, dial 1-833-816-1417 (US and Canada) or +1 412-317-0510 (International) and ask to join the Spark Networks' call.

A live and archived webcast of the conference call will be accessible on the Investor Relations section of the Company’s website at https://investor.spark.net/investor-relations/home. In addition, a phone replay will be available approximately two hours following the end of the call and will remain available for one week. To access the call replay, dial 1-877-344-7529 (US) or +1 412-317-0088 (International) and enter the replay passcode: 8925104.

About Spark Networks SE

Spark Networks SE (NASDAQ: LOV) is a leading social dating platform for meaningful relationships focusing on the 40+ demographic and faith-based affiliations. Spark’s portfolio of premium and freemium dating apps include Zoosk, EliteSingles, SilverSingles, Christian Mingle, Jdate, and JSwipe, among others. Spark is headquartered in Berlin, Germany, with offices in New York and Utah.

Safe Harbor Statement

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, statements involving known and unknown risks, uncertainties, and other factors that may cause Spark Networks’ performance or achievements to be materially different from those of any expected future results, performance, or achievements. These statements include, without limitation, statements regarding whether we will execute our transformation plan as expected; whether our transformational plan will drive the Company forward with growth as well as improved margins, Adjusted EBITDA and cash flow; whether we will identify more profitable ways to increase our marketing spend in order to improve subscription rates and drive future revenue; whether we will continue to see promising results from our new outsourced performance marketing initiative; whether we will work with a managed service provider and outsource a significant portion of our technology and other operations as expected; whether we will improve our product and technology stack as expected, while at the same time achieving long-term cost savings, revenue growth and improved operating margins; whether we will complete our outsourcing by the first quarter of 2024 and whether it will result in a dramatically reduced employee headcount; and whether we will continue to implement the initiatives in our plan over the next 18 months as expected.

Any statements in this press release that are not statements of historical fact may be considered to be forward-looking statements. Written words, such as “believes,” “hopes,” “intends,” “estimates,” “expects,” “projects,” “plans,” “anticipates,” “guides,” and variations thereof, or the use of future tense, identify forward-looking statements. By their nature, forward-looking statements and forecasts involve risks and uncertainties because they relate to events and depend on circumstances that will occur in the near future. There are a number of factors that could cause actual results and developments to differ materially, including, but not limited to, risks related to the degree of competition in the markets in which Spark Networks operates; risks related to the ability of Spark Networks to retain and hire key personnel, operating results and business generally; the timing and market acceptance of new products introduced by Spark Networks’ competitors; Spark Networks’ ability to comply with new and evolving regulations relating to data protection and data privacy; general competition and price measures in the market place; and general economic conditions. Additional factors that could cause actual results to differ are discussed under the heading “Risk Factors” in Spark Networks’ most recent Annual Report on Form 10-K and in other sections of Spark Networks’ filings with the Securities and Exchange Commission (“SEC”), and in Spark Networks’ other current and periodic reports filed or furnished from time to time with the SEC. All forward-looking statements in this press release are made as of the date hereof, based on information available to the Company as of the date hereof, and the Company assumes no obligation to update any forward-looking statement except as required by law.

For More Information

Investor contact:

MKR Investor Relations, Inc.

Todd Kehrli

lov@mkr-group.com

Non-GAAP Financial Measures

To supplement our consolidated financial statements, which are prepared and presented in accordance with GAAP, we use the following non-GAAP financial measures: constant currency revenue, Adjusted EBITDA and Adjusted EBITDA margin. These measures are derived on the basis of methodologies other than in accordance with U.S. GAAP. We are not able to provide a reconciliation of our Adjusted EBITDA margin financial guidance or other non-GAAP financial guidance to the corresponding GAAP measure without unreasonable effort because of the uncertainty and variability of the nature and amount of the non-recurring and other items that are excluded from such non-GAAP financial measures. Such adjustments in future periods are generally expected to be similar to the kinds of charges excluded from such non-GAAP financial measure in prior periods. The exclusion of these charges and costs in future periods could have a significant impact on our non-GAAP financial measures.

1 We provide a constant currency revenue amount to present a period-to-period comparison of business performance that excludes the impact of foreign currency fluctuations. We define non-GAAP constant currency revenue as total revenue excluding the effect of foreign exchange rate movements. Non-GAAP constant currency revenue are calculated by translating current quarter revenues using prior period exchange rates.

2 Revenue for the three and six months ended June 30, 2023 includes virtual currency deferred revenue of $0.3 million and $0.6 million. During the quarter ended September 30, 2022, the Company analyzed its virtual currency deferred revenue balance to determine the likelihood of redemption. Virtual currency is paid for upfront and is recorded as deferred revenue until the currency is redeemed, at which point the Company recognizes the revenue. The Company’s analysis showed a likelihood of redemption of its virtual currency after 12 months of purchase is remote. Based on this analysis, during the three and six months ended June 30, 2023, the Company recognized revenue of $0.3 million and $0.6 million related to its virtual currency deferred revenue that had been included in the Company’s deferred revenue balance for more than 12 months. Going forward the Company will continue to analyze its virtual currency deferred revenue balance and will recognize revenue on a quarterly basis for all virtual currency that is held for longer than 12 months.

3 Adjusted earnings before interest, taxes, depreciation and amortization ("Adjusted EBITDA"), a non-U.S. GAAP financial measure, and Adjusted EBITDA margin, a non-GAAP ratio, are a few of the primary metrics by which we evaluate the performance of our business, budget, forecast and compensate management. We believe these measures provide management and investors with a consistent view, period to period, of the core earnings generated from the ongoing operations and allows for greater transparency with respect to key metrics used by senior leadership in its financial and operational decision-making. We define Adjusted EBITDA as net earnings (loss) excluding interest expense, (gain) loss on foreign currency transactions, income tax (benefit) expense, depreciation and amortization, asset impairments, stock-based compensation expense, acquisition related costs and other costs. We define Adjusted EBITDA margin as Adjusted EBITDA divided by revenue. Each of Adjusted EBITDA and Adjusted EBITDA margin has inherent limitations in evaluating the performance of the Company, and you should not consider these measures in isolation or as a substitute for analyzing the Company’s results as reported under U.S. GAAP. Some of these limitations include:

•Adjusted EBITDA and Adjusted EBITDA margin do not reflect the cash capital expenditures during the measurement period;

•Adjusted EBITDA and Adjusted EBITDA margin do not reflect any changes in working capital requirements during the measurement period;

•Adjusted EBITDA and Adjusted EBITDA margin do not reflect the cash tax payments during the measurement period; and

•Adjusted EBITDA and Adjusted EBITDA margin may be calculated differently by other companies in our industry, thus limiting its value as a comparative measure.

Because of these limitations, Adjusted EBITDA and Adjusted EBITDA margin should be considered in addition to other financial performance measures, including net income (loss) and our other U.S. GAAP results. A reconciliation of the Adjusted EBITDA and Adjusted EBITDA margin for the three and six months ended June 30, 2023 and 2022 can be found in the table below captioned “Reconciliation of Net loss to Adjusted EBITDA.”

| | | | | | | | | | | | | | |

| Spark Networks SE |

| Condensed Consolidated Balance Sheets (Unaudited) |

| (in thousands) |

| | June 30, 2023 | | December 31, 2022 |

| Assets | | | | |

| Cash and cash equivalents | | $ | 5,683 | | | $ | 11,438 | |

| Accounts receivable, net | | 5,473 | | | 5,154 | |

| Goodwill and intangible assets | | 109,013 | | | 132,575 | |

| Other assets | | 14,617 | | | 15,210 | |

| Total assets | | 134,786 | | | $ | 164,377 | |

| Liabilities and Shareholders' Deficit | | | | |

| Debt | | $ | 94,197 | | | $ | 94,817 | |

| Accounts payable | | 7,142 | | | 6,487 | |

| Deferred revenue | | 27,401 | | | 28,085 | |

| Accrued expenses and other current liabilities | | 27,611 | | | 24,247 | |

| | | | |

| Other liabilities | | 17,065 | | | 17,527 | |

| Total liabilities | | 173,416 | | | 171,163 | |

| Total shareholders' deficit | | (38,630) | | | (6,786) | |

| Total liabilities and shareholders' deficit | | $ | 134,786 | | | $ | 164,377 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Spark Networks SE |

| Condensed Consolidated Statements of Operations (Unaudited) |

| (in thousands) |

| | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | | $ | 41,202 | | | $ | 48,035 | | | $ | 82,541 | | | $ | 97,942 | |

| Operating costs and expenses: | | | | | | | | |

| Cost of revenue, exclusive of depreciation and amortization | | 22,790 | | | 36,356 | | | 50,082 | | | 70,602 | |

| Other operating costs and expenses | | 41,392 | | | 15,097 | | | 56,616 | | | 31,135 | |

| Total operating costs and expenses | | 64,182 | | | 51,453 | | | 106,698 | | | 101,737 | |

| Operating loss | | (22,980) | | | (3,418) | | | (24,157) | | | (3,795) | |

| Other expense, net | | (3,998) | | | (5,150) | | | (7,135) | | | (12,536) | |

| Loss before income taxes | | (26,978) | | | (8,568) | | | (31,292) | | | (16,331) | |

| Income tax benefit (expense) | | 52 | | | (193) | | | 7 | | | 99 | |

| Net loss | | $ | (26,926) | | | $ | (8,761) | | | $ | (31,285) | | | $ | (16,232) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Net loss to Adjusted EBITDA (Unaudited): | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| (in thousands) | | 2023 | | 2022 | | 2023 | | 2022 |

| Net loss | | $ | (26,926) | | | $ | (8,761) | | | $ | (31,285) | | | $ | (16,232) | |

| Interest expense | | 4,058 | | | 2,706 | | | 7,875 | | | 9,588 | |

| (Gain) loss on foreign currency transactions | | 216 | | | 2,441 | | | (464) | | | 3,208 | |

| Income tax (benefit) expense | | (52) | | | 193 | | | (7) | | | (99) | |

| Depreciation and amortization | | 625 | | | 577 | | | 1,243 | | | 1,180 | |

| Impairment of intangible assets | | 21,847 | | | — | | | 22,947 | | | — | |

| Stock-based compensation expense | | 251 | | | 490 | | | 424 | | | 992 | |

| | | | | | | | |

| | | | | | | | |

Other costs(1) | | 5,433 | | | 614 | | | 7,084 | | | 636 | |

| Adjusted EBITDA | | $ | 5,452 | | | $ | (1,740) | | | $ | 7,817 | | | $ | (727) | |

Adjusted EBITDA margin(2) | | 13.2 | % | | (3.6) | % | | 9.5 | % | | (0.7) | % |

(1) Includes consulting and advisory fees related to special projects, CFO severance fees, and retention bonuses

(2) We define “Adjusted EBITDA margin” as Adjusted EBITDA divided by revenue.

Spark Networks SE

Condensed Consolidated Statements of Cash Flows (Unaudited)

(in thousands)

| | | | | | | | | | | | | | |

| | Six Months Ended June 30, |

| | 2023 | | 2022 |

| Net loss | | $ | (31,285) | | | $ | (16,232) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | | |

| Non-cash items and other non-operating charges | | 26,819 | | | 12,536 | |

| Change in operating assets and liabilities | | 1,796 | | | (6,999) | |

| Net cash used in operating activities | | (2,670) | | | (10,695) | |

| | | | |

| Capital expenditures | | (1,393) | | | (1,268) | |

| | | | |

| Net cash used in investing activities | | (1,393) | | | (1,268) | |

| | | | |

| Net cash (used in) provided by financing activities | | (1,250) | | | 7,774 | |

| Effects of exchange rate fluctuations on cash and cash equivalents and restricted cash | | (439) | | | (613) | |

| Net decrease in cash and cash equivalents and restricted cash | | (5,752) | | | (4,802) | |

| | | | |

| Cash and cash equivalents and restricted cash at beginning of period | | 11,569 | | | 16,279 | |

| Cash and cash equivalents and restricted cash at end of period | | $ | 5,817 | | | $ | 11,477 | |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=lov_AmericanDepositaryShareADSMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

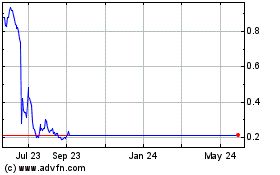

Spark Networks (NASDAQ:LOV)

Historical Stock Chart

From Dec 2024 to Jan 2025

Spark Networks (NASDAQ:LOV)

Historical Stock Chart

From Jan 2024 to Jan 2025