false

0001819576

0001819576

2024-09-11

2024-09-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported): September 11, 2024

| LIQUIDIA CORPORATION |

| (Exact name of registrant as specified in its charter) |

| |

|

|

| Delaware |

001-39724 |

85-1710962 |

|

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(IRS Employer

Identification No.) |

| |

|

|

| 419 Davis Drive, Suite 100, Morrisville, North Carolina |

27560 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including

area code: (919) 328-4400

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common stock |

LQDA |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act

of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 |

Entry into a Material Definitive Agreement. |

Underwriting Agreement

On

September 11, 2024, Liquidia Corporation, a Delaware corporation (the “Company”), entered into an underwriting

agreement (the “Underwriting Agreement”) with BofA Securities, Inc. (“Representative”), as

representative of the several underwriters named therein (collectively, the “Underwriters”), in connection with a sale

of 6,460,674 shares (the “Public Shares”) of the Company’s common stock, par value $0.001 per share (the

“Common Stock”), pursuant to a registration statement on Form S-3 (File No. 333-276244), which was filed with

the U.S. Securities and Exchange Commission (the “SEC”) on December 22, 2023, subsequently amended on

December 28, 2023, and declared effective by the SEC on January 3, 2024, and the prospectus contained therein, as may be

supplemented by a prospectus supplement (the “Prospectus Supplement”) to be filed with the SEC pursuant to

Rule 424(b) under the Securities Act of 1933, as amended (the “Securities Act”), in an underwritten registered

public offering (the “Public Offering”) at a public offering price of $8.90 per share. Gross proceeds from the Public

Offering, before deducting underwriting discounts and commissions and other offering expenses payable by the Company, are expected

to be approximately $57.5 million. The Public Offering is expected to close on September 12, 2024, subject to customary closing

conditions.

BofA

Securities, Inc. acted as sole book-running manager for the Public Offering. LifeSci Capital LLC acted as lead manager for the

Public Offering and Needham & Company, LLC acted as co-manager for the Public Offering. A fund affiliated with Paul Manning

participated in the Public Offering, investing an aggregate of approximately $3.0 million.

The Underwriting Agreement

contains customary representations and warranties, agreements and obligations, closing conditions and termination provisions. The Company

has agreed to indemnify the Underwriters against certain liabilities, including liabilities under the Securities Act and to contribute

to payments the Underwriters may be required to make because of any of those liabilities. In addition, subject to certain exceptions,

the Company and its officers and directors and certain affiliates have agreed not to offer, sell, transfer or otherwise dispose of any

shares of Common Stock during the 90-day period following the date of the Prospectus Supplement.

Purchase Agreement

On

September 10, 2024, the Company entered into a common stock purchase agreement (the “Purchase Agreement”) with

funds managed by Caligan Partners LP (collectively, the “Purchasers”), a fund affiliated with David Johnson, a director

of the Company, in connection with the sale of 1,123,595 shares of Common Stock (the “Private Shares” and together with

the Public Shares, the “Shares”) in a private placement exempt from the registration requirements of the Securities Act

at a purchase price of $8.90 per share for an aggregate investment amount of approximately $10.0 million (the “Private

Placement”). The Purchase Agreement contains customary representations and warranties, agreements and obligations and

termination provisions. The closing of the Public Offering is not conditioned upon the closing of the Private Placement, but the

closing of the Private Placement is conditioned upon the closing of the Public Offering. The Private Placement is expected to close

on September 12, 2024 concurrently with the closing of the Public Offering, subject to other customary closing conditions.

The Company intends to

use the proceeds from the Public Offering and the Private Placement for ongoing commercial development of YUTREPIA (treprostinil) inhalation

powder (“YUTREPIA”), formerly known as LIQ861, for continued development of YUTREPIA in other clinical trials, including but

not limited to trials for pediatric patients and trials further evaluating the use of YUTREPIA in WHO Group 1 and WHO Group 3 patients,

for clinical development of L606 and for general corporate purposes. The Company’s management will retain broad discretion over

the allocation of the net proceeds.

Registration Rights

Agreement

In connection with the

Private Placement, on September 10, 2024, the Company entered into a registration rights agreement (the “Registration Rights

Agreement”) with the Purchasers. Pursuant to the Registration Rights Agreement, the Company agreed to file a shelf registration statement

(the “Registration Statement”) with the SEC within 180 days following September 10, 2024

(the “Filing Deadline”) to register the Private Shares for resale and use its best efforts to cause the Registration Statement

to be declared effective by the SEC or otherwise become effective under the Securities Act as soon as practicable after the

filing thereof, but in no event later than that date that is the earlier of (i) in the event that such Registration Statement (x) is

not subject to a review by the SEC, 60 days after the earlier of (A) the Filing Deadline and (B) the date such Registration

Statement was filed with the SEC and (y) is subject to a review by the SEC, 90 days after the earlier of (A) the Filing Deadline

and (B) the date such Registration Statement was filed with the SEC and (ii) five (5) business days after the date the

Company receives written notification from the SEC that the Registration Statement will not be reviewed. The Company also agreed, among other things, to indemnify the selling holders under the Registration Statement from

certain liabilities and to pay all fees and expenses incident to the Company’s performance of or compliance with the Registration

Rights Agreement.

A copy of each of the

Underwriting Agreement, the Purchase Agreement and the Registration Rights Agreement will be filed as an amendment to this report on Form 8-K

or with a new Form 8-K. The foregoing descriptions of the Underwriting Agreement, the Purchase Agreement and the Registration Rights

Agreement do not purport to be complete and are qualified in their entirety by reference to such exhibits. The provisions of the Underwriting

Agreement, the Purchase Agreement and the Registration Rights Agreement, including the representations and warranties contained therein,

are not for the benefit of any party other than the parties to such agreement and are not intended as a document for investors and the

public to obtain factual information about the current state of affairs of the Company. Rather, investors and the public should look to

other disclosures contained in the Company’s filings with the SEC.

On September 11, 2024, the

Company issued a press release announcing (i) the pricing of the Public Offering and (ii) the Private Placement and (iii) the

Fifth Amendment (as defined below).

As previously disclosed, on September 11,

2024 (the “Effective Date”), Liquidia Technologies, Inc., a Delaware corporation and a wholly owned subsidiary of the

Company, entered into a Fifth Amendment (the “Fifth Amendment”) to that certain Revenue Interest Financing Agreement, dated

January 9, 2023, with HealthCare Royalty Partners IV, L.P. (“HCR”) (as amended, the “RIFA”). Pursuant

to the terms and conditions of the Fifth Amendment, the additional funding of $32.5 million under the second tranche of the RIFA would

be funded by HCR to the Company upon receipt by the Company of aggregate gross proceeds of not less than $50.0 million in connection with

the sale of the Company’s Common Stock in one or more transactions consummated on or after the Effective Date (the “Funding

Condition”). Upon the closing of the Public Offering and the Private Placement, the Funding Condition will have been satisfied.

The full text of the press release issued in connection with these announcements is attached as

Exhibit 99.1 to this Form 8-K and incorporated herein by reference.

| Item 9.01 |

Financial Statements and Exhibits. |

(d)

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| September 11, 2024 |

Liquidia Corporation |

| |

|

| |

By: |

/s/ Michael Kaseta |

| |

|

Name: Michael Kaseta |

| |

|

Title: Chief Financial Officer and Chief Operating Officer |

Exhibit 99.1

Liquidia Corporation Announces Raise of $67.5

Million from New Common Stock Financings and $32.5

Million Advance from HealthCare Royalty Under Current Financing Agreement

MORRISVILLE,

N.C., September 11, 2024 – Liquidia Corporation (NASDAQ: LQDA) (the “Company” or “Liquidia”),

a biopharmaceutical company developing innovative therapies for patients with rare cardiopulmonary diseases, announced today the pricing

of an underwritten public offering and a concurrent private placement, with anticipated total gross proceeds of approximately $67.5 million,

before deducting underwriting discounts and commissions, and expenses.

The Company offered 6,460,674 shares of common stock in the

public offering at a price of $8.90 per share. In addition, Liquidia entered into a common stock purchase agreement with funds

managed by Caligan Partners LP for the sale of 1,123,595 shares of common stock at a purchase price of $8.90 per share in a private

placement exempt from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”).

The closing of the public offering is not conditioned upon the closing of the private placement, but the closing of the private

placement is conditioned upon the closing of the public offering. The public offering and concurrent private placement are expected

to close on September 12, 2024, subject to other customary closing conditions.

BofA Securities acted as the sole book-running manager for the

public offering, LifeSci Capital acted as lead manager for the public offering and Needham & Company acted as co-manager

for the public offering.

Liquidia also announced today that the Company has entered into a

fifth amendment to the Revenue Interest Financing Agreement (“RIFA”) with HealthCare Royalty (“HCRx”) to

fund an additional $32.5 million (the “Fifth Amendment”), subject to certain closing conditions including the funding condition discussed further below. With this amendment,

HCRx will have invested the full $100 million in non-dilutive capital as originally contemplated under the RIFA entered in

January 2023.

The Fifth Amendment proceeds, together with the public offering

and concurrent private placement proceeds, aggregate to total gross proceeds of approximately $100 million before deducting

applicable underwriting discounts, commissions, and expenses. Net proceeds from the public offering, the concurrent private

placement and the Fifth Amendment are expected to fund ongoing commercial development of YUTREPIA™ (treprostinil) inhalation

powder for the potential treatment of pulmonary arterial hypertension (PAH) and pulmonary hypertension associated with interstitial

lung disease (PH-ILD), continued development of YUTREPIA in other clinical trials, including but not limited to trials for pediatric

patients and trials further evaluating the use of YUTREPIA in WHO Group 1 and WHO Group 3 patients, clinical development of L606 and

for general corporate purposes.

Michael Kaseta, Chief Financial Officer and Chief Operating Officer

of Liquidia, stated: “We are excited by HealthCare Royalty’s continued commitment and confidence in our ability to bring

new treatment options to market for patients with rare cardiopulmonary diseases. We believe we are financially well-positioned to continue

ongoing commercial development of YUTREPIA in anticipation of potential final regulatory approval, to progress development of YUTREPIA

in other clinical trials like ASCENT for PH-ILD, and to advance L606 (liposomal treprostinil) inhalation suspension into a global pivotal

study.”

Clarke Futch, Chairman and Chief Executive Officer of HCRx added: “We

view the recent grant of tentative approval of YUTREPIA to treat both PAH and PH-ILD as a significant milestone for the company. More

importantly, we are confident in Liquidia’s potential to address the needs of patients suffering from rare cardiopulmonary diseases.

We are excited to see how YUTREPIA may help change the lives of patients upon final approval and launch potentially in 2025.”

The Fifth Amendment to the RIFA moves the additional $32.5 million

that was funded from the third and fourth tranches to the second tranche such that, following the closing of the Fifth Amendment and the

funding of the remaining $32.5 million, HCRx will have funded a total of $67.5 million under the second tranche and each of the third

and fourth tranches will be eliminated. As a result, the Company will continue to pay HCRx on a fixed payment schedule and will not change

to a tiered royalty on the Company’s annual net revenue after the first commercial sale of YUTREPIA. As consideration for the additional

invested amount, Liquidia has agreed to a modified fixed payment schedule that extends expected termination of the RIFA from 2029 to 2031.

HCRx also agreed to defer a one-time fixed payment of $23.8 million that was originally due on July 30, 2025, into two equal payments

due in January 2026 and July 2026. The aggregate payments to HCRx are capped at 175% of the total amounts advanced by HCRx,

but also include a potential true-up payment to be made by Liquidia if HCRx’s internal rate of return is less than a threshold value

on the date the cap is reached. The threshold value for the newly advanced funds is 16% as compared to the 18% for the previously advanced

funds. Funding of the additional $32.5 million under the second tranche is conditioned upon Liquidia receiving not less than $50.0 million

in aggregate gross proceeds from the sale of the Company’s common stock in one or more transactions. Upon closing of the public

offering and concurrent private placement, this funding condition will be satisfied. The closing of the public offering and concurrent

private placement are each subject to customary closing conditions.

The shares of common stock in the public offering described above were

offered by Liquidia pursuant to its shelf registration statement on Form S-3, including a base prospectus, that was previously filed

by Liquidia with the Securities and Exchange Commission (the “SEC”) on December 22, 2023, and declared effective by the

SEC on January 3, 2024. The public offering was made by means of a written prospectus and prospectus supplement that formed part

of the registration statement. A final prospectus supplement and the accompanying prospectus relating to and describing the terms of the

public offering will be filed with the SEC and will be available at the SEC’s website located at www.sec.gov. Copies of the final

prospectus supplement and the accompanying prospectus relating to the offering may be obtained from BofA Securities, Attention: Prospectus

Department, NC1-022-02-25, 201 North Tryon Street, Charlotte, North Carolina 28255, or via email: dg.prospectus_requests@bofa.com.

The shares of common stock to be sold in the concurrent private placement

have not been registered under the Securities Act or under any state securities laws and, unless so registered, may not be offered or

sold in the United States except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the

Securities Act and applicable state securities laws.

This press release shall not constitute an offer to sell or the solicitation

of an offer to buy these securities, nor shall there be any offer, solicitation or sale of these securities in any jurisdiction in which

such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state

or jurisdiction.

About Liquidia Corporation

Liquidia Corporation is a biopharmaceutical company developing

innovative therapies for patients with rare cardiopulmonary diseases. The company’s current focus spans the development and commercialization

of products in pulmonary hypertension and other applications of its proprietary PRINT® Technology. PRINT enabled

the creation of Liquidia’s lead candidate, YUTREPIA™ (treprostinil) inhalation powder, an investigational drug for the treatment

of pulmonary arterial hypertension (PAH) and pulmonary hypertension associated with interstitial lung disease (PH-ILD). The company

is also developing L606, an investigational sustained-release formulation of treprostinil administered twice-daily with a next-generation

nebulizer, and currently markets generic Treprostinil Injection for the treatment of PAH.

Tyvaso® and Tyvaso DPI® are registered trademarks of United

Therapeutics Corporation.

About YUTREPIA™(treprostinil) Inhalation Powder

YUTREPIA is an investigational, inhaled dry-powder formulation of treprostinil

delivered through a convenient, low-effort, palm-sized device. YUTREPIA was designed using Liquidia’s PRINT® technology, which

enables the development of drug particles that are precise and uniform in size, shape and composition, and that are engineered for enhanced

deposition in the lung following oral inhalation. Liquidia has completed INSPIRE, or Investigation of the Safety and Pharmacology

of Dry Powder Inhalation of Treprostinil, an open-label, multi-center phase 3 clinical study of YUTREPIA in patients diagnosed with PAH

who are naïve to inhaled treprostinil or who are transitioning from Tyvaso® (nebulized treprostinil). YUTREPIA is currently being

studied in the ASCENT trial, an Open-Label Prospective Multicenter Study to Evaluate Safety and Tolerability of Dry Powder Inhaled Treprostinil

in Pulmonary Hypertension, with the objective of informing YUTREPIA’s dosing and tolerability profile in patients with PH-ILD. YUTREPIA

was previously referred to as LIQ861 in investigational studies.

Cautionary Statements Regarding Forward-Looking Statements

This press release may include forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this press release other than statements

of historical facts, including statements regarding our future results of operations and financial position, our strategic and financial

initiatives, our business strategy and plans and our objectives for future operations, are forward-looking statements. Such forward-looking

statements include statements regarding the closing of the public offering, the concurrent private placement and the funding under the

Fifth Amendment; the intended use of proceeds from these transactions; our plans regarding clinical trials, clinical studies and other

clinical work (including the funding therefor, anticipated patient enrollment, safety data, study data, trial outcomes, timing or associated

costs), regulatory applications and related submission contents and timelines, including the potential for final FDA approval of the NDA

for YUTREPIA; the potential for and timing of commercial launch of YUTREPIA; the potential benefits of YUTREPIA for patients; and our

ability to execute on our strategic or financial initiatives; involve significant risks and uncertainties and actual results could differ

materially from those expressed or implied herein. The words “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,”

“predict,” “project,” “should,” “target,” “would,” and similar expressions

are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations

and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business

strategy, short-term and long-term business operations and objectives and financial needs. These forward-looking statements are subject

to a number of risks discussed in our filings with the SEC, as well as a number of uncertainties and assumptions. Moreover, we operate

in a very competitive and rapidly changing environment and our industry has inherent risks. New risks emerge from time to time. It is

not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which

any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements

we may make. In light of these risks, uncertainties and assumptions, the future events discussed in this press release may not occur and

actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. Nothing in this

press release should be regarded as a representation by any person that these goals will be achieved, and we undertake no duty to update

our goals or to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise.

Contact Information

Investors:

Jason Adair

919.328.4350

jason.adair@liquidia.com

Media:

Patrick Wallace

919.328.4383

patrick.wallace@liquidia.com

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

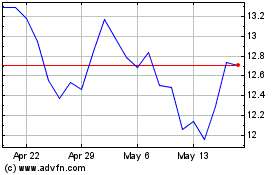

Liquidia (NASDAQ:LQDA)

Historical Stock Chart

From Jan 2025 to Feb 2025

Liquidia (NASDAQ:LQDA)

Historical Stock Chart

From Feb 2024 to Feb 2025